| 1 NASDAQ: WULFJune 2022An Infrastructure-Focused Mining CompanyAccelerating the Transition to a Zero-Carbon Future |

| SAFE HARBOR STATEMENT Thispresentationisforinformationalpurposesonlyandcontainsforward-lookingstatementswithinthemeaningofthe"safeharbor"provisionsofthePrivateSecuritiesLitigationReformActof1995,asamended.Suchforward-lookingstatementsincludestatementsconcerninganticipatedfutureeventsandexpectationsthatarenothistoricalfacts.Allstatements,otherthanstatementsofhistoricalfact,arestatementsthatcouldbedeemedforward-lookingstatements.Inaddition,forward-lookingstatementsaretypicallyidentifiedbywordssuchas"plan,""believe,""goal,""target,""aim,""expect,""anticipate,""intend,""outlook,""estimate,""forecast,""project,""continue,""could,""may,""might,""possible,""potential,""predict,""should,""would"andothersimilarwordsandexpressions,althoughtheabsenceofthesewordsorexpressionsdoesnotmeanthatastatementisnotforward-looking.Forward-lookingstatementsarebasedonthecurrentexpectationsandbeliefsofTeraWulf'smanagementandareinherentlysubjecttoanumberoffactors,risks,uncertaintiesandassumptionsandtheirpotentialeffects.Therecanbenoassurancethatfuturedevelopmentswillbethosethathavebeenanticipated.Actualresultsmayvarymateriallyfromthoseexpressedorimpliedbyforward-lookingstatementsbasedonanumberoffactors,risks,uncertaintiesandassumptions,including,amongothers:(1)conditionsinthecryptocurrencyminingindustry,includingfluctuationinthemarketpricingofbitcoinandothercryptocurrencies,andtheeconomicsofcryptocurrencymining,includingastovariablesorfactorsaffectingthecost,efficiencyandprofitabilityofcryptocurrencymining;(2)competitionamongthevariousprovidersofdataminingservices;(3)changesinapplicablelaws,regulationsand/orpermitsaffectingTeraWulf'soperationsortheindustriesinwhichitoperates,includingregulationregardingpowergeneration,cryptocurrencyusageand/orcryptocurrencymining;(4)theabilitytoimplementcertainbusinessobjectivesandtotimelyandcost-effectivelyexecuteintegratedprojects;(5)failuretoobtainadequatefinancingonatimelybasisand/oronacceptabletermswithregardtogrowthstrategiesoroperations;(6)lossofpublicconfidenceinbitcoinorothercryptocurrenciesandthepotentialforcryptocurrencymarketmanipulation;(7)thepotentialofcybercrime,money-laundering,malwareinfectionsandphishingand/orlossandinterferenceasaresultofequipmentmalfunctionorbreak-down,physicaldisaster,datasecuritybreach,computermalfunctionorsabotage(andthe costsassociatedwithanyoftheforegoing);(8)theavailability,deliveryscheduleandcostofequipmentnecessarytomaintainandgrowthebusinessandoperationsofTeraWulf,includingminingequipmentandequipmentmeetingthetechnicalorotherspecificationsrequiredtoachieveitsgrowthstrategy;(9)employmentworkforcefactors,includingthelossofkeyemployees;(10)litigationrelatingtoTeraWulf,IKONICSand/orthebusinesscombination;(11)theabilitytorecognizetheanticipatedobjectivesandbenefitsofthebusinesscombination;and(12)otherrisksanduncertaintiesdetailedfromtimetotimeintheCompany'sfilingswiththeSecuritiesandExchangeCommission("SEC").Potentialinvestors,stockholdersandotherreadersarecautionednottoplaceunduerelianceontheseforward-lookingstatements,whichspeakonlyasofthedateonwhichtheyweremade.TeraWulfdoesnotassumeanyobligationtopubliclyupdateanyforward-lookingstatementafteritwasmade,whetherasaresultofnewinformation,futureeventsorotherwise,exceptasrequiredbylaworregulation.Investorsarereferredtothefulldiscussionofrisksanduncertaintiesassociatedwithforward-lookingstatementsandthediscussionofriskfactorscontainedintheCompany'sfilingswiththeSEC,whichareavailableatwww.sec.gov. |

| Our MissionTo be the premier U.S. based, large-scale, zero-carbonbitcoin miner,generating attractive investorreturnswhile providingsustainable benefits forourcommunities. Experienced Energy EntrepreneursInfrastructure FirstScalable and FlexibleTransparent Governance Business IntegrityResponsible Energy SourcingZero-Carbon EnergyFlexible BaseloadEnvironmental StewardshipOur Core ValuesESG is at the core of TeraWulf's corporate strategy and ties directly to its business success, risk mitigation, and reputational value. 3 |

| (1)Average estimated bitcoin production cost assumes miner efficiency of 100 TH/s and global network hash rate of 215 EH/s. (2)Future estimates reflect anticipated infrastructure capacity based on current estimates and market conditions and are subjecttochange.TeraWulf at a Glance•Introducing a new paradigm for best-in-class crypto mining–Generating sustainable low-cost, domestic bitcoin at industrial scale–Targeting 100% zero-carbon emissions utilizing nuclear, hydro, and solar energy sources–Established digital infrastructure provides ability to build and scale mining operations rapidly•Offering one of the most attractive economics of any bitcoin miner–Generating bitcoin at an average marginal production cost of $5,500(1)•Continuing its rapid deployment plan for 2022 and 2023 after commencing bitcoin mining in March 2022(2)–Targeting fully developed net capacity of up to 210 MW (or 7.1 EH/s) by YE 2022 and expansion to 400 MW (or 13.5 EH/s) by YE 2023–Anticipating net capacity of up to 800 MW (23 EH/s) by YE 2025•Vertically integrated and strengthening the electric grid to enable decarbonization–Facilities serve as a resource to further enable the electric grid’s transition to a zero-carbon future•Led by energy entrepreneur Paul Prager and a seasoned management team–Accomplished management team with decades of experience in energy infrastructure and power supply optimization–Proud to have industry leading diversity, with many leadership positions held by women•Driving value by focusing on best ESG practices–Committed to purpose-driven business practices, clean energy goals, and support for communities4 |

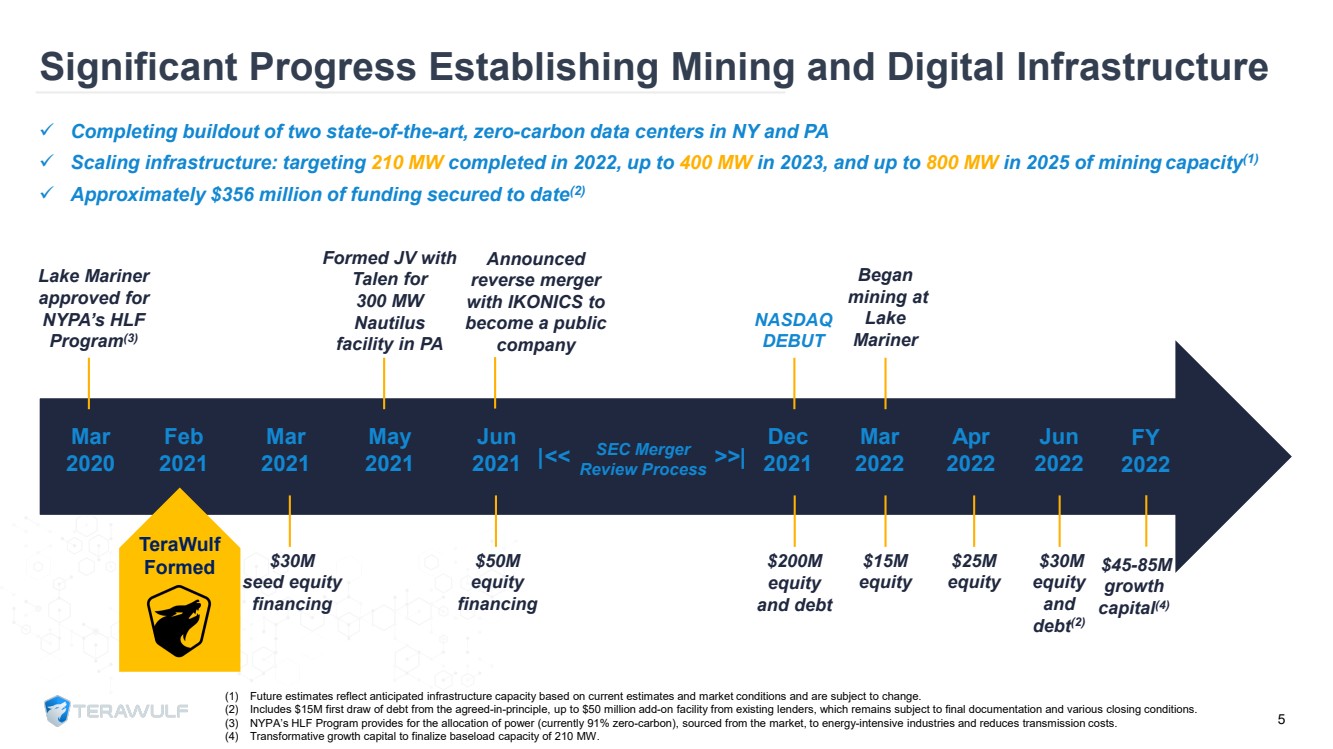

| Mar2022Feb2021Mar2021May2021Jun2021Dec2021 TeraWulf Formed Lake Mariner approved for NYPA’s HLF Program(3)$30M seed equity financingSEC Merger Review Process$50M equity financing Formed JV with Talen for 300 MW Nautilus facility in PACompleting buildout of two state-of-the-art, zero-carbon data centers in NY and PAScaling infrastructure: targeting 210 MW completed in 2022, up to 400 MW in 2023, and up to 800 MW in 2025 of miningcapacity(1)Approximately $356 million of funding secured to date(2)Beganmining at Lake Mariner$200M equity and debt$15M equity5Significant Progress Establishing Mining and Digital Infrastructure Apr2022 $25M equityJun2022 NASDAQ DEBUT $30M equity and debt(2) Announced reverse merger with IKONICS to become a public company(1)Future estimates reflect anticipated infrastructure capacity based on current estimates and market conditions and are subjecttochange.(2)Includes $15M first draw of debt from the agreed-in-principle, up to $50 million add-on facility from existing lenders, which remains subject to final documentation and various closing conditions. (3)NYPA’s HLF Program provides for the allocation of power (currently 91% zero-carbon), sourced from the market, to energy-intensive industries and reduces transmission costs.(4)Transformative growth capital to finalize baseload capacity of 210 MW. Mar2020 FY2022 $45-85M growth capital(4)|<<>>| |

| Why WULF Wins: The Four “P’s”Digital Asset Infrastructure FirstFoundation to Scale Experienced Energy EntrepreneursPower & InfrastructureExpertsSustainable, Scalable FacilitiesKey Relationships and Site ControlESG Principled and PracticedDriving the Future of Mining6 PlugsPeoplePowerPriorities |

