1 Investor Presentation March 2024 An Infrastructure- Focused Mining Company

SAFE HARBOR STATEMENT This presentation is for informational purposes only and contains forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements include statements concerning anticipated future events and expectations that are not historical facts. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements. In addition, forward-looking statements are typically identified by words such as "plan," "believe," "goal," "target," "aim," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "continue," "could," "may," "might," "possible," "potential," "predict," "should," "would" and other similar words and expressions, although the absence of these words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are based on the current expectations and beliefs of TeraWulf's management and are inherently subject to a number of factors, risks, uncertainties and assumptions and their potential effects. There can be no assurance that future developments will be those that have been anticipated. Actual results may vary materially from those expressed or implied by forward-looking statements based on a number of factors, risks, uncertainties and assumptions, including, among others: (1) conditions in the cryptocurrency mining industry, including fluctuation in the market pricing of bitcoin and other cryptocurrencies, and the economics of cryptocurrency mining, including as to variables or factors affecting the cost, efficiency and profitability of cryptocurrency mining; (2) competition among the various providers of data mining services; (3) changes in applicable laws, regulations and/or permits affecting TeraWulf's operations or the industries in which it operates, including regulation regarding power generation, cryptocurrency usage and/or cryptocurrency mining; (4) the ability to implement certain business objectives and to timely and cost-effectively execute integrated projects; (5) failure to obtain adequate financing on a timely basis and/or on acceptable terms with regard to growth strategies or operations; (6) loss of public confidence in bitcoin or other cryptocurrencies and the potential for cryptocurrency market manipulation; (7) the potential of cybercrime, money-laundering, malware infections and phishing and/or loss and interference as a result of equipment malfunction or break-down, physical disaster, data security breach, computer malfunction or sabotage (and the costs associated with any of the foregoing); (8) the availability, delivery schedule and cost of equipment necessary to maintain and grow the business and operations of TeraWulf, including mining equipment and equipment meeting the technical or other specifications required to achieve its growth strategy; (9) employment workforce factors, including the loss of key employees; (10) litigation relating to TeraWulf, RM 101 f/k/a IKONICS Corporation and/or the business combination; (11) the ability to recognize the anticipated objectives and benefits of the business combination; and (12) other risks and uncertainties detailed from time to time in the Company's filings with the Securities and Exchange Commission ("SEC"). Potential investors, stockholders and other readers are cautioned not to place undue reliance on these forward- looking statements, which speak only as of the date on which they were made. TeraWulf does not assume any obligation to publicly update any forward-looking statement after it was made, whether as a result of new information, future events or otherwise, except as required by law or regulation. Investors are referred to the full discussion of risks and uncertainties associated with forward-looking statements and the discussion of risk factors contained in the Company's filings with the SEC, which are available at www.sec.gov.

