| 1 Investor PresentationJanuary 2023An Infrastructure-Focused Mining Company |

| SAFE HARBOR STATEMENT This presentation is for informational purposes only and contains forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements include statements concerning anticipated future events and expectations that are not historical facts. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements. In addition, forward-looking statements are typically identified by words such as "plan," "believe," "goal," "target," "aim," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "continue," "could," "may," "might," "possible," "potential," "predict," "should," "would" and other similar words and expressions, although the absence of these words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are based on the current expectations and beliefs of TeraWulf's management and are inherently subject to a number of factors, risks, uncertainties and assumptions and their potential effects. There can be no assurance that future developments will be those that have been anticipated. Actual results may vary materially from those expressed or implied by forward-looking statements based on a number of factors, risks, uncertainties and assumptions, including, among others: (1) conditions in the cryptocurrency mining industry, including fluctuation in the market pricing of bitcoin and other cryptocurrencies, and the economics of cryptocurrency mining, including as to variables or factors affecting the cost, efficiency and profitability of cryptocurrency mining; (2) competition among the various providers of data mining services; (3) changes in applicable laws, regulations and/or permits affecting TeraWulf's operations or the industries in which it operates, including regulation regarding power generation, cryptocurrency usage and/or cryptocurrency mining; (4) the ability to implement certain business objectives and to timely and cost-effectively execute integrated projects; (5) failure to obtain adequate financing on a timely basis and/or on acceptable terms with regard to growth strategies or operations; (6) loss of public confidence in bitcoin or other cryptocurrencies and the potential for cryptocurrency market manipulation; (7) the potential of cybercrime, money-laundering, malware infections and phishing and/or loss and interference as a result of equipment malfunction or break-down, physical disaster, data security breach, computer malfunction or sabotage (and the costs associated with any of the foregoing); (8) the availability, delivery schedule and cost of equipment necessary to maintain and grow the business and operations of TeraWulf, including mining equipment and equipment meeting the technical or other specifications required to achieve its growth strategy; (9) employment workforce factors, including the loss of key employees; (10) litigation relating to TeraWulf, RM 101 f/k/a IKONICS Corporation and/or the business combination; (11) the ability to recognize the anticipated objectives and benefits of the business combination; and (12) other risks and uncertainties detailed from time to time in the Company's filings with the Securities and Exchange Commission ("SEC"). Potential investors, stockholders and other readers are cautioned not to place undue reliance on these forward- looking statements, which speak only as of the date on which they were made. TeraWulf does not assume any obligation to publicly update any forward-looking statement after it was made, whether as a result of new information, future events or otherwise, except as required by law or regulation. Investors are referred to the full discussion of risks and uncertainties associated with forward-looking statements and the discussion of risk factors contained in the Company's filings with the SEC, which are available at www.sec.gov. |

