Execution Version MEMBERSHIP INTEREST PURCHASE AGREEMENT by and among Beowulf E&D Holdings Inc., as Seller, TeraCub Inc. as Buyer and TeraWulf Inc. Dated as of May 21, 2025

- i - TABLE OF CONTENTS Page ARTICLE 1 DEFINITIONS AND CONSTRUCTION ............................................................................... 1 1.1 Specific Definitions ...................................................................................................................... 1 1.2 Construction................................................................................................................................ 12 ARTICLE 2 PURCHASE AND SALE OF MEMBERSHIP INTERESTS ............................................... 13 2.1 Purchase and Sale ....................................................................................................................... 13 2.2 Purchase Price; Payment of Purchase Price ................................................................................ 13 2.3 Change of Control Consideration ............................................................................................... 13 2.4 Withholding ................................................................................................................................ 13 ARTICLE 3 CLOSING; CLOSING DELIVERIES ................................................................................... 14 3.1 Closing ........................................................................................................................................ 14 3.2 Buyer’s Closing Deliveries ......................................................................................................... 14 3.3 Seller’s Closing Deliveries ......................................................................................................... 15 ARTICLE 4 POST-CLOSING PURCHASE PRICE ADJUSTMENT ...................................................... 16 4.1 Adjustment Statement ................................................................................................................. 16 4.2 Review and Dispute .................................................................................................................... 16 4.3 Resolution of Dispute ................................................................................................................. 16 4.4 Accounting Firm ......................................................................................................................... 16 4.5 Accounting Firm Determination ................................................................................................. 16 4.6 Aggregated Adjustments ............................................................................................................ 17 4.7 Downward Adjustment ............................................................................................................... 17 4.8 Upward Adjustment .................................................................................................................... 18 ARTICLE 5 REPRESENTATIONS AND WARRANTIES OF SELLER ................................................ 18 5.1 Organization, Authority, Validity and Non-Contravention ........................................................ 18 5.2 No Adverse Order or Injunctions ............................................................................................... 19 5.3 Solvency ..................................................................................................................................... 19 5.4 Third Party Consents .................................................................................................................. 19 5.5 Brokers........................................................................................................................................ 19 5.6 Compliance with Laws ............................................................................................................... 19 ARTICLE 6 REPRESENTATIONS AND WARRANTIES WITH RESPECT TO THE ACQUIRED COMPANIES ........................................................................................................................ 19 6.1 Organization and Authority ........................................................................................................ 19 6.2 Membership Interests ................................................................................................................. 20 6.3 Books and Records ..................................................................................................................... 20 6.4 No Order or Injunctions .............................................................................................................. 20

- ii - 6.5 Solvency ..................................................................................................................................... 20 6.6 Litigation .................................................................................................................................... 20 6.7 No Conflicts ................................................................................................................................ 20 6.8 Acquired Company Assets ......................................................................................................... 21 6.9 Real Property .............................................................................................................................. 21 6.10 No Undisclosed Liabilities ......................................................................................................... 22 6.11 Tax Matters ................................................................................................................................. 22 6.12 Material Contracts ...................................................................................................................... 24 6.13 Legal Compliance ....................................................................................................................... 24 6.14 Intellectual Property ................................................................................................................... 25 6.15 Insurance ..................................................................................................................................... 25 6.16 Employees .................................................................................................................................. 25 6.17 Benefit Plans ............................................................................................................................... 25 6.18 Financial Statements ................................................................................................................... 27 6.19 No Other Representations and Warranties ................................................................................. 28 ARTICLE 7 REPRESENTATIONS AND WARRANTIES OF BUYER AND TERAWULF ................. 28 7.1 Organization, Authority, Validity and Non-Contravention of Buyer ......................................... 28 7.2 Organization, Authority, Validity and Non-Contravention of TeraWulf ................................... 29 7.3 No Adverse Order or Injunctions ............................................................................................... 29 7.4 Solvency ..................................................................................................................................... 30 7.5 Third Party Consents .................................................................................................................. 30 7.6 Sufficiency of Funds; Common Stock ........................................................................................ 30 7.7 Independent Investigation ........................................................................................................... 30 7.8 Brokers........................................................................................................................................ 30 7.9 Forward Looking Information .................................................................................................... 31 7.10 Compliance with Laws ............................................................................................................... 31 7.11 Investment .................................................................................................................................. 31 ARTICLE 8 COVENANTS AND AGREEMENTS OF THE PARTIES .................................................. 31 8.1 Confidential Information ............................................................................................................ 31 8.2 Public Announcements ............................................................................................................... 32 8.3 Books and Records; Post-Closing Access to Certain Information ............................................. 32 8.4 Privileged Matters ....................................................................................................................... 33 8.5 Earnout Consideration; Registration Rights Agreement ............................................................ 34 8.6 Director and Officer Indemnification ......................................................................................... 34 8.7 Employees; Employee Benefits .................................................................................................. 35 8.8 Right to use “Beowulf” Name. ................................................................................................... 36

- iii - 8.9 Further Assurances ..................................................................................................................... 36 ARTICLE 9 INDEMNIFICATION ............................................................................................................ 37 9.1 Indemnity by Seller .................................................................................................................... 37 9.2 Indemnity by Buyer .................................................................................................................... 37 9.3 Survival ....................................................................................................................................... 37 9.4 Limitation of Liability ................................................................................................................ 38 9.5 Exclusive Remedy ...................................................................................................................... 38 9.6 Indemnification Procedures ........................................................................................................ 39 9.7 Subrogation ................................................................................................................................. 40 9.8 Mitigation ................................................................................................................................... 40 9.9 Recoveries .................................................................................................................................. 40 9.10 Tax Treatment ............................................................................................................................. 40 9.11 Buyer and TeraWulf Joint and Several Liability ........................................................................ 41 ARTICLE 10 TAX MATTERS .................................................................................................................. 41 10.1 Tax Treatment ............................................................................................................................. 41 10.2 Allocation ................................................................................................................................... 41 10.3 Tax Returns................................................................................................................................. 42 10.4 Tax Contest ................................................................................................................................. 43 10.5 Cooperation ................................................................................................................................ 43 10.6 Transfer Taxes ............................................................................................................................ 44 10.7 Straddle Periods .......................................................................................................................... 44 10.8 Tax Refunds ................................................................................................................................ 44 ARTICLE 11 MISCELLANEOUS ............................................................................................................ 45 11.1 Successors and Assigns .............................................................................................................. 45 11.2 Notices ........................................................................................................................................ 45 11.3 Waiver ........................................................................................................................................ 46 11.4 Entire Agreement; Amendments; Attachments .......................................................................... 46 11.5 Severability ................................................................................................................................. 46 11.6 Governing Law; Jurisdiction ...................................................................................................... 46 11.7 Section Headings ........................................................................................................................ 47 11.8 Counterparts................................................................................................................................ 47 11.9 No Third Party Beneficiaries ...................................................................................................... 47 11.10 No Joint Venture ......................................................................................................................... 47 11.11 Costs ........................................................................................................................................... 47 11.12 Specific Performance .................................................................................................................. 47

