TERAWULF INC.

9 Federal Street

Easton, Maryland 21601

October 11, 2023

VIA EDGAR

U.S. Securities and Exchange Commission

Division of Corporation Finance

Office of Crypto Assets

100 F Street, N.E.

Washington, D.C. 20549

Attn: Mr. Rolf Sundwall and Mr. David Irving

Re: TERAWULF INC.

Form 10-K for the Fiscal Year Ended December 31, 2022

Filed March 31, 2023

Form 8-K filed August 14, 2023

File No. 001-41163

Dear Mr. Sundwall and Mr. Irving:

On behalf of TeraWulf, Inc. (“TeraWulf” or the “Company”), we are providing the following response to the comments on the above-referenced reports provided by staff members (the “Staff”) of the U.S. Securities and Exchange Commission (the “SEC”) by letter dated September 20, 2023. To assist in your review, we have included the heading and comment from that letter in italics followed by the Company’s response in regular typeface.

Form 10-K for the Fiscal Year Ended December 31, 2022

Notes to Consolidated Financial Statements

Note 2 - Significant Accounting Policies

Impairment of Long-lived Assets, page 71

| 1. | Given the significant decline in the price of bitcoin and disruptions in the cryptocurrency market in the periods presented, tell us how you considered the factors in ASC 360-10-35-21 through 22 in evaluating your long-lived assets for recoverability and potential impairment. |

Response:

We acknowledge the Staff’s comment and respectfully advise the Staff that we considered guidance at ASC 360 when evaluating long-lived assets for recoverability and potential impairment as of December 31, 2022. Per ASC 360-10-35-21, a long-lived asset (asset group) shall be tested for recoverability whenever events or changes in circumstances indicate that its carrying amount may not be recoverable. Although this guidance does not dictate a formal requirement to test for impairment annually, we evaluated the example indicators provided in ASC 360-10-35-21 to determine whether potential triggering events or changes in circumstances had occurred as of December 31, 2022.

In identifying our asset group(s), we considered guidance at ASC 360-10-35-23 which states that a long-lived asset (or assets) shall be grouped with other assets and liabilities at the lowest level for which identifiable cash flows are largely independent of the cash flows of other assets and

Securities and Exchange Commission

October 11, 2023

Page 2

liabilities. As of December 31, 2022, substantially all of the Company’s property, plant and equipment were deployed at the mining facility in New York (“Lake Mariner facility”) to support bitcoin mining operations, which commenced in March 2022 and continued throughout the fiscal year ended December 31, 2022, or was construction in process relating to Building 2. As such, we identified the asset group as the Lake Mariner facility for purposes of this assessment.

In accordance with ASC 360-10-35-21 (a) and (b), we considered whether there was a significant decrease in the market price of the long-lived asset group or whether there was a significant adverse change in the extent or manner in which the long-lived asset group was being used or in its physical conditions. As of December 31, 2022, we reported property, plant and equipment, net of $191.5 million, primarily consisting of miners in service, deposits on miners not yet received, leasehold improvements and construction in process on Building 2. As disclosed in Note 12, Commitments and Contingencies, of our Form 10-K for the Fiscal Year Ended December 31, 2022, the Company entered into and paid deposits for various sale and purchase agreements with Bitmain Technologies Limited (“Bitmain”) for the purchase of bitcoin miners, the first of which were entered into during December 2021 (the “2021 Agreements”). In September 2022 through December 2022, the Company subsequently cancelled certain batches of miners originally scheduled for delivery under the 2021 Agreements (representing 12,000 of the 18,000 originally contracted miners) and entered into renegotiated Future Sale and Purchase Agreements (the “2022 Agreements’). The Company’s original deposits on miners under the 2021 Agreements were applied as credits to fully satisfy the purchase price of the 2022 Agreements, reflecting the current market price of miners at the time of renegotiation, where the price of miners is positively correlated to the price of bitcoin (see considerations of ASC 360-10-35-21 (c) in the following paragraph for further discussion regarding the decline in bitcoin prices during the fiscal year ended December 31, 2022). During the fiscal year ended December 31, 2022, the majority of miners placed into service were installed during Q3 and Q4 2022 subsequent to the completion of construction on Building 1, and comprised the then most recently released air-cooled series of miners produced by Bitmain (i.e., the S19 series). Furthermore, as disclosed in Note 11, Joint Venture, of our Form 10-K for the Fiscal Year Ended December 31, 2022, approximately 5,000 of the miners placed in service at the Lake Mariner facility were received as distributions from Nautilus Cryptomine LLC (“Nautilus” or the “Joint Venture), such that the miners were written down to fair value upon distribution and the Company recognized its portion of the loss as a component of equity in net loss of investee, net of tax within the consolidated statement of operations for the year ended December 31, 2022. Based on these considerations, and as the Lake Mariner facility was fully operational with Building 1 and construction substantially complete on Building 2 (with no further plans to significantly change operations outside of continued expansion with additional buildings at the facility), we did not identify any significant changes in market price or the extent or manner in which the long-lived asset group was being used that would indicate impairment as of December 31, 2022.

