Exhibit 99.1

1 NASDAQ: WULF April 2022 An Infrastructure - Focused Mining Company Accelerating the Transition to a Zero - Carbon Future

SAFE HARBOR STATEMENT This presentation is for informational purposes only and contains forward - looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995 , as amended . Such forward - looking statements include statements concerning anticipated future events and expectations that are not historical facts . All statements, other than statements of historical fact, are statements that could be deemed forward - looking statements . In addition, forward - looking statements are typically identified by words such as "plan," "believe," "goal," "target," "aim," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "continue," "could," "may," "might," "possible," "potential," "predict," "should," "would" and other similar words and expressions, although the absence of these words or expressions does not mean that a statement is not forward - looking . Forward - looking statements are based on the current expectations and beliefs of TeraWulf's management and are inherently subject to a number of factors, risks, uncertainties and assumptions and their potential effects . There can be no assurance that future developments will be those that have been anticipated . Actual results may vary materially from those expressed or implied by forward - looking statements based on a number of factors, risks, uncertainties and assumptions, including, among others : ( 1 ) conditions in the cryptocurrency mining industry, including fluctuation in the market pricing of bitcoin and other cryptocurrencies, and the economics of cryptocurrency mining, including as to variables or factors affecting the cost, efficiency and profitability of cryptocurrency mining ; ( 2 ) competition among the various providers of data mining services ; ( 3 ) changes in applicable laws, regulations and/or permits affecting TeraWulf's operations or the industries in which it operates, including regulation regarding power generation, cryptocurrency usage and/or cryptocurrency mining ; ( 4 ) the ability to implement certain business objectives and to timely and cost - effectively execute integrated projects ; ( 5 ) failure to obtain adequate financing on a timely basis and/or on acceptable terms with regard to growth strategies or operations ; ( 6 ) loss of public confidence in bitcoin or other cryptocurrencies and the potential for cryptocurrency market manipulation ; ( 7 ) the potential of cybercrime, money - laundering, malware infections and phishing and/or loss and interference as a result of equipment malfunction or break - down, physical disaster, data security breach, computer malfunction or sabotage (and the costs associated with any of the foregoing) ; ( 8 ) the availability, delivery schedule and cost of equipment necessary to maintain and grow the business and operations of TeraWulf, including mining equipment and equipment meeting the technical or other specifications required to achieve its growth strategy ; ( 9 ) employment workforce factors, including the loss of key employees ; ( 10 ) litigation relating to TeraWulf, IKONICS and/or the business combination ; ( 11 ) the ability to recognize the anticipated objectives and benefits of the business combination ; and ( 12 ) other risks and uncertainties detailed from time to time in the Company's filings with the Securities and Exchange Commission ("SEC") . Potential investors, stockholders and other readers are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date on which they were made . TeraWulf does not assume any obligation to publicly update any forward - looking statement after it was made, whether as a result of new information, future events or otherwise, except as required by law or regulation . Investors are referred to the full discussion of risks and uncertainties associated with forward - looking statements and the discussion of risk factors contained in the Company's filings with the SEC, which are available at www . sec . gov .

