0001083301DEF 14AFALSE00010833012023-01-012023-12-310001083301wulf:PaulPragerMember2023-01-012023-12-31iso4217:USD0001083301wulf:GlennSandgrenMember2023-01-012023-12-310001083301wulf:PaulPragerMember2022-01-012022-12-310001083301wulf:GlennSandgrenMember2022-01-012022-12-3100010833012022-01-012022-12-310001083301wulf:PaulPragerMember2021-01-012021-12-310001083301wulf:GlennSandgrenMember2021-01-012021-12-3100010833012021-01-012021-12-310001083301ecd:NonPeoNeoMemberwulf:AdjustmentGrantDateFairValueOfOptionAwardsAndStockAwardsGrantedInFiscalYearMember2023-01-012023-12-310001083301ecd:NonPeoNeoMemberwulf:AdjustmentFairValueAtFiscalYearEndOfOutstandingAndUnvestedOptionAwardsAndStockAwardsGrantedInFiscalYearMember2023-01-012023-12-310001083301ecd:NonPeoNeoMemberwulf:AdjustmentFairValueAtVestingDateOfOptionAwardsAndStockAwardsGrantedAndVestedInFiscalYearMember2023-01-012023-12-310001083301ecd:NonPeoNeoMemberwulf:ChangeInFairValueOfOutstandingAndUnvestedOptionAwardsAndStockAwardsGrantedInPriorFiscalYearsMember2023-01-012023-12-310001083301ecd:NonPeoNeoMemberwulf:ChangeInFairValueAsOfVestingDateOfOptionAwardsAndStockAwardsGrantedInPriorFiscalYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalYearMember2023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

| | |

| TERAWULF INC. |

(Name of Registrant as Specified in its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| x | No fee required |

| o | Fee paid previously with preliminary materials |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

LETTER TO STOCKHOLDERS

March 20, 2024

Dear Fellow Stockholders:

On behalf of the Board of Directors, it is my pleasure to invite you to TeraWulf Inc.’s 2024 Annual Meeting of Stockholders (the “Annual Meeting”). The Annual Meeting will be held in a virtual meeting format only, on Thursday, April 16, 2024, at 11:00 A.M., Eastern Time.

Enclosed you will find information regarding the matters to be voted on in the accompanying notice of the annual meeting of stockholders and proxy statement. We are sending our stockholders this proxy statement, our annual report for the fiscal year ended December 31, 2023 and other relevant materials. The proxy statement contains important information about the business to be conducted at the Annual Meeting, the proposals we will consider and how you can vote your shares. Please be sure to carefully follow the instructions contained in these proxy materials.

You may visit www.investors.terawulf.com to access various web-based reports, executive messages and timely information about TeraWulf’s global business.

Whether or not you plan to attend the virtual Annual Meeting, please submit your proxy or voting instructions using one of the voting methods described in the accompanying proxy statement. Submitting your proxy or voting instructions by any of these methods will not affect your right to attend the meeting and vote your shares at the meeting if you wish to do so.

If you have questions about the Annual Meeting or need additional copies of our proxy materials, please contact Investor Relations at 410-770-9500 or info@terawulf.com. If you require assistance in submitting your proxy or voting your shares, please contact EQ Shareowner Services at stocktransfer@equiniti.com or 651-450-4064.

If your bank, brokerage firm or other nominee holds your shares, you also should contact your nominee for additional information.

We look forward to your attendance at our virtual Annual Meeting and appreciated your continued support.

Sincerely,

Paul Prager

Chairman of the Board of Directors

TERAWULF INC.

9 Federal Street

Easton, MD 21601

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

You are cordially invited to attend the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of TeraWulf Inc. (the “Company”). The Annual Meeting will be held in a virtual meeting format only on Thursday, April 16, 2024, at 11:00 A.M., Eastern Time. You will be able to attend and participate in the annual meeting online by visiting: www.proxypush.com/WULF, where you will be able to listen to the meeting live, submit questions and vote. To be admitted to the virtual meeting, eligible persons must first register at anytime before the Annual Meeting by visiting register.proxypush.com/WULF on their smartphone, tablet or computer. You will then be required to enter the 16-digit control number found on your proxy card or voting instruction form. If your shares are held in “street name” through a broker, bank or other nominee, you may obtain your control number by contacting them. If you encounter any trouble registering at visiting register.poxypush.com/WULF, you may seek assistance by clicking “Having trouble registering?” at the bottom of the page. After registering, you will receive a confirmation email. Additionally, you will receive a reminder email approximately one hour before the start of the meeting to the email address provided during registration. If you encounter any difficulty accessing the Annual Meeting or during the Annual Meeting, please call the technical support number posted on the Annual Meeting website. The technical support number will be available at least 15 minutes before the start of the meeting.

We encourage shareholders to visit www.proxypush.com/WULF for the most up-to-date information on the Annual Meeting, any procedures and limitations concerning attendance, and instructions on how to vote and ask questions during the Annual Meeting. Whether or not shareholders plan to attend the virtual-only Annual Meeting, we urge shareholders to vote and submit their proxies in advance of the meeting by one of the methods described in these proxy materials. The Annual Meeting is being held for the following purposes:

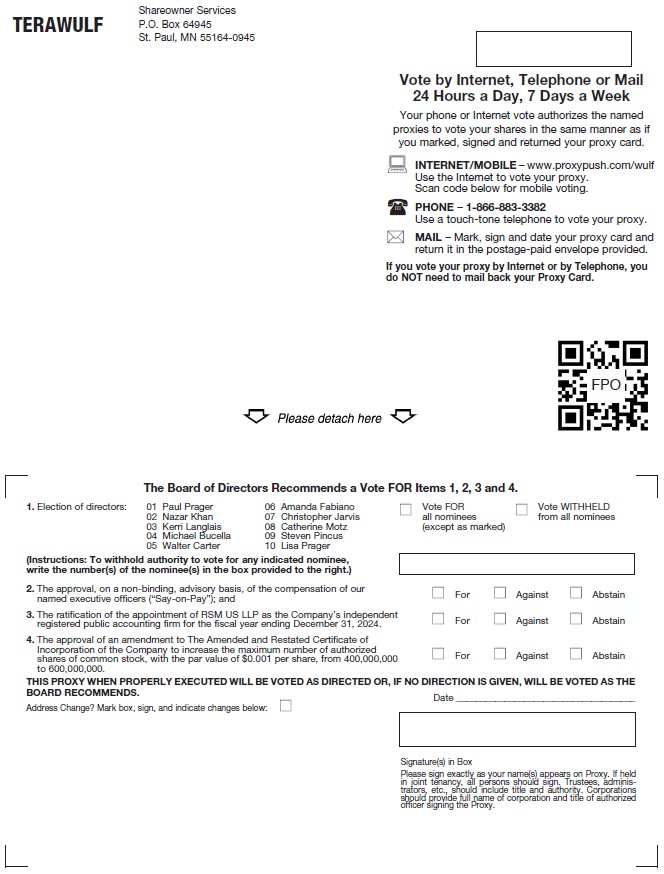

1.The election of Paul Prager, Nazar Khan, Kerri Langlais, Michael Bucella, Walter Carter, Amanda Fabiano, Christopher Jarvis, Catherine Motz, Steven Pincus and Lisa Prager to the Company’s Board of Directors for one-year terms;

2.The approval, on a non-binding, advisory basis, of the compensation of our named executive officers (“Say-on-Pay”);

3.The ratification of the appointment of RSM US LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024;

4.The approval of an amendment to the Amended and Restated Certificate of Incorporation of the Company to increase the maximum number of authorized shares of common stock, with the par value of $0.001 per share, from 400,000,000 to 600,000,000 (the “Charter Amendment”); and

5.To transact such other business as may properly come before the Annual Meeting, or any postponement or adjournment thereof.