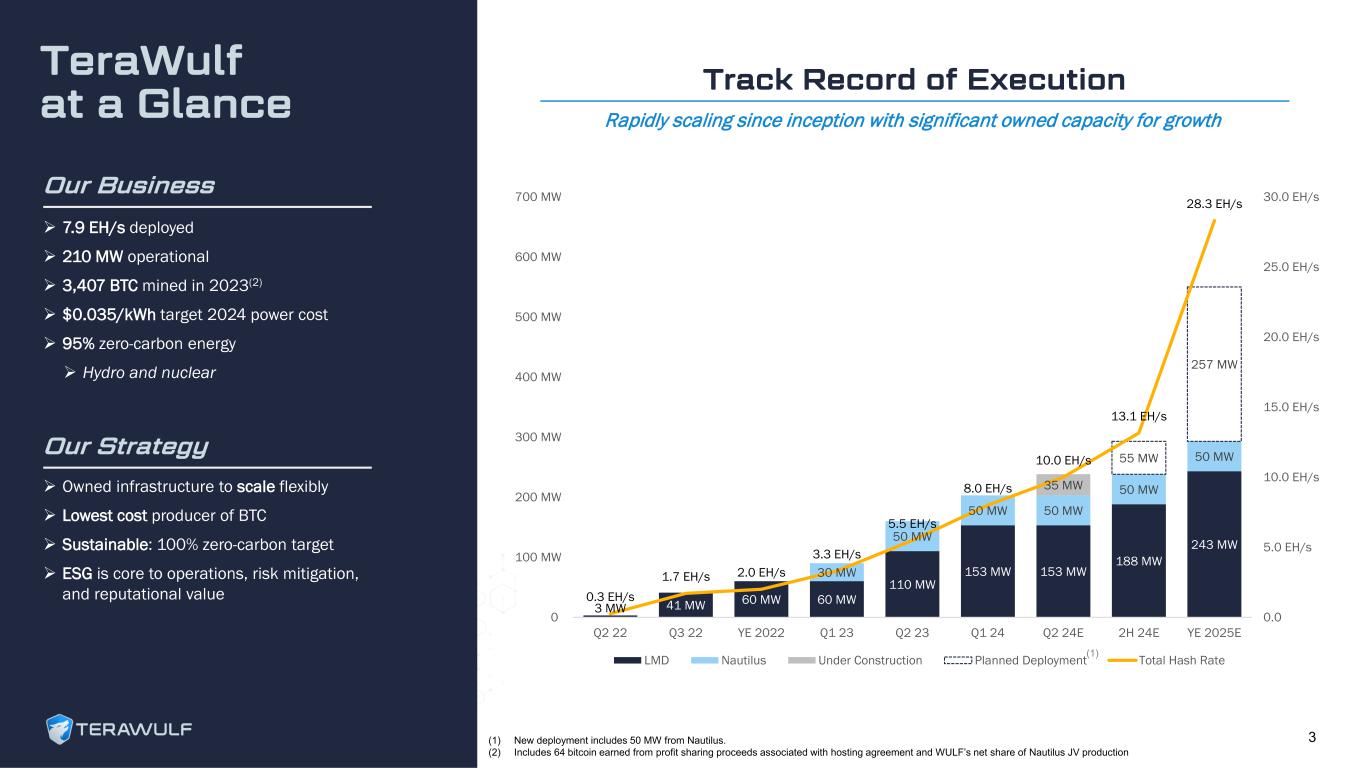

TeraWulf at a Glance 3 Our Business Owned infrastructure to scale flexibly Lowest cost producer of BTC Sustainable: 100% zero-carbon target ESG is core to operations, risk mitigation, and reputational value Our Strategy 7.9 EH/s deployed 210 MW operational 3,407 BTC mined in 2023(2) $0.035/kWh target 2024 power cost 95% zero-carbon energy Hydro and nuclear Track Record of Execution Rapidly scaling since inception with significant owned capacity for growth 3 MW 41 MW 60 MW 60 MW 110 MW 153 MW 153 MW 188 MW 243 MW 30 MW 50 MW 50 MW 50 MW 50 MW 50 MW 35 MW 55 MW 257 MW 0.3 EH/s 1.7 EH/s 2.0 EH/s 3.3 EH/s 5.5 EH/s 8.0 EH/s 10.0 EH/s 13.1 EH/s 28.3 EH/s 0.0 5.0 EH/s 10.0 EH/s 15.0 EH/s 20.0 EH/s 25.0 EH/s 30.0 EH/s 0 100 MW 200 MW 300 MW 400 MW 500 MW 600 MW 700 MW Q2 22 Q3 22 YE 2022 Q1 23 Q2 23 Q1 24 Q2 24E 2H 24E YE 2025E LMD Nautilus Under Construction Planned Deployment Total Hash Rate (1) New deployment includes 50 MW from Nautilus. (2) Includes 64 bitcoin earned from profit sharing proceeds associated with hosting agreement and WULF’s net share of Nautilus JV production (1)

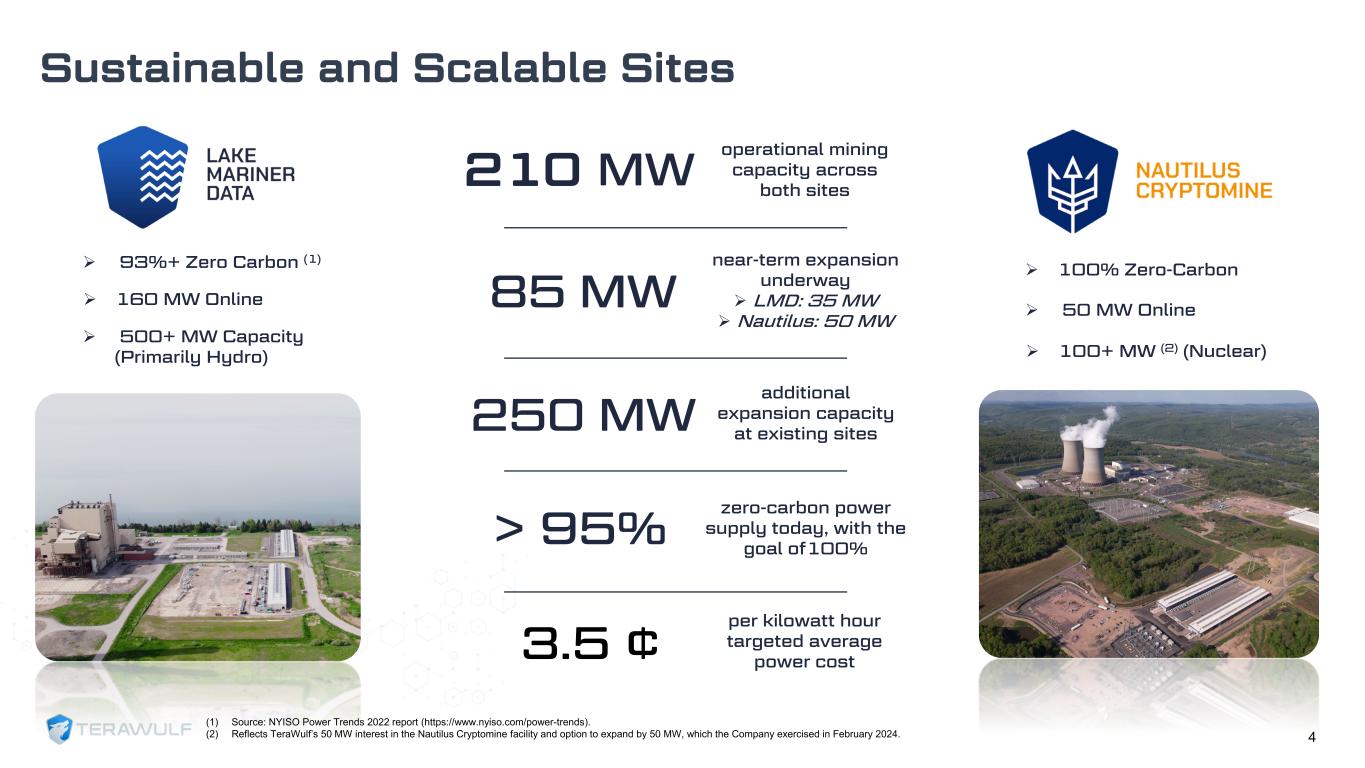

Sustainable and Scalable Sites 93%+ Zero Carbon (1) 160 MW Online 500+ MW Capacity (Primarily Hydro) 100% Zero-Carbon 50 MW Online 100+ MW (2) (Nuclear) 250 MW additional expansion capacity at existing sites > 95% zero-carbon power supply today, with the goal of100% 210 MW operational mining capacity across both sites 85 MW near-term expansion underway LMD: 35 MW Nautilus: 50 MW 3.5 ¢ per kilowatt hour targeted average power cost (1) Source: NYISO Power Trends 2022 report (https://www.nyiso.com/power-trends). (2) Reflects TeraWulf’s 50 MW interest in the Nautilus Cryptomine facility and option to expand by 50 MW, which the Company exercised in February 2024. 4

