TeraWulf Reports Fourth Quarter and Full Year 2023 Results Annual Revenue Grows 360% Year-Over-Year; Annual BTC Self-Mined Increases 550% to 3,407 Reports Realized Cost of Power of 3.2 Cents Per Kilowatt Hour in 2023, Outperforming Company Guidance of 3.5 Cents Per Kilowatt Hour by 9% Self-Mining Operating Capacity Reaches 8 EH/s, More Than Quadrupling Capacity Since Beginning of 2023 Reports Current Cash and Bitcoin Holdings of $49 million as of February 29, 2024 EASTON, Md., March 19, 2024 (GLOBE NEWSWIRE) -- TeraWulf Inc. (Nasdaq: WULF) (“TeraWulf” or the “Company”), which owns and operates vertically integrated, domestic bitcoin mining facilities powered by more than 95% zero-carbon energy, today announced its financial results for the fourth quarter and full year ended December 31, 2023. Management Commentary “In addition to our outstanding financial achievements in 2023, attributable to the unwavering dedication and hard work of our team, TeraWulf has made significant strides towards our financial and operational objectives. These include proactive debt reduction, rapid expansion of our organic infrastructure, and a steadfast commitment to financial transparency," commented Paul Prager, Founder and Chief Executive Officer of TeraWulf. "Moreover, given the premium on available digital infrastructure, our current facilities offer substantial room for expansion, positioning us to deliver even greater value. Our strategic plan entails reaching operational capacity of 300 MW by the close of 2024 and scaling up to 550 MW by the conclusion of 2025.” Patrick Fleury, TeraWulf’s Chief Financial Officer added, “In 2023, TeraWulf demonstrated exceptional operational performance and expansive growth, resulting in record levels of revenue and profitability, as demonstrated by both GAAP and non-GAAP metrics. With an industry-leading 3.2 cents per kilowatt hour cost of power, we also achieved a substantial reduction in our debt of $40 million in the aggregate as of February 29, 2024, significantly bolstering our financial standing. As of the end of February, our balance sheet reflects a fortified financial foundation, with $49 million in cash and cash equivalents and bitcoin. This substantial reduction in debt and enhanced liquidity position underscores TeraWulf's resolute commitment to prudent financial management, positioning us even more securely to capitalize on future opportunities with confidence.” “As we look ahead, we're excited to leverage our highly efficient and cost-effective infrastructure to significantly expand hash rate at our top tier sites,” added Nazar Khan, Chief Operating Officer of TeraWulf. “Additionally, we're actively pursuing opportunities to optimize the utilization of our proprietary infrastructure and unlock additional value, including the assessment of advanced AI and HPC applications.” Full Year 2023 Operational and Financial Highlights Key financial and operational highlights for the fiscal year ended December 31, 2023 include: Š Revenue increased 360% to $69.2 million in 2023, as compared to $15.0 million in fiscal 2022 driven by increased bitcoin production and higher average realized bitcoin prices during the period. Š Gross profit increased 960% to $41.9 million in 2023, as compared to $4.0 million in fiscal 2022. Š Non-GAAP adjusted EBITDA increased by $64.9 million to $30.7 million in 2023, as compared to $(34.2) million in fiscal 2022. Š Reported cash and cash equivalents of $54.4 million as of December 31, 2023, as compared to $1.3 million at fiscal year-end 2022. Š Net debt¹ at fiscal year-end 2023 declined 41% to $84.9 million, as compared to $144.7 million at fiscal year-end 2022. Net debt was reduced another 32% to $58.0 million as of February 29, 2024. Additional non-GAAP metrics for fiscal year 2023, which include the impact of TeraWulf’s joint venture interest in the Nautilus Cryptomine facility², include: Š Self-mining operating capacity increased by 464% to 7.9 exahash per second (“EH/s”) as of December 31, 2023, as compared to 1.4 EH/s as of December 31, 2022. Š Self-mined bitcoin production increased 550% to 3,407 in 2023, as compared to 524 in fiscal 2022. Š Power cost averaged $8,676 per bitcoin self-mined, or approximately $0.032/kWh in 2023. ___________________________________ ¹ Net debt calculated as the outstanding principal balance of the Company’s term loan less cash and cash equivalents.

