| 1 NASDAQ: WULFSeptember 2022An Infrastructure-Focused Mining CompanyAccelerating the Transition to a Zero-Carbon Future |

| SAFE HARBOR STATEMENT Thispresentationisforinformationalpurposesonlyandcontainsforward-lookingstatementswithinthemeaningofthe"safeharbor"provisionsofthePrivateSecuritiesLitigationReformActof1995,asamended.Suchforward-lookingstatementsincludestatementsconcerninganticipatedfutureeventsandexpectationsthatarenothistoricalfacts.Allstatements,otherthanstatementsofhistoricalfact,arestatementsthatcouldbedeemedforward-lookingstatements.Inaddition,forward-lookingstatementsaretypicallyidentifiedbywordssuchas"plan,""believe,""goal,""target,""aim,""expect,""anticipate,""intend,""outlook,""estimate,""forecast,""project,""continue,""could,""may,""might,""possible,""potential,""predict,""should,""would"andothersimilarwordsandexpressions,althoughtheabsenceofthesewordsorexpressionsdoesnotmeanthatastatementisnotforward-looking.Forward-lookingstatementsarebasedonthecurrentexpectationsandbeliefsofTeraWulf'smanagementandareinherentlysubjecttoanumberoffactors,risks,uncertaintiesandassumptionsandtheirpotentialeffects.Therecanbenoassurancethatfuturedevelopmentswillbethosethathavebeenanticipated.Actualresultsmayvarymateriallyfromthoseexpressedorimpliedbyforward-lookingstatementsbasedonanumberoffactors,risks,uncertaintiesandassumptions,including,amongothers:(1)conditionsinthecryptocurrencyminingindustry,includingfluctuationinthemarketpricingofbitcoinandothercryptocurrencies,andtheeconomicsofcryptocurrencymining,includingastovariablesorfactorsaffectingthecost,efficiencyandprofitabilityofcryptocurrencymining;(2)competitionamongthevariousprovidersofdataminingservices;(3)changesinapplicablelaws,regulationsand/orpermitsaffectingTeraWulf'soperationsortheindustriesinwhichitoperates,includingregulationregardingpowergeneration,cryptocurrencyusageand/orcryptocurrencymining;(4)theabilitytoimplementcertainbusinessobjectivesandtotimelyandcost-effectivelyexecuteintegratedprojects;(5)failuretoobtainadequatefinancingonatimelybasisand/oronacceptabletermswithregardtogrowthstrategiesoroperations;(6)lossofpublicconfidenceinbitcoinorothercryptocurrenciesandthepotentialforcryptocurrencymarketmanipulation;(7)thepotentialofcybercrime,money-laundering,malwareinfectionsandphishingand/orlossandinterferenceasaresultofequipmentmalfunctionorbreak-down,physicaldisaster,datasecuritybreach,computermalfunctionorsabotage(andthe costsassociatedwithanyoftheforegoing);(8)theavailability,deliveryscheduleandcostofequipmentnecessarytomaintainandgrowthebusinessandoperationsofTeraWulf,includingminingequipmentandequipmentmeetingthetechnicalorotherspecificationsrequiredtoachieveitsgrowthstrategy;(9)employmentworkforcefactors,includingthelossofkeyemployees;(10)litigationrelatingtoTeraWulf,IKONICSand/orthebusinesscombination;(11)theabilitytorecognizetheanticipatedobjectivesandbenefitsofthebusinesscombination;and(12)otherrisksanduncertaintiesdetailedfromtimetotimeintheCompany'sfilingswiththeSecuritiesandExchangeCommission("SEC").Potentialinvestors,stockholdersandotherreadersarecautionednottoplaceunduerelianceontheseforward-lookingstatements,whichspeakonlyasofthedateonwhichtheyweremade.TeraWulfdoesnotassumeanyobligationtopubliclyupdateanyforward-lookingstatementafteritwasmade,whetherasaresultofnewinformation,futureeventsorotherwise,exceptasrequiredbylaworregulation.Investorsarereferredtothefulldiscussionofrisksanduncertaintiesassociatedwithforward-lookingstatementsandthediscussionofriskfactorscontainedintheCompany'sfilingswiththeSEC,whichareavailableatwww.sec.gov. |

| Our MissionTo be the premier U.S. based, large-scale, zero-carbonbitcoin miner,generating attractive investorreturnswhile providingsustainable benefits forourcommunities. Experienced Energy EntrepreneursInfrastructure FirstScalable and FlexibleTransparent Governance Business IntegrityResponsible Energy SourcingZero-Carbon EnergyFlexible BaseloadEnvironmental StewardshipOur Core ValuesESG is at the core of TeraWulf's corporate strategy and ties directly to its business success, risk mitigation, and reputational value. 3 |