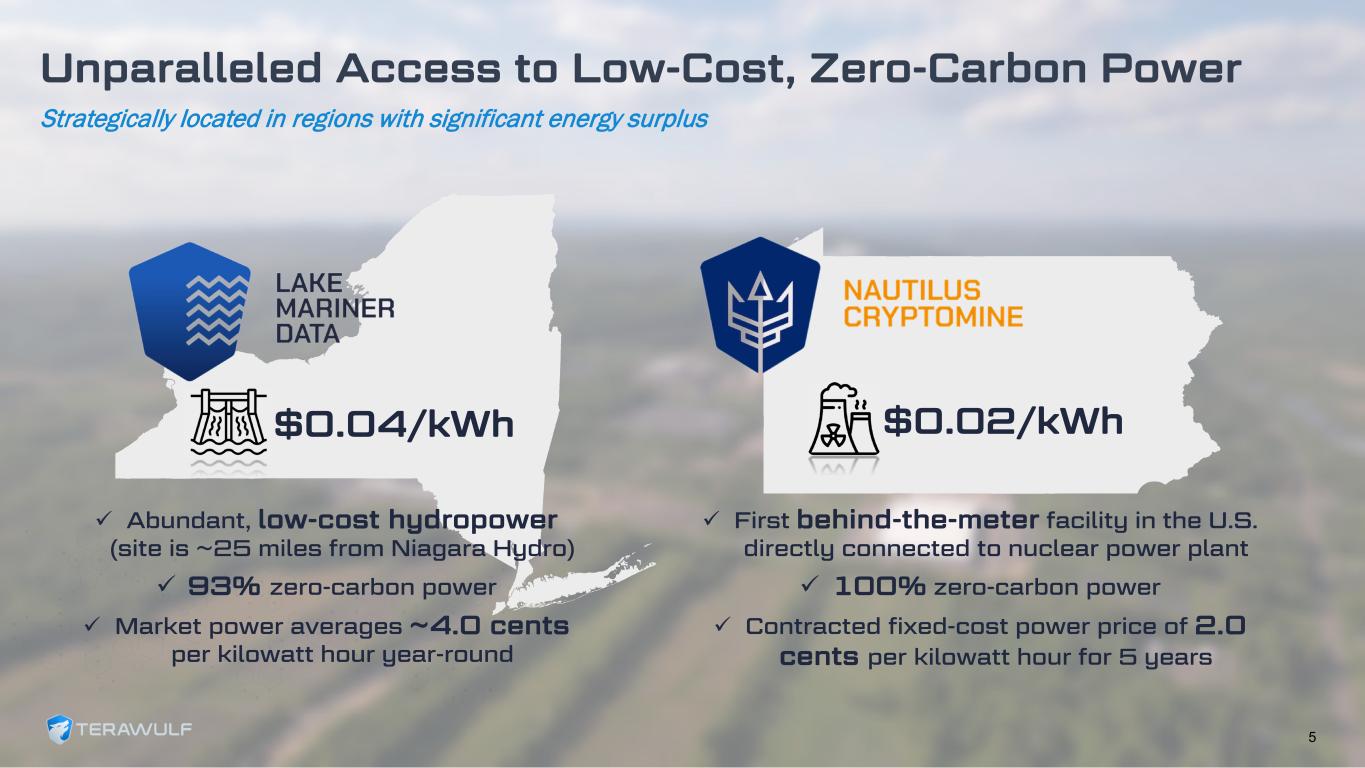

Unparalleled Access to Low-Cost, Zero-Carbon Power Strategically located in regions with significant energy surplus 5 Abundant, low-cost hydropower (site is ~25 miles from Niagara Hydro) 93% zero-carbon power Market power averages ~4.0 cents per kilowatt hour year-round First behind-the-meter facility in the U.S. directly connected to nuclear power plant 100% zero-carbon power Contracted fixed-cost power price of 2.0 cents per kilowatt hour for 5 years $0.04/kWh $0.02/kWh

