| 1 Q3 2022 Investor UpdateNovember 2022An Infrastructure-Focused Mining Company |

| SAFE HARBOR STATEMENT Thispresentationisforinformationalpurposesonlyandcontainsforward-lookingstatementswithinthemeaningofthe"safeharbor"provisionsofthePrivateSecuritiesLitigationReformActof1995,asamended.Suchforward-lookingstatementsincludestatementsconcerninganticipatedfutureeventsandexpectationsthatarenothistoricalfacts.Allstatements,otherthanstatementsofhistoricalfact,arestatementsthatcouldbedeemedforward-lookingstatements.Inaddition,forward-lookingstatementsaretypicallyidentifiedbywordssuchas"plan,""believe,""goal,""target,""aim,""expect,""anticipate,""intend,""outlook,""estimate,""forecast,""project,""continue,""could,""may,""might,""possible,""potential,""predict,""should,""would"andothersimilarwordsandexpressions,althoughtheabsenceofthesewordsorexpressionsdoesnotmeanthatastatementisnotforward-looking.Forward-lookingstatementsarebasedonthecurrentexpectationsandbeliefsofTeraWulf'smanagementandareinherentlysubjecttoanumberoffactors,risks,uncertaintiesandassumptionsandtheirpotentialeffects.Therecanbenoassurancethatfuturedevelopmentswillbethosethathavebeenanticipated.Actualresultsmayvarymateriallyfromthoseexpressedorimpliedbyforward-lookingstatementsbasedonanumberoffactors,risks,uncertaintiesandassumptions,including,amongothers:(1)conditionsinthecryptocurrencyminingindustry,includingfluctuationinthemarketpricingofbitcoinandothercryptocurrencies,andtheeconomicsofcryptocurrencymining,includingastovariablesorfactorsaffectingthecost,efficiencyandprofitabilityofcryptocurrencymining;(2)competitionamongthevariousprovidersofdataminingservices;(3)changesinapplicablelaws,regulationsand/orpermitsaffectingTeraWulf'soperationsortheindustriesinwhichitoperates,includingregulationregardingpowergeneration,cryptocurrencyusageand/orcryptocurrencymining;(4)theabilitytoimplementcertainbusinessobjectivesandtotimelyandcost-effectivelyexecuteintegratedprojects;(5)failuretoobtainadequatefinancingonatimelybasisand/oronacceptabletermswithregardtogrowthstrategiesoroperations;(6)lossofpublicconfidenceinbitcoinorothercryptocurrenciesandthepotentialforcryptocurrencymarketmanipulation;(7)thepotentialofcybercrime,money-laundering,malwareinfectionsandphishingand/orlossandinterferenceasaresultofequipmentmalfunctionorbreak-down,physicaldisaster,datasecuritybreach,computermalfunctionorsabotage(andthe costsassociatedwithanyoftheforegoing);(8)theavailability,deliveryscheduleandcostofequipmentnecessarytomaintainandgrowthebusinessandoperationsofTeraWulf,includingminingequipmentandequipmentmeetingthetechnicalorotherspecificationsrequiredtoachieveitsgrowthstrategy;(9)employmentworkforcefactors,includingthelossofkeyemployees;(10)litigationrelatingtoTeraWulf,RM101f/k/aIKONICSCorporationand/orthebusinesscombination;(11)theabilitytorecognizetheanticipatedobjectivesandbenefitsofthebusinesscombination;and(12)otherrisksanduncertaintiesdetailedfromtimetotimeintheCompany'sfilingswiththeSecuritiesandExchangeCommission("SEC").Potentialinvestors,stockholdersandotherreadersarecautionednottoplaceunduerelianceontheseforward-lookingstatements,whichspeakonlyasofthedateonwhichtheyweremade.TeraWulfdoesnotassumeanyobligationtopubliclyupdateanyforward-lookingstatementafteritwasmade,whetherasaresultofnewinformation,futureeventsorotherwise,exceptasrequiredbylaworregulation.Investorsarereferredtothefulldiscussionofrisksanduncertaintiesassociatedwithforward-lookingstatementsandthediscussionofriskfactorscontainedintheCompany'sfilingswiththeSEC,whichareavailableatwww.sec.gov. |