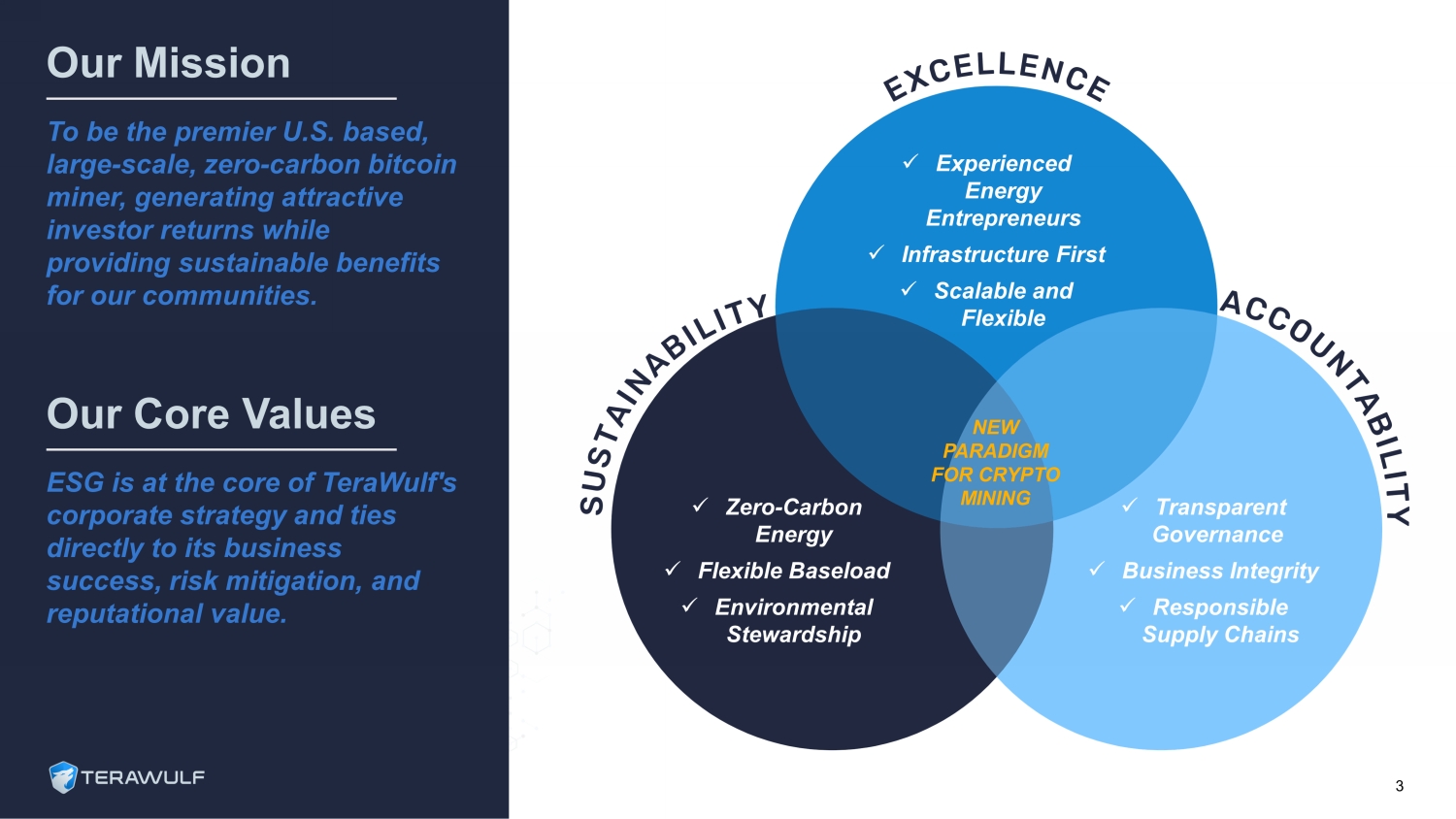

Our Mission To be the premier U.S. based, large - scale, zero - carbon bitcoin miner, generating attractive investor returns while providing sustainable benefits for our communities. x Experienced Energy Entrepreneurs x Infrastructure First x Scalable and Flexible x Transparent Governance x Business Integrity x Responsible Supply Chains x Zero - Carbon Energy x Flexible Baseload x Environmental Stewardship Our Core Values ESG is at the core of TeraWulf's corporate strategy and ties directly to its business success, risk mitigation, and reputational value. 3 NEW PARADIGM FOR CRYPTO MINING

(1) Company estimates and assumptions as of March 30, 2022. Average production cost based on 100 TH/s efficiency. TeraWulf at a Glance • Introducing a new paradigm for best - in - class crypto mining – Generating sustainable low - cost, domestic bitcoin at industrial scale – Targeting 100% zero - carbon emissions utilizing nuclear, hydro, and solar energy sources – Infrastructure first strategy has enabled ability to build and scale mining operations with established digital infrastructur e • Offering one of the most attractive economics of any bitcoin miner – Generating bitcoin at ~$5,500 on average, each of which is worth approximately $45,000 1 • Continuing its rapid deployment plan for 2022 and 2023 after commencing bitcoin mining in March 2022 – Anticipating 210 MW, net (or 4.9 EH/s) of capacity by YE 2022 and 400 MW, net (or 12 EH/s) by YE 2023 – Expects to achieve 800 MW, net (or 23 EH/s) of capacity deployed by YE 2025 • Vertically integrated and strengthening the electric grid to enable decarbonization – Facilitating and expediting the electric grid’s transition to a zero - carbon future • Led by energy entrepreneur Paul Prager and a seasoned management team – Led by an accomplished, diverse management team with decades of experience in energy infrastructure and power supply optimiza tio n – Proud to have many leadership positions held by women • Driving value by focusing on best ESG practices – Committed to purpose - driven business practices, clean energy goals, and support for communities 4

Energy Infrastructure Influences TeraWulf’s Foundational Pillars Digital Asset Infrastructure First Foundation to Scale Experienced Energy Entrepreneurs Power & Infrastructure Experts Sustainable, Scalable Facilities Key Relationships and Site Control ESG Principled and Practiced Driving the Future of Mining 5 1 2 3 4