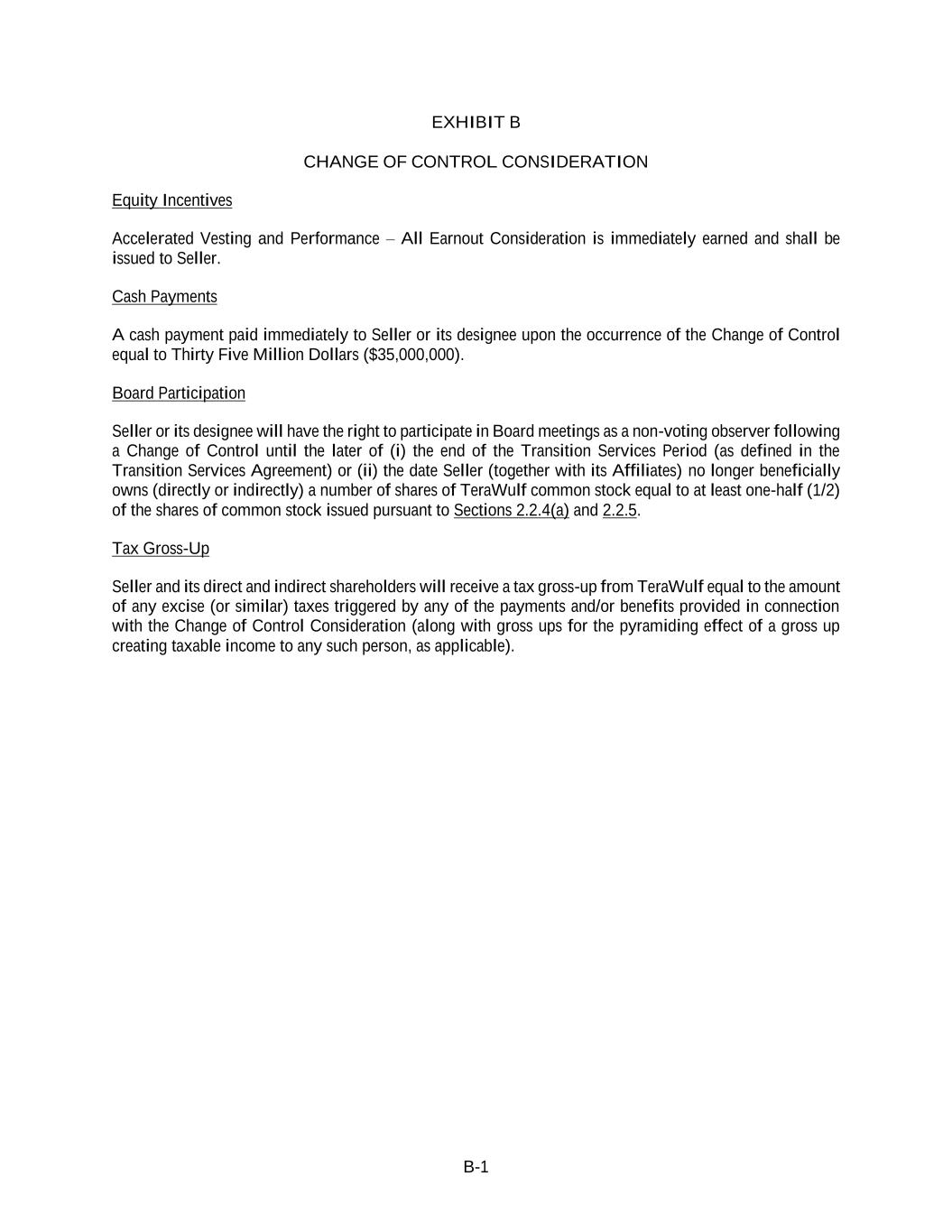

- iv - Exhibits Exhibit A Form of Assignment of Membership Interests Exhibit B Change of Control Consideration Schedules SCHEDULE A Seller’s Disclosure Schedules: SCHEDULE B Buyer’s Disclosure Schedules: APPENDIX 1 Closing Statement

- 1 - MEMBERSHIP INTEREST PURCHASE AGREEMENT This MEMBERSHIP INTEREST PURCHASE AGREEMENT (this “Agreement”), dated as of May 21, 2025 (the “Effective Date”), is made by and among Beowulf E&D Holdings Inc., a Delaware corporation (“Seller”), TeraCub Inc., a Delaware corporation (“Buyer”), and TeraWulf Inc. (“TeraWulf”). Buyer, TeraWulf and Seller may each be referred to herein as a “Party”, and collectively as the “Parties”. RECITALS WHEREAS, Beowulf Electricity & Data LLC, a Delaware limited liability company (“Beowulf E&D”) is a subsidiary of Seller and owns certain Assets material to Seller’s business; WHEREAS Beowulf E&D (MD) LLC, a Delaware limited liability company (“Beowulf E&D (MD)”) is a subsidiary of Seller and owns certain Assets material to Seller’s business; WHEREAS, Beowulf E&D (NY) LLC, a Delaware limited liability company (“Beowulf E&D (NY),” and together with Beowulf E&D and Beowulf E&D (MD), the “Acquired Companies” and each individually, an “Acquired Company”) is a subsidiary of Seller and owns certain Assets material to Seller’s business; WHEREAS, Seller owns, beneficially and of record (i) 100% of the issued and outstanding membership interests of Beowulf E&D, (ii) 100% of the issued and outstanding membership interests of Beowulf E&D (MD) and (iii) 100% of the issued and outstanding membership interests of Beowulf E&D (NY) (collectively the “Membership Interests”); and WHEREAS, Seller desires to sell, and Buyer desires to purchase, on the terms and subject to the conditions of this Agreement, all of the Membership Interests. NOW, THEREFORE, in consideration of the foregoing recitals, which are incorporated herein, and of the mutual promises and covenants contained in this Agreement, the adequacy and sufficiency of which are hereby acknowledged, the Parties agree as follows: ARTICLE 1 DEFINITIONS AND CONSTRUCTION 1.1 Specific Definitions. As used in this Agreement, the following terms shall have the meaning ascribed to them below: “Accounting Firm” shall mean a national accounting firm of recognized standing. “Acquired Company” or “Acquired Companies” shall have the meaning given to it in the recitals. “Action” shall mean any action, cause of action, lawsuit, arbitration, proceeding, hearing or litigation of any nature, including civil, criminal, administrative, regulatory or otherwise, whether at law or in equity. “Adjustment Statement” shall have the meaning given to it in Section 0. “Affiliate” shall mean, with respect to any Person, any other Person which directly or indirectly controls, is controlled by or is under common control with such Person. As used in this definition, “control” (including, its correlative meaning “controlled by” and “under common control with”) shall mean

- 2 - possession, directly or indirectly, of power to direct or cause the direction of management or policies (whether through ownership of fifty percent (50%) or more of outstanding voting securities or partnership or other ownership interests, by Contract or otherwise). For the avoidance of doubt: (i) TeraWulf, Buyer and their respective direct and indirect subsidiaries, on one hand, and Seller and its direct and indirect parent companies and owners, and their respective subsidiaries, on the other hand, shall not be deemed “Affiliates” of each other for purposes of this Agreement or any other Transaction Document; and (ii) the Acquired Companies are Affiliates of Seller prior to Closing and Affiliates of Buyer and TeraWulf as of and following Closing. “Agreement” shall have the meaning given to it in the Preamble. “Allocation” shall have the meaning given to it in Section 0. “Allocation Statement” shall have the meaning given to it in Section 0. “Applicable Law” shall mean all applicable foreign, federal, state, local, county or municipal laws, statutes, codes, acts, treaties, ordinances, orders, judgments, writs, decrees, injunctions, rules, regulations, Permits and requirements (including Environmental Laws) of all Governmental Authorities. “Assets” shall mean, with respect to any Person, all right, title and interest of such Person in and to material assets and rights of any kind, whether tangible or intangible, real or personal, including land and properties (or interests therein, including rights of way, leaseholds and easements), any property tax abatements and value limitation agreements, buildings, equipment, machinery, improvements, fixtures, Contracts, data center development pipeline, reports and studies, rights under or pursuant to all warranties, cash, accounts receivable, deposits and prepaid expenses. Notwithstanding anything to the contrary herein, an Acquired Company’s Assets do not include any rights that it may have in its project development pipeline in Maryland, Montana or with respect to assets owned by any Affiliate of Seller. “Assignment of Membership Interests” shall mean that certain Assignment of Membership Interests of the Acquired Companies, to be dated as of the Closing Date, by and between Seller and Buyer, in the form attached hereto as Exhibit A. “Benefit Plan” means an “employee benefit plan” (as defined in Section 3(3) of ERISA), and any other plan, policy, program, agreement or arrangement providing for compensation or benefits, including, without limitation, bonuses, stock options, equity or equity-based or incentive compensation, retirement savings, profit-sharing, deferred compensation, life insurance, medical, dental, vision, life insurance, disability, welfare or fringe benefits, change of control, retention, employment, severance, or vacation pay, whether or not subject to ERISA, whether funded or unfunded, written or unwritten, insured or self-insured, which is maintained, sponsored, contributed to, or required to be contributed to, by Seller or an Acquired Company or any of its ERISA Affiliates for the benefit of any Relevant Service Provider (or their respective dependents or beneficiaries) or under which an Acquired Company has any Liability. “Beowulf E&D” shall have the meaning given to it in the recitals. “Beowulf E&D (MD)” shall have the meaning given to it in the recitals. “Beowulf E&D (NY)” shall have the meaning given to it in the recitals. “Books and Records” shall mean, (i) to the extent existing, with respect to any limited liability company, minute books, membership interest certificates (if any), membership interest transfer ledgers and Organizational Documents of the applicable limited liability company since the day of its formation as a

