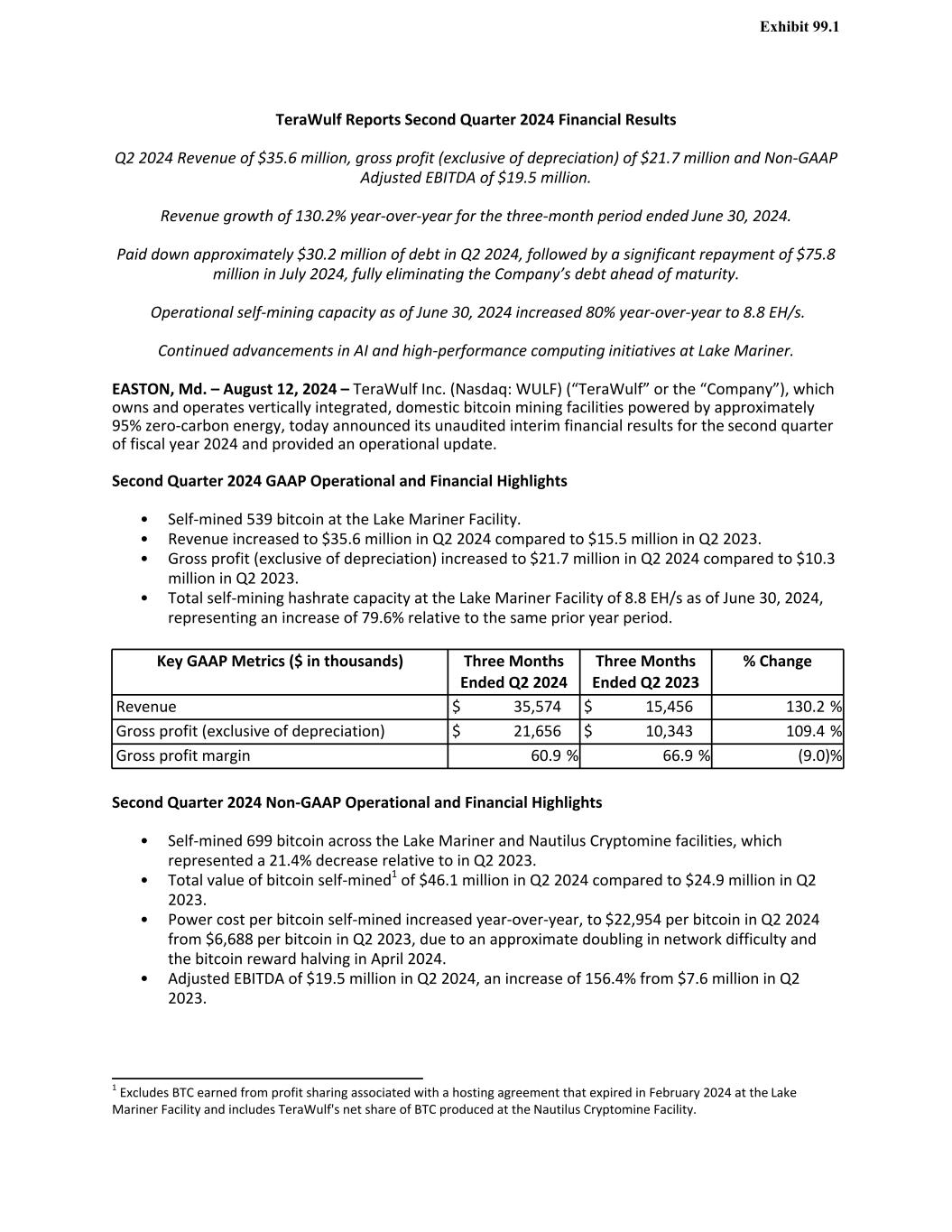

TeraWulf Reports Second Quarter 2024 Financial Results Q2 2024 Revenue of $35.6 million, gross profit (exclusive of depreciation) of $21.7 million and Non-GAAP Adjusted EBITDA of $19.5 million. Revenue growth of 130.2% year-over-year for the three-month period ended June 30, 2024. Paid down approximately $30.2 million of debt in Q2 2024, followed by a significant repayment of $75.8 million in July 2024, fully eliminating the Company’s debt ahead of maturity. Operational self-mining capacity as of June 30, 2024 increased 80% year-over-year to 8.8 EH/s. Continued advancements in AI and high-performance computing initiatives at Lake Mariner. EASTON, Md. – August 12, 2024 – TeraWulf Inc. (Nasdaq: WULF) (“TeraWulf” or the “Company”), which owns and operates vertically integrated, domestic bitcoin mining facilities powered by approximately 95% zero-carbon energy, today announced its unaudited interim financial results for the second quarter of fiscal year 2024 and provided an operational update. Second Quarter 2024 GAAP Operational and Financial Highlights • Self-mined 539 bitcoin at the Lake Mariner Facility. • Revenue increased to $35.6 million in Q2 2024 compared to $15.5 million in Q2 2023. • Gross profit (exclusive of depreciation) increased to $21.7 million in Q2 2024 compared to $10.3 million in Q2 2023. • Total self-mining hashrate capacity at the Lake Mariner Facility of 8.8 EH/s as of June 30, 2024, representing an increase of 79.6% relative to the same prior year period. Key GAAP Metrics ($ in thousands) Three Months Ended Q2 2024 Three Months Ended Q2 2023 % Change Revenue $ 35,574 $ 15,456 130.2 % Gross profit (exclusive of depreciation) $ 21,656 $ 10,343 109.4 % Gross profit margin 60.9 % 66.9 % (9.0) % Second Quarter 2024 Non-GAAP Operational and Financial Highlights • Self-mined 699 bitcoin across the Lake Mariner and Nautilus Cryptomine facilities, which represented a 21.4% decrease relative to in Q2 2023. • Total value of bitcoin self-mined1 of $46.1 million in Q2 2024 compared to $24.9 million in Q2 2023. • Power cost per bitcoin self-mined increased year-over-year, to $22,954 per bitcoin in Q2 2024 from $6,688 per bitcoin in Q2 2023, due to an approximate doubling in network difficulty and the bitcoin reward halving in April 2024. • Adjusted EBITDA of $19.5 million in Q2 2024, an increase of 156.4% from $7.6 million in Q2 2023. Exhibit 99.1 1 Excludes BTC earned from profit sharing associated with a hosting agreement that expired in February 2024 at the Lake Mariner Facility and includes TeraWulf's net share of BTC produced at the Nautilus Cryptomine Facility.

