1

2

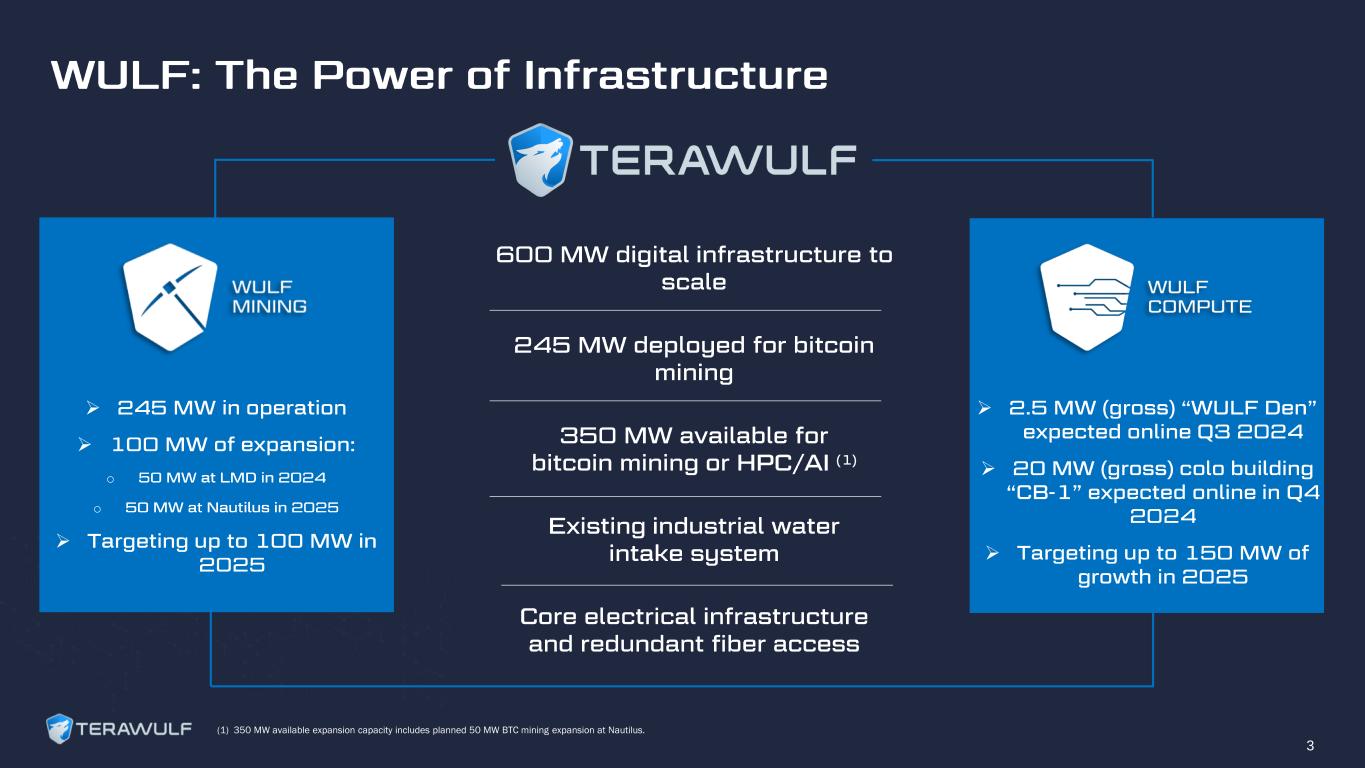

➢ ➢ o o ➢ ➢ ➢ ➢ (1) 350 MW available expansion capacity includes planned 50 MW BTC mining expansion at Nautilus. 3

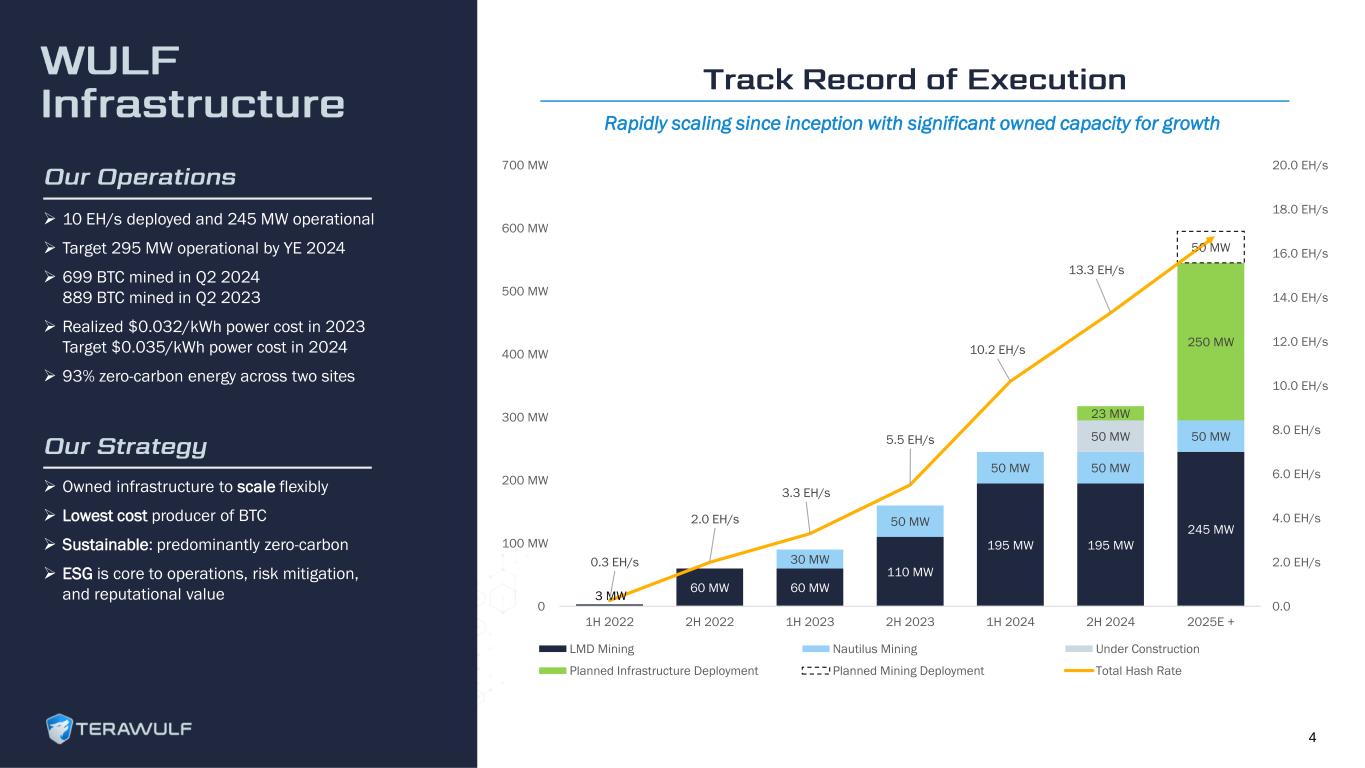

3 MW 60 MW 60 MW 110 MW 195 MW 195 MW 245 MW 30 MW 50 MW 50 MW 50 MW 50 MW50 MW 23 MW 250 MW 50 MW 0.3 EH/s 2.0 EH/s 3.3 EH/s 5.5 EH/s 10.2 EH/s 13.3 EH/s 0.0 2.0 EH/s 4.0 EH/s 6.0 EH/s 8.0 EH/s 10.0 EH/s 12.0 EH/s 14.0 EH/s 16.0 EH/s 18.0 EH/s 20.0 EH/s 0 100 MW 200 MW 300 MW 400 MW 500 MW 600 MW 700 MW 1H 2022 2H 2022 1H 2023 2H 2023 1H 2024 2H 2024 2025E + LMD Mining Nautilus Mining Under Construction Planned Infrastructure Deployment Planned Mining Deployment Total Hash Rate 4 ➢ Owned infrastructure to scale flexibly ➢ Lowest cost producer of BTC ➢ Sustainable: predominantly zero-carbon ➢ ESG is core to operations, risk mitigation, and reputational value ➢ 10 EH/s deployed and 245 MW operational ➢ Target 295 MW operational by YE 2024 ➢ 699 BTC mined in Q2 2024 889 BTC mined in Q2 2023 ➢ Realized $0.032/kWh power cost in 2023 Target $0.035/kWh power cost in 2024 ➢ 93% zero-carbon energy across two sites Rapidly scaling since inception with significant owned capacity for growth

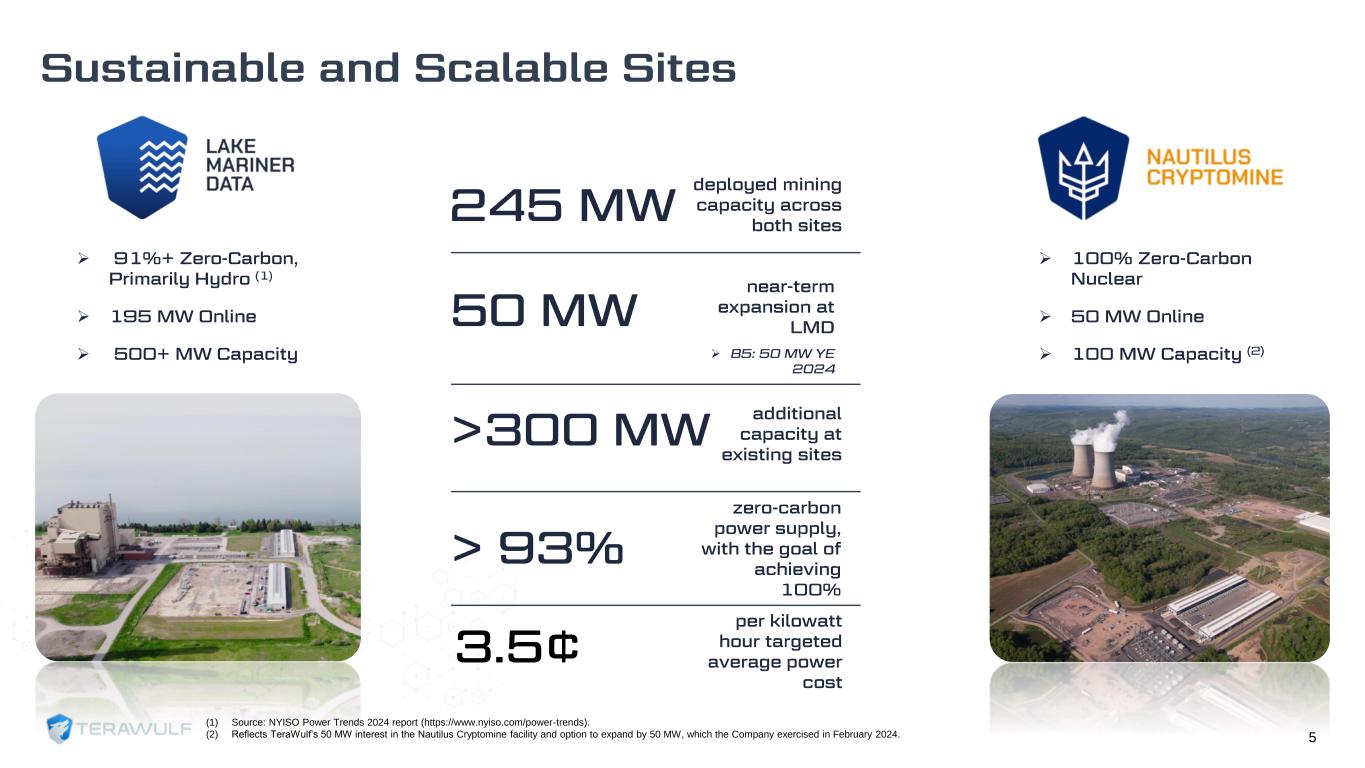

➢ ➢ ➢ ➢ (1) Source: NYISO Power Trends 2024 report (https://www.nyiso.com/power-trends). (2) Reflects TeraWulf’s 50 MW interest in the Nautilus Cryptomine facility and option to expand by 50 MW, which the Company exercised in February 2024. 5 ➢ ➢ ➢