- 3 - limited liability company, and (ii) as the context requires, any books and records retained by the Acquired Companies with respect to the business and operations of TeraWulf and its subsidiaries. “Business Day” shall mean a day other than (i) Saturday, (ii) Sunday or (iii) a day on which national banks are not required or authorized by law or executive order to close in the State of New York. “Buyer” shall have the meaning given to it in the Preamble. “Buyer 401(k) Plan” has the meaning given to it in Section 0. “Buyer Ancillary Agreements” shall mean all agreements, certificates, instruments and documents being or to be executed and delivered by Buyer or an Affiliate of Buyer under this Agreement or in connection with the Transactions, including the Assignment of Membership Interests. “Buyer Confidential Information” shall have the meaning given to it in Section 0. “Buyer Consents” shall have the meaning given to it in Section 0. “Buyer’s Disclosure Schedules” shall mean the disclosure schedules delivered by Buyer to Seller, which are attached hereto as Schedule B. “Buyer Indemnified Party” shall have the meaning given to it in Section 0. “Buyer Plans” has the meaning given to it in Section 0. “Buyer Prepared Tax Return” shall have the meaning given to it in Section 0. “Buyer Welfare Plans” has the meaning given to it in Section 0. “Cap” shall have the meaning given to it in Section 0. “Cash Closing Payment” shall have the meaning given to it in Section 0. “CB-1 Project” shall mean that certain data center development project referred to as CB-1 and located at the Lake Mariner site located in the Town of Somerset, County of Niagara, New York. “CB-1 Earnout Consideration” shall have the meaning given to it in Section 0. “CB-1 Earnout Milestone” shall mean the date on which the breakers to the busway which energizes the data hall for the CB-1 Project are closed. “CB-2 Project” shall mean that certain data center development project referred to as CB-2 and located at the Lake Mariner site located in the Town of Somerset, County of Niagara, New York. “CB-3 Project” shall mean that certain data center development project referred to as CB-3 and located at the Lake Mariner site located in the Town of Somerset, County of Niagara, New York. “CB-3 Earnout Consideration” shall have the meaning given to it in Section 0. “CB-3 Earnout Milestone” shall mean the execution by TeraWulf and/or any of its subsidiaries of a data center lease for the CB-3 Project.

- 4 - “Change of Control” means, (a) if the Ultimate Seller Parent ceases to be the Chief Executive Officer of TeraWulf, other than as a result of his voluntary resignation (which, for avoidance of doubt, does not include a resignation for “Good Reason” as defined in Ultimate Seller Parent’s employment agreement), or (b) if a Person that is not currently a five percent (5%) or greater equityholder of TeraWulf acquires a majority of the voting power of the issued and outstanding Common Stock. “Change of Control Consideration” shall mean the consideration set forth on Exhibit B hereto. “Claim” shall have the meaning given to it in Section 0. “Claim Notice” shall have the meaning given to it in Section 0. “Closing” shall have the meaning given to it in Section 0. “Closing Common Stock” shall have the meaning given to it in Section 0. “Closing Date” shall mean the date of the Closing, which shall be the Effective Date. “Closing Indebtedness” shall mean the calculation of the aggregate amount of Indebtedness of the Acquired Companies outstanding as of immediately prior to the Closing. “Closing Statement” shall mean the statement mutually prepared and agreed by the Parties in the form attached hereto as Appendix 1 and delivered pursuant to Section 0 setting forth the (i) estimated Net Working Capital, (ii) Closing Indebtedness and (iii) Closing Transaction Expenses. “Closing Transaction Expenses” shall mean the calculation of the aggregate amount of unpaid Transaction Expenses as of immediately prior to the Closing. “Code” shall mean the United States Internal Revenue Code of 1986, as amended. “Common Stock” shall mean the common stock, par value $0.001 per share of TeraWulf. “Consent” shall mean any consent, material approval, material authorization, waiver, license, registration, declaration, qualification, filing or notice. “Contract” shall mean any legally binding contract, agreement, license, sublicense, purchase agreement, security agreement, guarantee, option, right of first refusal, or other arrangement or agreement, in each case whether oral or written, including any amendments and other modifications thereto. “Data Room” shall mean all documents and materials posted to the Ideals Virtual Data Room to which Buyer and its Representatives have been provided access. “Deductible” shall have the meaning given to it in Section 0. “Disclosure Schedules” or “Schedules” shall mean either Buyer’s Disclosure Schedules or Seller’s Disclosure Schedules, as the context requires. “Downward Adjustment Amount” shall have the meaning given to it in Section 0. “Earnout Milestone” shall mean each of the CB-1 Earnout Milestone, the CB-3 Earnout Milestone and the Project Financing Closing.

- 5 - “Earnout Consideration” shall mean the CB-3 Earnout Consideration, CB-1 Earnout Consideration and the Project Financing Consideration. “Effective Date” shall have the meaning given to it in the preamble. “Eligible Employee Trust” shall mean the grantor trust established by TeraWulf on the Effective Date pursuant to that certain Employee B Discretionary Trust Agreement and administered by a third-party trustee for the benefit of certain individuals that were employed by, or provided services to, an Acquired Company or its Affiliates, as defined therein. “Employee” shall have the meaning given to it in Section 0. “Environmental Laws” shall mean all Applicable Laws (including rules, regulations, codes, plans, injunctions, judgments, orders, ordinances, decrees, rulings and charges thereunder) of Governmental Authorities (and all agencies thereof) concerning pollution or protection of health, natural resources, flora, fauna, wildlife, historic resources or the environment, including laws relating to emissions, discharges, Releases, or threatened Releases of pollutants, contaminants or toxic or hazardous substances, wastes or materials or petroleum products into the air, surface water, ground water, lands or subsurface, or otherwise relating to the manufacture, processing, distribution, use, treatment, storage, disposal, transport, or handling of Hazardous Materials, including the Comprehensive Environmental Response, Compensation and Liability Act, the Resource Conservation and Recovery Act, the Clean Air Act, Endangered Species Act, National Environmental Policy Act, National Historic Preservation Act, and the Clean Water Act, each as amended, and any analogous state or local laws and regulations. “ERISA” shall mean the Employee Retirement Income Security Act of 1974, as amended. “ERISA Affiliate” means any Person, trade or business that is treated as a single employer or under common control with an Acquired Company for purposes of Section 414(b), (c), (m) or (o) of the Code. “Final Indebtedness” shall have the meaning given to it in Section 0. “Final Net Working Capital” shall have the meaning given to it in Section 0. “Final Transaction Expenses” shall have the meaning given to it in Section 0. “Fraud” shall mean any intentional misrepresentation of a material fact or concealment of a material fact by a Party, with the intent to deceive and mislead the other Party and upon which such other Party has reasonably relied and suffered damages as a result of such reasonable reliance (and does not include any fraud claim based on constructive knowledge, negligent misrepresentation, recklessness or a similar theory or any equitable fraud, promissory fraud or unfair dealing fraud). “Fundamental Indemnity Period” shall have the meaning set forth in Section 0. “Fundamental Representations” shall mean the representations and warranties set forth in Section 0 (Organization, Authority, Validity and Non-Contravention), Section 0 (Brokers), Section 0 (Organization and Authority), Section 0 (Membership Interests), and Section 0 (Organization, Authority, Validity and Non-Contravention of Buyer). “GAAP” shall mean the generally accepted accounting principles in the United States of America, as in effect from time to time, consistently applied.