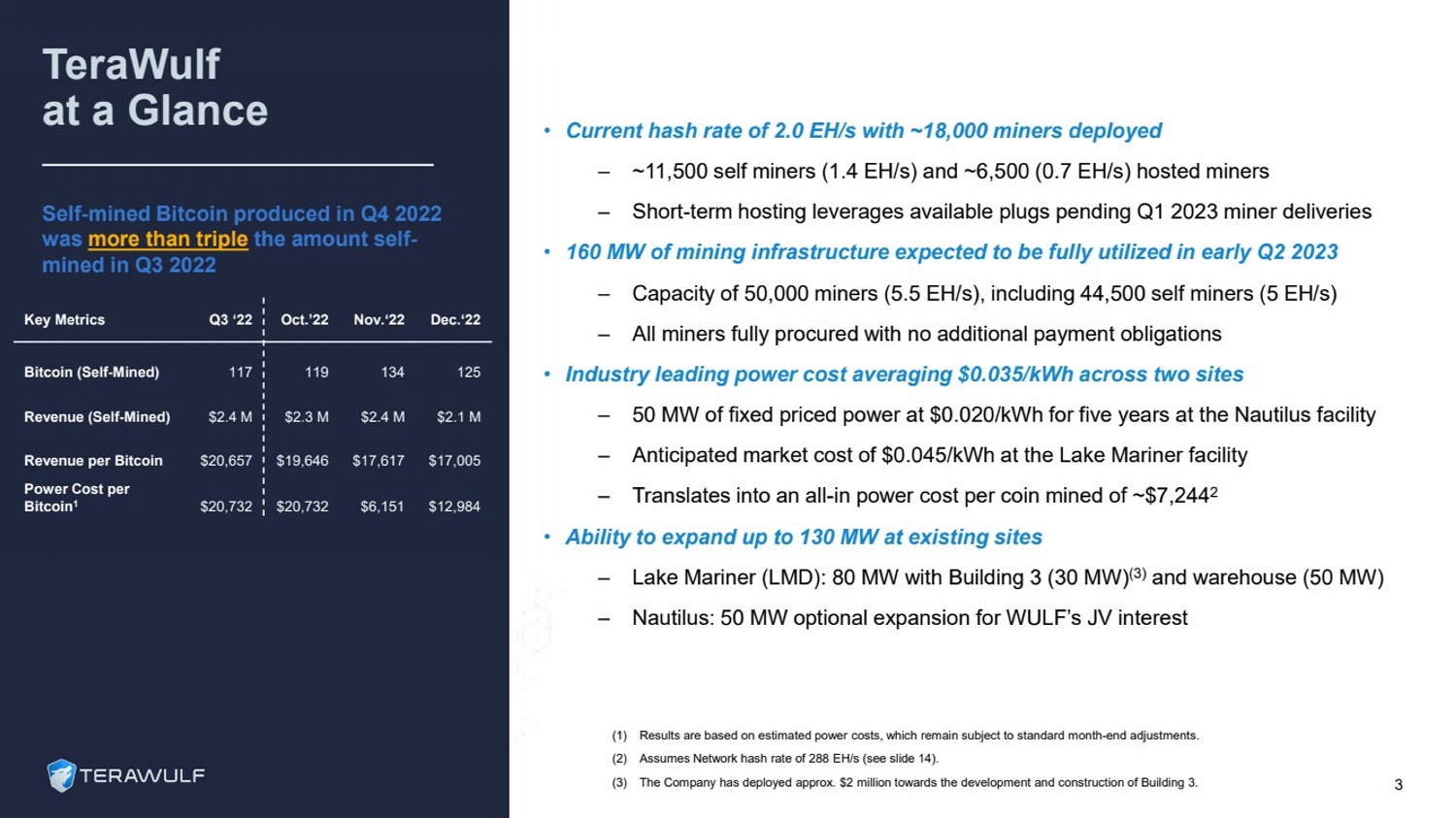

| TeraWulf at a Glance 3•Current hash rate of 2.0 EH/s with ~18,000 miners deployed–~11,500 self miners (1.4 EH/s) and ~6,500 (0.7 EH/s) hosted miners–Short-term hosting leverages available plugs pending Q1 2023 miner deliveries•160 MW of mining infrastructure expected to be fully utilized in early Q2 2023–Capacity of 50,000 miners (5.5 EH/s), including 44,500 self miners (5 EH/s)–All miners fully procured with no additional payment obligations•Industry leading power cost averaging $0.035/kWh across two sites–50 MW of fixed priced power at $0.020/kWh for five years at the Nautilus facility–Anticipated market cost of $0.045/kWh at the Lake Mariner facility–Translates into an all-in power cost per coin mined of ~$7,2442•Ability to expand up to 130 MW at existing sites –Lake Mariner (LMD): 80 MW with Building 3 (30 MW)(3)and warehouse (50 MW)–Nautilus: 50 MW optional expansion for WULF’s JV interest Key MetricsQ3 ‘22Oct.’22Nov.‘22Dec.‘22Bitcoin (Self-Mined)117119134125Revenue (Self-Mined)$2.4 M$2.3 M$2.4 M$2.1 MRevenue per Bitcoin$20,657$19,646$17,617$17,005Power Cost per Bitcoin1$20,732$20,732$6,151$12,984Self-mined Bitcoin produced in Q4 2022 was more than triple the amount self-mined in Q3 2022(1)Results are based on estimated power costs, which remain subject to standard month-end adjustments.(2)Assumes Network hash rate of 288 EH/s (see slide 14).(3)The Company has deployed approx. $2 million towards the development and construction of Building 3. |

| Why WULF Wins: The Four “P’s”Digital Asset Infrastructure FirstFoundation to Scale Experienced Energy EntrepreneursPower & InfrastructureExpertsSustainable, Scalable FacilitiesKey Relationships & Site ControlESG Principled and PracticedDriving the Future of Bitcoin Mining4 PlugsPeoplePowerPriorities |

| Plugs: Sustainable and Scalable Sites130 MWNear-term additional capacity available at existing sites> 91%Zero-carbon power supply today, with goal of achieving 100%3.5 ¢ Per kilowatt hour targeted average power cost5 91%+ Zero Carbon (1)110 MW Online early Q2 2023500+ MW Hydro, Solar 100% Zero Carbon50 MW Online early Q2 2023 (2)100+ MW (3)Nuclear (1)Source: NYISO Power Trends 2022 report (https://www.nyiso.com/power-trends).(2)Energization of the Nautilus Cryptominecommences in Q1 2023.(3)Reflects TeraWulf’s50 MW interest in the Nautilus Cryptominefacility and option to expand by 50 MW. 160 MWAnticipated fully developed capacity in early Q2 2023 |

| People: Best-in-Class Management TeamLed by an accomplished, diverse management team with 30+ years of experience in developing and managing energy infrastructure N A Z A R K H A NCo-Founder, Chief Operating Officer & Chief Technology Officer20+ years in energy infrastructure and cryptocurrency mining. Previously at Evercore. K E R R I L A N G L A I S Chief Strategy Officer20+ years of M&A, financing, strategy, and power sector experience. Previously at Goldman Sachs.S E A N F A R RE L LVP, Operations12+ years of energy experience in renewables, grid optimization, digitalization, and storage solutions. Previously at Siemens Energy.P A U L P R A G E RCo-Founder, Chairman & Chief Executive Officer30+ year energy infrastructure entrepreneur. USNA Foundation Investment Committee Trustee.P A T R I C K F L E U R Y Chief Financial Officer20+ years of financial experience in the energy, power, and commodity sectors. Previously at Platinum Equity and Blackstone.S T E F A N I E F L E I S C H M A N NGeneral CounselGeneral Counsel for 15+ years overseeing all legal and compliance matters. Previously at Paul, Weiss.6 |