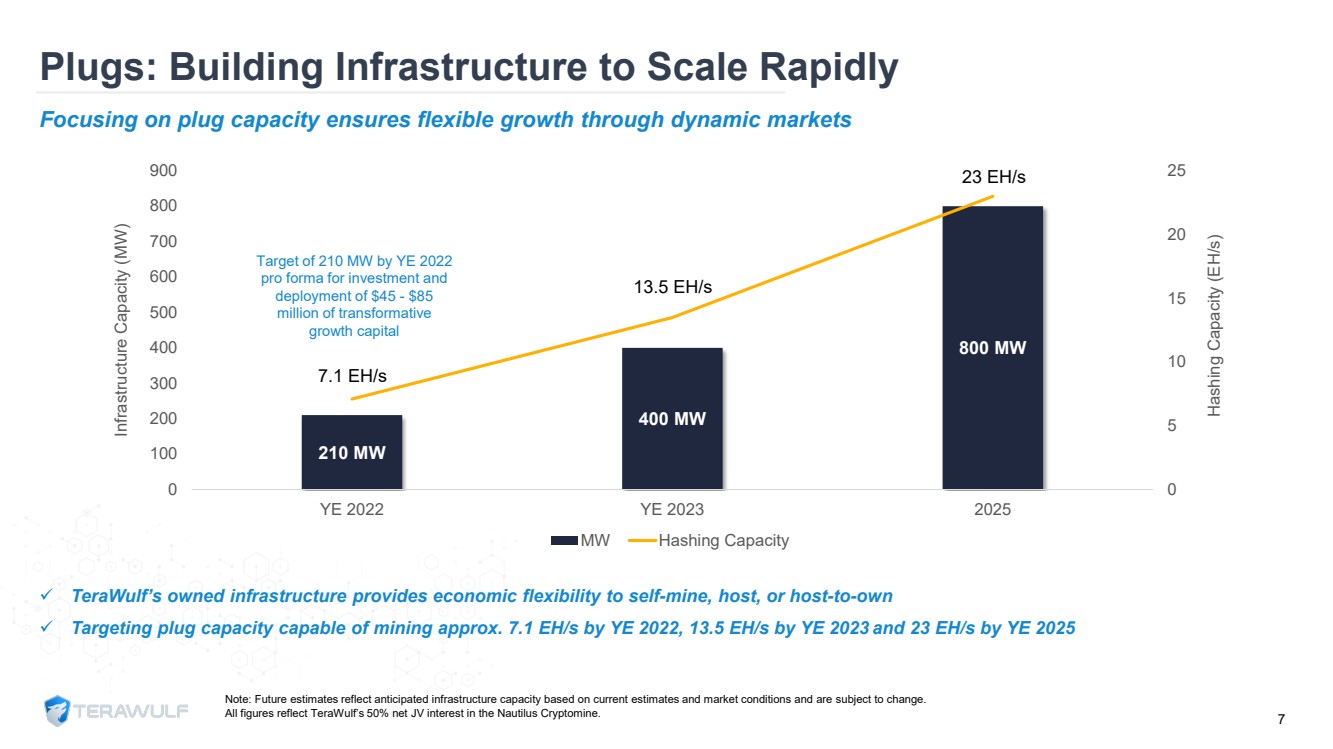

| Note: Future estimates reflect anticipated infrastructure capacity based on current estimates and market conditions and are subject to change. All figures reflect TeraWulf’s 50% net JV interest in the Nautilus Cryptomine.Focusing on plug capacity ensures flexible growth through dynamic marketsTeraWulf’s owned infrastructure provides economic flexibility to self-mine, host, or host-to-ownTargeting plug capacity capable of mining approx. 7.1 EH/s by YE 2022, 13.5 EH/s by YE 2023and 23 EH/s by YE 2025 210MW400MW800MW 7.1 EH/s 13.5EH/s23EH/s0510 1520 250100200 300400500600 700800900YE 2022YE 20232025 Hashing Capacity (EH/s) Infrastructure Capacity (MW) MW Hashing Capacity7 Plugs: Building Infrastructure to Scale RapidlyTarget of 210 MW by YE 2022 pro forma for investment and deployment of $45 -$85 million of transformative growth capital |

| People: Best-in-Class Management TeamLed by an accomplished, diverse management team with 30+ years of experience in developing and managing energy infrastructureand disruptive technology N A Z A R K H A NCo-Founder, Chief Operating Officer & Chief Technology Officer20+ years in energy infrastructure and cryptocurrency mining. Previously at Evercore. K E R R I L A N G L A I S Chief Strategy Officer20+ years of M&A, financing, strategy, and power sector experience. Previously at Goldman Sachs.S A N D Y H A R R I S O NVP, Investor Relations20+ years in financial and marketing communications, equity research, financial analysis, and strategic planning. Previously at Semtech Corp. P A U L P R A G E RCo-Founder, Chairman & Chief Executive Officer30+ year energy infrastructure entrepreneur. USNA Foundation Investment Committee Trustee.P A T R I C K F L E U R Y Chief Financial Officer20+ years of financial experience in the energy, power, and commodity sectors. Previously at Platinum Equity and Blackstone.S T E F A N I E F L E I S C H M A N NGeneral CounselGeneral Counsel for 15+ years overseeing all legal and compliance matters. Previously at Paul, Weiss.8 |

| Power: Sustainable and Scalable Sites800 MWMining capacity by 2025 at existing sites> 91%ZERO-carbon power supply today, with goal of achieving 100%< 3 ¢ Per kilowatt hour target average power cost9 91%+ Zero Carbon(1)110 MW Available Exiting 2022500+ MW Hydro, Solar 100% Zero Carbon100 MW Available Exiting 2022(2)300+ MW Nuclear (1)Source: NYISO Power Trends 2022 report (https://www.nyiso.com/power-trends).(2)Figures represent TeraWulf’s 50% net JV interest in Nautilus Cryptomine.210 MWTargeting fully developed high scale capacity by YE 2022 |

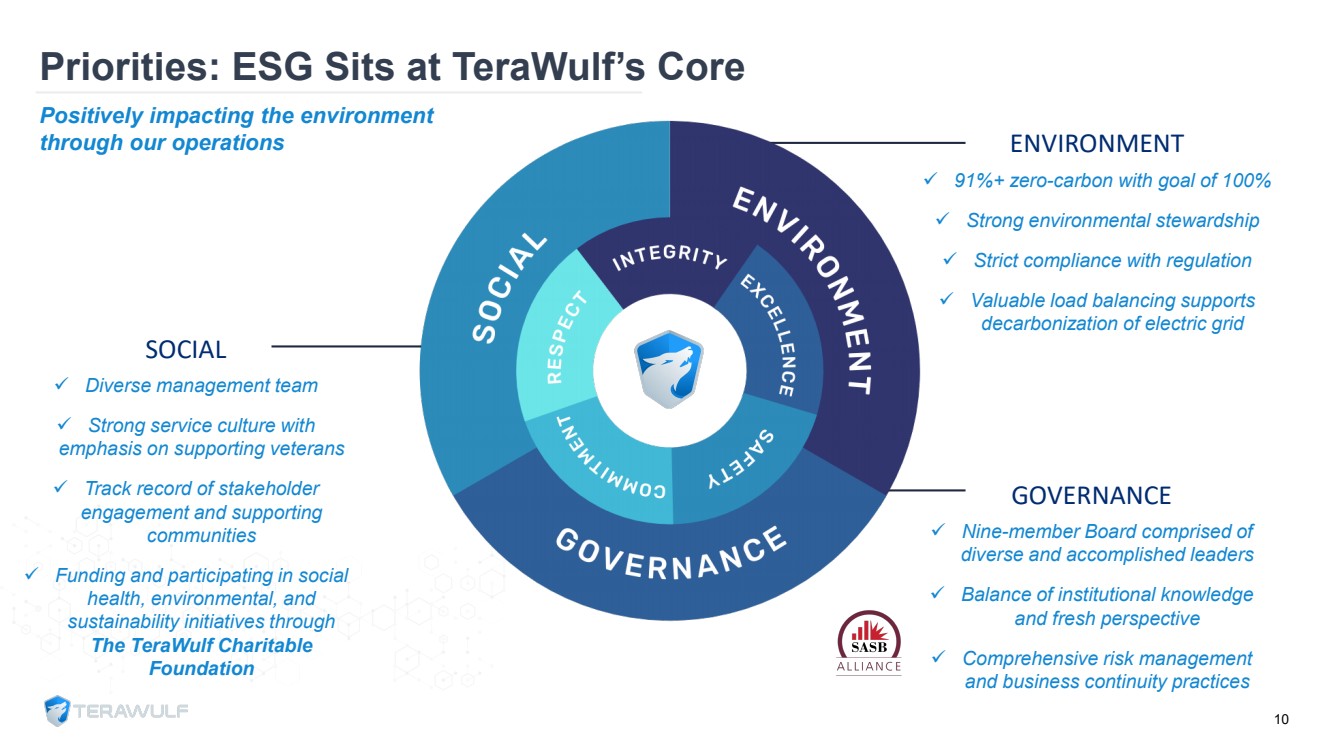

| Positively impacting theenvironment through our operations SOCIALDiverse management team Strong service culture with emphasis on supporting veteransTrack record of stakeholder engagement and supporting communitiesFunding and participating in social health, environmental, and sustainability initiatives through TheTeraWulf Charitable FoundationENVIRONMENT91%+ zero-carbon with goal of 100%Strong environmental stewardshipStrict compliance with regulationValuable load balancing supports decarbonization of electric gridGOVERNANCENine-member Board comprised of diverse and accomplished leadersBalance of institutional knowledge and fresh perspectiveComprehensive risk management and business continuity practices 10 Priorities: ESG Sits at TeraWulf’s Core |