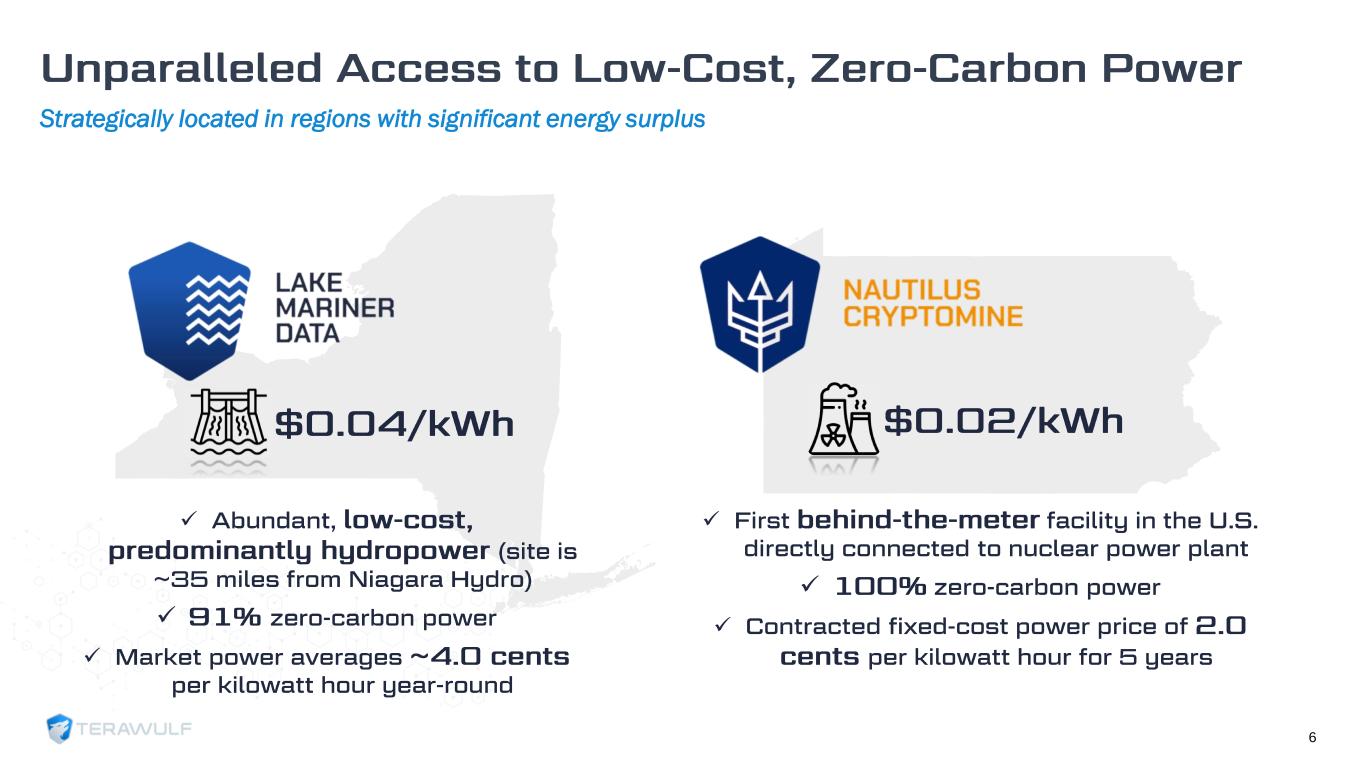

Strategically located in regions with significant energy surplus 6 ✓ ✓ ✓ ✓ ✓ ✓

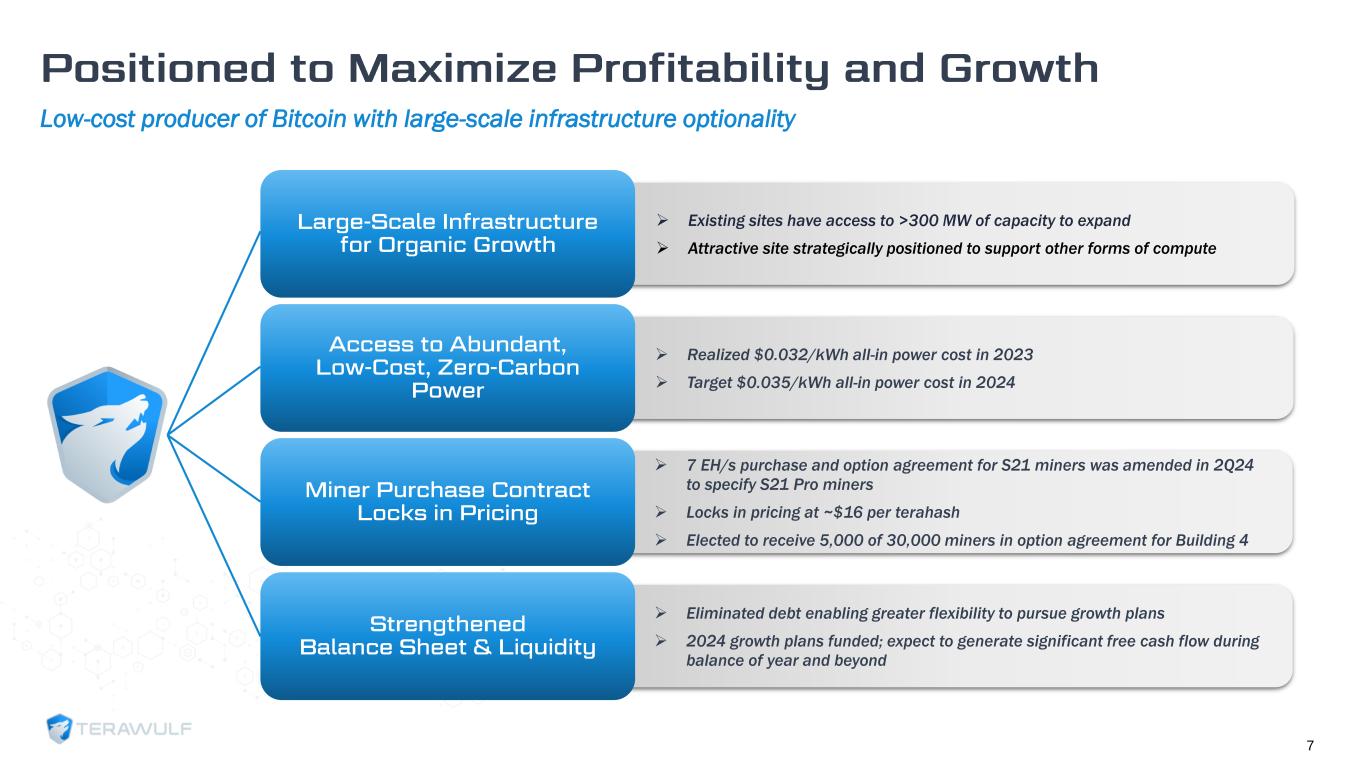

Low-cost producer of Bitcoin with large-scale infrastructure optionality ➢ Existing sites have access to >300 MW of capacity to expand ➢ Attractive site strategically positioned to support other forms of compute ➢ Realized $0.032/kWh all-in power cost in 2023 ➢ Target $0.035/kWh all-in power cost in 2024 ➢ 7 EH/s purchase and option agreement for S21 miners was amended in 2Q24 to specify S21 Pro miners ➢ Locks in pricing at ~$16 per terahash ➢ Elected to receive 5,000 of 30,000 miners in option agreement for Building 4 ➢ Eliminated debt enabling greater flexibility to pursue growth plans ➢ 2024 growth plans funded; expect to generate significant free cash flow during balance of year and beyond 7

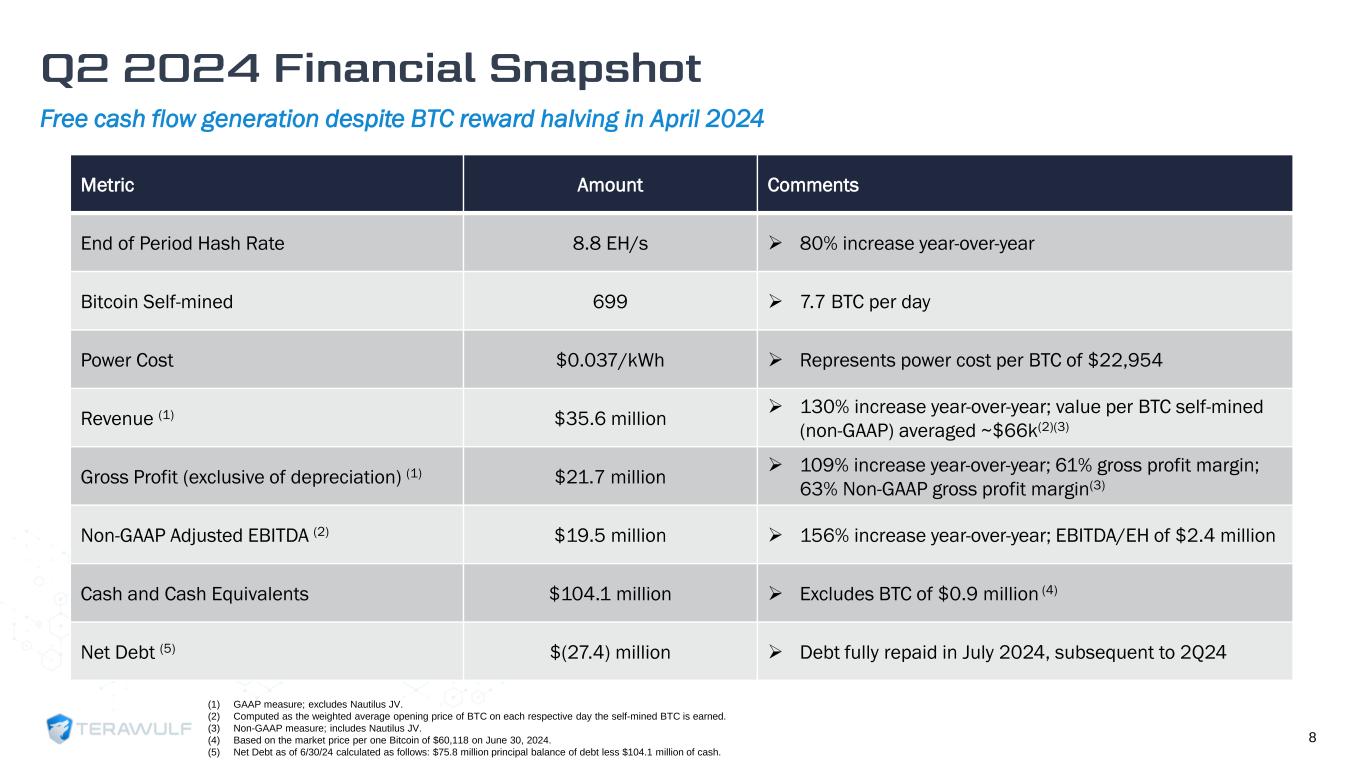

Free cash flow generation despite BTC reward halving in April 2024 8 Metric Amount Comments End of Period Hash Rate 8.8 EH/s ➢ 80% increase year-over-year Bitcoin Self-mined 699 ➢ 7.7 BTC per day Power Cost $0.037/kWh ➢ Represents power cost per BTC of $22,954 Revenue (1) $35.6 million ➢ 130% increase year-over-year; value per BTC self-mined (non-GAAP) averaged ~$66k(2)(3) Gross Profit (exclusive of depreciation) (1) $21.7 million ➢ 109% increase year-over-year; 61% gross profit margin; 63% Non-GAAP gross profit margin(3) Non-GAAP Adjusted EBITDA (2) $19.5 million ➢ 156% increase year-over-year; EBITDA/EH of $2.4 million Cash and Cash Equivalents $104.1 million ➢ Excludes BTC of $0.9 million (4) Net Debt (5) $(27.4) million ➢ Debt fully repaid in July 2024, subsequent to 2Q24 (1) GAAP measure; excludes Nautilus JV. (2) Computed as the weighted average opening price of BTC on each respective day the self-mined BTC is earned. (3) Non-GAAP measure; includes Nautilus JV. (4) Based on the market price per one Bitcoin of $60,118 on June 30, 2024. (5) Net Debt as of 6/30/24 calculated as follows: $75.8 million principal balance of debt less $104.1 million of cash.