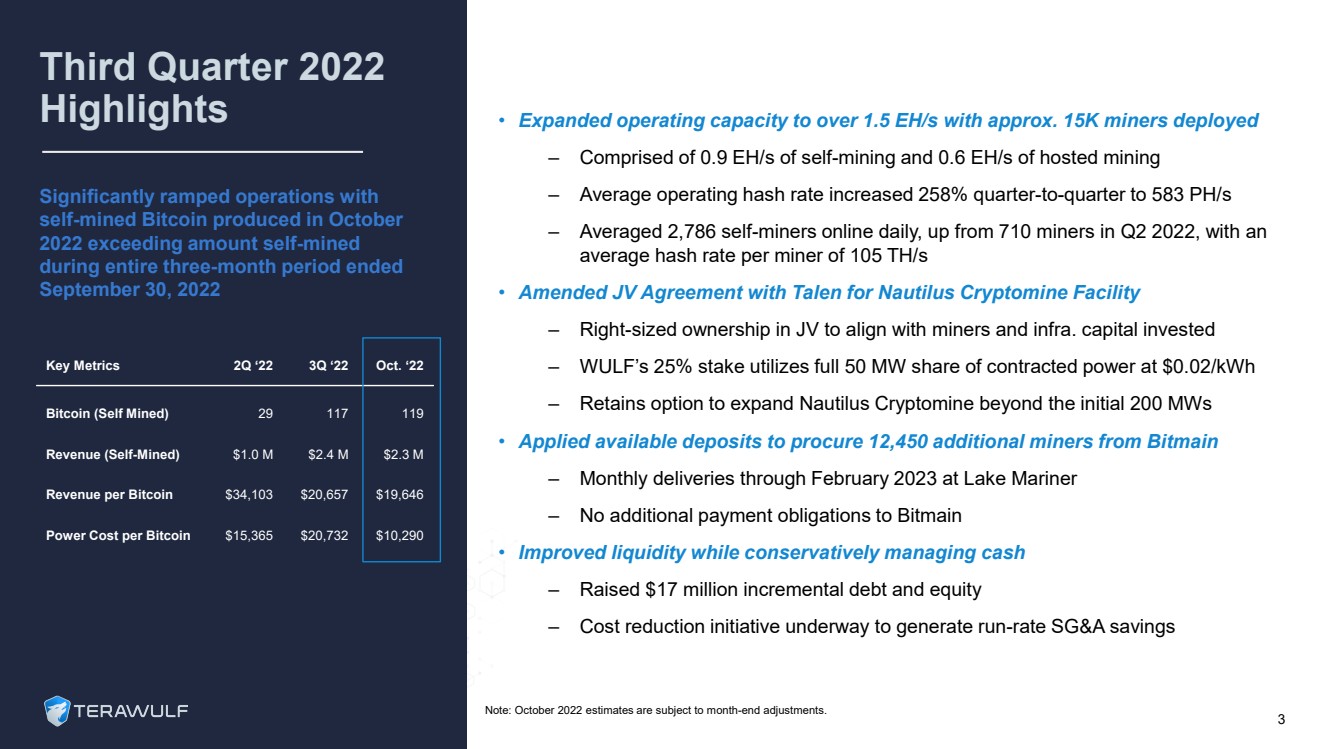

| Third Quarter 2022 Highlights 3•Expanded operating capacity to over 1.5 EH/s with approx. 15K miners deployed–Comprised of 0.9 EH/s of self-mining and 0.6 EH/s of hosted mining–Average operating hash rate increased 258% quarter-to-quarter to 583 PH/s–Averaged 2,786 self-miners online daily, up from 710 miners in Q2 2022,with an average hash rate per miner of 105 TH/s •Amended JV Agreement with Talen for Nautilus Cryptomine Facility–Right-sized ownership in JV to align with miners and infra. capital invested –WULF’s 25% stake utilizes full 50 MW share of contracted power at $0.02/kWh –Retains option to expand Nautilus Cryptomine beyond the initial 200 MWs•Applied available deposits to procure 12,450 additional miners from Bitmain–Monthly deliveries through February 2023 at Lake Mariner–No additional payment obligations to Bitmain•Improved liquidity while conservatively managing cash–Raised $17 million incremental debt and equity–Cost reduction initiative underway to generate run-rate SG&A savings Key Metrics2Q ‘223Q ‘22Oct. ‘22Bitcoin (Self Mined)29117119Revenue (Self-Mined)$1.0 M$2.4 M$2.3 MRevenue per Bitcoin$34,103$20,657$19,646Power Cost per Bitcoin$15,365$20,732$10,290Significantly ramped operations with self-mined Bitcoin produced in October 2022 exceeding amount self-mined during entire three-month period ended September 30, 2022 Note: October 2022 estimates are subject to month-end adjustments. |