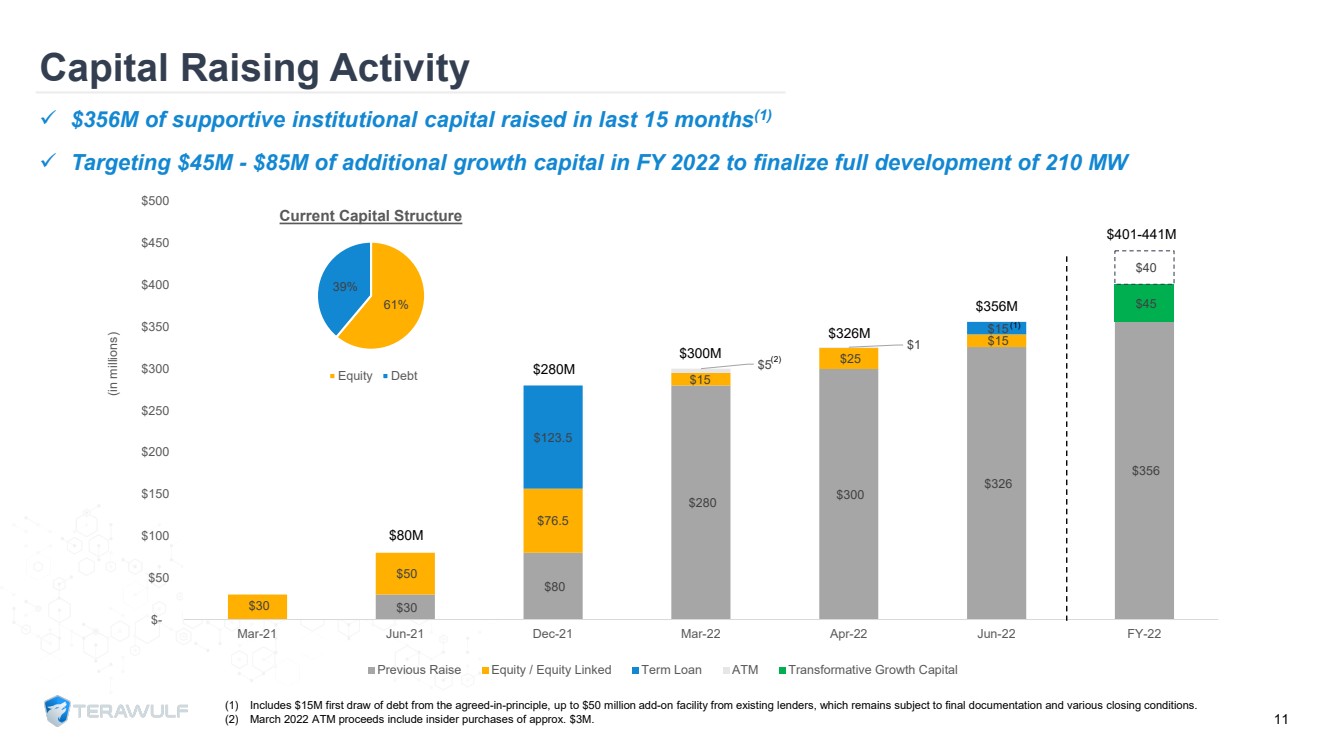

| (1)Includes $15M first draw of debt from the agreed-in-principle, up to $50 million add-on facility from existing lenders, which remains subject to final documentation and various closing conditions. (2)March 2022 ATM proceeds include insider purchases of approx. $3M. $30 $80 $280 $300 $326 $356 $30 $50 $76.5$15 $25 $15 $123.5$15 $5$1$45 $40 $- $50 $100 $150 $200 $250 $300 $350 $400 $450 $500Mar-21Jun-21Dec-21Mar-22Apr-22Jun-22FY-22(in millions) Previous Raise Equity / Equity Linked Term Loan ATM Transformative Growth Capital $280M $80M$326M$300M$356M$401-441M$356M of supportive institutional capital raised in last 15 months(1)Targeting$45M -$85M of additional growth capital in FY 2022 to finalize full development of 210 MW Capital Raising Activity11(2) 61%39%Current Capital Structure Equity Debt(1) |

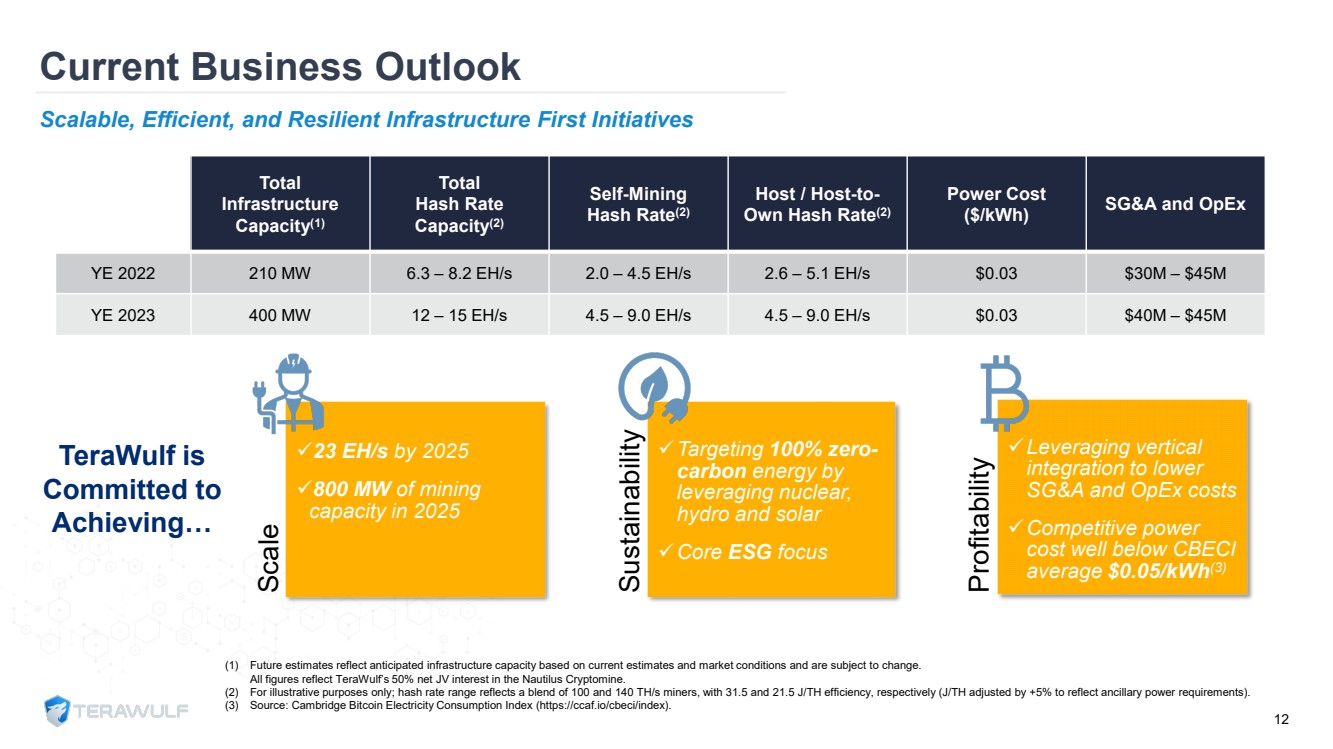

| (1)Future estimates reflect anticipated infrastructure capacity based on current estimates and market conditions and are subjecttochange. All figures reflect TeraWulf’s 50% net JV interest in the Nautilus Cryptomine. (2)For illustrative purposes only; hash rate range reflects a blendof 100 and 140 TH/s miners, with 31.5 and 21.5 J/TH efficiency, respectively (J/TH adjusted by +5% to reflect ancillary powerrequirements).(3)Source: Cambridge Bitcoin Electricity Consumption Index (https://ccaf.io/cbeci/index).12 TotalInfrastructure Capacity(1)TotalHash Rate Capacity(2)Self-Mining Hash Rate(2)Host / Host-to-Own Hash Rate(2)Power Cost ($/kWh)SG&A and OpExYE 2022210 MW6.3 –8.2 EH/s2.0 –4.5 EH/s2.6 –5.1 EH/s$0.03$30M –$45MYE 2023400 MW12 –15 EH/s4.5 –9.0 EH/s4.5 –9.0 EH/s $0.03$40M –$45M Current Business OutlookScalable, Efficient, and Resilient Infrastructure First InitiativesTeraWulf is Committed to Achieving…Scale 23 EH/s by 2025800 MWof mining capacity in 2025 Sustainability Targeting 100% zero-carbon energy by leveraging nuclear, hydro and solar CoreESG focus Profitability Leveraging vertical integration to lower SG&A and OpEx costs Competitive power cost well below CBECI average $0.05/kWh(3) |