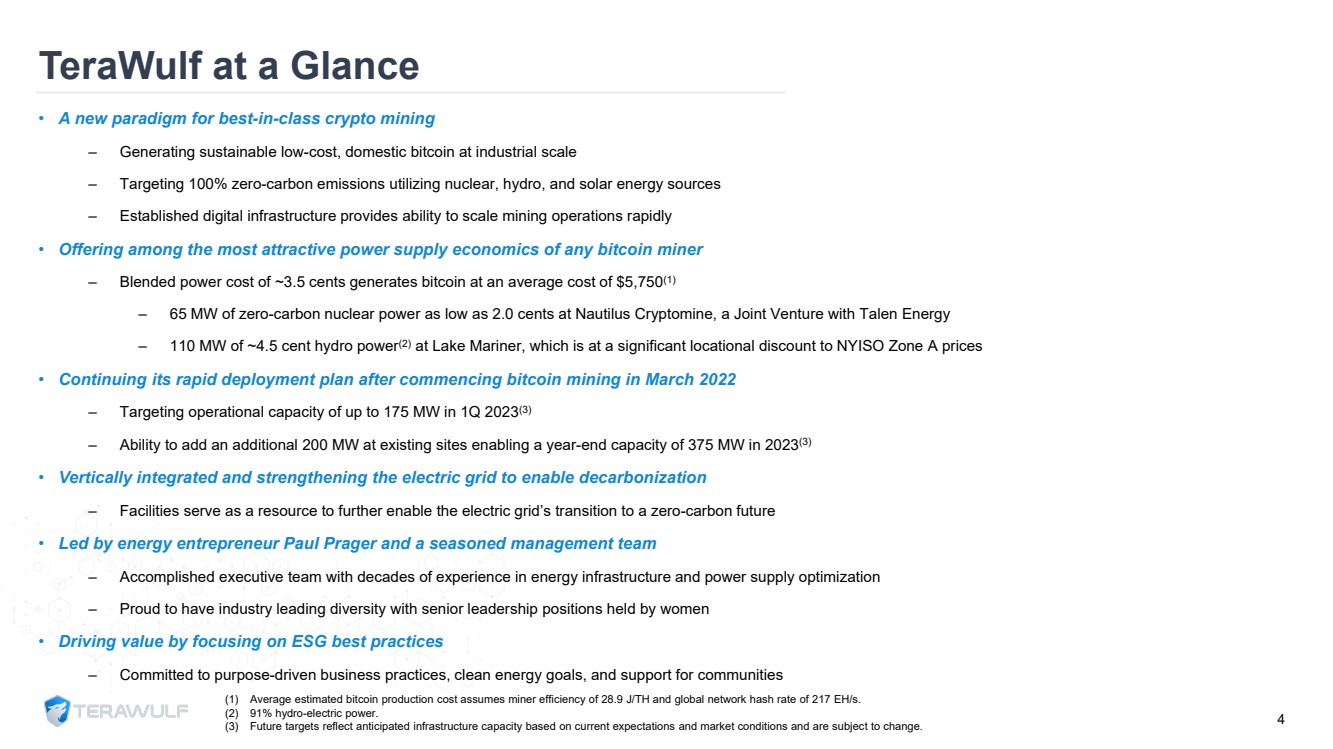

| (1)Average estimated bitcoin production cost assumes miner efficiency of 28.9 J/TH and global network hash rate of 217 EH/s. (2)91% hydro-electric power. (3)Future targets reflect anticipated infrastructure capacity based on current expectations and market conditions and are subject to change. TeraWulf at a Glance•A new paradigm for best-in-class crypto mining–Generating sustainable low-cost, domestic bitcoin at industrial scale–Targeting 100% zero-carbon emissions utilizing nuclear, hydro, and solar energy sources–Established digital infrastructure provides ability to scale mining operations rapidly•Offering among the most attractive power supply economics of any bitcoin miner–Blended power cost of ~3.5 cents generates bitcoin at an average cost of $5,750(1)–65 MW of zero-carbon nuclear power as low as 2.0 cents at Nautilus Cryptomine, a Joint Venture with Talen Energy–110 MW of ~4.5 cent hydro power(2)at Lake Mariner, which is at a significant locational discount to NYISO Zone A prices•Continuing its rapid deployment plan after commencing bitcoin mining in March 2022–Targeting operational capacity of up to 175 MW in 1Q 2023(3)–Ability to add an additional 200 MW at existing sites enabling a year-end capacity of 375 MW in 2023(3)•Vertically integrated and strengthening the electric grid to enable decarbonization–Facilities serve as a resource to further enable the electric grid’s transition to a zero-carbon future•Led by energy entrepreneur Paul Prager and a seasoned management team–Accomplished executive team with decades of experience in energy infrastructure and power supply optimization–Proud to have industry leading diversity with senior leadership positions held by women•Driving value by focusing on ESG best practices–Committed to purpose-driven business practices, clean energy goals, and support for communities4 |

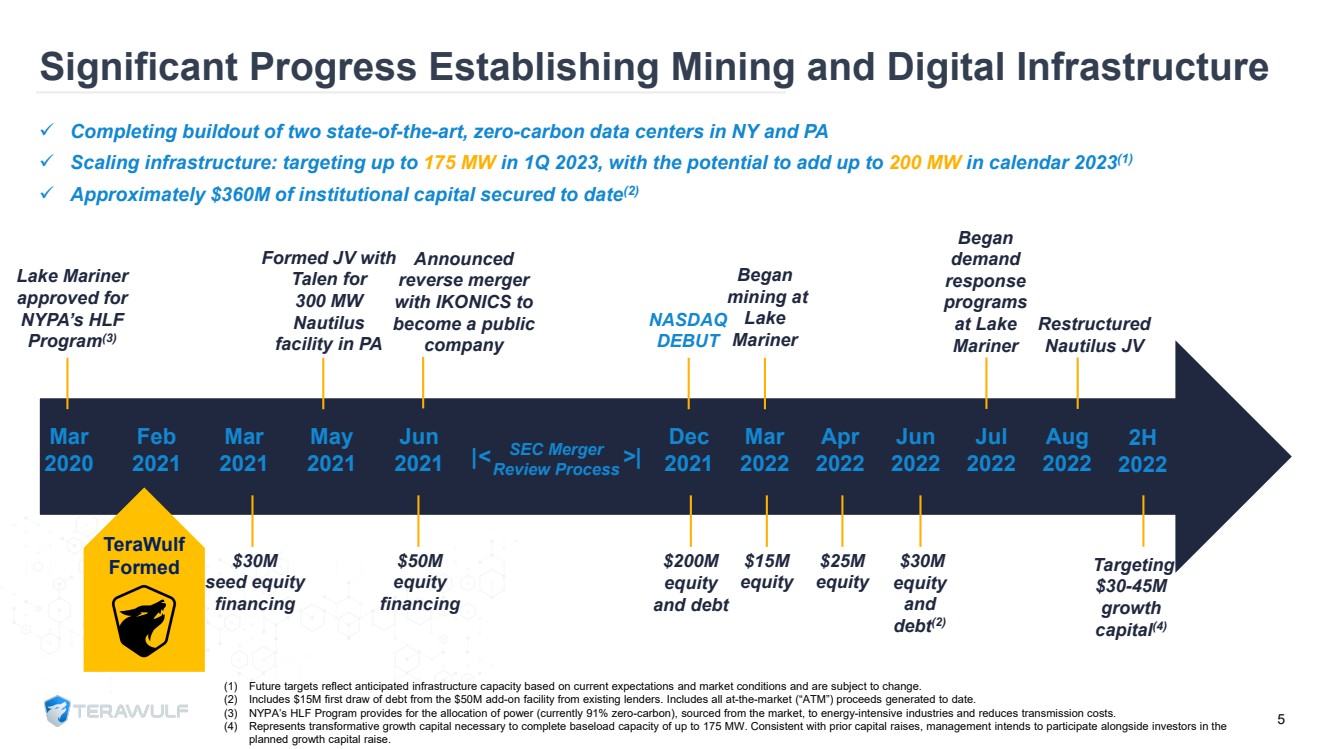

| Mar2022Feb2021Mar2021May2021Jun2021Dec2021 TeraWulf Formed Lake Mariner approved for NYPA’s HLF Program(3)$30M seed equity financingSEC Merger Review Process$50M equity financing Formed JV with Talen for 300 MW Nautilus facility in PACompleting buildout of two state-of-the-art, zero-carbon data centers in NY and PAScaling infrastructure: targeting up to 175 MW in 1Q 2023, with the potential to add up to 200 MW in calendar 2023(1)Approximately $360M of institutional capital secured to date(2)Beganmining at Lake Mariner$200M equity and debt$15M equity5Significant Progress Establishing Mining and Digital Infrastructure Apr2022 $25M equityJun2022 NASDAQ DEBUT $30M equity and debt(2) Announced reverse merger with IKONICS to become a public company(1)Future targets reflect anticipated infrastructure capacity based on current expectations and market conditions and are subject to change.(2)Includes $15M first draw of debt from the $50M add-on facility from existing lenders. Includes all at-the-market (“ATM”) proceeds generated to date.(3)NYPA’s HLF Program provides for the allocation of power (currently 91% zero-carbon), sourced from the market, to energy-intensive industries and reduces transmission costs.(4)Represents transformative growth capital necessary to complete baseload capacity of up to 175 MW. Consistent with prior capital raises, management intends to participate alongside investors in the planned growth capital raise.Mar2020 2H2022 Targeting $30-45M growth capital(4)|<>|Aug2022Jul2022 Restructured Nautilus JV Began demand response programs at Lake Mariner |

| Why WULF Wins: The Four “P’s”Digital Asset Infrastructure FirstFoundation to Scale Experienced Energy EntrepreneursPower & InfrastructureExpertsSustainable, Scalable FacilitiesKey Relationships & Site ControlESG Principled and PracticedDriving the Future of Bitcoin Mining6 PlugsPeoplePowerPriorities |

| People: Best-in-Class Management TeamLed by an accomplished, diverse management team with 30+ years of experience in developing and managing energy infrastructureand disruptive technology N A Z A R K H A NCo-Founder, Chief Operating Officer & Chief Technology Officer20+ years in energy infrastructure and cryptocurrency mining. Previously at Evercore. K E R R I L A N G L A I S Chief Strategy Officer20+ years of M&A, financing, strategy, and power sector experience. Previously at Goldman Sachs.S E A N F A R RE L LVP, Operations12+ years of energy experience in renewables, grid optimization, digitalization, and storage solutions. Previously at Siemens Energy.P A U L P R A G E RCo-Founder, Chairman & Chief Executive Officer30+ year energy infrastructure entrepreneur. USNA Foundation Investment Committee Trustee.P A T R I C K F L E U R Y Chief Financial Officer20+ years of financial experience in the energy, power, and commodity sectors. Previously at Platinum Equity and Blackstone.S T E F A N I E F L E I S C H M A N NGeneral CounselGeneral Counsel for 15+ years overseeing all legal and compliance matters. Previously at Paul, Weiss.7 |

