2 Safe Harbor Statement This Investor Presentation shall not, and is not intended to, constitute or contain an offer or invitation to sell or the solicitation of an offer to buy, and may not be used as, or in connection with, an offer or invitation to sell or a solicitation to buy any securities. It does not comprise a prospectus for the purposes of EU Directive 2010/73/EU or otherwise. The definitive terms of any financing referred to herein that is in the form of securities will described in the preliminary offering memorandum (the "Preliminary Offering Memorandum") or the offering memorandum (the "Final Offering Memorandum") related thereto, when they are available. Investors should not make any investment decision based on, or subscribe for any financing referred to herein on the basis of, this Investor Presentation. To the extent any such financing is in the form of securities, any such decision or subscription should only be made, and will be deemed to have been made, on the basis of information contained in the Preliminary Offering Memorandum or the Final Offering Memorandum, when they are available. By accepting receipt of this Investor Presentation, with respect to any financing in the form of securities, you will be deemed to have agreed that any such decision or subscription should only be made, and will be deemed to have been made, on the basis of information contained in the Preliminary Offering Memorandum or the Final Offering Memorandum, when they are available. This Investor Presentation is highly confidential. You may not reproduce or distribute this Investor Presentation, in whole or in part. Distribution of this Investor Presentation, or any of its contents, to any other person is prohibited. Each recipient hereof, by accepting delivery of this Investor Presentation, agrees to the foregoing. IN GENERAL. This disclaimer applies to this document and the verbal or written comments of any person presenting it. This document, taken together with any such verbal or written comments, is referred to herein as the "Presentation." The information contained on, or accessible through, any websites included in this Presentation is not incorporated by reference into, and should not be considered a part of, this Presentation. FORWARD-LOOKING STATEMENTS. This presentation is for informational purposes only and contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward- looking statements include statements concerning anticipated future events and expectations that are not historical facts. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements. In addition, forward- looking statements are typically identified by words such as “plan,” “believe,” “goal,” “target,” “aim,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “seek,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “strategy,” “opportunity,” “predict,” “should,” “would” and other similar words and expressions, although the absence of these words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are based on the current expectations and beliefs of TeraWulf Inc.’s (“TeraWulf”) management and are inherently subject to a number of factors, risks, uncertainties and assumptions and their potential effects. There can be no assurance that future developments will be those that have been anticipated. Actual results may vary materially from those expressed or implied by forward-looking statements based on a number of factors, risks, uncertainties and assumptions, including, among