Exhibit 5.1

April 26, 2022

TeraWulf Inc.

9 Federal Street

Easton, Maryland 21601

Ladies and Gentlemen:

We have acted as special counsel to TeraWulf Inc., a Delaware corporation (the “Company”), in connection with the Registration Statement on Form S-3 (File No. 333-262226) (the “Registration Statement”) filed with the Securities and Exchange Commission (the “Commission”) pursuant to the Securities Act of 1933, as amended (the “Securities Act”), and the rules and regulations thereunder (the “Rules”), which became effective on February 4, 2022. You have asked us to furnish our opinion as to the legality of shares (the “Shares”) of common stock of the Company, par value $0.001 per share (the “Common Stock”), having an aggregate offering price of up to $200,000,000, which are registered under the Registration Statement and which are subject to sale pursuant to the sales agreement (the “Sales Agreement”), dated as of April 26, 2022, by and among the Company, Cantor Fitzgerald & Co., B. Riley Securities, Inc., and D.A. Davidson & Co., each as sales agent and/or principal.

| TeraWulf Inc. | 2 |

In connection with the furnishing of this opinion, we have examined originals, or copies certified or otherwise identified to our satisfaction, of the following documents:

1. the Registration Statement;

2. the final prospectus supplement dated April 26, 2022 (the “Final Prospectus”); and

3. the Sales Agreement.

In addition, we have examined (i) such corporate records of the Company as we have considered appropriate, including a copy of the certificate of incorporation, as amended, and by-laws, as amended, of the Company certified by the Company as in effect on the date of this letter, and copies of resolutions of the board of directors of the Company relating to the issuance of the Shares, and (ii) such other certificates, agreements and documents as we deemed relevant and necessary as a basis for the opinions expressed below. We have also relied upon the factual matters contained in the representations and warranties of the Company made in the documents reviewed by us and upon certificates of public officials and the officers of the Company.

| TeraWulf Inc. | 3 |

In our examination of the documents referred to above, we have assumed, without independent investigation, the genuineness of all signatures, the legal capacity of all individuals who have executed any of the documents reviewed by us, the authenticity of all documents submitted to us as originals, the conformity to the originals of all documents submitted to us as certified, photostatic, reproduced or conformed copies of valid existing agreements or other documents, the authenticity of all such latter documents and that the statements regarding matters of fact in the certificates, records, agreements, instruments and documents that we have examined are accurate and complete.

Based upon the above, and subject to the stated assumptions, exceptions and qualifications, we are of the opinion that the Shares have been duly authorized by all necessary corporate action on the part of the Company and, when issued, delivered and paid for as contemplated in the Registration Statement and in accordance with the terms of the Sales Agreement, the Shares will be validly issued, fully paid and non-assessable.

The opinion expressed above is limited to the Delaware General Corporation Law. Our opinion is rendered only with respect to the laws, and the rules, regulations and orders under those laws, that are currently in effect.

| TeraWulf Inc. | 4 |

We hereby consent to the use of this opinion as an exhibit to the Company’s Current Report on Form 8-K filed by the Company with the Commission on the date hereof, and to the use of our name under the heading “Legal Matters” contained in the base prospectus included in the Registration Statement and in the Final Prospectus. In giving this consent, we do not thereby admit that we come within the category of persons whose consent is required by the Securities Act or the Rules.

| Very truly yours, | |

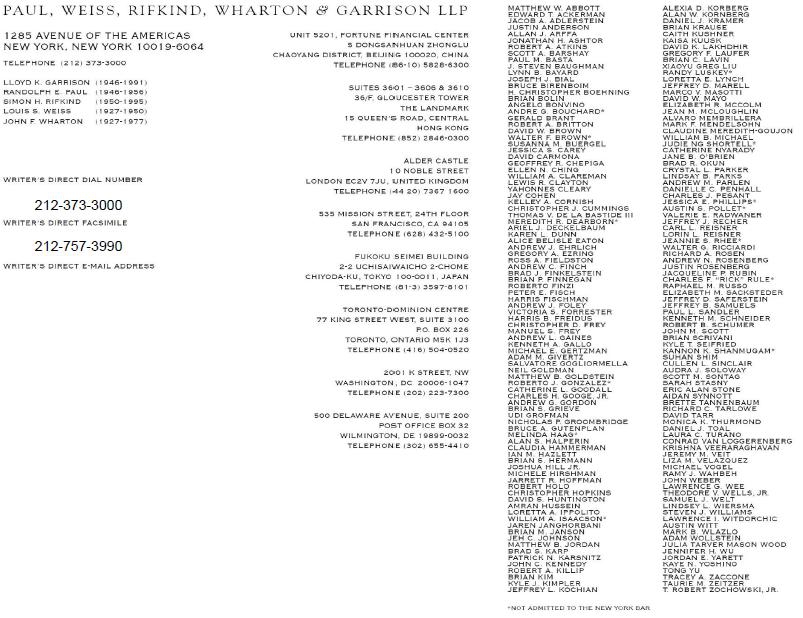

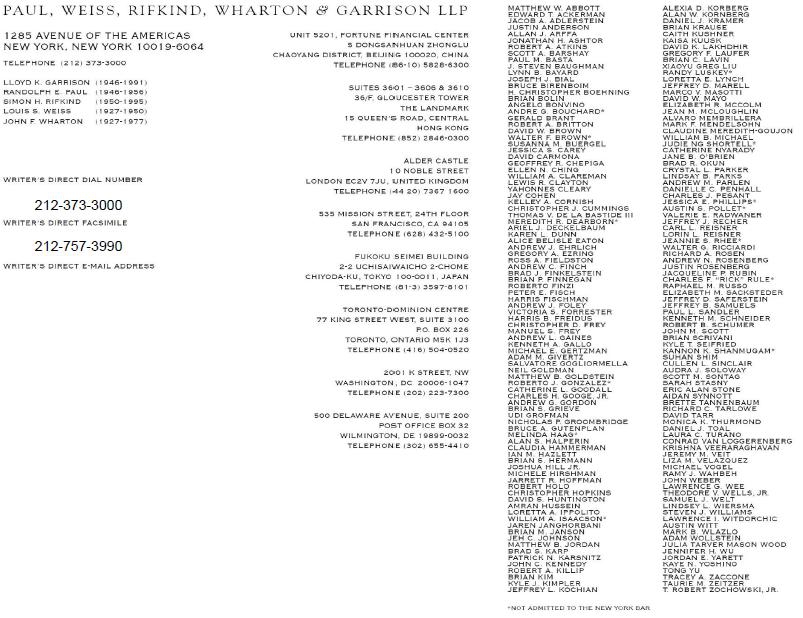

| /s/ PAUL, WEISS, RIFKIND, WHARTON & GARRISON LLP |