| 1 Company Presentation July 2023 An Infrastructure-Focused Mining Company |

| SAFE HARBOR STATEMENT This presentation is for informational purposes only and contains forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements include statements concerning anticipated future events and expectations that are not historical facts. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements. In addition, forward-looking statements are typically identified by words such as "plan," "believe," "goal," "target," "aim," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "continue," "could," "may," "might," "possible," "potential," "predict," "should," "would" and other similar words and expressions, although the absence of these words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are based on the current expectations and beliefs of TeraWulf's management and are inherently subject to a number of factors, risks, uncertainties and assumptions and their potential effects. There can be no assurance that future developments will be those that have been anticipated. Actual results may vary materially from those expressed or implied by forward-looking statements based on a number of factors, risks, uncertainties and assumptions, including, among others: (1) conditions in the cryptocurrency mining industry, including fluctuation in the market pricing of bitcoin and other cryptocurrencies, and the economics of cryptocurrency mining, including as to variables or factors affecting the cost, efficiency and profitability of cryptocurrency mining; (2) competition among the various providers of data mining services; (3) changes in applicable laws, regulations and/or permits affecting TeraWulf's operations or the industries in which it operates, including regulation regarding power generation, cryptocurrency usage and/or cryptocurrency mining; (4) the ability to implement certain business objectives and to timely and cost-effectively execute integrated projects; (5) failure to obtain adequate financing on a timely basis and/or on acceptable terms with regard to growth strategies or operations; (6) loss of public confidence in bitcoin or other cryptocurrencies and the potential for cryptocurrency market manipulation; (7) the potential of cybercrime, money-laundering, malware infections and phishing and/or loss and interference as a result of equipment malfunction or break-down, physical disaster, data security breach, computer malfunction or sabotage (and the costs associated with any of the foregoing); (8) the availability, delivery schedule and cost of equipment necessary to maintain and grow the business and operations of TeraWulf, including mining equipment and equipment meeting the technical or other specifications required to achieve its growth strategy; (9) employment workforce factors, including the loss of key employees; (10) litigation relating to TeraWulf, RM 101 f/k/a IKONICS Corporation and/or the business combination; (11) the ability to recognize the anticipated objectives and benefits of the business combination; and (12) other risks and uncertainties detailed from time to time in the Company's filings with the Securities and Exchange Commission ("SEC"). Potential investors, stockholders and other readers are cautioned not to place undue reliance on these forward- looking statements, which speak only as of the date on which they were made. TeraWulf does not assume any obligation to publicly update any forward-looking statement after it was made, whether as a result of new information, future events or otherwise, except as required by law or regulation. Investors are referred to the full discussion of risks and uncertainties associated with forward-looking statements and the discussion of risk factors contained in the Company's filings with the SEC, which are available at www.sec.gov. |