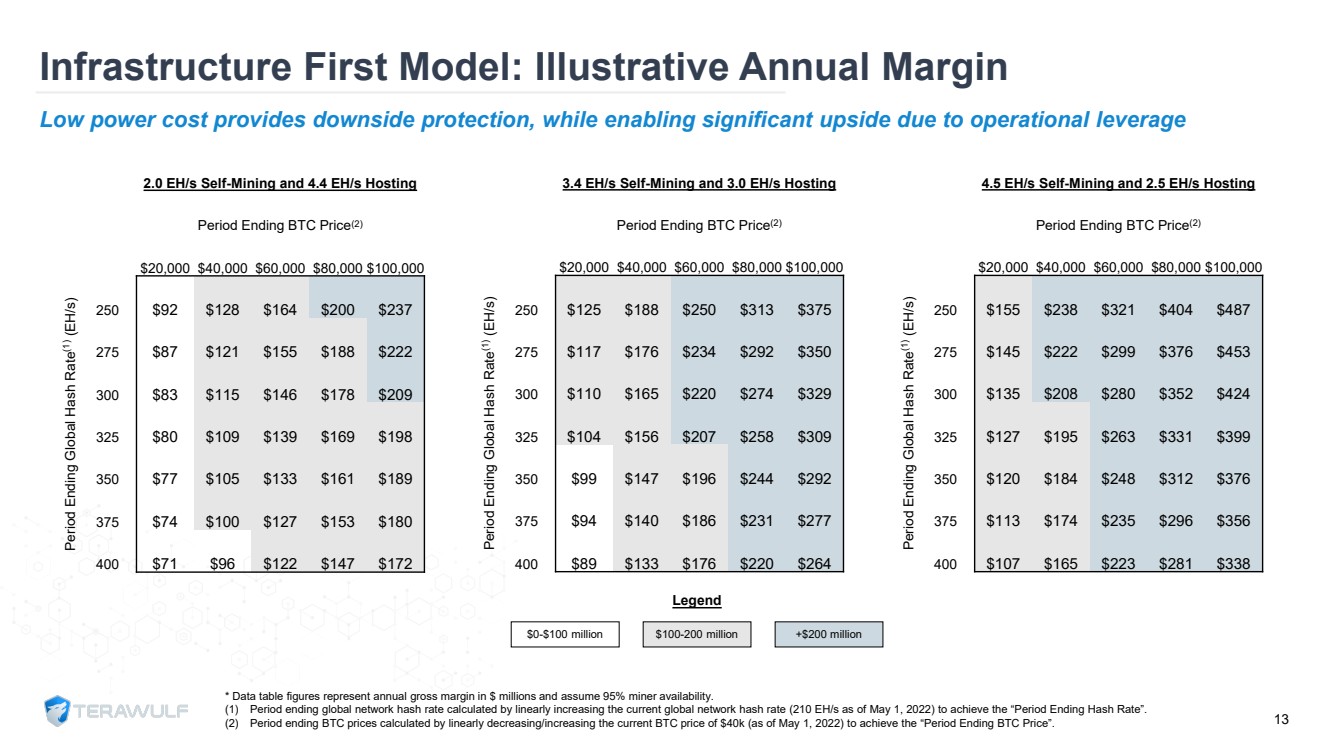

| 2.0 EH/s Self-Mining and 4.4 EH/s HostingPeriod Ending BTC Price(2) $20,000 $40,000 $60,000 $80,000 $100,000 Period Ending Global Hash Rate(1)(EH/s)250$92 $128 $164 $200 $237 275$87 $121 $155 $188 $222 300$83 $115 $146 $178 $209 325$80 $109 $139 $169 $198 350$77 $105 $133 $161 $189 375$74 $100 $127 $153 $180 400$71 $96 $122 $147 $172 Infrastructure First Model: Illustrative Annual Margin* Data table figures represent annual gross margin in $ millions and assume 95% miner availability.(1)Period ending global network hash rate calculated by linearly increasing the current global network hash rate (210 EH/s as ofMay 1, 2022) to achieve the “Period Ending Hash Rate”.(2)Period ending BTC prices calculated by linearly decreasing/increasing the current BTC price of $40k (as of May 1, 2022) to achieve the “Period Ending BTC Price”. 3.4 EH/s Self-Mining and 3.0 EH/s HostingPeriod Ending BTC Price(2) $20,000 $40,000 $60,000 $80,000 $100,000 Period Ending Global Hash Rate(1)(EH/s)250$125 $188 $250 $313 $375 275$117 $176 $234 $292 $350 300$110 $165 $220 $274 $329 325$104 $156 $207 $258 $309 350$99 $147 $196 $244 $292 375$94 $140 $186 $231 $277 400$89 $133 $176 $220 $264 13 $0-$100 million $100-200 million +$200 millionLegend Low power cost provides downside protection, while enabling significant upside due to operational leverage 4.5 EH/s Self-Mining and 2.5 EH/s HostingPeriod Ending BTC Price(2) $20,000 $40,000 $60,000 $80,000 $100,000 Period Ending Global Hash Rate(1)(EH/s)250$155 $238 $321 $404 $487 275$145 $222 $299 $376 $453 300$135 $208 $280 $352 $424 325$127 $195 $263 $331 $399 350$120 $184 $248 $312 $376 375$113 $174 $235 $296 $356 400$107 $165 $223 $281 $338 |

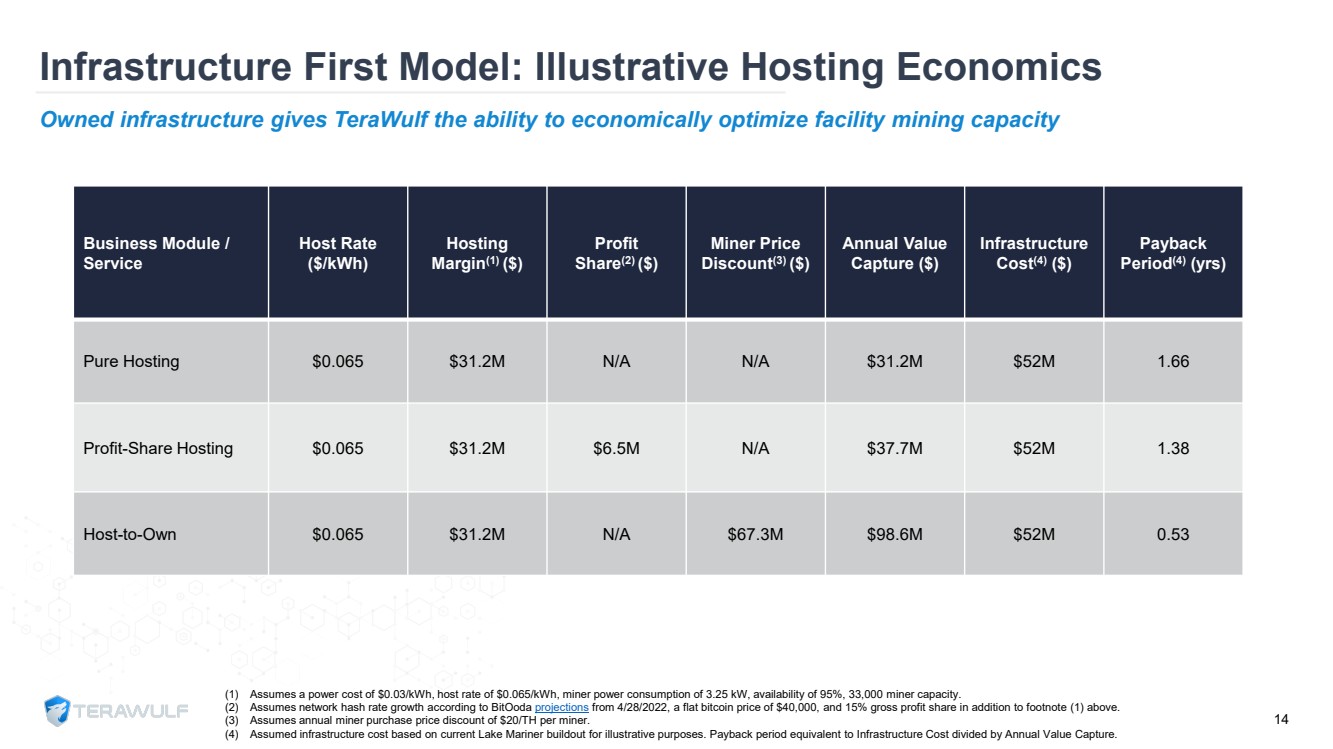

| Business Module / ServiceHost Rate($/kWh)Hosting Margin(1) ($)Profit Share(2) ($)Miner Price Discount(3) ($)Annual Value Capture ($)Infrastructure Cost(4)($)Payback Period(4)(yrs)Pure Hosting$0.065$31.2MN/AN/A$31.2M$52M1.66Profit-Share Hosting$0.065$31.2M$6.5MN/A$37.7M$52M1.38Host-to-Own$0.065$31.2MN/A$67.3M$98.6M$52M0.53 (1)Assumes a power cost of $0.03/kWh, host rate of $0.065/kWh, miner power consumption of 3.25 kW, availability of 95%, 33,000 miner capacity.(2)Assumes network hash rate growth according to BitOoda projections from 4/28/2022, a flat bitcoin price of $40,000, and 15% gross profit share in addition to footnote (1) above.(3)Assumes annual miner purchase price discount of $20/TH per miner.(4)Assumed infrastructure cost based on current Lake Mariner buildout for illustrative purposes. Payback period equivalent to Infrastructure Cost divided by Annual Value Capture.14Infrastructure First Model: Illustrative Hosting EconomicsOwned infrastructure gives TeraWulf the ability to economically optimize facility mining capacity |

| TeraWulf is an Emerging Leader in Digital Asset Infrastructure•Best-in-class crypto mining due to low-cost, sustainable, and domestic bitcoin mining at industrial scale targeting zero-carbon energy leveraging nuclear, hydro, and solar resources•Vertically integrated, infrastructure first strategy ensures ability to create and take advantage of plug-ready digital asset infrastructure•Delivering peer leading economics with a comprehensive and compelling business outlook•Experienced team with decades of energy infrastructure experienceand a model for sustainable, large-scale bitcoin mining•Core ESG focusdifferentiates TeraWulf and contributes to the acceleration of the U.S. transition to a more resilient, stable energy grid15 |

| SITE OVERVIEWS |

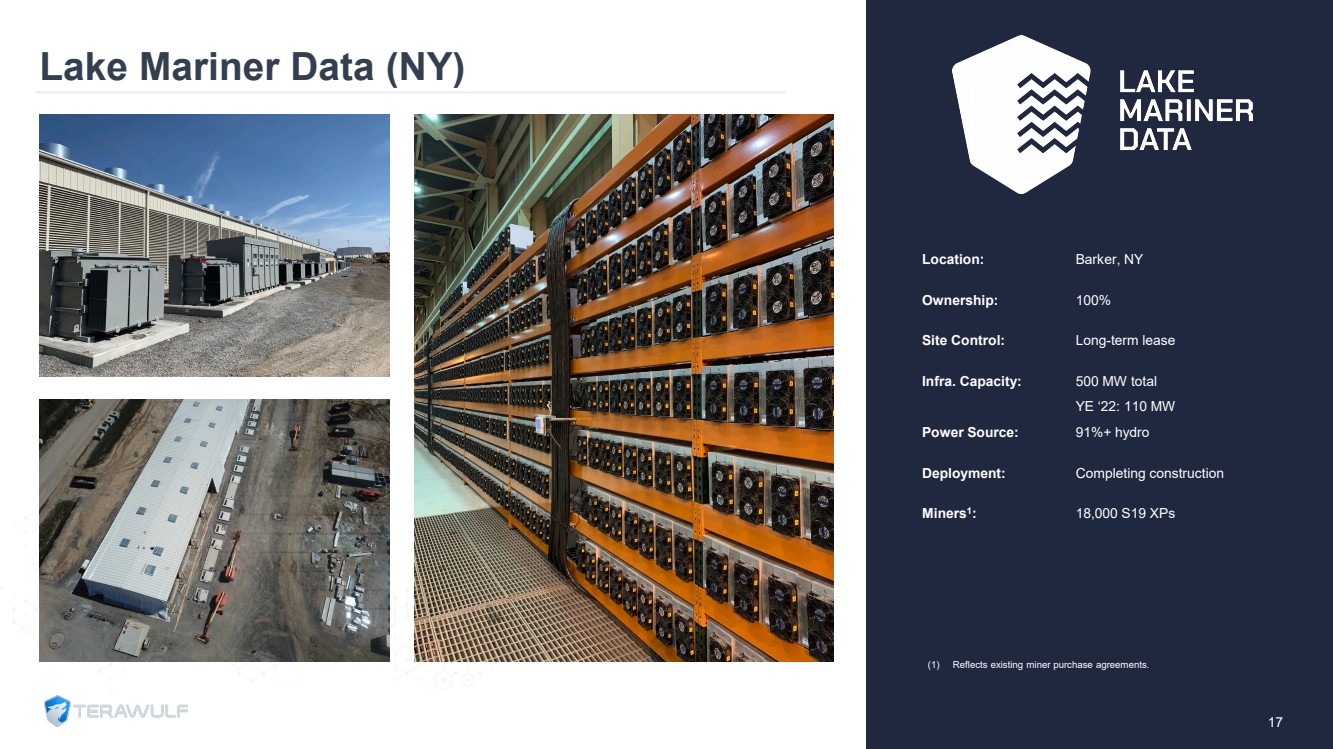

| Lake Mariner Data (NY) 17 Location:Barker, NYOwnership:100%Site Control:Long-term leaseInfra. Capacity:500 MW totalYE ‘22: 110 MWPower Source:91%+ hydroDeployment:Completing constructionMiners1:18,000 S19 XPs(1)Reflects existing miner purchase agreements. |

