MASTER SALES AND PURCHASE AGREEMENT BETWEEN LUXOR TECHNOLOGY CORPORATION (“Purchaser”) AND TERALEASE LLC (“Supplier”)

-1- This Master Sales and Purchase Agreement (this “Agreement”) is entered into on October 3, 2024 (the “Effective Date”) by and between: TeraLease LLC, a Delaware limited liability company (“Supplier”), with its principal place of business at 9 Federal Street, Easton, MD 21601. and Luxor Technology Corporation, a Delaware corporation (“Purchaser”; together with Supplier, the “Parties” and each individually, a “Party”), with its principal place of business registered at 1100 Bellevue Way NE, Suite 8A #514, Bellevue, WA 98004. WHEREAS, Purchaser is willing to purchase, and Supplier is willing to supply, certain Bitcoin mining equipment in accordance with the terms and conditions of this Agreement and the applicable Order Form; and WHEREAS, Purchaser fully understands the market risks, the price-setting principles and the market fluctuations relating to the Products sold under this Agreement. NOW, THEREFORE, in consideration of the mutual covenants, terms, and conditions set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereby agree as follows: 1. Definitions and Interpretations The following terms, as used herein, have the following meanings: 1.1. “Affiliate” means, with respect to any Person, any other Person directly or indirectly Controlling, Controlled by, or under common Control with such Person. 1.2. “Applicable Law” means all laws, statutes, rules, regulations, codes, ordinances, constitutions, orders or treaties of the United States, any state of the United States, and any political subdivision thereof applicable to this Agreement and the transactions contemplated thereunder. 1.3. “Control” means the power or authority, whether exercised or not, to direct the business, management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise, provided that such power or authority shall conclusively be presumed to exist upon possession of beneficial ownership or power to direct the vote of more than fifty percent (50%) of the votes entitled to be cast at a meeting of the members or shareholders of such Person or power to control the composition of a majority of the board of directors of such Person. The terms “Controlled” and “Controlling” have meanings correlative to the foregoing. 1.4. “Force Majeure” means in respect of either Party, any event or occurrence whatsoever beyond the reasonable control of that Party, which delays, prevents or hinders that Party from performing any obligation imposed upon that Party under this Agreement (other than an obligation to make payment), including to the extent such event or occurrence shall delay, prevent or hinder such Party from performing such obligation, war (declared or undeclared), terrorist activities, acts of sabotage, blockade, fire, lightning, acts of god, national strikes, riots, insurrections, civil commotions, quarantine restrictions, epidemics, earthquakes, landslides, avalanches, floods, hurricanes, explosions, delays caused by any third party, including but not limited to Manufacturers or Freight Forwarders, and

-2- regulatory and administrative or similar action or delays to take actions of any governmental authority. 1.5. “Freight Forwarder” means any Person engaged by Supplier or Purchaser to transport and deliver the Products pursuant to this Agreement and any applicable Order Form. 1.6. “Futures” means Products to be manufactured and made available for Purchaser’s pickup at a certain timeframe in the future, sold at a predetermined price with potential adjustments of specifications. 1.7. “Insolvency Event” means any of the following events for either Party: 1.7.1. a receiver, receiver and manager, judicial manager, official manager, trustee, administrator or similar official is appointed, or steps are taken for such appointment, over all or any part of the assets, equipment or undertaking of such Party; 1.7.2. if such Party stops or suspends payments to its creditors generally, is unable to or admits its inability to pay its debts as they fall due, or is declared or becomes bankrupt or insolvent or enters into liquidation; or 1.7.3. a petition is presented, a proceeding is commenced, an order is made or an effective resolution is passed for the liquidation, winding up, insolvency, judicial management, administration, reorganization, reconstruction, dissolution or bankruptcy of such Party, otherwise than for the purpose of a bona fide scheme of solvent amalgamation or reconstruction. 1.8. “Manufacturer” is the Person who produces the Products and provides warranty on the Products, if applicable. 1.9. “Order Form” means the contractual document in which Purchaser’s agrees to purchase from Supplier, and Supplier agrees to sell to Purchaser, Products in accordance with the applicable Order Form under the governance of this Agreement, and references to this Agreement shall include the applicable Order Form. 1.10. “Person” means any individual, corporation, partnership, limited partnership, proprietorship, association, limited liability company, firm, trust, estate or other enterprise or entity. 1.11. “Products” means the Bitcoin mining equipment specified in the applicable Order Form that Supplier will provide to Purchaser in accordance with this Agreement. 1.12. “Total Purchase Price” means the aggregate amount payable by Purchaser as set out in the applicable Order Form. 2. Sale and Purchase of Products 2.1. Supplier will provide the Products set forth in the applicable Order Form to Purchaser in accordance with the provisions of Section 2, Section 3, Section 4, Section 5 and Section 6 of this Agreement and the applicable Order Form, and Purchaser shall make payment in accordance with the terms specified in this Agreement and the applicable Order Form. 2.2. For Futures, both Parties further acknowledge and agree that in the event that the hardware available from Supplier does not match exactly the Products listed hereunder on the applicable Order Form, all obligations of this Agreement on the part of Purchaser will remain fully intact, and no refunded amounts will need to be paid by Supplier to Purchaser.