² The Company’s share of the earnings or losses from operations at the Nautilus Cryptomine facility is reflected within “Equity in net loss of investee, net of tax” in the consolidated statements of operations. Accordingly, operating results of the Nautilus Cryptomine facility are not reflected in revenue, cost of revenue or cost of operations lines in TeraWulf’s consolidated statements of operations. The Company uses these metrics as indictors of operational progress and effectiveness and believes they are useful to investors for the same purposes and to provide comparisons to peer companies. Hash Rate Growth In the fiscal year 2023, TeraWulf experienced significant growth, with its self-mining operating capacity reaching 7.9 EH/s by year-end, representing a more than quadruple increase from the 1.4 EH/s recorded at the end of 2022. As of February 29, 2024, the Company had a self-mining hash rate of 7.5 EH/s, with a fleet of approximately 64,500 miners deployed. Among these, 48,500 miners are operating at the Lake Mariner facility, while the Nautilus Cryptomine facility houses around 16,000 of the Company’s miners. Further expansion is ongoing at the wholly owned Lake Mariner facility which is fueled by 93% zero-carbon power, with the construction of Building 4 entering its final phase. This incremental infrastructure is expected to contribute an additional 35 MW of capacity, raising TeraWulf’s total operational mining capacity across both sites to approximately 10 EH/s. With considerable room for expansion within its existing facilities, the Company reaffirms its commitment to achieving an operational infrastructure capacity of 300 MW by the end of 2024. Additionally, it endeavors to deploy 550 MW, equivalent to approximately 28.3 EH/s, utilizing the current generation of miners by 2025. Continuously evaluating the most profitable utilization of its energy and digital infrastructure, the Company is actively exploring potential applications of High-Performance Computing (HPC) and Artificial Intelligence (AI). Fiscal Year 2023 Financial Results Revenue for the year ended December 31, 2023 increased 360% to $69.2 million compared to $15.0 million in fiscal 2022. The increase in revenue is attributable to a 550% increase in bitcoin production year-over-year following the energization of Building 2 (50 MW) in June. Building 3 (45 MW) was subsequently completed in December, bringing online capacity at the Lake Mariner facility to 160 MW. Gross profit for the year ended December 31, 2023 was $41.9 million (61% of revenue), as compared to $4.0 million (26% of revenue) for the year ended December 31, 2022, an increase of $37.9 million (or 961%) resulting from the aforementioned increase in operational capacity. Cost of operations for the year ended December 31, 2023 totaled $71.3 million, as compared to $47.7 million for the year ended December 31, 2022. The increase in cost of operations was primarily driven by higher depreciation expense due to the increase in mining operations at the Lake Mariner facility in 2023. Non-GAAP adjusted EBITDA for the year ended December 31, 2023 was $30.7 million, as compared to a loss of $34.2 million for the year ended December 