These matters are more fully described in the enclosed proxy statement. The Board of Directors recommends that you vote FOR ALL the director nominees, FOR the advisory approval of the Say-on-Pay proposal, FOR the ratification of the appointment of the independent auditors and FOR the Charter Amendment. Holders of shares of the Company’s common stock, par value $0.001 per share (“Common Stock”), and holders of shares of our Series A Convertible Preferred Stock, par value $0.001 per share (“Series A Preferred Stock”), voting together as a single class, of record at the close of business on March 19, 2024 are entitled to notice of, and to vote at, the Annual Meeting or any postponements or adjournments thereof.

If you have questions about the Annual Meeting or need additional copies of our proxy materials, please contact Investor Relations at 410-770-9500 or info@terawulf.com. If you require assistance in submitting your proxy or voting your shares, please contact EQ Shareowner Services at stocktransfer@equiniti.com or 651-450-4064.

| | | | | |

| March 20, 2024 | By order of the Board of Directors |

| |

| |

| Paul Prager |

| Chairman of the Board of Directors |

YOUR VOTE IS IMPORTANT

Whether or not you plan to attend TeraWulf Inc.’s Annual Meeting, we strongly encourage you to submit your proxy or voting instructions as soon as possible.

We also encourage you to submit your proxy or voting instructions via the Internet. For instructions on how to submit your proxy or voting instructions and how to vote your shares, please refer to the section entitled “Some Questions You May Have Regarding This Proxy Statement” beginning on page 1 of the accompanying proxy statement.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR THE ANNUAL MEETING

The proxy statement for the Annual Meeting and the Company’s annual report for the fiscal year ended December 31, 2023 are available on the Internet at www.investors.terawulf.com.

TABLE OF CONTENTS

TERAWULF INC.

PROXY STATEMENT

Annual Meeting of Stockholders of TeraWulf Inc. to be held on April 16, 2024

Some Questions You May Have Regarding This Proxy Statement

Why did I receive these proxy materials?

The Board of Directors (the “Board of Directors”) of TeraWulf Inc. (the “Company”) is soliciting proxies for our 2024 Annual Meeting of Stockholders (the “Annual Meeting”). The Annual Meeting will be held in a virtual meeting format only, on Thursday, April 16, 2024, at 11:00 A.M., Eastern Time. As a holder of shares of our Common Stock, par value $0.001 per share (“Common Stock”), or as a holder of shares of our Series A Convertible Preferred Stock, par value $0.001 per share (“Series A Preferred Stock”), as of the close of business on March 19, 2024, which is the record date (the “Record Date”) fixed by the Board of Directors, you are invited to attend the Annual Meeting and are entitled and urged to vote your shares on the proposals described in this proxy statement. The information included in this proxy statement relates to the proposals to be voted on at the Annual Meeting, the voting process, the compensation of directors and our most highly paid executive officers, and other matters. Our annual report to stockholders for the fiscal year ended December 31, 2023 is available to review with this proxy statement.

What proposals will be voted on at the Annual Meeting?

The three matters scheduled to be voted on at the Annual Meeting are:

1.The election of Paul Prager, Nazar Khan, Kerri Langlais, Michael Bucella, Walter Carter, Amanda Fabiano, Christopher Jarvis, Catherine Motz, Steven Pincus and Lisa Prager to the Company’s Board of Directors for one-year terms;

2.An advisory vote to approve the compensation of our named executive officers (“Say-on-Pay”);

3.The ratification of the appointment of RSM US LLP (“RSM”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024; and

4.The approval of an amendment to the Amended and Restated Certificate of Incorporation of the Company to increase the maximum number of authorized shares of common stock, with the par value of $0.001 per share, from 400,000,000 to 600,000,000 (the “Charter Amendment”).

In addition, such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof may be voted on.

Who can vote at the Annual Meeting?

Anyone owning shares of Common Stock or Series A Preferred Stock at the close of business on the Record Date for this year’s Annual Meeting is entitled to attend and to vote on all items properly presented at the Annual Meeting.

Stockholder of Record: Shares Registered in Your Name. If, at the close of business on the Record Date, your shares were registered directly in your name with our transfer agent, EQ Shareowner Services (“EQ”), then you are a stockholder of record. As a stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card, to vote electronically at the Annual Meeting, or by Internet or by telephone, or, if you received paper copies of the proxy materials by mail, to vote by mail by following the instructions on the proxy card or voting instruction card.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank. If, at the close of business on the Record Date, your shares were held not in your name, but rather in an account at a brokerage firm, bank or other nominee, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that nominee. The nominee holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank or other nominee regarding how to vote the shares in your

account by following the voting instructions your broker, bank or other nominee provides. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares electronically at the Annual Meeting unless you obtain a legal proxy from your broker, bank or other nominee. Please see “How do I vote” below regarding voting procedures for beneficial owners.

How do I vote?

Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record, you may vote in any one of the following ways:

•You may vote at the Annual Meeting. If you or your proxy wish to vote at the Annual Meeting, you or your proxy will need to attend the Annual Meeting by visiting www.proxypush.com/WULF. To be admitted to the virtual meeting, eligible persons must first register at anytime before the Annual Meeting by visiting register.proxypush.com/WULF on their smartphone, tablet or computer. You will then be required to enter your 16-digit control number included in your voting instruction form or proxy card. If you encounter any difficulty accessing the Annual Meeting or during the Annual Meeting, please call the technical support number posted on the Annual Meeting Website. The technical support number will be available at least 15 minutes before the start of the meeting. If you vote in advance online, by phone or by mailing in a proxy card, you may still attend the Annual Meeting and vote during the meeting, but, in that case, only the votes you enter during the meeting will count. Even if you plan to attend the Annual Meeting, we recommend that you also vote either by telephone, by Internet, or by mail so that your vote will be counted if you ultimately decide not, or are unable, to attend.

•You may vote by mail. To vote by mail, complete, sign and date the proxy card that accompanies this proxy statement and return it promptly in the postage-prepaid envelope provided (if you received printed proxy materials). Your completed, signed and dated proxy card must be received prior to the Annual Meeting.

•You may vote by telephone. To vote over the telephone, call toll-free 1-866-883-3382 from any touch-tone telephone and follow the instructions. Have your Notice or proxy card available when you call. You will be asked to provide the control number from your Notice or proxy card. Telephone voting is available 24 hours a day, 7 days a week, until 11:59 p.m., Eastern Time, on April 15, 2024.

•You may vote via the Internet. To vote via the Internet, go to www.proxypush.com/WULF to complete an electronic proxy card (have your Notice or proxy card in hand when you visit the website). You will be asked to provide the control number from your Notice or proxy card. Internet voting is available 24 hours a day, 7 days a week, until 11:59 p.m., Eastern Time, on April 15, 2024.

Beneficial Owner of Shares Held in “Street Name”: Shares Registered in the Name of a Broker, Bank or Other Nominee. If you are a beneficial owner of shares held of record by a broker, bank or other nominee, you will receive voting instructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank or other nominee in order to instruct your broker, bank or other nominee on how to vote your shares. Beneficial owners of shares should generally be able to vote by returning the voting instruction card received from their broker, bank or other nominee to such nominee, or by telephone or via the Internet. However, the availability of telephone or Internet voting will depend on the voting process of your broker, bank or other nominee. As discussed above, if you are a beneficial owner, you may not vote your shares electronically at the Annual Meeting unless you obtain a legal proxy from your broker, bank or other nominee. We therefore urge you to vote in advance of the Annual Meeting using the voting instructions provided by your broker, bank or other nominee.

How can I participate during the Annual Meeting?

We have designed the virtual Annual Meeting to provide substantially the same opportunities to participate as shareholders would have at an in-person meeting. Our virtual Annual Meeting will be conducted on the Internet via live webcast. Shareholders will be able to attend and participate online and submit questions in advance and during the Annual Meeting by visiting www.proxypush.com/WULF.

The virtual Annual Meeting format allows shareholders to communicate with us during the Annual Meeting so they can ask questions of our management and Board, as appropriate. If you wish to submit a question or questions in advance of the Annual Meeting, you may do so at www.proxypush.com/WULF on an ongoing basis. If you wish to submit a question during the Annual Meeting, you may do so by logging into the virtual meeting platform at

www.proxypush.com,/WULF, clicking the Q&A button on your screen and typing your question into the provided text field.