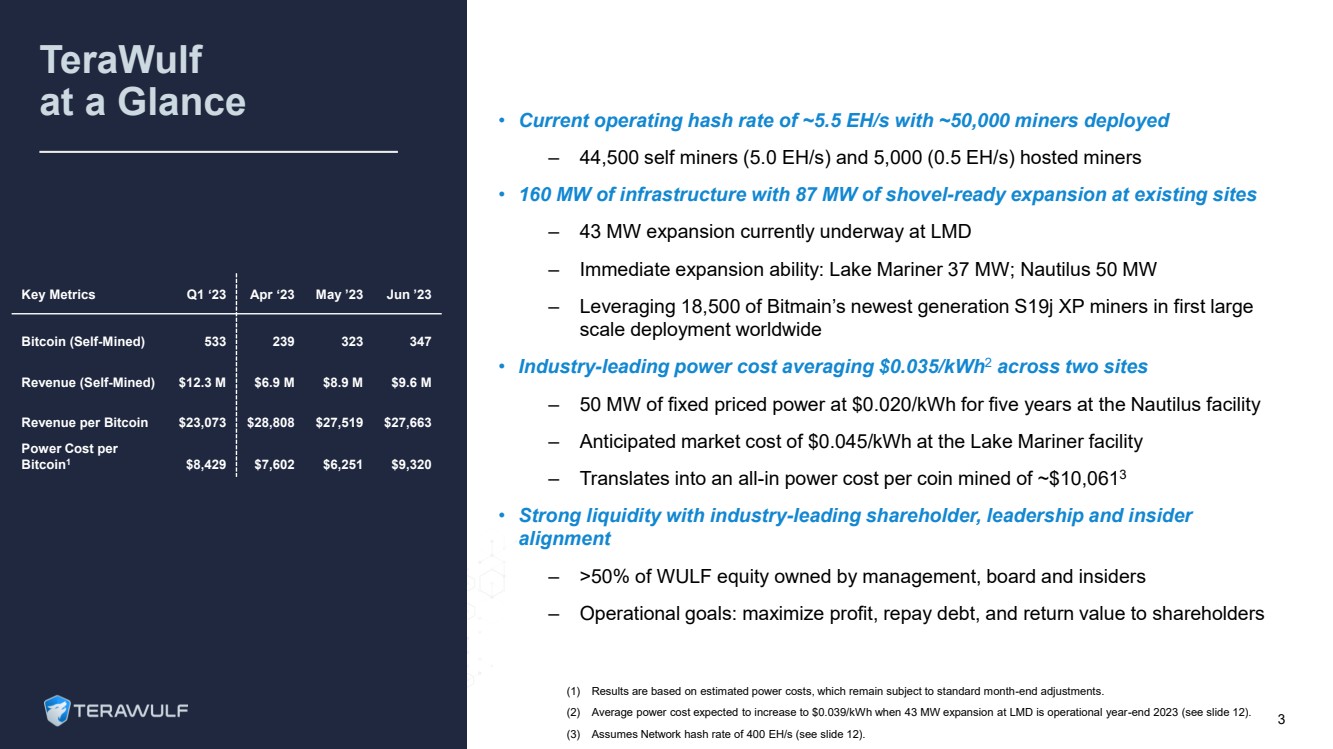

| TeraWulf at a Glance 3 • Current operating hash rate of ~5.5 EH/s with ~50,000 miners deployed – 44,500 self miners (5.0 EH/s) and 5,000 (0.5 EH/s) hosted miners • 160 MW of infrastructure with 87 MW of shovel-ready expansion at existing sites – 43 MW expansion currently underway at LMD – Immediate expansion ability: Lake Mariner 37 MW; Nautilus 50 MW – Leveraging 18,500 of Bitmain’s newest generation S19j XP miners in first large scale deployment worldwide • Industry-leading power cost averaging $0.035/kWh2 across two sites – 50 MW of fixed priced power at $0.020/kWh for five years at the Nautilus facility – Anticipated market cost of $0.045/kWh at the Lake Mariner facility – Translates into an all-in power cost per coin mined of ~$10,0613 • Strong liquidity with industry-leading shareholder, leadership and insider alignment – >50% of WULF equity owned by management, board and insiders – Operational goals: maximize profit, repay debt, and return value to shareholders Key Metrics Q1 ‘23 Apr ‘23 May ’23 Jun ’23 Bitcoin (Self-Mined) 533 239 323 347 Revenue (Self-Mined) $12.3 M $6.9 M $8.9 M $9.6 M Revenue per Bitcoin $23,073 $28,808 $27,519 $27,663 Power Cost per Bitcoin1 $8,429 $7,602 $6,251 $9,320 (1) Results are based on estimated power costs, which remain subject to standard month-end adjustments. (2) Average power cost expected to increase to $0.039/kWh when 43 MW expansion at LMD is operational year-end 2023 (see slide 12). (3) Assumes Network hash rate of 400 EH/s (see slide 12). |

| Why WULF Wins: The Four “P’s” Digital Asset Infrastructure First Foundation to Scale Experienced Energy Professionals Power & Infrastructure Experts Sustainable, Scalable Facilities Key Relationships & Site Control ESG Principled and Practiced Driving the Future of Bitcoin Mining 4 Plugs People Power Priorities |

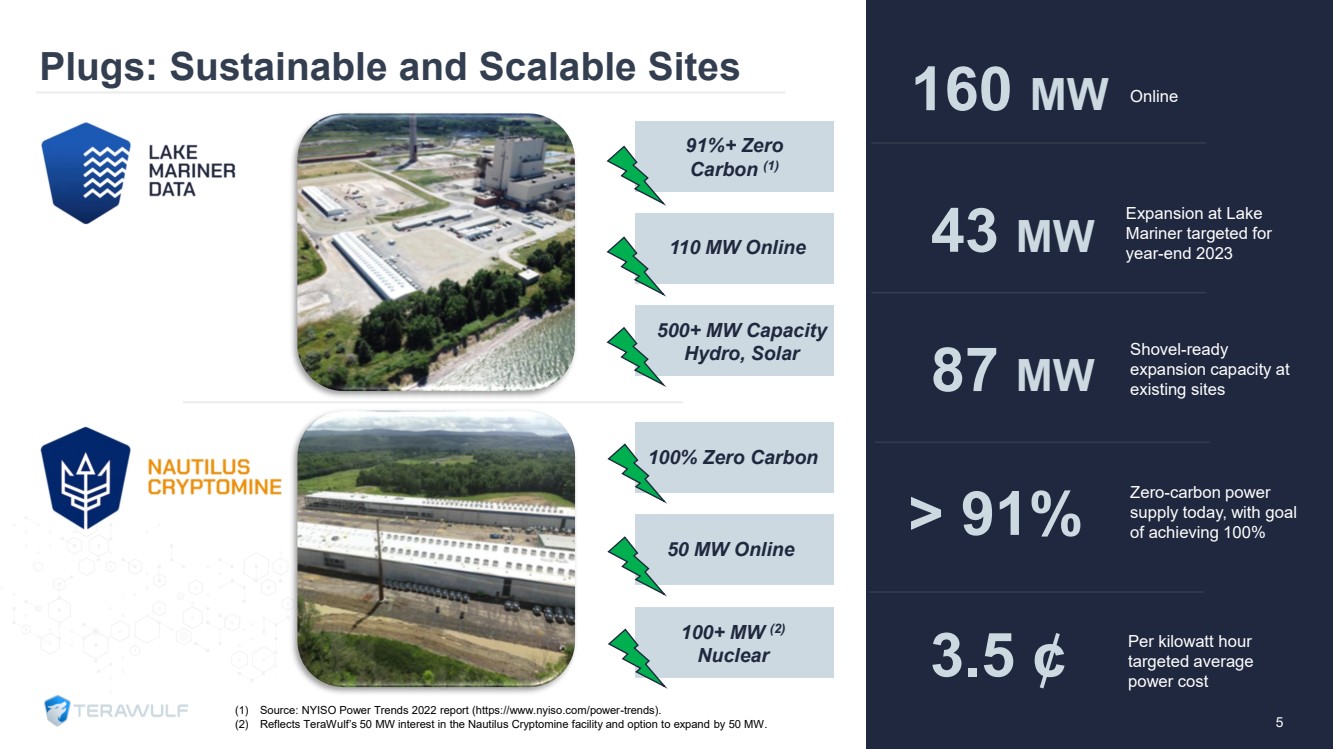

| Plugs: Sustainable and Scalable Sites 87 MW Shovel-ready expansion capacity at existing sites > 91% Zero-carbon power supply today, with goal of achieving 100% 3.5 ¢ Per kilowatt hour targeted average power cost 5 91%+ Zero Carbon (1) 110 MW Online 500+ MW Capacity Hydro, Solar 100% Zero Carbon 50 MW Online 100+ MW (2) Nuclear (1) Source: NYISO Power Trends 2022 report (https://www.nyiso.com/power-trends). (2) Reflects TeraWulf’s 50 MW interest in the Nautilus Cryptomine facility and option to expand by 50 MW. 160 MW Online 43 MW Expansion at Lake Mariner targeted for year-end 2023 |