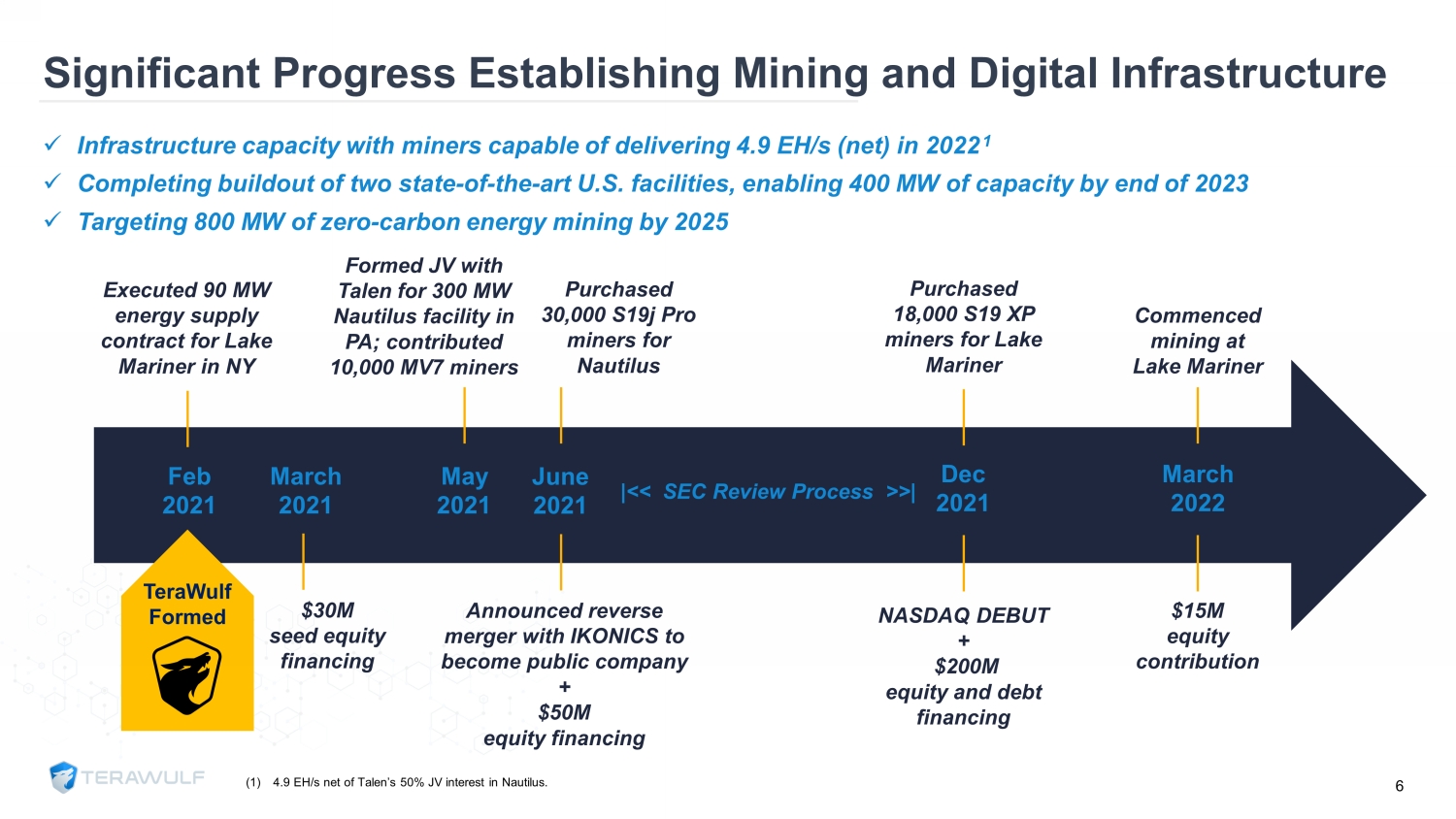

March 2022 Feb 2021 March 2021 May 2021 June 2021 Dec 2021 TeraWulf Formed Executed 90 MW energy supply contract for Lake Mariner in NY $30M seed equity financing |<< SEC Review Process >>| Announced reverse merger with IKONICS to become public company + $50M equity financing Formed JV with Talen for 300 MW Nautilus facility in PA; contributed 10,000 MV7 miners x Infrastructure capacity with miners capable of delivering 4.9 EH/s (net) in 2022 1 x Completing buildout of two state - of - the - art U.S. facilities, enabling 400 MW of capacity by end of 2023 x Targeting 800 MW of zero - carbon energy mining by 2025 Purchased 30,000 S19j Pro miners for Nautilus Purchased 18,000 S19 XP miners for Lake Mariner Commenced mining at Lake Mariner NASDAQ DEBUT + $200M equity and debt financing $15M equity contribution 6 (1) 4.9 EH/s net of Talen’s 50% JV interest in Nautilus. Significant Progress Establishing Mining and Digital Infrastructure