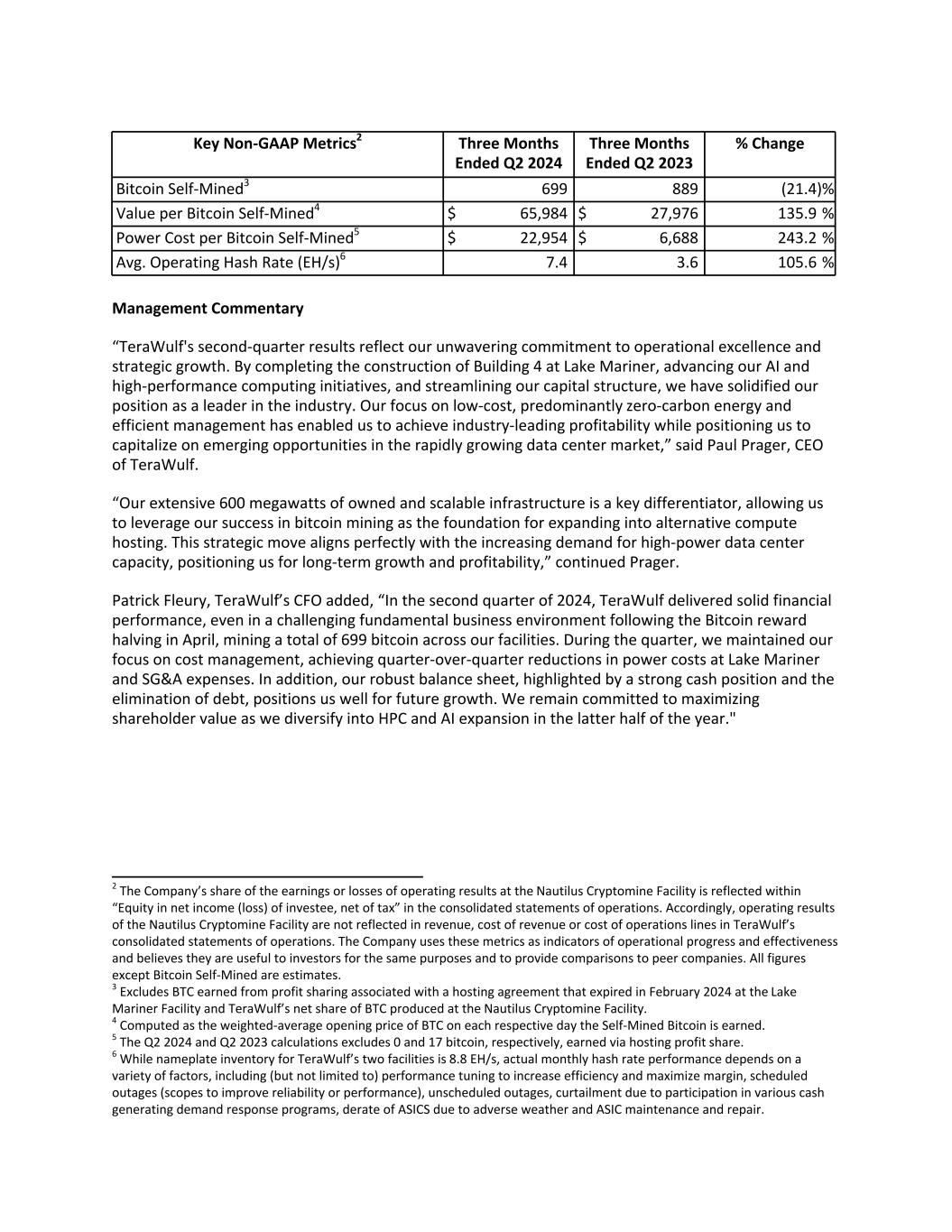

Key Non-GAAP Metrics2 Three Months Ended Q2 2024 Three Months Ended Q2 2023 % Change Bitcoin Self-Mined3 699 889 (21.4) % Value per Bitcoin Self-Mined4 $ 65,984 $ 27,976 135.9 % Power Cost per Bitcoin Self-Mined5 $ 22,954 $ 6,688 243.2 % Avg. Operating Hash Rate (EH/s)6 7.4 3.6 105.6 % Management Commentary “TeraWulf's second-quarter results reflect our unwavering commitment to operational excellence and strategic growth. By completing the construction of Building 4 at Lake Mariner, advancing our AI and high-performance computing initiatives, and streamlining our capital structure, we have solidified our position as a leader in the industry. Our focus on low-cost, predominantly zero-carbon energy and efficient management has enabled us to achieve industry-leading profitability while positioning us to capitalize on emerging opportunities in the rapidly growing data center market,” said Paul Prager, CEO of TeraWulf. “Our extensive 600 megawatts of owned and scalable infrastructure is a key differentiator, allowing us to leverage our success in bitcoin mining as the foundation for expanding into alternative compute hosting. This strategic move aligns perfectly with the increasing demand for high-power data center capacity, positioning us for long-term growth and profitability,” continued Prager. Patrick Fleury, TeraWulf’s CFO added, “In the second quarter of 2024, TeraWulf delivered solid financial performance, even in a challenging fundamental business environment following the Bitcoin reward halving in April, mining a total of 699 bitcoin across our facilities. During the quarter, we maintained our focus on cost management, achieving quarter-over-quarter reductions in power costs at Lake Mariner and SG&A expenses. In addition, our robust balance sheet, highlighted by a strong cash position and the elimination of debt, positions us well for future growth. We remain committed to maximizing shareholder value as we diversify into HPC and AI expansion in the latter half of the year." 2 The Company’s share of the earnings or losses of operating results at the Nautilus Cryptomine Facility is reflected within “Equity in net income (loss) of investee, net of tax” in the consolidated statements of operations. Accordingly, operating results of the Nautilus Cryptomine Facility are not reflected in revenue, cost of revenue or cost of operations lines in TeraWulf’s consolidated statements of operations. The Company uses these metrics as indicators of operational progress and effectiveness and believes they are useful to investors for the same purposes and to provide comparisons to peer companies. All figures except Bitcoin Self-Mined are estimates. 3 Excludes BTC earned from profit sharing associated with a hosting agreement that expired in February 2024 at the Lake Mariner Facility and TeraWulf’s net share of BTC produced at the Nautilus Cryptomine Facility. 4 Computed as the weighted-average opening price of BTC on each respective day the Self-Mined Bitcoin is earned. 5 The Q2 2024 and Q2 2023 calculations excludes 0 and 17 bitcoin, respectively, earned via hosting profit share. 6 While nameplate inventory for TeraWulf’s two facilities is 8.8 EH/s, actual monthly hash rate performance depends on a variety of factors, including (but not limited to) performance tuning to increase efficiency and maximize margin, scheduled outages (scopes to improve reliability or performance), unscheduled outages, curtailment due to participation in various cash generating demand response programs, derate of ASICS due to adverse weather and ASIC maintenance and repair.