-3- 2.3. Purchaser acknowledges and confirms that any purchase made pursuant to this Agreement and any applicable Order Form is irrevocable and cannot be canceled by Purchaser after the applicable Order Form is signed. 2. Prices and Terms of Payment 2.1. The Parties understand and agree that the applicable prices of the Products are exclusive of applicable bank transaction fees, duties, taxes, freight, or other fees. Purchaser acknowledges that Purchaser shall pay directly, or reimburse Supplier for, any U.S. State and local sales taxes or any other taxes levied on or assessed against the amounts payable hereunder, including but not limited to value-added, turnover, withholding, or similar taxes. If any payment is subject to withholding, Purchaser shall pay such additional amounts as necessary, to ensure that Supplier receives the full amount it would have received had the payment not been subject to such withholding. 2.2. The Total Purchase Price shall be payable by Purchaser to Supplier as set forth in the applicable Order Form. 2.3. Supplier and Purchaser further agree to the profit split upon Purchaser’s resale of the Products as set forth in the applicable Order Form. 3. Delivery of Products 3.1. Subject to the limitations stated in the applicable Order Form, the terms of delivery of the Products shall be EXW (Ex Works) according to Incoterms 2010. Purchaser shall pick up the Products at a Supplier-designated place. Supplier shall provide commercially reasonable efforts to facilitate Purchaser’s pickup. 3.2. Unless otherwise stated in the applicable Order Form, once the Products are under Purchaser’s or its representative’s (e.g. a Purchaser-contracted Freight Forwarder) control, Supplier shall have fulfilled its obligation to facilitate the purchase of the Products, and the title, ownership, and risks of loss shall pass to Purchaser. Supplier shall not be responsible, and Purchaser shall be fully and exclusively responsible, for any loss of Products, personal injury, property damage, other damage or liability caused by the Products either to Purchaser or any third party, or theft of or damage to the Products. 3.3. Supplier shall not be responsible for any damages, failure, error, or delay in delivery caused by Purchaser or any third parties, including but not limited to Manufacturers and Freight Forwarders. 4. Warranty of Products Both Parties acknowledge that: 4.1. The availability of the warranty of the Products is determined and provided by the Manufacturer, as facilitated by Supplier. The warranty may or may not be available in accordance with the Manufacturer’s after-sales service policy, which may be varied and changed from time to time, and may or may not be assignable to, and/or used in any way by Purchaser. Supplier shall use commercially reasonable efforts to obtain the Manufacturer’s consent, if and to the extent required, to the assignment of any applicable Manufacturer warranty regarding the Products to Purchaser.