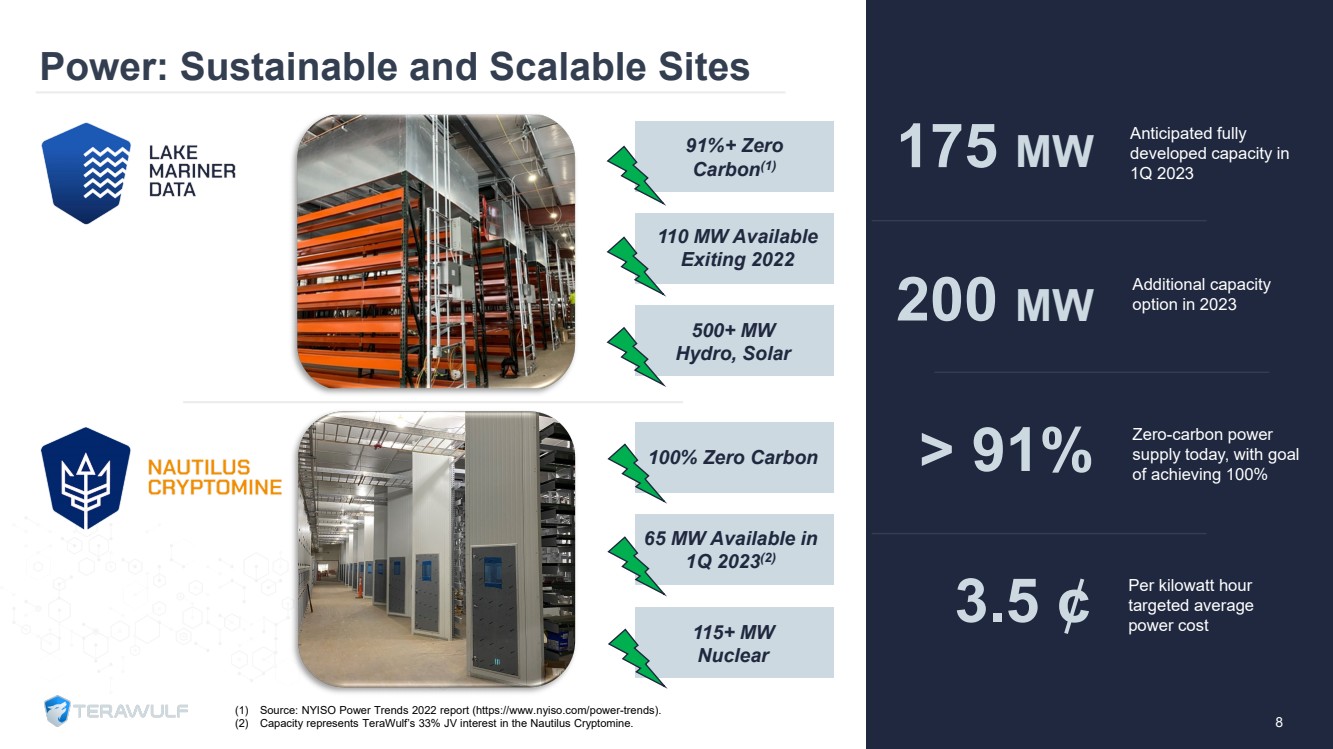

| Power: Sustainable and Scalable Sites200 MWAdditional capacity option in 2023> 91%Zero-carbon power supply today, with goal of achieving 100%3.5 ¢ Per kilowatt hour targeted average power cost8 91%+ Zero Carbon(1)110 MW Available Exiting 2022500+ MW Hydro, Solar 100% Zero Carbon65 MW Available in 1Q 2023(2)115+ MW Nuclear (1)Source: NYISO Power Trends 2022 report (https://www.nyiso.com/power-trends).(2)Capacity represents TeraWulf’s33% JV interest in the Nautilus Cryptomine.175 MWAnticipated fully developed capacity in 1Q 2023 |

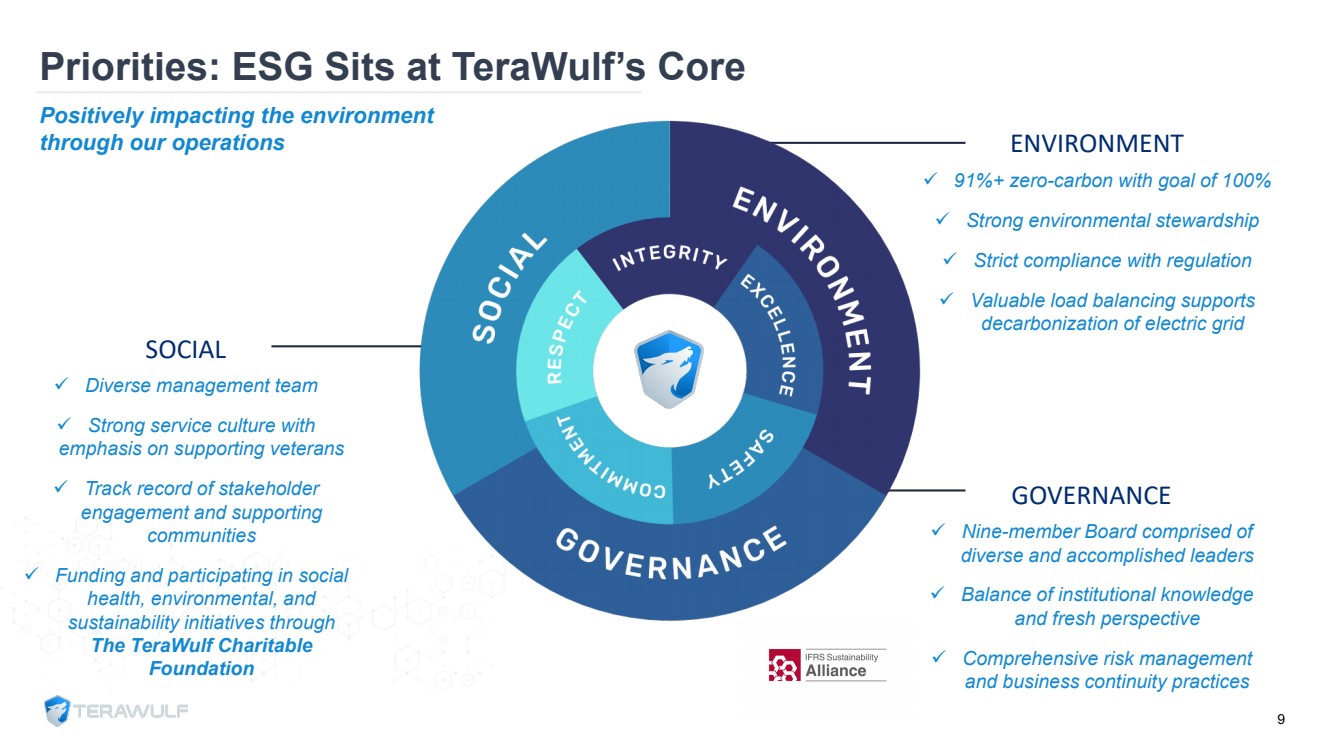

| Positively impacting theenvironment through our operations SOCIALDiverse management team Strong service culture with emphasis on supporting veteransTrack record of stakeholder engagement and supporting communitiesFunding and participating in social health, environmental, and sustainability initiatives through TheTeraWulf Charitable FoundationENVIRONMENT91%+ zero-carbon with goal of 100%Strong environmental stewardshipStrict compliance with regulationValuable load balancing supports decarbonization of electric gridGOVERNANCENine-member Board comprised of diverse and accomplished leadersBalance of institutional knowledge and fresh perspectiveComprehensive risk management and business continuity practices 9 Priorities: ESG Sits at TeraWulf’s Core |