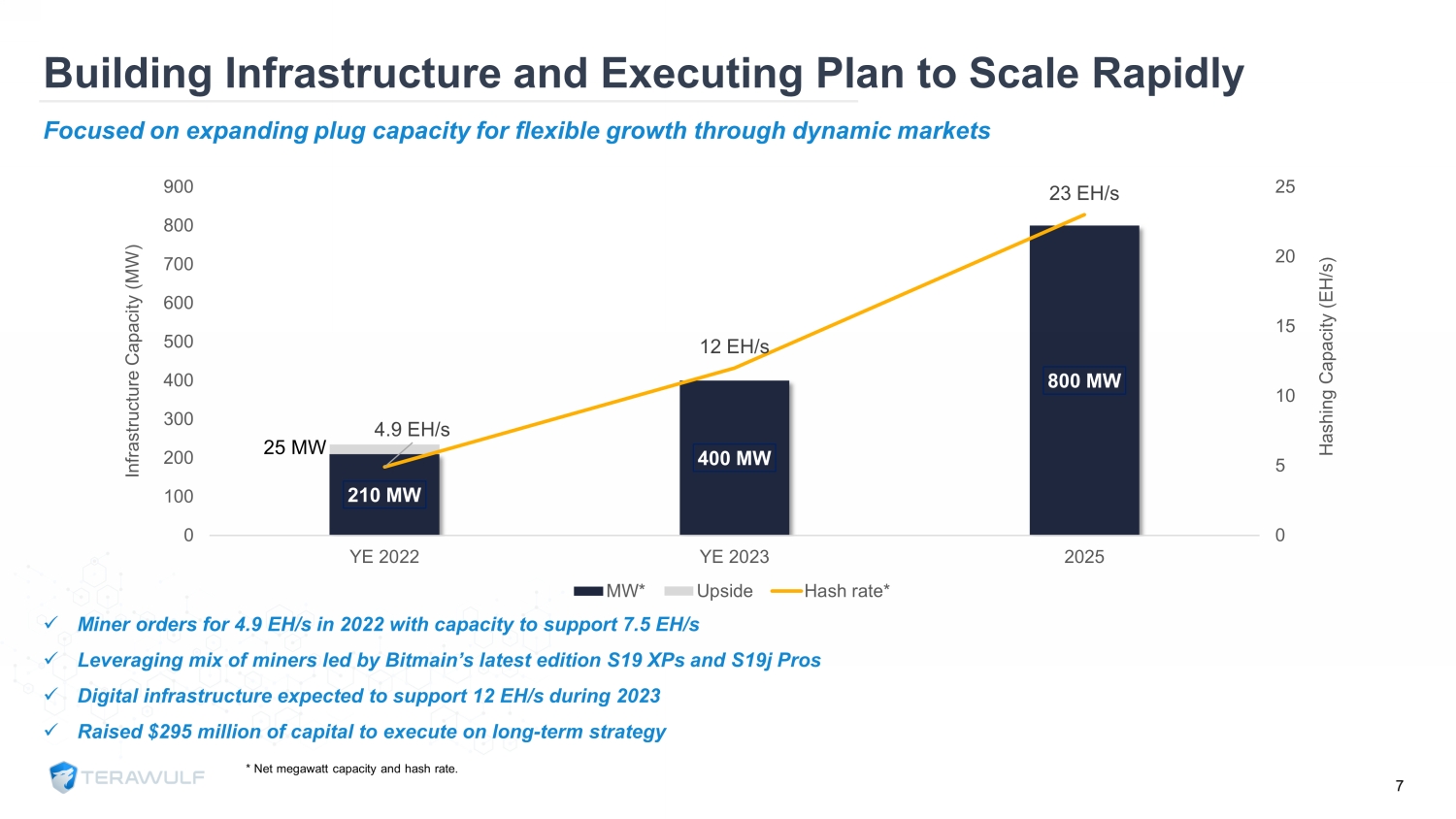

* Net megawatt capacity and hash rate. Focused on expanding plug capacity for flexible growth through dynamic markets x Miner orders for 4.9 EH/s in 2022 with capacity to support 7.5 EH/s x Leveraging mix of miners led by Bitmain’s latest edition S19 XPs and S19j Pros x Digital infrastructure expected to support 12 EH/s during 2023 x Raised $295 million of capital to execute on long - term strategy 210 MW 400 MW 800 MW 4.9 EH/s 12 EH/s 23 EH/s 0 5 10 15 20 25 0 100 200 300 400 500 600 700 800 900 YE 2022 YE 2023 2025 Hashing Capacity (EH/s) Infrastructure Capacity (MW) MW* Upside Hash rate* 7 Building Infrastructure and Executing Plan to Scale Rapidly 25 MW

Best - in - Class Management Team Led by an accomplished, diverse management team with 30+ years of experience in developing and managing energy infrastructure and disruptive technology N A Z A R K H A N Chief Operating Officer & Chief Technology Officer 20+ years in energy infrastructure and cryptocurrency mining. Previously at Evercore. K E R R I L A N G L A I S Chief Strategy Officer 20+ years of M&A, financing, strategy, and power sector experience. Previously at Goldman Sachs. S A N D Y H A R R I S O N VP, Investor Relations 20+ years in financial and marketing communications, equity research, financial analysis, and strategic planning. Previously at Semtech Corp. P A U L P R A G E R Chairman & Chief Executive Officer 30+ year energy infrastructure entrepreneur. USNA Foundation Investment Committee Trustee. K E N N E T H D E A N E Chief Financial Officer 20+ years of financial and operation experience in the power, high tech, and public accounting sectors. Previously at Isonics Corp. and Sun Microsystems. S T E F A N I E F L E I S C H M A N N General Counsel General Counsel for 15+ years overseeing all legal and compliance matters. Previously at Paul, Weiss. 8

Sustainable and Scalable Sites (1) Nautilus Cryptomine capacity represents TeraWulf’s 50% JV interest. 800 MW Mining capacity by 2025 at existing sites > 90% ZERO - carbon power supply today, with goal of achieving 100% < 3 ¢ Per kilowatt hour average power cost 9 500+ MW Hydro, Solar 90%+ Zero Carbon 110 MW Available Exiting 2022 300+ MW Nuclear 100% Zero Carbon 100 MW Available Exiting 2022 1