-4- 4.2. Purchaser expressly acknowledges and agrees that Supplier does not provide any warranty regarding the Products sold to Purchaser, whether written, oral, express, implied, or statutory, and none of the warranties of merchantability, fitness for a particular purpose, title, interference with Purchaser’s quiet enjoyment, and non-infringement of third party or arising from a course of dealing or usage in trade shall apply. The Products are provided “As Is” with all faults, and the entire risk as to the satisfactory quality, accuracy, and effort lies with Purchaser. Purchaser acknowledges and agrees that it has not relied on any oral or written information or advice, whether given by Supplier or its representatives, agents, or employees. 4.3. Purchaser expressly acknowledges and agrees that the Products provided by Supplier do not guarantee any cryptocurrency mining time or hashrate, and Supplier shall not be liable for any cryptocurrency mining time or hashrate loss or cryptocurrency mining revenue loss that are caused by downtime of any Products or any part or component thereof. Supplier does not warrant that the Products will be uninterrupted or error-free. 4.4. Purchaser expressly acknowledges and agrees that the Products are not designed, manufactured, or intended for use in hazardous or critical environments or in activities requiring emergency or fail-safe operation, such as the operation of nuclear facilities, aircraft navigation or communication systems or in any other applications or activities in which failure of the Products may pose the risk of environmental harm or physical injury or death to humans. Supplier specifically disclaims any express or implied warranty of fitness for any of the above-described applications and any such use shall be at Purchaser’s sole risk. 5. Representations and Warranties Each Party hereby represents and warrants as follows, as of the Effective Date and as of the date of any payment made under an applicable Order Form: 5.1. Such Party is duly organized, validly existing and in good standing under the laws of its jurisdiction of formation, and such Party is duly qualified or licensed to do business in each jurisdiction in which the ownership or operation of its assets makes such qualification necessary, except where the failure to be so duly qualified or licensed would not, individually or in the aggregate, reasonably be expected to have a material adverse effect on such Party’s ability to perform its obligations under this Agreement; 5.2. Such Party has the full power and authority to enter into this Agreement and perform its obligations hereunder; 5.3. The obligations of such Party hereunder are legal, valid, binding and enforceable against such Party in accordance with their terms, subject to applicable bankruptcy, insolvency, fraudulent conveyance, reorganization, rehabilitation, liquidation, preferential transfer, moratorium and similar laws now or hereafter affecting creditors’ rights generally and subject, as to enforceability, to general principles of equity (regardless of whether enforcement is sought in a proceeding at law or in equity); 5.4. Such Party has the power to enter into, perform and deliver, and has taken all necessary action to authorize its entry into, performance and delivery of, this Agreement and the transactions contemplated hereunder;

-5- 5.5. The entry into and performance by such Party of, and the transactions contemplated by, this Agreement do not violate (i) its organizational documents, (ii) any agreement or instrument binding upon it or any of its assets or (ii) any Applicable Law, except as would not, individually or in the aggregate, reasonably be expected to have a material adverse effect on such Party’s ability to perform its obligations under this Agreement; and 5.6. Such Party is not the target of economic sanctions administered by the Office of Foreign Assets Control of the U.S. Department of the Treasury (“OFAC”), the U.S. Department of State, the United Nations Security Council, the European Union, Her Majesty’s Treasury or Singapore (“Sanctions”), including by being (i) listed on the Specially Designated Nationals and Blocked Persons (“SDN”) List maintained by OFAC or any other Sanctions list maintained by one of the foregoing governmental authorities, or (ii) directly or indirectly owned or controlled by one or more SDNs or other Persons included on any other Sanctions list, or located, organized or resident in a country or territory that is the target of Sanctions and, assuming the accuracy of the representations and warranties of either Party set forth in this Section 5, the sale and purchase of the Products will not violate any Sanctions or import and export control related laws and regulations. 6. Limitation of Liability 6.1. Neither Party shall, under any circumstances, be liable to the other Party for any consequential loss, or loss of goodwill, business, anticipated profits, revenue, contract, or business opportunity arising out of or in connection with this Agreement and/or the Products even if such Party had been advised of the possibility of such damages. Each Party hereby waives any claim it may at any time have against the other Party in respect of any such damages. The foregoing limitation of liability shall apply whether in an action at law, including but not limited to contract, strict liability, negligence, willful misconduct or other tortious action, or an action in equity. 6.2. Each Party’s and its respective Affiliates’ cumulative aggregate liability pursuant to this Agreement, whether arising from tort, breach of contract or any other cause of action shall be limited to and not exceed the amount of one hundred percent (100%) of the payment actually received by Supplier from Purchaser for the Products. 6.3. The above limitations and exclusions shall apply notwithstanding the failure of essential purpose of any exclusive or limited remedy, and whether or not either Party has been advised of the possibility of such damages. This Section allocates the risks under this Agreement and the pricing reflects this allocation of risk and the above limitations. 7. Term and Termination of this Agreement 7.1. This Agreement will be effective upon the Effective Date first listed above and remain in force until terminated in accordance with the provisions of this Section 7. 7.2. Either Party shall be entitled to terminate this Agreement with immediate effect upon written notice to the other Party if: 7.2.1. The other Party fails to comply in any material respect with any provision of this Agreement , and where that failure is capable of being remedied, fails to remedy it within thirty (30) days of being required by such Party to do so;