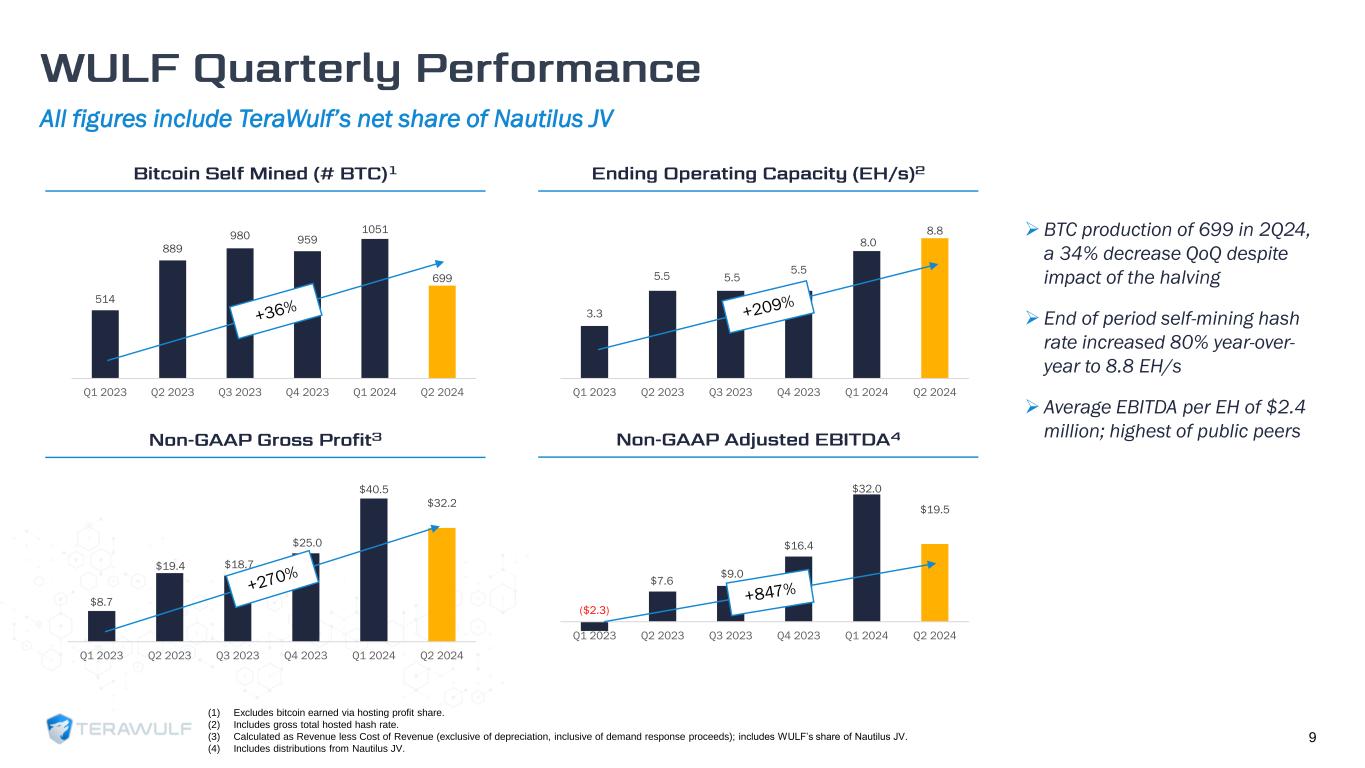

All figures include TeraWulf’s net share of Nautilus JV 9 514 889 980 959 1051 699 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 3.3 5.5 5.5 5.5 8.0 8.8 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 $8.7 $19.4 $18.7 $25.0 $40.5 $32.2 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 ($2.3) $7.6 $9.0 $16.4 $32.0 $19.5 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 (1) Excludes bitcoin earned via hosting profit share. (2) Includes gross total hosted hash rate. (3) Calculated as Revenue less Cost of Revenue (exclusive of depreciation, inclusive of demand response proceeds); includes WULF’s share of Nautilus JV. (4) Includes distributions from Nautilus JV. ➢BTC production of 699 in 2Q24, a 34% decrease QoQ despite impact of the halving ➢ End of period self-mining hash rate increased 80% year-over- year to 8.8 EH/s ➢ Average EBITDA per EH of $2.4 million; highest of public peers

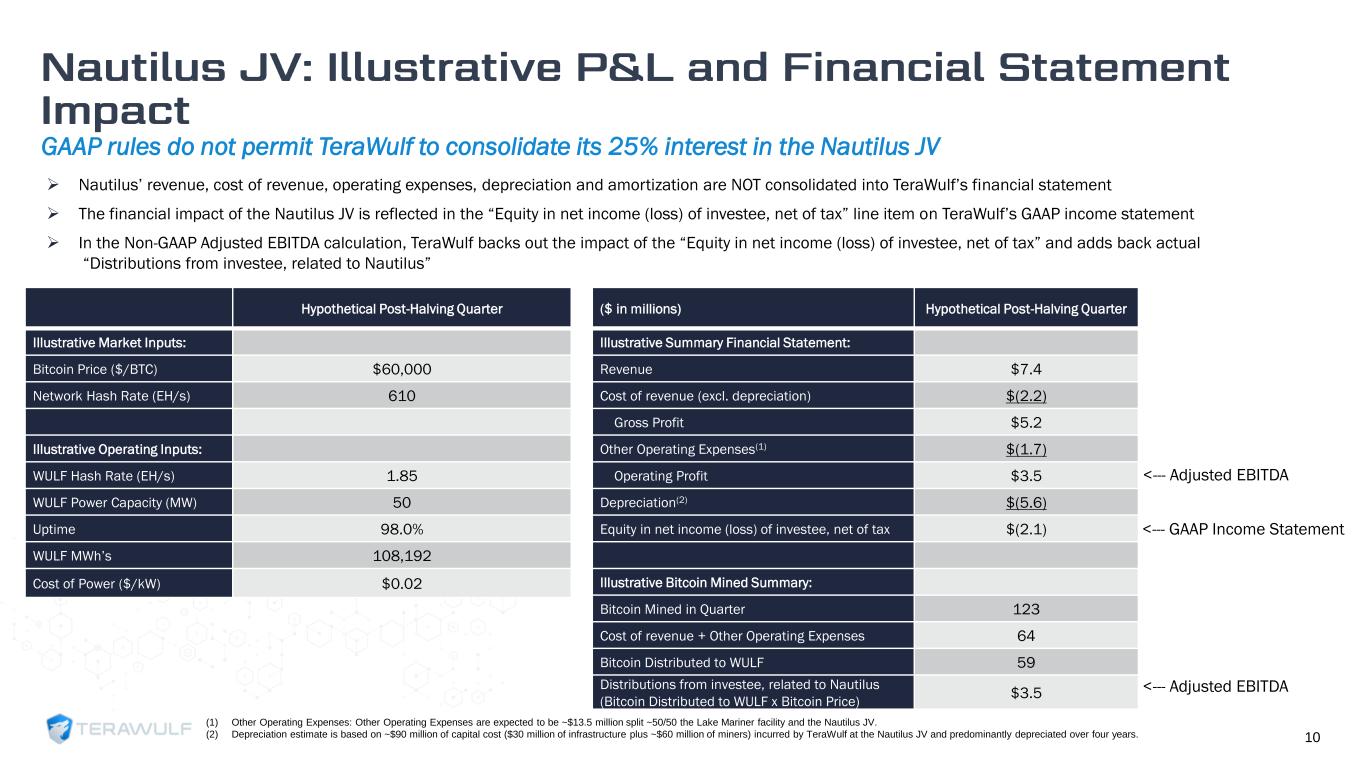

GAAP rules do not permit TeraWulf to consolidate its 25% interest in the Nautilus JV 10 Hypothetical Post-Halving Quarter Illustrative Market Inputs: Bitcoin Price ($/BTC) $60,000 Network Hash Rate (EH/s) 610 Illustrative Operating Inputs: WULF Hash Rate (EH/s) 1.85 WULF Power Capacity (MW) 50 Uptime 98.0% WULF MWh’s 108,192 Cost of Power ($/kW) $0.02 ($ in millions) Hypothetical Post-Halving Quarter Illustrative Summary Financial Statement: Revenue $7.4 Cost of revenue (excl. depreciation) $(2.2) Gross Profit $5.2 Other Operating Expenses(1) $(1.7) Operating Profit $3.5 Depreciation(2) $(5.6) Equity in net income (loss) of investee, net of tax $(2.1) Illustrative Bitcoin Mined Summary: Bitcoin Mined in Quarter 123 Cost of revenue + Other Operating Expenses 64 Bitcoin Distributed to WULF 59 Distributions from investee, related to Nautilus (Bitcoin Distributed to WULF x Bitcoin Price) $3.5 <--- Adjusted EBITDA <--- GAAP Income Statement <--- Adjusted EBITDA ➢ Nautilus’ revenue, cost of revenue, operating expenses, depreciation and amortization are NOT consolidated into TeraWulf’s financial statement ➢ The financial impact of the Nautilus JV is reflected in the “Equity in net income (loss) of investee, net of tax” line item on TeraWulf’s GAAP income statement ➢ In the Non-GAAP Adjusted EBITDA calculation, TeraWulf backs out the impact of the “Equity in net income (loss) of investee, net of tax” and adds back actual “Distributions from investee, related to Nautilus” (1) Other Operating Expenses: Other Operating Expenses are expected to be ~$13.5 million split ~50/50 the Lake Mariner facility and the Nautilus JV. (2) Depreciation estimate is based on ~$90 million of capital cost ($30 million of infrastructure plus ~$60 million of miners) incurred by TeraWulf at the Nautilus JV and predominantly depreciated over four years.

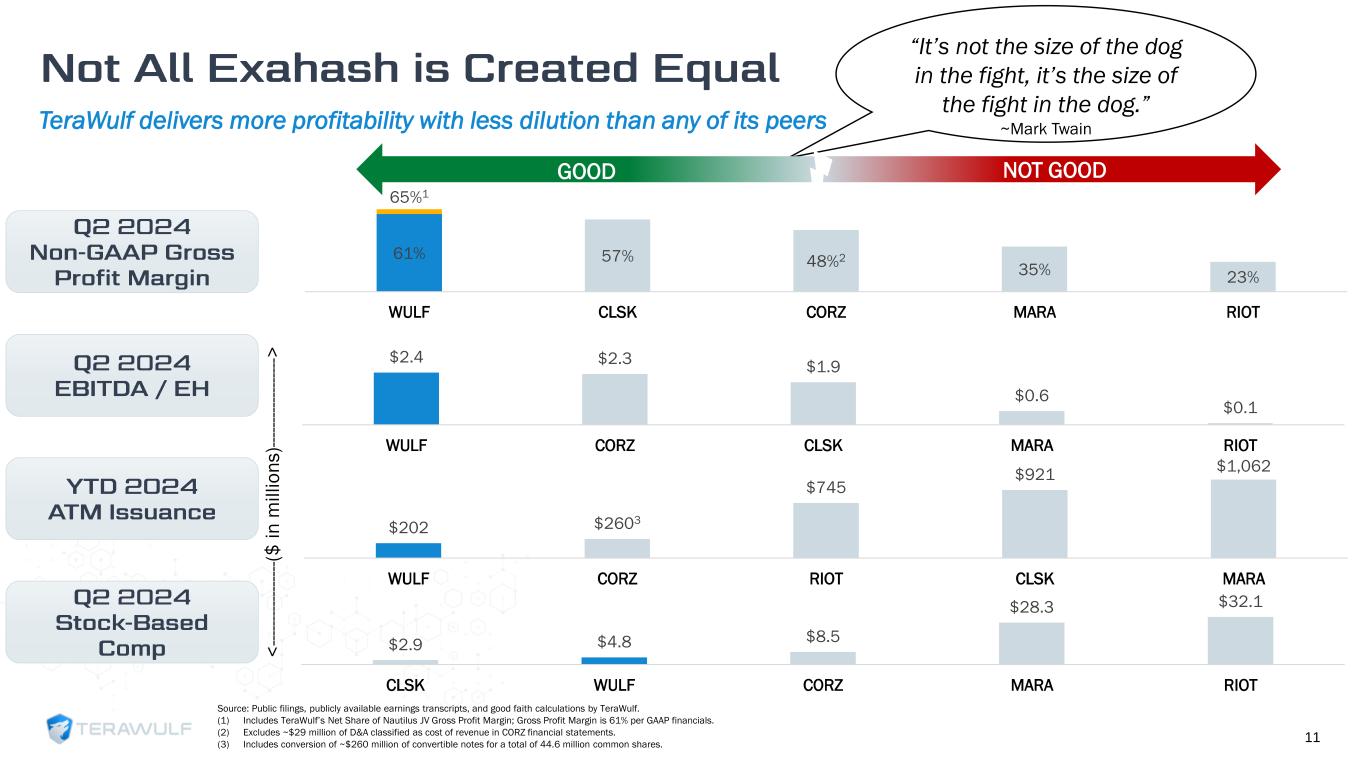

$2.9 $4.8 $8.5 $28.3 $32.1 CLSK WULF CORZ MARA RIOT $202 $2603 $745 $921 $1,062 WULF CORZ RIOT CLSK MARA TeraWulf delivers more profitability with less dilution than any of its peers 11 Source: Public filings, publicly available earnings transcripts, and good faith calculations by TeraWulf. (1) Includes TeraWulf’s Net Share of Nautilus JV Gross Profit Margin; Gross Profit Margin is 61% per GAAP financials. (2) Excludes ~$29 million of D&A classified as cost of revenue in CORZ financial statements. (3) Includes conversion of ~$260 million of convertible notes for a total of 44.6 million common shares. $2.4 $2.3 $1.9 $0.6 $0.1 WULF CORZ CLSK MARA RIOT < -- -- -- -- -- -- -- -- -( $ i n m il li o n s )- -- -- -- -- -- -- -- -- -> NOT GOOD “It’s not the size of the dog in the fight, it’s the size of the fight in the dog.” ~Mark Twain GOOD 61% 57% 48%2 35% 23% 65%1 WULF CLSK CORZ MARA RIOT