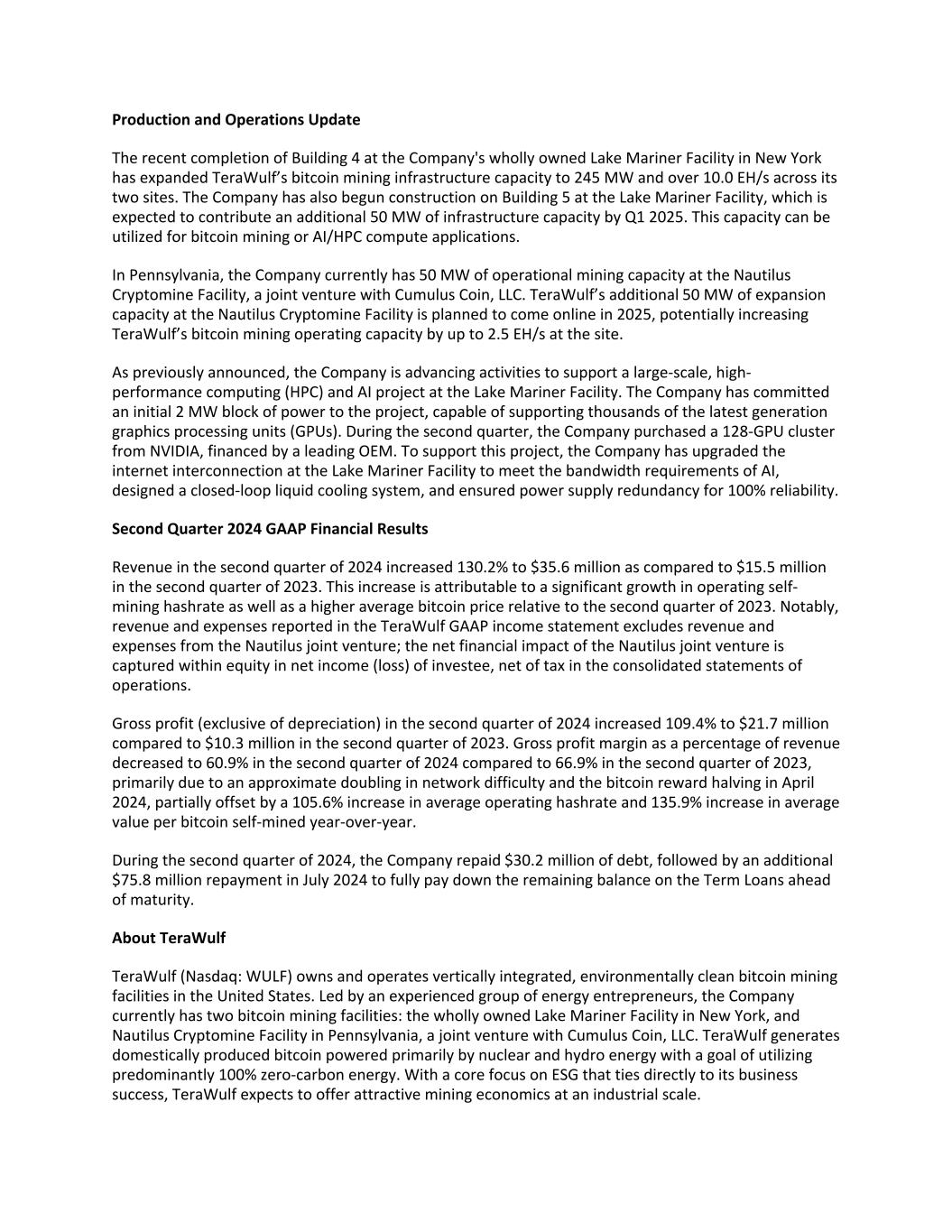

Production and Operations Update The recent completion of Building 4 at the Company's wholly owned Lake Mariner Facility in New York has expanded TeraWulf’s bitcoin mining infrastructure capacity to 245 MW and over 10.0 EH/s across its two sites. The Company has also begun construction on Building 5 at the Lake Mariner Facility, which is expected to contribute an additional 50 MW of infrastructure capacity by Q1 2025. This capacity can be utilized for bitcoin mining or AI/HPC compute applications. In Pennsylvania, the Company currently has 50 MW of operational mining capacity at the Nautilus Cryptomine Facility, a joint venture with Cumulus Coin, LLC. TeraWulf’s additional 50 MW of expansion capacity at the Nautilus Cryptomine Facility is planned to come online in 2025, potentially increasing TeraWulf’s bitcoin mining operating capacity by up to 2.5 EH/s at the site. As previously announced, the Company is advancing activities to support a large-scale, high- performance computing (HPC) and AI project at the Lake Mariner Facility. The Company has committed an initial 2 MW block of power to the project, capable of supporting thousands of the latest generation graphics processing units (GPUs). During the second quarter, the Company purchased a 128-GPU cluster from NVIDIA, financed by a leading OEM. To support this project, the Company has upgraded the internet interconnection at the Lake Mariner Facility to meet the bandwidth requirements of AI, designed a closed-loop liquid cooling system, and ensured power supply redundancy for 100% reliability. Second Quarter 2024 GAAP Financial Results Revenue in the second quarter of 2024 increased 130.2% to $35.6 million as compared to $15.5 million in the second quarter of 2023. This increase is attributable to a significant growth in operating self- mining hashrate as well as a higher average bitcoin price relative to the second quarter of 2023. Notably, revenue and expenses reported in the TeraWulf GAAP income statement excludes revenue and expenses from the Nautilus joint venture; the net financial impact of the Nautilus joint venture is captured within equity in net income (loss) of investee, net of tax in the consolidated statements of operations. Gross profit (exclusive of depreciation) in the second quarter of 2024 increased 109.4% to $21.7 million compared to $10.3 million in the second quarter of 2023. Gross profit margin as a percentage of revenue decreased to 60.9% in the second quarter of 2024 compared to 66.9% in the second quarter of 2023, primarily due to an approximate doubling in network difficulty and the bitcoin reward halving in April 2024, partially offset by a 105.6% increase in average operating hashrate and 135.9% increase in average value per bitcoin self-mined year-over-year. During the second quarter of 2024, the Company repaid $30.2 million of debt, followed by an additional $75.8 million repayment in July 2024 to fully pay down the remaining balance on the Term Loans ahead of maturity. About TeraWulf TeraWulf (Nasdaq: WULF) owns and operates vertically integrated, environmentally clean bitcoin mining facilities in the United States. Led by an experienced group of energy entrepreneurs, the Company currently has two bitcoin mining facilities: the wholly owned Lake Mariner Facility in New York, and Nautilus Cryptomine Facility in Pennsylvania, a joint venture with Cumulus Coin, LLC. TeraWulf generates domestically produced bitcoin powered primarily by nuclear and hydro energy with a goal of utilizing predominantly 100% zero-carbon energy. With a core focus on ESG that ties directly to its business success, TeraWulf expects to offer attractive mining economics at an industrial scale.