others: (1) our ability to attract additional customers to lease our HPC data centers; (2) our ability to perform under our existing data center lease agreements; (3) changes in applicable laws, regulations and/or permits affecting TeraWulf and/or WULF Compute LLCs’ (“WULF Compute”) operations or the industries in which they operate; (4) the ability to implement certain business objectives, including our HPC data center development, and to timely and cost-effectively execute related projects; (5) failure to obtain adequate financing on a timely basis and/or on acceptable terms with regard to expansion or existing operations; (6) adverse geopolitical or economic conditions, including a high inflationary environment, the implementation of new tariffs and more restrictive trade regulations; (7) the potential of cybercrime, money-laundering, malware infections and phishing and/or loss and interference as a result of equipment malfunction or break-down, physical disaster, data security breach, computer malfunction or sabotage (and the costs associated with any of the foregoing); (8) the availability and cost of power as well as electrical infrastructure equipment necessary to maintain and grow the business and operations of TeraWulf and/or WULF Compute; and (9) other risks and uncertainties detailed from time to time in the TeraWulf’s filings with the Securities and Exchange Commission (“SEC”). Potential investors, stockholders and other readers are cautioned not to place undue reliance on these forward- looking statements, which speak only as of the date on which they were made. TeraWulf and WULF Compute do not assume any obligation to publicly update any forward-looking statement after it was made, whether as a result of new information, future events or otherwise, except as required by law or regulation. Investors are referred to the full discussion of risks and uncertainties associated with forward-looking statements and the discussion of risk factors contained in the TeraWulf’s filings with the SEC, which are available at www.sec.gov. PAST PERFORMANCE. Past performance is not a reliable indicator of future results and should not be relied upon for any reason. NO OFFER; NO RELIANCE. This Presentation does not constitute an offer to sell or issue, or a solicitation of an offer to purchase or subscribe for, any securities or other interests in the Company or any of its subsidiaries. There can be no assurance if or when the Company or any of its subsidiaries will offer any security or the terms of any such offering. Any such offer would only be made by means of formal documents, the terms of which would govern in all respects. If at any time there should commence an offering of securities, any decision to invest in any such securities must be based wholly on the information contained in a final offering document issued or to be issued in connection with any such offering and not on the contents hereof. You should not rely on this Presentation as the basis upon which to make any investment decision. NON-GAAP FINANCIAL INFORMATION. This Presentation includes information based on financial measures that are not recognized under generally accepted accounting principles (GAAP). You should use Non-GAAP information in addition to, and not as an alternative to, financial information prepared in accordance with GAAP. Our Non-GAAP measure may not be identical or comparable to measures with the same name presented by other