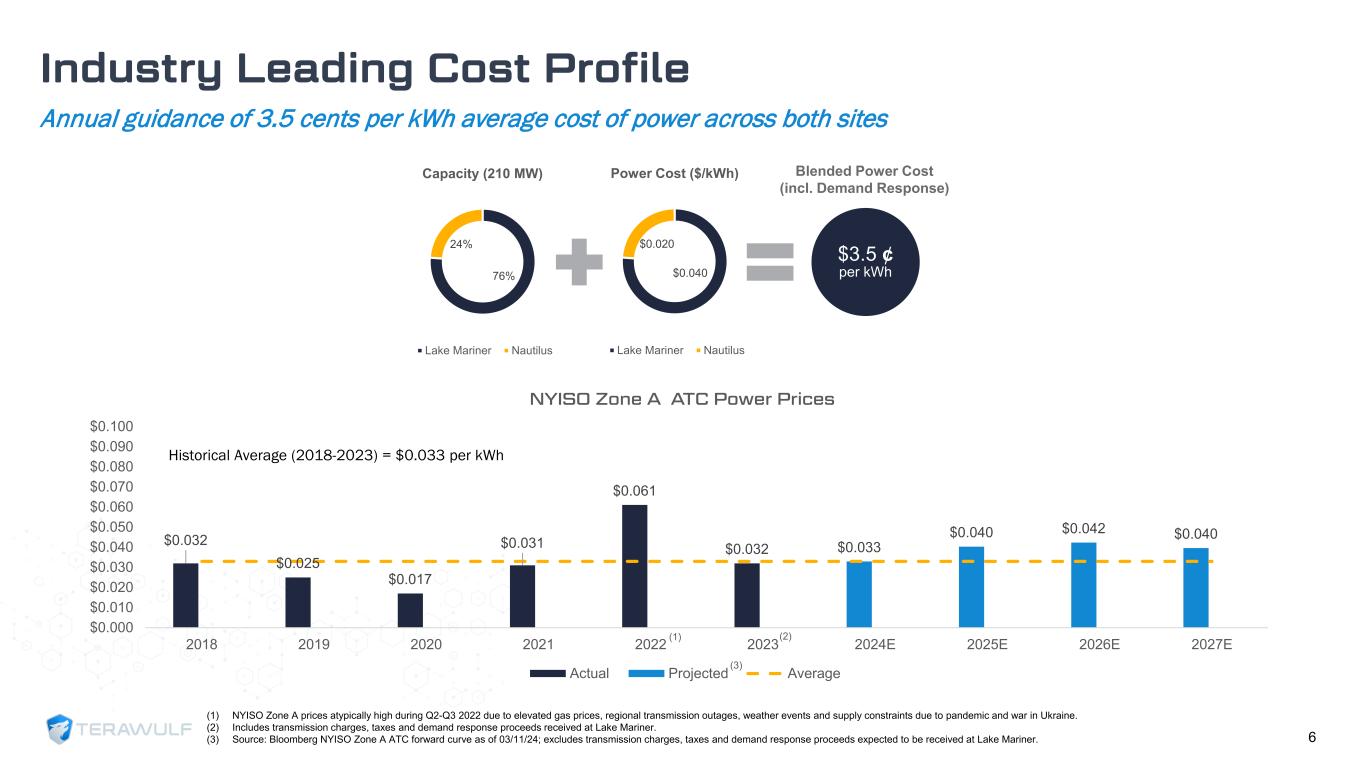

$0.032 $0.025 $0.017 $0.031 $0.061 $0.032 $0.033 $0.040 $0.042 $0.040 $0.000 $0.010 $0.020 $0.030 $0.040 $0.050 $0.060 $0.070 $0.080 $0.090 $0.100 2018 2019 2020 2021 2022 2023 2024E 2025E 2026E 2027E NYISO Zone A ATC Power Prices Actual Projected Average $3.5 ¢ per kWh76% 24% Capacity (210 MW) Lake Mariner Nautilus $0.040 $0.020 Power Cost ($/kWh) Lake Mariner Nautilus Blended Power Cost (incl. Demand Response) Industry Leading Cost Profile Annual guidance of 3.5 cents per kWh average cost of power across both sites 6 Historical Average (2018-2023) = $0.033 per kWh (1) NYISO Zone A prices atypically high during Q2-Q3 2022 due to elevated gas prices, regional transmission outages, weather events and supply constraints due to pandemic and war in Ukraine. (2) Includes transmission charges, taxes and demand response proceeds received at Lake Mariner. (3) Source: Bloomberg NYISO Zone A ATC forward curve as of 03/11/24; excludes transmission charges, taxes and demand response proceeds expected to be received at Lake Mariner. (1) (3) (2)