We reserve the right to exclude questions regarding topics that are not pertinent to meeting matters or Company business or are inappropriate. If we receive substantially similar questions, we may group such questions together and provide a single response to avoid repetition. Any questions that are appropriate and pertinent to the Annual Meeting will be answered in the live Question and Answer session during the Annual Meeting, subject to time constraints. Additional information regarding the ability of shareholders to ask questions during the Annual Meeting, related rules of conduct, and other materials for the Annual Meeting will be available during the Annual Meeting at www.proxypush.com/WULF.

Can I change my vote or revoke my proxy?

Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record, you can change your vote or revoke your proxy by:

•Providing another proxy, or using any of the available methods for voting, with a later date;

•Notifying the Company’s Secretary in writing before the Annual Meeting that you wish to revoke your proxy; or

•Voting at the Annual Meeting.

Beneficial Owner of Shares Held in “Street Name”: Shares Registered in the Name of a Broker, Bank or Other Nominee. If you are the beneficial owner of your shares, you must contact the broker, bank or other nominee holding your shares and follow their instructions to change your vote or revoke your proxy.

Who is asking me for my vote?

The Company is soliciting your proxy on behalf of the Board of Directors. The Company will bear the cost of soliciting proxies and will reimburse brokerage firms and others for expenses involved in forwarding proxy materials to beneficial owners or soliciting their execution. In addition to solicitations by mail, the Company, through its directors and employees, may solicit proxies in person, by telephone or by electronic means. Such directors and employees will not receive any special remuneration for these efforts.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our Board of Directors. The persons named in the proxy have been designated as proxies for the Annual Meeting by our Board of Directors. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder on such proxy. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our Board of Directors on the proposals as described below and, if any other matters are properly brought before the Annual Meeting, the shares will be voted in accordance with the proxies’ judgment.

What are my voting rights?

Each share of Common Stock is entitled to one vote on each matter properly presented at the Annual Meeting and each share of Series A Preferred Stock is entitled to vote with the Common Stock on an as-converted basis, voting together as a single class. At the close of business on the Record Date, there were 302,235,299 shares of Common Stock outstanding and 9,566 shares of Series A Preferred Stock, representing 1,142,335 shares of Common Stock on an as-converted basis. A list of all record stockholders as of the Record Date will be available during ordinary business hours at the Company’s principal place of business located at 9 Federal Street, Easton, MD 21601, from Friday, April 5, 2024, at least 10 days before the Annual Meeting, and will also be available for inspection at the Annual Meeting.

How does the Board of Directors recommend that I vote?

The Board of Directors recommends that you vote:

•FOR the election of each of the director nominees named in this proxy statement;

•FOR the approval, on a non-binding, advisory basis, of the compensation of our named executive officers;

•FOR the ratification of the appointment of RSM US LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024; and

•FOR the approval of the Charter Amendment.

What is the quorum requirement for the Annual Meeting?

A quorum is the minimum number of shares required to be present or represented at the Annual Meeting for the meeting to be properly held. The presence, represented in person or by proxy, of the holders of a majority of the voting power of our outstanding Common Stock and Series A Preferred Stock entitled to vote at the Annual Meeting will constitute a quorum to transact business at the Annual Meeting. Abstentions, “WITHHOLD” votes and “broker non-votes” are counted as present and entitled to vote for purposes of determining a quorum. If there is no quorum, the chair of the meeting may adjourn the meeting to another time or place.

What are broker non-votes?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker, bank or other nominee, as applicable, as to how to vote on matters deemed “non-routine” and there is at least one “routine” matter to be voted upon at the Annual Meeting. The beneficial owner of shares held in “street name” is entitled to give voting instructions to the broker, bank or other nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker, bank or other nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. In the event that a broker, bank or other nominee votes shares on the “routine” matters but does not vote shares on the “non-routine” matters, those shares will be treated as broker non-votes with respect to the “non-routine” proposals. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your vote is counted on each of the proposals.

What matters are considered “routine” and “non-routine”?

The ratification of the appointment of RSM US LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024 (Proposal No.3) and the Charter Amendment (Proposal No. 4) are considered “routine.” The election of directors (Proposal No. 1) and the non-binding, advisory vote to approve the compensation of our named executive officers (Proposal No. 2) are considered “non-routine.”

What are the effects of abstentions and broker non-votes?

An abstention represents a stockholder’s affirmative choice to decline to vote on a proposal. If a stockholder indicates on its proxy card that it wishes to abstain from voting its shares, or if a broker, bank or other nominee causes abstentions to be recorded for shares, these shares will be considered present and entitled to vote at the Annual Meeting. As a result, abstentions will be counted for purposes of determining the presence or absence of a quorum and will also count as votes against a proposal in cases where approval of the proposal requires the affirmative vote of a majority of the voting power of the shares present or represented by proxy and entitled to vote on such proposal at the Annual Meeting (Proposal Nos. 2, 3 and 4). However, because the outcome of Proposal No. 1 (election of directors) will be determined by a plurality vote, you may only vote “FOR” or “WITHHOLD” authority to vote for each of the nominees. If you “WITHHOLD” authority to vote with respect to one or more director nominees, your vote will have no effect on the election of such nominees.

Broker non-votes will be counted for purposes of calculating whether a quorum is present at the Annual Meeting. Broker non-votes will not be counted for purposes of determining the number of votes cast on a proposal. Therefore, a broker non-vote will make a quorum more readily attainable but will not otherwise affect the outcome of the vote on any of the proposals.

What is the voting requirement to approve each of the proposals?

Proposal No. 1: Election of Directors. Directors are elected by a plurality of the votes cast. For each director nominee, you may vote (i) “FOR” or (ii) “WITHHOLD.” Because the outcome of this proposal will be determined by a plurality vote, shares voted “WITHHOLD” will not prevent a director nominee from being elected as a director. Broker non-votes will not affect the outcome of voting on this proposal.

Proposal No. 2: “Say-On-Pay.” The approval, on a non-binding, advisory basis, of the compensation of our named executive officers requires the affirmative vote of the majority of voting power of the shares present or represented by proxy at the Annual Meeting and entitled to vote thereon. You may vote “FOR,” “AGAINST” or “ABSTAIN” on this proposal. Abstentions will count towards the quorum requirement for the Annual Meeting and will have the same effect as a vote against the proposal. Broker non-votes will not affect the outcome of voting on this proposal. While the results of this advisory vote are non-binding, the Board values the opinions of our stockholders and will consider the outcome of the vote, along with other relevant factors, in deciding whether any actions are necessary to address the concerns raised by the vote and when making future compensation decisions for our named executive officers.

Proposal No. 3: Ratification of Appointment of RSM US LLP. The ratification of the appointment of RSM US LLP requires the affirmative vote of a majority of the voting power of the shares present or represented by proxy at the Annual Meeting and entitled to vote thereon. You may vote “FOR,” “AGAINST” or “ABSTAIN” on this proposal. Abstentions will count towards the quorum requirement for the Annual Meeting and will have the same effect as a vote against the proposal. As it is a “routine” proposal, we do not expect broker non-votes on this proposal.

Proposal No. 4: Charter Amendment. The approval of the Charter Amendment to increase the number of authorized shares requires the affirmative vote the holders of at least a majority of the total outstanding shares entitled to vote, regardless of whether such shares are present in person or represented by proxy at the Annual Meeting. You may vote “FOR” or “AGAINST” this proposal, or you may indicate that you wish to “ABSTAIN” from voting on this proposal. Abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum and will have the same effect as a vote “AGAINST” this proposal. As a “routine” proposal, we do not expect broker non-votes on this proposal.

Who will count the votes?

A representative of EQ will tabulate the votes and act as inspector of elections.

May I vote confidentially?

Yes. Our policy is to keep your vote confidential, except as otherwise legally required, to allow for the tabulation and certification of votes and to facilitate proxy solicitation.