- 6 - “Governmental Authority” shall mean any (i) federal, state, county, municipal or local government (whether domestic or foreign) or any political subdivision thereof, (ii) any court or administrative tribunal, (iii) any other governmental, quasi-governmental, regulatory, judicial, public or statutory instrumentality, authority, body, agency, bureau, taxing authority or entity of competent jurisdiction (including any self- regulatory organization, electric reliability organization, independent system operator or regional transmission operator)or (iv) any arbitrator with authority to bind a Party at law. “Hazardous Material” shall mean (i) any petroleum, petroleum constituents or petroleum products, flammable, ignitable, corrosive or explosive substances or materials, radioactive materials, biohazardous materials, asbestos in any form that is or could become friable, urea formaldehyde foam insulation and transformers or other equipment that contain dielectric fluid containing levels of polychlorinated biphenyls, (ii) any chemicals or other materials or substances which are defined as or included in the definition of “hazardous substances,” “hazardous wastes,” “hazardous materials,” “extremely hazardous wastes,” “restricted hazardous wastes,” “toxic substances,” “toxic pollutants” or words of similar import under any Environmental Law, and (iii) any other chemical or other material or substance, exposure to which is prohibited, limited or regulated by any Governmental Authority under any Environmental Law. “Income Tax Return” any Tax Return for Income Taxes. “Income Taxes” shall mean any income, franchise, or similar Taxes. “Indebtedness” of any Person shall mean any of the following, including any unpaid interest: (i) any indebtedness for borrowed money; (ii) any obligations to pay money evidenced by Liens, bonds, debentures, notes or other similar instruments; and (iii) any letters of credit or similar facilities. “Indebtedness Deficit” shall have the meaning given to it in Section 0. “Indebtedness Surplus” shall have the meaning given to it in Section 0. “Indemnified Party” shall have the meaning given to it in Section 0. “Indemnifying Party” shall have the meaning given to it in Section 0. “Indemnity Period” shall have the meaning given to it in Section 0. “Insurance Policies” shall have the meaning given to it in Section 0. “Intended Tax Treatment” shall have the meaning given to it in Section 0. “Lease Agreement” means that certain Amended and Restated Lease Agreement, by and between Somerset Operating Company, LLC, Riesling Power LLC, Lake Mariner Data LLC and TeraWulf Inc. “Liability” and “Liabilities” of any Person shall mean any Indebtedness, claim, commitment, obligation, duty, Losses, payable or liability of any nature (including any unknown, undisclosed, unmatured, unaccrued, unasserted, contingent, indirect, conditional, implied, vicarious, derivative, joint, several or secondary liability and including Tax) that would be required to be disclosed on a balance sheet prepared in accordance with GAAP. “Lien” shall mean any mortgage, deed of trust, lien, pledge, charge, security interest, claim, right of way, right of first refusal, judgment, encroachment, license, easement, restriction, reservation, assignment, or hypothecation, whether arising by Contract or under any Applicable Law and whether or

- 7 - not filed, recorded or otherwise perfected or effective under any Applicable Law, or any preference, priority or preferential arrangement of any kind or nature whatsoever including the interest of a vendor or lessor under any conditional sale agreement, capital lease or other title retention agreement. “Losses” shall have the meaning given to it in Section 0. “Made Available” shall mean the documents and materials that were posted to (and not removed from) the Data Room accessible by Buyer or otherwise provided to Buyer prior to the Closing Date. “Material Adverse Effect” shall mean any event, result, occurrence, development, fact, change or effect of whatever nature, that, individually or in the aggregate, (i) with respect to Seller, is or would reasonably be expected to be materially adverse to the ability of Seller to consummate the Transactions and to satisfy all of its obligations contemplated by this Agreement or (ii) with respect to the Acquired Companies, has or would reasonably be expected to have a material and adverse effect on the business, operations, Assets, liabilities, or financial condition of the Acquired Companies, taken as a whole; provided, however, that “Material Adverse Effect” shall not include any event, result, occurrence, development, fact, change or effect resulting from (a) changes generally affecting the international, national or regional industries or markets in which the Acquired Companies participate, (b) changes in the financial, banking, credit, securities or capital markets (including any suspension of trading in, or limitation on prices for, securities on any stock exchange or any changes in interest rates) or any change in the general international, national or regional economic or financial conditions, (c) changes generally affecting the international, national or regional electric generating, transmission or distribution industry, (d) changes generally affecting the international, national or regional wholesale or retail markets for electric power including design or pricing or the price of energy, capacity or ancillary services, (e) changes in any Tax or accounting rules or principles (or any interpretations thereof), including changes in GAAP, (f) changes in any Applicable Laws that apply generally to the Acquired Companies, or any changes in the enforcement thereof, (g) any change in national or international regulatory, social or political conditions, including any engagement in or escalation of hostilities, whether or not pursuant to the declaration of a national emergency or war, armed hostilities, sabotage or the occurrence of any military or terrorist attack or changes or additional security measures imposed by a Governmental Authority in connection therewith, (h) weather, natural disaster, meteorological or geological events, (i) a strike, lockout, work stoppage or other labor action, (j) the announcement of the execution of this Agreement (or any other agreement to be entered into pursuant to this Agreement), or the pendency of or consummation of the Transactions, or the identity of Buyer, or the consummation of the Transactions, (k) actions taken pursuant to or in accordance with this Agreement or any action taken (or omitted to be taken) with the written consent of or at the written request of Buyer, (l) any change or effect that is cured (including by the payment of money) before the earlier of the Closing and the termination of this Agreement, (m) any action of any competitor, (n) any epidemics, pandemics, disease outbreaks, or other public health emergencies, or (o) any matter disclosed on any Disclosure Schedule, except, in the case of clauses (a) – (g) above, to the extent that any such change, event, occurrence or effect has a disproportionate effect on the business, Assets, results of operation or condition of the Acquired Companies. “Material Contract” shall mean any of the following Contracts to which any Acquired Company is a party: (a) any Contract, other than any Contract that has been terminated, completed or fully performed without any continuing liabilities of the applicable Acquired Company as to which the expected annual cost of performing such Contract in the ordinary course by the applicable Acquired Company, or the annual revenue expected to be received under such Contract by the applicable Acquired Company in the ordinary course, exceeds Two Hundred and Fifty Thousand Dollars ($250,000);

- 8 - (b) any Contract between any Acquired Company and any Affiliate thereof that is not an Acquired Company; (c) any construction or maintenance agreement, including any engineering, construction and procurement contract and any operation and maintenance contract; (d) any exclusivity agreements with any contractor, manufacturer or other supplier, or a utility contractor not terminable by the applicable Acquired Company upon thirty (30) days’ notice; (e) any Contract providing for the borrowing of Indebtedness or the mortgaging, pledging or otherwise placing a Lien on any of the Acquired Company Assets, or the guarantying of any obligation, Liability or Indebtedness (other than endorsements made for collection in the ordinary course of business); and (f) any employment, severance, retention or change in control agreement with a Relevant Service Provider to which any Acquired Company is a party and continues to be subject to substantial performance obligations. “Membership Interests” shall have the meaning given to it in the recitals. “Net Working Capital” shall mean, as of the Closing without giving effect to the transactions contemplated by this Agreement, (a) current assets of the Acquired Companies (but excluding deferred Tax assets and Income Tax assets) minus (b) current liabilities of the Acquired Companies (but excluding any Indebtedness, deferred Tax liabilities, Income Tax liabilities, or Transaction Expenses), in each case as determined in accordance with GAAP. “Notice of Disagreement” shall have the meaning given to it in Section 0. “Organizational Documents” shall mean, with respect to a particular Person (other than a natural person), the certificate or articles of incorporation, articles of organization, bylaws, partnership agreement, limited liability company agreement, operating agreement, stockholders’ agreement, trust agreement and/or similar organizational documents or agreements, as applicable, of such Person, including all amendments thereto. “Party” or “Parties” shall have the meanings given to them in the Preamble. “Pass-Through Tax Return” means any Tax Return in respect of Income Taxes filed or required to be filed by any Acquired Company to the extent that: (a) such Acquired Company is treated as a partnership, S corporation, or other “pass-through entity” for purposes of such Tax Return; and (b) the items of income, gain, deduction, loss or credit or the results of operations reflected on such Tax Returns are also reflected on the Tax Returns of the direct or indirect beneficial owners of such Acquired Company. “Permits” shall mean all permits, licenses, approvals, orders, registrations, privileges, franchises, memberships, certificates, entitlements and other authorizations issued by Governmental Authorities, including environmental, site plan approval, use permits, variances, building permits, zoning permits, certificates of occupancy, and all amendments, modifications, supplements, general conditions and addenda thereto. “Permitted Liens” shall mean any of the following: (a) any Lien for Taxes not yet delinquent or that are being contested in good faith through appropriate proceedings and, in each case, for which adequate reserves have been established and maintained in accordance with GAAP; (b) any Lien (inclusive of