-6- 7.2.2. It is or becomes unlawful for either Party to perform or comply with any of its material obligations under this Agreement or all or a material part of the obligations of such Party under this Agreement are not or cease to be valid, binding and enforceable; 7.2.3. An Insolvency Event occurs in respect of either Party; or 7.2.4. An event of Forcey Majeure occurs in respect of the other Party and continues for more than 180 consecutive calendar days. 7.3. If Purchaser fails to comply in any material respect with this Agreement, Supplier will also have the right to request and Purchaser will be obliged to pay to Supplier liquidated damages for such breach in the amount of a maximum of 100% of the payment already made by Purchaser. No additional financial penalties shall apply, including penalties such as those relating to opportunity cost. 7.4. The provisions of Sections 4, 6, and 10 through 17of this Agreement shall survive the termination of this Agreement. 8. Force Majeure 8.1. To the extent that a Party is fully or partially delayed, prevented or hindered by an event of Force Majeure from performing any obligation under this Agreement (other than an obligation to make payment), subject to the exercise of reasonable diligence by the affected Party, the failure to perform shall be excused by the occurrence of such event of Force Majeure. A Party claiming that its performance is excused by an event of Force Majeure shall, promptly after the occurrence of such event of Force Majeure, notify the other Party of the nature, date of inception and expected duration of such event of Force Majeure and the extent to which the Party expects that the event will delay, prevent or hinder the Party from performing its obligations under this Agreement. 8.2. The Party affected by Force Majeure shall use reasonable diligence to remove the event of Force Majeure, and shall keep the other Party informed of all significant developments. 9. [Intentionally Omitted.] 10. Entire Agreement and Amendment This Agreement, including any Order Form, constitutes the entire agreement of the Parties hereto and can only be amended in writing by both Parties. 11. Severability To the extent possible, if any provision of this Agreement is held to be illegal, invalid or unenforceable in whole or in part by a court, the provision shall apply with whatever deletion or modification is necessary so that such provision is legal, valid and enforceable and gives effect to the commercial intention of the Parties. The remaining provisions of this Agreement shall not be affected and shall remain in full force and effect. 12. Conflict with the Terms and Conditions In the event of any ambiguity or discrepancy between the provisions of this Agreement and the terms and conditions from time to time of any other agreement between Supplier and Purchaser, it