What if additional matters are presented at the Annual Meeting?

We do not know of any business to be considered at the Annual Meeting other than the proposals described in this proxy statement. If any other business is presented at the Annual Meeting, your properly executed proxy gives authority to Paul Prager, the Chairman of our Board of Directors, and Stefanie C. Fleischmann, our Chief Legal Officer and Secretary, to vote on such matters at their discretion.

How is solicitation being made?

We are making this solicitation and as such, the cost of solicitation of proxies will be borne by us. Our directors, officers and employees may make solicitation, personally or by telephone, email or fax. The Notice of Annual Meeting, the proxy statement and proxy card will be distributed to beneficial owners of common stock through brokers, custodians, nominees and other like parties, and we expect to reimburse such parties for their charges and expenses. We have retained D.F. King, a proxy solicitor, to assist us in the solicitation of proxies for the Annual Meeting. The Company will pay D.F. King $12,500 plus reimbursement for its reasonable out-of-pocket expenses. The Company will indemnify D.F. King and its affiliates against certain claims, liabilities, losses, damages and expenses for its services as our proxy solicitor.

We may supplement the original solicitation of proxies by mail with solicitation by telephone, and other means by directors, officers and/or employees of the Company and by Internet, phone or other means by D.F. King. We will not pay any additional compensation to these individuals, other than D.F. King, for any such services.

Where can I find the voting results from the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting and will publish final results in a Current Report on Form 8-K that we will file with the Securities and Exchange Commission (the “SEC”) within four (4) business days after the date the Annual Meeting concludes.

How can I obtain information about the Company?

A copy of our annual report on Form 10-K for the fiscal year ended December 31, 2023 (our “Annual Report”) is available on our website at www.investors.terawulf.com. Stockholders may also obtain a free copy of our Annual Report, including the financial statements and the financial statement schedules, by visiting our website or by sending a request in writing to Attention: Chief Legal Officer, TeraWulf Inc., 9 Federal Street, Easton, MD 21601.

PROPOSAL 1 – ELECTION OF DIRECTORS

Under the Company’s amended and restated bylaws (the “bylaws”) and an amended and restated certificate of incorporation (the “certificate of incorporation”), the Board of Directors shall consist of not less than three (3) nor more than ten (10) members, which number is determined by resolution of the Board of Directors. Directors are elected at each annual meeting of stockholders by the plurality of the votes cast. Except for directors elected by the holders of any series of preferred stock, any director or the entire Board may be removed from office at any time, with or without cause, but only by the affirmative vote of a majority of the total voting power of the outstanding shares of capital stock entitled to vote generally in the election of directors, voting together as a single class. Newly created directorships resulting from any increase in our authorized number of directors or any vacancies in our Board of Directors resulting from death, resignation, retirement, removal from office or other cause shall be filled solely by the affirmative vote of a majority of the remaining directors then in office, even though less than a quorum of the Board, or by a sole remaining director. The Board of Directors currently consists of nine directors.

All nominees for directors are members of the current Board of Directors. If any nominee for election to the Board of Directors should be unable or unwilling to accept nomination or election as a director, which is not expected, your proxy may be voted for a substitute or substitutes designated by the Board of Directors or the number of directors constituting the Board of Directors may be reduced in accordance with the Company’s certificate of incorporation and bylaws.

The Board of Directors recommends that the stockholders vote FOR the election of the nominees for directors listed below.

THE BOARD OF DIRECTORS

The following table sets forth certain information about our directors as of the date of this proxy statement.

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

| Paul Prager | | 65 | | Co-Founder, Chairman of the Board of Directors and Chief Executive Officer |

| Nazar Khan | | 47 | | Co-Founder, Chief Operating Officer, Chief Technology Officer and Executive Director |

| Kerri Langlais | | 48 | | Chief Strategy Officer and Executive Director |

| Michael Bucella | | 37 | | Director |

| Walter Carter | | 64 | | Director |

Amanda Fabiano | | 37 | | Director |

| Christopher Jarvis | | 61 | | Director |

| Catherine Motz | | 52 | | Director |

| Steven Pincus | | 65 | | Director |

| Lisa Prager | | 67 | | Director |

Paul Prager has been the Co-Founder, Chairman of the Board of Directors, and Chief Executive Officer of the Company since February 2021. In 1990, Mr. Prager founded and has since been the President of Beowulf Electricity & Data Inc. (“Beowulf”), a private energy and digital infrastructure company, and its predecessor companies. He also founded Brooklyn Marine & Oil LLC (a shipowner and operator) and was previously the Chief Executive Officer of Direct Gas. Mr. Prager is a graduate of the U.S. Naval Academy and is a member of the investment committee and trustee of the U.S. Naval Academy Foundation. Mr. Prager has valuable experience leading organizations and a strong operational and strategic background with significant experience in power generation, infrastructure development, commodity trading and international shipping.

Nazar Khan is the Co-Founder, Chief Operating Officer and Chief Technology Officer of the Company and has also served on the Board of Directors since February 2021. As the Chief Operating Officer and Chief Technology Officer, Mr. Khan oversees the development and implementation of TeraWulf’s day-to-day operations, including hardware procurement, site evaluation, infrastructure buildout and identification of future growth opportunities. As the Chief Technology Officer, Mr. Khan is responsible for TeraWulf’s technology resources and identifies the technologies to improve the efficiency of TeraWulf’s bitcoin mining business. From January 2002 to February 2021, Mr. Khan served as the Executive Vice President of Beowulf, where he led the firm’s acquisition and development efforts. Prior to Beowulf, Mr. Khan worked at Evercore Partners Inc. in both investment banking and private equity. Mr. Khan received a B.S. and a

B.A. from the University of Pennsylvania. Mr. Khan brings tremendous experience in energy infrastructure and cryptocurrency mining to the Board of Directors and has led TeraWulf’s business strategy since its inception.

Kerri Langlais has been the Chief Strategy Officer of TeraWulf since February 2021 and has also served on the Board of Directors since March 2022, where she is responsible for the development and implementation of the Company’s overall corporate strategy, business development, strategic partnerships and growth initiatives. From July 2010 to February 2021, Ms. Langlais served as an executive at Beowulf, where she led the firm’s M&A and financing efforts. Prior to Beowulf, Ms. Langlais spent nearly a decade in the Investment Banking Division at Goldman Sachs, where she was most recently in the Natural Resources advisory group in New York. Ms. Langlais also worked at Harvard University, where she provided advisory services to the university’s overall financial strategy and planning. Ms. Langlais received a B.A. in finance and graduated with honors from Boston College. Ms. Langlais brings more than 20 years of M&A, financing, strategy and power sector experience to the Board of Directors.

Michael Bucella has been a member of the Board of Directors since March 2022. Mr. Bucella was most recently a Partner and Global Head of Strategic Partnerships at BlockTower Capital, an institutional cryptocurrency investment firm bringing professional trading and portfolio management to an emerging digital asset class, since October 2017. Prior to joining BlockTower, Mr. Bucella spent nearly a decade with Goldman Sachs in a variety of roles, where he most recently ran the Multi-Asset Sales & Trading business in Canada and led efforts to expand this strategy globally and previously led the Institutional Global Equities business in Canada. Mr. Bucella is a graduate of Fordham University and currently a member of the Fordham University President’s Council. Mr. Bucella earned a B.S. in Finance, Economics & Accounting from Fordham University. Mr. Bucella brings extensive capital markets experience, institutional knowledge and deep experience in the digital asset space to the Board of Directors.