- 9 - statutory or common law Liens in favor of carriers, warehousemen, mechanics and materialmen, and statutory or common law Liens to secure claims for labor, materials or supplies) arising in the ordinary course of business by operation of Applicable Law with respect to a Liability that is not yet due or delinquent or that Seller is contesting and for which adequate reserves have been established and maintained in accordance with GAAP; (c) any rights, obligations, covenants, conditions, encumbrances, easements, rights of way, restrictions, encroachments, protrusions, mineral rights and interests and any other imperfections or irregularities of title that do not, individually or in the aggregate, materially affect the suitability, use, operation, or value of the applicable Real Property; (d) zoning, planning, building and other similar laws, limitations, ordinances, resolutions, regulations, and restrictions, and all rights of any Governmental Authority having jurisdiction over the property and which are not violated by the current use, operation, or occupancy of the Real Property or business conducted thereon; (e) any Liens created by or through Buyer; (f ) any rights, obligations, covenants, conditions, encumbrances, easements, leases, rights of way, restrictions, mineral rights and interests and other similar matters shown on the current title commitment and survey provided to Buyer which do not, individually or in the aggregate, materially affect the suitability, use, operation, or value of the applicable Real Property; and; and (g) any Liens set forth on Schedule 1.1-PL. “Person” shall mean any natural person, corporation, limited liability company, trust, partnership, firm, joint venture, association, Governmental Authority or any other entity whether acting in an individual, fiduciary or other capacity. “Pre-Closing Tax Period” means any Tax period (or portion thereof) ending on or before the Closing Date. “Pre-Closing Taxes” means, without duplication, (a) any Taxes (other than Transfer Taxes) of (i) any Acquired Company for any Pre-Closing Tax Period (in the case of any Straddle Period, the amount allocated to the Pre-Closing Tax Period in the manner set forth in Section 0) or (ii) Seller; or (b) any Taxes of any other Person (other than another Acquired Company) for which any Acquired Company becomes liable by reason of (i) being a member of an affiliated, aggregate, combined, consolidated, unitary, or similar group at any time prior to the Closing, including pursuant to Treasury Regulations Section 1.1502-6 or any analogous or similar provision under any state, local, or foreign Tax Applicable Law, (ii) being a successor- in-interest or transferee of any other Person, Contract (other than any Contracts entered into in the ordinary course of business that are not primarily related to Taxes), Applicable Law, or otherwise, which Taxes relate to an event or transaction occurring prior to Closing, or (iii) having an express or implied obligation to indemnify any other Person under any Tax allocation Contract, Tax sharing Contract, Tax indemnity Contract, or other similar Contract relating to Taxes that was executed or in effect at any time prior to Closing, in each case, other than any Contracts entered into in the ordinary course of business that are not primarily related to Taxes; or (c) Seller’s share of Transfer Taxes as set forth in Section 0; provided that no such amount of Tax will constitute Pre-Closing Taxes to the extent such Tax (I) results from actions taken by Buyer, any of its Affiliates or any Acquired Company on the Closing Date but after the Closing, unless such actions were expressly contemplated by this Agreement, required by Applicable Law, or taken at the written request or with the written consent of Seller, or (II) was included in the finally determined Final Net Working Capital or Final Transaction Expenses. “Project Financing Closing” shall mean the execution by TeraWulf or any of its direct or indirect subsidiaries of definitive documentation for the project financing of the CB-1 Project and the CB-2 Project. “Project Financing Consideration” shall have the meaning given to it in Section 0. “Public Statement” shall have the meaning given to it in Section 0.

- 10 - “Purchase Price” shall have the meaning given to it in Section 0. “Real Property” shall mean all fee, leasehold and easement or other real property interests held by the Acquired Companies. “Real Property Documents” shall mean any and all leases, easements or other agreements vesting in the Acquired Companies, including all non-fee and fee Real Property set forth on Schedule 6.9.1. “Registration Rights Agreement” shall mean that certain Registration Rights Agreement dated as of the date hereof by and between Seller and TeraWulf. “Release” shall mean any spilling, leaking, pumping, pouring, emitting, emptying, discharging, injecting, escaping, leaching, dumping, or disposing. “Release and Waiver Agreement” shall mean that certain Release and Waiver Agreement dated as of the date hereof by and between Buyer, TeraWulf and Seller. “Relevant Service Provider” means any employee, officer, director of an Acquired Company, or any other individual service provider to an Acquired Company party to a services agreement with such Acquired Company that has not been terminated or expired. “Representatives” shall mean, as to any Person, its officers, directors, stockholders, members, partners, employees, counsel, accountants, financial advisors, consultants and other representatives of such Person. “Resolved Matters” shall have the meaning given to it in Section 0. “Securities Act” shall mean the Securities Act of 1933, as amended. “Seller” shall have the meaning given to it in the recitals. “Seller Ancillary Agreements” shall mean all agreements, certificates, instruments and documents being or to be executed and delivered by Seller or an Affiliate of Seller under this Agreement or in connection with the Transactions, including the Assignment of Membership Interests. “Seller Confidential Information” shall have the meaning given to it in Section 0. “Seller Consent” shall have the meaning given to it in Section 0. “Seller’s Disclosure Schedules” shall mean the disclosure schedules delivered by Seller to Buyer, which are attached hereto as Schedule A. “Seller Indemnified Party” shall have the meaning given to it in Section 0. “Seller Tax Return” shall have the meaning given to it in Section 0. “Seller’s Knowledge” shall mean the actual knowledge of Barbara Guiltinan and Daniel Stewart. “Straddle Period” means any Tax period beginning on or before and ending after the Closing Date. “Tax” and “Taxes” shall mean any and all U.S. federal, state, local, foreign, or other taxes, fees, levies, or other charges, in each case, in the nature of a tax imposed by any Governmental Authority,

- 11 - including any income, franchise, windfall or other profits, gross receipts, property, sales, use, capital stock, payroll, estimated, employment, social security, workers’ compensation, unemployment compensation, net worth, excise, withholding, ad valorem, stamp, transfer, value-added, gains, or other taxes, together with any interest, penalties, or additions to tax, whether disputed or not. “Tax Contest” shall have the meaning given to it in Section 0. “Tax Rep. Indemnity Period” shall have the meaning given to it in Section 0. “Tax Return” shall mean any return, report, statement, form, claim for refund, information return or statement, or other documentation (including any additional or supporting material, any schedule or attachment, and any amendments or supplements) filed or required to be filed with a Governmental Authority with respect to Taxes. “Third Party Claim” shall have the meaning given to it in Section 0. “Trade Name” shall have the meaning given to it in Section 0. “Transaction Documents” shall have the meaning given to it in Section 0. “Transaction Expenses” shall mean the transaction expenses of Seller incurred in connection with this Agreement or the transactions described herein, including, (i) all fees and expenses of attorneys, accountants and other professionals, and (ii) any sale or transaction related bonuses, change in control bonuses or stay or retention bonuses that become payable to any Relevant Service Provider relating to the Transactions, whether directly in connection with the transactions set forth herein or following the occurrence of any additional event (in whole or in part, whether by single-trigger, double-trigger or multiple-trigger conditions) as a result of the execution of this Agreement or the consummation of the Transactions, inclusive of the employer portion of any payroll, social security, unemployment and similar Taxes related to thereto. “Transaction Expenses Deficit” shall have the meaning given to it in Section 0. “Transaction Expenses Surplus” shall have the meaning given to it in Section 0. “Transactions” shall mean all of the transactions provided for in, or contemplated by, this Agreement, including Closing and the execution, delivery and performance of the Transaction Documents. “Transfer Taxes” shall have the meaning given to it in Section 0. “Transition Services Agreement” shall mean that certain Transition Services Agreement dated as of the date hereof by and between Heorot Power Holdings LLC (an Affiliate of Seller), the Acquired Companies and TeraWulf. “Treasury Regulations” shall mean the regulations promulgated under the Code by the United States Department of Treasury, as such regulations may be amended from time to time. “Ultimate Seller Parent” shall mean Paul Prager. “Unresolved Matters” shall have the meaning given to it in Section 0. “Upward Adjustment Amount” shall have the meaning given to it in Section 0.