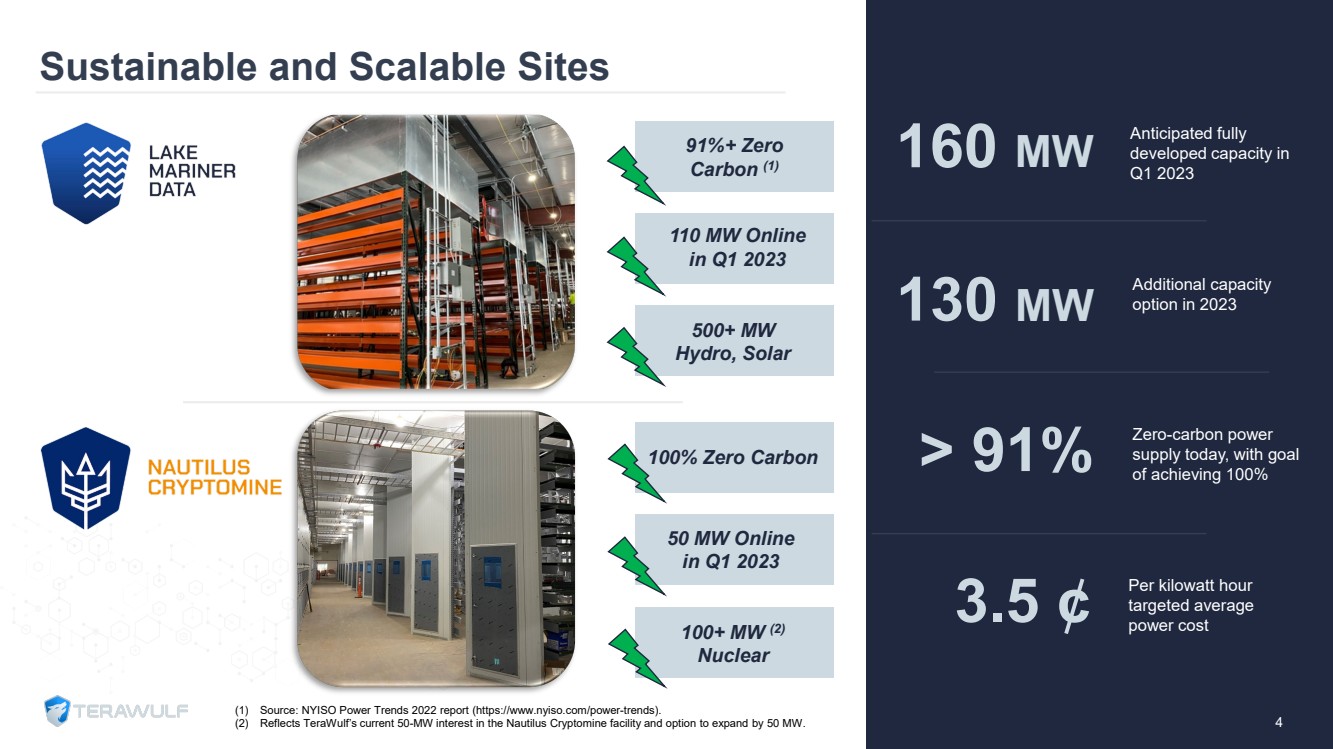

| Sustainable and Scalable Sites130 MWAdditional capacity option in 2023> 91%Zero-carbon power supply today, with goal of achieving 100%3.5 ¢ Per kilowatt hour targeted average power cost4 91%+ Zero Carbon (1)110 MW Online in Q1 2023500+ MW Hydro, Solar 100% Zero Carbon50 MW Online in Q1 2023100+ MW (2)Nuclear (1)Source: NYISO Power Trends 2022 report (https://www.nyiso.com/power-trends).(2)Reflects TeraWulf’s current 50-MW interest in the Nautilus Cryptomine facility and option to expand by 50 MW. 160 MWAnticipated fully developed capacity in Q1 2023 |