Forward-Looking Statements This press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements include statements concerning anticipated future events and expectations that are not historical facts. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements. In addition, forward-looking statements are typically identified by words such as “plan,” “believe,” “goal,” “target,” “aim,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, although the absence of these words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are based on the current expectations and beliefs of TeraWulf’s management and are inherently subject to a number of factors, risks, uncertainties and assumptions and their potential effects. There can be no assurance that future developments will be those that have been anticipated. Actual results may vary materially from those expressed or implied by forward-looking statements based on a number of factors, risks, uncertainties and assumptions, including, among others: (1) conditions in the cryptocurrency mining industry, including fluctuation in the market pricing of bitcoin and other cryptocurrencies, and the economics of cryptocurrency mining, including as to variables or factors affecting the cost, efficiency and profitability of cryptocurrency mining; (2) competition among the various providers of cryptocurrency mining services; (3) changes in applicable laws, regulations and/or permits affecting TeraWulf’s operations or the industries in which it operates, including regulation regarding power generation, cryptocurrency usage and/or cryptocurrency mining, and/or regulation regarding safety, health, environmental and other matters, which could require significant expenditures; (4) the ability to implement certain business objectives and to timely and cost-effectively execute integrated projects; (5) failure to obtain adequate financing on a timely basis and/or on acceptable terms with regard to growth strategies or operations; (6) loss of public confidence in bitcoin or other cryptocurrencies and the potential for cryptocurrency market manipulation; (7) adverse geopolitical or economic conditions, including a high inflationary environment; (8) the potential of cybercrime, money- laundering, malware infections and phishing and/or loss and interference as a result of equipment malfunction or break-down, physical disaster, data security breach, computer malfunction or sabotage (and the costs associated with any of the foregoing); (9) the availability, delivery schedule and cost of equipment necessary to maintain and grow the business and operations of TeraWulf, including mining equipment and infrastructure equipment meeting the technical or other specifications required to achieve its growth strategy; (10) employment workforce factors, including the loss of key employees; (11) litigation relating to TeraWulf and/or its business; and (12) other risks and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange Commission (“SEC”). Potential investors, stockholders and other readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they were made. TeraWulf does not assume any obligation to publicly update any forward-looking statement after it was made, whether as a result of new information, future events or otherwise, except as required by law or regulation. Investors are referred to the full discussion of risks and uncertainties associated with forward-looking statements and the discussion of risk factors contained in the Company’s filings with the SEC, which are available at www.sec.gov. Company Contact: Jason Assad Director of Corporate Communications assad@terawulf.com (678) 570-6791