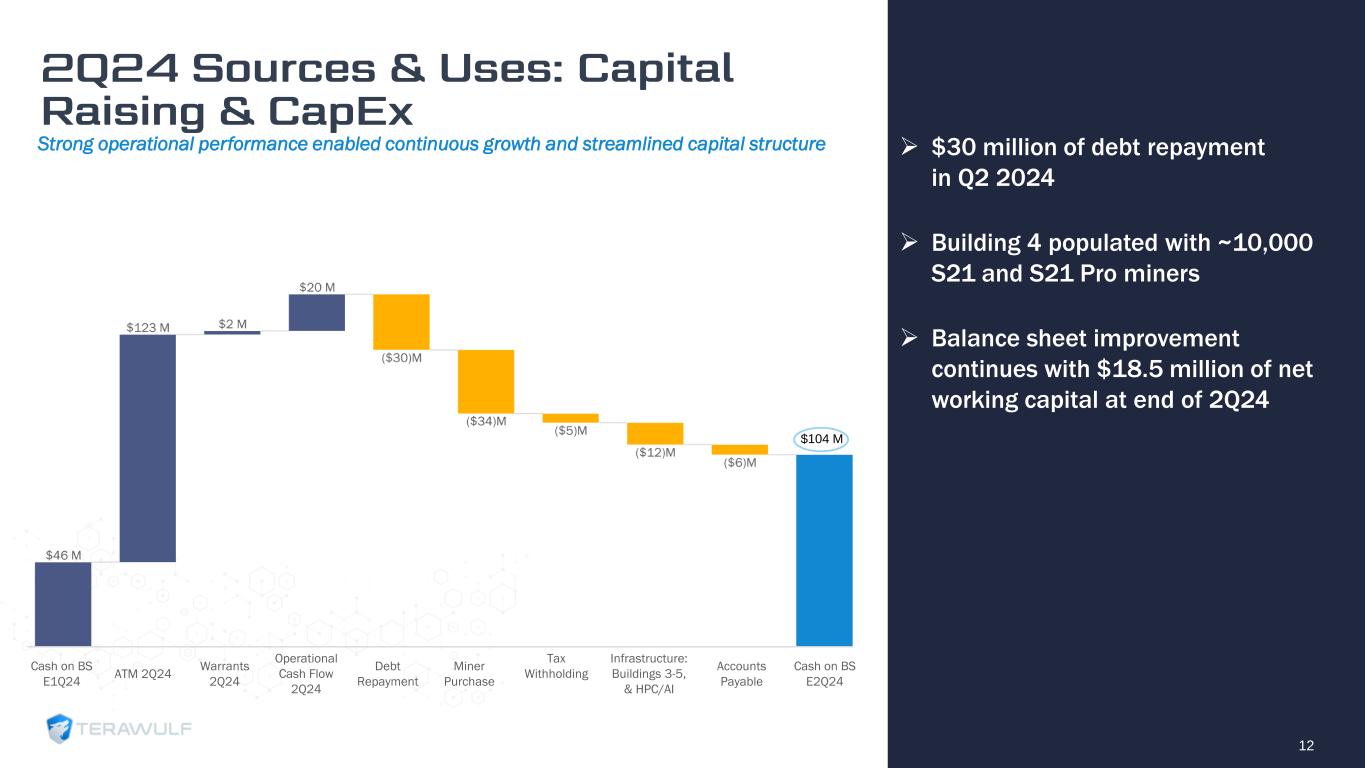

12 ➢ $30 million of debt repayment in Q2 2024 ➢ Building 4 populated with ~10,000 S21 and S21 Pro miners ➢ Balance sheet improvement continues with $18.5 million of net working capital at end of 2Q24 $104 M ATM 2Q24 Warrants 2Q24 Operational Cash Flow 2Q24 Debt Repayment Miner Purchase Tax Withholding Infrastructure: Buildings 3-5, & HPC/AI Cash on BS E2Q24 Strong operational performance enabled continuous growth and streamlined capital structure Accounts Payable Cash on BS E1Q24

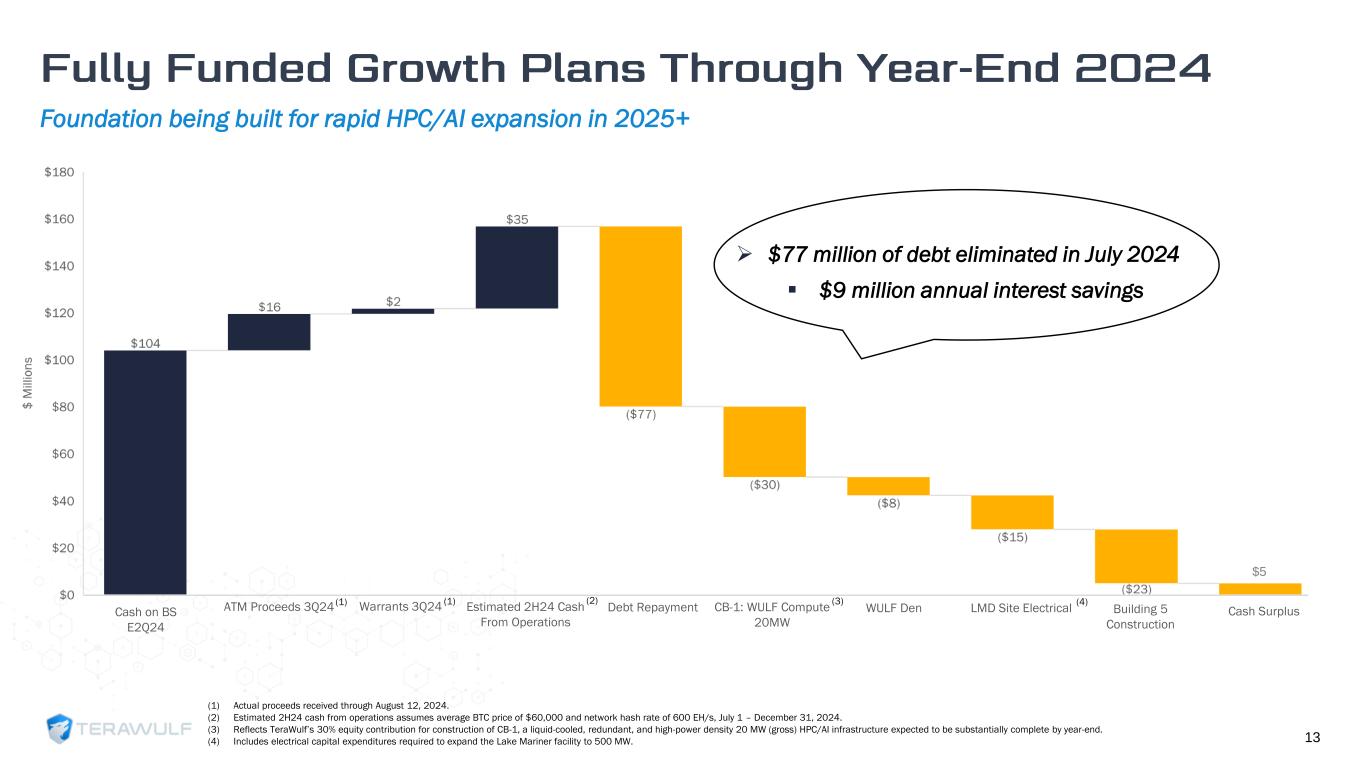

Foundation being built for rapid HPC/AI expansion in 2025+ 13 (1) Actual proceeds received through August 12, 2024. (2) Estimated 2H24 cash from operations assumes average BTC price of $60,000 and network hash rate of 600 EH/s, July 1 – December 31, 2024. (3) Reflects TeraWulf’s 30% equity contribution for construction of CB-1, a liquid-cooled, redundant, and high-power density 20 MW (gross) HPC/AI infrastructure expected to be substantially complete by year-end. (4) Includes electrical capital expenditures required to expand the Lake Mariner facility to 500 MW. Cash on BS E2Q24 ATM Proceeds 3Q24 Warrants 3Q24 Estimated 2H24 Cash From Operations Debt Repayment WULF Den LMD Site Electrical Building 5 Construction Cash Surplus (2) (3) (4) CB-1: WULF Compute 20MW $5 (1)(1) ➢ $77 million of debt eliminated in July 2024 ▪ $9 million annual interest savings

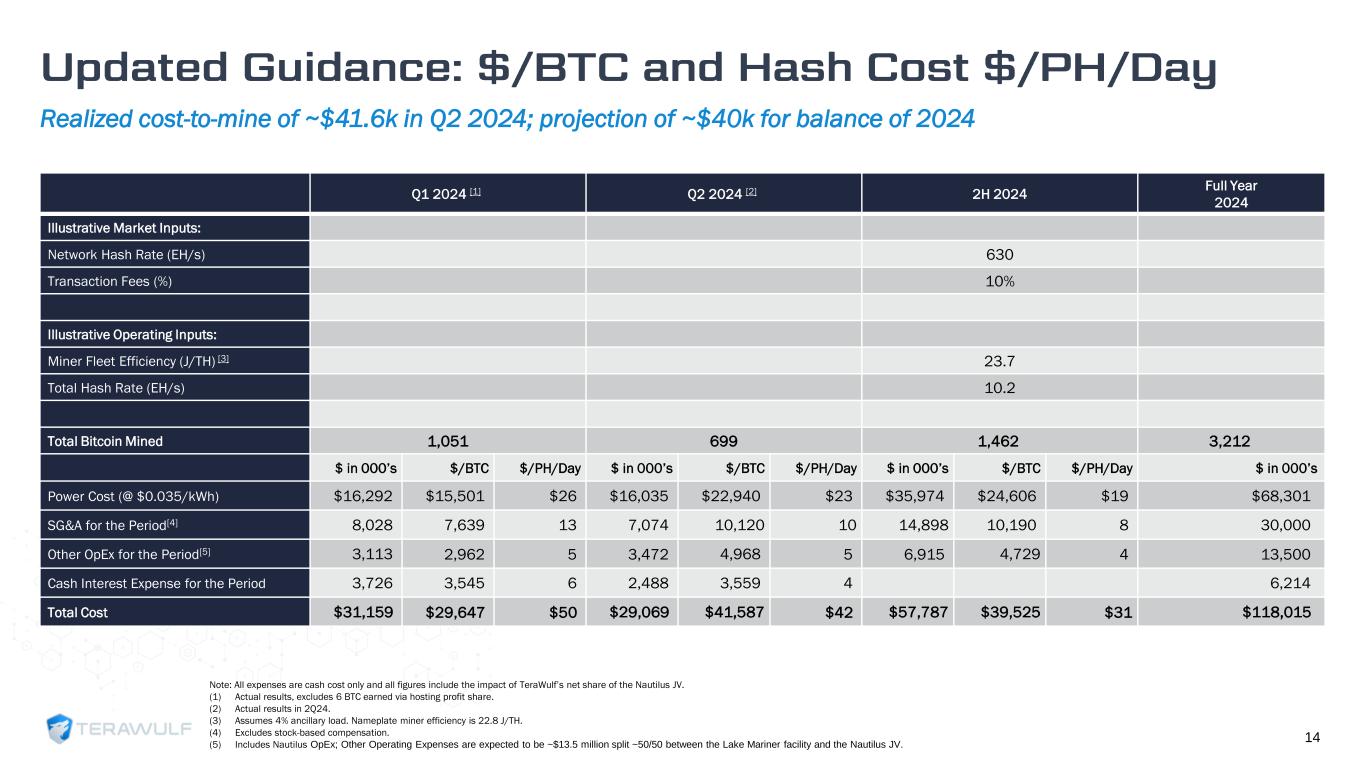

Realized cost-to-mine of ~$41.6k in Q2 2024; projection of ~$40k for balance of 2024 14 Q1 2024 [1] Q2 2024 [2] 2H 2024 Full Year 2024 Illustrative Market Inputs: Network Hash Rate (EH/s) 630 Transaction Fees (%) 10% Illustrative Operating Inputs: Miner Fleet Efficiency (J/TH) [3] 23.7 Total Hash Rate (EH/s) 10.2 Total Bitcoin Mined 1,051 699 1,462 3,212 $ in 000’s $/BTC $/PH/Day $ in 000’s $/BTC $/PH/Day $ in 000’s $/BTC $/PH/Day $ in 000’s Power Cost (@ $0.035/kWh) $16,292 $15,501 $26 $16,035 $22,940 $23 $35,974 $24,606 $19 $68,301 SG&A for the Period[4] 8,028 7,639 13 7,074 10,120 10 14,898 10,190 8 30,000 Other OpEx for the Period[5] 3,113 2,962 5 3,472 4,968 5 6,915 4,729 4 13,500 Cash Interest Expense for the Period 3,726 3,545 6 2,488 3,559 4 6,214 Total Cost $31,159 $29,647 $50 $29,069 $41,587 $42 $57,787 $39,525 $31 $118,015 Note: All expenses are cash cost only and all figures include the impact of TeraWulf’s net share of the Nautilus JV. (1) Actual results, excludes 6 BTC earned via hosting profit share. (2) Actual results in 2Q24. (3) Assumes 4% ancillary load. Nameplate miner efficiency is 22.8 J/TH. (4) Excludes stock-based compensation. (5) Includes Nautilus OpEx; Other Operating Expenses are expected to be ~$13.5 million split ~50/50 between the Lake Mariner facility and the Nautilus JV.

