1

; ; 2

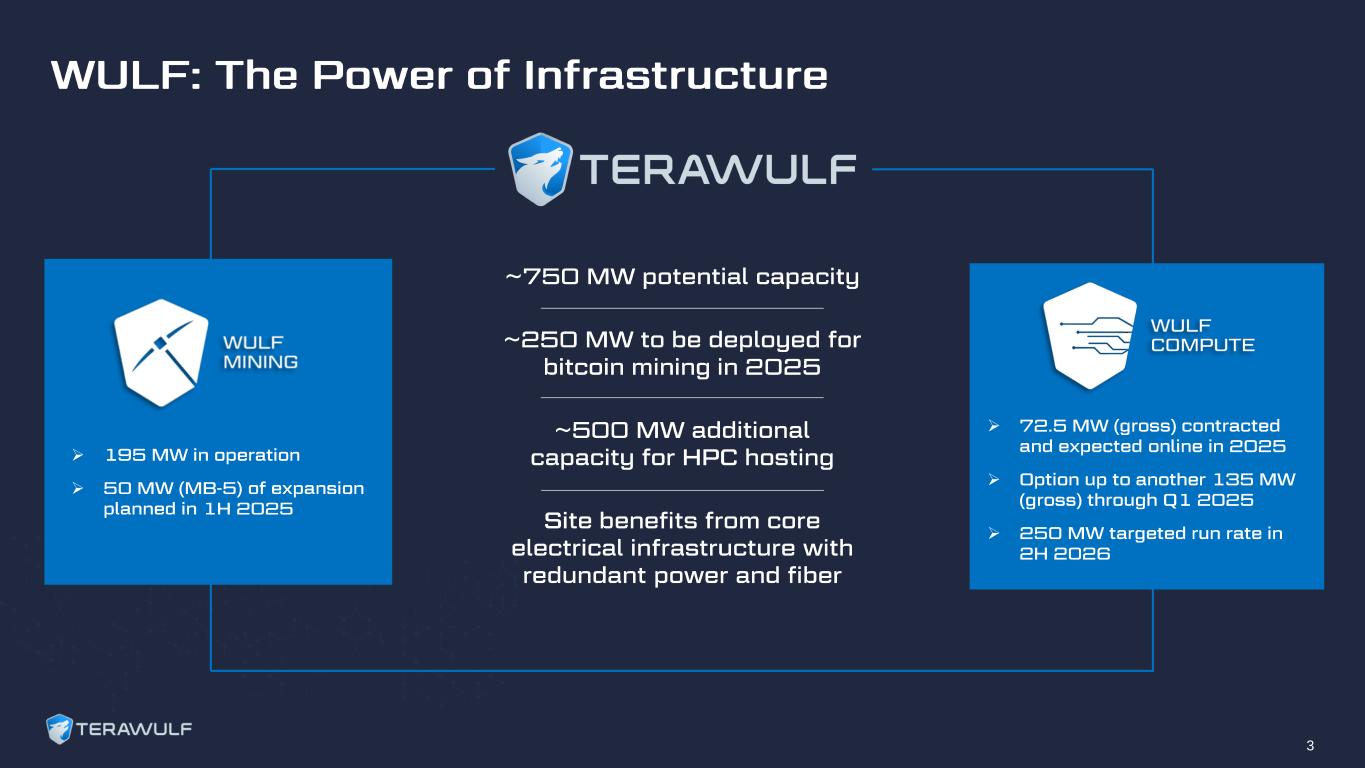

➢ ➢ ➢ ➢ ➢ 3

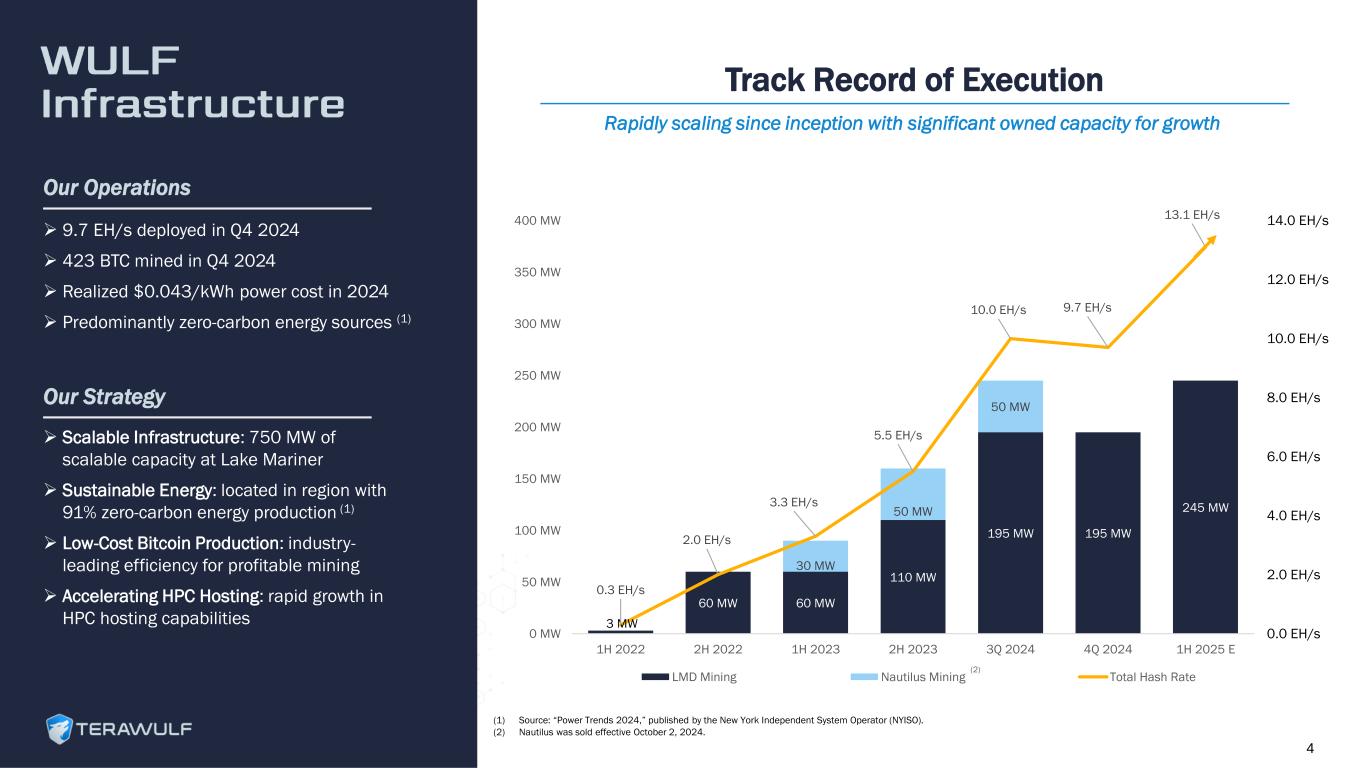

3 MW 60 MW 60 MW 110 MW 195 MW 195 MW 245 MW 30 MW 50 MW 50 MW 0.3 EH/s 2.0 EH/s 3.3 EH/s 5.5 EH/s 10.0 EH/s 9.7 EH/s 13.1 EH/s 0.0 EH/s 2.0 EH/s 4.0 EH/s 6.0 EH/s 8.0 EH/s 10.0 EH/s 12.0 EH/s 14.0 EH/s 0 MW 50 MW 100 MW 150 MW 200 MW 250 MW 300 MW 350 MW 400 MW 1H 2022 2H 2022 1H 2023 2H 2023 3Q 2024 4Q 2024 1H 2025 E LMD Mining Nautilus Mining Total Hash Rate Our Operations ➢ Scalable Infrastructure: 750 MW of scalable capacity at Lake Mariner ➢ Sustainable Energy: located in region with 91% zero-carbon energy production (1) ➢ Low-Cost Bitcoin Production: industry- leading efficiency for profitable mining ➢ Accelerating HPC Hosting: rapid growth in HPC hosting capabilities Our Strategy ➢ 9.7 EH/s deployed in Q4 2024 ➢ 423 BTC mined in Q4 2024 ➢ Realized $0.043/kWh power cost in 2024 ➢ Predominantly zero-carbon energy sources (1) Track