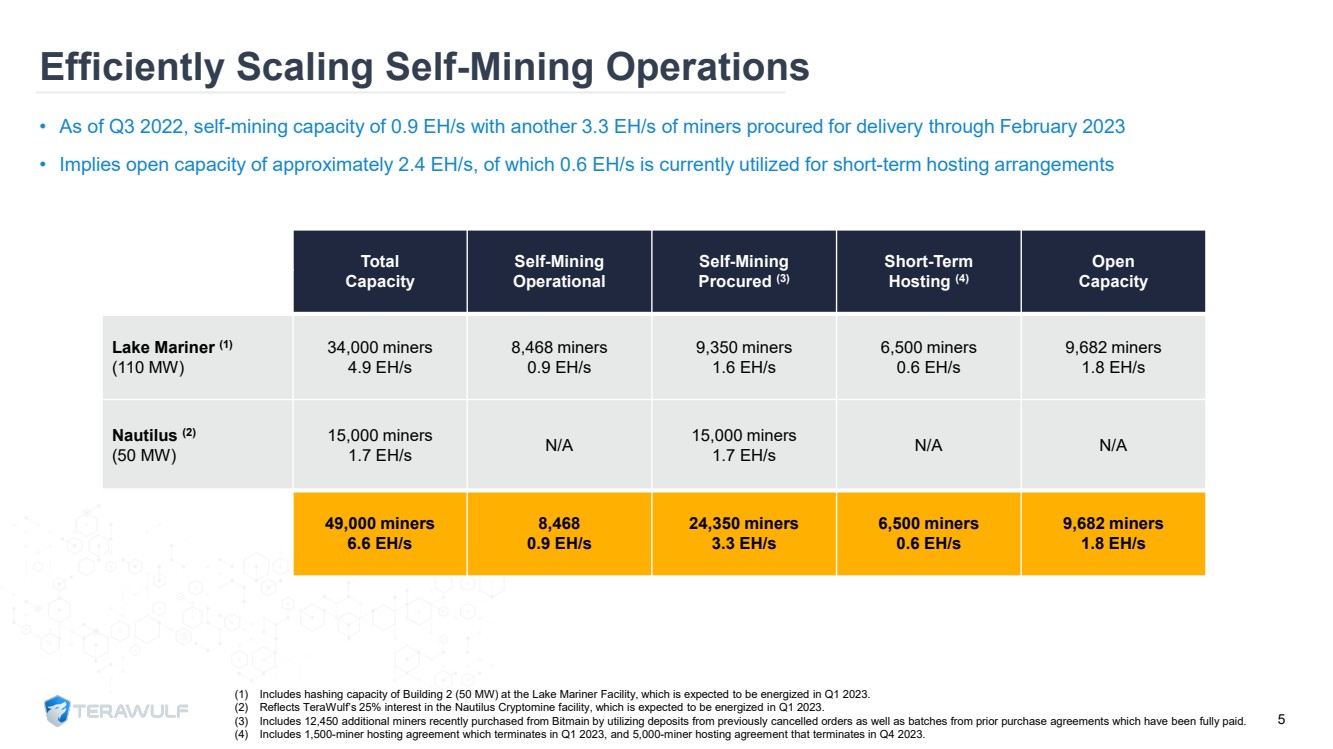

| Total CapacitySelf-MiningOperationalSelf-MiningProcured (3)Short-TermHosting (4)OpenCapacityLake Mariner (1)(110 MW)34,000 miners4.9 EH/s8,468 miners0.9 EH/s9,350 miners1.6 EH/s6,500 miners0.6 EH/s9,682 miners1.8 EH/sNautilus (2)(50 MW)15,000 miners1.7 EH/sN/A15,000 miners1.7 EH/sN/AN/A49,000 miners6.6 EH/s8,4680.9 EH/s24,350 miners3.3 EH/s6,500 miners0.6 EH/s9,682 miners1.8 EH/s •As of Q3 2022, self-mining capacity of 0.9 EH/s with another 3.3 EH/s of miners procured for delivery through February 2023•Implies open capacity of approximately 2.4 EH/s, of which 0.6 EH/s is currently utilized for short-term hosting arrangementsEfficiently Scaling Self-Mining Operations(1)Includes hashing capacity of Building 2 (50 MW) at the Lake Mariner Facility, which is expected to be energized in Q1 2023.(2)Reflects TeraWulf’s 25% interest in the Nautilus Cryptomine facility, which is expected to be energized in Q1 2023.(3)Includes 12,450 additional miners recently purchased from Bitmain by utilizing deposits from previously cancelled orders as wellas batches from prior purchase agreements which have been fully paid.(4)Includes 1,500-miner hosting agreement which terminates in Q1 2023, and 5,000-miner hosting agreement that terminates in Q4 2023. 5 |