| People: Best -in -Class Management Team Led by an accomplished, diverse management team with 30+ years of experience in developing and managing energy infrastructure N A Z A R K H A N Co -Founder, Chief Operating Officer & Chief Technology Officer 20+ years in energy infrastructure and cryptocurrency mining. Previously at Evercore. K E R R I L A N G L A I S Chief Strategy Officer 20+ years of M&A, financing, strategy, and power sector experience. Previously at Goldman Sachs. S E A N F A R R E L L VP, Operations 13+ years of energy experience in renewables, grid optimization, digitalization, and storage solutions. Previously at Siemens Energy. P A U L P R A G E R Co -Founder, Chairman & Chief Executive Officer 30+ year energy infrastructure entrepreneur. USNA Foundation Investment Committee Trustee. P A T R I C K F L E U R Y Chief Financial Officer 20+ years of financial experience in the energy, power, and commodity sectors. Previously at Platinum Equity and Blackstone. S T E F A N I E F L E I S C H M A N N General Counsel General Counsel for 15+ years overseeing all legal and compliance matters. Previously at Paul, Weiss. 6 |

| WULF Mission To be the premier large-scale, zero-carbon bitcoin miner, generating attractive investor returns while providing sustainable benefits for our communities. ✓ Experienced Energy Professionals ✓ Scalable and Flexible ✓ Transparent Reporting and Governance ✓ Business Integrity ✓ Responsible Energy Sourcing ✓ Zero-Carbon Energy ✓ Flexible Baseload ✓ Environmental Stewardship WULF Core Values ESG is at the core of TeraWulf's corporate strategy and ties directly to its business success, risk mitigation, and reputational value. 7 Priorities: |