31, 2022. Liquidity and Capital Resources As of December 31, 2023, and February 29, 2024, the Company held $56.2 million and $49.1 million, respectively, in cash and cash equivalents and bitcoin on its balance sheet. As of the same periods, the Company had outstanding indebtedness of approximately $139.4 million and $106.0 million, respectively. The Company anticipates an additional repayment of approximately $30.0 million during the first week of April, thereby reducing the debt balance to $76.0 million. Investor Conference Call and Webcast As previously announced, TeraWulf will host its fourth quarter and full year 2023 earnings call and business update for investors today, Tuesday, March 19, 2024, commencing at 5:00 p.m. Eastern Time (3:00 p.m. Pacific Time). Prepared remarks will be followed by a question-and-answer session with management. The conference call will be broadcast live and will be available for replay via “Events & Presentations” under the “Investors” section of the Company’s website at https://investors.terawulf.com/events-and-presentations/. About TeraWulf TeraWulf owns and operates vertically integrated, environmentally clean bitcoin mining facilities in the United States. Led by an experienced group of energy entrepreneurs, the Company currently has two Bitcoin mining facilities: the wholly owned Lake Mariner facility in New York, and Nautilus Cryptomine facility in Pennsylvania, a joint venture with Cumulus Coin, LLC. TeraWulf generates domestically produced Bitcoin powered by 95% zero carbon energy resources including nuclear, hydro, and solar with a goal of utilizing 100% zero-carbon energy. With a core focus on ESG that ties directly to its business success, TeraWulf expects to provide industry leading mining economics at an industrial scale. Forward-Looking Statements This press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements include statements concerning anticipated future events and expectations that are not historical facts. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements. In addition, forward-looking statements are typically identified by words such as “plan,” “believe,” “goal,” “target,” “aim,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, although the absence of these words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are based on the current expectations and beliefs of

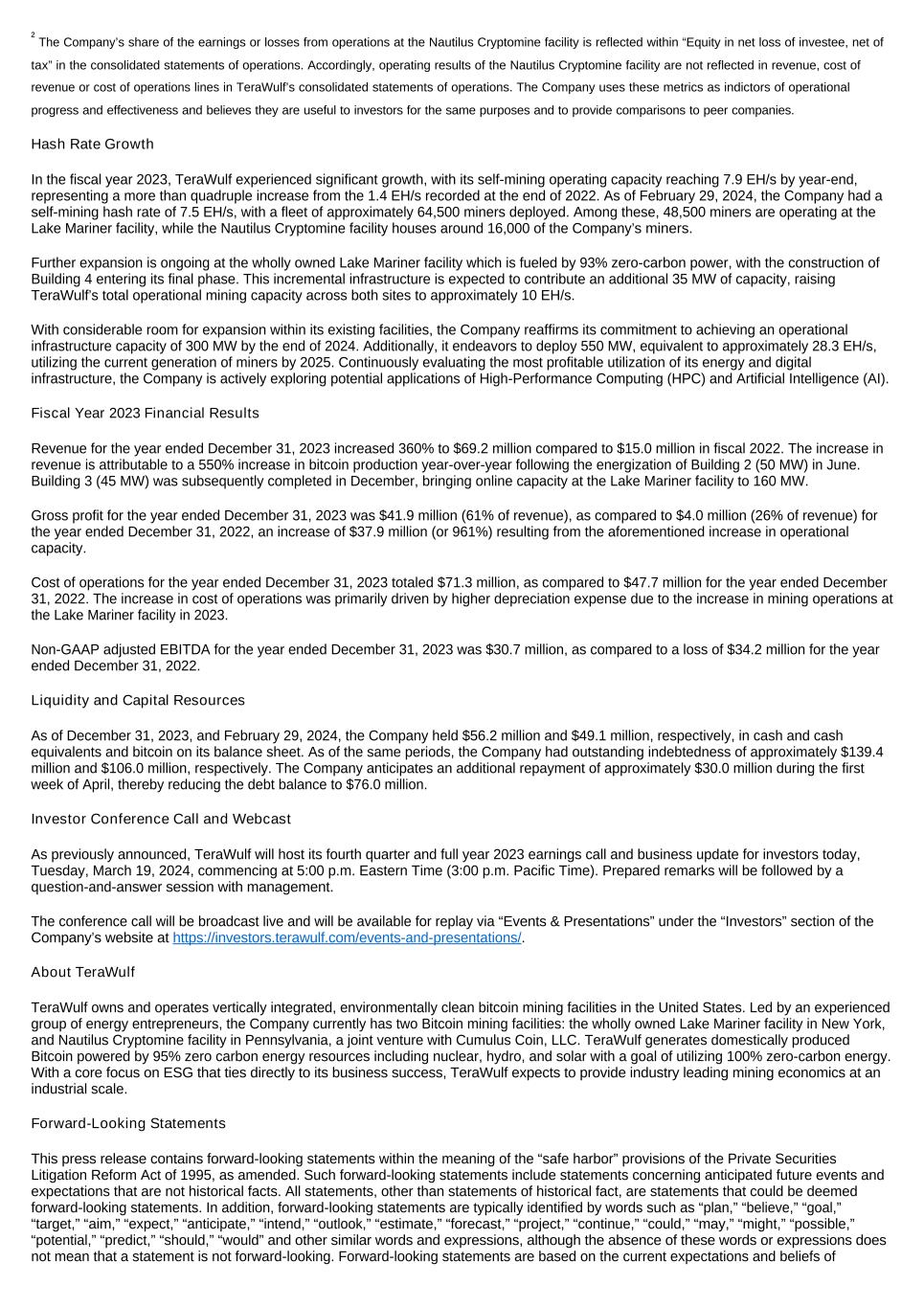

TeraWulf’s management and are inherently subject to a number of factors, risks, uncertainties and assumptions and their potential effects. There can be no assurance that future developments will be those that have been anticipated. Actual results may vary materially from those expressed or implied by forward-looking statements based on a number of factors, risks, uncertainties and assumptions, including, among others: (1) conditions in the cryptocurrency mining industry, including fluctuation in the market pricing of bitcoin and other cryptocurrencies, and the economics of cryptocurrency mining, including as to variables or factors affecting the cost, efficiency and profitability of cryptocurrency mining; (2) competition among the various providers of cryptocurrency mining