-7- is intended that the provisions of this Agreement shall prevail and the Parties shall comply with and give effect to this Agreement unless expressly agreed otherwise. 13. Governing Law and Jurisdiction 13.1. This Agreement and the rights and obligations of the parties thereunder shall be governed by and construed in accordance with the laws of the state of Delaware, without reference to the conflict of laws provision thereof which would give rise to the application of the domestic substantive law of any other jurisdiction. 13.2. Each Party hereby irrevocably and unconditionally consents to the exclusive jurisdiction of the federal and state courts sitting in Wilmington, Delaware, for any claim, dispute, action, suit or proceeding (“Claim”) arising out of or related hereto. Each Party hereto further hereby irrevocably and unconditionally waives any objection to the laying of venue of any Claim arising out of or relating to this Agreement in such courts, and hereby further irrevocably and unconditionally waives and agrees not to plead or claim in any such court that any such Claim brought in any such court has been brought in any inconvenient forum. Each Party hereby knowingly, voluntarily and intentionally waives any right (to the fullest extent permitted by applicable law) to a trial by jury of any Claim arising out of, under or relating to, this Agreement and agrees that any such Claim shall be tried before a judge sitting without a jury. 14. No Waiver Failure by either Party to enforce at any time any provision of this Agreement, or to exercise any election of options provided herein shall not constitute a waiver of such provision or option, nor affect the validity of this Agreement or any part thereof, or the right of the waiving Party to thereafter enforce each and every such provision or option. 15. Independent Contractors The Parties are independent contractors. There is no relationship of partnership, joint venture, employment, franchise, or agency created hereby between the Parties. Neither Party will have the power to bind the other or incur obligations on the other Party’s behalf without the other Party’s prior written consent. 16. Counterparts and Electronic Signatures This Agreement may be executed in one or more counterparts, each of which will be deemed to be an original copy of this Agreement, and all of which, when taken together, will be deemed to constitute one and the same agreement. The facsimile, email or other electronically delivered signatures of the Parties shall be deemed to constitute original signatures, and facsimile or electronic copies hereof shall be deemed to constitute duplicate originals. 17. Third Party Rights 17.1. A Person who is not a Party to this Agreement has no right to enforce or to enjoy the benefit of any term of this Agreement.