Record of Execution Rapidly scaling since inception with significant owned capacity for growth 4 (2) (1) Source: “Power Trends 2024,” published by the New York Independent System Operator (NYISO). (2) Nautilus was sold effective October 2, 2024.

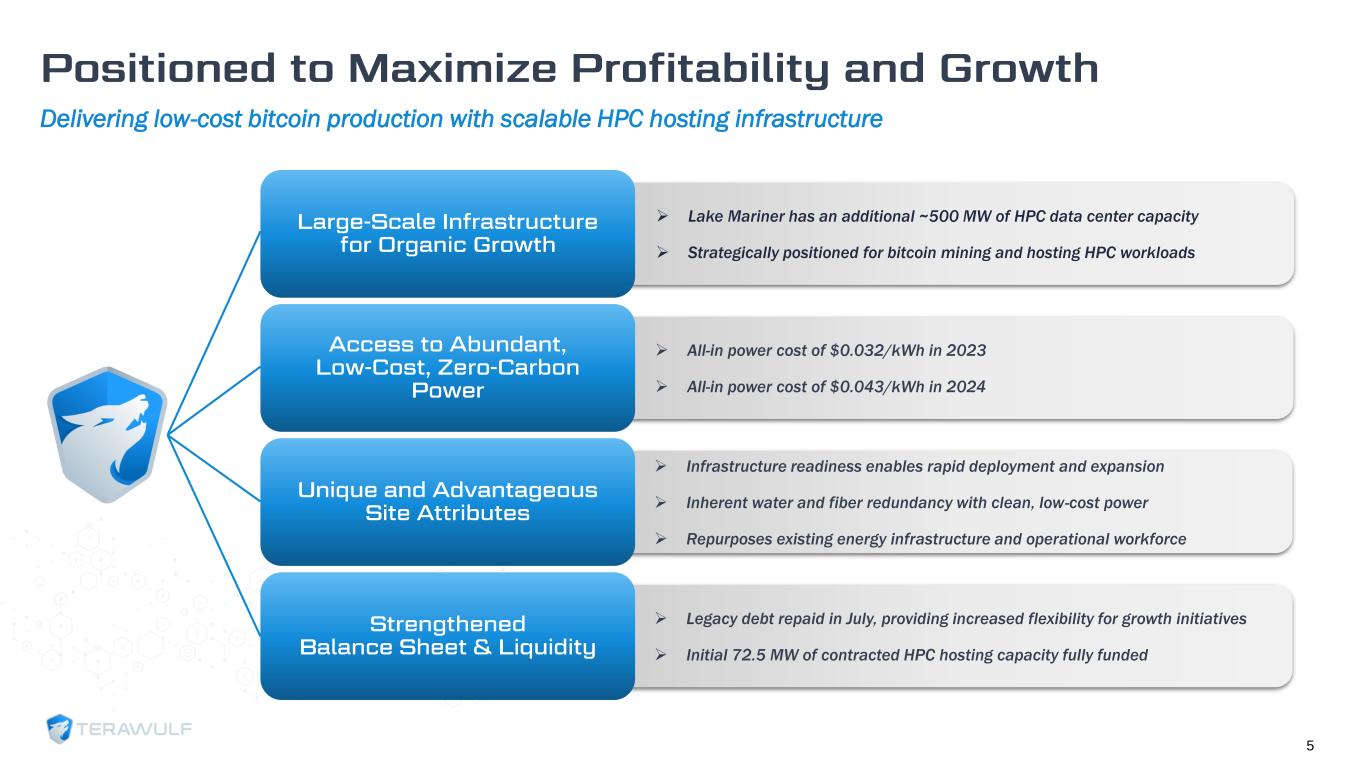

Delivering low-cost bitcoin production with scalable HPC hosting infrastructure ➢ Lake Mariner has an additional ~500 MW of HPC data center capacity ➢ Strategically positioned for bitcoin mining and hosting HPC workloads ➢ All-in power cost of $0.032/kWh in 2023 ➢ All-in power cost of $0.043/kWh in 2024 ➢ Infrastructure readiness enables rapid deployment and expansion ➢ Inherent water and fiber redundancy with clean, low-cost power ➢ Repurposes existing energy infrastructure and operational workforce ➢ Legacy debt repaid in July, providing increased flexibility for growth initiatives ➢ Initial 72.5 MW of contracted HPC hosting capacity fully funded 5