services; (3) changes in applicable laws, regulations and/or permits affecting TeraWulf’s operations or the industries in which it operates, including regulation regarding power generation, cryptocurrency usage and/or cryptocurrency mining, and/or regulation regarding safety, health, environmental and other matters, which could require significant expenditures; (4) the ability to implement certain business objectives and to timely and cost- effectively execute integrated projects; (5) failure to obtain adequate financing on a timely basis and/or on acceptable terms with regard to growth strategies or operations; (6) loss of public confidence in bitcoin or other cryptocurrencies and the potential for cryptocurrency market manipulation; (7) adverse geopolitical or economic conditions, including a high inflationary environment; (8) the potential of cybercrime, money-laundering, malware infections and phishing and/or loss and interference as a result of equipment malfunction or break-down, physical disaster, data security breach, computer malfunction or sabotage (and the costs associated with any of the foregoing); (9) the availability, delivery schedule and cost of equipment necessary to maintain and grow the business and operations of TeraWulf, including mining equipment and infrastructure equipment meeting the technical or other specifications required to achieve its growth strategy; (10) employment workforce factors, including the loss of key employees; (11) litigation relating to TeraWulf, RM 101 f/k/a IKONICS Corporation and/or the business combination; and (12) other risks and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange Commission (“SEC”). Potential investors, stockholders and other readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they were made. TeraWulf does not assume any obligation to publicly update any forward-looking statement after it was made, whether as a result of new information, future events or otherwise, except as required by law or regulation. Investors are referred to the full discussion of risks and uncertainties associated with forward-looking statements and the discussion of risk factors contained in the Company’s filings with the SEC, which are available at www.sec.gov. Non-GAAP Measures We have not provided reconciliations of preliminary and projected Adjusted EBITDA to the most comparable GAAP measure of net income/ (loss) to common shareholders. Providing net income/(loss) to common shareholders guidance is potentially misleading and not practical given the difficulty of projecting event-driven transactional and other non-core operating items that are included in net income/(loss) to common shareholders, including but not limited to asset impairments and income tax valuation adjustments. Reconciliations of this non- GAAP measure with the most comparable GAAP measure for historical periods is indicative of the reconciliations that will be prepared upon completion of the periods covered by the non-GAAP guidance. Please reference the “Non-GAAP financial information” accompanying our quarterly earnings conference call presentations on our website at www.terawulf.com/investors for our GAAP results and the reconciliations