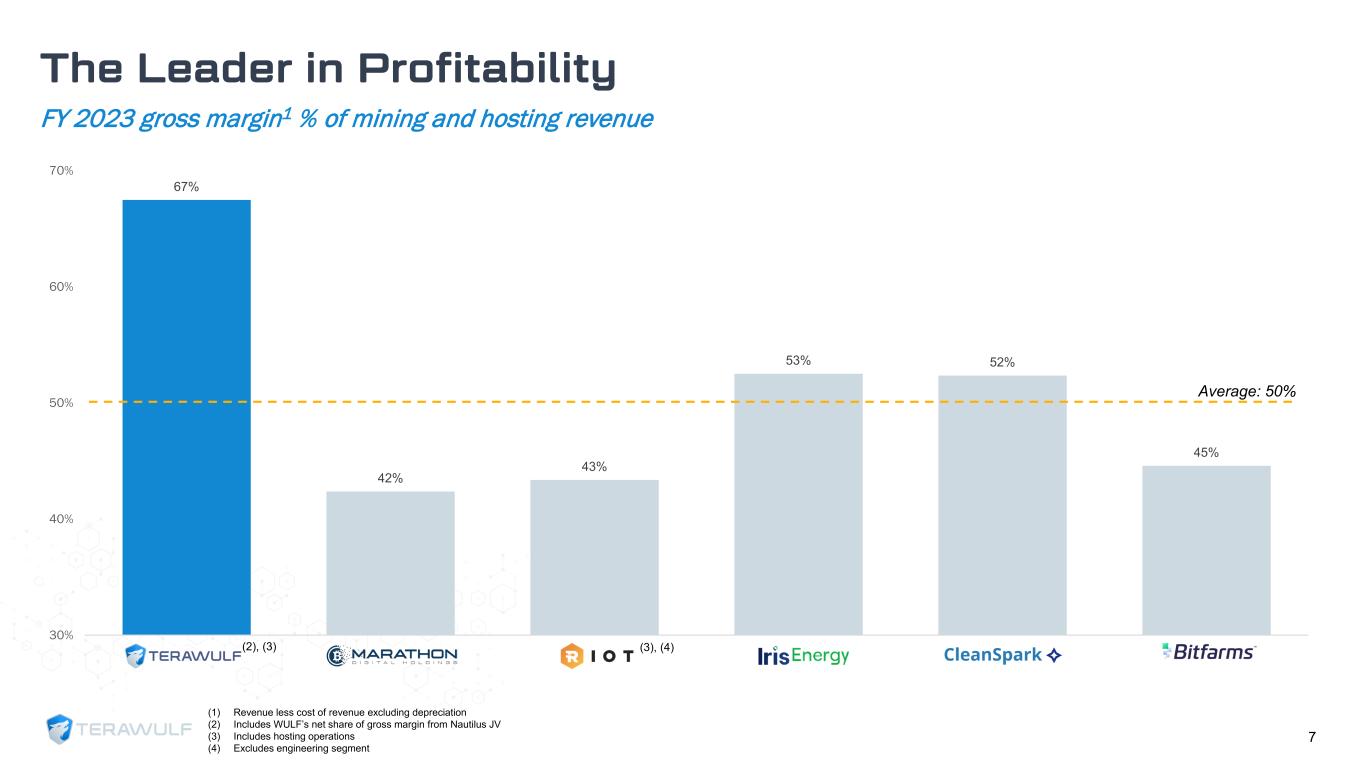

67% 42% 43% 53% 52% 45% 30% 40% 50% 60% 70% WULF MARA RIOT IREN CLSK BITF Average: 50% (2), (3) (3), (4) The Leader in Profitability FY 2023 gross margin1 % of mining and hosting revenue 7 (1) Revenue less cost of revenue excluding depreciation (2) Includes WULF’s net share of gross margin from Nautilus JV (3) Includes hosting operations (4) Excludes engineering segment

$4.0 $41.9 FY 2022 FY 2023 $15.0 $69.2 FY 2022 FY 2023 1.4 5.5 FY 2022 FY 2023 524 3,407 FY 2022 FY 2023 (1) Revenue less cost of revenue excluding depreciation (2) Includes WULF’s net share of Nautilus hash rate (3) Includes 64 bitcoin earned from profit sharing proceeds associated with hosting agreement and WULF’s net share of Nautilus JV production Revenue ($M) - GAAP Gross Profit ($M) - GAAP (1) Operating Capacity (EH/s)(2) Bitcoin Self-Mined (# BTC) (3) +361% +961% +293% +550% Revenue growth of 361% over prior year Gross profit margin of 61% Demand response proceeds of $3.5M in 2023; increasing participation to 3 programs Record of 5.5 EH/s operating hash rate capacity with ~46,000 miners deployed as of YE 2023 Operating hash rate capacity increased by 293% year-over-year Capacity over 8.0 EH/s by Q1 24E Produced 3,407 bitcoin in 2023, nearly 6.5x increase year-over-year despite significant increase in network hash rate Reflects significant expansion of proprietary infrastructure and hash rate deployed at Lake Mariner facility, with the addition of Building 2, and Nautilus Delivering Exceptional Growth Year-over-Year 8