In accordance with ASC 360-10-35-21 (c), we considered whether a significant adverse change in legal factors or in the business climate that could affect the value of the long-lived asset group, including an adverse action or assessment by a regulator, indicated that its carrying value may not be recoverable. Throughout the fiscal year ended December 31, 2022, the Company monitored the price of bitcoin which declined from over $46 thousand per bitcoin as of January

Securities and Exchange Commission

October 11, 2023

Page 3

1, 2022, to approximately $20 thousand per bitcoin in Q2 2022 and further down to $16.5 thousand per bitcoin as of December 31, 2022. Based on management’s assessment, the declines in the price of bitcoin were not primarily driven by adverse changes in legal factors, but more correlated with multiple cryptocurrency market participants filing for bankruptcy during 2022 resulting in a loss of confidence in participants of the digital asset ecosystem and negative publicity surrounding digital assets more broadly. Although the declines in the price of bitcoin are significant year over year, management does not believe this to be indicative of impairment in the value of our long-lived asset group (the Lake Mariner facility). The price of bitcoin has historically been volatile; over the last 10 years, the price of bitcoin has fluctuated frequently and significantly from values less than $1 thousand per bitcoin to over $68 thousand in November 2021. Management determined the decrease in price noted during the fiscal year ended December 31, 2022, was not dissimilar to price drops historically experienced and, as such, management did not believe there to be indications of a permanent, non-temporary decrease in the price of bitcoin. Additionally, we continued operating our miners profitably (despite the lower Q4 2022 bitcoin prices) except for certain days with significant electricity spikes due to excessive winter-condition grid demand. Separately, construction on Building 1 of the facility was recently completed with Building 2 continuing to be constructed to expand mining operations, and such infrastructure and related electrical equipment were unaffected by fluctuations in the price of bitcoin. Additionally, the Company had taken steps to mitigate the risk that our miners may become unprofitable by deploying miners at the Lake Mariner facility that are Bitmain’s current generation and power-efficient models, and had no plans of discontinuing or scaling back operations in response to the declines in the price of bitcoin as of December 31, 2022. Furthermore, deposits on miners expected to be placed in service in the near-term were renegotiated at prices reflecting current prices of miners as of Q4 2022.

In accordance with ASC 360-10-35-21 (e), we considered whether a current-period operating or cash flow loss combined with a history of operating or cash flow losses or a projection or forecast demonstrated continuing losses associated with the use of the long-lived asset group. Although the Company reported operating losses of $43.7 million and net cash used in operating activities from continuing operations of $32.3 million during the fiscal year ended December 31, 2022, this was within management’s expectations as mining operations continue to grow towards profitability. As noted above, mining operations began in March 2022 with the majority of miners being placed in service starting in Q3 2022 or later, resulting in reported revenues of only $15.0 million for the year (versus costs of revenue and operations of $58.8 million). Additionally, operations at the Lake Mariner facility had not yet grown to the scale required to support its principal operations. For the majority of the fiscal year ended December 31, 2022, the Lake Mariner facility supported only 10 MW of total mining capacity which increased to 60 MW of total mining capacity by December 31, 2022. As disclosed within Exhibit 99.1 to our Current Report on Form 8-K filed on August 14, 2023, as of Q2 2023 the Company completed construction on Building 2 in accordance with its planned growth, expanding total mining capacity to 110MW (representing approximately 34,000 miners) and has begun to expand the Lake Mariner facility with the addition of a third building, which will house an incremental 43 MW of bitcoin mining capacity. Based on the considerations above, we determined the operating and cash flow losses reflected the early stage of the Company’s mining operations and were not indicative of impairment of the long-lived asset group.