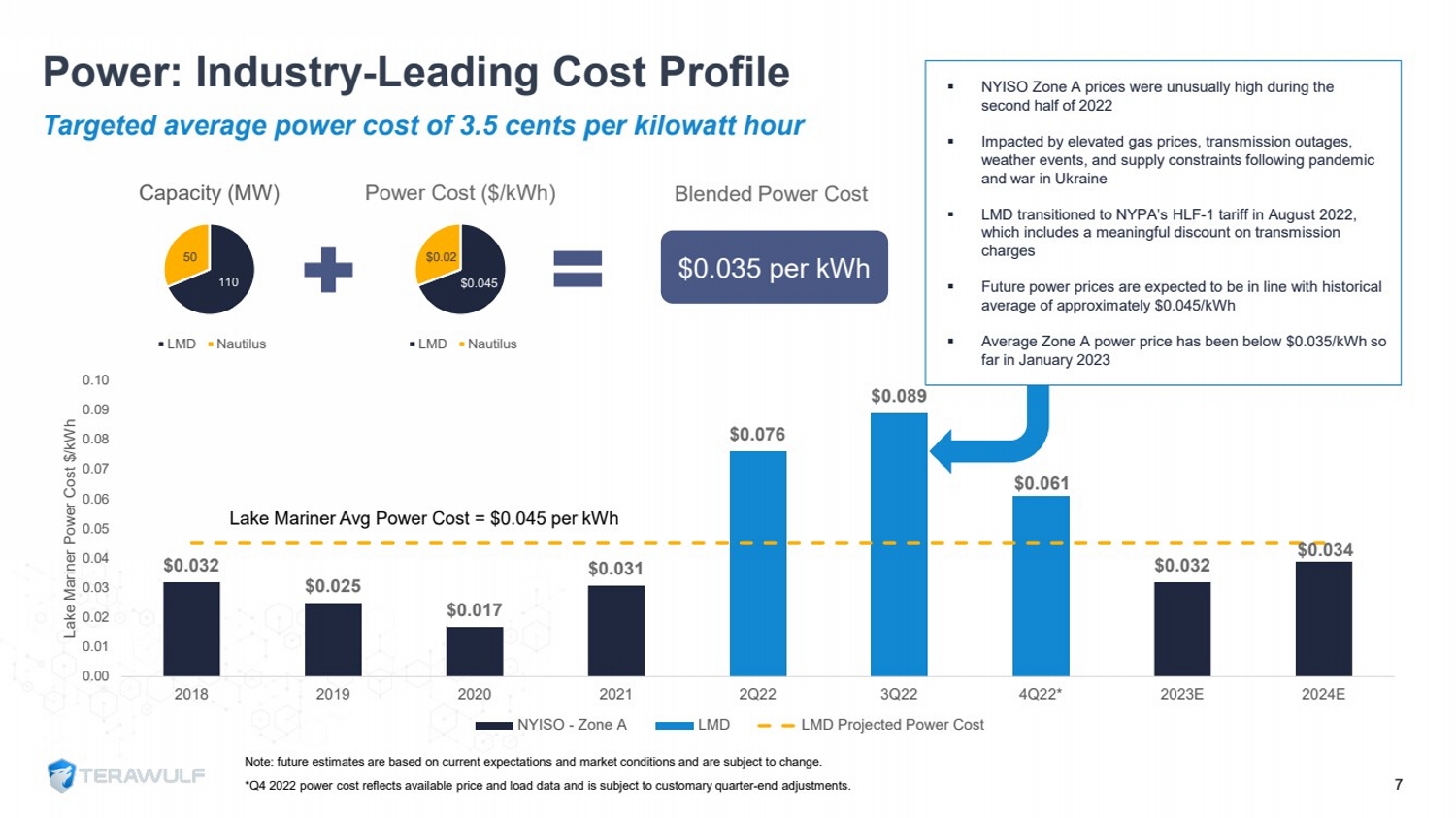

| Power: Industry-Leading Cost ProfileNote: future estimates are based on current expectations and market conditions and are subject to change.*Q4 2022 power cost reflects available price and load data and is subject to customary quarter-end adjustments. $0.032 $0.025 $0.017 $0.031 $0.076 $0.089 $0.061 $0.032 $0.034 0.000.01 0.020.030.04 0.05 0.060.070.080.090.1020182019202020212Q223Q224Q22*2023E2024E Lake Mariner Power Cost $/kWh NYISO - Zone A LMD LMD Projected Power CostTargeted average power cost of 3.5 cents per kilowatt hour7 11050Capacity (MW) LMD Nautilus $0.045 $0.02 Power Cost ($/kWh) LMD Nautilus $0.035 per kWhBlended Power Cost NYISO Zone A prices were unusually high during the second half of 2022Impacted by elevated gas prices, transmission outages, weather events, and supply constraints following pandemic and war in UkraineLMD transitioned to NYPA’s HLF-1 tariff in August 2022, which includes a meaningful discount on transmission chargesFuture power prices are expected to be in line with historical average of approximately $0.045/kWh Average Zone A power price has been below $0.035/kWh so far in January 2023Lake Mariner Avg Power Cost = $0.045 per kWh |

| WULF MissionTo be the premier large-scale, zero-carbonbitcoin miner,generating attractive investorreturnswhile providingsustainable benefits forourcommunities. Experienced Energy EntrepreneursInfrastructure FirstScalable and FlexibleTransparent Governance Business IntegrityResponsible Energy SourcingZero-Carbon EnergyFlexible BaseloadEnvironmental StewardshipWULF Core ValuesESG is at the core of TeraWulf'scorporate strategy and ties directly to its business success, risk mitigation, and reputational value. 8 Priorities: |