Patrick Fleury Chief Financial Officer 10-3-24

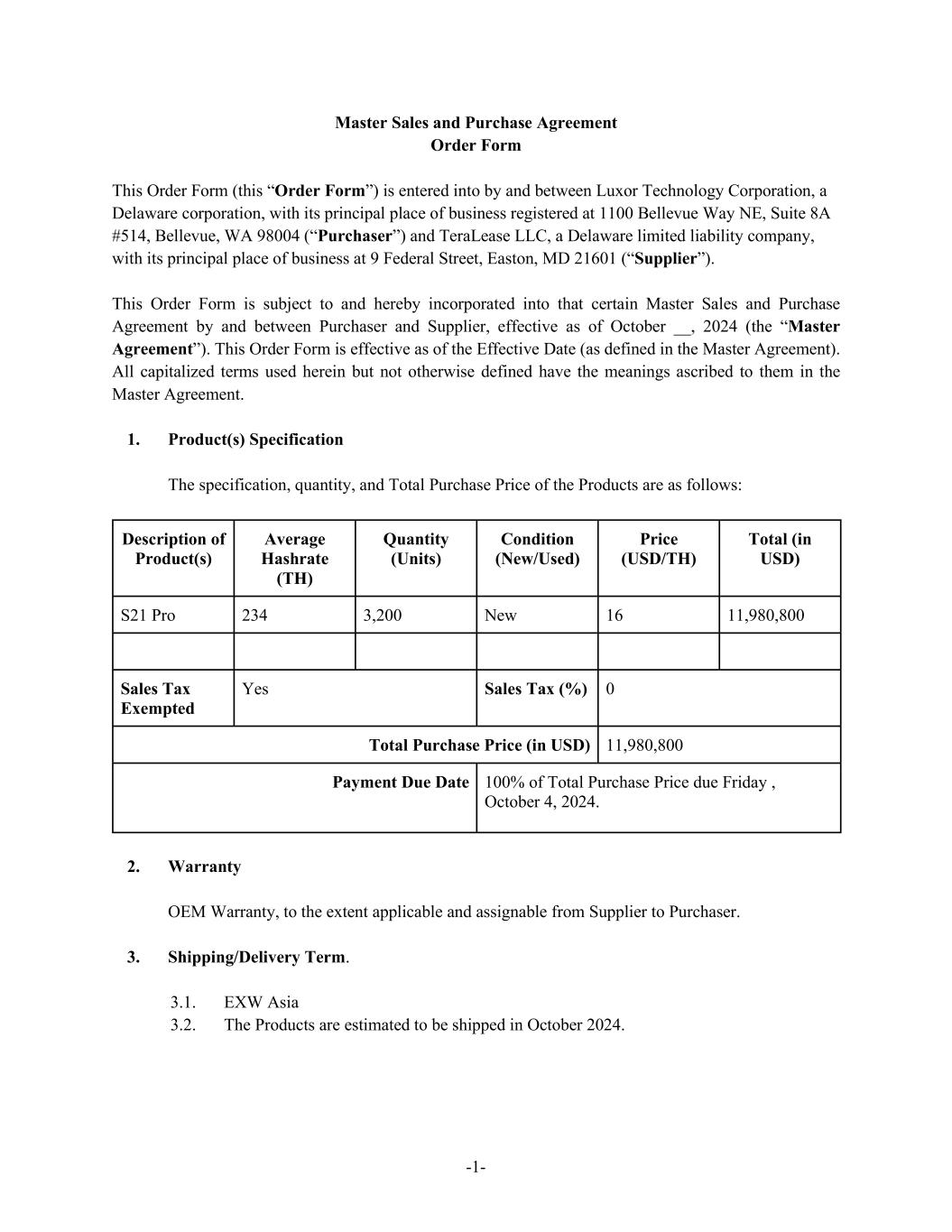

-1- Master Sales and Purchase Agreement Order Form This Order Form (this “Order Form”) is entered into by and between Luxor Technology Corporation, a Delaware corporation, with its principal place of business registered at 1100 Bellevue Way NE, Suite 8A #514, Bellevue, WA 98004 (“Purchaser”) and TeraLease LLC, a Delaware limited liability company, with its principal place of business at 9 Federal Street, Easton, MD 21601 (“Supplier”). This Order Form is subject to and hereby incorporated into that certain Master Sales and Purchase Agreement by and between Purchaser and Supplier, effective as of October __, 2024 (the “Master Agreement”). This Order Form is effective as of the Effective Date (as defined in the Master Agreement). All capitalized terms used herein but not otherwise defined have the meanings ascribed to them in the Master Agreement. 1. Product(s) Specification The specification, quantity, and Total Purchase Price of the Products are as follows: Description of Product(s) Average Hashrate (TH) Quantity (Units) Condition (New/Used) Price (USD/TH) Total (in USD) S21 Pro 234 3,200 New 16 11,980,800 Sales Tax Exempted Yes Sales Tax (%) 0 Total Purchase Price (in USD) 11,980,800 Payment Due Date 100% of Total Purchase Price due Friday , October 4, 2024. 2. Warranty OEM Warranty, to the extent applicable and assignable from Supplier to Purchaser. 3. Shipping/Delivery Term. 3.1. EXW Asia 3.2. The Products are estimated to be shipped in October 2024.