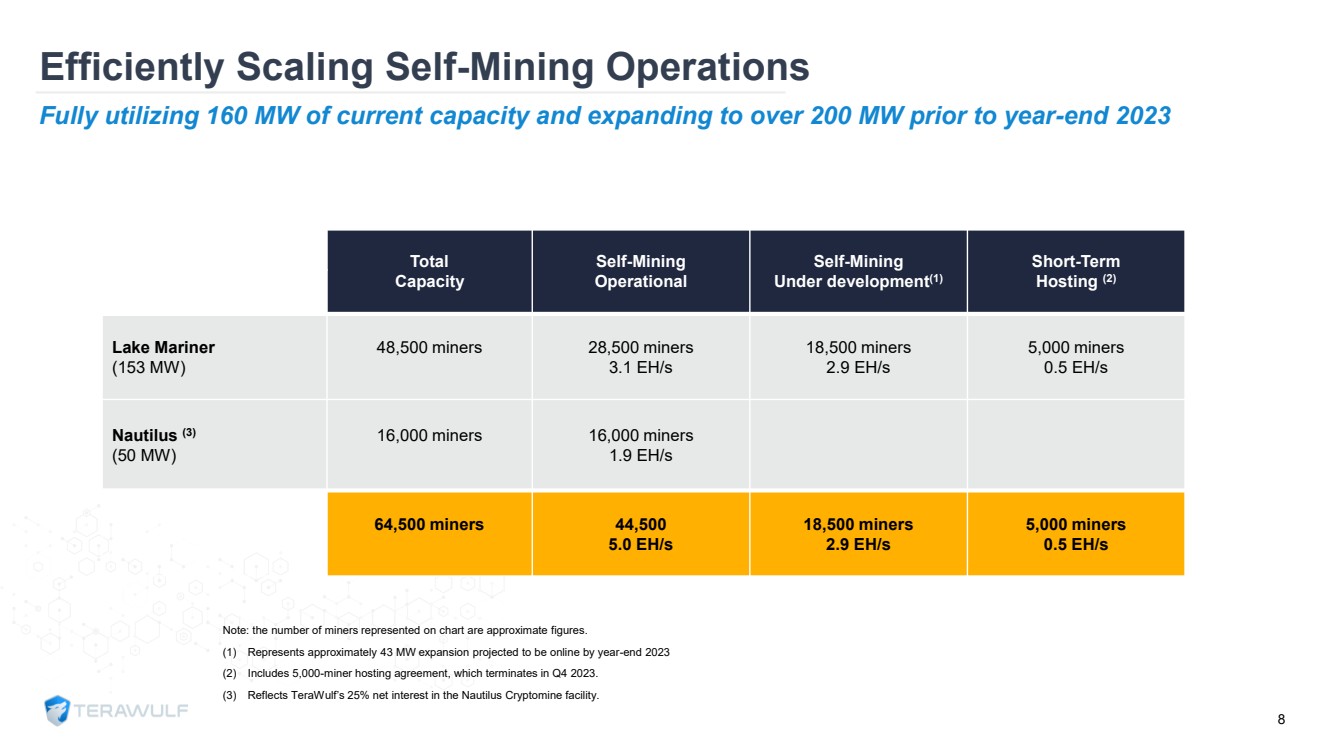

| Efficiently Scaling Self-Mining Operations Note: the number of miners represented on chart are approximate figures. (1) Represents approximately 43 MW expansion projected to be online by year-end 2023 (2) Includes 5,000-miner hosting agreement, which terminates in Q4 2023. (3) Reflects TeraWulf’s 25% net interest in the Nautilus Cryptomine facility. 8 Fully utilizing 160 MW of current capacity and expanding to over 200 MW prior to year-end 2023 Total Capacity Self-Mining Operational Self-Mining Under development(1) Short-Term Hosting (2) Lake Mariner (153 MW) 48,500 miners 28,500 miners 3.1 EH/s 18,500 miners 2.9 EH/s 5,000 miners 0.5 EH/s Nautilus (3) (50 MW) 16,000 miners 16,000 miners 1.9 EH/s 64,500 miners 44,500 5.0 EH/s 18,500 miners 2.9 EH/s 5,000 miners 0.5 EH/s |

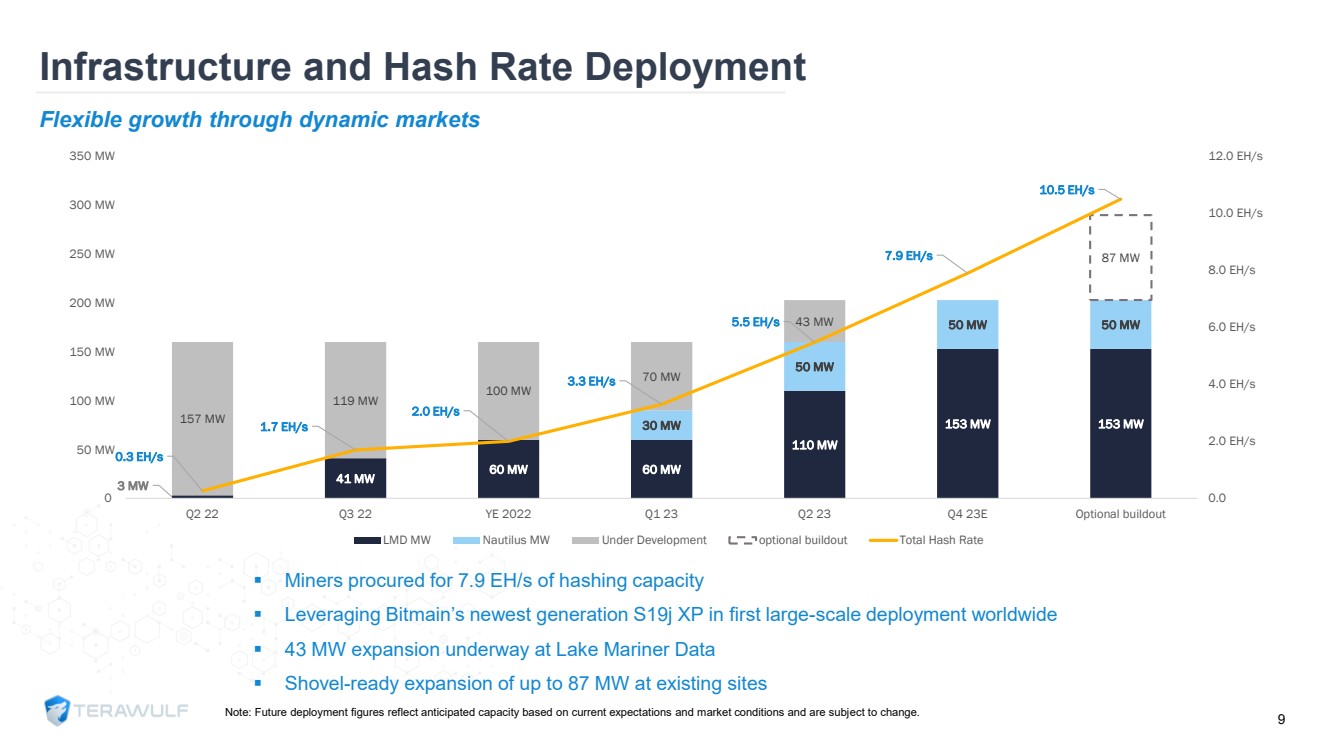

| Note: Future deployment figures reflect anticipated capacity based on current expectations and market conditions and are subject to change. Flexible growth through dynamic markets 9 Infrastructure and Hash Rate Deployment ▪ Miners procured for 7.9 EH/s of hashing capacity ▪ Leveraging Bitmain’s newest generation S19j XP in first large-scale deployment worldwide ▪ 43 MW expansion underway at Lake Mariner Data ▪ Shovel-ready expansion of up to 87 MW at existing sites 3 MW 41 MW 60 MW 60 MW 110 MW 30 MW 153 MW 153 MW 50 MW 50 MW 50 MW 157 MW 119 MW 100 MW 70 MW 43 MW 87 MW 0.3 EH/s 1.7 EH/s 2.0 EH/s 3.3 EH/s 5.5 EH/s 7.9 EH/s 10.5 EH/s 0.0 2.0 EH/s 4.0 EH/s 6.0 EH/s 8.0 EH/s 10.0 EH/s 12.0 EH/s 0 50 MW 100 MW 150 MW 200 MW 250 MW 300 MW 350 MW Q2 22 Q3 22 YE 2022 Q1 23 Q2 23 Q4 23E Optional buildout LMD MW Nautilus MW Under Development optional buildout Total Hash Rate |