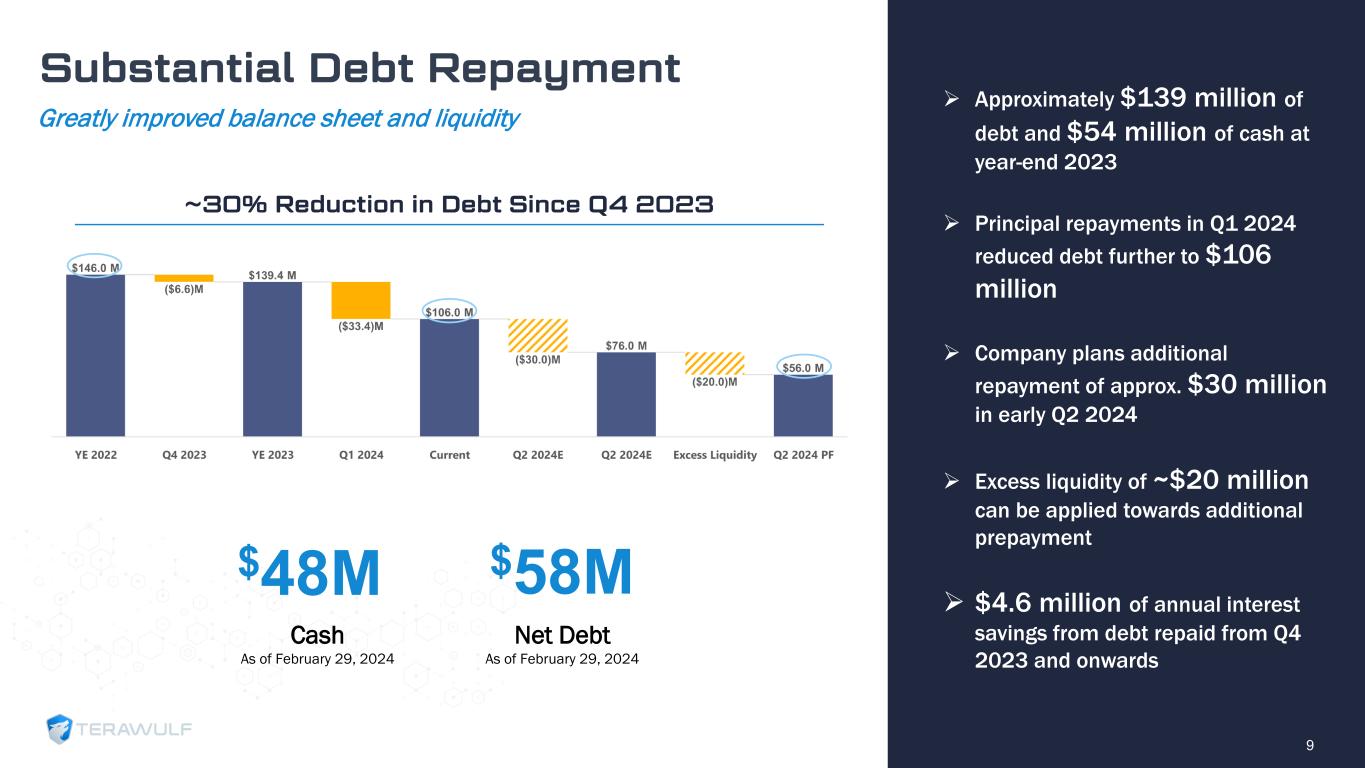

Substantial Debt Repayment 9 Approximately $139 million of debt and $54 million of cash at year-end 2023 Principal repayments in Q1 2024 reduced debt further to $106 million Company plans additional repayment of approx. $30 million in early Q2 2024 Excess liquidity of ~$20 million can be applied towards additional prepayment $4.6 million of annual interest savings from debt repaid from Q4 2023 and onwards $48M Cash As of February 29, 2024 $58M Net Debt As of February 29, 2024 Greatly improved balance sheet and liquidity ~30% Reduction in Debt Since Q4 2023

In-house digital innovation center focused on the research, development and deployment of scalable digital infrastructure Near-term catalyst for growth and revenue diversification With significant capacity to scale at existing sites, TeraWulf is evaluating the highest return use for its data center infrastructure, including the potential application of machine learning, generative AI and HPC workloads In 2023, TeraWulf dedicated a 2 MW block at Lake Mariner for operating and servicing advanced generative AI/ML compute loads The Lake Mariner site offers several competitive advantages: Access to 93%+ zero-carbon power averaging 4 cents per kWh year-round. Redundant power and high-speed fiber connectivity with significant water-cooling capabilities Core electrical infrastructure in place and ample land with existing lay-down areas for efficient growth WULF COMPUTE 10