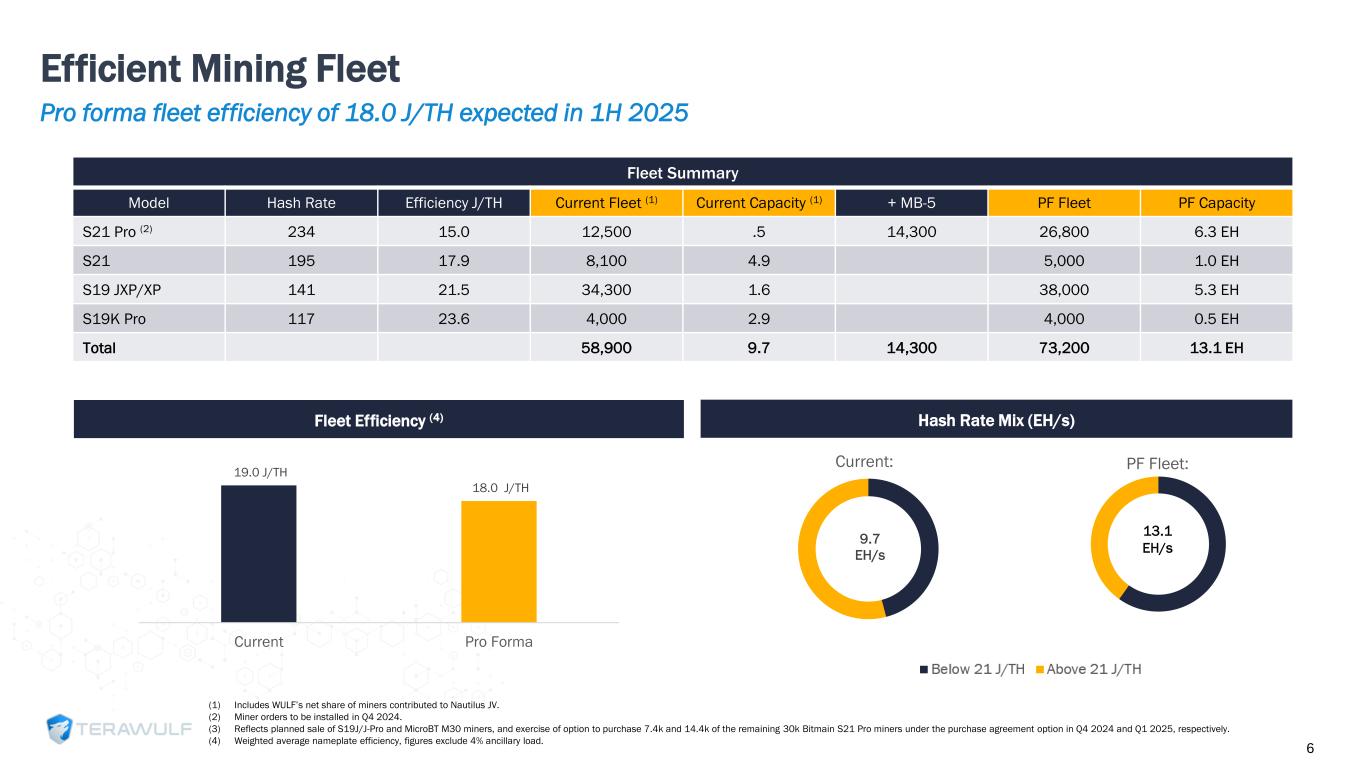

Efficient Mining Fleet (1) Includes WULF’s net share of miners contributed to Nautilus JV. (2) Miner orders to be installed in Q4 2024. (3) Reflects planned sale of S19J/J-Pro and MicroBT M30 miners, and exercise of option to purchase 7.4k and 14.4k of the remaining 30k Bitmain S21 Pro miners under the purchase agreement option in Q4 2024 and Q1 2025, respectively. (4) Weighted average nameplate efficiency, figures exclude 4% ancillary load. Fleet Summary Model Hash Rate Efficiency J/TH Current Fleet (1) Current Capacity (1) + MB-5 PF Fleet PF Capacity S21 Pro (2) 234 15.0 12,500 .5 14,300 26,800 6.3 EH S21 195 17.9 8,100 4.9 5,000 1.0 EH S19 JXP/XP 141 21.5 34,300 1.6 38,000 5.3 EH S19K Pro 117 23.6 4,000 2.9 4,000 0.5 EH Total 58,900 9.7 14,300 73,200 13.1 EH Fleet Efficiency (4) Hash Rate Mix (EH/s) 9.7 EH/s Current: PF Fleet: 13.1 EH/s 6 Pro forma fleet efficiency of 18.0 J/TH expected in 1H 2025 19.0 J/TH 18.0 J/TH Current Pro Forma