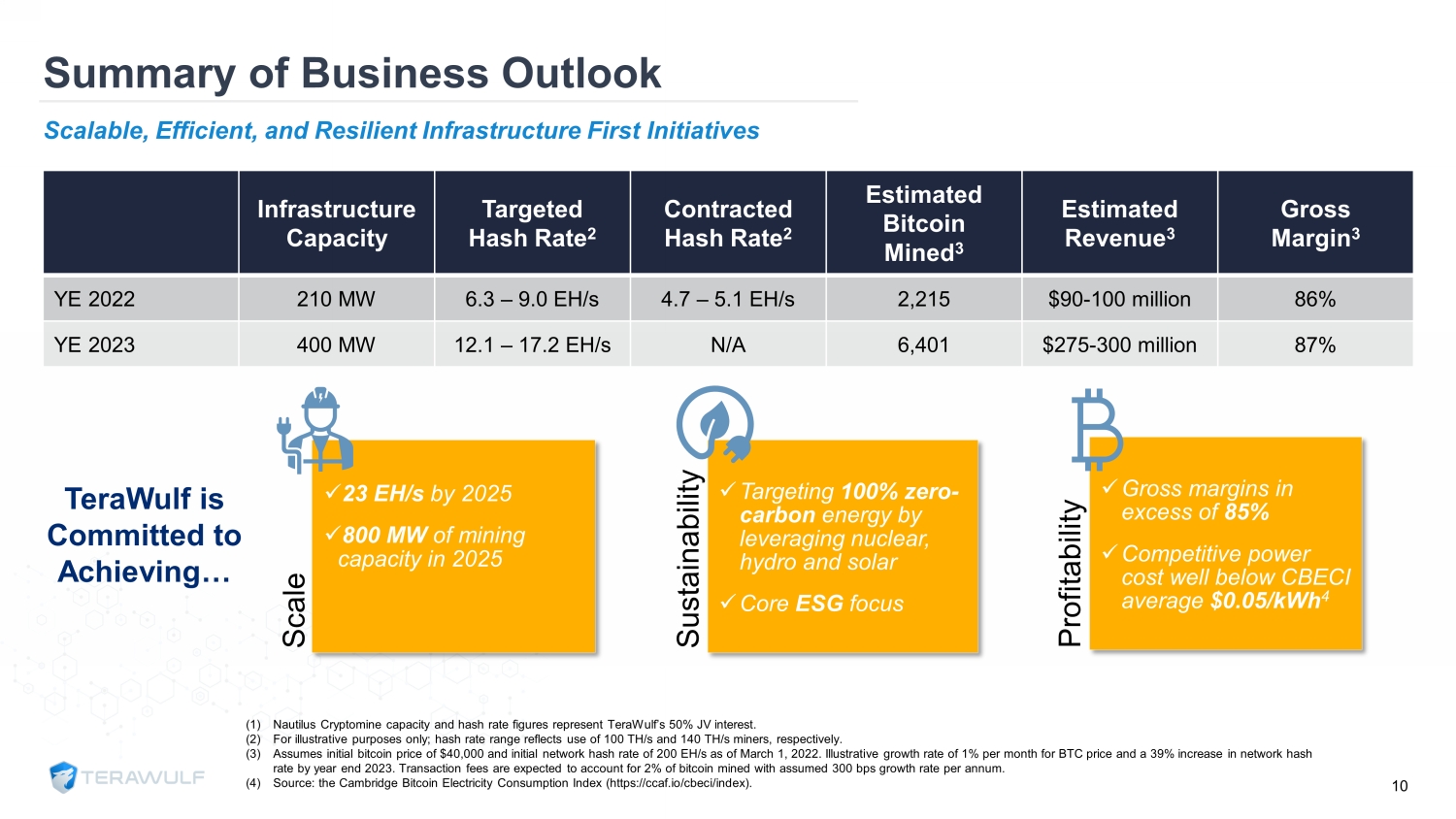

(1) Nautilus Cryptomine capacity and hash rate figures represent TeraWulf’s 50% JV interest. (2) For illustrative purposes only; hash rate range reflects use of 100 TH/s and 140 TH/s miners, respectively. (3) Assumes initial bitcoin price of $40,000 and initial network hash rate of 200 EH/s as of March 1, 2022. Illustrative growth r ate of 1% per month for BTC price and a 39% increase in network hash rate by year end 2023. Transaction fees are expected to account for 2% of bitcoin mined with assumed 300 bps growth rate per ann um. (4) Source: the Cambridge Bitcoin Electricity Consumption Index (https://ccaf.io/cbeci/index). 10 Infrastructure Capacity Targeted Hash Rate 2 Contracted Hash Rate 2 Estimated Bitcoin Mined 3 Estimated Revenue 3 Gross Margin 3 YE 2022 210 MW 6.3 – 9.0 EH/s 4.7 – 5.1 EH/s 2,215 $90 - 100 million 86% YE 2023 400 MW 12.1 – 17.2 EH/s N/A 6,401 $275 - 300 million 87% Summary of Business Outlook Scalable, Efficient, and Resilient Infrastructure First Initiatives TeraWulf is Committed to Achieving… Scale x 23 EH/s by 2025 x 800 MW of mining capacity in 2025 Sustainability x Targeting 100% zero - carbon energy by leveraging nuclear, hydro and solar x Core ESG focus Profitability x Gross margins in excess of 85% x Competitive power cost well below CBECI average $0.05/kWh 4