- 12 - “VWAP” means for the Common Stock for a specified period, the dollar volume-weighted average price for the Common Stock on the Nasdaq for such period, in each case as reported on the Nasdaq or by another reputable source such as Bloomberg, L.P. “Working Capital Deficit” shall have the meaning given to it in Section 0. “Working Capital Surplus” shall have the meaning given to it in Section 0. 1.2 Construction. 1.2.1 Headings and the rendering of text in bold and/or italics are for convenience and reference purposes only and do not affect the meaning or interpretation of this Agreement. 1.2.2 A reference to an Exhibit, Schedule, Article, Section or other provision shall be, unless otherwise specified, to exhibits, schedules, articles, sections or other provisions of this Agreement, which exhibits and schedules are incorporated herein by reference. 1.2.3 Any reference in this Agreement to another Contract or document shall be construed as a reference to that other Contract or document as the same may have been, or may from time to time be, varied, amended, supplemented, substituted, novated, assigned or otherwise transferred. 1.2.4 Any reference in this Agreement to “this Agreement,” “herein,” “hereof” or “hereunder” shall be deemed to be a reference to this Agreement as a whole and not limited to the particular Article, Section, Exhibit, Schedule or provision in which the relevant reference appears and to this Agreement as varied, amended, supplemented, substituted, novated, assigned or otherwise transferred from time to time. 1.2.5 References to any Party shall, where appropriate, include any successors, transferees and permitted assigns of the Party. 1.2.6 References to the term “includes” or “including” shall mean “includes, without limitation” or “including, without limitation.” 1.2.7 Words importing the singular include the plural and vice versa and the masculine, feminine and neuter genders include all genders. 1.2.8 If the time for performing an obligation under this Agreement occurs or expires on a day that is not a Business Day, the time for performance of such obligation shall be extended until the next succeeding Business Day. 1.2.9 References to any statute, code or statutory provision are to be construed as a reference to the same as it may have been, or may from time to time be, amended, modified or reenacted, and include references to all bylaws, instruments, orders and regulations for the time being made thereunder or deriving validity therefrom unless the context otherwise requires. 1.2.10 References to any amount of money shall mean a reference to the amount in United States Dollars. 1.2.11 References to the word “or” to connect two or more phrases shall be construed as inclusive of all such phrases (e.g., “A or B” means “A or B, or both”) and the use of the conjunction “and/or” shall be construed as “any or all of.”

- 13 - ARTICLE 2 PURCHASE AND SALE OF MEMBERSHIP INTERESTS 2.1 Purchase and Sale. Subject to the terms and conditions set forth in this Agreement and in consideration of the Purchase Price, at the Closing, Seller shall sell, assign, convey, deliver and transfer to Buyer, and Buyer shall purchase, acquire and accept from Seller, all of the right, title and interest of Seller in and to the Membership Interests, so that upon the Closing, Buyer shall own, directly, all of the Membership Interests free and clear of all Liens or other limitations whatsoever (other than any restrictions on transfer of the Membership Interests under any Applicable Law, the Organizational Documents of Seller or the Acquired Companies, or in accordance with this Agreement, the Buyer Ancillary Agreements or the Seller Ancillary Agreements). 2.2 Purchase Price; Payment of Purchase Price. In full consideration of the purchase by Buyer and sale by Seller of the Membership Interests pursuant to Section 0, Buyer shall pay to Seller the purchase price in the amounts and upon the events identified below (the “Purchase Price”). Each installment of the Purchase Price shall become due and payable, and will be made, as follows: 2.2.1 On the Closing Date, an amount equal to Three Million Dollars ($3,000,000) (the “Cash Closing Payment”) of immediately available funds shall be paid by wire transfer to a bank account designated by Seller in writing. 2.2.2 On the Closing Date, TeraWulf will issue to Seller five million (5,000,000) shares of Common Stock (the “Closing Common Stock”). 2.2.3 Immediately upon the later to occur of the Closing Date and achievement of the CB-3 Earnout Milestone, an amount equal to Thirteen Million Dollars ($13,000,000) (the “CB-3 Earnout Consideration”) of immediately available funds shall be paid by wire transfer to a bank account designated by Seller in writing. 2.2.4 Immediately upon the later to occur of the Closing Date and achievement of the CB-1 Earnout Milestone, (a) TeraWulf will issue to Seller shares of Common Stock valued at Six Million Five Hundred-Thousand Dollars ($6,500,000), calculated on the basis of a sixty (60) day trailing VWAP as of the date that the CB-1 Earnout Milestone is achieved and (b) an amount equal to Six Million Dollars ($6,000,000) of immediately available funds shall be paid by wire transfer to a bank account designated by Seller in writing (the consideration in clauses (a) and (b) hereof, the “CB-1 Earnout Consideration”). 2.2.5 Immediately upon the later to occur of the Closing Date and achievement of the Project Financing Closing, TeraWulf will issue to Seller shares of Common Stock valued at Six Million Five Hundred-Thousand Dollars ($6,500,000), calculated on the basis of a sixty (60) day trailing VWAP as of the date that the Project Financing Closing occurs (the “Project Financing Consideration”). 2.3 Change of Control Consideration. If at any time a Change of Control occurs, Buyer and TeraWulf will promptly pay the Change of Control Consideration to Seller. 2.4 Withholding. Each of Buyer and the Acquired Companies shall be entitled to deduct and withhold from any amounts payable to any Person pursuant to this Agreement any Taxes required to be withheld and paid over to the applicable Governmental Authority under the Code, or any applicable provision of Applicable Law; provided that, other than with respect to amounts payable to a Relevant Service Provider that are treated as compensation for applicable Tax purposes or withholding Taxes owed as a result of the failure of Seller to deliver the form described in Section 0, Buyer will, prior to any deduction or withholding to be made by Buyer, notify Seller of any anticipated withholding (including a

- 14 - description of the legal basis therefor and calculation thereof), and reasonably cooperate with Seller to minimize the amount of any applicable withholding to such affected Person. To the extent such amounts are so deducted and withheld and properly remitted to the correct Governmental Authority, such amounts shall be treated for all purposes under this Agreement as having been paid to the Person in respect of which such deduction and withholding was made. ARTICLE 3 CLOSING; CLOSING DELIVERIES 3.1 Closing. The consummation of the Transactions (the “Closing”) shall take place electronically or at the offices of Bracewell LLP located at 2001 M Street, NW, Suite 900, Washington, D.C. 20036 on the Closing Date. The Closing shall be effective as of 11:59 p.m. on the Closing Date. 3.2 Buyer’s Closing Deliveries. At the Closing, Buyer and TeraWulf (as applicable) shall deliver, or cause to be delivered, to Seller all of the following: 3.2.1 the Cash Closing Payment; 3.2.2 the Closing Common Stock; 3.2.3 a counterpart signature page to the Assignment of Membership Interests, duly executed by Buyer; 3.2.4 a certificate for Buyer, dated as of the Closing Date, executed by a duly authorized officer or manager of Buyer, certifying that attached thereto is: (a) a true, accurate and complete copy of the certificate issued by the Secretary of State of the State of Delaware, dated no more than five (5) days prior to the Closing Date and certifying that Buyer is validly existing and in good standing under the laws of the State of Delaware; (b) a true, accurate and complete copy of the resolutions of the Board of Directors of TeraWulf and the board of Buyer in form and substance acceptable to Seller duly authorizing the execution, delivery and performance by Buyer of this Agreement, the Buyer Ancillary Agreements to which Buyer is a party and the Transactions, and that such resolutions are in full force and effect as of the Closing Date; and (c) a true, complete and correct copy of the certificate of formation of Buyer; 3.2.5 counterpart signature pages to the Transition Services Agreement, duly executed by Buyer, TeraWulf and each Acquired Company; 3.2.6 counterpart signature pages to the Registration Rights Agreement, duly executed by TeraWulf; 3.2.7 counterpart signature pages to the Lease Agreement, duly executed by TeraWulf and Lake Mariner Data LLC; 3.2.8 counterpart signature pages to the Release and Waiver Agreement, duly executed by Buyer, TeraWulf and each Acquired Company; and 3.2.9 copies of the Buyer Consents.