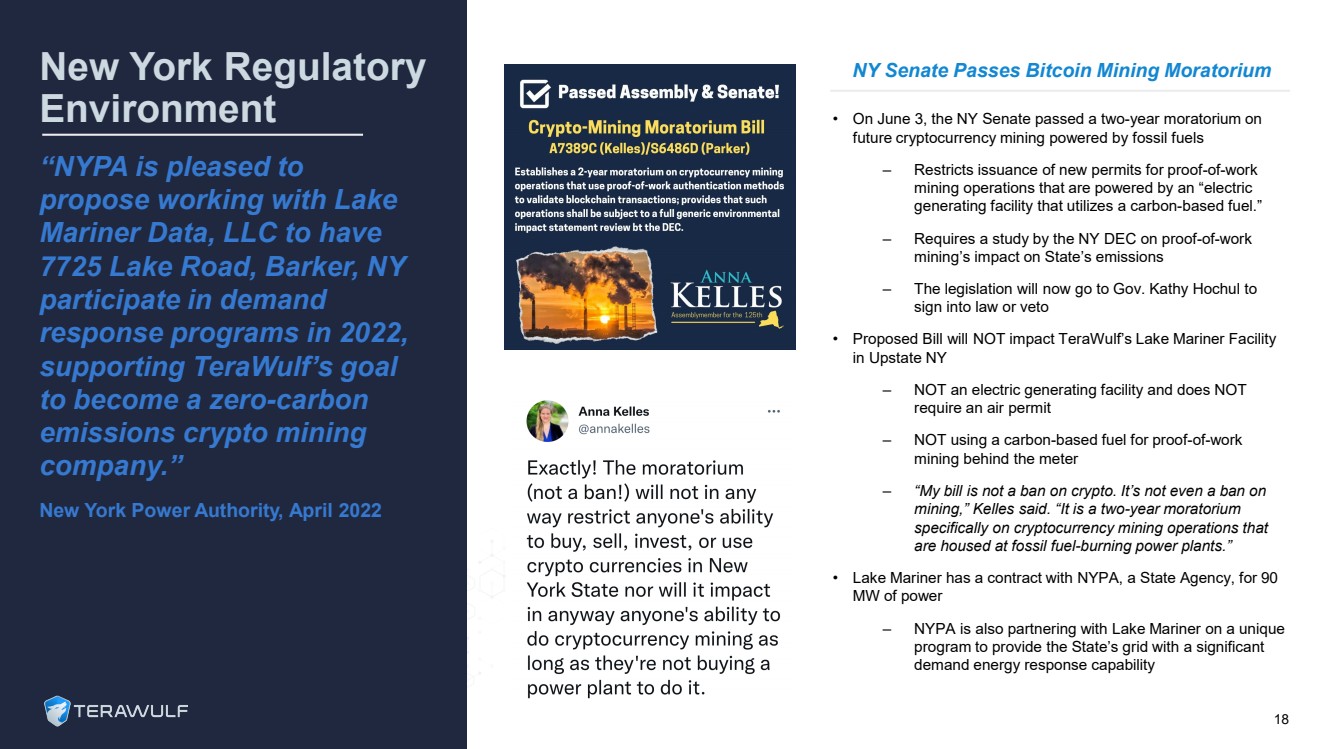

| New York Regulatory Environment“NYPA is pleased to propose working with Lake Mariner Data, LLC to have 7725 Lake Road, Barker, NY participate in demand response programs in 2022, supporting TeraWulf’s goal to become a zero-carbon emissions crypto mining company.”New York Power Authority, April 2022 •On June 3, the NY Senate passed a two-year moratorium on future cryptocurrency mining powered by fossil fuels –Restricts issuance of new permits for proof-of-work mining operations that are powered by an “electric generating facility that utilizes a carbon-based fuel.” –Requires a study by the NY DEC on proof-of-work mining’s impact on State’s emissions–The legislation will now go to Gov. Kathy Hochul to sign into law or veto•Proposed Bill will NOT impact TeraWulf’s Lake Mariner Facility in Upstate NY–NOT an electric generating facility and does NOT require an air permit–NOT using a carbon-based fuel for proof-of-work mining behind the meter–“My bill is not a ban on crypto. It’s not even a ban on mining,” Kelles said. “It is a two-year moratorium specifically on cryptocurrency mining operations that are housed at fossil fuel-burning power plants.”•Lake Mariner has a contract with NYPA, a State Agency, for 90 MW of power –NYPA is also partnering with Lake Mariner on a unique program to provide the State’s grid with a significant demand energy response capability NY Senate Passes Bitcoin Mining Moratorium 18 |

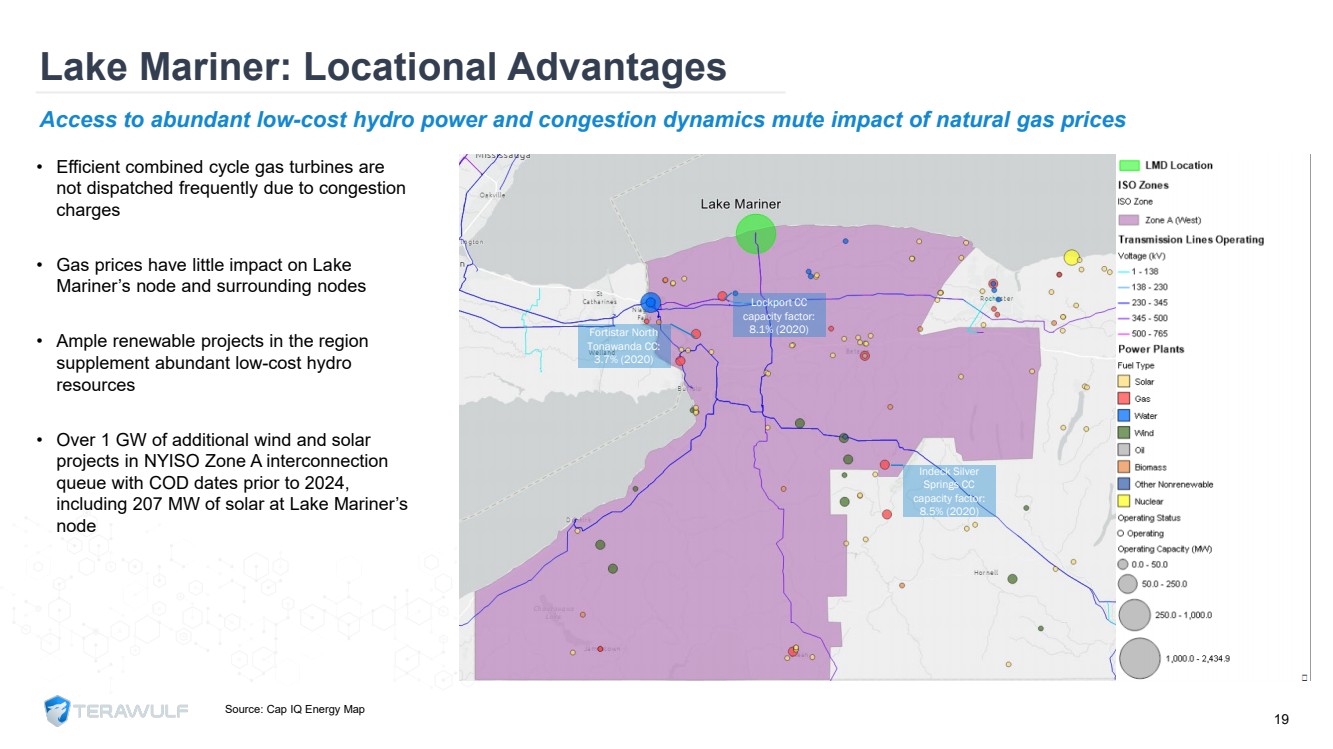

| Lake Mariner: Locational Advantages 19Access to abundant low-costhydro power and congestion dynamics mute impact of natural gas pricesSource: Cap IQ Energy Map Lockport CC capacity factor: 8.1% (2020) Indeck Silver Springs CC capacity factor: 8.5% (2020) Fortistar North Tonawanda CC: 3.7% (2020) •Efficient combined cycle gas turbines are not dispatched frequently due to congestion charges•Gas prices have little impact on Lake Mariner’s node and surrounding nodes•Ample renewable projects in the region supplement abundant low-cost hydro resources•Over 1 GW of additional wind and solar projects in NYISO Zone A interconnection queue with COD dates prior to 2024, including 207 MW of solar at Lake Mariner’s node |