Walter “Ted” Carter has been a member of the Board of Directors since November 2021. Mr. Carter was appointed as president of The Ohio State University on August 22, 2023. Prior to this appointment, he was the president of the University of Nebraska since January 2020, after retiring as Vice Admiral following 38 years of service in the U.S. Navy. Most recently from July 2014 until July 2019, Mr. Carter served as Superintendent of the U.S. Naval Academy, his alma matter. Under his leadership, the U.S. Naval Academy reached the No. 1 public school ranking by Forbes and expanded academic opportunity and diversity. Mr. Carter is a Distinguished Flying Cross and Bronze Star recipient. He graduated from the Navy Fighter Weapons School (Top Gun) in Miramar, California, and was commander for the Carrier Strike Group Twelve, in which he commanded 20 ships, two nuclear-powered aircraft carriers and two carrier air wings that were deployed to Afghanistan in the Arabian Gulf. He is a naval flight officer with more than 6,300 flying hours and has completed 2,016 carrier-arrested landings, an American record. Mr. Carter’s extensive leadership background brings a strong commitment to corporate ethics, values and business practices to the Board of Directors.

Amanda Fabiano has been a member of the Board of Directors since January 2024. Ms. Fabiano established the bitcoin mining advisory firm, Fabiano Consulting, in 2023. Previously, Ms. Fabiano was the founding member of cryptocurrency financial services firm Galaxy Digital Holdings’ (TSX: GLXY) proprietary bitcoin mining business, where she spearheaded Galaxy’s acquisition of Helios from Argo Blockchain in December 2022. Prior to Galaxy, Ms. Fabiano served as Director of Bitcoin Mining at Fidelity Investments from 2014. Ms. Fabiano previously served on the boards of Compass Mining and Aspen Creek Digital Corporation and has had her work featured in various publications, such as CNBC, Forbes, Bloomberg and CoinDesk. Ms. Fabiano holds a bachelor’s degree in Sociology, with a concentration in Criminal Justice from the University of Massachusetts.

Christopher Jarvis has been a member of the Board of Directors since January 2024. Mr. Jarvis currently serves as a Senior Business Development Analyst at Lockheed Martin Corporation supporting the cybersecurity development and strategy execution for Navy communications initiatives, space-based ground architecture, and launch platforms. Prior to joining Lockheed Martin in 2019, Mr. Jarvis spent 34 years in the U.S. Intelligence Community. He was a member of the Senior Executive Service (SES) and held key leadership positions within the National Geospatial-Intelligence Agency (NGA). During his time with the NGA, Mr. Jarvis was the senior leader assigned to the U.S. Southern Command, the Federal Bureau of Investigation (FBI) and the Director of Expeditionary Operations. In each role, he was responsible for the worldwide deployments of personnel, technology and logistics. Mr. Jarvis holds a master’s degree from the Joint Military Intelligence College.

Catherine “Cassie” Motz has been a member of the Board of Directors since November 2021. Since January 2014, Ms. Motz has been the Executive Director of the CollegeBound Foundation in Baltimore, a nonprofit focused on helping Baltimore City students matriculate to college. Ms. Motz previously served on the University System of Maryland Board of Regents from June 2014 through March 2015 and as a Deputy Chief of Staff to Maryland Governor Martin O’Malley. She also served as Deputy Legal Counsel to Governor O’Malley and as the Interim Director of the Governor’s Office for Children. Earlier in her career as an Assistant U.S. Attorney, Ms. Motz prosecuted homicide and domestic violence cases and argued appellate cases in federal and local courts. She later served as a Deputy Attorney General for the District of Columbia government, representing the city’s child welfare and mental health agencies. Ms. Motz also taught as an adjunct professor at the University of Maryland School of Law. Ms. Motz graduated summa cum laude from Dartmouth College with a B.A. in history and earned a J.D. from Yale Law School. Ms. Motz brings extensive leadership and public policy experience to the Board of Directors. Her distinguished career in both non-profit and government helps the Company execute its strategy of sustainable growth and community impact.

Steven Pincus has been a member of the Board of Directors since November 2021. Mr. Pincus served as an Executive Vice President with global insurance company Willis Towers Watson since April 2002 and was the Global Head of Broking for the firm’s FINEX business until August 2022. Most recently, he served as Executive Vice President of Willis Towers in Corporate Risk and Broking until his recent retirement in 2023. With over 40 years of experience, Mr. Pincus has extensive expertise in the energy and high-tech sectors. Mr. Pincus began his career at AIG and held senior roles at Johnson & Higgins and Aon. Mr. Pincus served on the board of The Storefront Academy, a tuition-free private school in Harlem, New York. He received his BSBA in economics from the University of Arizona. Mr. Pincus brings substantial risk management, financial oversight and operational expertise to the Board of Directors.

Lisa Prager has been a member of the Board of Directors since November 2021. Ms. Prager serves as the General Counsel and Executive Vice President of the Agricultural Bank of China - New York Branch, an international commercial bank and financial services provider, since September 2017. Prior to joining the Agricultural Bank of China and through August 2017, Ms. Prager was a partner in law firms where she focused on government investigations. Prior to entering private practice, Ms. Prager was a federal prosecutor in the U.S. Attorney’s Office for the District of Columbia and Acting Assistant Secretary and Deputy Assistant Secretary for Export Enforcement at the U.S. Department of Commerce’s Bureau of Industry and Security. As an Assistant U.S. Attorney, Ms. Prager handled federal cases involving terrorism, wire and mail fraud, economic espionage, and export control violations, among other matters. Ms. Prager received a B.A. from Yale University and J.D. from Western New England University School of Law. Ms. Prager brings broad legal, compliance and regulatory expertise to the Board of Directors.

Family Relationships

Lisa Prager is a sister of Paul Prager, the Company’s Co-Founder, Chief Executive Officer and Chairman of the Board of Directors. There are no other family relationships among any of the Company’s executive officers or members of the Board of Directors.

Board Diversity

| | | | | | | | | | | | | | | | | | | | | | | |

| Diversity Matrix |

| Total Number of Directors | 10 |

| Female | | Male | | Non-Binary | | Did Not Disclose

Gender |

| Part I: Gender Identity | | | | | | | |

| Directors | 4 | | 6 | | 0 | | 0 |

| Part II: Demographic Background | | | | | | | |

| African American or Black | 0 | | 0 | | 0 | | 0 |

| Alaskan Native or Native American | 0 | | 0 | | 0 | | 0 |

| Asian | 0 | | 1 | | 0 | | 0 |

| Hispanic or Latinx | 0 | | 0 | | 0 | | 0 |

| Native Hawaiian or Pacific Islander | 0 | | 0 | | 0 | | 0 |

| White | 4 | | 5 | | 0 | | 0 |

| Two or More Races or Ethnicities | 0 | | 0 | | 0 | | 0 |

| LGBTQ+ | 0 | | 0 | | 0 | | 0 |

| Did Not Disclose Demographic Background | 0 | | 0 | | 0 | | 0 |

Directors who are Military Veterans: 2 | | | | | | | |

Required Vote

The directors will be elected by a plurality of the votes cast at the Annual Meeting. Shares voted “WITHHOLD” will not prevent a director nominee from being elected as a director. Brokers do not have the discretion to vote any uninstructed shares over the election of directors. Such broker non-votes will not affect the outcome of voting on this proposal.

CORPORATE GOVERNANCE

Director Independence

Nasdaq listing rules generally require that a majority of a company’s board of directors must consist of “independent directors” within the meaning of Nasdaq listing rules. The Board of Directors has determined that each of Michael Bucella, Walter Carter, Amanda Fabiano, Christopher Jarvis, Catherine Motz and Steven Pincus is an “independent director” within the meaning of Nasdaq listing rules.

Board of Directors Leadership Structure and Board’s Role in Risk Oversight

The Board of Directors is responsible for overseeing the Company’s risk management process. The Board of Directors focuses on the Company’s general risk management strategy and the most significant risks facing the Company and oversees the implementation of risk mitigation strategies by the Company’s management. The Board’s Audit Committee is also responsible for discussing the Company’s policies with respect to risk assessment and risk management. The Board of Directors believes its administration of its risk oversight function has not negatively affected the leadership structure of the Board of Directors.

Paul Prager currently serves as the Chairman of our Board of Directors and our Chief Executive Officer. Our Board of Directors does not currently have a policy as to whether the role of Chairman of our Board of Directors and the Chief Executive Officer should be separate. Instead, such a relationship is defined and governed by the certificate of incorporation and the bylaws, which permit the same person to hold both offices. In addition, Steven Pincus is currently serving as our lead independent director.