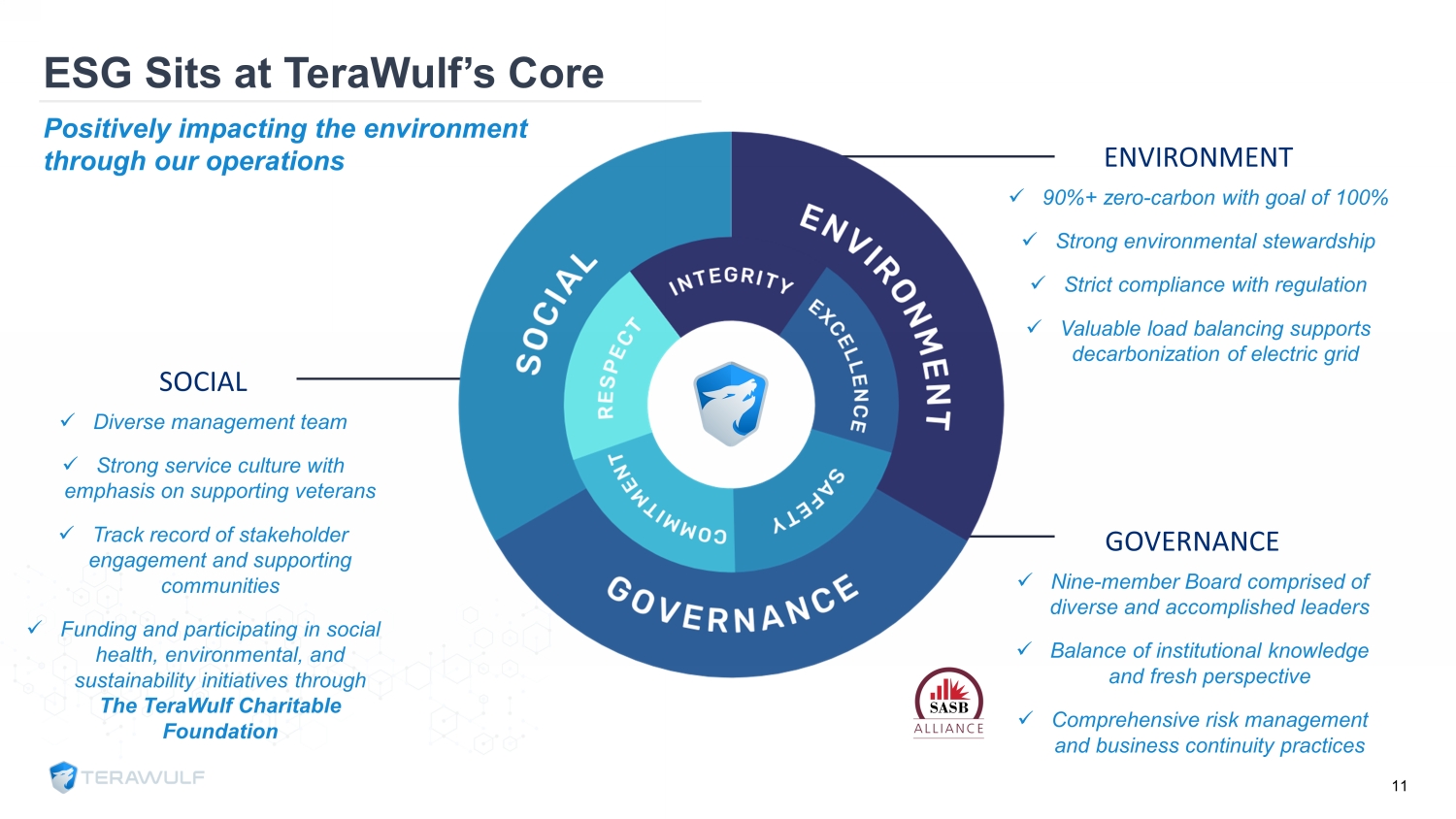

Positively impacting the environment through our operations SOCIAL x Diverse management team x Strong service culture with emphasis on supporting veterans x Track record of stakeholder engagement and supporting communities x Funding and participating in social health, environmental, and sustainability initiatives through The TeraWulf Charitable Foundation ENVIRONMENT x 90%+ zero - carbon with goal of 100% x Strong environmental stewardship x Strict compliance with regulation x Valuable load balancing supports decarbonization of electric grid GOVERNANCE x Nine - member Board comprised of diverse and accomplished leaders x Balance of institutional knowledge and fresh perspective x Comprehensive risk management and business continuity practices 11 ESG Sits at TeraWulf’s Core

TeraWulf is an Emerging Leader in Digital Asset Infrastructure • Best - in - class crypto mining due to low - cost, sustainable, and domestic bitcoin mining at industrial scale targeting zero - carbon energy leveraging nuclear, hydro, and solar resources • Vertically integrated, infrastructure first strategy ensures ability to create and take advantage of plug - ready digital asset infrastructure • Delivering peer leading economics with a comprehensive and compelling business outlook • Experienced team with decades of energy infrastructure experience and a model for sustainable, large - scale bitcoin mining • Core ESG focus differentiates TeraWulf and contributes to the acceleration of the U.S. transition to a more resilient, stable energy grid 12