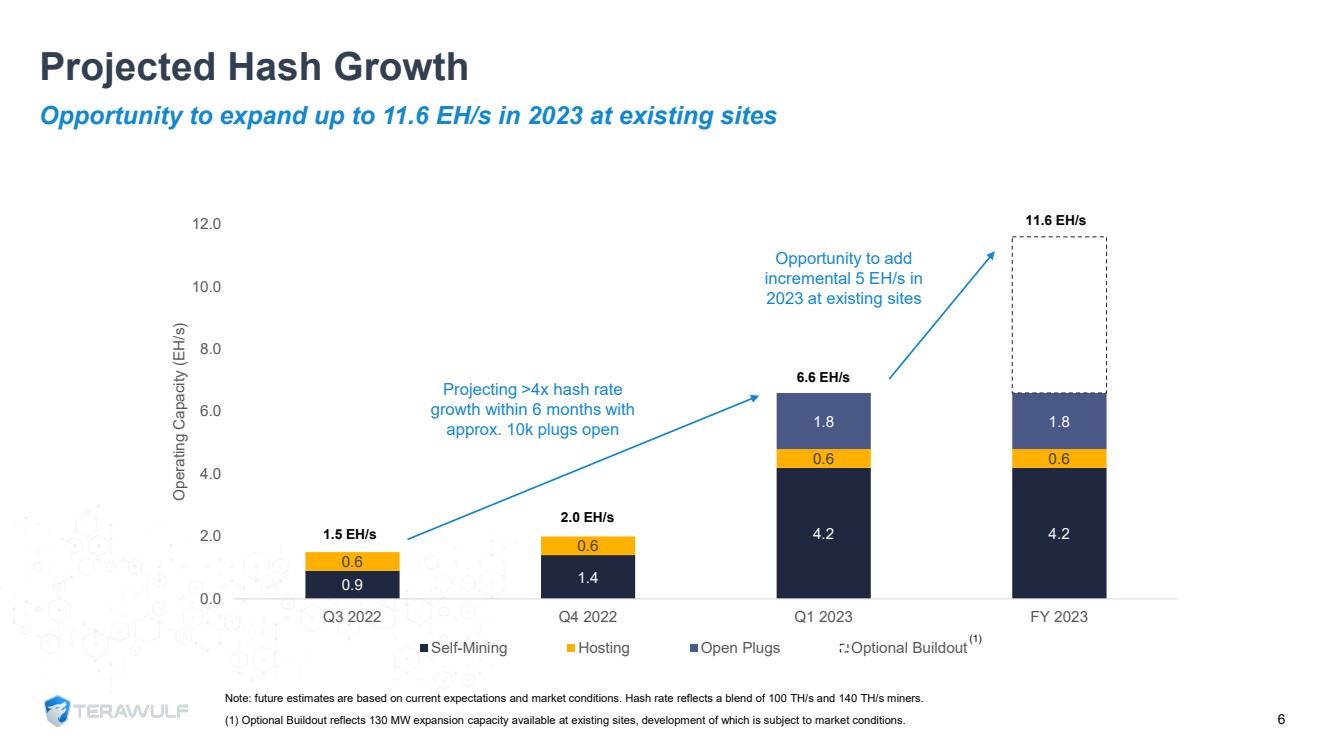

| Projected Hash GrowthNote: future estimates are based on current expectations and market conditions. Hash rate reflects a blend of 100 TH/s and 140 TH/s miners. (1) Optional Buildout reflects 130 MW expansion capacity available at existing sites, development of which is subject to market conditions.Opportunity to expand up to 11.6 EH/s in 2023 at existing sites 0.91.44.24.20.60.60.60.61.81.80.02.04.06.0 8.010.012.0Q3 2022Q4 2022Q1 2023FY 2023 Operating Capacity (EH/s) Self-Mining Hosting Open Plugs Optional Buildout61.5 EH/s2.0 EH/s6.6 EH/s11.6 EH/s Opportunity to add incremental 5 EH/s in 2023 at existing sites Projecting >4x hash rate growth within 6 months with approx. 10k plugs open(1) |