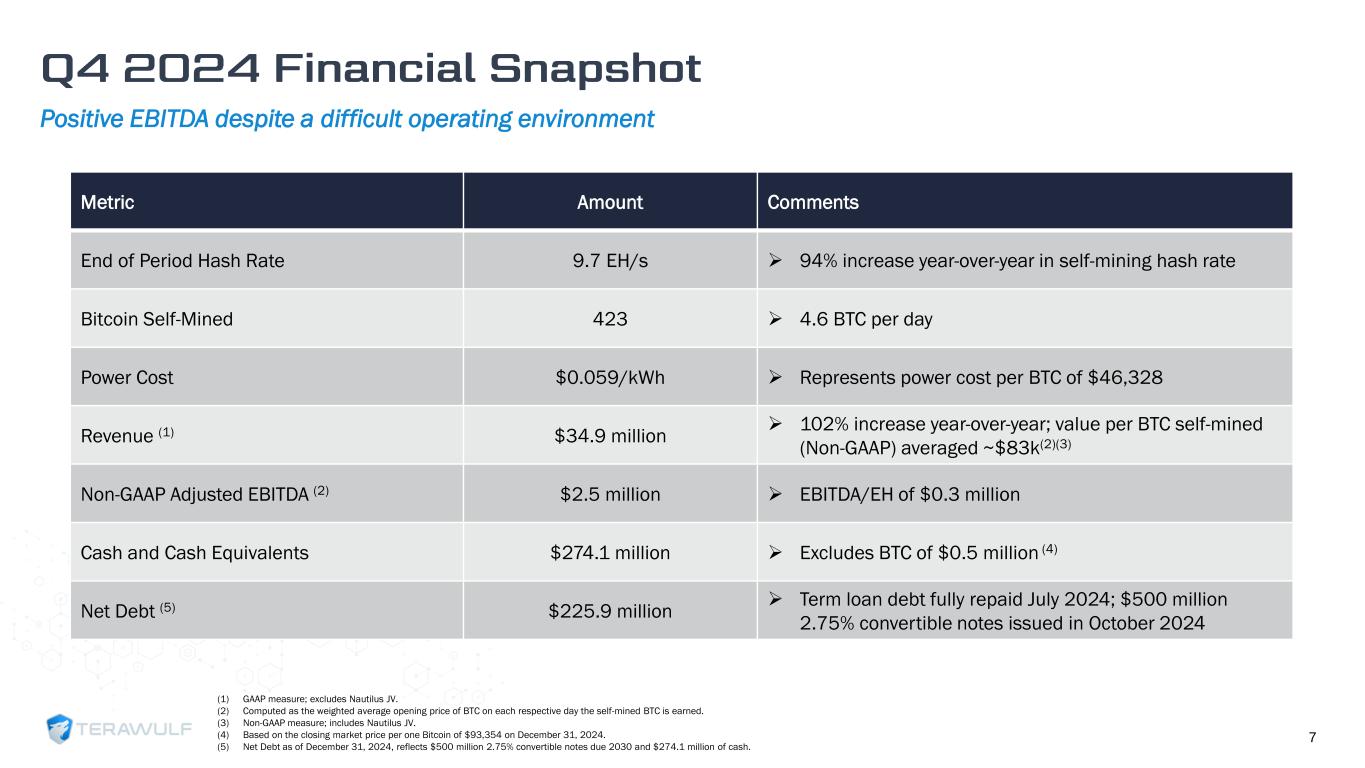

Positive EBITDA despite a difficult operating environment 7 Metric Amount Comments End of Period Hash Rate 9.7 EH/s ➢ 94% increase year-over-year in self-mining hash rate Bitcoin Self-Mined 423 ➢ 4.6 BTC per day Power Cost $0.059/kWh ➢ Represents power cost per BTC of $46,328 Revenue (1) $34.9 million ➢ 102% increase year-over-year; value per BTC self-mined (Non-GAAP) averaged ~$83k(2)(3) Non-GAAP Adjusted EBITDA (2) $2.5 million ➢ EBITDA/EH of $0.3 million Cash and Cash Equivalents $274.1 million ➢ Excludes BTC of $0.5 million (4) Net Debt (5) $225.9 million ➢ Term loan debt fully repaid July 2024; $500 million 2.75% convertible notes issued in October 2024 (1) GAAP measure; excludes Nautilus JV. (2) Computed as the weighted average opening price of BTC on each respective day the self-mined BTC is earned. (3) Non-GAAP measure; includes Nautilus JV. (4) Based on the closing market price per one Bitcoin of $93,354 on December 31, 2024. (5) Net Debt as of December 31, 2024, reflects $500 million 2.75% convertible notes due 2030 and $274.1 million of cash.

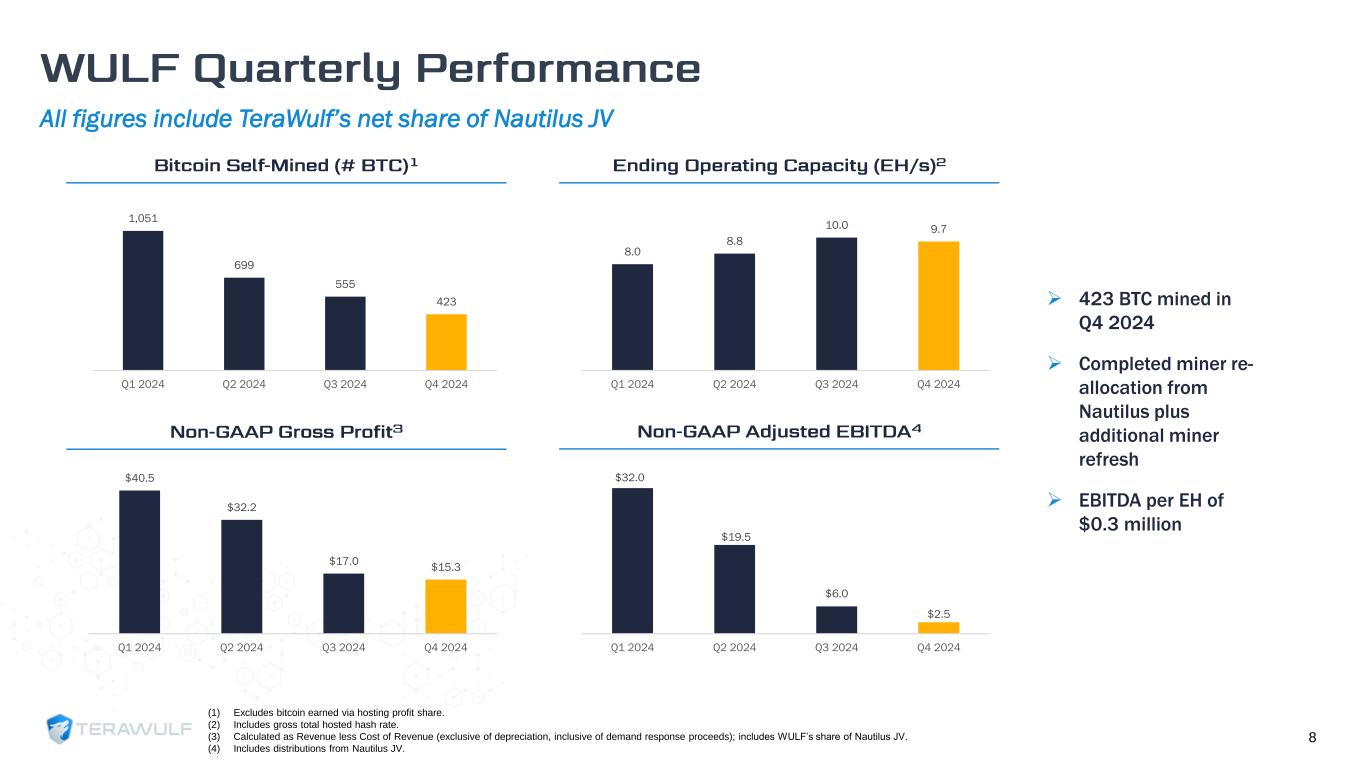

All figures include TeraWulf’s net share of Nautilus JV 8 1,051 699 555 423 Q1 2024 Q2 2024 Q3 2024 Q4 2024 8.0 8.8 10.0 9.7 Q1 2024 Q2 2024 Q3 2024 Q4 2024 $40.5 $32.2 $17.0 $15.3 Q1 2024 Q2 2024 Q3 2024 Q4 2024 $32.0 $19.5 $6.0 $2.5 Q1 2024 Q2 2024 Q3 2024 Q4 2024 (1) Excludes bitcoin earned via hosting profit share. (2) Includes gross total hosted hash rate. (3) Calculated as Revenue less Cost of Revenue (exclusive of depreciation, inclusive of demand response proceeds); includes WULF’s share of Nautilus JV. (4) Includes distributions from Nautilus JV. ➢ 423 BTC mined in Q4 2024 ➢ Completed miner re- allocation from Nautilus plus additional miner refresh ➢ EBITDA per EH of $0.3 million