The Board of Directors understands that no single approach to board leadership is universally accepted and that the appropriate leadership structure may vary based on several factors, such as a company’s size, industry, operations,

history and culture. Accordingly, our Board of Directors assesses its leadership structure in light of these factors and the current environment to achieve the optimal model for us and for our stockholders.

The composition of the Board of Directors, the tenure of the directors with the Company, the overall experience of the directors and the experience that the directors have had with the Chairman and the executive management team permit and encourage each member to take an active role in all discussions, and each member does actively participate in all substantive discussions. We and our Board believe that our current Board of Directors leadership structure is currently serving the Company well

Board of Directors Meetings and Committees

The Board of Directors has five committees: the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee, the Strategic Review Committee and the Sustainability Committee (together, the “Committees”).

The Committees operate under written charters, which are available at the Company’s website at www.investors.terawulf.com. The current committee membership of our Board of Directors is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director | | Audit

Committee | | Compensation

Committee | | Nominating and Corporate Governance Committee | | Strategic Review Committee | | Sustainability

Committee |

| Paul Prager+ | | | | | | | | | | ✓ |

| Nazar Khan | | | | | | | | C | | |

| Kerri Langlais | | | | | | | | | | C |

| Michael Bucella | | | | ✓ | | | | ✓ | | |

| Walter Carter | | C | | | | ✓ | | | | |

| Amanda Fabiano | | | | | | | | ✓ | | |

Christopher Jarvis | | | | | | ✓ | | | | |

| Catherine Motz | | ✓ | | ✓ | | C | | | | |

| Steven Pincus | | ✓ | | C | | | | | | |

Lisa Prager | | | | | | | | | | ✓ |

__________________________________

+ = Chairman of the Board of Directors

C = Chair

During the year ended December 31, 2023, the Board of Directors held 16 regular and special meetings, of which there was 90% attendance. Additionally, in 2023, the Audit Committee and the Compensation Committee held 8 and 5 meetings, respectively, of which there was 95% and 100% attendance, respectively.

Audit Committee

Our Audit Committee consists of Walter Carter, as Chair, Catherine Motz and Steven Pincus.

Our Board of Directors has determined that each member of the Audit Committee is independent under the Nasdaq listing standards and Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board of Directors has determined that Mr. Carter is an “audit committee financial expert” within the meaning of the SEC rules and regulations. In addition, the Board of Directors has determined that each member of the Audit Committee has the requisite financial sophistication required under the applicable requirements of Nasdaq. In arriving at this determination, the Board of Directors examined each member’s scope of experience and the nature of his or her employment in the corporate finance sector.

The principal duties and responsibilities of our Audit Committee are as follows:

•appointing, compensating, retaining, evaluating, terminating and overseeing the Company’s independent registered public accounting firm;

•discussing with the independent registered public accounting firm its independence from the Company’s management;

•reviewing, with the Company’s independent registered public accounting firm, the scope and results of its audit;

•approving all audit and permissible non-audit services to be performed by the Company’s independent registered public accounting firm;

•overseeing the financial reporting process and discussing with the Company’s management and independent registered public accounting firm the quarterly and annual financial statements that the Company files with the SEC;

•overseeing the Company’s financial and accounting controls and compliance with legal and regulatory requirements;

•reviewing the Company’s policies on risk assessment and risk management;

•reviewing related person transactions; and

•establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters.

Compensation Committee

Our Compensation Committee consists of Steven Pincus, as Chair, Michael Bucella and Catherine Motz. The principal duties and responsibilities of the Compensation Committee are as follows:

•review and approve the Company’s compensation strategy to ensure it is appropriately tailored towards attracting, retaining and motivating senior management and other key employees;

•reviewing and approving the corporate goals and objectives, evaluating the performance of and reviewing and approving the compensation of the Company’s Chief Executive Officer and other executive officers;

•reviewing and approving or making recommendations to the Board of Directors regarding the Company’s incentive compensation and equity-based plans, policies and programs;

•reviewing and approving any employment agreement or compensatory transaction with an executive officer of the Company involving compensation in excess of $120,000 per year;

•making recommendations to the Board of Directors regarding the executive officer and director indemnification and insurance matters; and

•retaining and overseeing any compensation consultants.

Each member of the Compensation Committee is “independent” under the Nasdaq listing standards and a “non-employee director” as defined in Rule 16b-3 under the Exchange Act.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Catherine Motz, as Chair, Walter Carter and Christopher Jarvis. The principal duties and responsibilities of the Nominating and Corporate Governance Committee are as follows:

•develop criteria for the selection and qualifications desirable in members of the Board of Directors in accordance with the Company’s Corporate Governance Guidelines, while also accounting for the mix of skills and other qualities that provide for an appropriate board composition;

•make recommendations to the Board of Directors regarding the selection and approval of the nominees for director to be submitted to a stockholder vote at the annual meeting of stockholders;

•review and assess the adequacy of the Company’s Corporate Governance Guidelines; and

•perform any other activities as the Committee deems appropriate, or as are requested by the Board or management, consistent with this Charter, the Company’s bylaws and applicable laws and regulations.

Strategic Review Committee

Our Strategic Review Committee consists of Nazar Khan, as Chair, Michael Bucella and Amanda Fabiano. The principal duties and responsibilities of the Strategic Review Committee are to consider and monitor the strategic direction of, as well as strategic opportunities and alternatives available to, the Company, and in connection therewith to make recommendations to the Board and management on the following:

•the Company’s long-term strategic plan, as developed by the Company’s management and approved by the Board;

•exploration of partnerships or other strategic arrangements;

•any potential extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Company or any of its subsidiaries; and

•any potential sale or transfer of a material amount of assets of the Company or any sale or transfer of assets of any of the Company’s subsidiaries which are material to the Company.

Sustainability Committee

Our Sustainability Committee consists of Kerri Langlais, as Chair, Paul Prager and Lisa Prager. The principal duties and responsibilities of the Sustainability Committee are as follows:

•review and monitor the Company’s practices related to corporate sustainability matters and make recommendations to the Board as appropriate;

•monitor developments, trends and best practices in managing corporate sustainability matters, and make recommendations to the Board as appropriate; and

•report to the Board as needed, and as the Board may request.

Director Nominations

The Nominating and Corporate Governance Committee is responsible for selecting and/or approving director nominees and recommending their approval to the Board of Directors. The Nominating and Corporate Governance Committee considers director candidates recommended for nomination by the Company’s stockholders during such times as they are seeking proposed director nominees to stand for election at the next annual meeting of stockholders (or, if applicable, a special meeting of stockholders). A stockholder of the Company that wishes to nominate a director for election to the Board of Directors should follow the procedures set forth in the bylaws.

The Company’s Corporate Governance Guidelines detail minimum qualifications that must be met or skills that are necessary for directors to possess when the Nominating and Corporate Governance Committee is recommending candidates for election, and the Board of Directors, in approving (and in the case of vacancies, appointing) such candidates to the Board of Directors. They may each take into account many factors including: personal and professional integrity, ethics and values; experience in corporate management, such as serving as an officer or former officer of a publicly held company; strong finance experience; relevant social policy concerns; experience relevant to the Company’s industry; experience as a board member or executive officer of another publicly held company; relevant academic expertise or other proficiency in an area of the Company’s operations; diversity of expertise and experience in substantive matters pertaining to the Company’s business relative to other Board of Directors members; diversity of background and perspective, including, but not limited to, with respect to age, gender, race, place of residence and specialized experience; practical and

mature business judgement, including but not limited to, the ability to make independent analytical inquiries; and any other relevant qualifications. The Board of Directors evaluates each individual in the context of the Board of Directors as a whole, with the objective of assembling a group that can best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgement using its diversity and experience in these various areas. In determining whether to recommend a director for re-election, the Nominating and Corporate Governance Committee may also consider the director’s past attendance at meetings and participation in and contribution to activities of the Board.