of these measures, where used, to the comparable GAAP measures. Company Contact: Jason Assad Director of Corporate Communications assad@terawulf.com (678) 570-6791 CONSOLIDATED BALANCE SHEETS AS OF December 31, 2023 AND 2022 (In thousands, except number of shares, per share amounts and par value) December 31, 2023 December 31, 2022 ASSETS CURRENT ASSETS: Cash and cash equivalents $ 54,439 $ 1,279 Restricted cash — 7,044 Digital currency, net 1,801 183 Prepaid expenses 4,540 5,095 Other receivables 1,001 — Other current assets 806 543 Total current assets 62,587 14,144 Equity in net assets of investee 98,613 98,741 Property, plant and equipment, net 205,284 191,521 Right-of-use asset 10,943 11,944 Other assets 679 1,337 TOTAL ASSETS 378,106 317,687 LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES: Accounts payable 15,169 21,862 Accrued construction liabilities 1,526 2,903 Other accrued liabilities 9,179 14,963 Share based liabilities due to related party 2,500 14,583

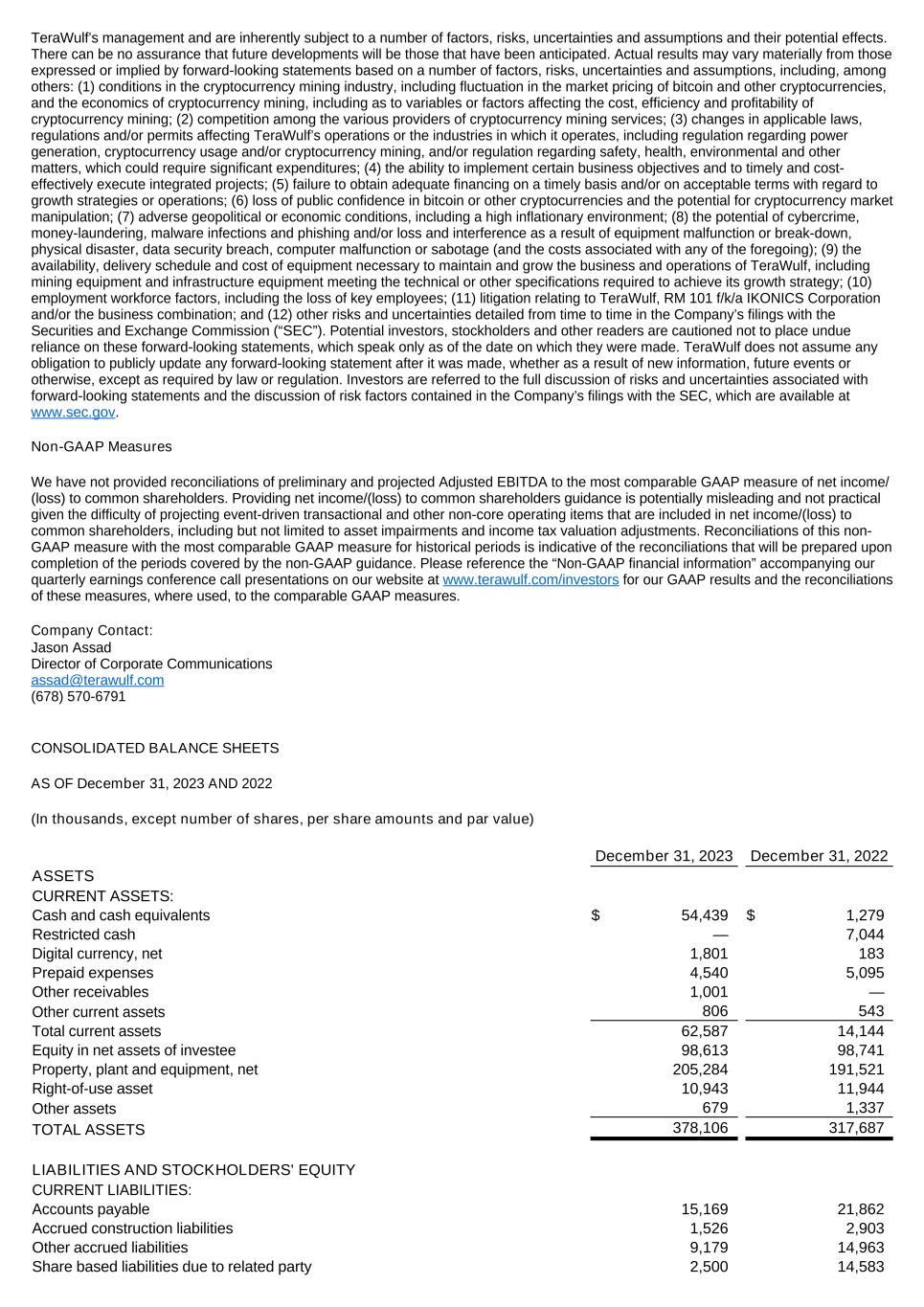

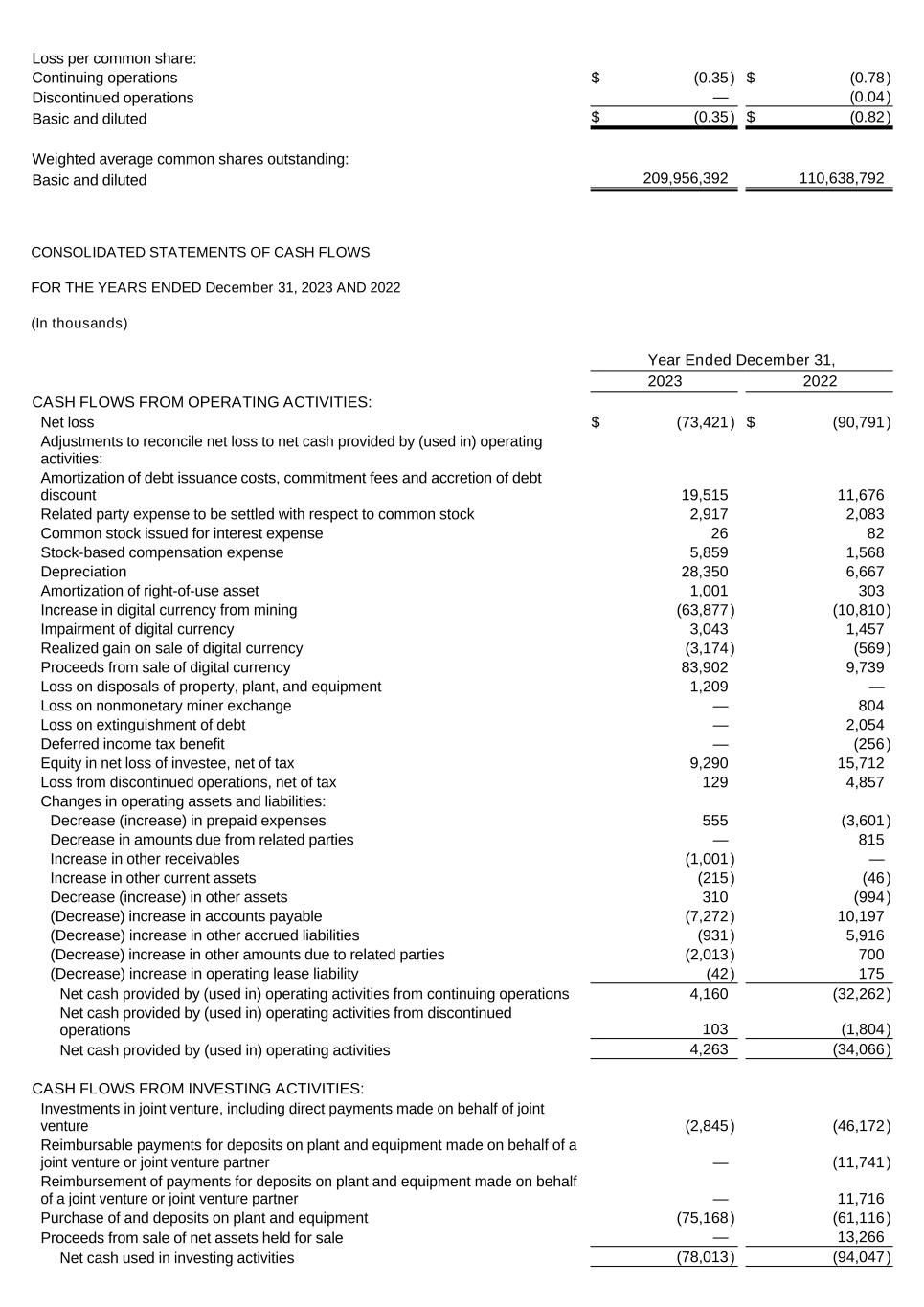

CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE YEARS ENDED December 31, 2023 AND 2022 (In thousands, except number of shares and loss per common share) Other amounts due to related parties 972 3,295 Contingent value rights — 10,900 Current portion of operating lease liability 48 42 Insurance premium financing payable 1,803 2,117 Convertible promissory notes — 3,416 Current portion of long-term debt 123,465 51,938 Total current liabilities 154,662 126,019 Operating lease liability, net of current portion 899 947 Long-term debt 56 72,967 TOTAL LIABILITIES 155,617 199,933 Commitments and Contingencies (See Note 12) STOCKHOLDERS' EQUITY: Preferred stock, $0.001 par value, 100,000,000 and 25,000,000 authorized at December 31, 2023 and 2022, respectively; 9,566 shares issued and outstanding at December 31, 2023 and 2022; aggregate liquidation preference of $11,423 and $10,349 at December 31, 2023 and 2022, respectively. 9,273 9,273 Common stock, $0.001 par value, 400,000,000 and 200,000,000 authorized at December 31, 2023 and 2022, respectively; 276,733,329 and 145,492,971 issued and outstanding at December 31, 2023 and 2022, respectively. 277 145 Additional paid-in capital 472,834 294,810 Accumulated deficit (259,895) (186,474) Total stockholders' equity 222,489 117,754 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 378,106 $ 317,687 Year Ended December 31, 2023 2022 Revenue $ 69,229 $ 15,033 Cost of revenue (exclusive of depreciation shown below) 27,315 11,083 Gross profit 41,914 3,950 Cost of operations: Operating expenses 2,116 2,038 Operating expenses — related party 2,773 1,248 Selling, general and administrative expenses 23,693 22,770 Selling, general and administrative expenses — related party 13,325 13,280 Depreciation 28,350 6,667 Realized gain on sale of digital currency (3,174) (569) Impairment of digital currency 3,043 1,457 Loss on disposals of property, plant, and equipment 1,209 — Loss on nonmonetary miner exchange — 804 Total cost of operations 71,335 47,695 Operating loss (29,421) (43,745) Interest expense (34,812) (24,679) Loss on extinguishment of debt — (2,054) Other income 231 — Loss before income tax and equity in net loss of investee (64,002) (70,478) Income tax benefit — 256 Equity in net loss of investee, net of tax (9,290) (15,712) Loss from continuing operations (73,292) (85,934) Loss from discontinued operations, net of tax (129) (4,857) Net loss (73,421) (90,791) Preferred stock dividends (1,074) (783) Net loss attributable to common stockholders $ (74,495) $ (91,574)

CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE YEARS ENDED December 31, 2023 AND 2022 (In thousands) Loss per common share: Continuing operations $ (0.35) $ (0.78) Discontinued operations — (0.04 ) Basic and diluted $ (0.35) $ (0.82) Weighted average common shares outstanding: Basic and diluted 209,956,392 110,638,792 Year Ended December 31, 2023 2022 CASH FLOWS FROM OPERATING ACTIVITIES: Net loss $ (73,421) $ (90,791) Adjustments to reconcile net loss to net cash provided by (used in) operating activities: Amortization of debt issuance costs, commitment fees and accretion of debt discount 19,515 11,676 Related party expense to be settled with respect to common stock 2,917 2,083 Common stock issued for interest expense 26 82 Stock-based compensation expense 5,859 1,568 Depreciation 28,350 6,667 Amortization of right-of-use asset 1,001 303 Increase in digital currency from mining (63,877) (10,810) Impairment of digital currency 3,043 1,457 Realized gain on sale of digital currency (3,174) (569) Proceeds from sale of digital currency 83,902 9,739 Loss on disposals of property, plant, and equipment 1,209 — Loss on nonmonetary miner exchange — 804 Loss on extinguishment of debt — 2,054 Deferred income tax benefit — (256 ) Equity in net loss of investee, net of tax 9,290 15,712 Loss from discontinued operations, net of tax 129 4,857 Changes in operating assets and liabilities: Decrease (increase) in prepaid expenses 555 (3,601) Decrease in amounts due from related parties — 815 Increase in other receivables (1,001) — Increase in other current assets (215) (46 ) Decrease (increase) in other assets 310 (994) (Decrease) increase in accounts payable (7,272) 10,197 (Decrease) increase in other accrued liabilities (931) 5,916 (Decrease) increase in other amounts due to related parties (2,013) 700 (Decrease) increase in operating lease liability (42 ) 175 Net cash provided by (used in) operating activities from continuing operations 4,160 (32,262) Net cash provided by (used in) operating activities from discontinued operations 103 (1,804) Net cash provided by (used in) operating activities 4,263 (34,066) CASH FLOWS FROM INVESTING ACTIVITIES: Investments in joint venture, including direct payments made on behalf of joint venture (2,845) (46,172) Reimbursable payments for deposits on plant and equipment made on behalf of a joint venture or joint venture partner — (11,741) Reimbursement of payments for deposits on plant and equipment made on behalf of a joint venture or joint venture partner — 11,716 Purchase of and deposits on plant and equipment (75,168) (61,116) Proceeds from sale of net assets held for sale — 13,266 Net cash used in investing activities (78,013) (94,047)

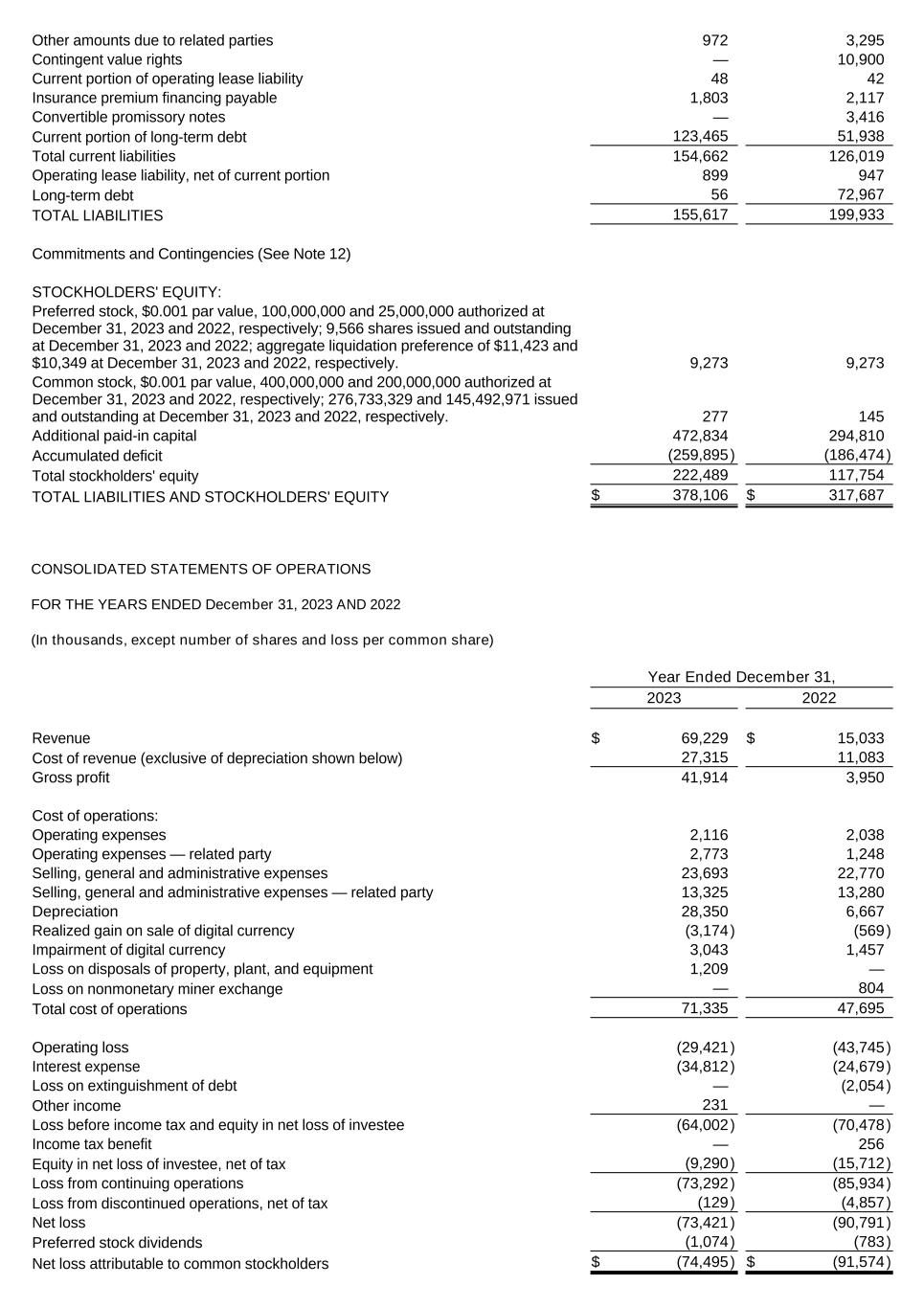

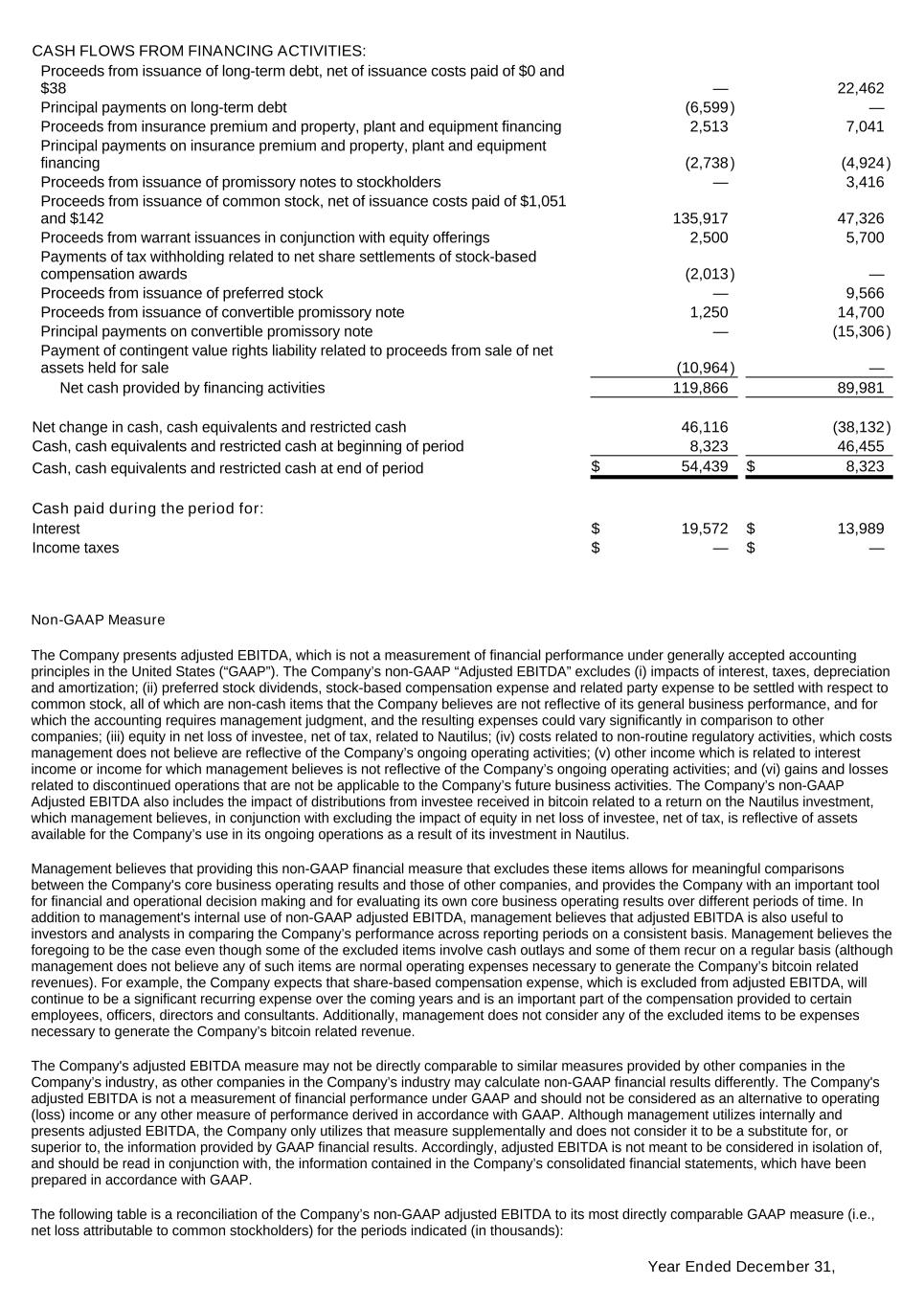