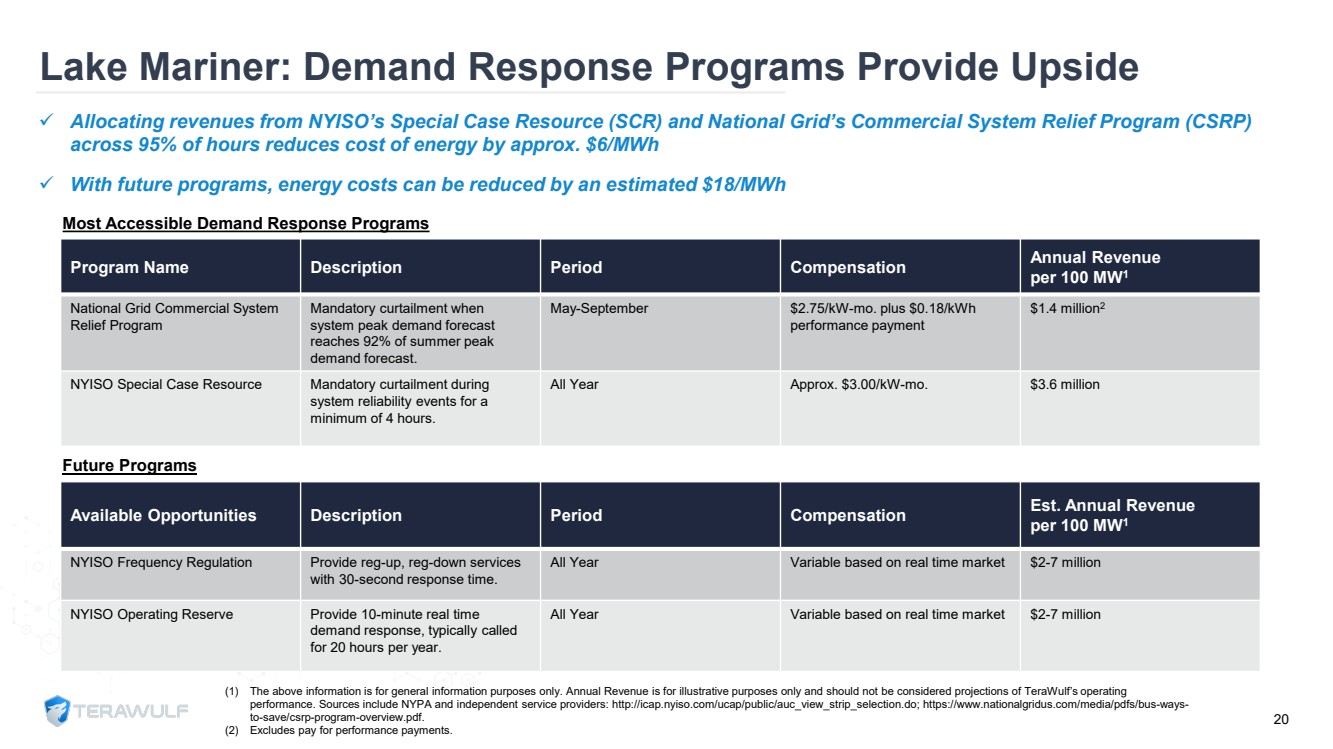

| (1)The above information is for general information purposes only. Annual Revenue is for illustrative purposes only and should not be considered projections of TeraWulf’s operating performance. Sources include NYPA and independent service providers: http://icap.nyiso.com/ucap/public/auc_view_strip_selection.do; https://www.nationalgridus.com/media/pdfs/bus-ways-to-save/csrp-program-overview.pdf. (2)Excludes pay for performance payments.Lake Mariner: Demand Response Programs Provide Upside 20 Program NameDescriptionPeriodCompensationAnnual Revenue per 100 MW1National Grid Commercial System Relief ProgramMandatory curtailment when system peak demand forecast reaches 92% of summer peak demand forecast.May-September$2.75/kW-mo. plus $0.18/kWh performance payment$1.4 million2NYISO Special Case ResourceMandatory curtailment during system reliability events for a minimum of 4 hours.All YearApprox. $3.00/kW-mo.$3.6 million Available OpportunitiesDescriptionPeriodCompensationEst. Annual Revenue per 100 MW1NYISO Frequency RegulationProvide reg-up, reg-down services with 30-second response time.All YearVariable based on real time market$2-7 million NYISO Operating Reserve Provide 10-minute real time demand response, typically called for 20 hours per year.All YearVariable based on real time market$2-7 millionAllocating revenues from NYISO’s Special Case Resource (SCR) and National Grid’s Commercial System Relief Program (CSRP) across 95% of hours reduces cost of energy by approx. $6/MWh With future programs, energy costs can be reduced by an estimated $18/MWh Most Accessible Demand Response Programs Future Programs |

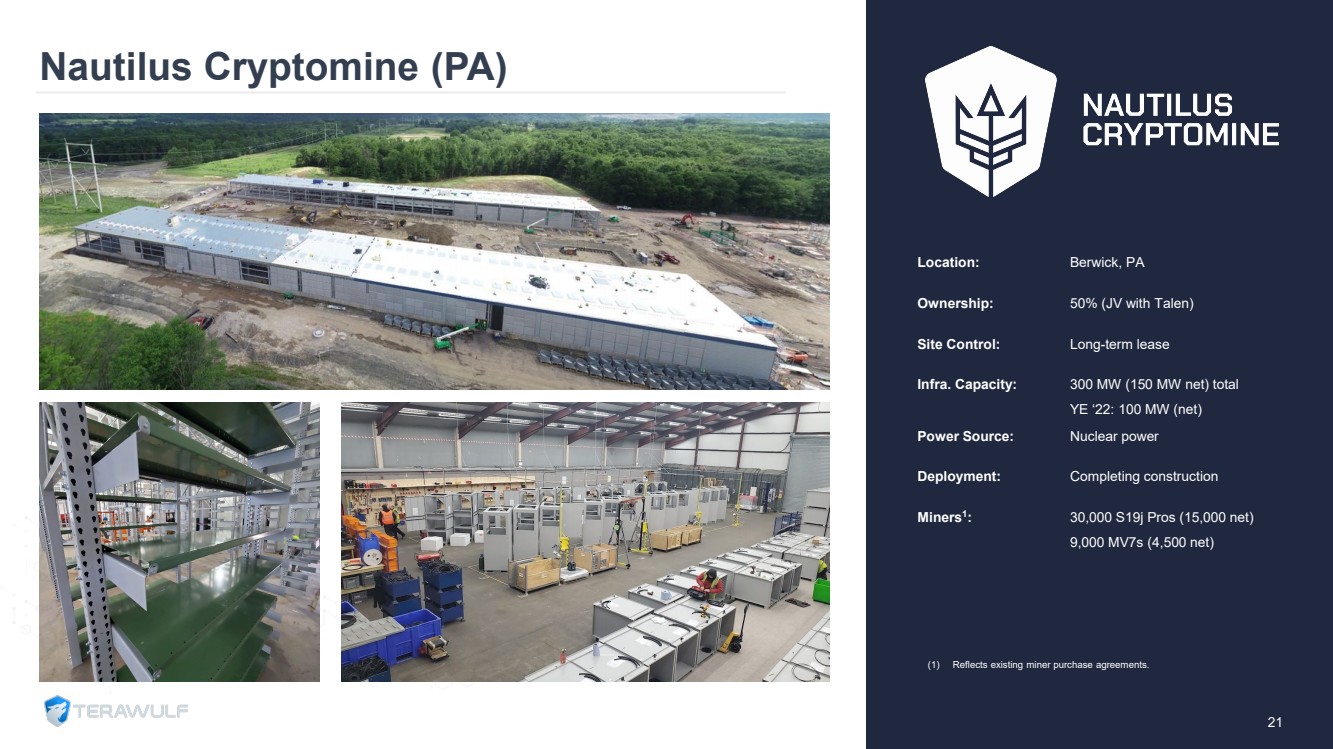

| Nautilus Cryptomine (PA) 21 Location:Berwick, PAOwnership:50% (JV with Talen)Site Control:Long-term leaseInfra. Capacity:300 MW (150 MW net) totalYE ‘22: 100 MW (net)Power Source:Nuclear powerDeployment:Completing constructionMiners1:30,000 S19j Pros (15,000 net) 9,000 MV7s (4,500 net) (1)Reflects existing miner purchase agreements. |

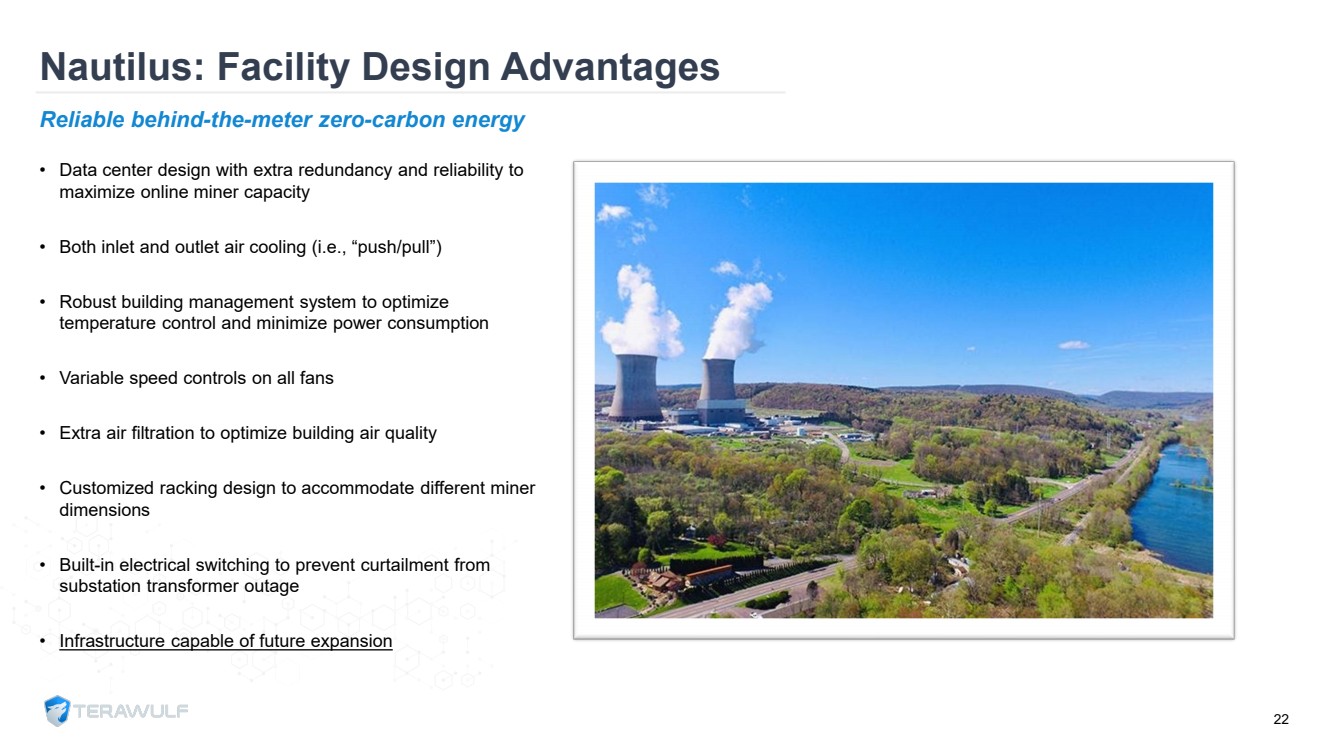

| Nautilus: Facility Design Advantages 22Reliable behind-the-meter zero-carbon energy •Data center design with extra redundancy and reliability to maximize online miner capacity•Both inlet and outlet air cooling (i.e., “push/pull”)•Robust building management system to optimize temperature control and minimize power consumption•Variable speed controls on all fans•Extra air filtration to optimize building air quality•Customized racking design to accommodate different miner dimensions•Built-in electrical switching to prevent curtailment from substation transformer outage•Infrastructure capable of future expansion |