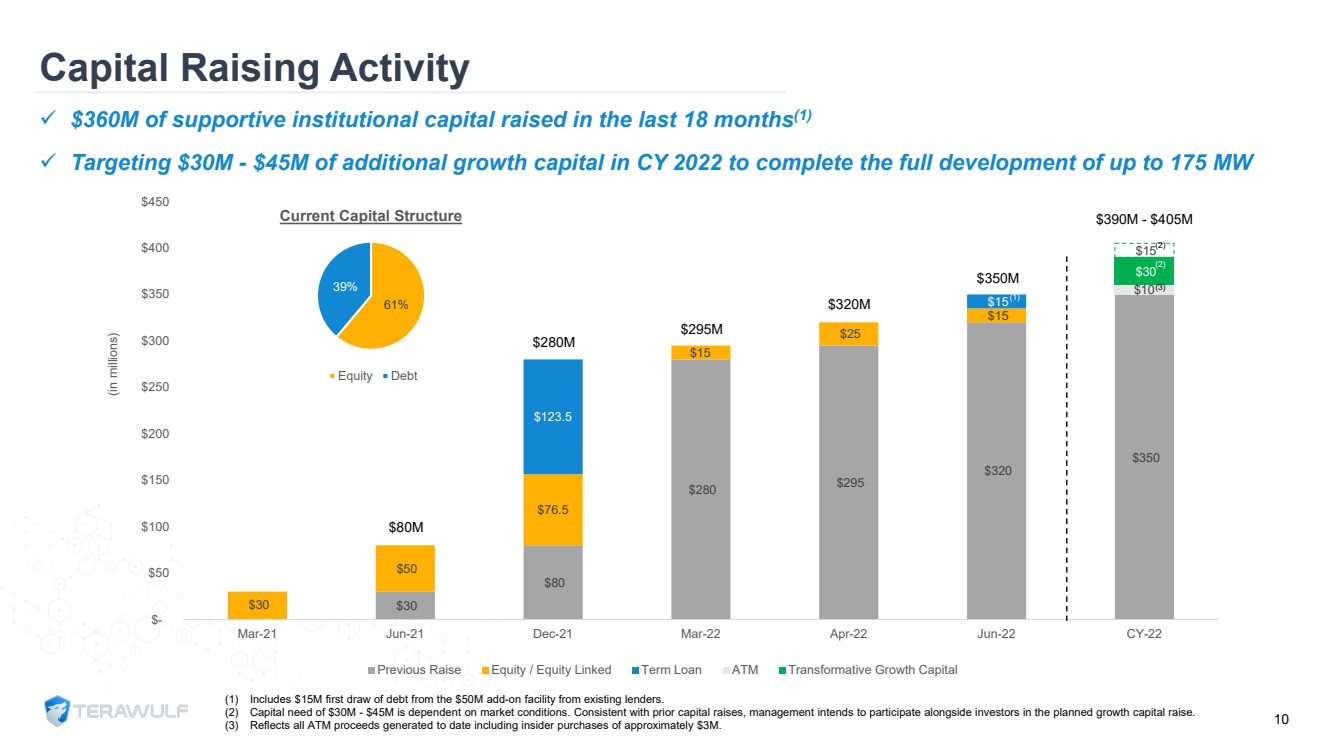

| (1)Includes $15M first draw of debt from the $50M add-on facility from existing lenders.(2)Capital need of $30M -$45M is dependent on market conditions. Consistent with prior capital raises, management intends to participate alongside investors in the planned growth capital raise.(3)Reflects all ATM proceeds generated to date including insider purchases of approximately $3M. $30 $80 $280 $295 $320 $350 $30 $50 $76.5$15 $25 $15 $123.5$15 $10$30 $15 $- $50 $100 $150 $200 $250 $300 $350 $400 $450Mar-21Jun-21Dec-21Mar-22Apr-22Jun-22CY-22(in millions) Previous Raise Equity / Equity Linked Term Loan ATM Transformative Growth Capital $280M $80M$320M$295M$350M$390M -$405M$360M of supportive institutional capital raised in the last 18 months(1)Targeting$30M -$45M of additional growth capital in CY 2022 to complete the full development of up to 175 MW Capital Raising Activity10(3) 61%39%Current Capital Structure Equity Debt(1) (2)(2) |

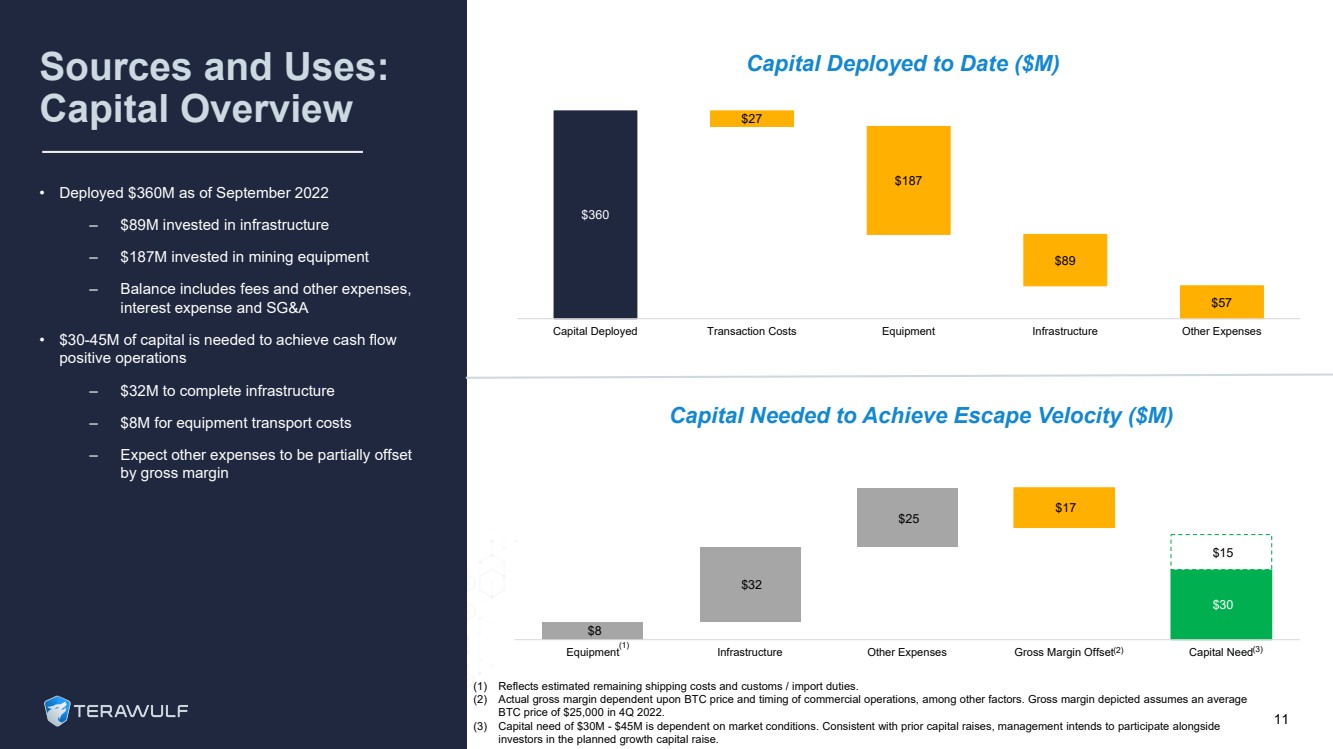

| $8 $32 $25 $17 $30 $15 EquipmentInfrastructureOther ExpensesGross Margin OffsetCapital NeedSources and Uses: Capital Overview•Deployed $360M as of September 2022–$89M invested in infrastructure–$187M invested in mining equipment–Balance includes fees and other expenses, interest expense and SG&A•$30-45M of capital is needed to achieve cash flow positive operations–$32M to complete infrastructure–$8M for equipment transport costs–Expect other expenses to be partially offset by gross margin(1)Reflects estimated remaining shipping costs and customs / import duties.(2)Actual gross margin dependent upon BTC price and timing of commercial operations, among other factors. Gross margin depicted assumes an average BTC price of $25,000 in 4Q 2022.(3)Capital need of $30M -$45M is dependent on market conditions. Consistent with prior capital raises, management intends to participate alongside investors in the planned growth capital raise. $360$27$187$89$57Capital DeployedTransaction CostsEquipmentInfrastructureOther Expenses 11Capital Deployed to Date ($M)Capital Needed to Achieve Escape Velocity ($M)(2)(3)(1) |