APPENDIX

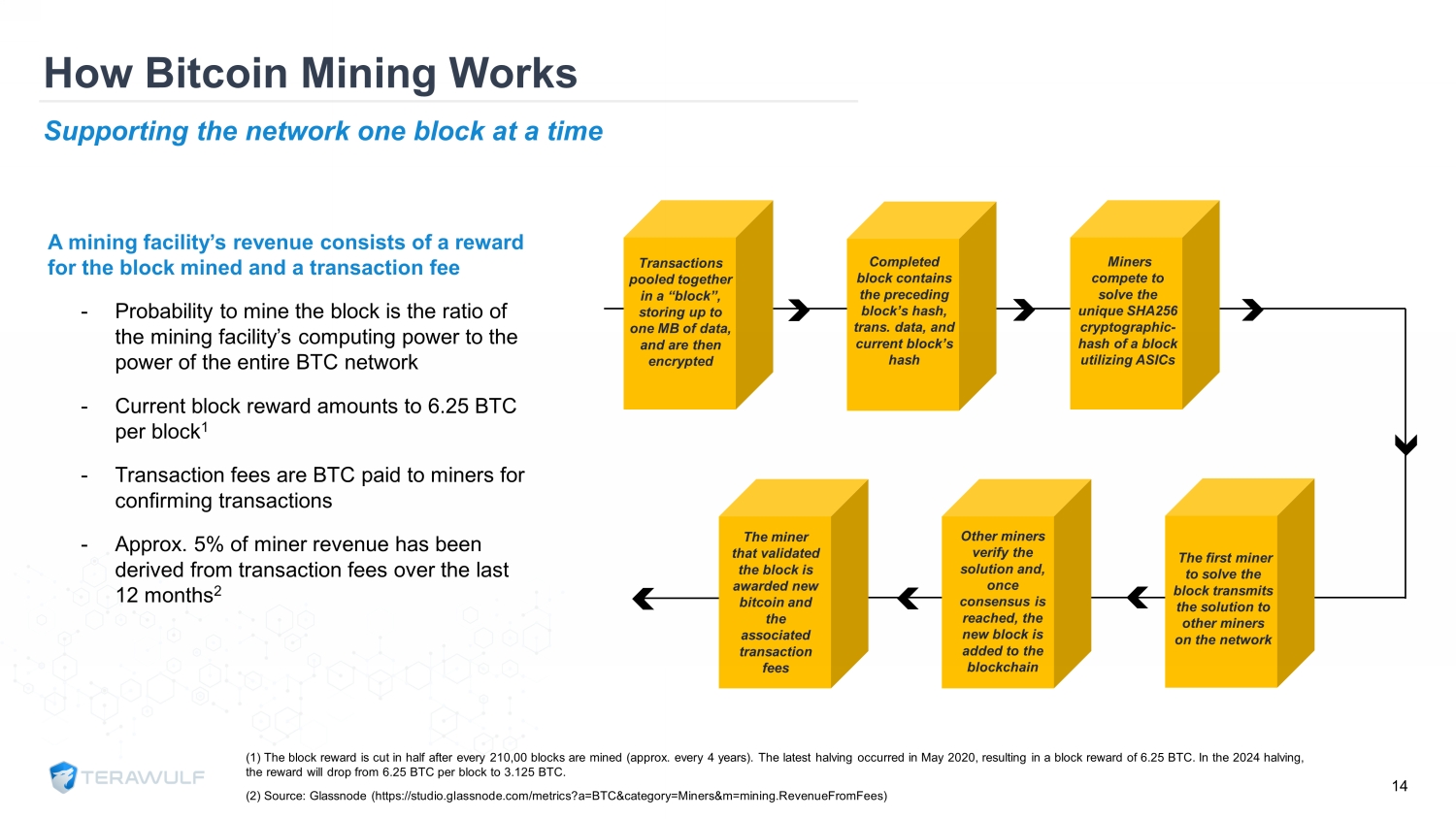

How Bitcoin Mining Works Supporting the network one block at a time Transactions pooled together in a “block”, storing up to one MB of data, and are then encrypted Completed block contains the preceding block’s hash, trans. data, and current block’s hash Miners compete to solve the unique SHA256 cryptographic - hash of a block utilizing ASICs The first miner to solve the block transmits the solution to other miners on the network Other miners verify the solution and, once consensus is reached, the new block is added to the blockchain The miner that validated the block is awarded new bitcoin and the associated transaction fees A mining facility’s revenue consists of a reward for the block mined and a transaction fee - Probability to mine the block is the ratio of the mining facility’s computing power to the power of the entire BTC network - Current block reward amounts to 6.25 BTC per block 1 - Transaction fees are BTC paid to miners for confirming transactions - Approx. 5% of miner revenue has been derived from transaction fees over the last 12 months 2 (1) The block reward is cut in half after every 210,00 blocks are mined (approx. every 4 years). The latest halving occurred in May 2020, resulting in a block reward of 6.25 BTC. In the 2024 halving, the reward will drop from 6.25 BTC per block to 3.125 BTC. (2) Source: Glassnode (https://studio.glassnode.com/metrics?a=BTC&category=Miners&m=mining.RevenueFromFees) 14