Securities and Exchange Commission

October 11, 2023

Page 4

We also evaluated the examples in ASC 360-10-35-21 (d) and (f), and did not identify an accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of the long-lived asset group nor a current expectation that, more likely than not, the long-lived asset group will be sold or otherwise disposed of significantly before the end of its previously estimated useful life.

Revenue Recognition – Mining Pool, page 76

| 2. | Please provide us your analysis supporting your revenue recognition policy for your mining pool participation activities. In your response, where appropriate, reference for us the authoritative literature you relied upon to support your accounting: |

| • | Provide us a representative sample contract and cross reference your analysis to the specific provisions of that contract. Be sure to include terms related to the promises and related performance obligations, calculation of transaction consideration, and payment; |

| • | Tell us how you determined the term of your contracts and the period of service for which the mining pool operators determine your compensation. |

| • | Tell us about your process to identify your performance obligations. Refer to ASC 606-10-25-14 to 25-22; |

| • | You disclose that you are entitled to compensation regardless of whether the pool operator successfully records a block to the bitcoin blockchain, and that you recognize revenue when it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur. Tell us how your accounting policy considered ASC 606-10-25-23 to 25-25, and when during the contract term you recognize revenue; |

| • | You disclose that all of the consideration to be received under the contract is variable. Tell us your consideration of ASC 606-10-32-11 to 32-12, whether any of the consideration is constrained and discuss at what point the uncertainty associated with the variable consideration is resolved and why; and |

| • | You determine the fair value of the cryptocurrency award using the quoted price of the related cryptocurrency in your principal market at the time of contract inception. Tell us what your principal market is, and how you determined that it was the principal market. |

Response:

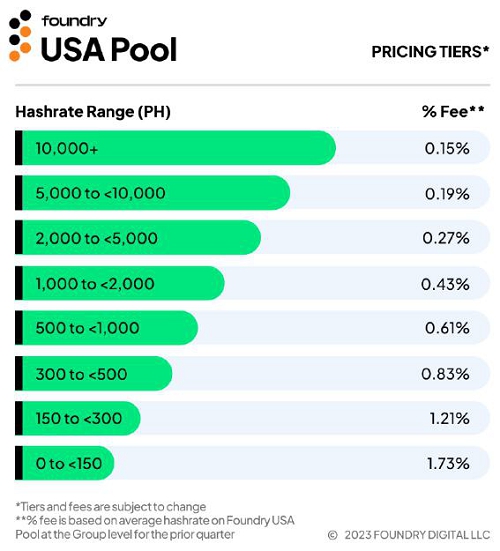

The Company respectfully advises the Staff that it performed an analysis of its revenue recognition related to mining pool activities in accordance with ASC 606, Revenue from Contracts with Customers. The Company has included the Foundry USA Pool Service Agreement, dated August 27, 2020 (effective during the fiscal year ended December 31, 2022), as Exhibit 10.1 within our Form 8-K filed with the SEC on February 1, 2023. Please see Appendix A.1 for a representative sample contract with the customer (the “Pool Operator”). Though there is not a countersigned agreement with the Pool Operator, the Pool activities are subject to the Service Agreement and Terms and Conditions (each found on the Pool Operator’s website) that govern any entity’s interaction with the Pool Operator in that capacity. Specifically, the Service Agreement states,

"By accessing and using the Pool, User accepts and agrees to the Terms, conditions, and Privacy Policy (collectively, the “Service Agreement”). As the operator of the Pool, Foundry shall provide a mining Pool Service (as defined below) to Users under the Service Agreement.”