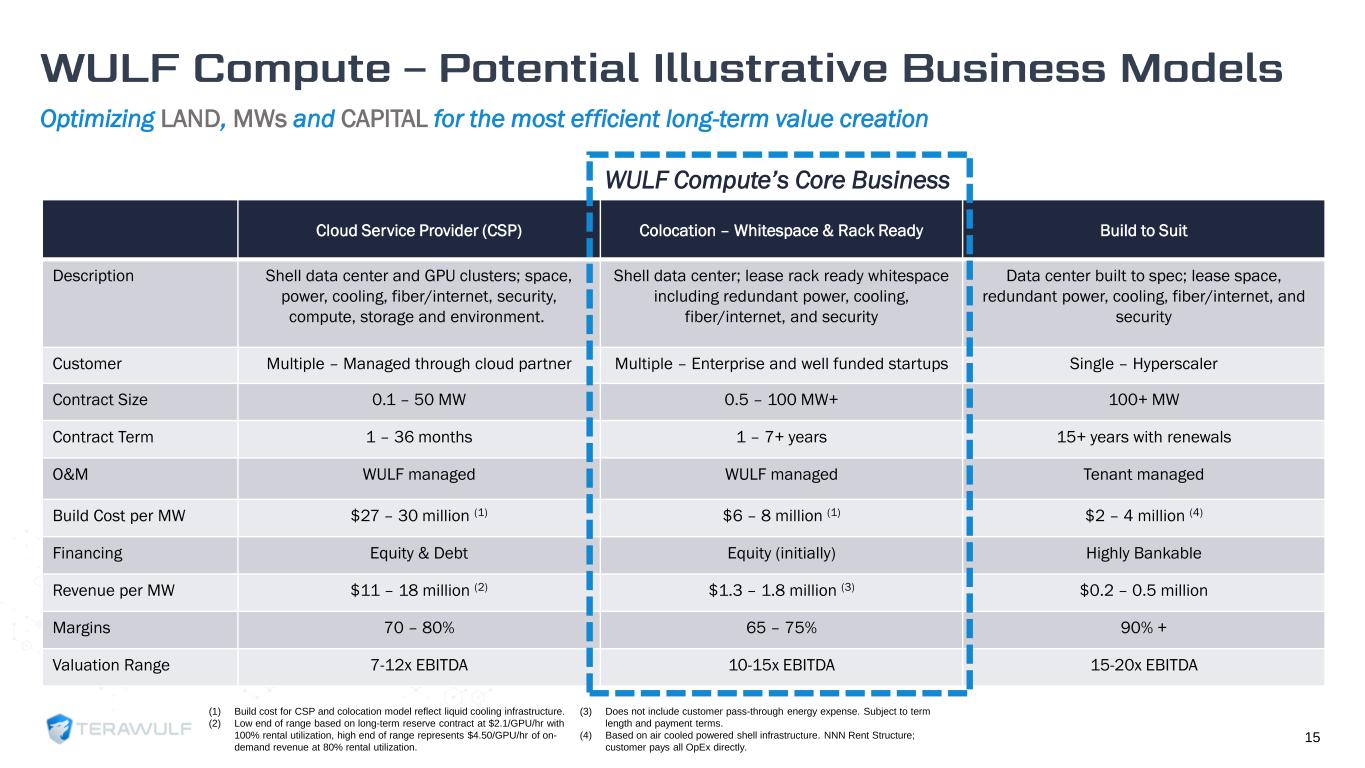

Optimizing LAND, MWs and CAPITAL for the most efficient long-term value creation 15 Cloud Service Provider (CSP) Colocation – Whitespace & Rack Ready Build to Suit Description Shell data center and GPU clusters; space, power, cooling, fiber/internet, security, compute, storage and environment. Shell data center; lease rack ready whitespace including redundant power, cooling, fiber/internet, and security Data center built to spec; lease space, redundant power, cooling, fiber/internet, and security Customer Multiple – Managed through cloud partner Multiple – Enterprise and well funded startups Single – Hyperscaler Contract Size 0.1 – 50 MW 0.5 – 100 MW+ 100+ MW Contract Term 1 – 36 months 1 – 7+ years 15+ years with renewals O&M WULF managed WULF managed Tenant managed Build Cost per MW $27 – 30 million (1) $6 – 8 million (1) $2 – 4 million (4) Financing Equity & Debt Equity (initially) Highly Bankable Revenue per MW $11 – 18 million (2) $1.3 – 1.8 million (3) $0.2 – 0.5 million Margins 70 – 80% 65 – 75% 90% + Valuation Range 7-12x EBITDA 10-15x EBITDA 15-20x EBITDA (1) Build cost for CSP and colocation model reflect liquid cooling infrastructure. (2) Low end of range based on long-term reserve contract at $2.1/GPU/hr with 100% rental utilization, high end of range represents $4.50/GPU/hr of on- demand revenue at 80% rental utilization. (3) Does not include customer pass-through energy expense. Subject to term length and payment terms. (4) Based on air cooled powered shell infrastructure. NNN Rent Structure; customer pays all OpEx directly. WULF Compute’s Core Business

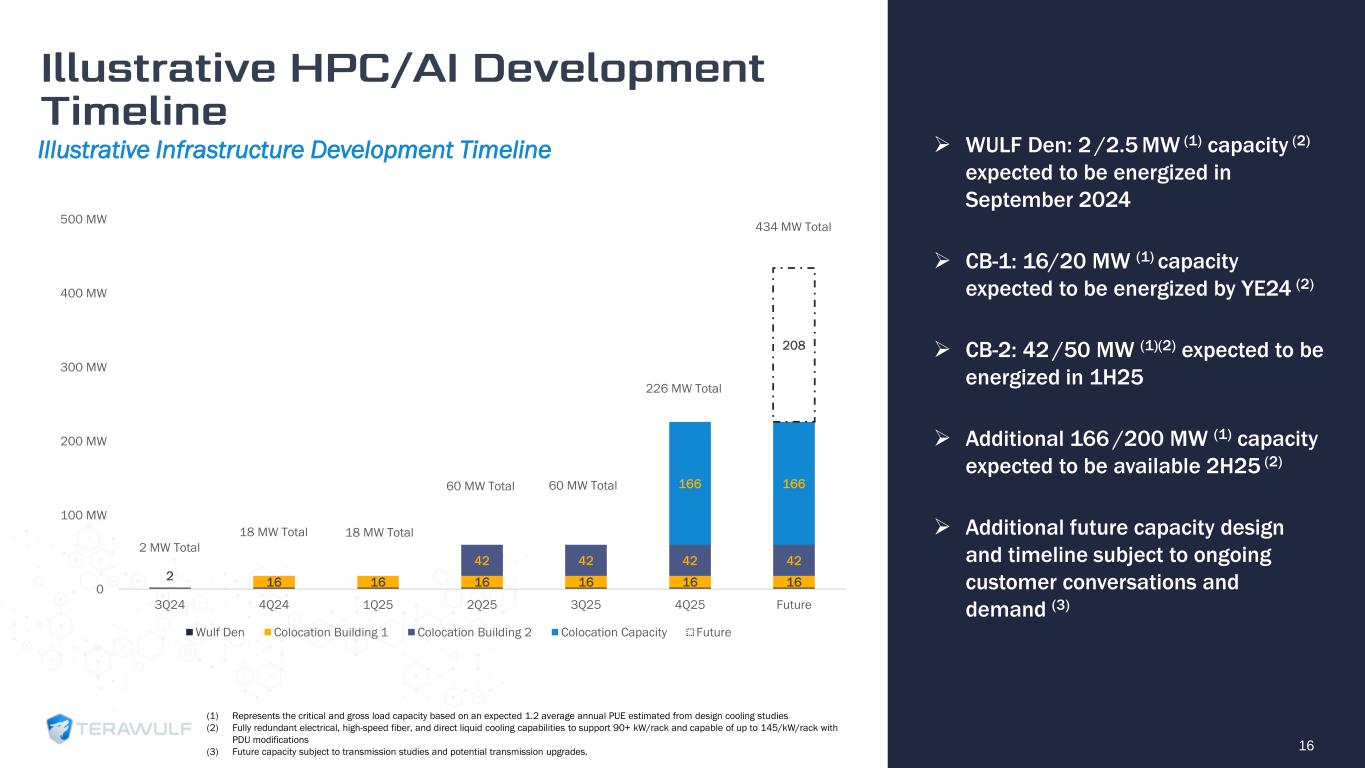

16 ➢ WULF Den: 2 /2.5 MW (1) capacity (2) expected to be energized in September 2024 ➢ CB-1: 16/20 MW (1) capacity expected to be energized by YE24 (2) ➢ CB-2: 42 /50 MW (1)(2) expected to be energized in 1H25 ➢ Additional 166 /200 MW (1) capacity expected to be available 2H25 (2) ➢ Additional future capacity design and timeline subject to ongoing customer conversations and demand (3) Illustrative Infrastructure Development Timeline (1) Represents the critical and gross load capacity based on an expected 1.2 average annual PUE estimated from design cooling studies (2) Fully redundant electrical, high-speed fiber, and direct liquid cooling capabilities to support 90+ kW/rack and capable of up to 145/kW/rack with PDU modifications (3) Future capacity subject to transmission studies and potential transmission upgrades. 18 MW Total 2 MW Total 60 MW Total 226 MW Total 18 MW Total 60 MW Total 2 16 16 16 16 16 16 42 42 42 42 166 166 208 0 100 MW 200 MW 300 MW 400 MW 500 MW 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 Future Wulf Den Colocation Building 1 Colocation Building 2 Colocation Capacity Future 434 MW Total

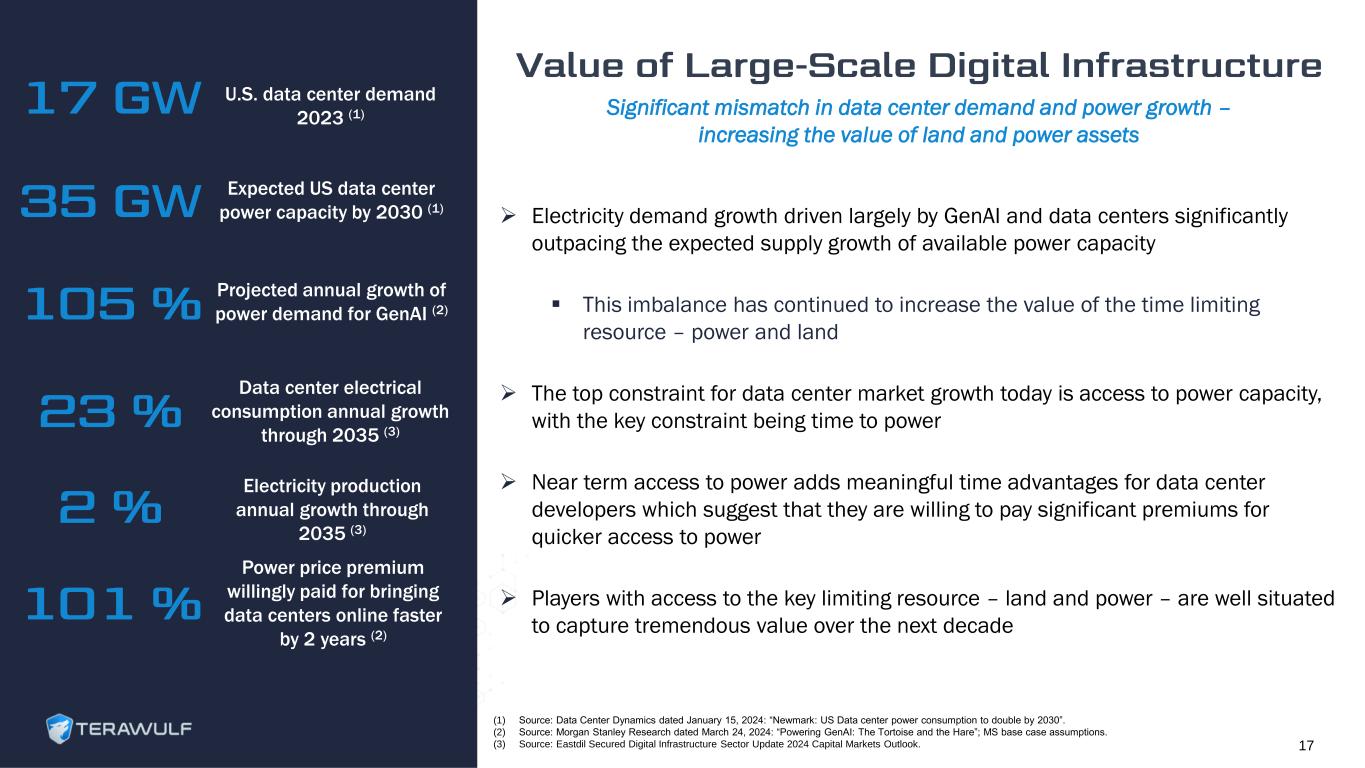

Significant mismatch in data center demand and power growth – increasing the value of land and power assets ➢ Electricity demand growth driven largely by GenAI and data centers significantly outpacing the expected supply growth of available power capacity ▪ This imbalance has continued to increase the value of the time limiting resource – power and land ➢ The top constraint for data center market growth today is access to power capacity, with the key constraint being time to power ➢ Near term access to power adds meaningful time advantages for data center developers which suggest that they are willing to pay significant premiums for quicker access to power ➢ Players with access to the key limiting resource – land and power – are well situated to capture tremendous value over the next decade Electricity production annual growth through 2035 (3) Power price premium willingly paid for bringing data centers online faster by 2 years (2) Expected US data center power capacity by 2030 (1) Projected annual growth of power demand for GenAI (2) Data center electrical consumption annual growth through 2035 (3) U.S. data center demand 2023 (1) (1) Source: Data Center Dynamics dated January 15, 2024: “Newmark: US Data center power consumption to double by 2030”. (2) Source: Morgan Stanley Research dated March 24, 2024: “Powering GenAI: The Tortoise and the Hare”; MS base case assumptions. (3) Source: Eastdil Secured Digital Infrastructure Sector Update 2024 Capital Markets Outlook. 17