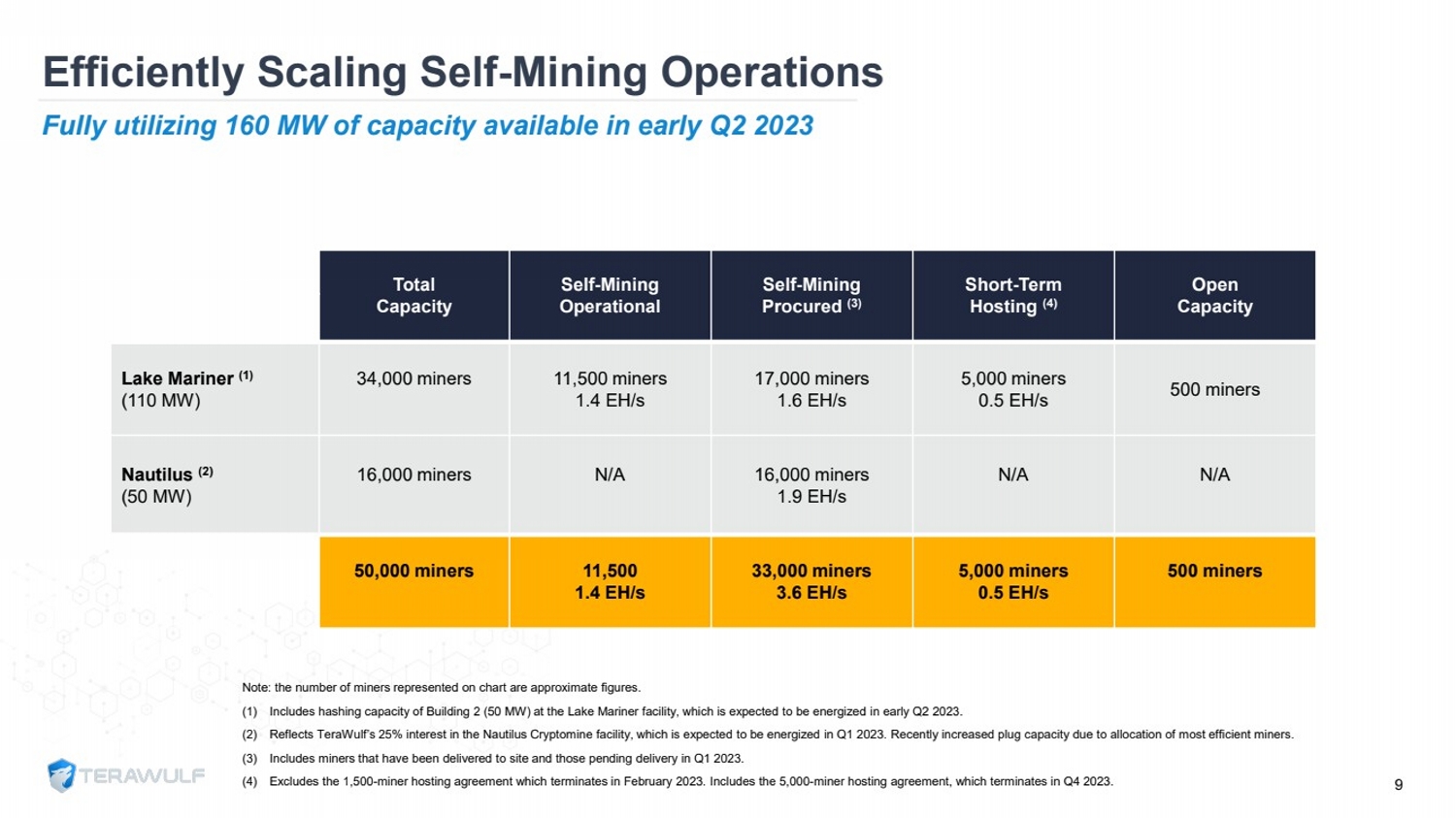

| Efficiently Scaling Self-Mining OperationsNote: the number of miners represented on chart are approximate figures.(1)Includes hashing capacity of Building 2 (50 MW) at the Lake Mariner facility, which is expected to be energized in early Q2 2023.(2)Reflects TeraWulf’s 25% interest in the Nautilus Cryptominefacility, which is expected to be energized in Q1 2023. Recently increased plug capacity due to allocation of most efficient miners.(3)Includes miners that have been delivered to site and those pending delivery in Q1 2023.(4)Excludes the 1,500-miner hosting agreement which terminates in February 2023. Includes the 5,000-miner hosting agreement, which terminates in Q4 2023. 9Fully utilizing 160 MW of capacity available in early Q2 2023 Total CapacitySelf-MiningOperationalSelf-MiningProcured (3)Short-TermHosting (4)OpenCapacityLake Mariner (1)(110 MW)34,000 miners11,500 miners1.4 EH/s17,000 miners1.6 EH/s5,000 miners0.5 EH/s500 minersNautilus (2)(50 MW)16,000 minersN/A16,000 miners1.9 EH/sN/AN/A50,000 miners11,5001.4 EH/s33,000 miners3.6 EH/s5,000 miners0.5 EH/s500 miners |