Compensation Committee Interlocks and Insider Participation

Members of our Compensation Committee during 2023 included Steven Pincus, Michael Bucella and Catherine Motz. None of these directors has ever served as an officer or employee of the Company. During 2023, none of the members of the Compensation Committee had any relationship with the Company requiring disclosure under Item 404 of Regulation S-K. None of our executive officers served as a member of the Board of Directors or Compensation Committee, or similar committee, of any other company whose executive officer(s) served as a member of our Board of Directors or our Compensation Committee.

Code of Ethics

Our Board of Directors has adopted a code of conduct and ethics that applies to all our directors, officers and employees and is intended to comply with the relevant listing requirements for a code of conduct as well as qualify as a “code of ethics” as defined by the rules of the SEC. The code of conduct and ethics contains general guidelines for conducting our business consistent with the highest standards of business ethics. We intend to disclose future amendments to certain provisions of our code of conduct and ethics, or waivers of such provisions applicable to any principal executive officer, principal financial officer, principal accounting officer and controller, or persons performing similar functions, and our directors, on our website at www.investors.terawulf.com. The code of conduct is available on our website.

Compensation Risk Assessment

We believe that the performance goals and incentive plan structures generally established under the Company’s executive, annual and long-term incentive programs would not contribute to excessive risk taking by our senior executives or employees. The approved goals under our incentive programs are consistent with our financial operating plans and strategies, and these programs are discussed and reviewed by the Compensation Committee. The Company’s compensation systems are balanced, rewarding both short-term and long-term performance, and its performance goals are team-oriented, rather than individually focused, and include measurable factors and objective criteria. The Compensation Committee is actively engaged in setting compensation systems, monitoring those systems during the year and using discretion in making rewards, as necessary. As a result of the procedures and practices described above, the Compensation Committee believes that the Company’s compensation policies and practices for its employees do not encourage risk taking that is reasonably likely to have a material adverse effect on the Company.

Communications with the Board of Directors

Stockholders and other interested parties desiring to communicate directly with the full Board of Directors, the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee, the Strategic Review Committee, the Sustainability Committee, the non-management directors as a group or with any individual director or directors may do so by sending such communication in writing, addressed to the attention of the intended recipient(s), c/o the Office of the General Counsel, TeraWulf Inc., 9 Federal Street, Easton, MD 21601. Interested parties may communicate anonymously and/or confidentially if they desire. All communications received that relate to accounting, internal accounting controls or auditing matters will be referred to the chair of the Audit Committee unless the communication is otherwise addressed. All other communications received will be forwarded to the appropriate director or directors.

Director Attendance at Annual Meeting

The Company encourages all of our directors to attend each annual meeting of stockholders. All directors attended our 2023 Annual Meeting.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires the Company’s officers and directors, and persons who own more than 10% of our common stock, to file reports of ownership and changes of ownership of such securities with the SEC. Based solely on a review of the reports received by the SEC, the Company believes that during the fiscal year ended December 31, 2023, the Company’s officers, directors and greater than 10% owners timely filed all reports they were required to file under Section 16(a), with the exception of our late Form 4 filings by each of Mr. Khan, Mr. Bucella, Mr. Carter, Ms. Motz. Mr. Pincus and Ms. Prager, due to an administrative error.

Hedging Policy

The Company’s Securities Trading Policy discourages speculative hedging transactions, but does permit directors, officers and employees of the Company to enter into long-term (12 months or longer) hedging transactions that are designed to protect the individual’s investment in his or her shares of common stock or stock options of the Company, subject to the pre-clearance procedures outlined in the Securities Trading Policy. None of the Company’s directors or officers have entered into any such hedging transactions.

EXECUTIVE OFFICERS

The names of the current executive officers of the Company (and their respective ages as of the date of this proxy statement) are set forth below.

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

Paul Prager | | 65 | | Chief Executive Officer and Chairman of the Board of Directors |

Kenneth Deane | | 54 | | Chief Accounting Officer and Treasurer |

Patrick Fleury | | 46 | | Chief Financial Officer |

| Nazar Khan | | 47 | | Chief Operating Officer, Chief Technology Officer and Director |

| Kerri Langlais | | 47 | | Chief Strategy Officer and Director |

Paul Prager. For the biography of Mr. Prager, please see “The Board of Directors.”

Kenneth Deane has been the Chief Accounting Officer and Treasurer of TeraWulf since May 16, 2022, where he is responsible for managing the Company’s financial functions, including accounting, audit, internal control and treasury. Prior to this role and from July 2021, Mr. Deane was the Company’s Chief Financial Officer. Mr. Deane brings more than 20 years of financial and operational experience in the power, high tech and public accounting sectors. From January 2008 until May 2021, Mr. Deane was an executive with Heorot Power Holdings LLC, an owner and operator of power generation assets. Before joining Heorot Power, Mr. Deane held positions of Chief Financial Officer, Vice President and Corporate Secretary at Isonics Corporation; a Senior Finance Manager at Sun Microsystems, Inc.; and an Audit Manager at Deloitte LLP. He holds a B.S. and M.S. in accounting from the University of Florida.

Patrick Fleury has been the Chief Financial Officer of TeraWulf since May 16, 2022, where he is responsible for directing and overseeing the financial activities of the Company, including investment of funds and additional capital for expansion. Mr. Fleury brings 24 years of finance experience, comprising of capital markets, principal investing and advisory roles. Most recently, Mr. Fleury served as a founding member of the credit team at Platinum Equity, where he was responsible for public and private credit investments. Before that, he was a Managing Director at Blackstone’s global credit platform, GSO Capital Partners. Mr. Fleury began his career in the Global Energy & Power Investment Banking Group at Banc of America Securities, LLC. Mr. Fleury received a B.A., magna cum laude, in Economics and Government & Legal Studies from Bowdoin College.

Nazar Khan. For the biography of Mr. Khan, please see “The Board of Directors.”

Kerri Langlais. For the biography of Ms. Langlais, please see “The Board of Directors.”

EXECUTIVE COMPENSATION

This section discusses the material components of the executive compensation program for our executive officers who are named in the “Summary Compensation Table” below. As a “smaller reporting company” as defined in Rule 12b-2 under the Exchange Act, we are not required to include a Compensation Discussion and Analysis and have elected to comply with the scaled disclosure requirements applicable to smaller reporting companies. Our named executive officers for the fiscal year ended December 31, 2023 were as follows:

•Paul Prager - Chief Executive Officer and Chairman of the Board of Directors

•Patrick Fleury - Chief Financial Officer

•Kerri Langlais - Chief Strategy Officer and Director

Summary Compensation Table

The following table sets forth compensation information for our named executive officers for services performed for the Company and its subsidiaries for the fiscal year ended December 31, 2023:

Summary Compensation Table for 2023 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | Salary ($)(1) | | Bonus ($)(2) | | Stock Awards ($)(3) | | All Other Compensation ($)(4) | | Total ($) |

| | | | | | | | | | | | |

| Paul Prager, Chief Executive Officer and Chairman of the Board of Directors | | 2023 | | 950,545 | | | 1,425,000 | | | — | | | 18,633 | | | 2,394,178 | |

| 2022 | | 959,818 | | | 1,425,000 | | | — | | | 17,355 | | | 2,402,173 | |

| 2021 | | 612,248 | | | — | | | — | | | 12,980 | | | 625,228 | |

| Patrick Fleury, Chief Financial Officer | | 2023 | | 390,907 | | | 400,000 | | | 724,880 | | | 377 | | | 1,516,164 | |

| 2022 | | 215,803 | | | 175,000 | | | 3,300,000 | | | 251 | | | 3,691,054 | |

| Kerri Langlais, Chief Strategy Officer and Director | | 2023 | | 401,055 | | | 400,000 | | | 724,880 | | | 17,630 | | | 1,543,565 | |

| 2022 | | 400,591 | | | 200,000 | | | — | | | 17,244 | | | 617,835 | |

| 2021 | | 261,789 | | | — | | | — | | | 12,222 | | | 274,011 | |

__________________________________

(1)The amounts shown in this column for Mr. Prager include amounts ($474,999 and $219,230, in 2023 and 2022, respectively) that he voluntarily elected to defer receipt to a later year.