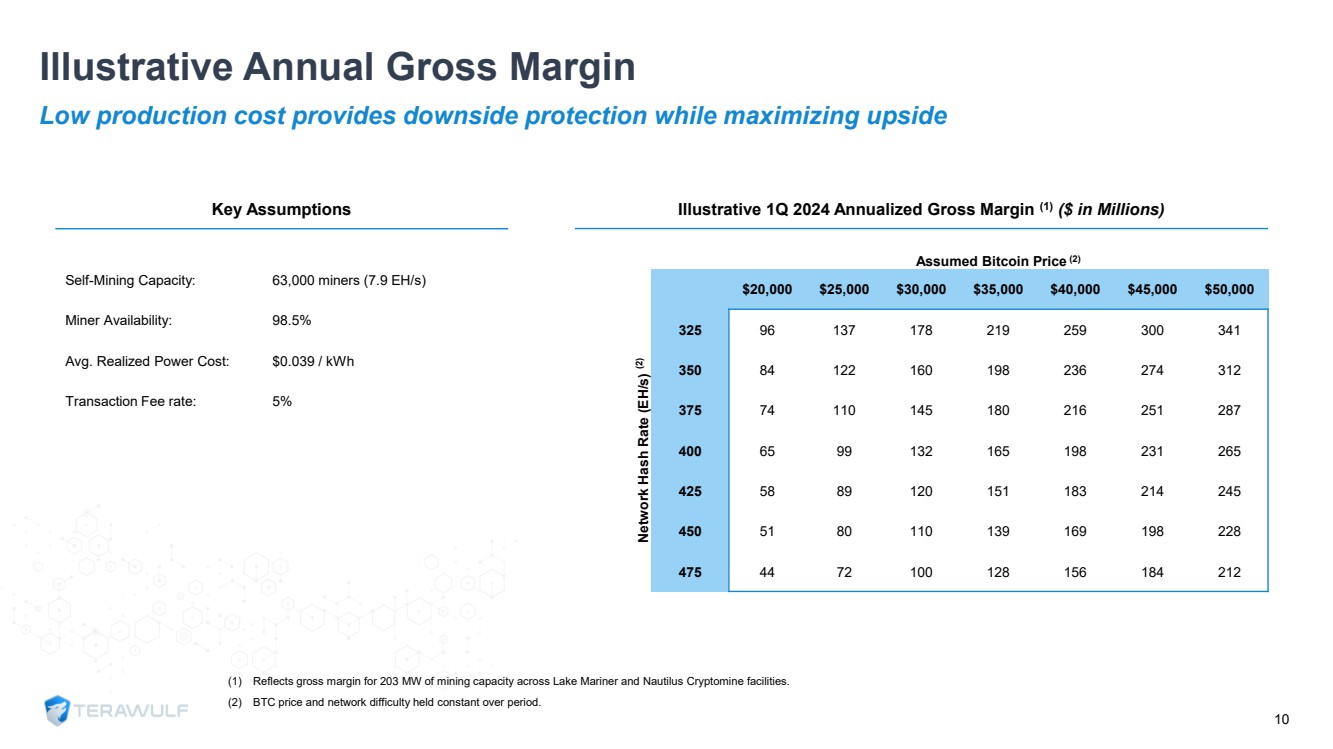

| Illustrative Annual Gross Margin (1) Reflects gross margin for 203 MW of mining capacity across Lake Mariner and Nautilus Cryptomine facilities. (2) BTC price and network difficulty held constant over period. Low production cost provides downside protection while maximizing upside Illustrative 1Q 2024 Annualized Gross Margin (1) ($ in Millions) Assumed Bitcoin Price (2) $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 $50,000 Network Hash Rate (EH/s) (2) 325 96 137 178 219 259 300 341 350 84 122 160 198 236 274 312 375 74 110 145 180 216 251 287 400 65 99 132 165 198 231 265 425 58 89 120 151 183 214 245 450 51 80 110 139 169 198 228 475 44 72 100 128 156 184 212 Key Assumptions Self-Mining Capacity: 63,000 miners (7.9 EH/s) Miner Availability: 98.5% Avg. Realized Power Cost: $0.039 / kWh Transaction Fee rate: 5% 10 |