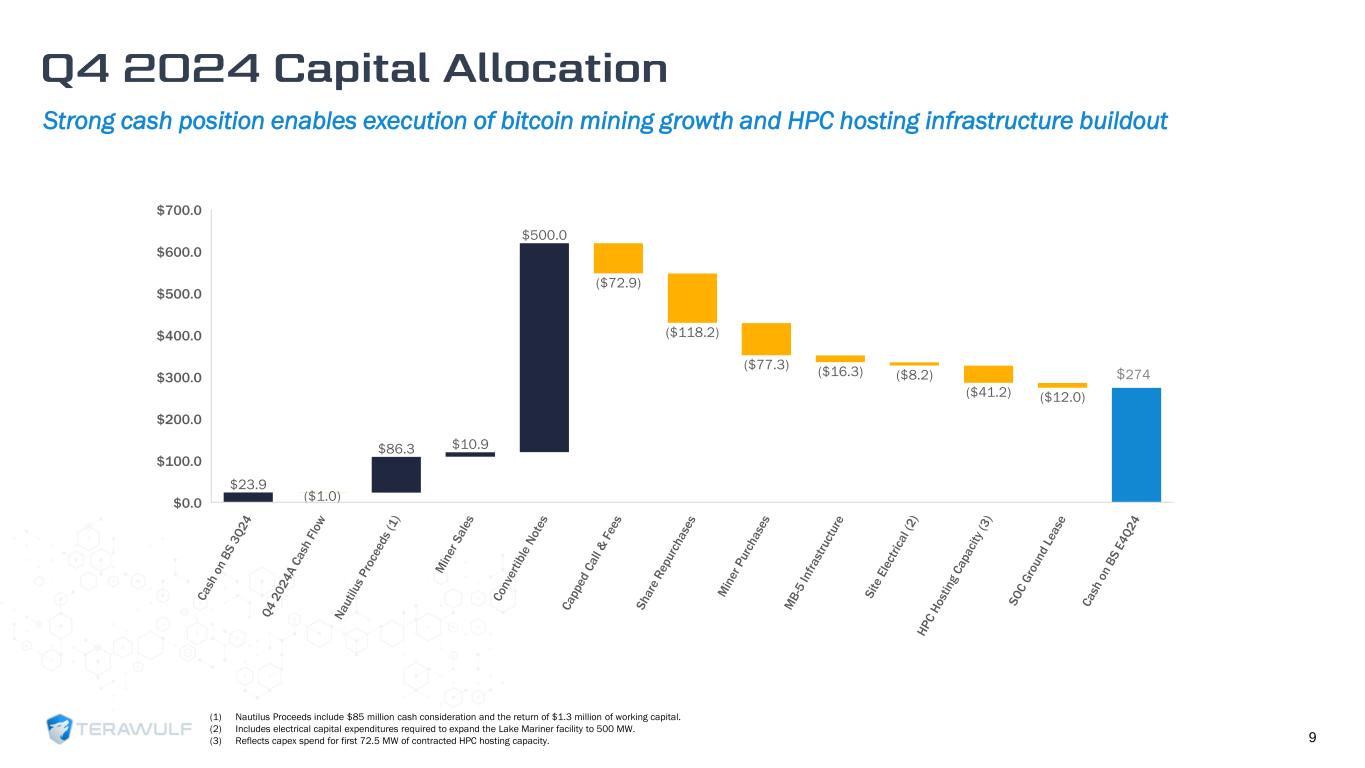

Strong cash position enables execution of bitcoin mining growth and HPC hosting infrastructure buildout 9 (1) Nautilus Proceeds include $85 million cash consideration and the return of $1.3 million of working capital. (2) Includes electrical capital expenditures required to expand the Lake Mariner facility to 500 MW. (3) Reflects capex spend for first 72.5 MW of contracted HPC hosting capacity. $23.9 ($1.0) $86.3 $10.9 $500.0 ($72.9) ($118.2) ($77.3) ($16.3) ($8.2) ($41.2) ($12.0) $0.0 $100.0 $200.0 $300.0 $400.0 $500.0 $600.0 $700.0 $274