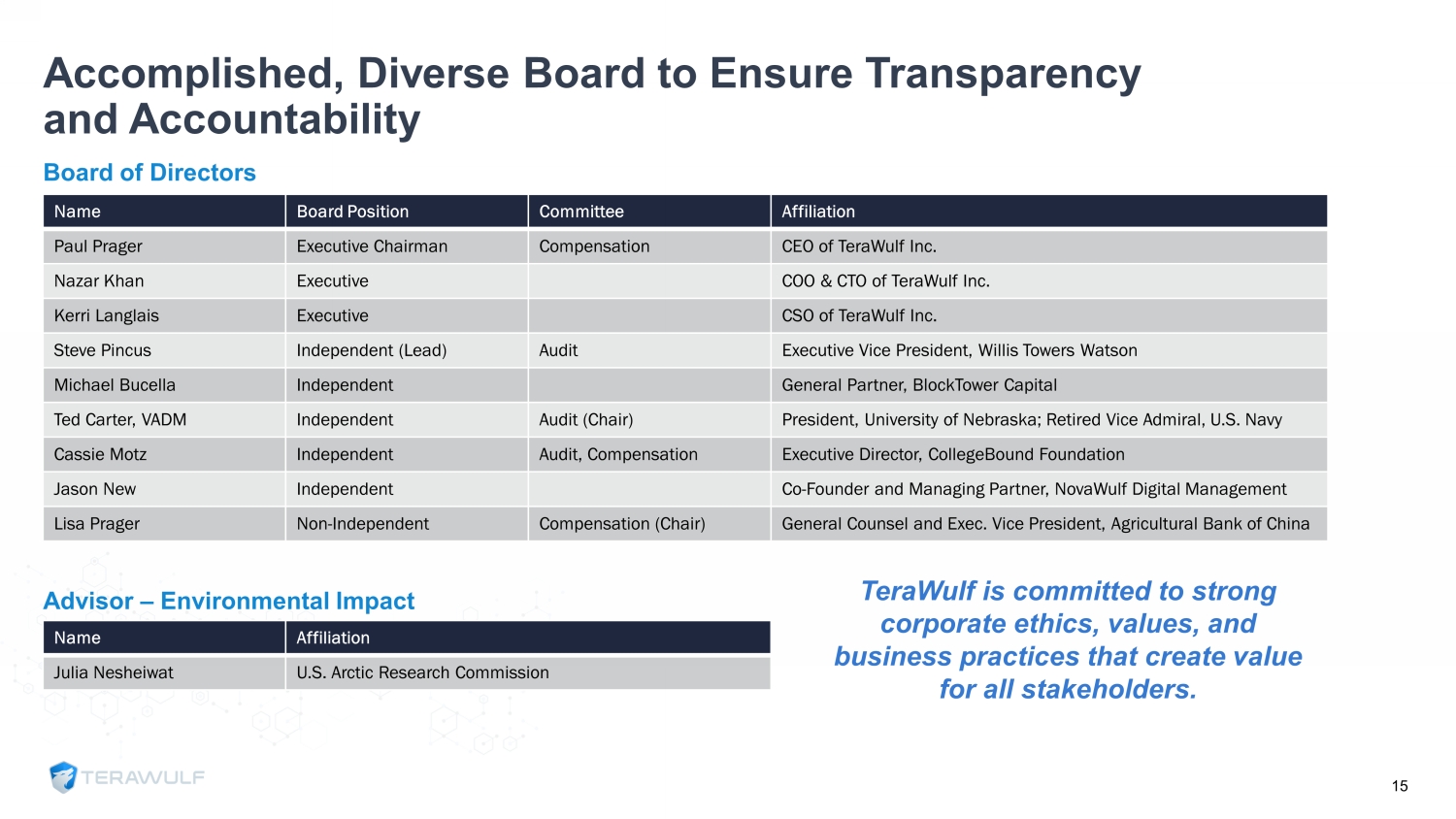

Accomplished, Diverse Board to Ensure Transparency and Accountability 15 Name Board Position Committee Affiliation Paul Prager Executive Chairman Compensation CEO of TeraWulf Inc. Nazar Khan Executive COO & CTO of TeraWulf Inc. Kerri Langlais Executive CSO of TeraWulf Inc. Steve Pincus Independent (Lead) Audit Executive Vice President, Willis Towers Watson Michael Bucella Independent General Partner, BlockTower Capital Ted Carter, VADM Independent Audit (Chair) President, University of Nebraska; Retired Vice Admiral, U.S. Navy Cassie Motz Independent Audit, Compensation Executive Director, CollegeBound Foundation Jason New Independent Co - Founder and Managing Partner, NovaWulf Digital Management Lisa Prager Non - Independent Compensation (Chair) General Counsel and Exec. Vice President, Agricultural Bank of China Name Affiliation Julia Nesheiwat U.S. Arctic Research Commission Board of Directors Advisor – Environmental Impact TeraWulf is committed to strong corporate ethics, values, and business practices that create value for all stakeholders.

16 Advancing TeraWulf’s Mission to Address Significant Societal Challenges of Today x Founded in 2021, the Foundation focuses on funding and participating in social health, environmental and sustainable programs. x Initial funding of 2.3% of outstanding WULF common stock. x In collaboration with reputable organizations and WULF’s talented employees, the Foundation’s objective is to affect large - scale change in the communities in which we operate and around the world. x In January 2022, the Foundation made its inaugural financial commitment to the Chesapeake Conservancy to support the initiative to elevate the national significance of the Chesapeake Bay and provide ecological, cultural, and economic benefits to its multi - state watershed region. TeraWulf Charitable Foundation A private, philanthropic organization focused on funding and participating in social health, environmental, and sustainability initiatives.

NASDAQ : WULF Contact: ir@terawulf.com www.TeraWulf.com/contact