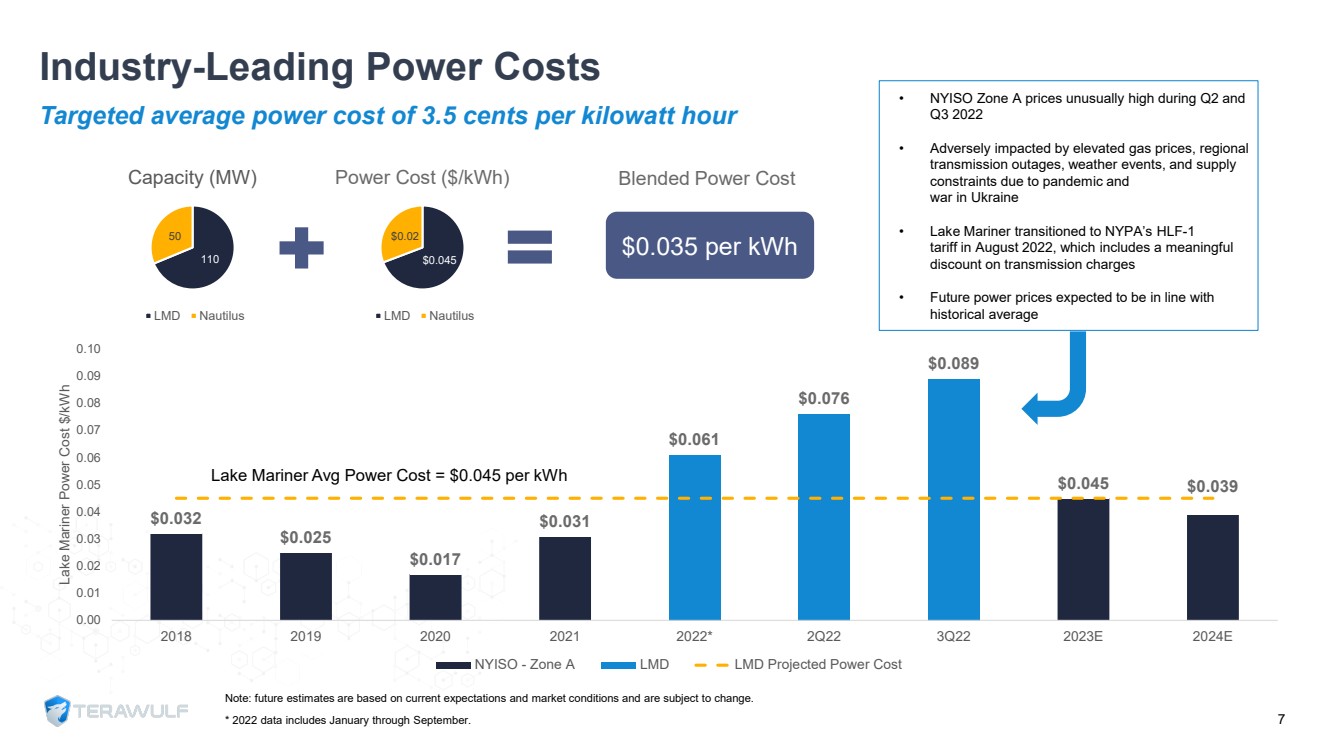

| Industry-Leading Power CostsNote: future estimates are based on current expectations and market conditions and are subject to change.* 2022 data includes January through September. $0.032 $0.025 $0.017 $0.031 $0.061 $0.076 $0.089 $0.045 $0.039 0.000.01 0.020.030.04 0.05 0.060.070.080.090.1020182019202020212022*2Q223Q222023E2024ELake Mariner Power Cost $/kWh NYISO - Zone A LMD LMD Projected Power CostTargeted average power cost of 3.5 cents per kilowatt hour7 11050Capacity (MW) LMD Nautilus $0.045 $0.02 Power Cost ($/kWh) LMD Nautilus $0.035 per kWhBlended Power Cost •NYISO Zone A prices unusually high during Q2 and Q3 2022•Adversely impacted by elevated gas prices, regional transmission outages, weather events, and supply constraints due to pandemic and war in Ukraine•Lake Mariner transitioned to NYPA’s HLF-1tariff in August 2022, which includes a meaningful discount on transmission charges•Future power prices expected to be in line with historical averageLake Mariner Avg Power Cost = $0.045 per kWh |