| APPENDIX |

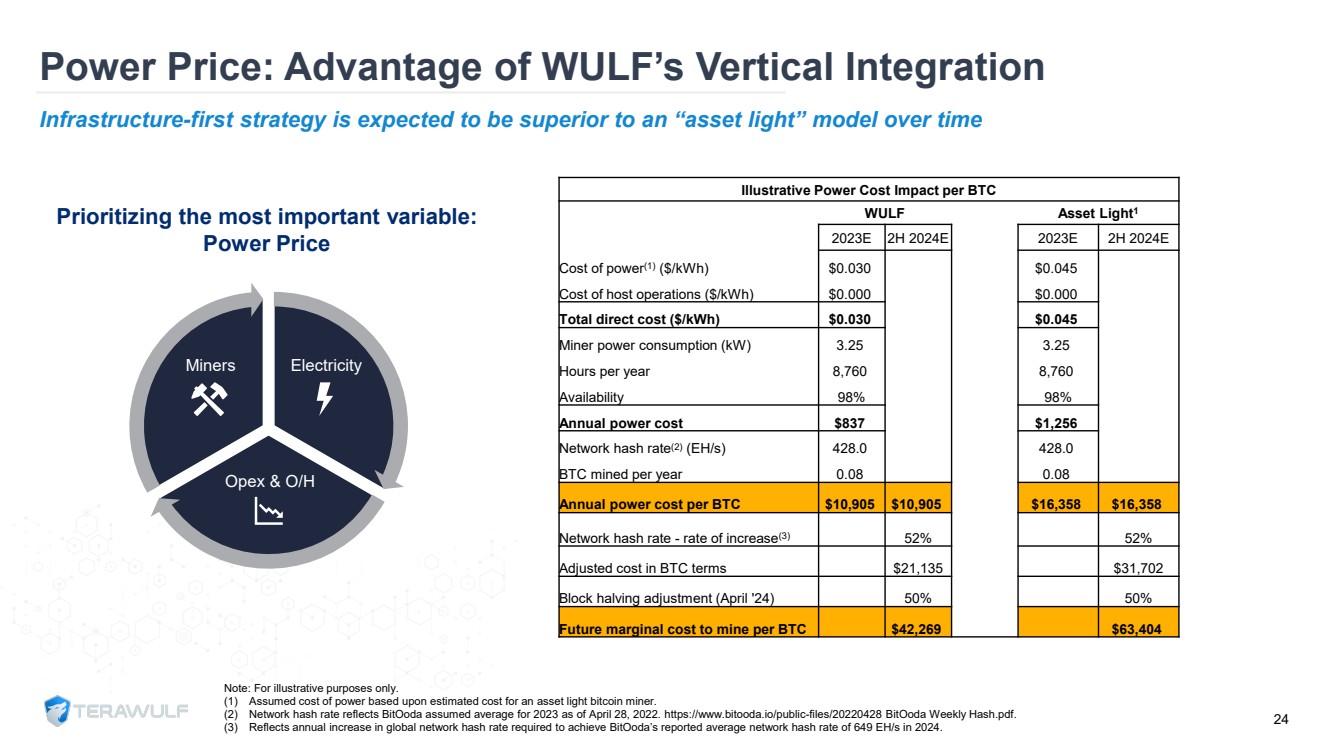

| Electricity Opex & O/H Miners Note: For illustrative purposes only.(1)Assumed cost of power based upon estimated cost for an asset light bitcoin miner.(2)Network hash rate reflects BitOoda assumed average for 2023 as of April 28, 2022. https://www.bitooda.io/public-files/20220428 BitOoda Weekly Hash.pdf.(3)Reflects annual increase in global network hash rate required to achieve BitOoda’sreported average network hash rate of 649 EH/s in 2024. Illustrative Power Cost Impact per BTCWULFAsset Light12023E2H 2024E2023E2H 2024E Cost of power (1)($/kWh) $0.030$0.045 Cost of host operations ($/kWh) $0.000$0.000 Total direct cost ($/kWh) $0.030$0.045 Miner power consumption (kW) 3.253.25 Hours per year 8,7608,760 Availability 98%98% Annual power cost $837$1,256 Network hash rate (2)(EH/s) 428.0428.0 BTC mined per year 0.080.08 Annual power cost per BTC $10,905$10,905$16,358$16,358 Network hash rate -rate of increase(3) 52%52% Adjusted cost in BTC terms $21,135$31,702 Block halving adjustment (April '24) 50%50% Future marginal cost to mine per BTC $42,269$63,404 Infrastructure-first strategy is expected to besuperior to an “asset light” model over timePrioritizing the most important variable: Power Price24Power Price: Advantage of WULF’s Vertical Integration |

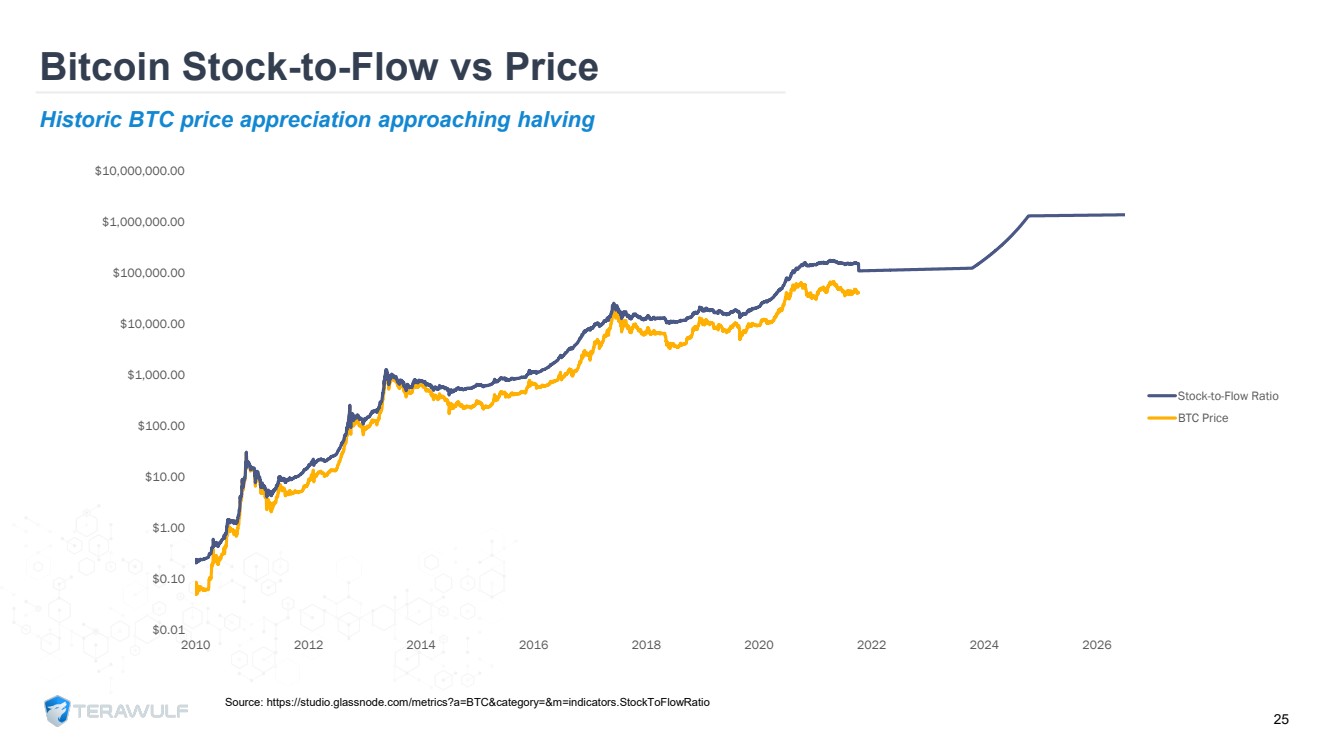

| Bitcoin Stock-to-Flow vs Price Historic BTC price appreciation approaching halvingSource: https://studio.glassnode.com/metrics?a=BTC&category=&m=indicators.StockToFlowRatio $0.01$0.10$1.00$10.00$100.00$1,000.00$10,000.00$100,000.00$1,000,000.00$10,000,000.00201020122014201620182020202220242026 Stock-to-Flow Ratio BTC Price25 |

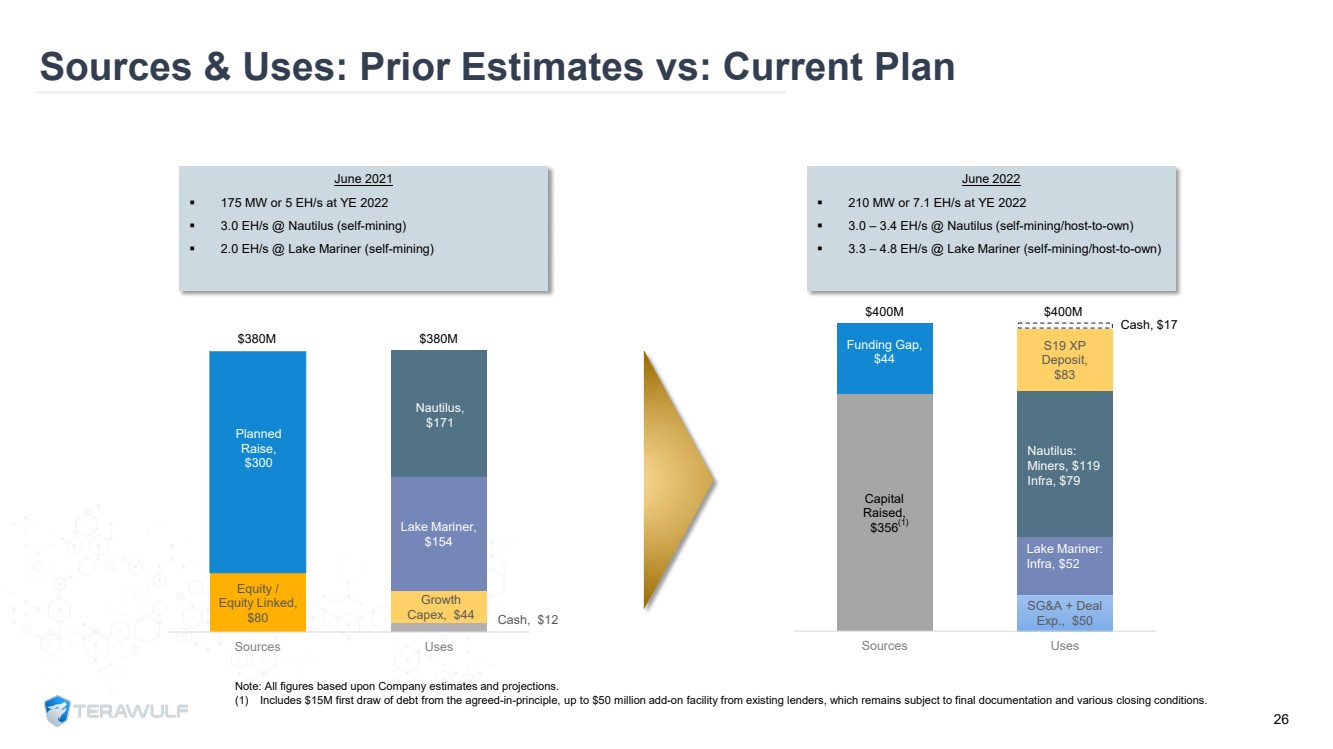

| Capital Raised, $356Funding Gap, $44SG&A + Deal Exp., $50 S19 XP Deposit, $83 SourcesUsesSources & Uses: Prior Estimates vs: Current Plan Equity / Equity Linked, $80 Planned Raise, $300 Cash, $12 Growth Capex, $44 Lake Mariner, $154 Nautilus, $171 SourcesUses$380M$380M$400M $400MCash, $1726 June 2021 175 MW or 5 EH/s at YE 20223.0 EH/s @ Nautilus (self-mining)2.0 EH/s @ Lake Mariner (self-mining) June 2022 210 MW or 7.1 EH/s at YE 20223.0 –3.4 EH/s @ Nautilus (self-mining/host-to-own)3.3 –4.8 EH/s @ Lake Mariner (self-mining/host-to-own) Nautilus:Miners, $119 Infra, $79Lake Mariner: Infra, $52Note: All figures based upon Company estimates and projections.(1)Includes $15M first draw of debt from the agreed-in-principle, up to $50 million add-on facility from existing lenders, which remains subject to final documentation and various closing conditions.(1) |