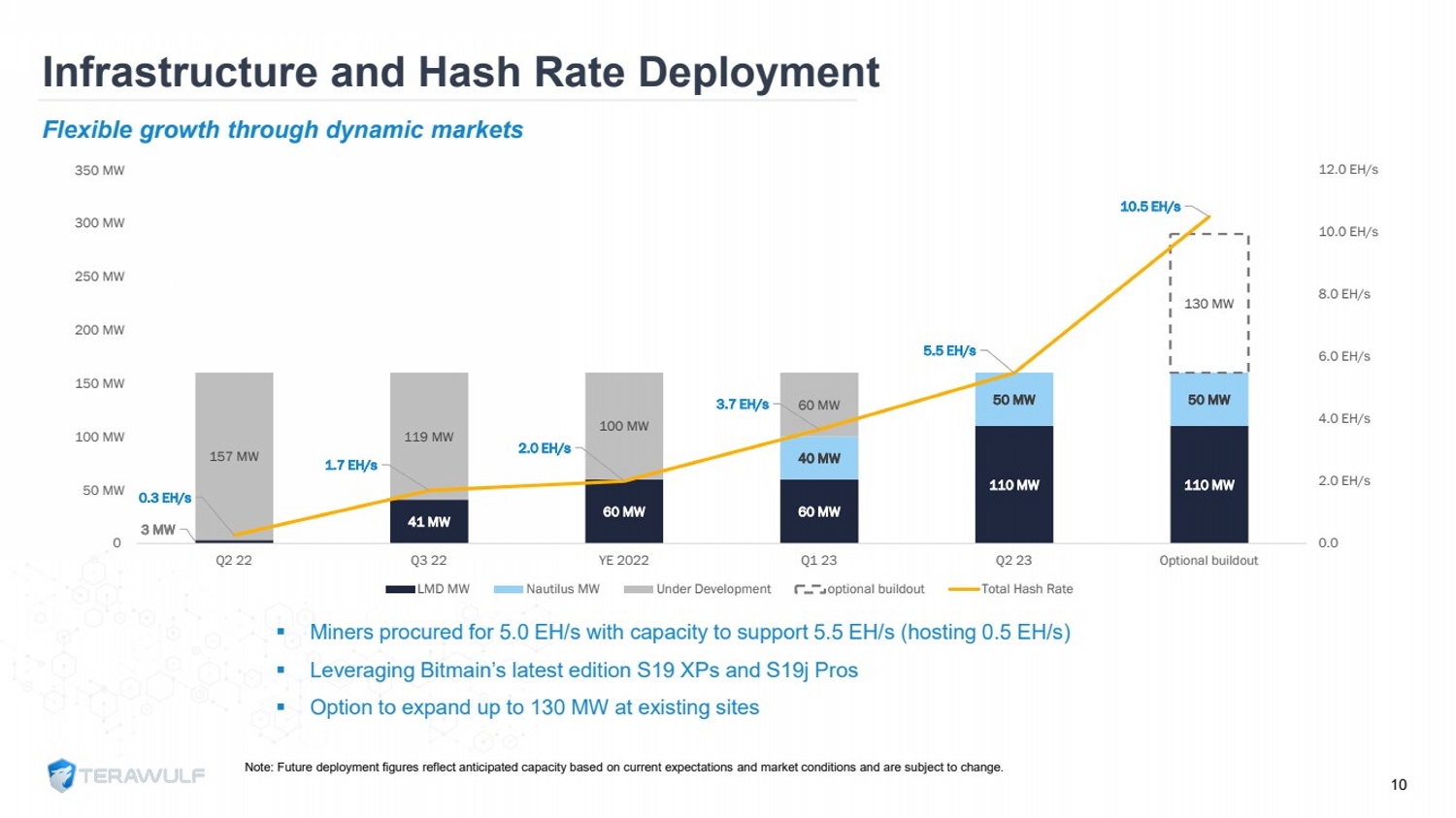

| Note: Future deployment figures reflect anticipated capacity based on current expectations and market conditions and are subjectto change.Flexible growth through dynamic markets10 Infrastructure and Hash Rate DeploymentMiners procured for 5.0 EH/s with capacity to support 5.5 EH/s (hosting 0.5 EH/s)Leveraging Bitmain’slatest edition S19 XPs and S19j ProsOption to expand up to 130 MW at existing sites 3 MW 41 MW 60 MW 60 MW 110 MW 110 MW 40 MW 50 MW 50 MW 157 MW119 MW100 MW60 MW130 MW 0.3 EH/s 1.7 EH/s 2.0 EH/s 3.7 EH/s 5.5 EH/s 10.5 EH/s 0.02.0 EH/s 4.0 EH/s 6.0 EH/s8.0 EH/s10.0 EH/s 12.0 EH/s050 MW100 MW150 MW 200 MW250 MW300 MW350 MWQ2 22Q3 22YE 2022Q1 23Q2 23Optional buildout LMD MW Nautilus MW Under Development optional buildout Total Hash Rate |