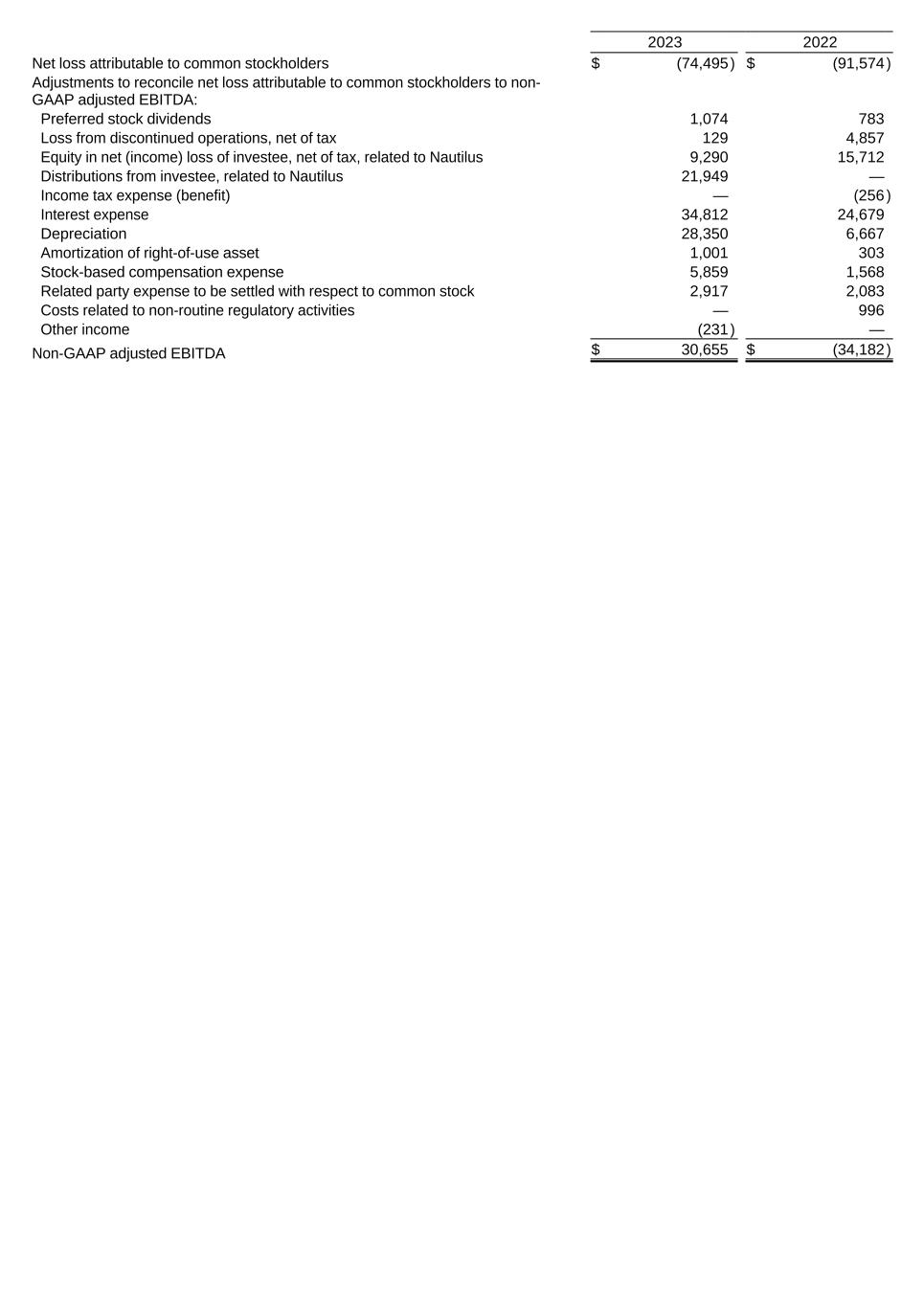

Non-GAAP Measure The Company presents adjusted EBITDA, which is not a measurement of financial performance under generally accepted accounting principles in the United States (“GAAP”). The Company’s non-GAAP “Adjusted EBITDA” excludes (i) impacts of interest, taxes, depreciation and amortization; (ii) preferred stock dividends, stock-based compensation expense and related party expense to be settled with respect to common stock, all of which are non-cash items that the Company believes are not reflective of its general business performance, and for which the accounting requires management judgment, and the resulting expenses could vary significantly in comparison to other companies; (iii) equity in net loss of investee, net of tax, related to Nautilus; (iv) costs related to non-routine regulatory activities, which costs management does not believe are reflective of the Company’s ongoing operating activities; (v) other income which is related to interest income or income for which management believes is not reflective of the Company’s ongoing operating activities; and (vi) gains and losses related to discontinued operations that are not be applicable to the Company’s future business activities. The Company’s non-GAAP Adjusted EBITDA also includes the impact of distributions from investee received in bitcoin related to a return on the Nautilus investment, which management believes, in conjunction with excluding the impact of equity in net loss of investee, net of tax, is reflective of assets available for the Company’s use in its ongoing operations as a result of its investment in Nautilus. Management believes that providing this non-GAAP financial measure that excludes these items allows for meaningful comparisons between the Company's core business operating results and those of other companies, and provides the Company with an important tool for financial and operational decision making and for evaluating its own core business operating results over different periods of time. In addition to management's internal use of non-GAAP adjusted EBITDA, management believes that adjusted EBITDA is also useful to investors and analysts in comparing the Company’s performance across reporting periods on a consistent basis. Management believes the foregoing to be the case even though some of the excluded items involve cash outlays and some of them recur on a regular basis (although management does not believe any of such items are normal operating expenses necessary to generate the Company’s bitcoin related revenues). For example, the Company expects that share-based compensation expense, which is excluded from adjusted EBITDA, will continue to be a significant recurring expense over the coming years and is an important part of the compensation provided to certain employees, officers, directors and consultants. Additionally, management does not consider any of the excluded items to be expenses necessary to generate the Company’s bitcoin related revenue. The Company's adjusted EBITDA measure may not be directly comparable to similar measures provided by other companies in the Company’s industry, as other companies in the