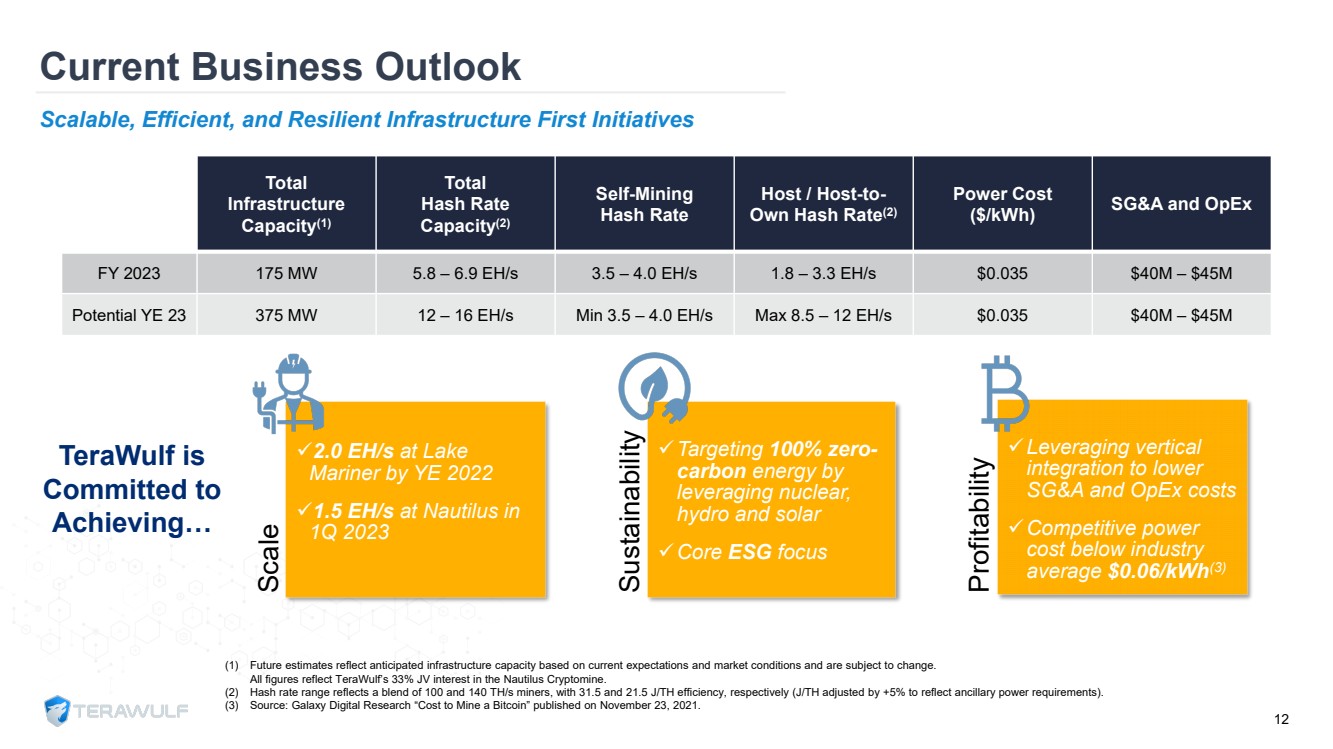

| (1)Future estimates reflect anticipated infrastructure capacity based on current expectations and market conditions and are subjectto change. All figures reflect TeraWulf’s 33% JV interest in the Nautilus Cryptomine. (2)Hash rate range reflects a blend of 100 and 140 TH/s miners, with 31.5 and 21.5 J/TH efficiency, respectively (J/TH adjusted by +5% to reflect ancillary power requirements). (3)Source: Galaxy Digital Research “Cost to Mine a Bitcoin” published on November 23, 2021.12 TotalInfrastructure Capacity(1)TotalHash Rate Capacity(2)Self-Mining Hash RateHost / Host-to-Own Hash Rate(2)Power Cost ($/kWh)SG&A and OpExFY 2023175 MW5.8 –6.9 EH/s3.5 –4.0 EH/s1.8 –3.3 EH/s$0.035$40M –$45MPotential YE 23375 MW12 –16 EH/sMin 3.5 –4.0 EH/sMax 8.5 –12 EH/s $0.035$40M –$45M Current Business OutlookScalable, Efficient, and Resilient Infrastructure First InitiativesTeraWulf is Committed to Achieving…Scale 2.0 EH/s at Lake Mariner by YE 20221.5 EH/s at Nautilus in 1Q 2023 Sustainability Targeting 100% zero-carbon energy by leveraging nuclear, hydro and solar CoreESG focus Profitability Leveraging vertical integration to lower SG&A and OpEx costs Competitive power cost below industry average $0.06/kWh(3) |

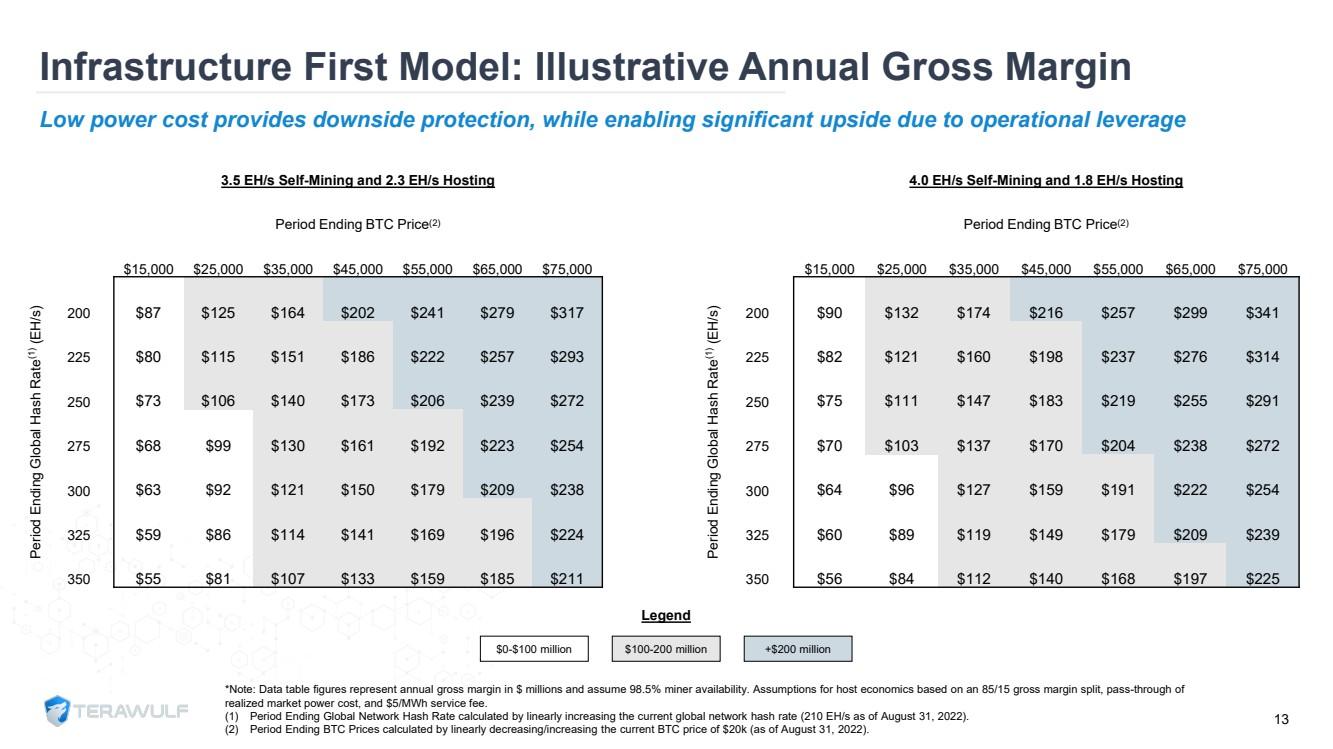

| 3.5 EH/s Self-Mining and 2.3 EH/s HostingPeriod Ending BTC Price(2)$15,000 $25,000 $35,000 $45,000 $55,000 $65,000 $75,000 Period Ending Global Hash Rate(1)(EH/s)200$87 $125 $164 $202 $241 $279$317225$80 $115 $151 $186 $222 $257$293250$73 $106 $140 $173 $206 $239$272275$68 $99 $130 $161 $192 $223$254300$63 $92 $121 $150 $179 $209$238325$59 $86 $114 $141 $169 $196$224350$55 $81 $107 $133 $159 $185$211Infrastructure First Model: Illustrative Annual Gross Margin*Note: Data table figures represent annual gross margin in $ millions and assume 98.5% miner availability. Assumptions for host economics based on an 85/15 gross margin split, pass-through of realized market power cost, and $5/MWh service fee.(1)Period Ending Global Network Hash Rate calculated by linearly increasing the current global network hash rate (210 EH/s as ofAugust 31, 2022).(2)Period Ending BTC Prices calculated by linearly decreasing/increasing the current BTC price of $20k (as of August 31, 2022). 13 $0-$100 million $100-200 million +$200 millionLegend Low power cost provides downside protection, while enabling significant upside due to operational leverage 4.0 EH/s Self-Mining and 1.8 EH/s HostingPeriod Ending BTC Price(2)$15,000 $25,000 $35,000 $45,000 $55,000 $65,000 $75,000 Period Ending Global Hash Rate(1)(EH/s)200$90$132 $174 $216 $257 $299$341225$82 $121 $160 $198 $237 $276$314250$75 $111 $147 $183 $219 $255$291275$70 $103$137 $170 $204 $238$272300$64 $96$127 $159 $191 $222$254325$60 $89 $119 $149 $179 $209$239350$56 $84 $112 $140 $168 $197$225 |