- 15 - 3.3 Seller’s Closing Deliveries. At the Closing, Seller shall deliver, or cause to be delivered, to Buyer all of the following: 3.3.1 a counterpart signature page to the Assignment of Membership Interests, duly executed by Seller; 3.3.2 certificates for each of the Acquired Companies, dated as of the Closing Date, executed by a duly authorized officer or manager of the applicable Acquired Company, certifying that attached thereto is: (a) a true, accurate and complete copy of the certificate issued by the Secretary of State of the applicable state of formation, dated no more than five (5) days prior to the Closing Date and certifying that such Acquired Company is validly existing and in good standing under the laws of such state; (b) a true, accurate and complete copy of the certificate of formation of such Acquired Company, as in effect on the Closing Date; (c) a true, accurate and complete copy of the limited liability company agreement of such Acquired Company, as in effect on the Closing Date; and (d) a true, accurate and complete copy of the resolutions of the sole member of such Acquired Company duly authorizing the execution, delivery and performance by such Acquired Company of any agreement, document or certificate to be delivered by such Acquired Company hereunder on the Closing Date, and that such resolutions are in full force and effect as of the Closing Date; 3.3.3 a certificate for Seller, dated as of the Closing Date, executed by a duly authorized officer or manager of Seller, certifying that attached thereto is: (a) a true, accurate and complete copy of the certificate issued by the Secretary of State of the State of Delaware, dated no more than five (5) days prior to the Closing Date and certifying that Seller is validly existing and in good standing under the laws of the State of Delaware; (b) a true, accurate and complete copy of the resolutions of the sole shareholder of Seller duly authorizing the execution, delivery and performance by Seller of this Agreement, the Seller Ancillary Agreements to which Seller is a party and the Transactions, and that such resolutions are in full force and effect as of the Closing Date; and (c) a true, complete and correct copy of the certificate of incorporation of Seller; 3.3.4 counterpart signature pages to the Transition Services Agreement, duly executed by Heorot Power Holdings LLC; 3.3.5 counterpart signature pages to the Registration Rights Agreement, duly executed by Seller; 3.3.6 counterpart signature pages to the Lease Agreement, duly executed by Riesling Power LLC and Somerset Operating Company, LLC; 3.3.7 counterpart signature pages to the Release and Waiver Agreement, duly executed by Seller; 3.3.8 an IRS Form W-9 of Seller, certifying that Seller is not subject to U.S. federal backup withholding tax, duly completed and executed and dated as of the Closing Date; and 3.3.9 the Closing Statement, updated by Seller through at least five (5) Business Days prior to the Closing Date.

- 16 - ARTICLE 4 POST-CLOSING PURCHASE PRICE ADJUSTMENT 4.1 Adjustment Statement. Within one-hundred twenty (120) days after the Closing Date, Buyer shall deliver to Seller a statement prepared by Buyer in good faith (the “Adjustment Statement”) of its determination of (i) Net Working Capital (the “Final Net Working Capital”), (ii) Closing Indebtedness (the “Final Indebtedness”), (iii) Closing Transaction Expenses (the “Final Transaction Expenses”), and (iv) the resulting Purchase Price, taking into account all provisions establishing the basis for such calculation set forth herein. 4.2 Review and Dispute. Within thirty (30) days following receipt by Seller of the Adjustment Statement, Seller shall either inform Buyer in writing that the Adjustment Statement is acceptable, or deliver written notice (the “Notice of Disagreement”) to Buyer of any dispute Seller has with respect to the preparation or content of the Adjustment Statement or the Final Net Working Capital, the Final Indebtedness and Final Transaction Expenses reflected therein. The Notice of Disagreement must describe in reasonable detail the items contained in the Adjustment Statement that Seller disputes. Any items included in the Adjustment Statement which are not disputed by Seller in the Notice of Disagreement (other than items necessary to offset an issue raised in the Notice of Disagreement) shall be deemed agreed to by Seller. If Seller does not notify Buyer of a dispute with respect to the Adjustment Statement within such thirty (30)-day period, the Adjustment Statement and the Final Net Working Capital, Final Indebtedness and Final Transaction Expenses reflected in the Adjustment Statement will be final, conclusive and binding. 4.3 Resolution of Dispute. In the event a Notice of Disagreement is delivered to Buyer during the thirty (30) days immediately following the receipt by Seller of the Adjustment Statement, Seller and Buyer shall attempt, each in good faith, to resolve any disagreement that they may have with respect to the matters specified in the Notice of Disagreement, and any resolution by them as to any disputed amounts shall be final, conclusive and binding. Any items agreed to by Buyer and Seller in writing, together with any items not disputed or objected to by Seller in the Notice of Disagreement, are collectively referred to herein as the “Resolved Matters”. 4.4 Accounting Firm. If Buyer and Seller fail to resolve any of the matters contained in the Notice of Disagreement (such unresolved matters, “Unresolved Matters”) within thirty (30) days after Seller delivers the Notice of Disagreement, then Buyer and Seller jointly shall engage the Accounting Firm to resolve such Unresolved Matters in accordance with the procedures set forth in this 0. Seller and Buyer each agree to promptly sign an engagement letter, in reasonable form, as may reasonably be required by the Accounting Firm. 4.5 Accounting Firm Determination. 4.5.1 Buyer and Seller shall instruct the Accounting Firm to render a written decision resolving the Unresolved Matters submitted to the Accounting Firm within thirty (30) days of its engagement in accordance with this Section 0. Each of Buyer and Seller shall submit to the Accounting Firm (with a copy delivered to the other Party on the same day), within ten (10) days after the date of the engagement of the Accounting Firm, a memorandum (which may include supporting exhibits) setting forth their respective positions with respect to the Unresolved Matters. Each of Buyer and Seller may (but shall not be required to) submit to the Accounting Firm (with a copy delivered to the other Party on the same day), within fifteen (15) days after the date of the engagement of the Accounting Firm, a memorandum responding to the initial memorandum submitted to the Accounting Firm by the other Party. There shall be no ex parte communications between Seller (or its representatives) or Buyer (or its representatives), on the one hand, and the Accounting Firm, on the other hand, relating to the Unresolved Matters and, unless