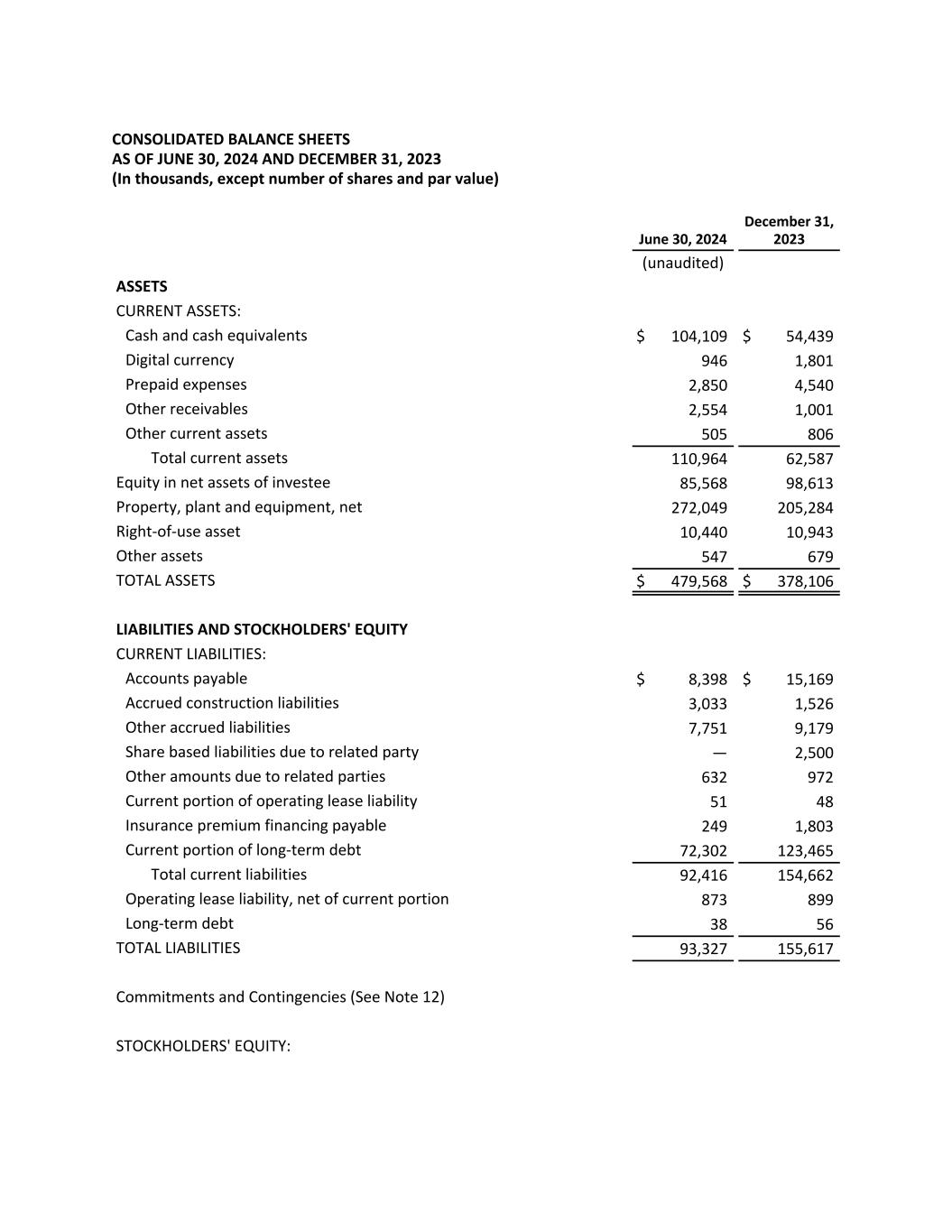

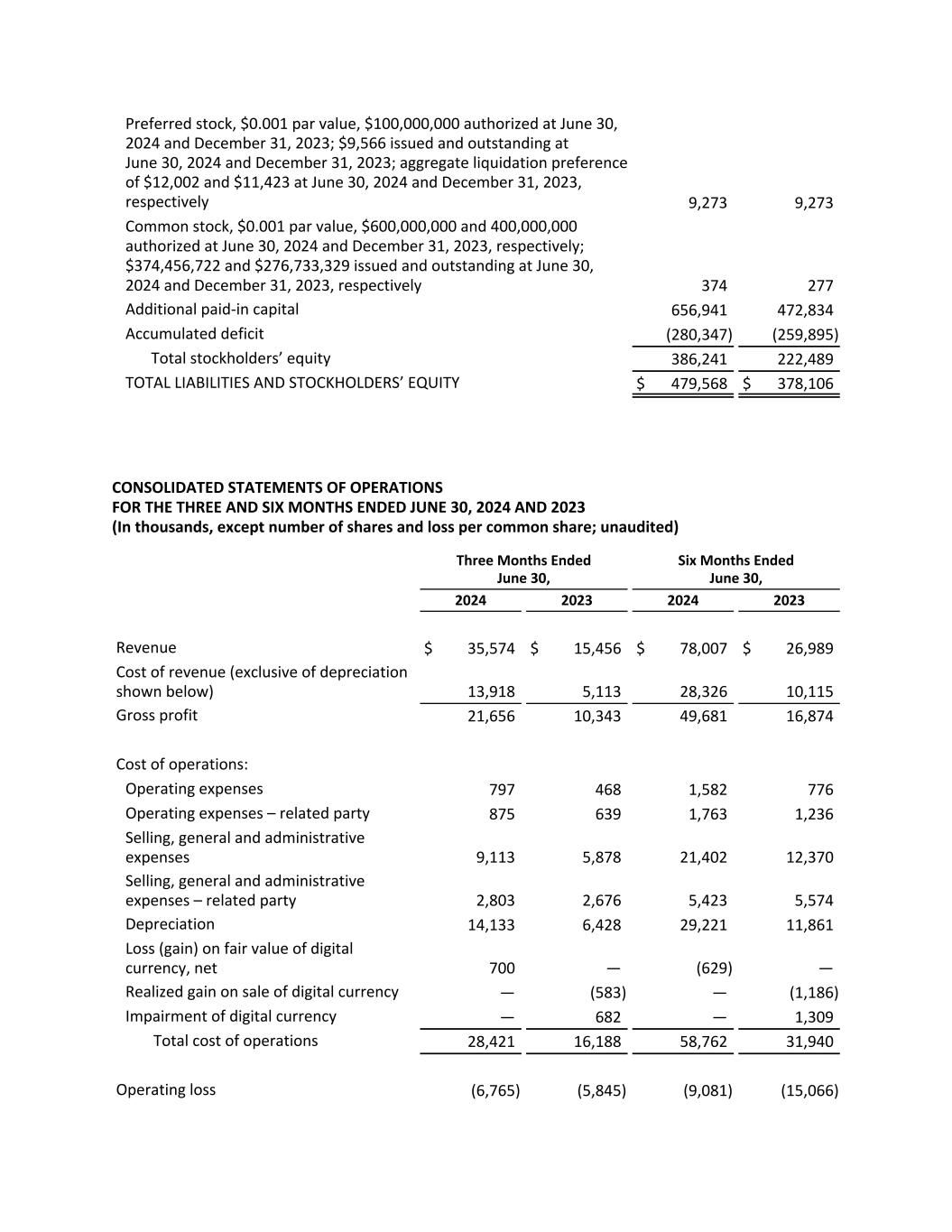

CONSOLIDATED BALANCE SHEETS AS OF JUNE 30, 2024 AND DECEMBER 31, 2023 (In thousands, except number of shares and par value) June 30, 2024 December 31, 2023 (unaudited) ASSETS CURRENT ASSETS: Cash and cash equivalents $ 104,109 $ 54,439 Digital currency 946 1,801 Prepaid expenses 2,850 4,540 Other receivables 2,554 1,001 Other current assets 505 806 Total current assets 110,964 62,587 Equity in net assets of investee 85,568 98,613 Property, plant and equipment, net 272,049 205,284 Right-of-use asset 10,440 10,943 Other assets 547 679 TOTAL ASSETS $ 479,568 $ 378,106 LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES: Accounts payable $ 8,398 $ 15,169 Accrued construction liabilities 3,033 1,526 Other accrued liabilities 7,751 9,179 Share based liabilities due to related party — 2,500 Other amounts due to related parties 632 972 Current portion of operating lease liability 51 48 Insurance premium financing payable 249 1,803 Current portion of long-term debt 72,302 123,465 Total current liabilities 92,416 154,662 Operating lease liability, net of current portion 873 899 Long-term debt 38 56 TOTAL LIABILITIES 93,327 155,617 Commitments and Contingencies (See Note 12) STOCKHOLDERS' EQUITY:

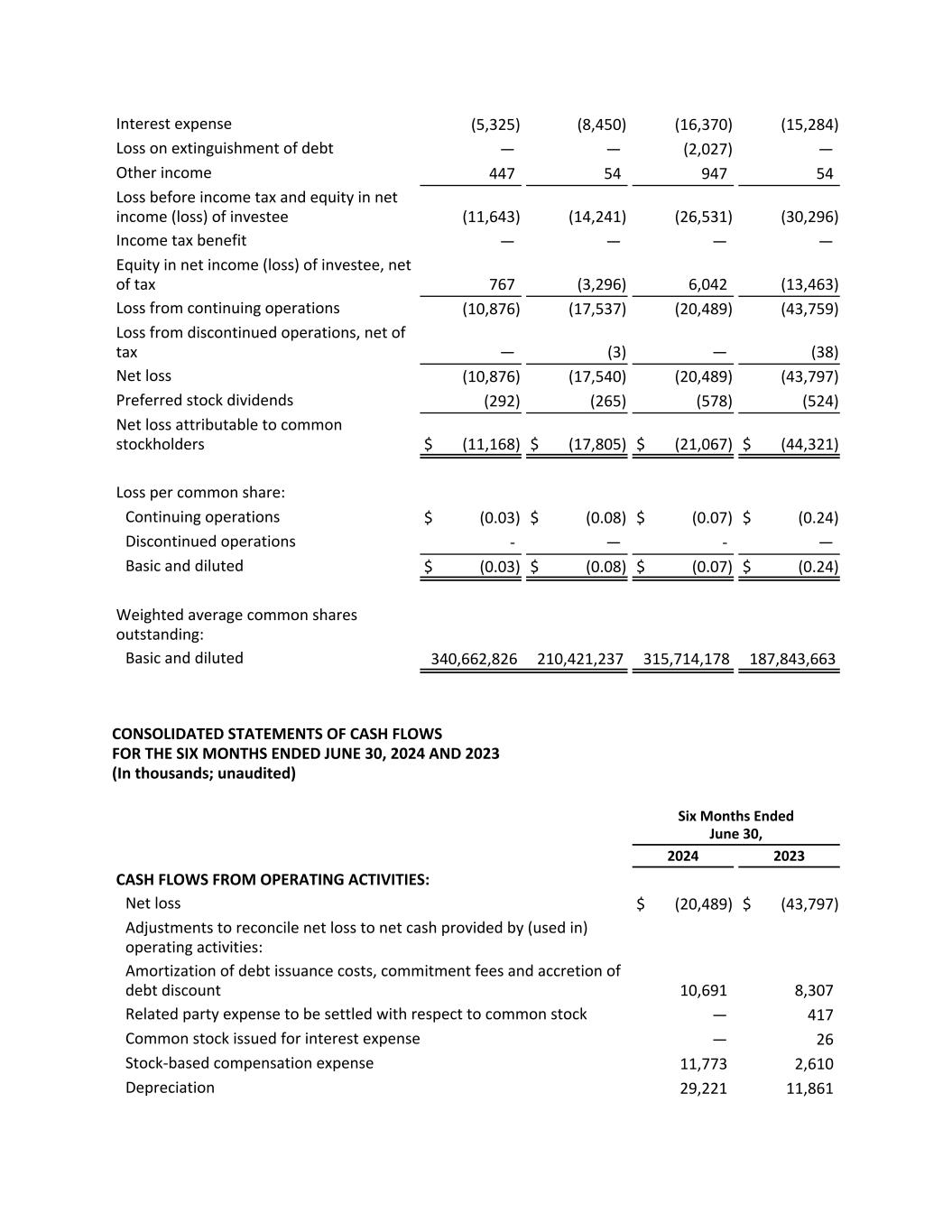

Preferred stock, $0.001 par value, $100,000,000 authorized at June 30, 2024 and December 31, 2023; $9,566 issued and outstanding at June 30, 2024 and December 31, 2023; aggregate liquidation preference of $12,002 and $11,423 at June 30, 2024 and December 31, 2023, respectively 9,273 9,273 Common stock, $0.001 par value, $600,000,000 and 400,000,000 authorized at June 30, 2024 and December 31, 2023, respectively; $374,456,722 and $276,733,329 issued and outstanding at June 30, 2024 and December 31, 2023, respectively 374 277 Additional paid-in capital 656,941 472,834 Accumulated deficit (280,347) (259,895) Total stockholders’ equity 386,241 222,489 TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY $ 479,568 $ 378,106 CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023 (In thousands, except number of shares and loss per common share; unaudited) Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Revenue $ 35,574 $ 15,456 $ 78,007 $ 26,989 Cost of revenue (exclusive of depreciation shown below) 13,918 5,113 28,326 10,115 Gross profit 21,656 10,343 49,681 16,874 Cost of operations: Operating expenses 797 468 1,582 776 Operating expenses – related party 875 639 1,763 1,236 Selling, general and administrative expenses 9,113 5,878 21,402 12,370 Selling, general and administrative expenses – related party 2,803 2,676 5,423 5,574 Depreciation 14,133 6,428 29,221 11,861 Loss (gain) on fair value of digital currency, net 700 — (629) — Realized gain on sale of digital currency — (583) — (1,186) Impairment of digital currency — 682 — 1,309 Total cost of operations 28,421 16,188 58,762 31,940 Operating loss (6,765) (5,845) (9,081) (15,066)

Interest expense (5,325) (8,450) (16,370) (15,284) Loss on extinguishment of debt — — (2,027) — Other income 447 54 947 54 Loss before income tax and equity in net income (loss) of investee (11,643) (14,241) (26,531) (30,296) Income tax benefit — — — — Equity in net income (loss) of investee, net of tax 767 (3,296) 6,042 (13,463) Loss from continuing operations (10,876) (17,537) (20,489) (43,759) Loss from discontinued operations, net of tax — (3) — (38) Net loss (10,876) (17,540) (20,489) (43,797) Preferred stock dividends (292) (265) (578) (524) Net loss attributable to common stockholders $ (11,168) $ (17,805) $ (21,067) $ (44,321) Loss per common share: Continuing operations $ (0.03) $ (0.08) $ (0.07) $ (0.24) Discontinued operations - — - — Basic and diluted $ (0.03) $ (0.08) $ (0.07) $ (0.24) Weighted average common shares outstanding: Basic and diluted 340,662,826 210,421,237 315,714,178 187,843,663 CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE SIX MONTHS ENDED JUNE 30, 2024 AND 2023 (In thousands; unaudited) Six Months Ended June 30, 2024 2023 CASH FLOWS FROM OPERATING ACTIVITIES: Net loss $ (20,489) $ (43,797) Adjustments to reconcile net loss to net cash provided by (used in) operating activities: Amortization of debt issuance costs, commitment fees and accretion of debt discount 10,691 8,307 Related party expense to be settled with respect to common stock — 417 Common stock issued for interest expense — 26 Stock-based compensation expense 11,773 2,610 Depreciation 29,221 11,861