(2)No annual cash bonuses were paid for fiscal year 2021.

(3)Represents the aggregate grant date fair value of the restricted stock units (“RSUs”) and performance-based restricted stock units (“PSUs”) granted in 2023 computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, Compensation-Stock Compensation, which, for PSU awards, is based on the probable outcome of the performance conditions. On March 4, 2023, Mr. Fleury and Ms. Langlais were granted awards under our 2021 Plan as follows: Mr. Fleury was granted 800,000 RSUs and 1,200,000 PSUs; and Ms. Langlais was granted 800,000 RSUs and 1,200,000 PSUs. See Notes 2 and 16 to our consolidated financial statements included in our Annual Report for the assumptions made in determining these values. The value for each PSU award, as of the grant date, assuming the maximum level of performance, is $782,160 for each of Mr. Fleury and Ms. Langlais. There can be no assurance that these grant date fair values will ever be realized by the named executive officers.

(4)Amounts reported in the Summary Compensation Table for 2023 as “All Other Compensation” for fiscal year 2023 include the following: for Mr. Prager: employer matching contributions to a defined contribution plan of $16,500 and life insurance premiums of $2,133; for Mr. Fleury: life insurance premiums of $377; and for Ms. Langlais: employer matching contributions to a defined contribution plan of $16,500 and life insurance premiums of $1,130. On two occasions in 2023, family members or guests of Mr. Prager accompanied him on business trips on a Company-leased aircraft. In those instances, there was no incremental cost to the Company, and as a result, no amount is reflected in the table.

Narrative to Summary Compensation Table

Employment Agreements

Paul Prager, Patrick Fleury and Kerri Langlais

The Company is party to an employment agreement with each of Mr. Prager, Mr. Fleury and Ms. Langlais (the “TW Employment Agreements”). The TW Employment Agreements provide for the general terms of employment, including annual base salary (which amounts are currently at $950,000 for Mr. Prager and $400,000 for each of Mr. Fleury and Ms. Langlais), annual target bonus opportunity (150% of base salary for Mr. Prager and 85% of base salary for each of Mr. Fleury and Ms. Langlais), business expense reimbursement, eligibility to participate and receive awards under the TeraWulf 2021 Omnibus Incentive Plan (the “2021 Plan”) (or its successor plan) and eligibility to participate in the benefit plans and programs made available from time to time for employees generally, including medical, 401(k) and paid time off, subject to the terms and conditions of such benefit plans and programs.

Mr. Fleury’s employment agreement also provides for an equity award of 1,000,000 RSUs, with 25% of such RSUs vesting on each of the first two anniversaries of the date of grant and the remaining 50% of the RSUs vesting on the third anniversary of the grant date, subject to Mr. Fleury’s continued employment or service with the Company through each such date (the “Inducement Award”). The Inducement Award was granted as an “employment inducement grant” within the meaning of Rule 5635(c)(4) of the Nasdaq Listing Rules and was therefore not awarded under the 2021 Plan.

See the section titled “Potential Payments upon Termination of Employment or Change in Control” below for additional details related to severance payments and benefits that will be provided to each of Mr. Prager, Mr. Fleury and Ms. Langlais pursuant to their respective TW Employment Agreements upon termination of their respective employment under certain circumstances.

Other Compensation and Benefit Plans

TeraWulf 2021 Omnibus Incentive Plan

The board of directors of TeraCub Inc. (f/k/a TeraWulf Inc.), a Delaware corporation and wholly owned subsidiary of the Company, adopted the 2021 Plan on May 13, 2021, and the 2021 Plan was approved by its stockholders on May 13, 2021. On December 14, 2021, our Board of Directors approved the assumption of, and the Company assumed the 2021 Plan in connection with the closing of the mergers. The purposes of the 2021 Plan are to attract and retain the best available personnel for positions of substantial responsibility, to provide additional incentive to our service providers and to promote the success of the Company’s business. The 2021 Plan is administered by the Compensation Committee of our Board of Directors.

Under the 2021 Plan, the Company is authorized to grant an aggregate of 15,685,119 shares of our common stock (the “Share Pool”) to eligible participants in the form of stock options, restricted stock awards, RSUs, stock appreciation rights, performance awards and other awards that may be settled in or based on our common stock. In addition, the 2021 Plan provides for an automatic increase in the number of shares reserved for issuance thereunder. The Share Pool will automatically increase each fiscal year following May 13, 2021, which began fiscal year 2022 and will end with fiscal year 2026 by the lesser of (i) 1% of the total number of shares of our common stock outstanding on the last day of the immediately preceding fiscal year on a fully diluted basis assuming that all shares available for issuance under the 2021 Plan are issued and outstanding or (ii) such number of shares of our common stock determined by our Board of Directors. The increase shall occur on the first day of each such fiscal year or another day selected by our board of during such fiscal year.

In 2023, the Company granted 800,000 RSUs and 1,200,000 PSUs to Mr. Fleury and 800,000 RSUs and 1,200,000 PSUs to Ms. Langlais, in each case, under the 2021 Plan. The RSUs are subject to service-based vesting conditions and will vest in two equal installments on each of the first two six-month anniversaries of the grant date. The PSUs are subject to performance-based vesting conditions measured over a three-year performance period and will vest based on the Company’s achievement of stock price hurdles as follows: (i) one-third of the PSUs are earned on the Company’s achievement of a stock price hurdle equal to $1.50 per share or greater; (i) one-third of the PSUs are earned on the Company’s achievement of a stock price hurdle equal to $2.50 per share or greater; and (iii) one-third of the PSUs are earned on the Company’s achievement of a stock price hurdle equal to $3.50 per share or greater, in each case, subject to the named executive officer’s continued service through the applicable determination date. The stock price hurdle represents the average closing price of the Company’s common stock on Nasdaq during the 45 trading days immediately preceding the applicable determination date. All of the PSUs will be forfeited if the performance targets are not achieved within three years of the grant date.

Retirement Plans

The Company and its subsidiaries sponsor a 401(k) defined contribution retirement plan intended to qualify for favorable tax treatment under Section 401(a) of the Internal Revenue Code of 1986, as amended (the “Code”). Employees who meet the eligibility requirements may make pre-tax contributions to the applicable plan from their eligible earnings up to the statutorily prescribed annual limit on pre-tax contributions under the Code.

Under the Company’s defined contribution retirement plan, we match contributions made by participants in the 401(k) plan up to a specified percentage of the employee contributions, and these matching contributions are fully vested as of the date on which the contribution is made. Mr. Prager and Ms. Langlais each participate in the Company’s defined contribution retirement plan, while Mr. Fleury does not.

Health and Welfare Plans, Perquisites and Other Personal Benefits

Our named executive officers are eligible to participate in our employee benefit plans, including our medical, dental, vision, life and disability plans, in each case, on the same basis as all of our other employees.

From time to time, our named executive officers travel on a Company-chartered aircraft to maximize the efficiency of their travel and availability for Company business. On two occasions in 2023, family members or guests of Mr. Prager accompanied him on business trips on Company chartered aircraft at no incremental cost to us.

Other Compensation Policies and Practices

Securities Trading Policy

Our Securities Trading Policy provides that employees, including our executive officers and the members of our Board of Directors, are prohibited from engaging in transactions in our securities if such employee possesses material, non-public information about the Company. In addition, certain persons covered by our Securities Trading Policy must advise our Chief Legal Officer before effectuating any transaction in our securities. Because the Company believes it is improper and inappropriate for any person to engage in short-term or speculative transactions involving the Company’s securities, it is the policy of the Company that directors, officers and employees of the Company, and their related persons, are prohibited from engaging in any of the following activities with respect to securities of the Company: (i) purchases of the Company’s stock of the Company on margin generally; (ii) short sales; and (iii) buying or selling puts, calls, options or other derivatives in respect of the Company’s securities.

Clawback Policy