Company’s industry may calculate non-GAAP financial results differently. The Company's adjusted EBITDA is not a measurement of financial performance under GAAP and should not be considered as an alternative to operating (loss) income or any other measure of performance derived in accordance with GAAP. Although management utilizes internally and presents adjusted EBITDA, the Company only utilizes that measure supplementally and does not consider it to be a substitute for, or superior to, the information provided by GAAP financial results. Accordingly, adjusted EBITDA is not meant to be considered in isolation of, and should be read in conjunction with, the information contained in the Company’s consolidated financial statements, which have been prepared in accordance with GAAP. The following table is a reconciliation of the Company’s non-GAAP adjusted EBITDA to its most directly comparable GAAP measure (i.e., net loss attributable to common stockholders) for the periods indicated (in thousands): CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from issuance of long-term debt, net of issuance costs paid of $0 and $38 — 22,462 Principal payments on long-term debt (6,599) — Proceeds from insurance premium and property, plant and equipment financing 2,513 7,041 Principal payments on insurance premium and property, plant and equipment financing (2,738) (4,924) Proceeds from issuance of promissory notes to stockholders — 3,416 Proceeds from issuance of common stock, net of issuance costs paid of $1,051 and $142 135,917 47,326 Proceeds from warrant issuances in conjunction with equity offerings 2,500 5,700 Payments of tax withholding related to net share settlements of stock-based compensation awards (2,013) — Proceeds from issuance of preferred stock — 9,566 Proceeds from issuance of convertible promissory note 1,250 14,700 Principal payments on convertible promissory note — (15,306) Payment of contingent value rights liability related to proceeds from sale of net assets held for sale (10,964) — Net cash provided by financing activities 119,866 89,981 Net change in cash, cash equivalents and restricted cash 46,116 (38,132) Cash, cash equivalents and restricted cash at beginning of period 8,323 46,455 Cash, cash equivalents and restricted cash at end of period $ 54,439 $ 8,323 Cash paid during the period for: Interest $ 19,572 $ 13,989 Income taxes $ — $ — Year Ended December 31,

2023 2022 Net loss attributable to common stockholders $ (74,495) $ (91,574) Adjustments to reconcile net loss attributable to common stockholders to non- GAAP adjusted EBITDA: Preferred stock dividends 1,074 783 Loss from discontinued operations, net of tax 129 4,857 Equity in net (income) loss of investee, net of tax, related to Nautilus 9,290 15,712 Distributions from investee, related to Nautilus 21,949 — Income tax expense (benefit) — (256 ) Interest expense 34,812 24,679 Depreciation 28,350 6,667 Amortization of right-of-use asset 1,001 303 Stock-based compensation expense 5,859 1,568 Related party expense to be settled with respect to common stock 2,917 2,083 Costs related to non-routine regulatory activities — 996 Other income (231) — Non-GAAP adjusted EBITDA $ 30,655 $ (34,182)