- 17 - requested by the Accounting Firm in writing, or agreed to by Buyer and Seller in writing, no Party may present any additional information or arguments to the Accounting Firm, either orally or in writing. 4.5.2 In resolving the Unresolved Matters, the Accounting Firm shall (A) consider only those Unresolved Matters that are in dispute, (B) be bound by the provisions of this Section 0, (C) choose, in its entirety, the resolution of the items in dispute as proposed by either Buyer or Seller, and make no other determination (including by combining elements of the proposed resolutions submitted by both Buyer and Seller), (D) review only the written presentations of Buyer and Seller in resolving any Unresolved Matters and (E) not modify any element of the Adjustment Statement that is not disputed by Buyer and Seller. Judgment may be entered upon the determination of the Accounting Firm in any court having jurisdiction over the Party against which such determination is to be enforced. All determinations made by the Accounting Firm will be final, conclusive and binding. 4.5.3 In the event that a Notice of Disagreement is duly delivered by Seller to Buyer in accordance with Section 0, the Adjustment Statement delivered by Buyer to Seller pursuant to Section 0 shall be adjusted by Buyer pursuant to the agreement of Seller and Buyer in accordance with the Resolved Matters, if any, in writing and then such Adjustment Statement shall be further adjusted by the Accounting Firm to be consistent with the final resolution by the Accounting Firm of the Unresolved Matters in accordance with this Section 0. The Adjustment Statement so revised shall be deemed to set forth the final, conclusive and binding Final Net Working Capital, Final Indebtedness and Final Transaction Expenses for purposes of this Agreement (including the determination of the Downward Adjustment Amount or Upward Adjustment Amount, as applicable). 4.5.4 The fees and expenses of the Accounting Firm shall be paid by Seller, on the one hand, and by Buyer, on the other hand, based upon the percentage that the amount actually contested but not awarded to Seller or Buyer, respectively, bears to the aggregate amount actually contested by Seller and Buyer. 4.6 Aggregated Adjustments. Any adjustments to the Purchase Price pursuant to Section 0 and Section 0 shall be aggregated by calculating an amount equal to (i) the sum of the Working Capital Surplus, the Indebtedness Surplus and the Transaction Expenses Surplus less (ii) the Working Capital Deficit, Indebtedness Deficit and the Transaction Expenses Deficit (such amount, if a positive number, the “Upward Adjustment Amount” and if a negative number, the “Downward Adjustment Amount”). 4.7 Downward Adjustment. 4.7.1 If the Final Net Working Capital as finally determined is less than the estimated Net Working Capital set forth in the Closing Statement (the amount of such deficit, the “Working Capital Deficit”), then the Purchase Price will be adjusted downward by an amount equal to the Working Capital Deficit. 4.7.2 If the Final Indebtedness as finally determined is greater than the estimated Indebtedness set forth in the Closing Statement (such amount, the “Indebtedness Deficit”), then the Purchase Price will be adjusted downward by an amount equal to the Indebtedness Deficit. 4.7.3 If the Final Transaction Expenses as finally determined is greater than the Closing Transaction Expenses set forth in the Closing Statement (such amount, the “Transaction Expenses Deficit”), then the Purchase Price will be adjusted downward by an amount equal to the Transaction Expenses Deficit.

- 18 - 4.7.4 In the event of a Downward Adjustment Amount, then within five (5) business days from the date on which the Purchase Price is finally determined pursuant to this 0, then Seller shall pay to Buyer the amount of the Downward Adjustment Amount by wire transfer of immediately available funds to an account designated by Buyer. 4.8 Upward Adjustment. 4.8.1 If the Final Net Working Capital as finally determined exceeds the estimated Net Working Capital set forth on the Closing Statement (the amount of such surplus, the “Working Capital Surplus”), then the Purchase Price will be adjusted upward by an amount equal to the Working Capital Surplus. 4.8.2 If the Final Indebtedness as finally determined is less than the estimated Indebtedness set forth in the Closing Statement (such amount, the “Indebtedness Surplus”), then the Purchase Price will be adjusted upward by an amount equal to Indebtedness Surplus. 4.8.3 If the Final Transaction Expenses as finally determined is less than the Closing Transaction Expenses as set forth in the Closing Statement (such amount, the “Transaction Expenses Surplus”), then the Purchase Price will be adjusted upward by an amount equal to the Transaction Expenses Surplus. 4.8.4 In the event of an Upward Adjustment Amount, then within five (5) business days from the date on which the Purchase Price is finally determined pursuant to this 0, Buyer shall pay to Seller an amount equal to the Upward Adjustment Amount by wire transfer of immediately available funds to an account designated by Seller. ARTICLE 5 REPRESENTATIONS AND WARRANTIES OF SELLER Seller represents and warrants to Buyer, subject to any qualification set forth in the Seller’s Disclosure Schedules, the following as of the Closing Date (unless another date is specified therein): 5.1 Organization, Authority, Validity and Non-Contravention. 5.1.1 Seller is a corporation duly incorporated, validly existing and in good standing under the laws of the State of Delaware. Seller has all requisite corporate power and authority to carry on its business as it is currently conducted and to own, lease and operate its Assets where such Assets are now owned, leased or operated except where such failure would not, in the aggregate, reasonably be expected to result in a Material Adverse Effect. 5.1.2 Seller has all requisite corporate power and authority to execute and deliver this Agreement and the Seller Ancillary Agreements to which it is a party, to perform its obligations hereunder and thereunder and to consummate the Transactions. The execution, delivery and performance by Seller of this Agreement and the Seller Ancillary Agreements to which Seller is a party and the consummation of the Transactions have been duly authorized by all necessary corporate action on the part of Seller. 5.1.3 This Agreement has been duly executed and delivered by Seller and constitutes the legal, valid and binding obligation of Seller, enforceable against Seller in accordance with its terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, moratorium, reorganization or other similar laws affecting the enforcement of creditors’ rights and subject to general equitable principles. Upon execution and delivery of the Seller Ancillary Agreements to which Seller is a

- 19 - party, each of the Seller Ancillary Agreements will constitute the legal, valid and binding obligation of Seller, enforceable against Seller in accordance with its terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, moratorium, reorganization or other similar laws affecting the enforcement of creditors’ rights and subject to general equitable principles. 5.1.4 The execution, delivery and performance of this Agreement and the Seller Ancillary Agreements by Seller does not and will not (a) conflict with, result in a breach of, or constitute a default under, any of Seller’s Organizational Documents or (b) assuming receipt of the Seller Consents, to Seller’s Knowledge, violate any Applicable Law except, in each case (c), for such violations as would not, individually or in the aggregate, reasonably be expected to result in a Material Adverse Effect. 5.2 No Adverse Order or Injunctions. There is no (a) Action or (b) judgment, order, writ, prohibition, injunction or decree of any court or other Governmental Authority outstanding or, in each case, to Seller’s Knowledge, threatened against Seller or any Membership Interests that questions or challenges the validity of this Agreement or any of the Seller Ancillary Agreements or Seller’s execution, delivery or performance of this Agreement or any of the Seller Ancillary Agreements to which Seller is a party. 5.3 Solvency. No petition or notice has been presented, no order has been made and no resolution has been passed for the bankruptcy, liquidation, winding-up or dissolution of Seller. No receiver, trustee, custodian or similar fiduciary has been appointed over the whole or any part of Seller’s Assets or the income of Seller. Seller has no plan or intention of, nor has received any written notice that any other Person has any plan or intention of, filing, making or obtaining any such petition, notice, order or resolution or of seeking the appointment of a receiver, trustee, custodian or similar fiduciary. 5.4 Third Party Consents. Except as set forth on Schedule 5.4 (the “Seller Consents”), there are no material Consents of or to Persons, or to Seller’s Knowledge, including any Governmental Authorities, that are required in connection with the execution and delivery by Seller of this Agreement or any of the Seller Ancillary Agreements to which Seller is a party, the performance of the obligations of Seller hereunder or thereunder or the consummation by Seller of the Transactions (including the sale of all of the Membership Interests to Buyer). 5.5 Brokers. Except as set forth on Schedule 5.5, neither Seller nor any of its Affiliates (including the Acquired Companies) has engaged any broker, finder or agent in connection with the Transactions so as to give rise to any claim against Buyer or any of its Affiliates (including, following the Closing, the Acquired Companies) for any brokerage or finder’s commission, fee or similar compensation. 5.6 Compliance with Laws. Seller is not in violation of any Applicable Law, except for violations that would not, individually or in the aggregate, reasonably be expected to result in a Material Adverse Effect. ARTICLE 6 REPRESENTATIONS AND WARRANTIES WITH RESPECT TO THE ACQUIRED COMPANIES Seller represents and warrants to Buyer, subject to any qualification set forth in the Seller’s Disclosure Schedules, the following as of the Closing Date (unless another date is specified therein) with respect to the Acquired Companies: 6.1 Organization and Authority. Each Acquired Company is a limited liability company duly organized, validly existing and in good standing under the laws of its applicable state of formation, and has