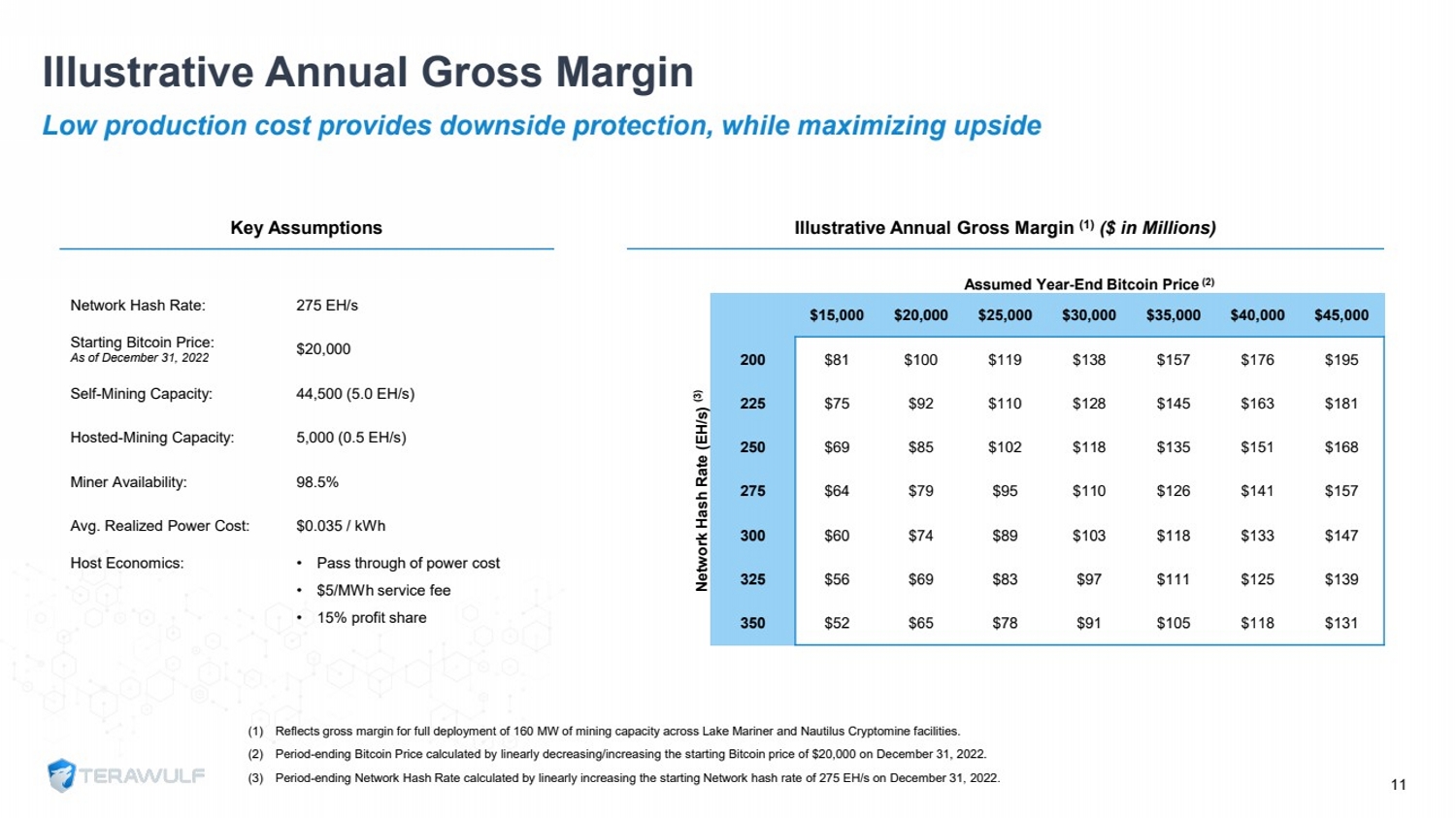

| Illustrative Annual Gross Margin(1)Reflects gross margin for full deployment of 160 MW of mining capacity across Lake Mariner and Nautilus Cryptominefacilities.(2)Period-ending Bitcoin Price calculated by linearly decreasing/increasing the starting Bitcoin price of $20,000 on December 31, 2022.(3)Period-ending Network Hash Rate calculated by linearly increasing the starting Network hash rate of 275 EH/s on December 31, 2022.Low production cost provides downside protection, while maximizing upside Illustrative Annual Gross Margin (1)($ in Millions)Assumed Year-End Bitcoin Price(2)$15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 Network Hash Rate (EH/s) (3)200$81 $100 $119 $138 $157 $176 $195 225$75 $92 $110 $128 $145 $163 $181 250$69 $85 $102 $118 $135 $151 $168 275$64 $79 $95 $110 $126 $141 $157 300$60 $74 $89 $103 $118 $133 $147 325$56 $69 $83 $97 $111 $125 $139 350$52 $65 $78 $91 $105 $118 $131 Key AssumptionsNetwork Hash Rate:275 EH/sStarting Bitcoin Price:As of December 31, 2022$20,000Self-Mining Capacity:44,500 (5.0 EH/s)Hosted-Mining Capacity:5,000 (0.5 EH/s)Miner Availability:98.5%Avg. Realized Power Cost:$0.035 / kWhHost Economics:•Pass through of power cost•$5/MWh service fee•15% profit share11 |