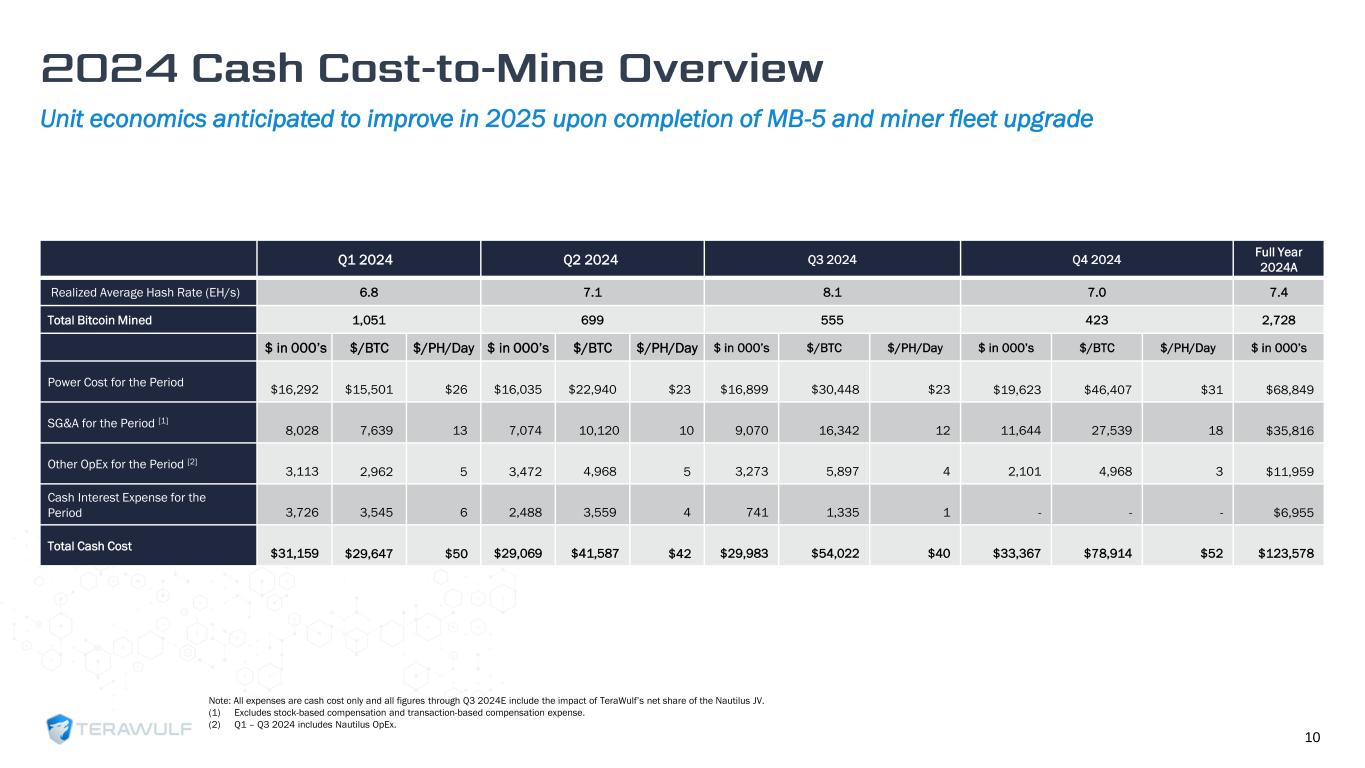

Unit economics anticipated to improve in 2025 upon completion of MB-5 and miner fleet upgrade 10 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Full Year 2024A Realized Average Hash Rate (EH/s) 6.8 7.1 8.1 7.0 7.4 Total Bitcoin Mined 1,051 699 555 423 2,728 $ in 000’s $/BTC $/PH/Day $ in 000’s $/BTC $/PH/Day $ in 000’s $/BTC $/PH/Day $ in 000’s $/BTC $/PH/Day $ in 000’s Power Cost for the Period $16,292 $15,501 $26 $16,035 $22,940 $23 $16,899 $30,448 $23 $19,623 $46,407 $31 $68,849 SG&A for the Period [1] 8,028 7,639 13 7,074 10,120 10 9,070 16,342 12 11,644 27,539 18 $35,816 Other OpEx for the Period [2] 3,113 2,962 5 3,472 4,968 5 3,273 5,897 4 2,101 4,968 3 $11,959 Cash Interest Expense for the Period 3,726 3,545 6 2,488 3,559 4 741 1,335 1 - - - $6,955 Total Cash Cost $31,159 $29,647 $50 $29,069 $41,587 $42 $29,983 $54,022 $40 $33,367 $78,914 $52 $123,578 Note: All expenses are cash cost only and all figures through Q3 2024E include the impact of TeraWulf’s net share of the Nautilus JV. (1) Excludes stock-based compensation and transaction-based compensation expense. (2) Q1 – Q3 2024 includes Nautilus OpEx.