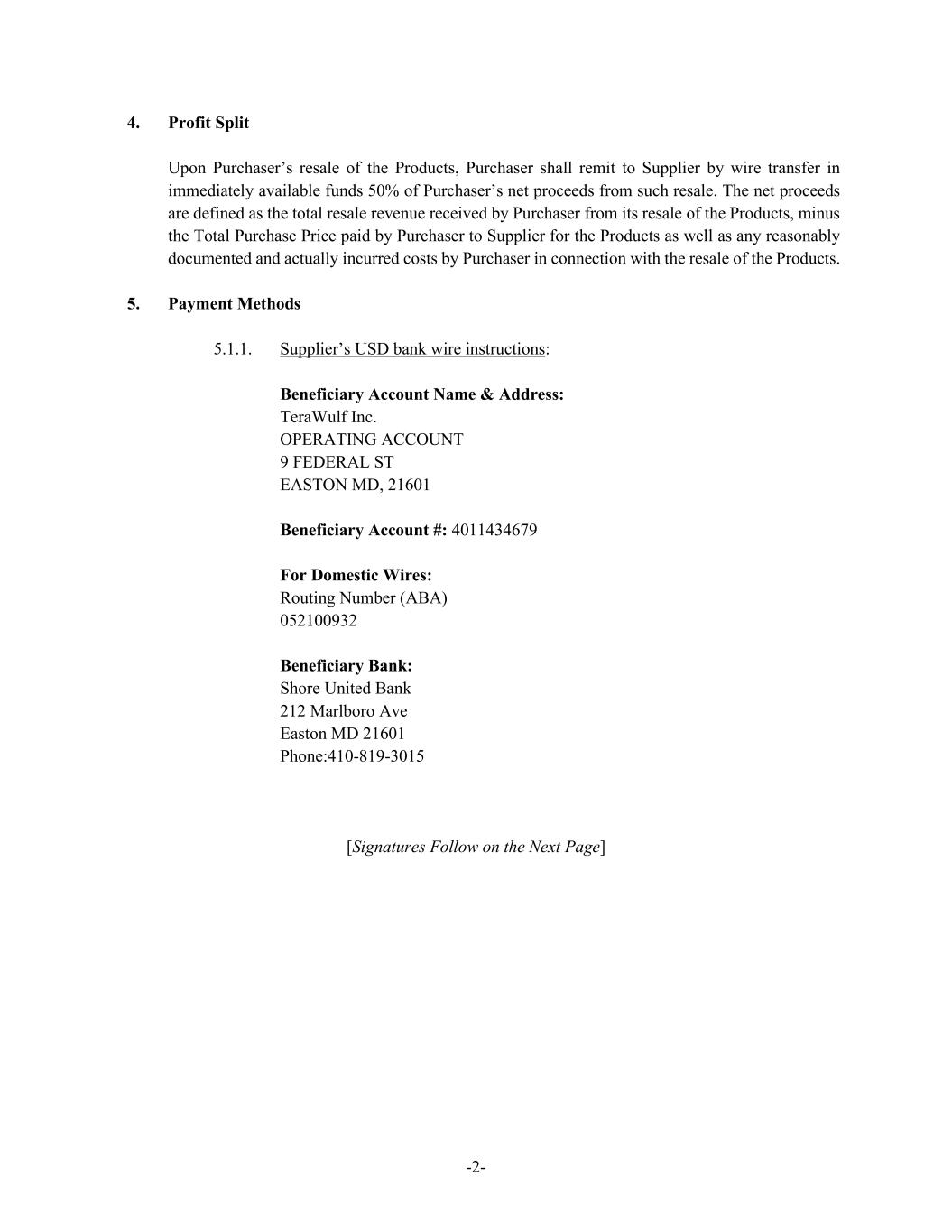

-2- 4. Profit Split Upon Purchaser’s resale of the Products, Purchaser shall remit to Supplier by wire transfer in immediately available funds 50% of Purchaser’s net proceeds from such resale. The net proceeds are defined as the total resale revenue received by Purchaser from its resale of the Products, minus the Total Purchase Price paid by Purchaser to Supplier for the Products as well as any reasonably documented and actually incurred costs by Purchaser in connection with the resale of the Products. 5. Payment Methods 5.1.1. Supplier’s USD bank wire instructions: Beneficiary Account Name & Address: TeraWulf Inc. OPERATING ACCOUNT 9 FEDERAL ST EASTON MD, 21601 Beneficiary Account #: 4011434679 For Domestic Wires: Routing Number (ABA) 052100932 Beneficiary Bank: Shore United Bank 212 Marlboro Ave Easton MD 21601 Phone:410-819-3015 [Signatures Follow on the Next Page]

Patrick Fleury Chief Financial Officer 10-3-24