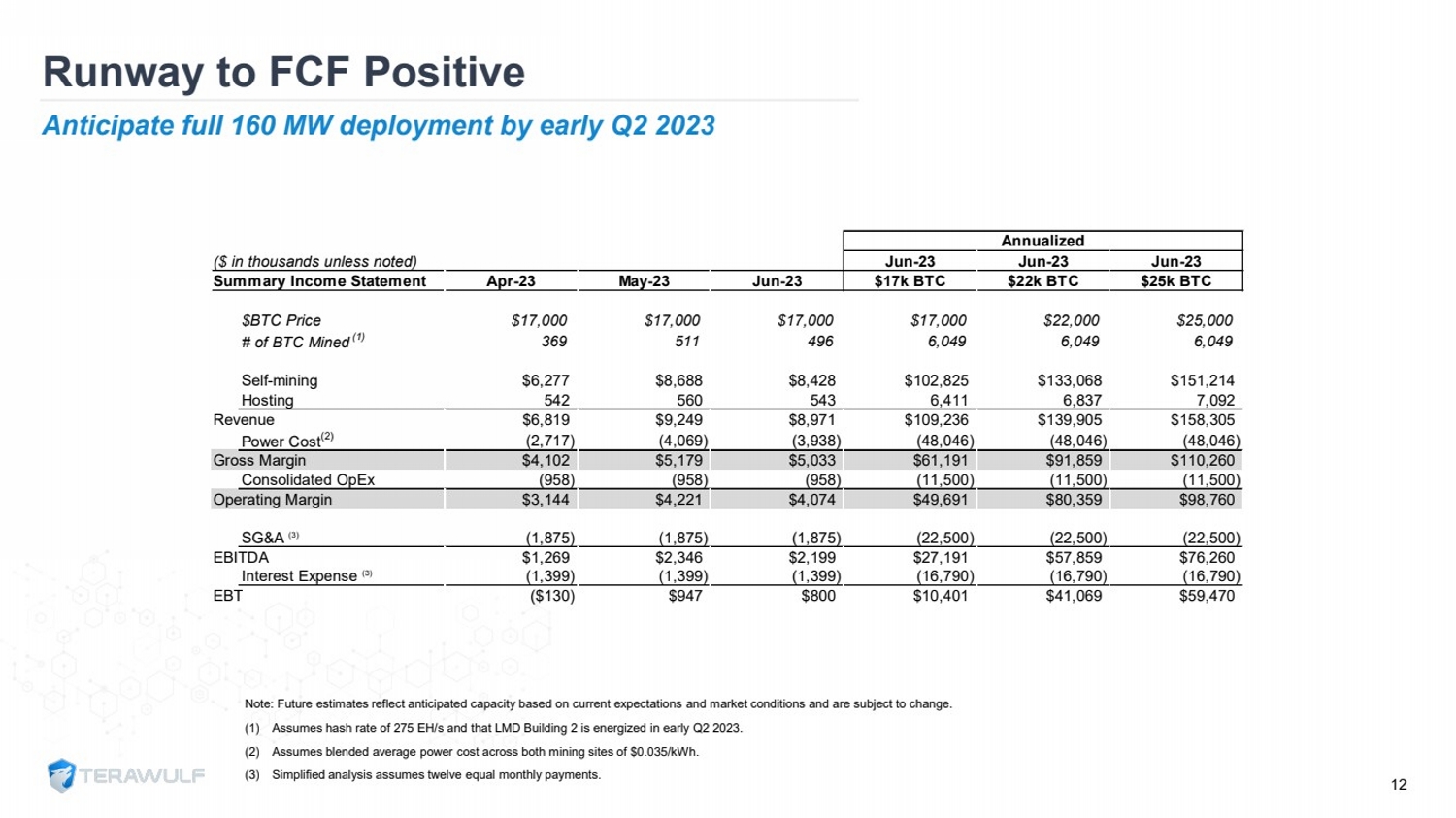

| Runway to FCF PositiveAnticipate full 160 MW deployment by early Q2 202312 Note: Future estimates reflect anticipated capacity based on current expectations and market conditions and are subject to change.(1)Assumes hash rate of 275 EH/s and that LMD Building 2 is energized in early Q2 2023.(2)Assumes blended average power cost across both mining sites of $0.035/kWh.(3)Simplified analysis assumes twelve equal monthly payments. ($ in thousands unless noted)Jun-23Jun-23Jun-23Summary Income StatementApr-23May-23Jun-23$17k BTC$22k BTC$25k BTC$BTC Price$17,000$17,000$17,000$17,000$22,000$25,000 # of BTC Mined(1)3695114966,0496,0496,049 Selfmining$6,277$,6$,42$102,25$133,06$151,214osting5425605436,4116,377,092evenue$6,19$9,249$,971$109,236$139,905$15,305 Power Cost(2)(2,717)(4,069)(3,93)(4,046)(4,046)(4,046) Gross Margin$4,102$5,179$5,033$61,191$91,59$110,260Consolidated pEx(95)(95)(95)(11,500)(11,500)(11,500)perating Margin$3,144$4,221$4,074$49,691$0,359$9,760 SG&A (3)(1,75)(1,75)(1,75)(22,500)(22,500)(22,500) EBITDA$1,269$2,346$2,199$27,191$57,59$76,260 Interest Expense (3)(1,399)(1,399)(1,399)(16,790)(16,790)(16,790) EBT($130)$947$00$10,401$41,069$59,470 Annualized |