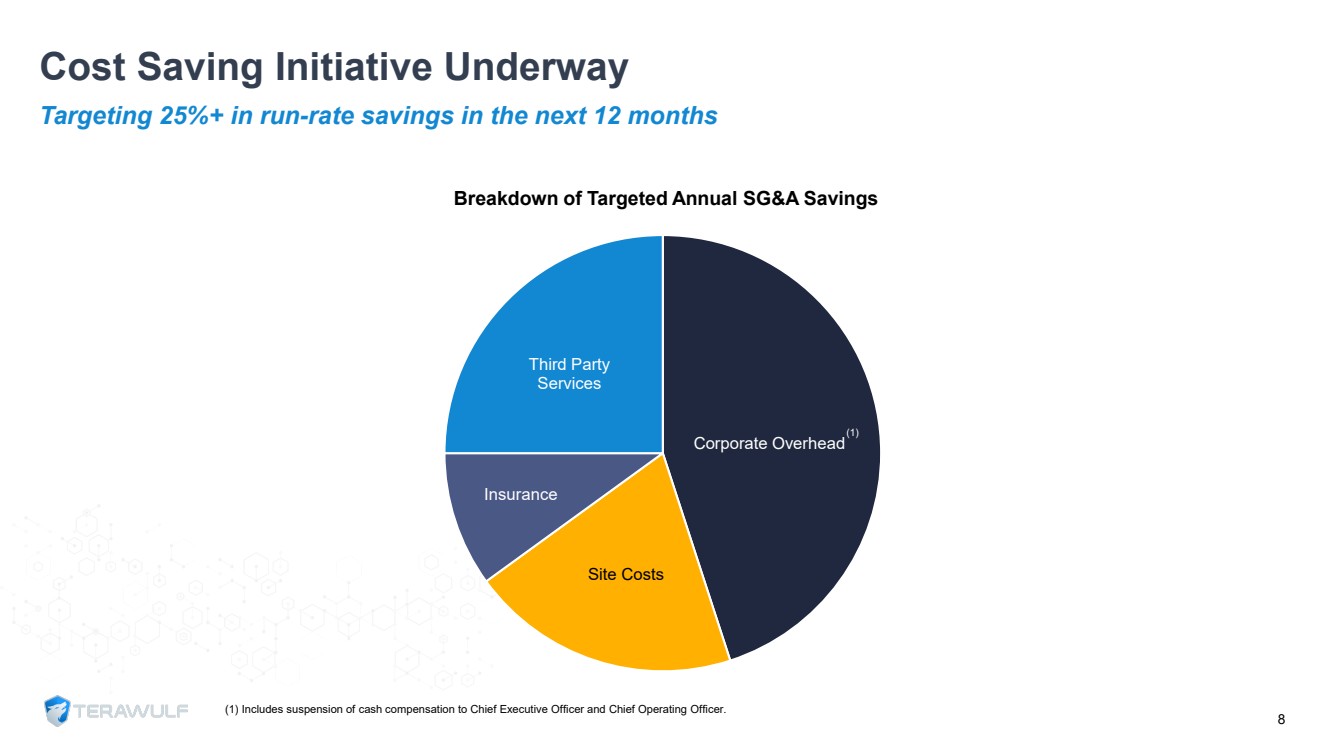

| Cost Saving Initiative UnderwayTargeting 25%+ in run-rate savings in the next 12 months Corporate OverheadSite CostsInsuranceThird Party Services(1)Breakdown of Targeted Annual SG&A Savings(1) Includes suspension of cash compensation to Chief Executive Officer and Chief Operating Officer. 8 |

| Emerging Leader in Digital Asset Infrastructure•Best-in-class Bitcoin mining due to low-cost, sustainable, and domestic bitcoin mining at industrial scale targeting zero-carbon energy leveraging nuclear, hydro, and solar resources•Vertically integrated, infrastructure first strategy ensures ability to create and take advantage of digital asset infrastructure•Experienced team with decades of energy infrastructure experienceand a model for sustainable, large-scale bitcoin mining•Core ESG focusdifferentiates TeraWulf and contributes to the acceleration of the transition to a more resilient, stable energy grid•Peer leading power supply economics with a comprehensive and compelling business outlook9 |

| SITE UPDATES |

| Lake Mariner Data (NY) 11 Location:Barker, NYOwnership:100%Site Control:Long-term leaseInfra. Capacity:500 MW site potentialPower Source:91%+ hydroDeployment:•60 MW operational•50 MW under construction, expected online Q1 2023•80 MW expansion potential in 2023Proprietary Miners:•12,000 Bitmain S19 XPs•5,000 Bitmain S19 J-Pros |