companies. PROJECTIONS. The projected financial data presented in this Presentation may not be indicative of our future results. Such data is not a prediction, should not be relied upon as such and is premised on a number of factors, all of which are inherently uncertain and subject to numerous business, industry, market, regulatory, geo-political, competitive and financial risks that are outside of our control. Any such projected financial data is based on available information and certain assumptions that we believe are reasonable under the circumstances. However, there can be no assurance that the assumptions made in connection with such data will prove accurate, and actual results may differ materially. We make no representations to any person regarding projected financial data and we do not intend to update or otherwise revise any such data to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such data are later shown to be incorrect. If our assumptions prove to be inaccurate, our actual results may differ substantially and materially from these projections. This Presentation is confidential and may not be reproduced, forwarded to any person or published, in whole or in part.

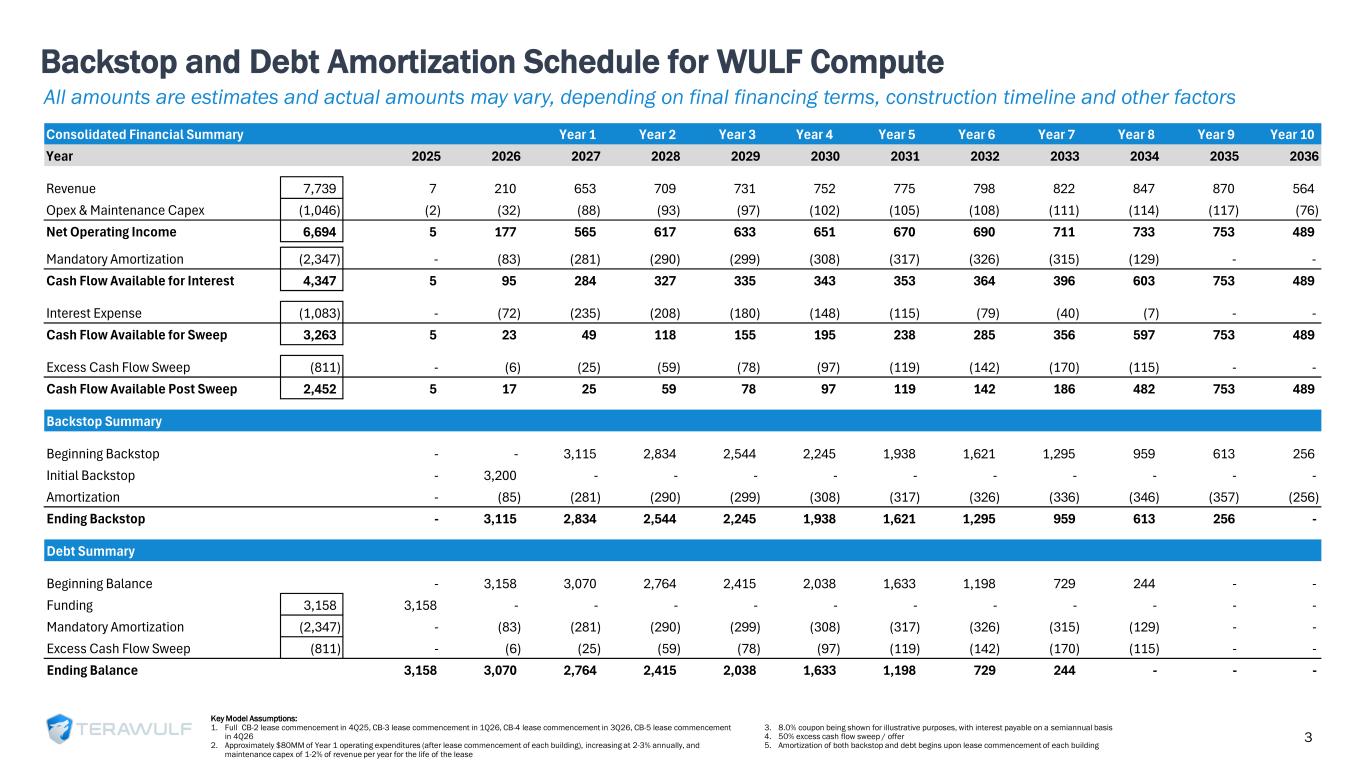

3 Consolidated Financial Summary Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 Revenue 7,739 7 210 653 709 731 752 775 798 822 847 870 564 Opex & Maintenance Capex (1,046) (2) (32) (88) (93) (97) (102) (105) (108) (111) (114) (117) (76) Net Operating Income 6,694 5 177 565 617 633 651 670 690 711 733 753 489 Mandatory Amortization (2,347) - (83) (281) (290) (299) (308) (317) (326) (315) (129) - - Cash Flow Available for Interest 4,347 5 95 284 327 335 343 353 364 396 603 753 489 Interest Expense (1,083) - (72) (235) (208) (180) (148) (115) (79) (40) (7) - - Cash Flow Available for Sweep 3,263 5 23 49 118 155 195 238 285 356 597 753 489 Excess Cash Flow Sweep (811) - (6) (25) (59) (78) (97) (119) (142) (170) (115) - - Cash Flow Available Post Sweep 2,452 5 17 25 59 78 97 119 142 186 482 753 489 Backstop Summary Beginning Backstop - - 3,115 2,834 2,544 2,245 1,938 1,621 1,295 959 613 256 Initial Backstop - 3,200 - - - - - - - - - - Amortization - (85) (281) (290) (299) (308) (317) (326) (336) (346) (357) (256) Ending Backstop - 3,115 2,834 2,544 2,245 1,938 1,621 1,295 959 613 256 - Debt Summary Beginning Balance - 3,158 3,070 2,764 2,415 2,038 1,633 1,198 729 244 - - Funding 3,158 3,158 - - - - - - - - - - - Mandatory Amortization (2,347) - (83) (281) (290) (299) (308) (317) (326) (315) (129) - - Excess Cash Flow Sweep (811) - (6) (25) (59) (78) (97) (119) (142) (170) (115) - - Ending Balance 3,158 3,070 2,764 2,415 2,038 1,633 1,198 729 244 - - - Backstop and Debt Amortization Schedule for WULF Compute Key Model Assumptions: 1. Full CB-2 lease commencement in 4Q25, CB-3 lease commencement in 1Q26, CB-4 lease commencement in 3Q26, CB-5 lease commencement in 4Q26 2. Approximately $80MM of Year 1 operating expenditures (after lease commencement of each building), increasing at 2-3% annually, and maintenance capex of 1-2% of revenue per year for the life of the lease 3. 8.0% coupon being shown for illustrative purposes, with interest payable on a semiannual basis 4. 50% excess cash flow sweep / offer 5. Amortization of both backstop and debt begins upon lease commencement of each building All amounts are estimates and actual amounts may vary, depending on final financing terms, construction timeline and other factors