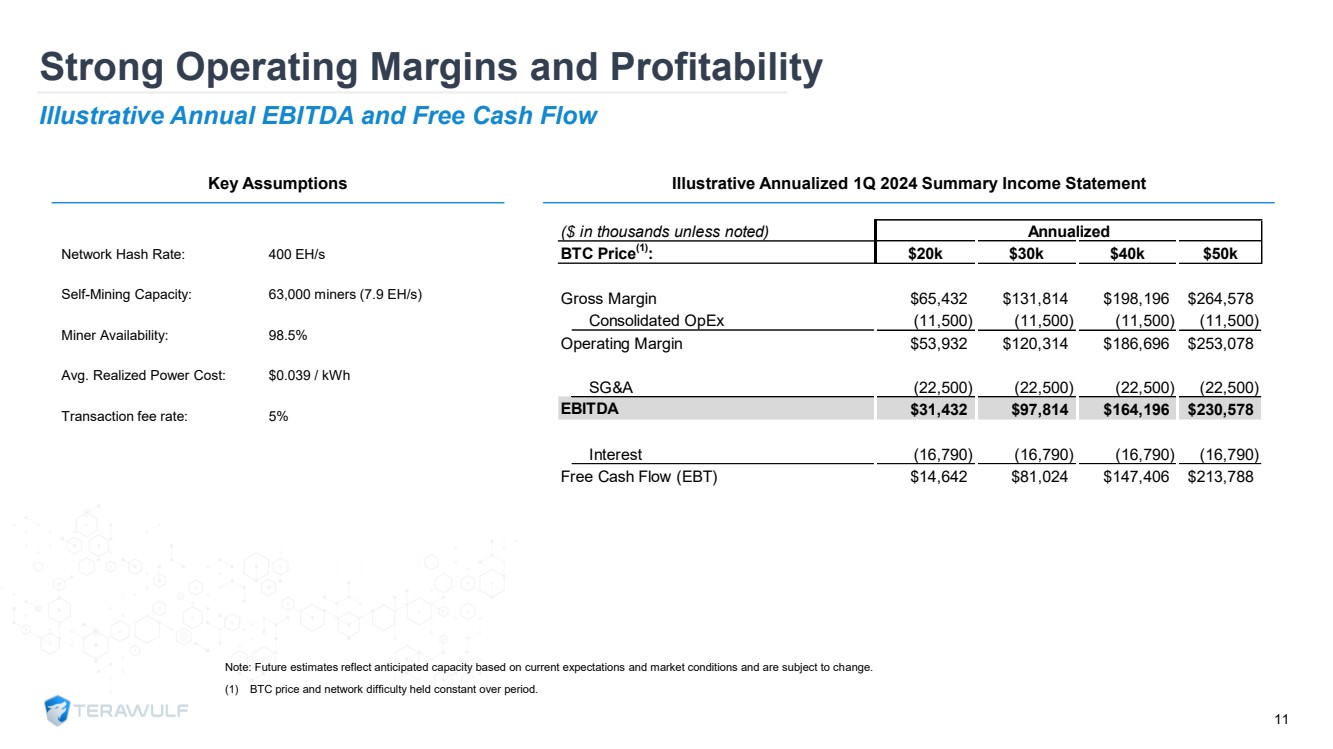

| Strong Operating Margins and Profitability Illustrative Annual EBITDA and Free Cash Flow 11 Note: Future estimates reflect anticipated capacity based on current expectations and market conditions and are subject to change. (1) BTC price and network difficulty held constant over period. Key Assumptions Network Hash Rate: 400 EH/s Self-Mining Capacity: 63,000 miners (7.9 EH/s) Miner Availability: 98.5% Avg. Realized Power Cost: $0.039 / kWh Transaction fee rate: 5% Illustrative Annualized 1Q 2024 Summary Income Statement ($ in thousands unless noted) BTC Price(1): $20k $30k $40k $50k Gross Margin $65,432 $131,814 $198,196 $264,578 (11,500) (11,500) (11,500) (11,500) Operating Margin $53,932 $120,314 $186,696 $253,078 (22,500) (22,500) (22,500) (22,500) EBITDA $31,432 $97,814 $164,196 $230,578 (16,790) (16,790) (16,790) (16,790) Free Cash Flow (EBT) $14,642 $81,024 $147,406 $213,788 Annualized Consolidated OpEx SG&A Interest |