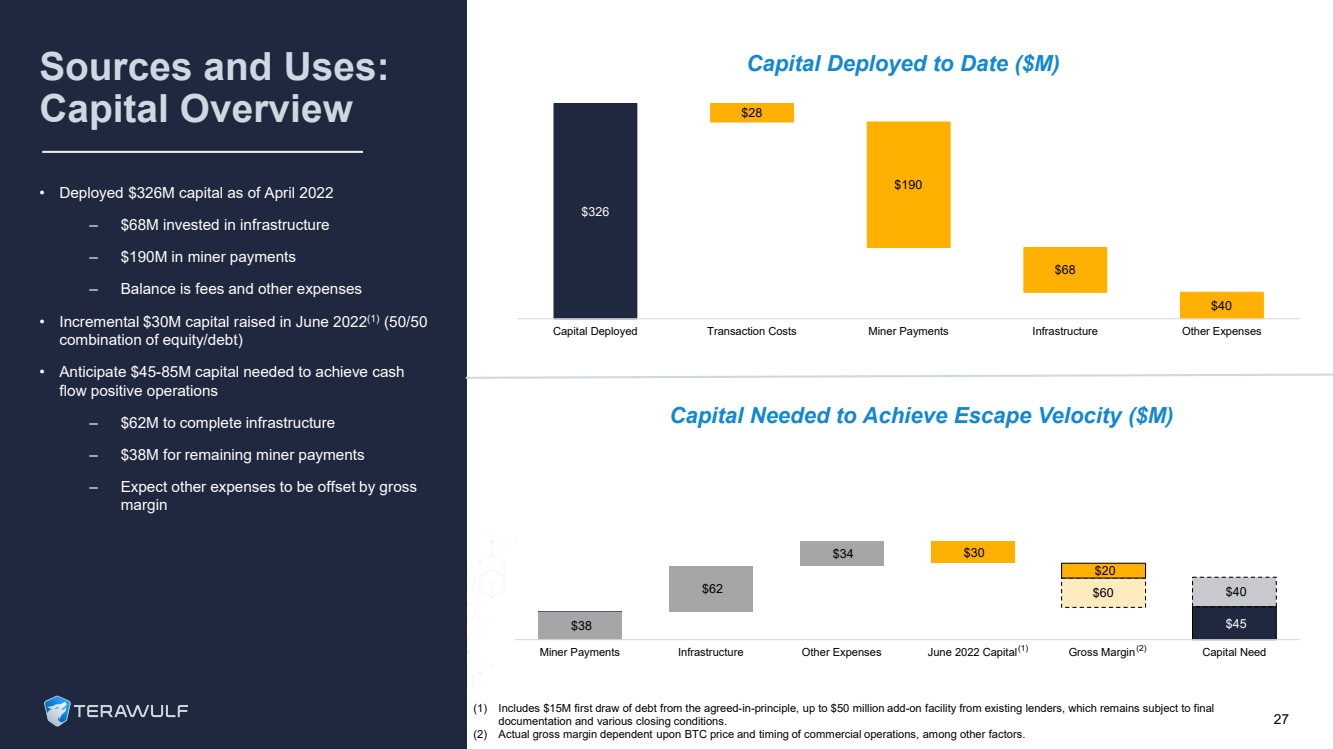

| $38 $62 $34 $30 $60$20 $45 $40 Miner PaymentsInfrastructureOther ExpensesJune 2022 CapitalGross MarginCapital NeedSources and Uses: Capital Overview•Deployed $326M capital as of April 2022–$68M invested in infrastructure–$190M in miner payments–Balance is fees and other expenses•Incremental $30M capital raised in June 2022(1)(50/50 combination of equity/debt)•Anticipate $45-85M capital needed to achieve cash flow positive operations–$62M to complete infrastructure–$38M for remaining miner payments–Expect other expenses to be offset by gross margin(1)Includes $15M first draw of debt from the agreed-in-principle, up to $50 million add-on facility from existing lenders, which remains subject to final documentation and various closing conditions.(2)Actual gross margin dependent upon BTC price and timing of commercial operations, among other factors. $326$28$190$68$40Capital DeployedTransaction CostsMiner PaymentsInfrastructureOther Expenses 27(2)$74Capital Deployed to Date ($M)Capital Needed to Achieve Escape Velocity ($M)(1) |

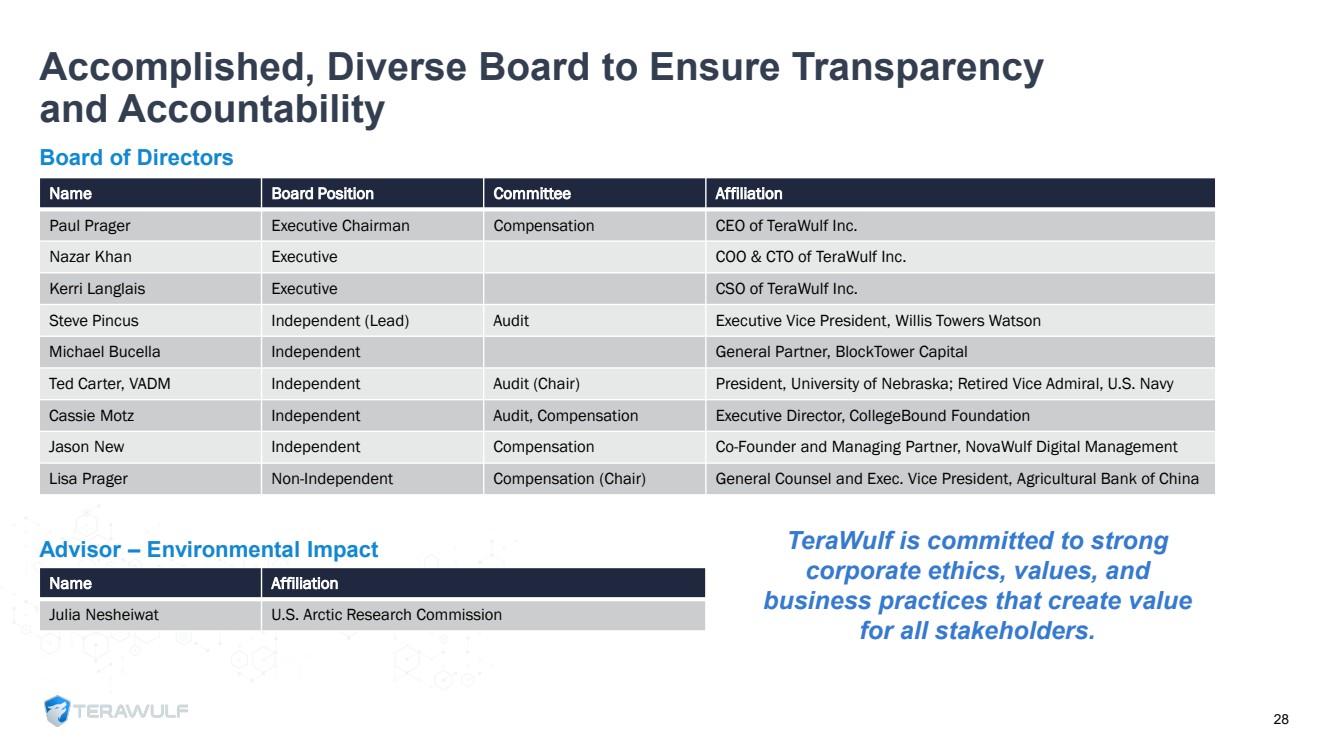

| Accomplished, Diverse Board to Ensure Transparency and Accountability28 Name Board Position Committee Affiliation Paul PragerExecutive ChairmanCompensationCEO of TeraWulf Inc.Nazar KhanExecutiveCOO & CTO of TeraWulf Inc.Kerri LanglaisExecutiveCSO of TeraWulf Inc.Steve PincusIndependent (Lead)AuditExecutive Vice President, Willis Towers WatsonMichael BucellaIndependentGeneral Partner, BlockTower CapitalTed Carter, VADMIndependentAudit (Chair)President, University of Nebraska; Retired Vice Admiral, U.S. NavyCassie MotzIndependentAudit, CompensationExecutive Director, CollegeBound FoundationJason NewIndependentCompensationCo-Founder and Managing Partner, NovaWulf Digital ManagementLisa PragerNon-IndependentCompensation (Chair)General Counsel and Exec. Vice President, Agricultural Bank of China Name Affiliation Julia NesheiwatU.S. Arctic Research CommissionBoard of DirectorsAdvisor –Environmental ImpactTeraWulf is committed to strong corporate ethics, values, and business practices that create value for all stakeholders. |

| 29Advancing TeraWulf’s Mission to Address Significant Societal Challenges of Today Founded in 2021, the Foundation focuses on funding and participating in social health, environmental and sustainable programs. Initial funding of 2.3% of outstanding WULF common stock.In collaboration with reputable organizations and WULF’s talented employees, the Foundation’s objective is to affect large-scale change in the communities in which we operate and around the world.In January 2022, the Foundation made its inaugural financial commitment to the Chesapeake Conservancy to support the initiative to elevate the national significance of the Chesapeake Bay and provide ecological, cultural, and economic benefits to its multi-state watershed region.TeraWulf Charitable FoundationA private, philanthropic organization focused on funding and participating in social health, environmental, and sustainability initiatives. |

| NASDAQ: WULFContact:ir@terawulf.comwww.TeraWulf.com/contact |