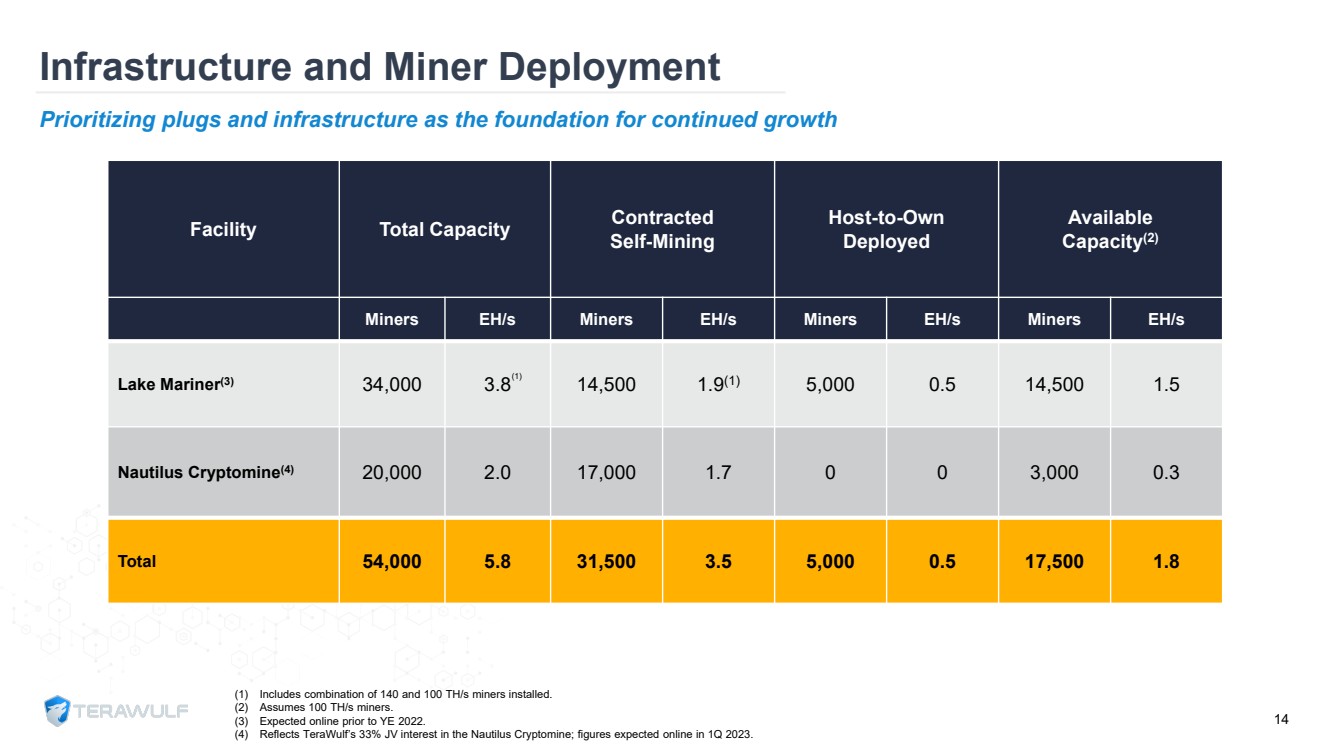

| FacilityTotal CapacityContractedSelf-MiningHost-to-Own DeployedAvailable Capacity(2)MinersEH/sMinersEH/sMinersEH/sMinersEH/sLake Mariner(3)34,0003.814,5001.9(1)5,0000.514,5001.5Nautilus Cryptomine(4)20,0002.017,0001.7003,0000.3Total54,0005.831,5003.55,0000.517,5001.8 Prioritizing plugs and infrastructure as the foundation for continued growthInfrastructure and Miner Deployment(1)Includes combination of 140 and 100 TH/s miners installed.(2)Assumes 100 TH/s miners. (3)Expected online prior to YE 2022.(4)Reflects TeraWulf’s33% JV interest in the Nautilus Cryptomine; figures expected online in 1Q 2023. 14(1) |

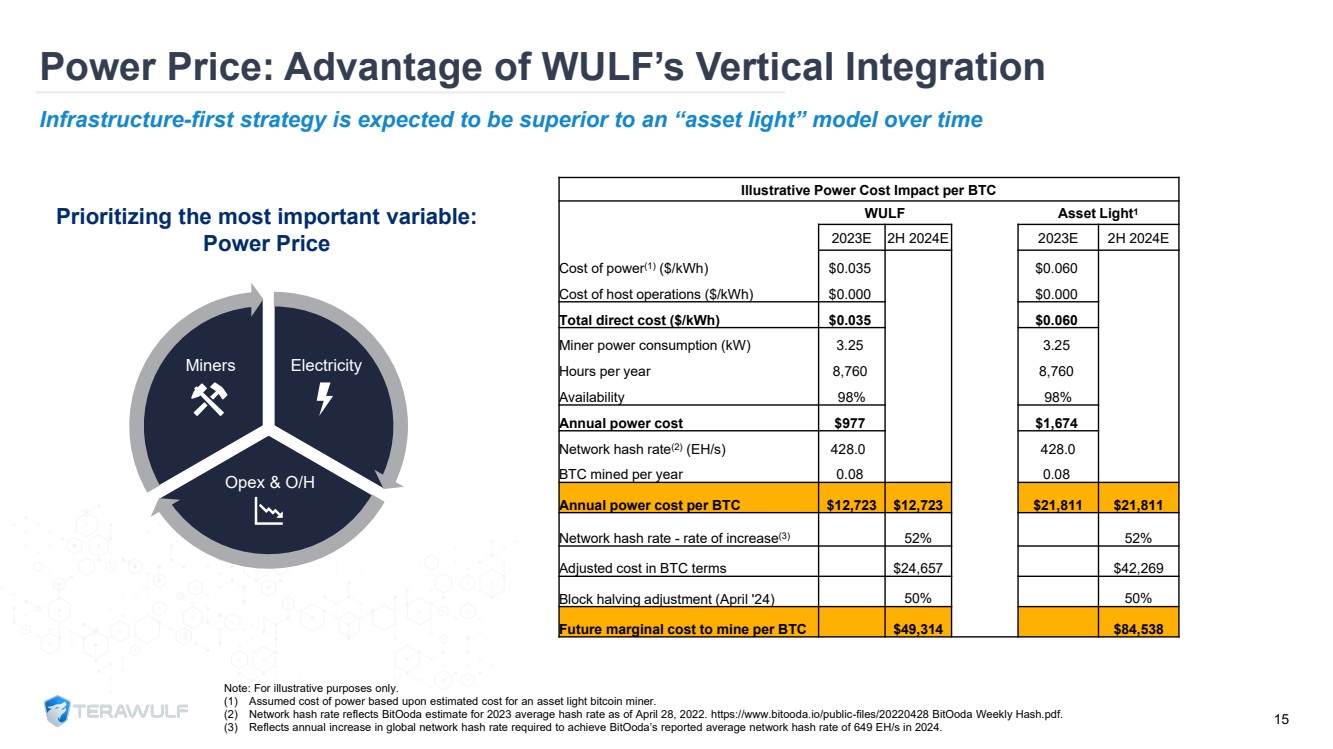

| Electricity Opex & O/H Miners Note: For illustrative purposes only.(1)Assumed cost of power based upon estimated cost for an asset light bitcoin miner.(2)Network hash rate reflects BitOodaestimate for 2023 average hash rate as of April 28, 2022. https://www.bitooda.io/public-files/20220428 BitOodaWeekly Hash.pdf.(3)Reflects annual increase in global network hash rate required to achieve BitOoda’sreported average network hash rate of 649 EH/s in 2024. Illustrative Power Cost Impact per BTCWULFAsset Light12023E2H 2024E2023E2H 2024E Cost of power (1)($/kWh) $0.035$0.060 Cost of host operations ($/kWh) $0.000$0.000 Total direct cost ($/kWh) $0.035$0.060 Miner power consumption (kW) 3.253.25 Hours per year 8,7608,760 Availability 98%98% Annual power cost $977$1,674 Network hash rate (2)(EH/s) 428.0 428.0 BTC mined per year 0.080.08 Annual power cost per BTC $12,723$12,723$21,811 $21,811 Network hash rate -rate of increase(3) 52%52% Adjusted cost in BTC terms $24,657 $42,269 Block halving adjustment (April '24) 50%50% Future marginal cost to mine per BTC $49,314 $84,538 Infrastructure-first strategy is expected to besuperior to an “asset light” model over timePrioritizing the most important variable: Power Price15Power Price: Advantage of WULF’s Vertical Integration |