18

TeraWulf is led by an accomplished, diverse management team with 30+ years of experience in developing and managing energy infrastructure and disruptive technology N A Z A R K H A N Co-Founder, Chief Operating Officer & Chief Technology Officer 20+ years in energy infrastructure and cryptocurrency mining; previously at Evercore K E R R I L A N G L A I S Chief Strategy Officer 20+ years of M&A, financing, strategy, and power sector experience; previously at Goldman Sachs S E A N F A R R E L L SVP, Operations 13+ years of energy experience in renewables, grid optimization, digitalization, and storage solutions; previously at Siemens Energy P A U L P R A G E R Co-Founder, Chairman & Chief Executive Officer 30+ year energy infrastructure entrepreneur; USNA Foundation Investment Committee Trustee P A T R I C K F L E U R Y Chief Financial Officer 20+ years of financial experience in the energy, power, and commodity sectors’ previously at Platinum Equity and Blackstone S T E F A N I E F L E I S C H M A N N Chief Legal Officer General Counsel for 15+ years overseeing all legal and compliance matters; previously at Paul, Weiss 19

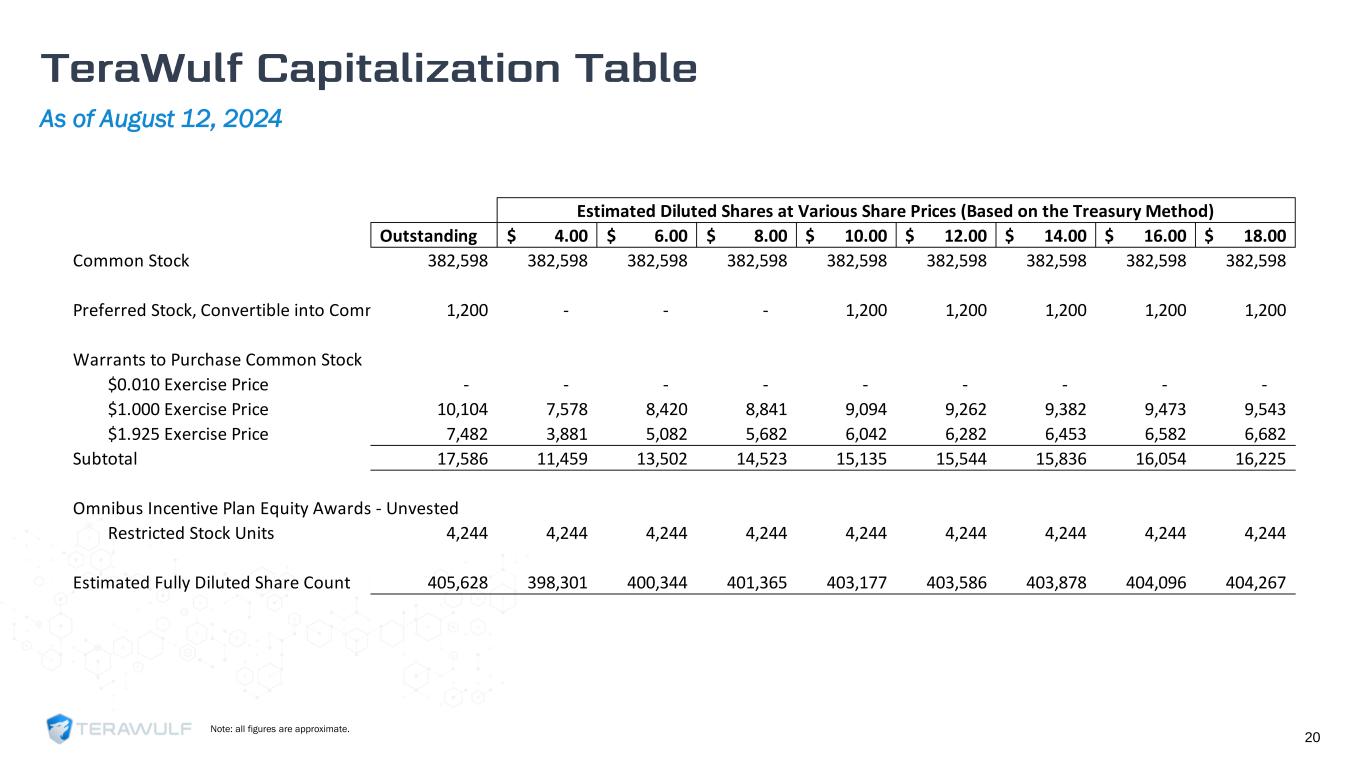

As of August 12, 2024 20 Note: all figures are approximate. Estimated Diluted Shares at Various Share Prices (Based on the Treasury Method) Outstanding 4.00$ 6.00$ 8.00$ 10.00$ 12.00$ 14.00$ 16.00$ 18.00$ Common Stock 382,598 382,598 382,598 382,598 382,598 382,598 382,598 382,598 382,598 Preferred Stock, Convertible into Common Stock1,200 - - - 1,200 1,200 1,200 1,200 1,200 Warrants to Purchase Common Stock $0.010 Exercise Price - - - - - - - - - $1.000 Exercise Price 10,104 7,578 8,420 8,841 9,094 9,262 9,382 9,473 9,543 $1.925 Exercise Price 7,482 3,881 5,082 5,682 6,042 6,282 6,453 6,582 6,682 Subtotal 17,586 11,459 13,502 14,523 15,135 15,544 15,836 16,054 16,225 Omnibus Incentive Plan Equity Awards - Unvested Restricted Stock Units 4,244 4,244 4,244 4,244 4,244 4,244 4,244 4,244 4,244 Estimated Fully Diluted Share Count 405,628 398,301 400,344 401,365 403,177 403,586 403,878 404,096 404,267

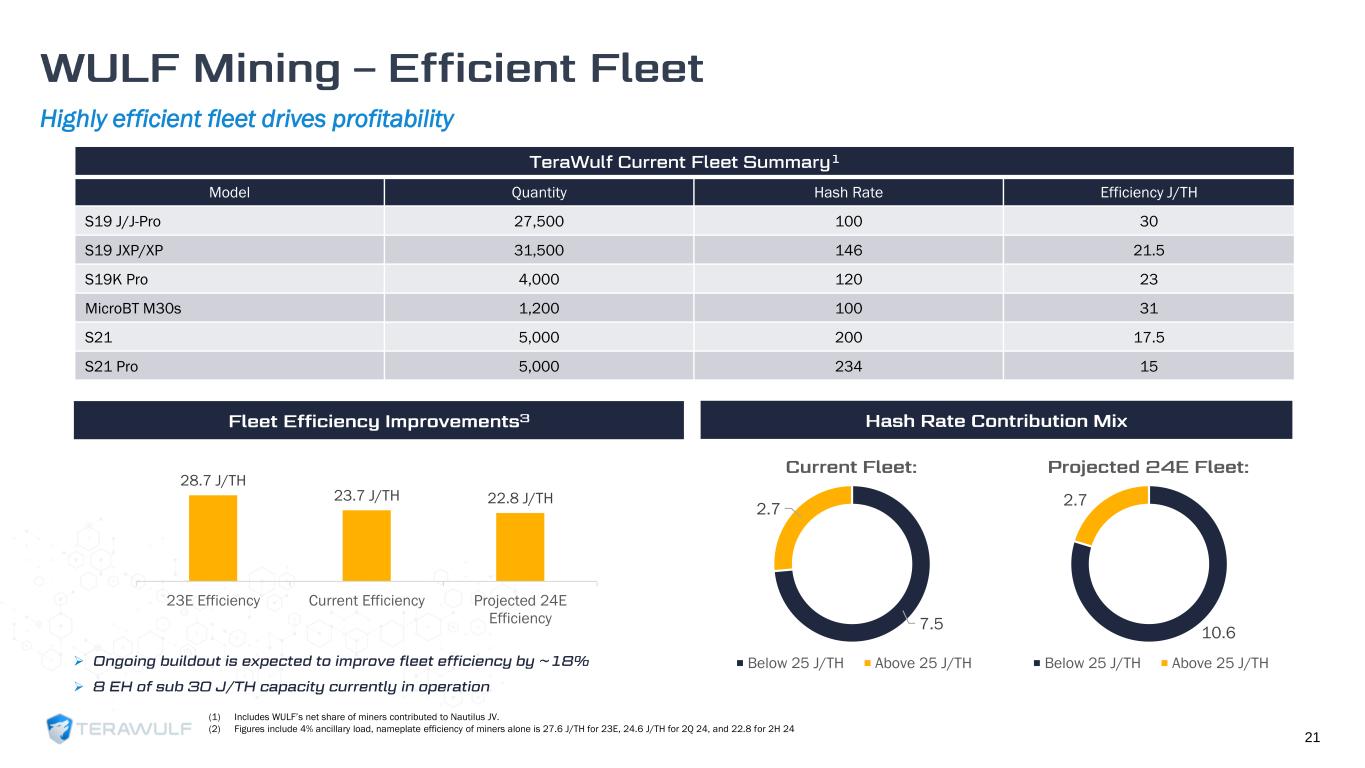

21 (1) Includes WULF’s net share of miners contributed to Nautilus JV. (2) Figures include 4% ancillary load, nameplate efficiency of miners alone is 27.6 J/TH for 23E, 24.6 J/TH for 2Q 24, and 22.8 for 2H 24 Model Quantity Hash Rate Efficiency J/TH S19 J/J-Pro 27,500 100 30 S19 JXP/XP 31,500 146 21.5 S19K Pro 4,000 120 23 MicroBT M30s 1,200 100 31 S21 5,000 200 17.5 S21 Pro 5,000 234 15 7.5 2.7 Below 25 J/TH Above 25 J/TH 28.7 J/TH 23.7 J/TH 22.8 J/TH 23E Efficiency Current Efficiency Projected 24E Efficiency ➢ ➢ Highly efficient fleet drives profitability 10.6 2.7 Below 25 J/TH Above 25 J/TH