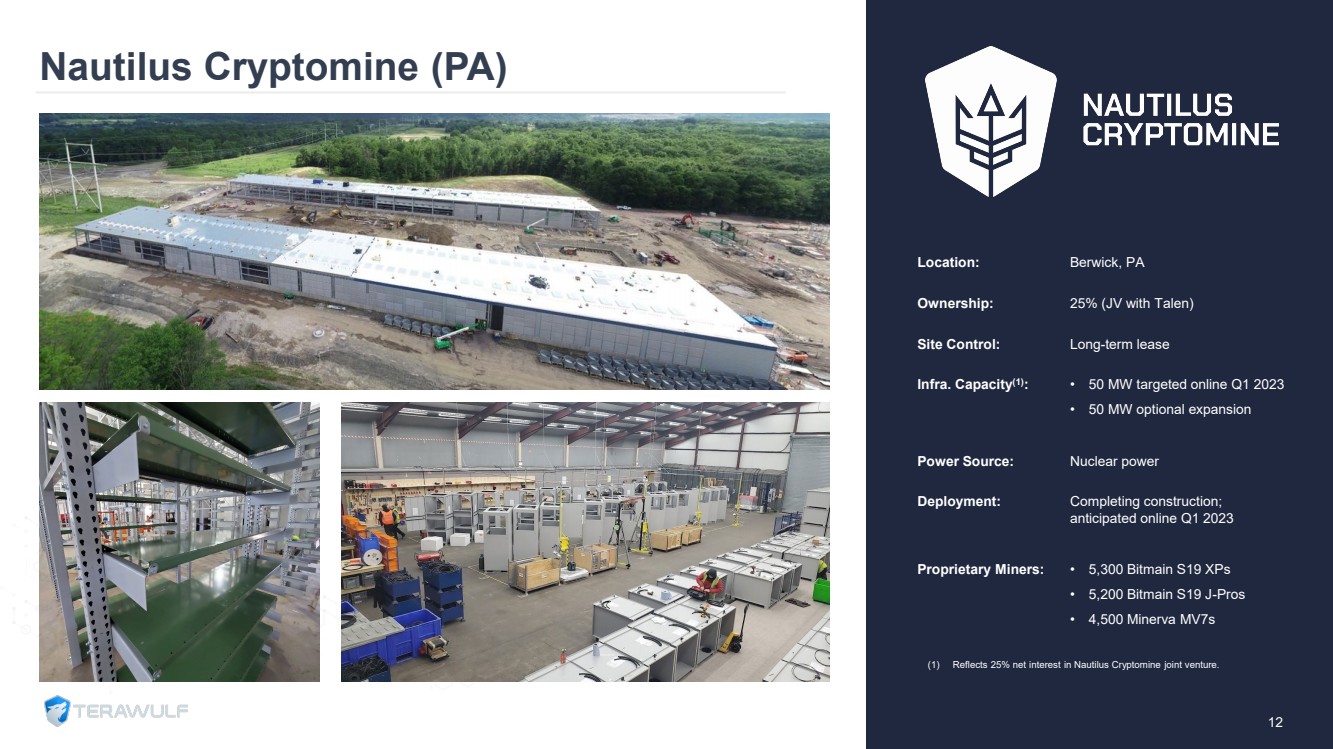

| Nautilus Cryptomine (PA) 12 Location:Berwick, PAOwnership:25% (JV with Talen)Site Control:Long-term leaseInfra. Capacity(1):•50 MW targeted online Q1 2023•50 MW optional expansionPower Source:Nuclear powerDeployment:Completing construction; anticipated online Q1 2023Proprietary Miners:•5,300 Bitmain S19 XPs•5,200 Bitmain S19 J-Pros •4,500 Minerva MV7s (1)Reflects 25% net interest in Nautilus Cryptomine joint venture. |

| NASDAQ: WULFContact:ir@terawulf.comwww.TeraWulf.com/contact |