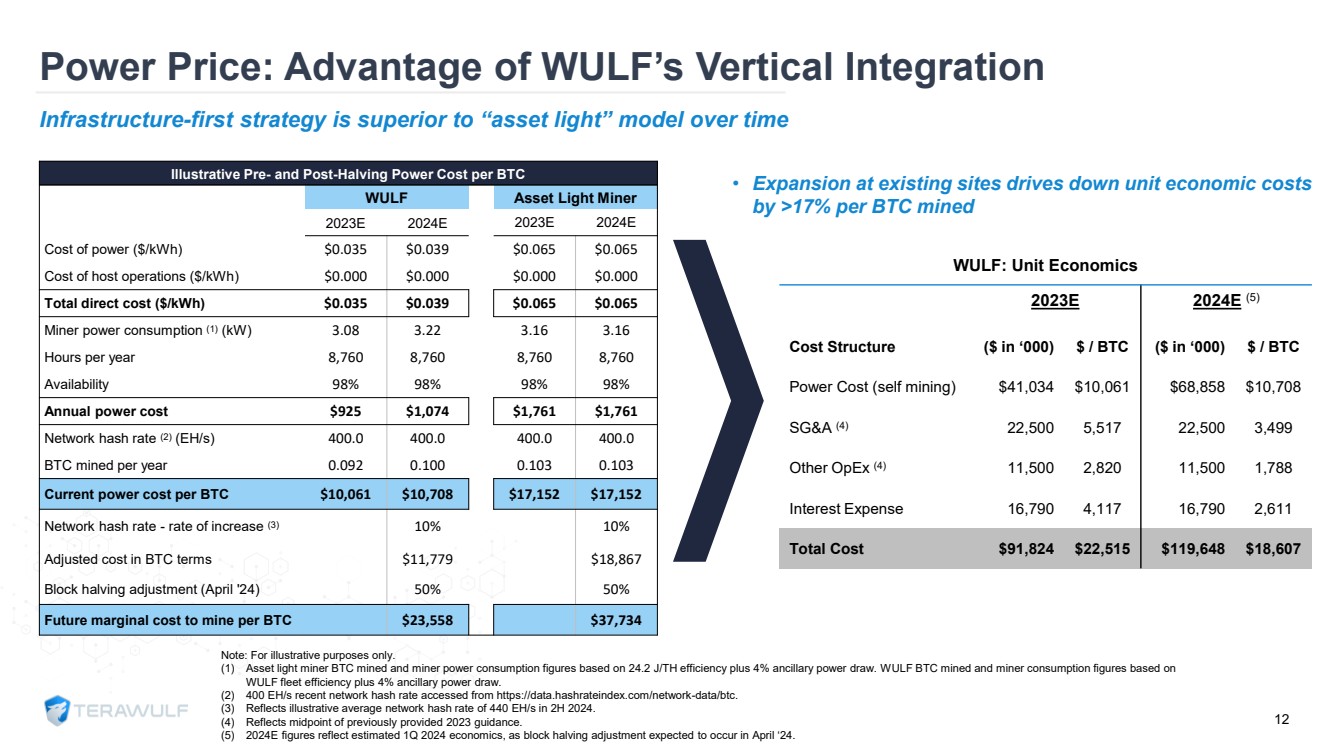

| Note: For illustrative purposes only. (1) Asset light miner BTC mined and miner power consumption figures based on 24.2 J/TH efficiency plus 4% ancillary power draw. WULF BTC mined and miner consumption figures based on WULF fleet efficiency plus 4% ancillary power draw. (2) 400 EH/s recent network hash rate accessed from https://data.hashrateindex.com/network-data/btc. (3) Reflects illustrative average network hash rate of 440 EH/s in 2H 2024. (4) Reflects midpoint of previously provided 2023 guidance. (5) 2024E figures reflect estimated 1Q 2024 economics, as block halving adjustment expected to occur in April ‘24. Illustrative Pre- and Post-Halving Power Cost per BTC WULF Asset Light Miner 2023E 2024E 2023E 2024E Cost of power ($/kWh) $0.035 $0.039 $0.065 $0.065 Cost of host operations ($/kWh) $0.000 $0.000 $0.000 $0.000 Total direct cost ($/kWh) $0.035 $0.039 $0.065 $0.065 Miner power consumption (1) (kW) 3.08 3.22 3.16 3.16 Hours per year 8,760 8,760 8,760 8,760 Availability 98% 98% 98% 98% Annual power cost $925 $1,074 $1,761 $1,761 Network hash rate (2) (EH/s) 400.0 400.0 400.0 400.0 BTC mined per year 0.092 0.100 0.103 0.103 Current power cost per BTC $10,061 $10,708 $17,152 $17,152 Network hash rate - rate of increase (3) 10% 10% Adjusted cost in BTC terms $11,779 $18,867 Block halving adjustment (April '24) 50% 50% Future marginal cost to mine per BTC $23,558 $37,734 Infrastructure-first strategy is superior to “asset light” model over time 12 Power Price: Advantage of WULF’s Vertical Integration WULF: Unit Economics 2023E 2024E (5) Cost Structure ($ in ‘000) $ / BTC ($ in ‘000) $ / BTC Power Cost (self mining) $41,034 $10,061 $68,858 $10,708 SG&A (4) 22,500 5,517 22,500 3,499 Other OpEx (4) 11,500 2,820 11,500 1,788 Interest Expense 16,790 4,117 16,790 2,611 Total Cost $91,824 $22,515 $119,648 $18,607 • Expansion at existing sites drives down unit economic costs by >17% per BTC mined |

| Emerging Leader in Digital Asset Infrastructure • Best-in-class bitcoin mining due to low-cost, sustainable, and domestic bitcoin mining at industrial scale • Vertically integrated strategy ensures ability to create and take advantage of digital asset infrastructure • Experienced team with decades of energy infrastructure experience drives unparalleled execution • Core ESG focus leveraging nearly entirely zero-carbon power (nuclear, hydro and solar) contributes to the acceleration of the transition to a more resilient, stable energy grid • 43 MW expansion online by year-end 2023 with shovel-ready expansion of up to 87 MW at existing sites • Strong liquidity, operating to maximize profits and value to shareholders • Rationalized capital structure through flexible debt amortization profile enabling continued growth • Industry leading management, with board and insider alignment >50% of WULF equity owned by leadership and insiders 13 |