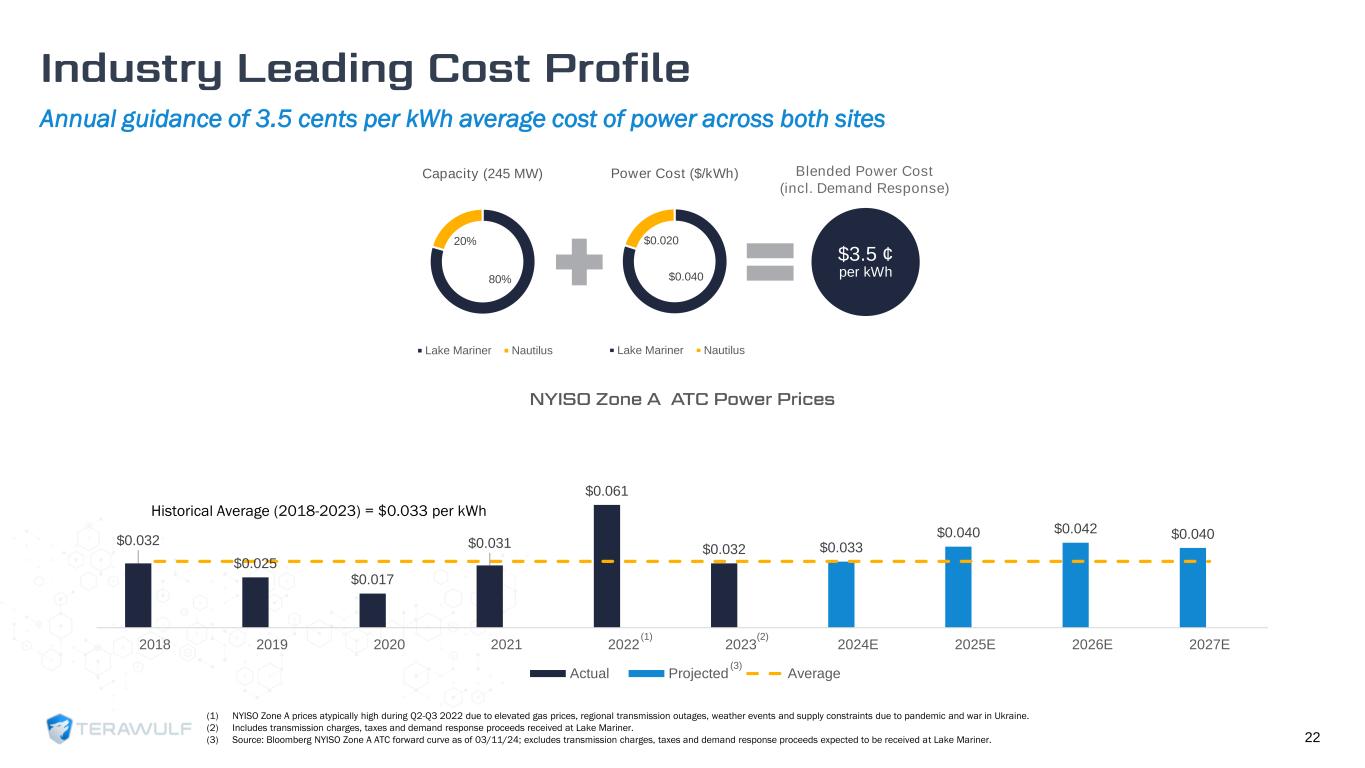

$0.032 $0.025 $0.017 $0.031 $0.061 $0.032 $0.033 $0.040 $0.042 $0.040 2018 2019 2020 2021 2022 2023 2024E 2025E 2026E 2027E Actual Projected Average $3.5 ¢ per kWh 80% 20% Capacity (245 MW) Lake Mariner Nautilus $0.040 $0.020 Power Cost ($/kWh) Lake Mariner Nautilus Blended Power Cost (incl. Demand Response) Annual guidance of 3.5 cents per kWh average cost of power across both sites 22 Historical Average (2018-2023) = $0.033 per kWh (1) NYISO Zone A prices atypically high during Q2-Q3 2022 due to elevated gas prices, regional transmission outages, weather events and supply constraints due to pandemic and war in Ukraine. (2) Includes transmission charges, taxes and demand response proceeds received at Lake Mariner. (3) Source: Bloomberg NYISO Zone A ATC forward curve as of 03/11/24; excludes transmission charges, taxes and demand response proceeds expected to be received at Lake Mariner. (1) (3) (2)

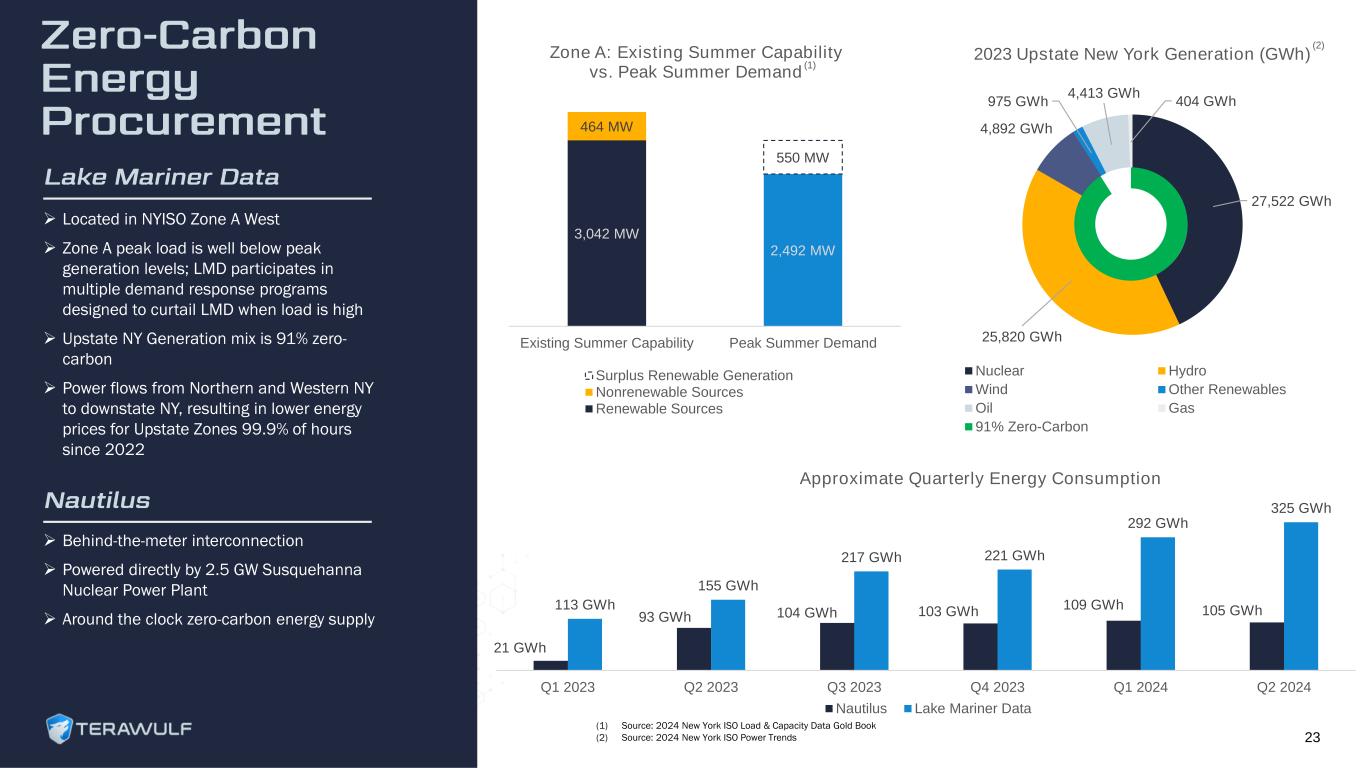

23 (1) Source: 2024 New York ISO Load & Capacity Data Gold Book (2) Source: 2024 New York ISO Power Trends 21 GWh 93 GWh 104 GWh 103 GWh 109 GWh 105 GWh113 GWh 155 GWh 217 GWh 221 GWh 292 GWh 325 GWh Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Approximate Quarterly Energy Consumption Nautilus Lake Mariner Data 27,522 GWh 25,820 GWh 4,892 GWh 975 GWh 4,413 GWh 404 GWh 2023 Upstate New York Generation (GWh) Nuclear Hydro Wind Other Renewables Oil Gas 91% Zero-Carbon (2) ➢ Behind-the-meter interconnection ➢ Powered directly by 2.5 GW Susquehanna Nuclear Power Plant ➢ Around the clock zero-carbon energy supply ➢ Located in NYISO Zone A West ➢ Zone A peak load is well below peak generation levels; LMD participates in multiple demand response programs designed to curtail LMD when load is high ➢ Upstate NY Generation mix is 91% zero- carbon ➢ Power flows from Northern and Western NY to downstate NY, resulting in lower energy prices for Upstate Zones 99.9% of hours since 2022 3,042 MW 464 MW 2,492 MW 550 MW Existing Summer Capability Peak Summer Demand Zone A: Existing Summer Capability vs. Peak Summer Demand Surplus Renewable Generation Nonrenewable Sources Renewable Sources (1)