11

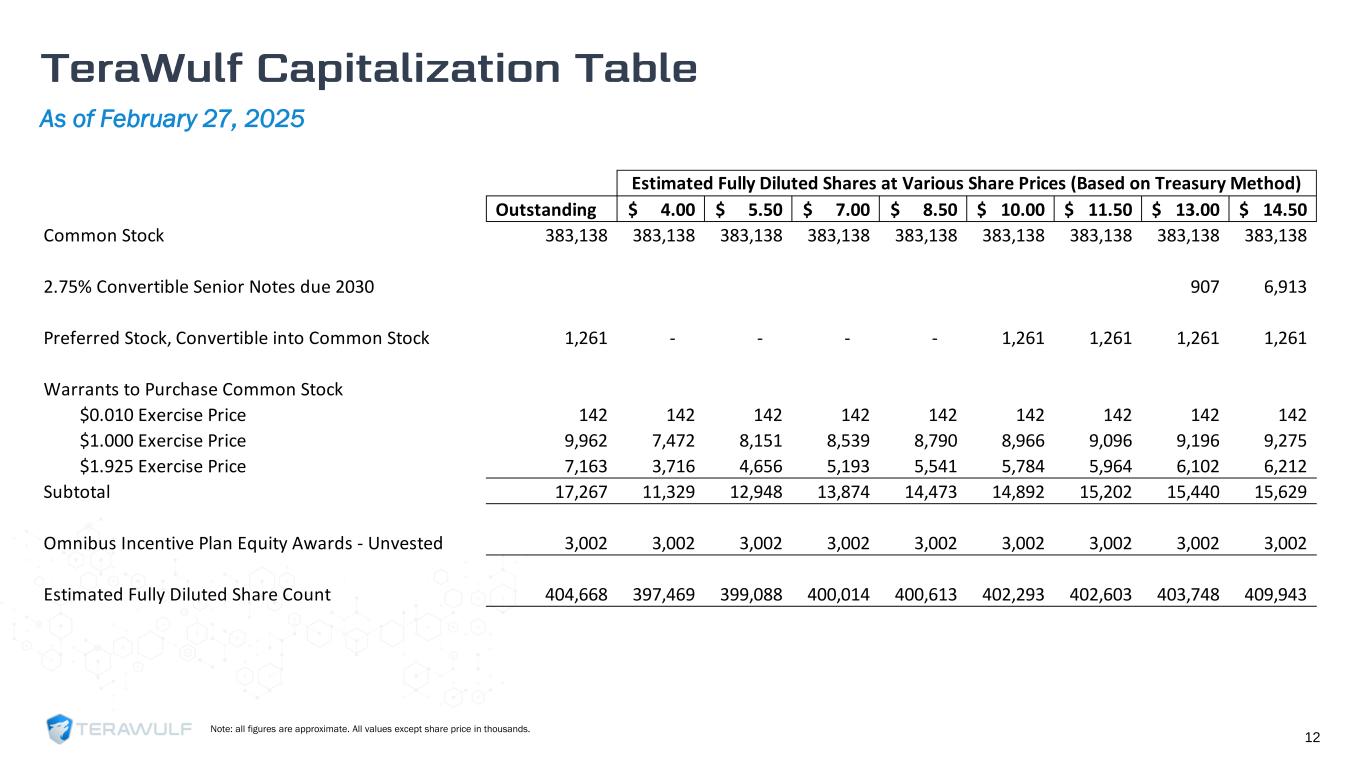

As of February 27, 2025 12 Note: all figures are approximate. All values except share price in thousands. Outstanding 4.00$ 5.50$ 7.00$ 8.50$ 10.00$ 11.50$ 13.00$ 14.50$ Common Stock 383,138 383,138 383,138 383,138 383,138 383,138 383,138 383,138 383,138 2.75% Convertible Senior Notes due 2030 907 6,913 Preferred Stock, Convertible into Common Stock 1,261 - - - - 1,261 1,261 1,261 1,261 Warrants to Purchase Common Stock $0.010 Exercise Price 142 142 142 142 142 142 142 142 142 $1.000 Exercise Price 9,962 7,472 8,151 8,539 8,790 8,966 9,096 9,196 9,275 $1.925 Exercise Price 7,163 3,716 4,656 5,193 5,541 5,784 5,964 6,102 6,212 Subtotal 17,267 11,329 12,948 13,874 14,473 14,892 15,202 15,440 15,629 Omnibus Incentive Plan Equity Awards - Unvested 3,002 3,002 3,002 3,002 3,002 3,002 3,002 3,002 3,002 Estimated Fully Diluted Share Count 404,668 397,469 399,088 400,014 400,613 402,293 402,603 403,748 409,943 Estimated Fully Diluted Shares at Various Share Prices (Based on Treasury Method)