| SITE OVERVIEWS |

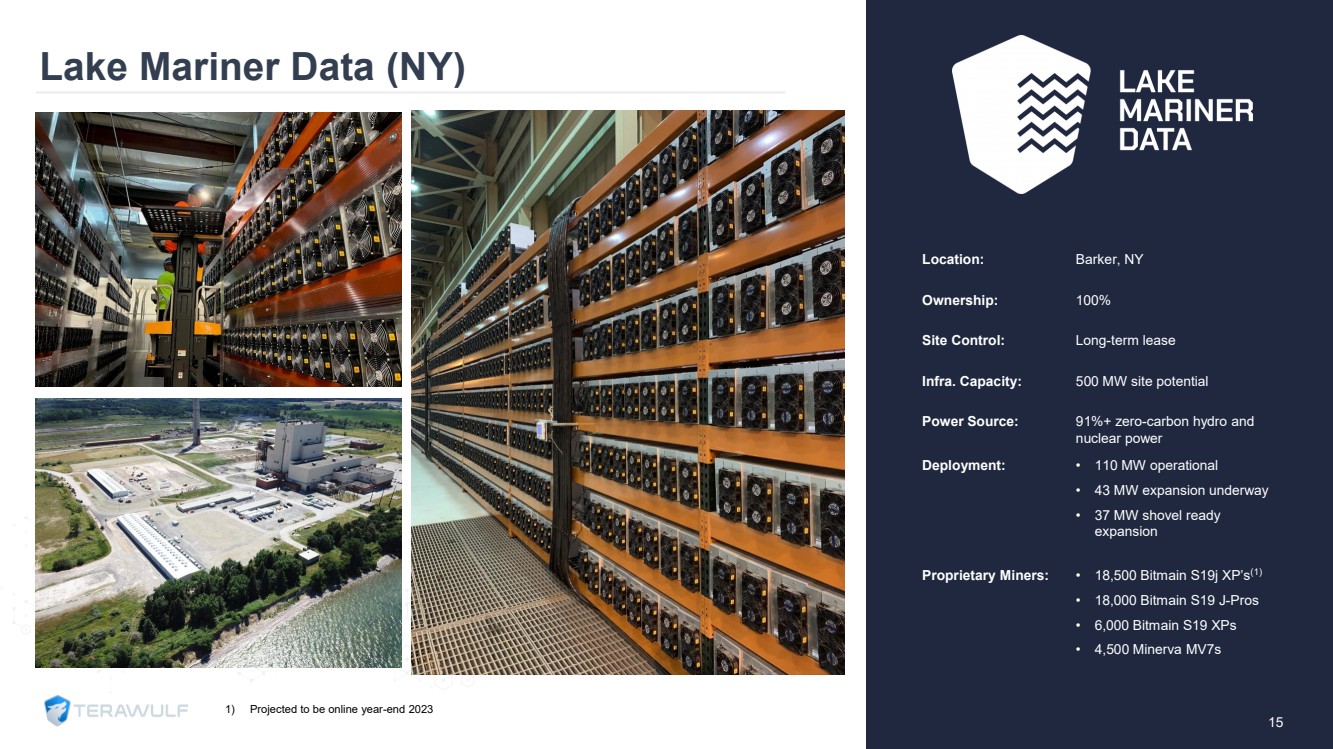

| Lake Mariner Data (NY) 15 Location: Barker, NY Ownership: 100% Site Control: Long-term lease Infra. Capacity: 500 MW site potential Power Source: 91%+ zero-carbon hydro and nuclear power Deployment: • 110 MW operational • 43 MW expansion underway • 37 MW shovel ready expansion Proprietary Miners: • 18,500 Bitmain S19j XP’s(1) • 18,000 Bitmain S19 J-Pros • 6,000 Bitmain S19 XPs • 4,500 Minerva MV7s 1) Projected to be online year-end 2023 |

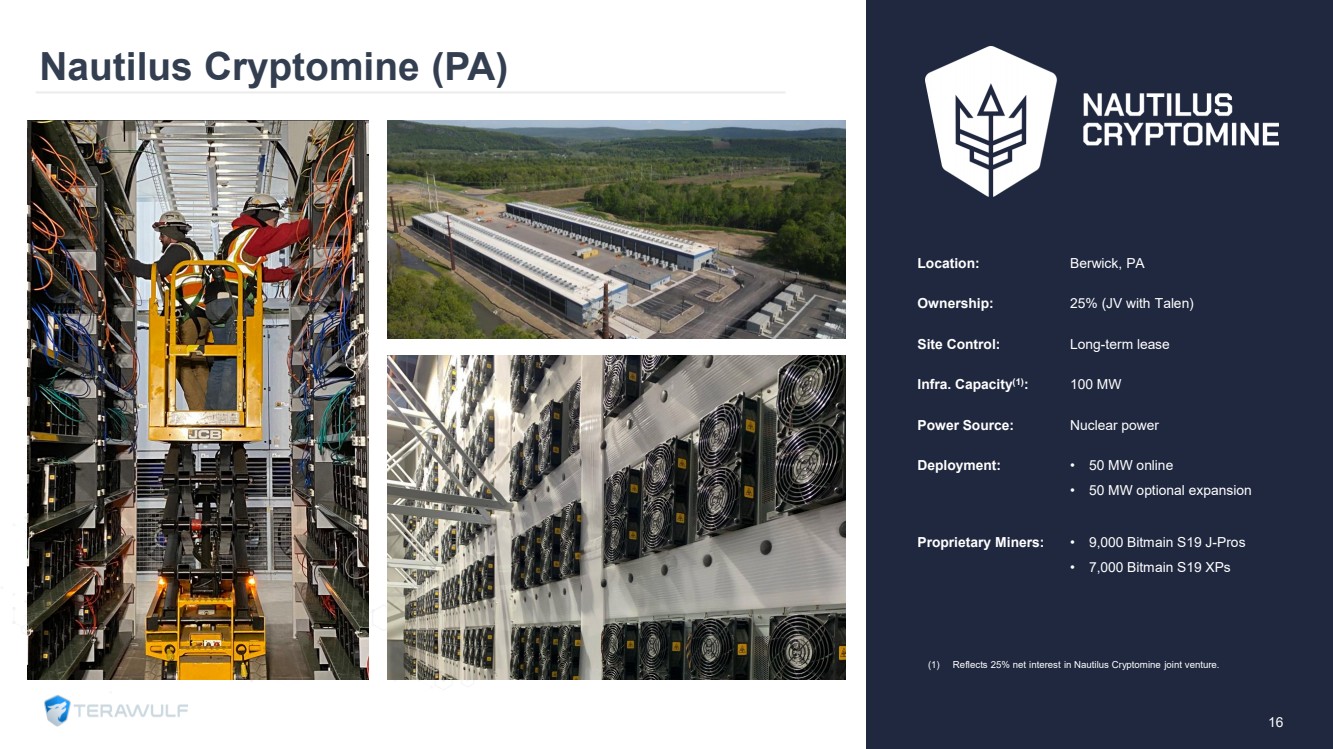

| Nautilus Cryptomine (PA) 16 Location: Berwick, PA Ownership: 25% (JV with Talen) Site Control: Long-term lease Infra. Capacity(1): 100 MW Power Source: Nuclear power Deployment: • 50 MW online • 50 MW optional expansion Proprietary Miners: • 9,000 Bitmain S19 J-Pros • 7,000 Bitmain S19 XPs (1) Reflects 25% net interest in Nautilus Cryptomine joint venture. |

| NASDAQ: WULF Contact: ir@terawulf.com www.TeraWulf.com/contact |