| TeraWulf is an Emerging Leader in Digital Asset Infrastructure•Best-in-class Bitcoin mining due to low-cost, sustainable, and domestic bitcoin mining at industrial scale targeting zero-carbon energy leveraging nuclear, hydro, and solar resources•Vertically integrated, infrastructure first strategy ensures ability to create and take advantage of plug-ready digital asset infrastructure•Experienced team with decades of energy infrastructure experienceand a model for sustainable, large-scale bitcoin mining•Core ESG focusdifferentiates TeraWulf and contributes to the acceleration of the U.S. transition to a more resilient, stable energy grid•Delivering peer leading power supply economics with a comprehensive and compelling business outlook16 |

| SITE OVERVIEWS |

| Lake Mariner Data (NY) 18 Location:Barker, NYOwnership:100%Site Control:Long-term leaseInfra. Capacity:•500 MW future potential•110 MW online YE 2022Power Source:91%+ hydroDeployment:•60 MW completed and energized•Additional 50 MW expected online Dec 2022Miners(1):•12,000 S19 XP•2,500 S19 J-Pro(1)Reflects existing miner purchase agreements. |

| New York Regulatory Environment“NYPA is pleased to propose working with Lake Mariner Data, LLC to have 7725 Lake Road, Barker, NY participate in demand response programs in 2022, supporting TeraWulf’s goal to become a zero-carbon emissions crypto mining company.”New York Power Authority, April 2022 •On June 3, the NY Senate passed a two-year moratorium on future cryptocurrency mining powered by fossil fuels –Restricts issuance of new permits for proof-of-work mining operations that are powered by an “electric generating facility that utilizes a carbon-based fuel.” –Requires a study by the NY DEC on proof-of-work mining’s impact on State’s emissions–Legislation awaits Governor Hochul’ssignature or veto•Proposed Bill will NOT impact TeraWulf’s Lake Mariner Facility in Upstate NY–NOT an electric generating facility and does NOT require an air permit–NOT using a carbon-based fuel for proof-of-work mining behind the meter–“My bill is not a ban on crypto. It’s not even a ban on mining,” Kellessaid. “It is a two-year moratorium specifically on cryptocurrency mining operations that are housed at fossil fuel-burning power plants.”•Lake Mariner has a contract with NYPA, a State Agency, for 90 MW of power –NYPA is also partnering with Lake Mariner on a unique program to provide the State’s grid with a significant demand energy response capability NY Senate Passes Bitcoin Mining Moratorium 19 |

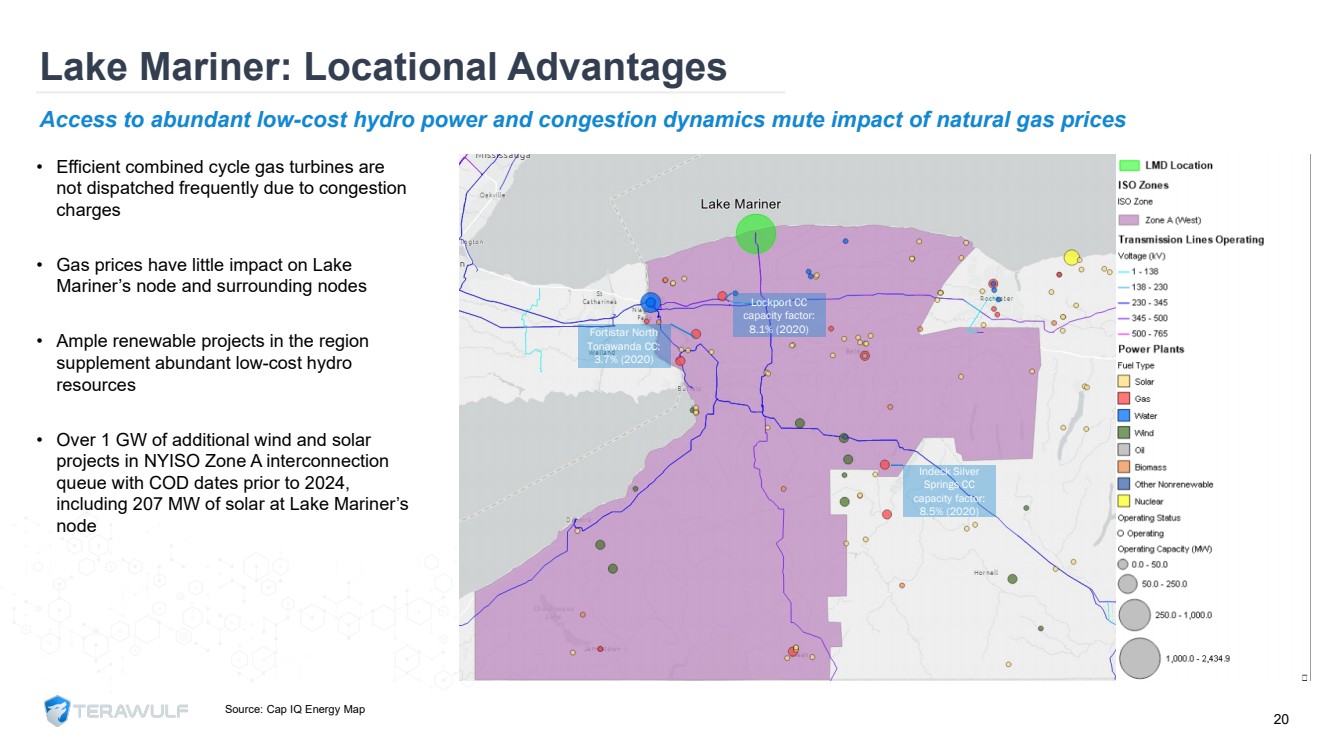

| Lake Mariner: Locational Advantages 20Access to abundant low-costhydro power and congestion dynamics mute impact of natural gas pricesSource: Cap IQ Energy Map Lockport CC capacity factor: 8.1% (2020) Indeck Silver Springs CC capacity factor: 8.5% (2020) Fortistar North Tonawanda CC: 3.7% (2020) •Efficient combined cycle gas turbines are not dispatched frequently due to congestion charges•Gas prices have little impact on Lake Mariner’s node and surrounding nodes•Ample renewable projects in the region supplement abundant low-cost hydro resources•Over 1 GW of additional wind and solar projects in NYISO Zone A interconnection queue with COD dates prior to 2024, including 207 MW of solar at Lake Mariner’s node |