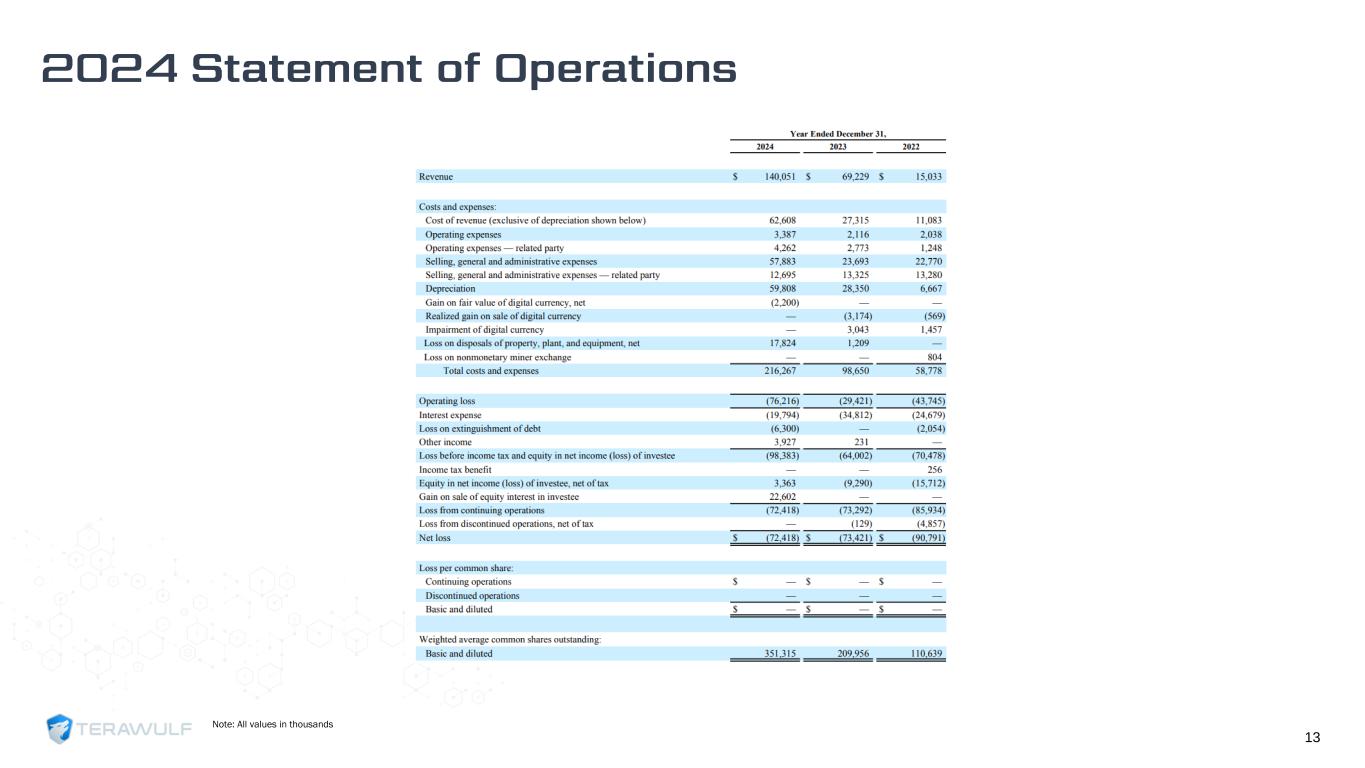

13 Note: All values in thousands

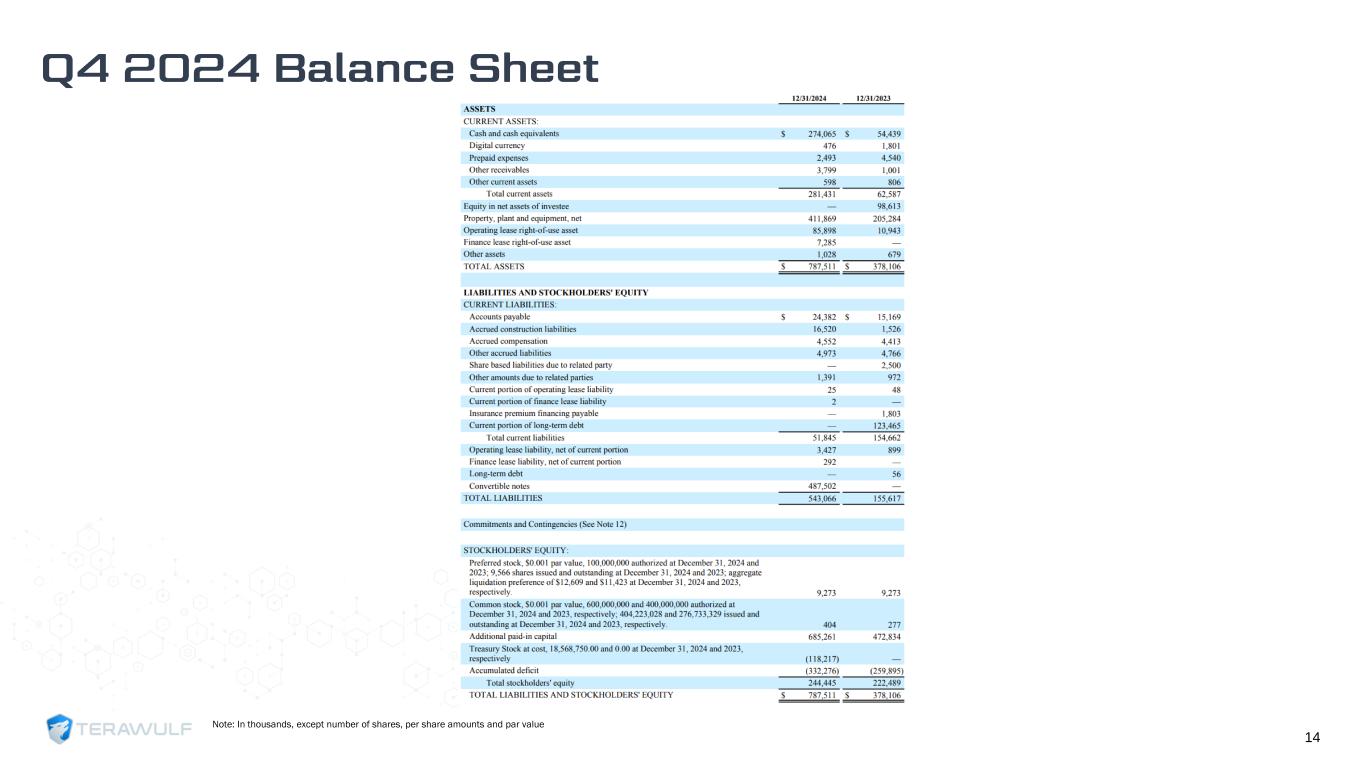

14 Note: In thousands, except number of shares, per share amounts and par value

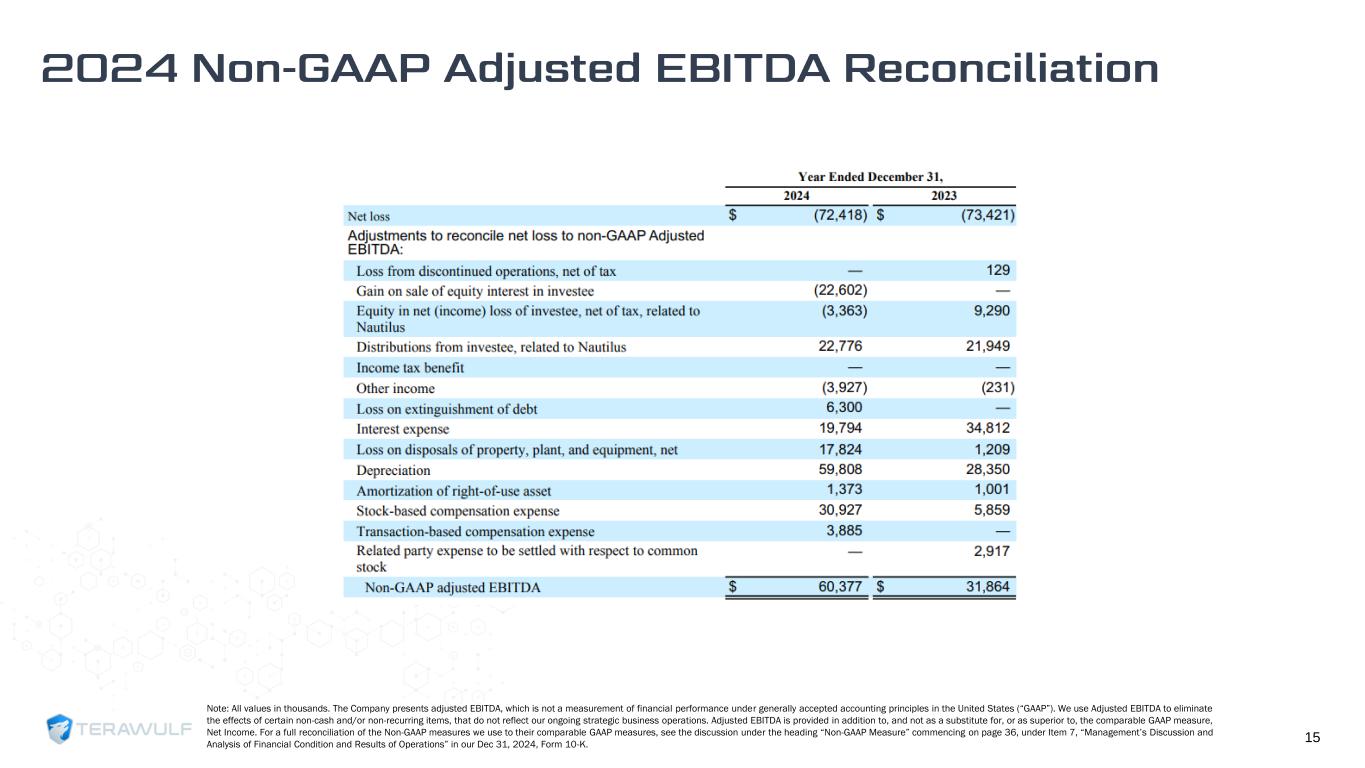

15 Note: All values in thousands. The Company presents adjusted EBITDA, which is not a measurement of financial performance under generally accepted accounting principles in the United States (“GAAP”). We use Adjusted EBITDA to eliminate the effects of certain non-cash and/or non-recurring items, that do not reflect our ongoing strategic business operations. Adjusted EBITDA is provided in addition to, and not as a substitute for, or as superior to, the comparable GAAP measure, Net Income. For a full reconciliation of the Non-GAAP measures we use to their comparable GAAP measures, see the discussion under the heading “Non-GAAP Measure” commencing on page 36, under Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Dec 31, 2024, Form 10-K.