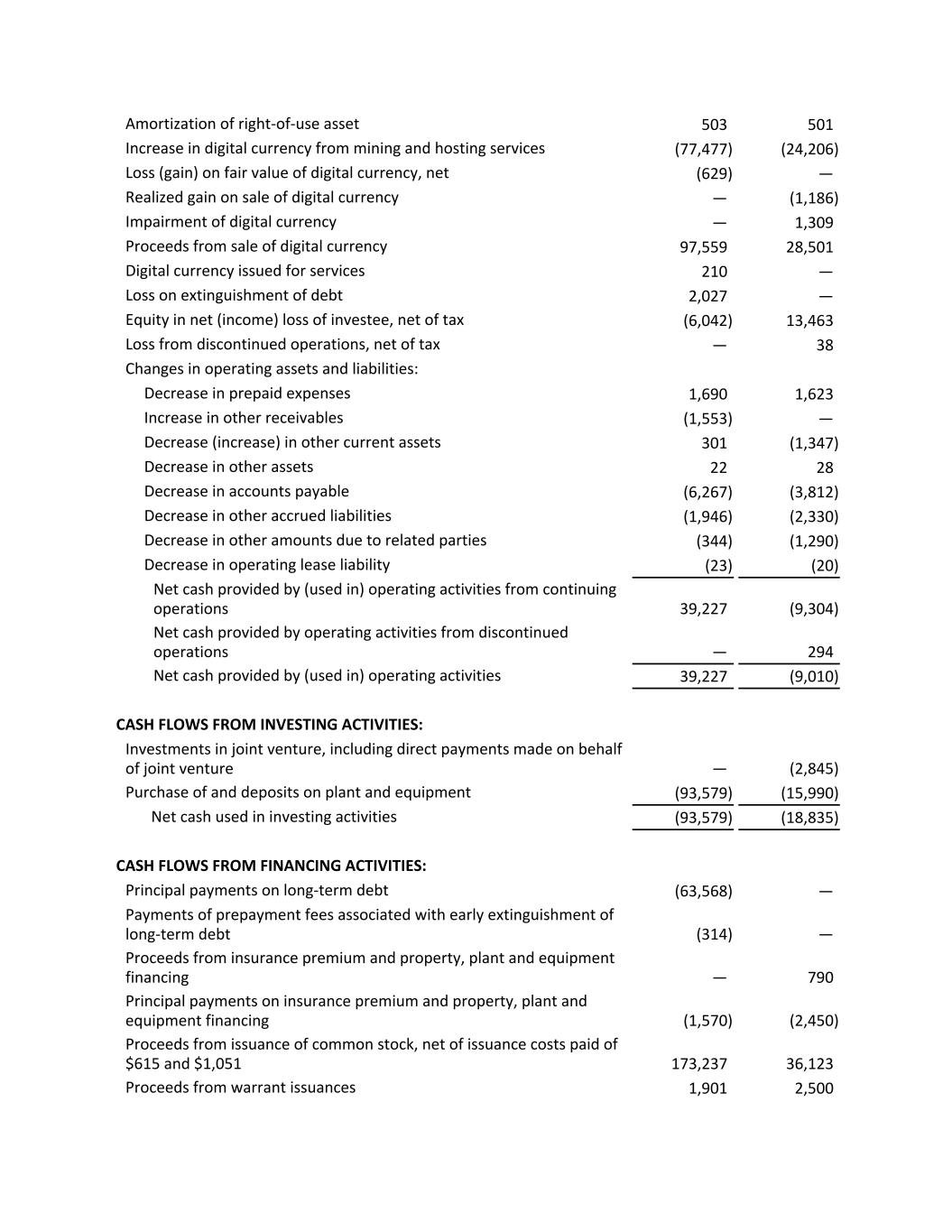

Amortization of right-of-use asset 503 501 Increase in digital currency from mining and hosting services (77,477) (24,206) Loss (gain) on fair value of digital currency, net (629) — Realized gain on sale of digital currency — (1,186) Impairment of digital currency — 1,309 Proceeds from sale of digital currency 97,559 28,501 Digital currency issued for services 210 — Loss on extinguishment of debt 2,027 — Equity in net (income) loss of investee, net of tax (6,042) 13,463 Loss from discontinued operations, net of tax — 38 Changes in operating assets and liabilities: Decrease in prepaid expenses 1,690 1,623 Increase in other receivables (1,553) — Decrease (increase) in other current assets 301 (1,347) Decrease in other assets 22 28 Decrease in accounts payable (6,267) (3,812) Decrease in other accrued liabilities (1,946) (2,330) Decrease in other amounts due to related parties (344) (1,290) Decrease in operating lease liability (23) (20) Net cash provided by (used in) operating activities from continuing operations 39,227 (9,304) Net cash provided by operating activities from discontinued operations — 294 Net cash provided by (used in) operating activities 39,227 (9,010) CASH FLOWS FROM INVESTING ACTIVITIES: Investments in joint venture, including direct payments made on behalf of joint venture — (2,845) Purchase of and deposits on plant and equipment (93,579) (15,990) Net cash used in investing activities (93,579) (18,835) CASH FLOWS FROM FINANCING ACTIVITIES: Principal payments on long-term debt (63,568) — Payments of prepayment fees associated with early extinguishment of long-term debt (314) — Proceeds from insurance premium and property, plant and equipment financing — 790 Principal payments on insurance premium and property, plant and equipment financing (1,570) (2,450) Proceeds from issuance of common stock, net of issuance costs paid of $615 and $1,051 173,237 36,123 Proceeds from warrant issuances 1,901 2,500

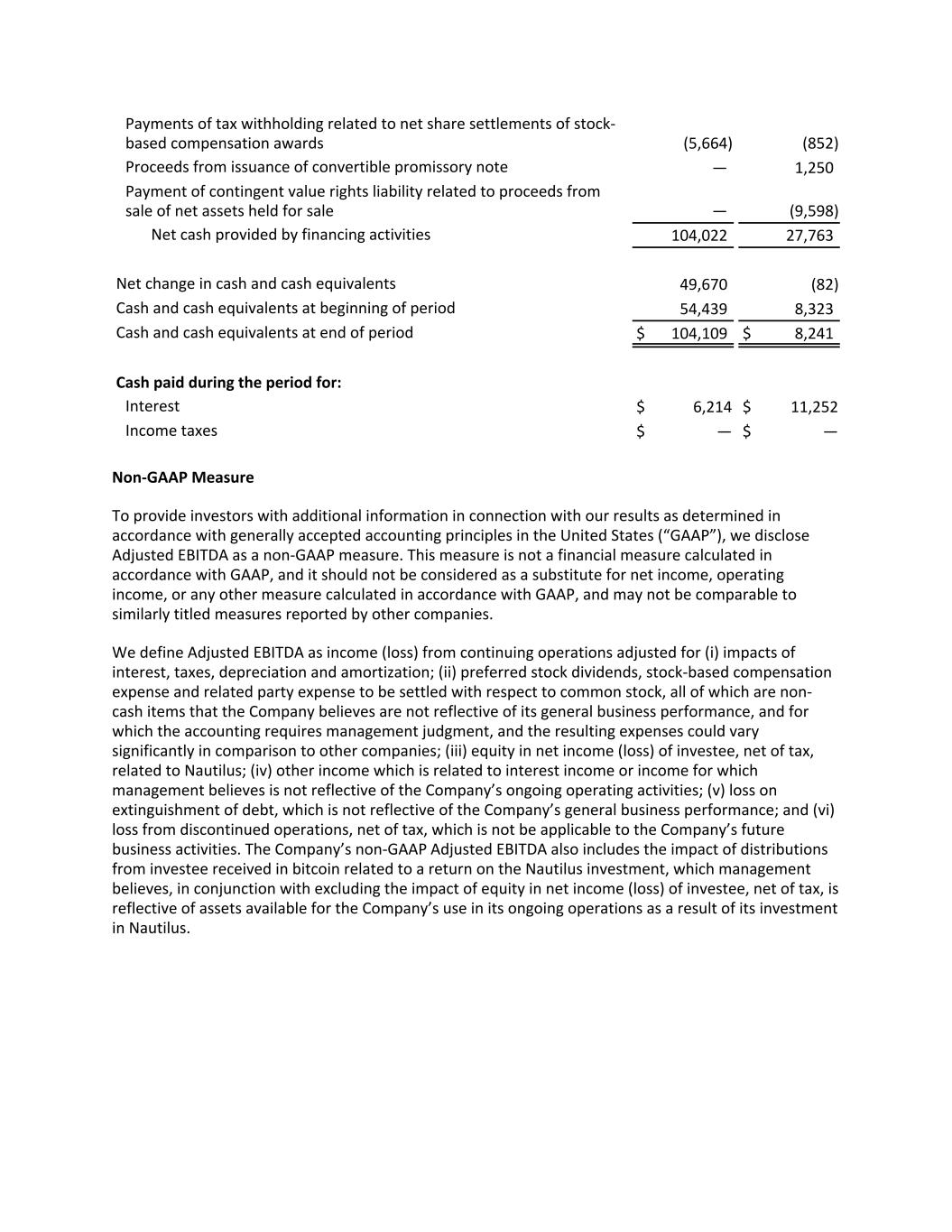

Payments of tax withholding related to net share settlements of stock- based compensation awards (5,664) (852) Proceeds from issuance of convertible promissory note — 1,250 Payment of contingent value rights liability related to proceeds from sale of net assets held for sale — (9,598) Net cash provided by financing activities 104,022 27,763 Net change in cash and cash equivalents 49,670 (82) Cash and cash equivalents at beginning of period 54,439 8,323 Cash and cash equivalents at end of period $ 104,109 $ 8,241 Cash paid during the period for: Interest $ 6,214 $ 11,252 Income taxes $ — $ — Non-GAAP Measure To provide investors with additional information in connection with our results as determined in accordance with generally accepted accounting principles in the United States (“GAAP”), we disclose Adjusted EBITDA as a non-GAAP measure. This measure is not a financial measure calculated in accordance with GAAP, and it should not be considered as a substitute for net income, operating income, or any other measure calculated in accordance with GAAP, and may not be comparable to similarly titled measures reported by other companies. We define Adjusted EBITDA as income (loss) from continuing operations adjusted for (i) impacts of interest, taxes, depreciation and amortization; (ii) preferred stock dividends, stock-based compensation expense and related party expense to be settled with respect to common stock, all of which are non- cash items that the Company believes are not reflective of its general business performance, and for which the accounting requires management judgment, and the resulting expenses could vary significantly in comparison to other companies; (iii) equity in net income (loss) of investee, net of tax, related to Nautilus; (iv) other income which is related to interest income or income for which management believes is not reflective of the Company’s ongoing operating activities; (v) loss on extinguishment of debt, which is not reflective of the Company’s general business performance; and (vi) loss from discontinued operations, net of tax, which is not be applicable to the Company’s future business activities. The Company’s non-GAAP Adjusted EBITDA also includes the impact of distributions from investee received in bitcoin related to a return on the Nautilus investment, which management believes, in conjunction with excluding the impact of equity in net income (loss) of investee, net of tax, is reflective of assets available for the Company’s use in its ongoing operations as a result of its investment in Nautilus.