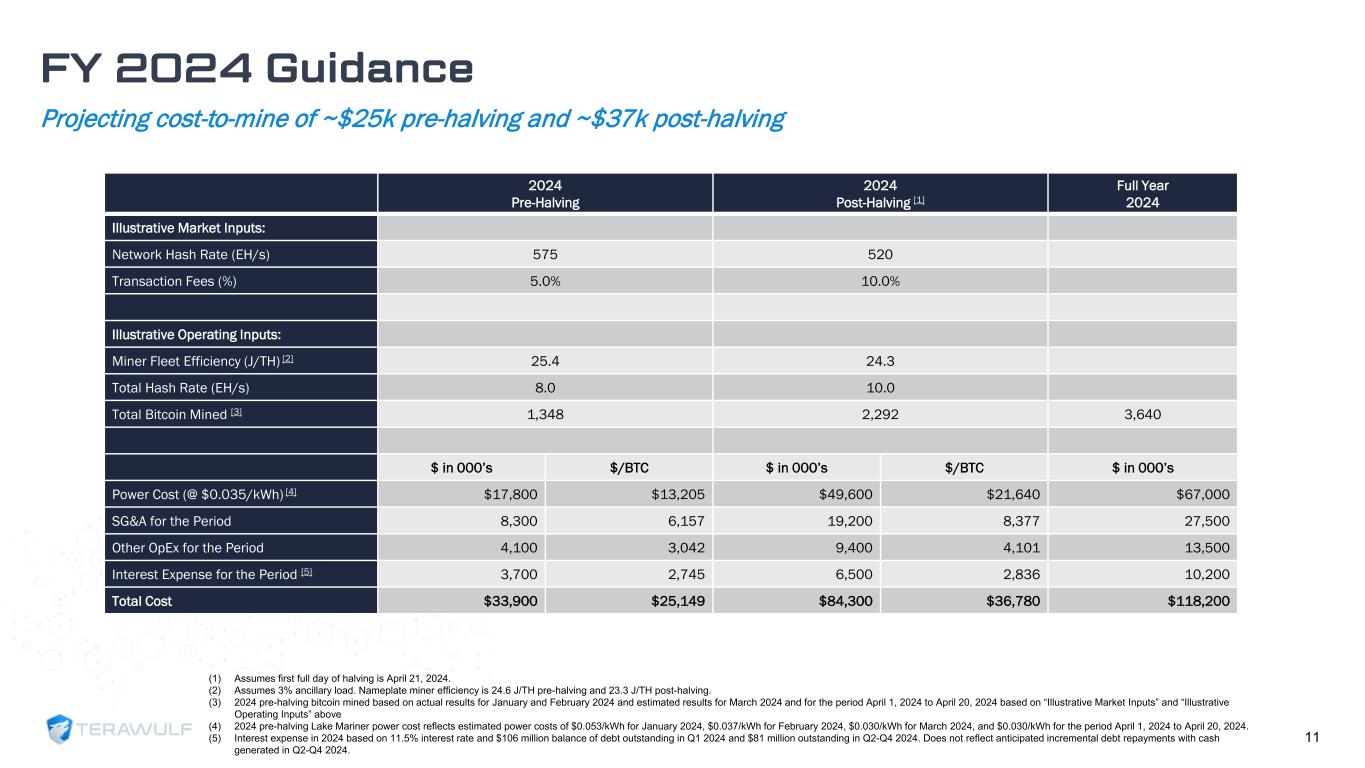

FY 2024 Guidance Projecting cost-to-mine of ~$25k pre-halving and ~$37k post-halving 11 2024 Pre-Halving 2024 Post-Halving [1] Full Year 2024 Illustrative Market Inputs: Network Hash Rate (EH/s) 575 520 Transaction Fees (%) 5.0% 10.0% Illustrative Operating Inputs: Miner Fleet Efficiency (J/TH) [2] 25.4 24.3 Total Hash Rate (EH/s) 8.0 10.0 Total Bitcoin Mined [3] 1,348 2,292 3,640 $ in 000’s $/BTC $ in 000’s $/BTC $ in 000’s Power Cost (@ $0.035/kWh) [4] $17,800 $13,205 $49,600 $21,640 $67,000 SG&A for the Period 8,300 6,157 19,200 8,377 27,500 Other OpEx for the Period 4,100 3,042 9,400 4,101 13,500 Interest Expense for the Period [5] 3,700 2,745 6,500 2,836 10,200 Total Cost $33,900 $25,149 $84,300 $36,780 $118,200 (1) Assumes first full day of halving is April 21, 2024. (2) Assumes 3% ancillary load. Nameplate miner efficiency is 24.6 J/TH pre-halving and 23.3 J/TH post-halving. (3) 2024 pre-halving bitcoin mined based on actual results for January and February 2024 and estimated results for March 2024 and for the period April 1, 2024 to April 20, 2024 based on “Illustrative Market Inputs” and “Illustrative Operating Inputs” above (4) 2024 pre-halving Lake Mariner power cost reflects estimated power costs of $0.053/kWh for January 2024, $0.037/kWh for February 2024, $0.030/kWh for March 2024, and $0.030/kWh for the period April 1, 2024 to April 20, 2024. (5) Interest expense in 2024 based on 11.5% interest rate and $106 million balance of debt outstanding in Q1 2024 and $81 million outstanding in Q2-Q4 2024. Does not reflect anticipated incremental debt repayments with cash generated in Q2-Q4 2024.

APPENDIX

Best-in-Class Management Team TeraWulf is led by an accomplished, diverse management team with 30+ years of experience in developing and managing energy infrastructure and disruptive technology N A Z A R K H A N Co-Founder, Chief Operating Officer & Chief Technology Officer 20+ years in energy infrastructure and cryptocurrency mining; previously at Evercore K E R R I L A N G L A I S Chief Strategy Officer 20+ years of M&A, financing, strategy, and power sector experience; previously at Goldman Sachs S E A N F A R R E L L VP, Operations 13+ years of energy experience in renewables, grid optimization, digitalization, and storage solutions; previously at Siemens Energy P A U L P R A G E R Co-Founder, Chairman & Chief Executive Officer 30+ year energy infrastructure entrepreneur; USNA Foundation Investment Committee Trustee P A T R I C K F L E U R Y Chief Financial Officer 20+ years of financial experience in the energy, power, and commodity sectors’ previously at Platinum Equity and Blackstone S T E F A N I E F L E I S C H M A N N Chief Legal Officer General Counsel for 15+ years overseeing all legal and compliance matters; previously at Paul, Weiss 13