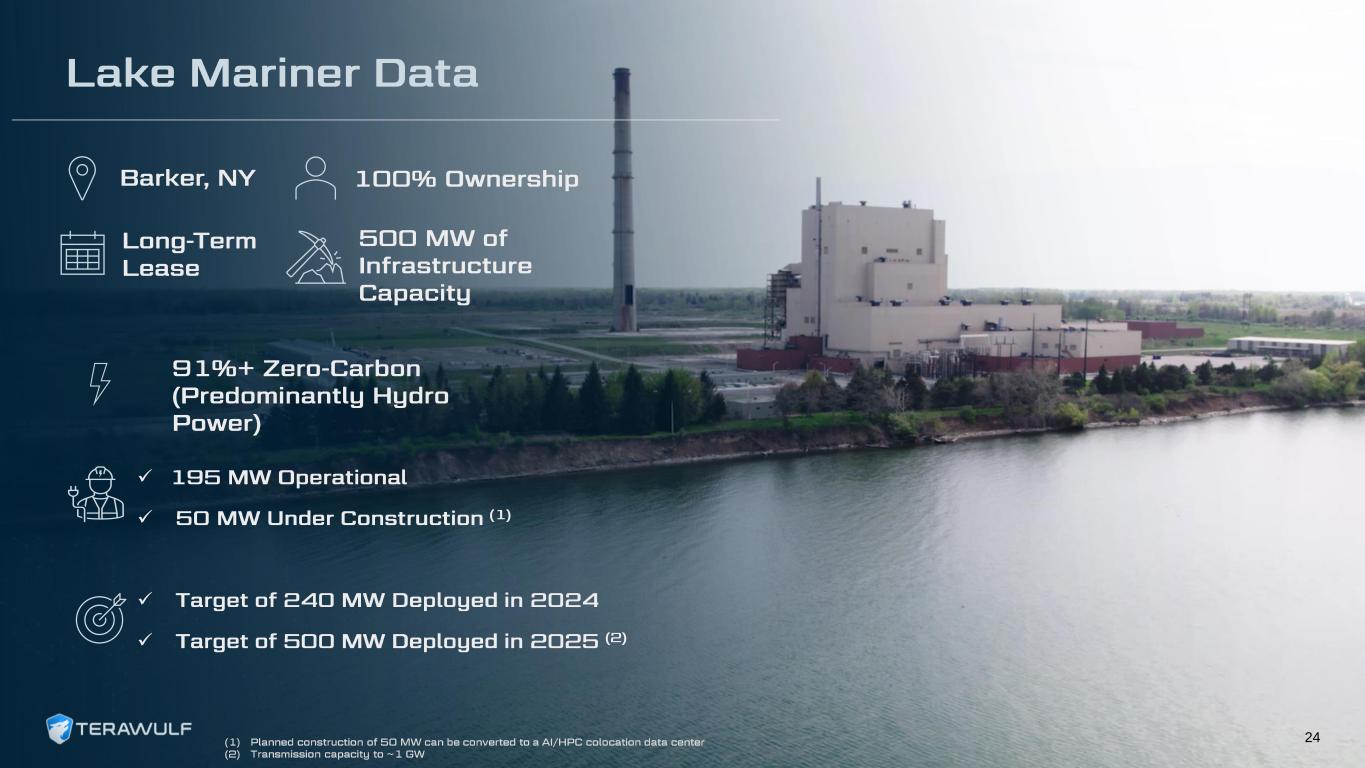

✓ ✓ ✓ ✓ 24

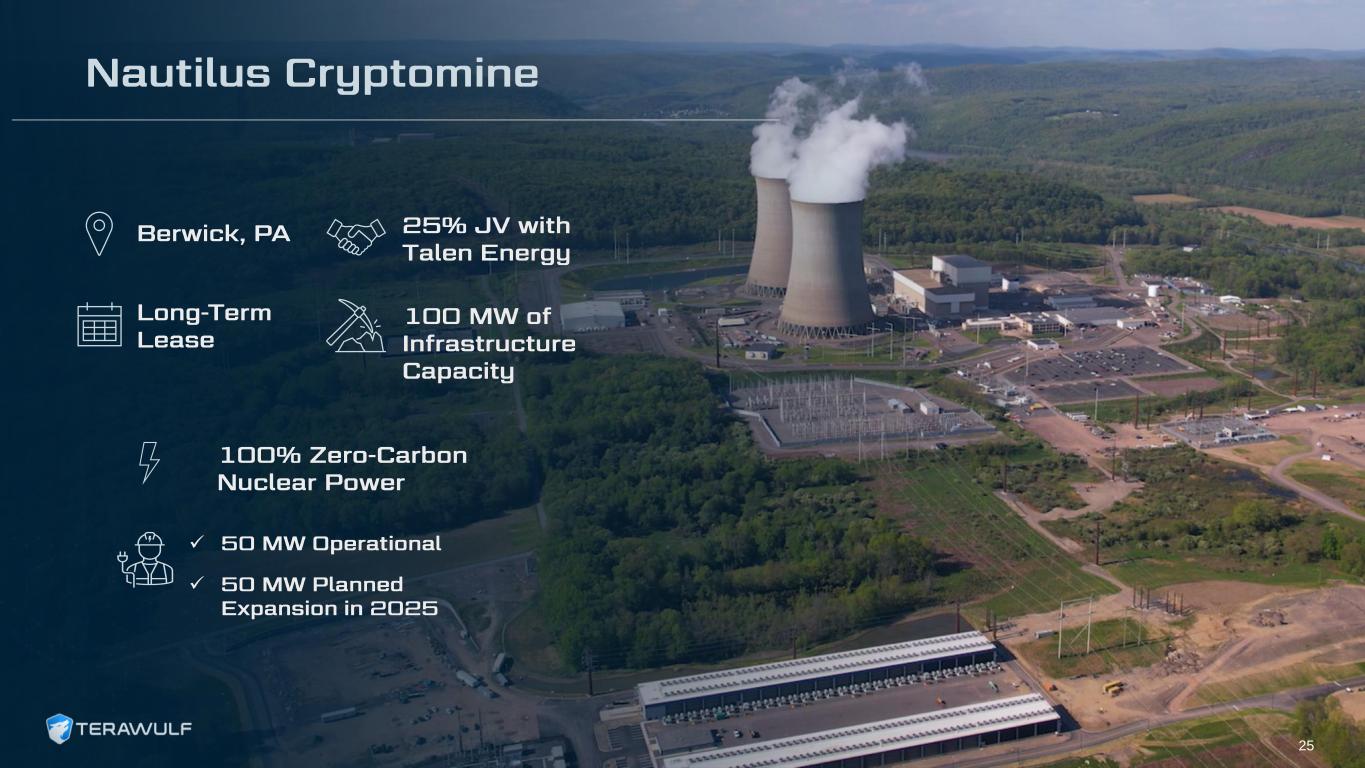

✓ ✓ 25

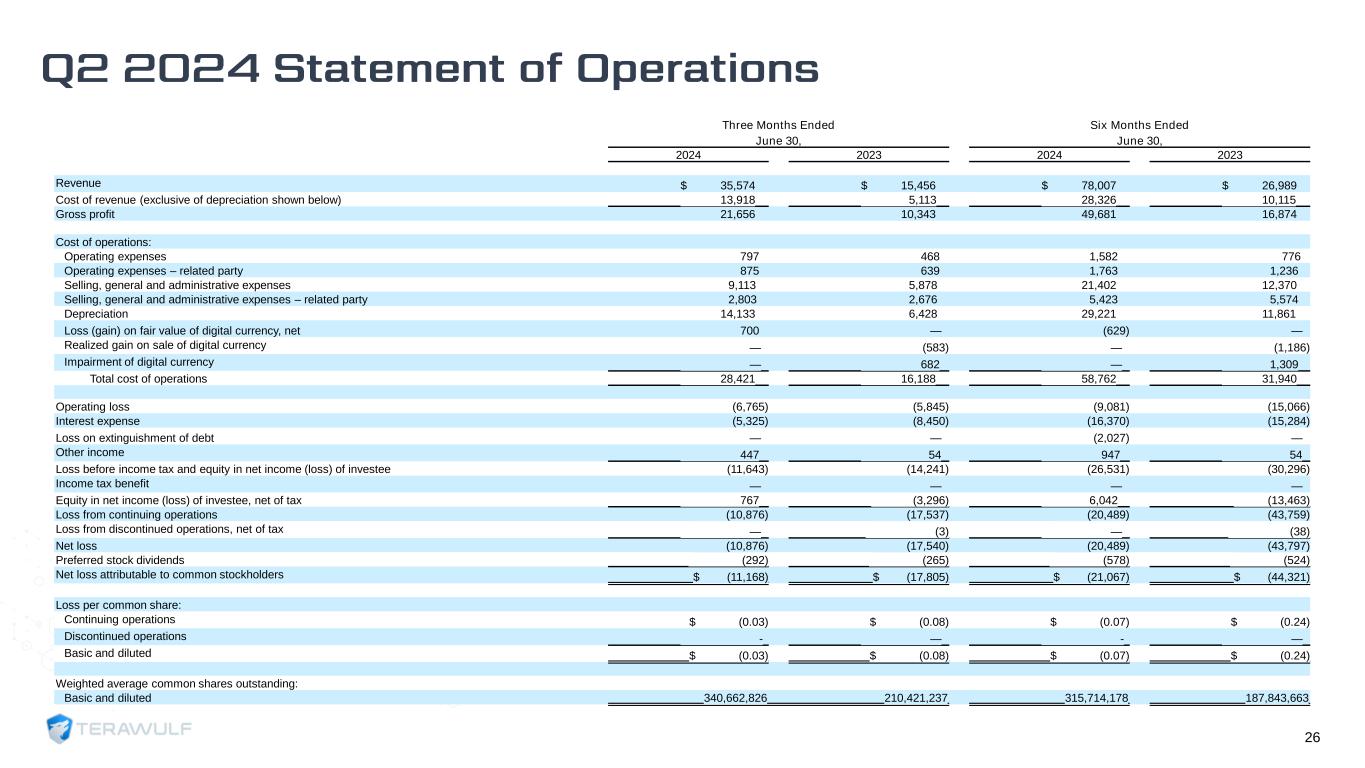

26 Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Revenue $ 35,574 $ 15,456 $ 78,007 $ 26,989 Cost of revenue (exclusive of depreciation shown below) 13,918 5,113 28,326 10,115 Gross profit 21,656 10,343 49,681 16,874 Cost of operations: Operating expenses 797 468 1,582 776 Operating expenses – related party 875 639 1,763 1,236 Selling, general and administrative expenses 9,113 5,878 21,402 12,370 Selling, general and administrative expenses – related party 2,803 2,676 5,423 5,574 Depreciation 14,133 6,428 29,221 11,861 Loss (gain) on fair value of digital currency, net 700 — (629) — Realized gain on sale of digital currency — (583) — (1,186) Impairment of digital currency — 682 — 1,309 Total cost of operations 28,421 16,188 58,762 31,940 Operating loss (6,765) (5,845) (9,081) (15,066) Interest expense (5,325) (8,450) (16,370) (15,284) Loss on extinguishment of debt — — (2,027) — Other income 447 54 947 54 Loss before income tax and equity in net income (loss) of investee (11,643) (14,241) (26,531) (30,296) Income tax benefit — — — — Equity in net income (loss) of investee, net of tax 767 (3,296) 6,042 (13,463) Loss from continuing operations (10,876) (17,537) (20,489) (43,759) Loss from discontinued operations, net of tax — (3) — (38) Net loss (10,876) (17,540) (20,489) (43,797) Preferred stock dividends (292) (265) (578) (524) Net loss attributable to common stockholders $ (11,168) $ (17,805) $ (21,067) $ (44,321) Loss per common share: Continuing operations $ (0.03) $ (0.08) $ (0.07) $ (0.24) Discontinued operations - — - — Basic and diluted $ (0.03) $ (0.08) $ (0.07) $ (0.24) Weighted average common shares outstanding: Basic and diluted 340,662,826 210,421,237 315,714,178 187,843,663

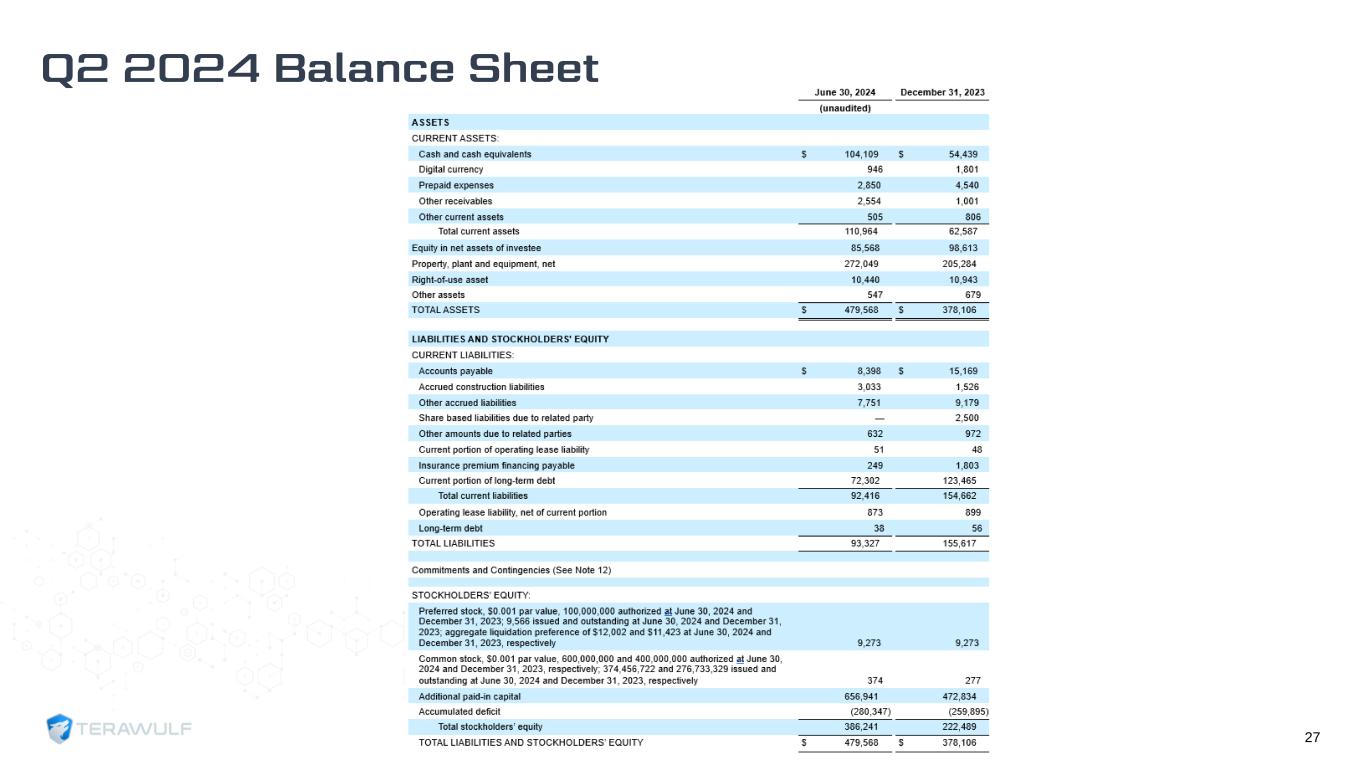

27

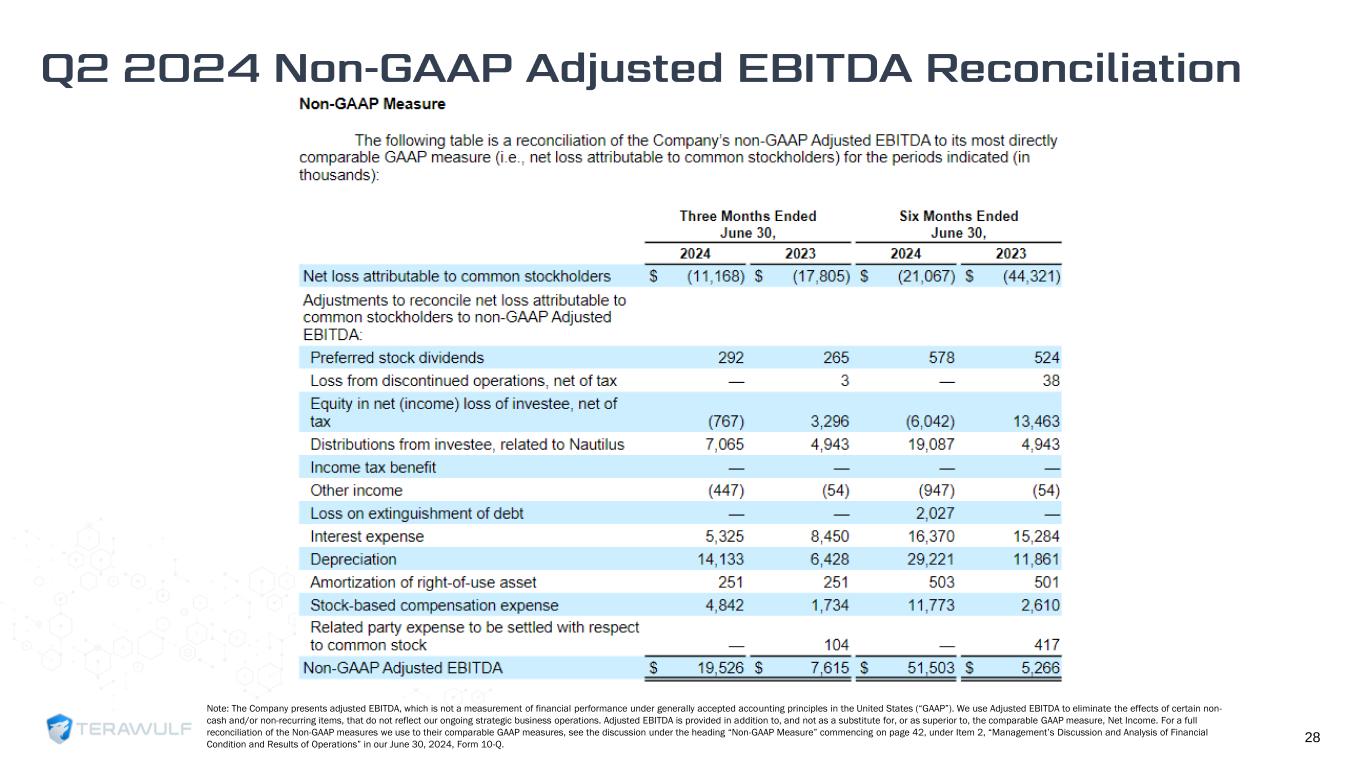

28 Note: The Company presents adjusted EBITDA, which is not a measurement of financial performance under generally accepted accounting principles in the United States (“GAAP”). We use Adjusted EBITDA to eliminate the effects of certain non- cash and/or non-recurring items, that do not reflect our ongoing strategic business operations. Adjusted EBITDA is provided in addition to, and not as a substitute for, or as superior to, the comparable GAAP measure, Net Income. For a full reconciliation of the Non-GAAP measures we use to their comparable GAAP measures, see the discussion under the heading “Non-GAAP Measure” commencing on page 42, under Item 2, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our June 30, 2024, Form 10-Q.