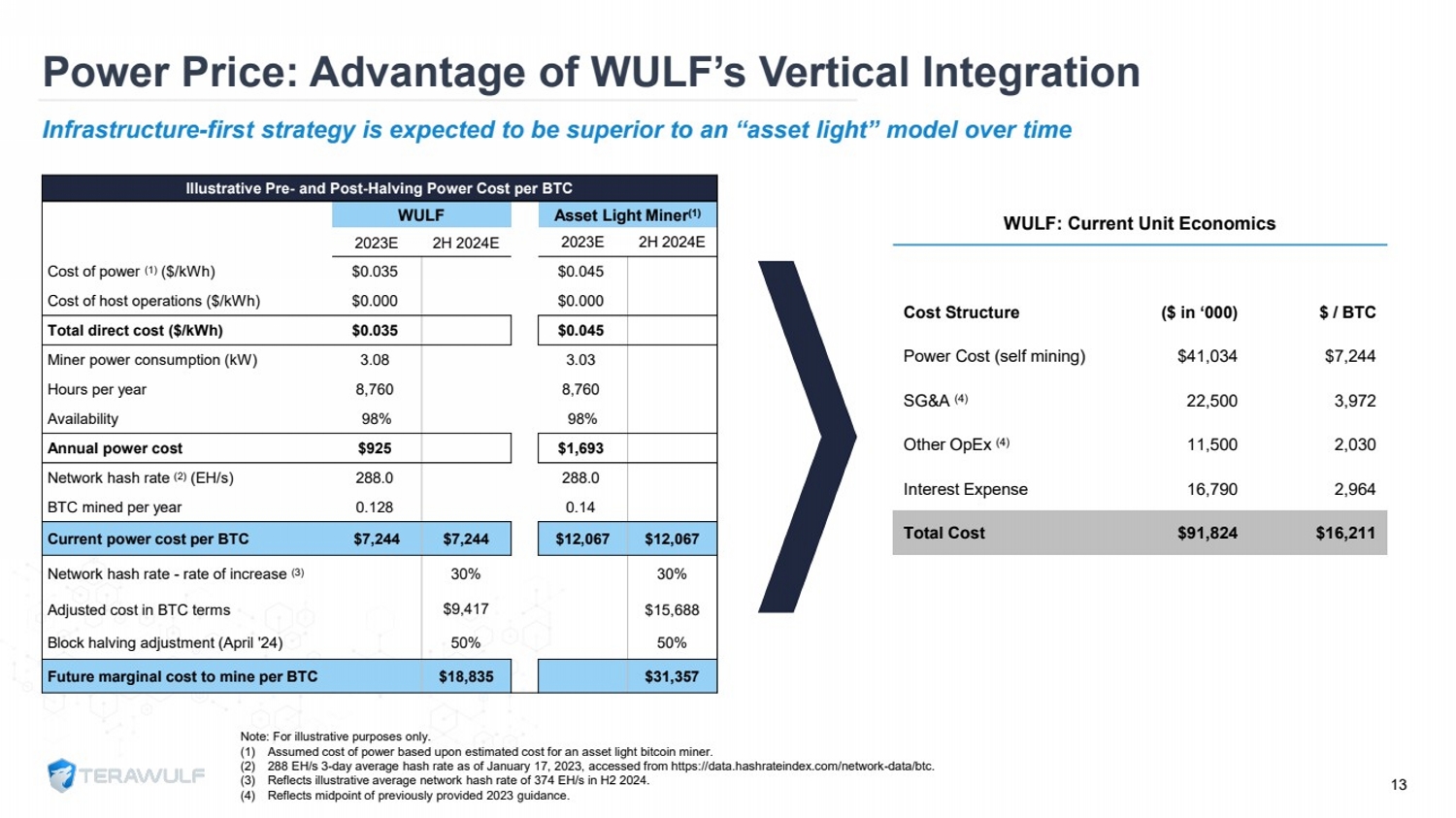

| Note: For illustrative purposes only.(1)Assumed cost of power based upon estimated cost for an asset light bitcoin miner.(2)288 EH/s 3-day average hash rate as of January 17, 2023, accessed from https://data.hashrateindex.com/network-data/btc.(3)Reflects illustrative average network hash rate of 374 EH/s in H2 2024.(4)Reflects midpoint of previously provided 2023 guidance. Illustrative Pre-and Post-Halving Power Cost per BTCWULFAsset Light Miner(1)2023E2H 2024E2023E2H 2024ECost of power (1)($/kWh)$0.035$0.045Cost of host operations ($/kWh)$0.000$0.000Total direct cost ($/kWh)$0.035$0.045Miner power consumption (kW)3.083.03Hours per year8,7608,760Availability98%98%Annual power cost$925$1,693Network hash rate (2)(EH/s)288.0288.0BTC mined per year0.1280.14Current power cost per BTC$7,244 $7,244$12,067$12,067Network hash rate -rate of increase (3)30%30%Adjusted cost in BTC terms$9,417 $15,688Block halving adjustment (April '24)50%50%Future marginal cost to mine per BTC$18,835$31,357 Infrastructure-first strategy is expected to besuperior to an “asset light” model over time13Power Price: Advantage of WULF’s Vertical Integration WULF: Current Unit EconomicsCost Structure($ in ‘000)$ / BTCPower Cost (self mining)$41,034 $7,244 SG&A (4)22,500 3,972 Other OpEx(4)11,500 2,030 Interest Expense16,790 2,964 Total Cost$91,824 $16,211 |

| Emerging Leader in Digital Asset Infrastructure•Best-in-class Bitcoin mining due to low-cost, sustainable, and domestic bitcoin mining at industrial scale targeting zero-carbon energy leveraging nuclear, hydro, and solar resources•Vertically integrated, infrastructure first strategy ensures ability to create and take advantage of digital asset infrastructure•Experienced team with decades of energy infrastructure experienceand a model for sustainable, large-scale bitcoin mining•Core ESG focusleveraging nearly entirely zero-carbon power differentiates TeraWulf and contributes to the acceleration of the transition to a more resilient, stable energy grid•Peer leading power supply economics with a comprehensive and compelling business outlook•Rationalized capital structure through flexible debt amortization profile enabling continued growth and M&A opportunity14 |

| SITE UPDATES |

| Lake Mariner Data (NY) 16 (1)Excludes 1,500-miner hosting agreement that terminates in February 2023. Location:Barker, NYOwnership:100%Site Control:Long-term leaseInfra. Capacity:500 MW site potentialPower Source:91%+ hydroDeployment:•60 MW operational•50 MW under construction, expected online in Q2 2023•80 MW expansion potential in 2023Proprietary Miners:•18,000 Bitmain S19 J-Pros•6,000 Bitmain S19 XPs•4,500 Minerva MV7sHosted Miners (1):•5,000 Bitmain S19 J-Pros |

| Nautilus Cryptomine (PA) 17 Location:Berwick, PAOwnership:25% (JV with Talen)Site Control:Long-term leaseInfra. Capacity(1):•50 MW targeted online early Q2 2023•50 MW optional expansionPower Source:Nuclear powerDeployment:Completing construction; commencing operations in Q1 2023Proprietary Miners:•9,000 Bitmain S19 J-Pros •7,000 Bitmain S19 XPs (1)Reflects 25% net interest in Nautilus Cryptomine joint venture. |

| NASDAQ: WULFContact:ir@terawulf.comwww.TeraWulf.com/contact |