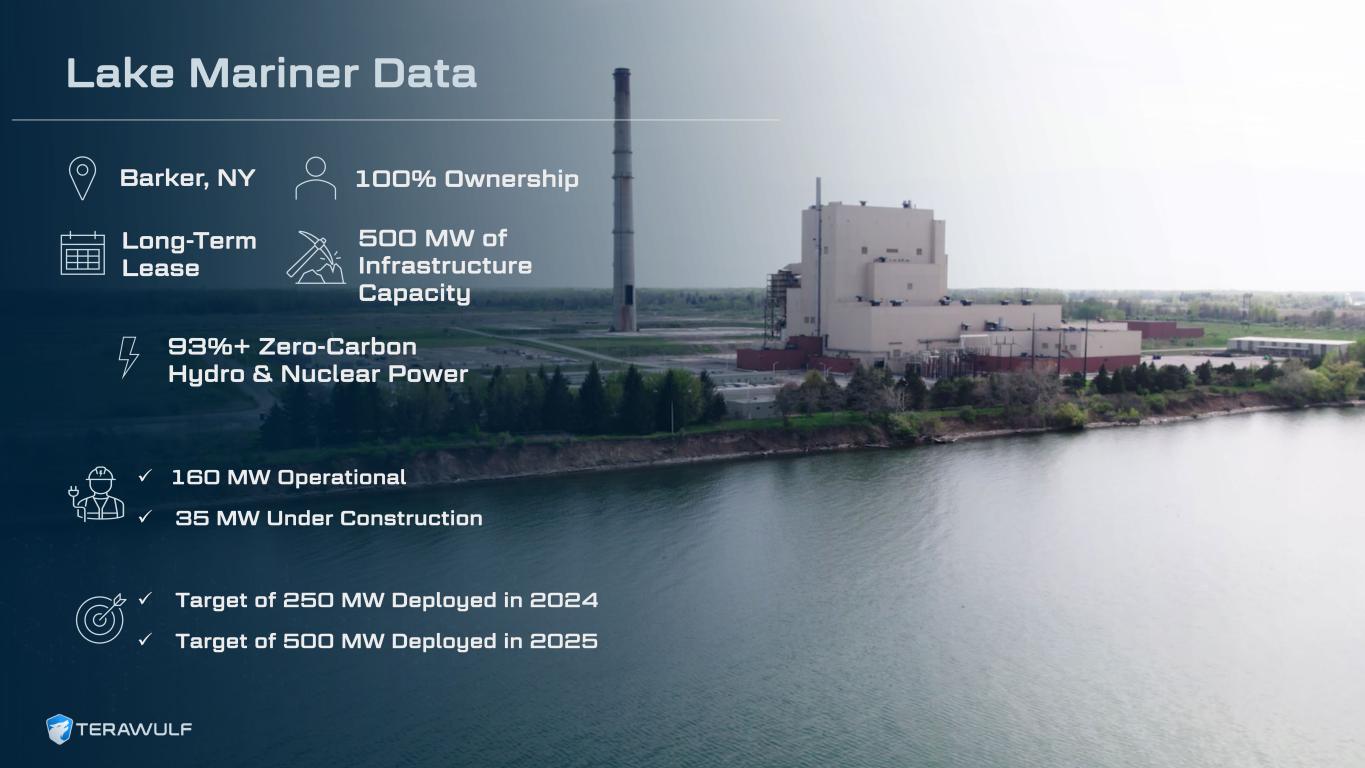

Barker, NY 100% Ownership Long-Term Lease 500 MW of Infrastructure Capacity 93%+ Zero-Carbon Hydro & Nuclear Power 160 MW Operational 35 MW Under Construction Target of 250 MW Deployed in 2024 Target of 500 MW Deployed in 2025 Lake Mariner Data

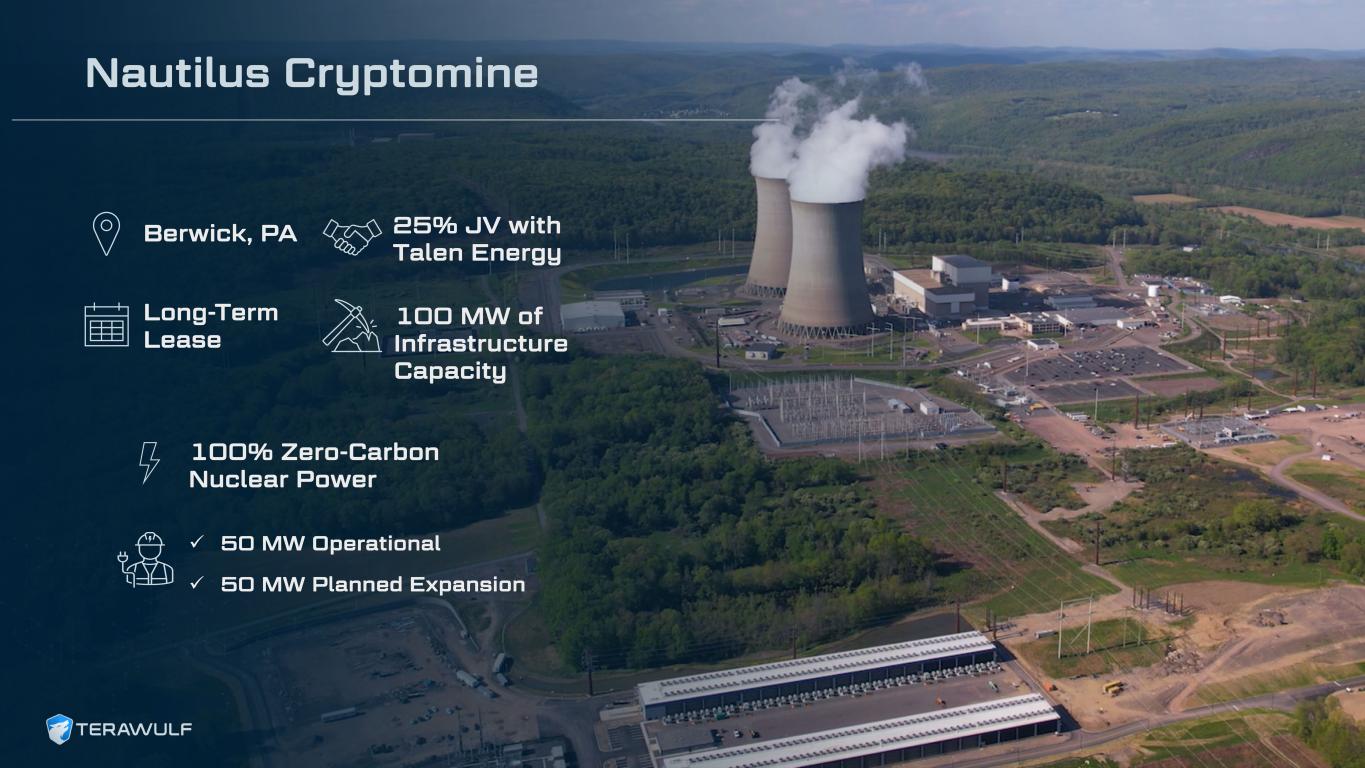

Berwick, PA 25% JV with Talen Energy Long-Term Lease 100 MW of Infrastructure Capacity 100% Zero-Carbon Nuclear Power 50 MW Operational 50 MW Planned Expansion Nautilus Cryptomine