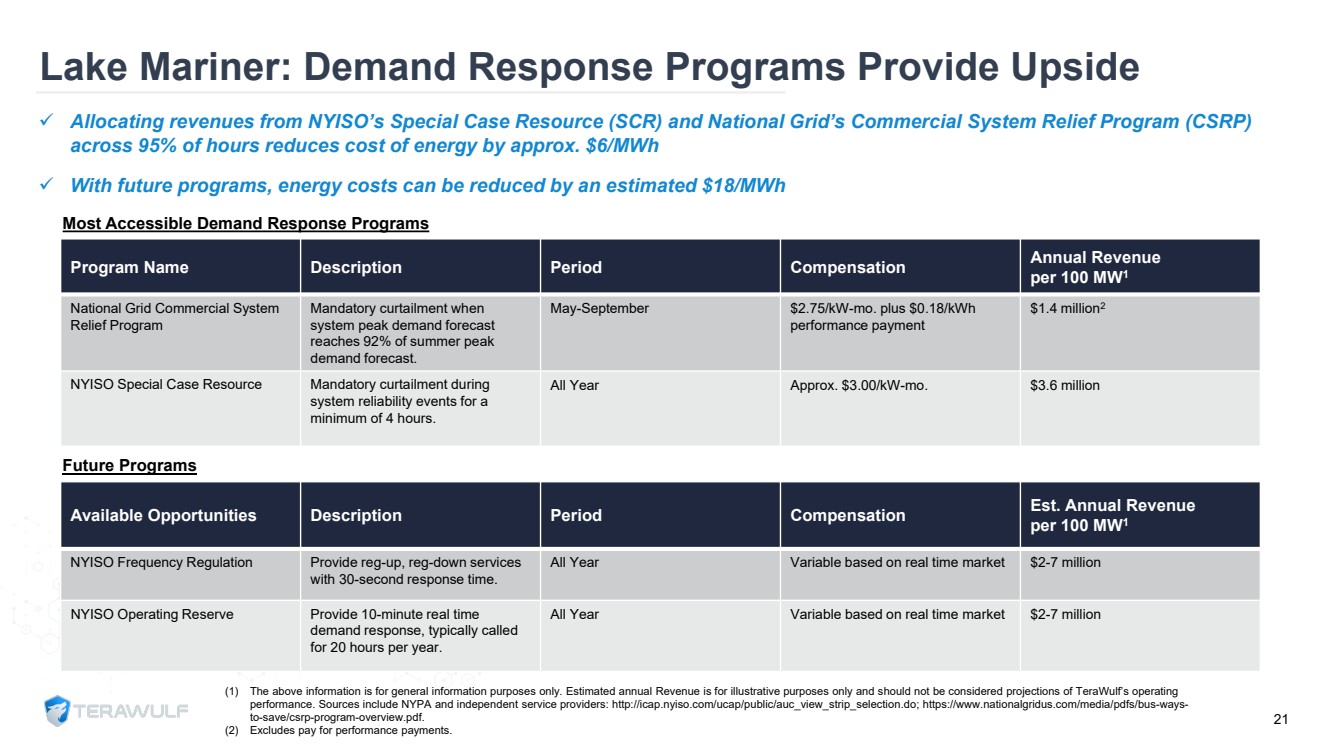

| (1)The above information is for general information purposes only. Estimated annual Revenue is for illustrative purposes only and should not be considered projections of TeraWulf’s operating performance. Sources include NYPA and independent service providers: http://icap.nyiso.com/ucap/public/auc_view_strip_selection.do; https://www.nationalgridus.com/media/pdfs/bus-ways-to-save/csrp-program-overview.pdf. (2)Excludes pay for performance payments.Lake Mariner: Demand Response Programs Provide Upside 21 Program NameDescriptionPeriodCompensationAnnual Revenue per 100 MW1National Grid Commercial System Relief ProgramMandatory curtailment when system peak demand forecast reaches 92% of summer peak demand forecast.May-September$2.75/kW-mo. plus $0.18/kWh performance payment$1.4 million2NYISO Special Case ResourceMandatory curtailment during system reliability events for a minimum of 4 hours.All YearApprox. $3.00/kW-mo.$3.6 million Available OpportunitiesDescriptionPeriodCompensationEst. Annual Revenue per 100 MW1NYISO Frequency RegulationProvide reg-up, reg-down services with 30-second response time.All YearVariable based on real time market$2-7 million NYISO Operating Reserve Provide 10-minute real time demand response, typically called for 20 hours per year.All YearVariable based on real time market$2-7 millionAllocating revenues from NYISO’s Special Case Resource (SCR) and National Grid’s Commercial System Relief Program (CSRP) across 95% of hours reduces cost of energy by approx. $6/MWh With future programs, energy costs can be reduced by an estimated $18/MWh Most Accessible Demand Response Programs Future Programs |

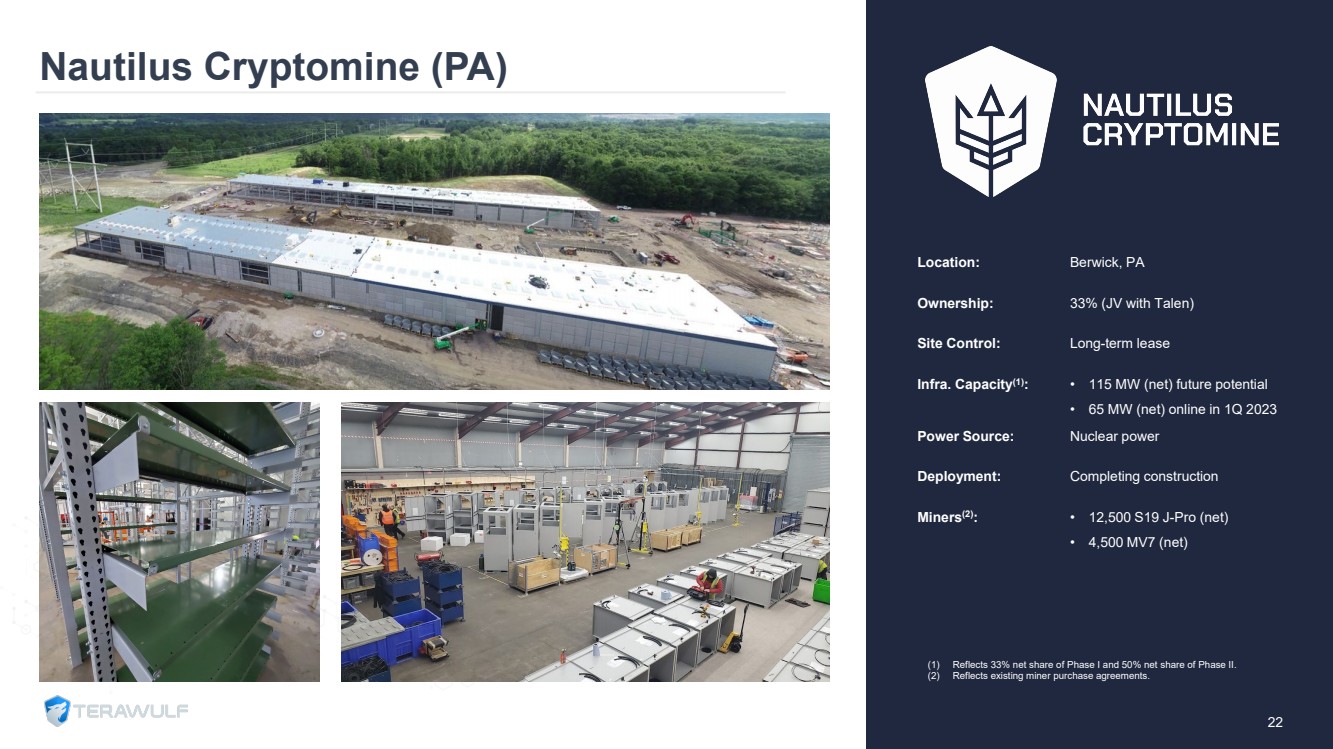

| Nautilus Cryptomine (PA) 22 Location:Berwick, PAOwnership:33% (JV with Talen)Site Control:Long-term leaseInfra. Capacity(1):•115 MW (net) future potential•65 MW (net) online in 1Q 2023Power Source:Nuclear powerDeployment:Completing constructionMiners(2):•12,500 S19 J-Pro (net)•4,500 MV7 (net) (1)Reflects 33% net share of Phase I and 50% net share of Phase II.(2)Reflects existing miner purchase agreements. |

| Nautilus: Facility Design Advantages 23Reliable behind-the-meter zero-carbon energy •Data center design with extra redundancy and reliability to maximize online miner capacity•Both inlet and outlet air cooling (i.e., “push/pull”)•Robust building management system to optimize temperature control and minimize power consumption•Variable speed controls on all fans•Extra air filtration to optimize building air quality•Customized racking design to accommodate different miner dimensions•Built-in electrical switching to prevent curtailment from substation transformer outage•Infrastructure capable of future expansion |

| NASDAQ: WULFContact:ir@terawulf.comwww.TeraWulf.com/contact |