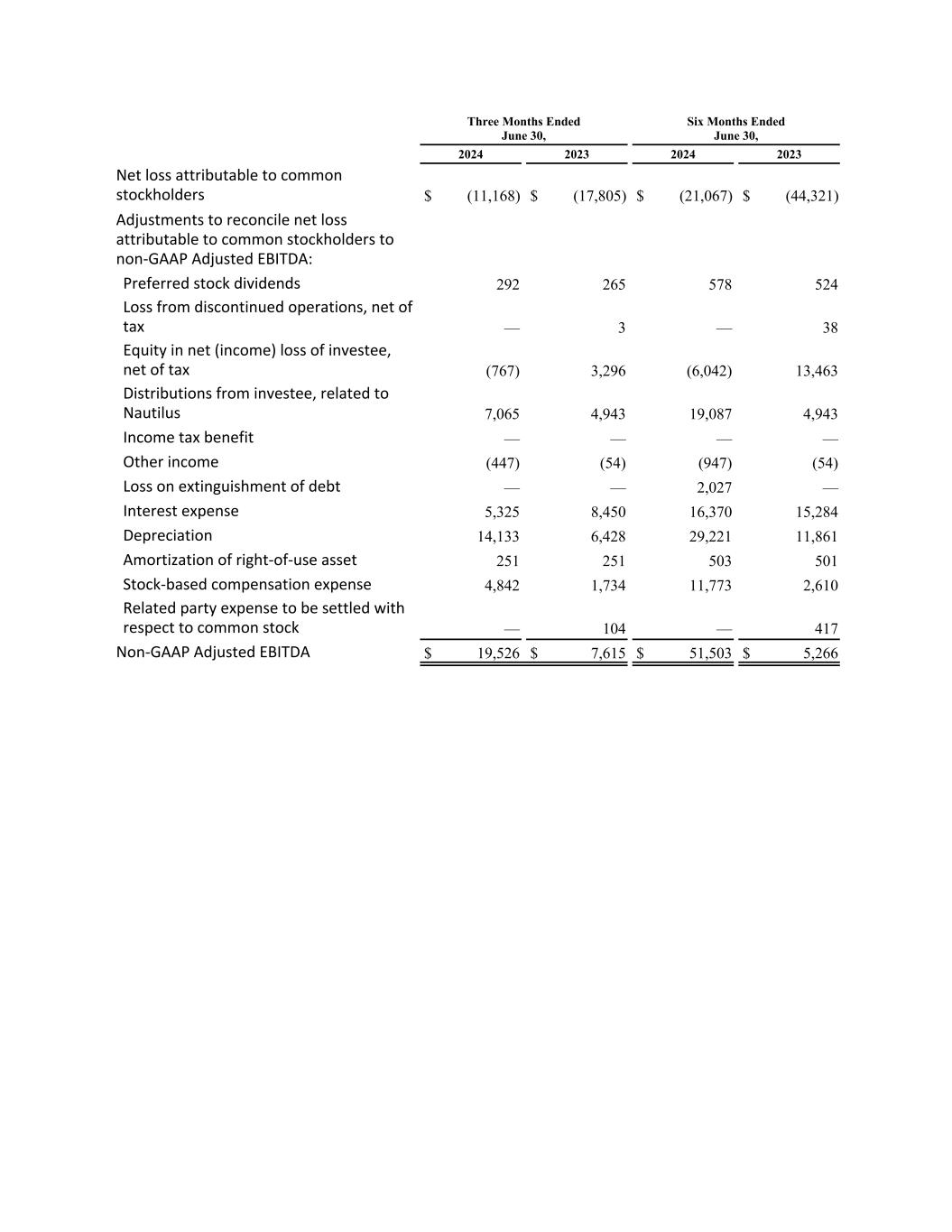

Management believes that providing this non-GAAP financial measure allows for meaningful comparisons between the Company's core business operating results and those of other companies, and provides the Company with an important tool for financial and operational decision making and for evaluating its own core business operating results over different periods of time. In addition to management's internal use of non-GAAP Adjusted EBITDA, management believes that Adjusted EBITDA is also useful to investors and analysts in comparing the Company’s performance across reporting periods on a consistent basis. Management believes the foregoing to be the case even though some of the excluded items involve cash outlays and some of them recur on a regular basis (although management does not believe any of such items are normal operating expenses necessary to generate the Company’s bitcoin related revenues). For example, the Company expects that share-based compensation expense, which is excluded from Adjusted EBITDA, will continue to be a significant recurring expense over the coming years and is an important part of the compensation provided to certain employees, officers, directors and consultants. Additionally, management does not consider any of the excluded items to be expenses necessary to generate the Company’s bitcoin related revenue. The Company's Adjusted EBITDA measure may not be directly comparable to similar measures provided by other companies in the Company’s industry, as other companies in the Company’s industry may calculate non-GAAP financial results differently. The Company's Adjusted EBITDA is not a measurement of financial performance under GAAP and should not be considered as an alternative to operating loss or any other measure of performance derived in accordance with GAAP. Although management utilizes internally and presents Adjusted EBITDA, the Company only utilizes that measure supplementally and does not consider it to be a substitute for, or superior to, the information provided by GAAP financial results. Accordingly, Adjusted EBITDA is not meant to be considered in isolation of, and should be read in conjunction with, the information contained in the Company’s consolidated financial statements, which have been prepared in accordance with GAAP. The following table is a reconciliation of the Company’s non-GAAP Adjusted EBITDA to its most directly comparable GAAP measure (i.e., net loss attributable to common stockholders) for the periods indicated (in thousands):

Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Net loss attributable to common stockholders $ (11,168) $ (17,805) $ (21,067) $ (44,321) Adjustments to reconcile net loss attributable to common stockholders to non-GAAP Adjusted EBITDA: Preferred stock dividends 292 265 578 524 Loss from discontinued operations, net of tax — 3 — 38 Equity in net (income) loss of investee, net of tax (767) 3,296 (6,042) 13,463 Distributions from investee, related to Nautilus 7,065 4,943 19,087 4,943 Income tax benefit — — — — Other income (447) (54) (947) (54) Loss on extinguishment of debt — — 2,027 — Interest expense 5,325 8,450 16,370 15,284 Depreciation 14,133 6,428 29,221 11,861 Amortization of right-of-use asset 251 251 503 501 Stock-based compensation expense 4,842 1,734 11,773 2,610 Related party expense to be settled with respect to common stock — 104 — 417 Non-GAAP Adjusted EBITDA $ 19,526 $ 7,615 $ 51,503 $ 5,266