Securities and Exchange Commission

October 11, 2023

Page 5

These agreements include the normal rights and obligations found in most contracts, including each party’s responsibilities, term, compensation, termination rights, limitation of liability, warranty (disclaimer thereof), and choice of law. The contract documents are enforceable and the arrangement is deemed a contract.

We determined the term of the contract and the period of service for which the Pool Operator determines our compensation in accordance with Section 7 of the Service Agreement, Term and Termination. Specifically, subsections (a) and (b) state,

“a. the Service Agreement will be in full force and effect until User’s access and usage rights to the Pool and Service are terminated by either User or Foundry in accordance with the Service Agreement, or as otherwise agreed upon between Foundry and User (“Term”).

b. User may terminate the Service Agreement at any time upon settlement of any pending transactions.”

The Pool Operator provides additional information within the Pool FAQs available on its website, including expanded explanation about information such as the payout scheme. Specifically, “Foundry USA Pool pays out to all pool members according to the Full-Pay-Per-Share (FPPS) payout scheme. Daily Earnings are calculated from midnight-to-midnight UTC time, and the sub-account balance is credited one hour later at 1 AM UTC time.” As the Pool Operator settles payments with Users under the arrangement daily, the Company initially determined per (b) above that the contract provides us the right to terminate the contract each 24-hour period, auto-renewing so long as participation in the Pool continues. Upon re-evaluating these terms in response to the Staff’s question, we identified certain factors that indicate the contract term is less than each successive 24-hour period. Specifically, the contract does not dictate any limitation to the customer’s (Pool Operator’s) ability to terminate the contract; additionally, the preamble to the Service Agreement states that the “User agrees that Foundry will have the right to modify the Service Agreement at any time,” which indicates the Pool Operator has the ability to modify (or terminate) the contract at any time without substantial penalty. Effective August 28, 2023, the Pool Operator updated Section 11, Contract Term and Termination, of the Terms of Service (see Appendix A.2), which clarifies the definition of a “Contract Day” to be “the period between 00:00:00 UTC and 23:59:59 UTC” and stipulates that, “(b) User’s access and usage rights to the Pool and Service may be terminated for any reason, without penalty, by either Foundry or User by providing one Contract Day’s prior written notice to the other party.” However, the preamble to the updated Terms of Service continues to state, “User agrees that Foundry will have the right to modify the Service Agreement at any time without prior notice” such that the Pool Operator still effectively has the ability to terminate the contract at any time. Based on these updated terms, we acknowledge the contract term could be, based on the Pool Operator modification, less than each 24-hour period (for example, the contract term could be, based on Pool Operator modification, less than each hour, minute, or second that the Company provides computing power to the Pool Operator). We understand that the Staff would not be opposed to the Company adopting an accounting policy to aggregate individual contracts with individual terms less than 24-hours within each intraday period and apply a consistent point to value noncash consideration. As such, the Company will aggregate the

Securities and Exchange Commission

October 11, 2023

Page 6

individual contracts in a 24-hour period and will continue to use the price of bitcoin at the start of day (00:00:00 UTC) when determining the fair value of noncash consideration received, ensuring that this point in time in each 24-hour period is consistently applied.

We respectfully advise the Staff that in future filings the Company will amend the disclosures within Note 2 - Significant Accounting Policies of our Form 10-K and Form 10-Q related to “Revenue Recognition - Mining Pool” to more clearly define the contract term used as follows:

“Mining Pool

The Company has entered into an arrangement with a cryptocurrency mining pool (the Foundry USA Pool) to provide computing power to the mining pool in exchange for consideration. The arrangement is terminable at any time without substantial penalty by Foundry USA Pool and may be terminated without substantial penalty by the Company upon providing one Contract Day’s, as defined, prior written notice. The Company’s enforceable right to compensation only begins when and continues while the Company provides computing power to its customer, the mining pool operator. Accordingly, the contract term with Foundry USA Pool is deemed to be less than 24 hours. The mining pool applies the Full Pay Per Share (“FPPS”) model. Under the FPPS model, in exchange for providing computing power to the pool, the Company is entitled to pay-per-share base amount and transaction fee reward compensation, calculated on a daily basis, at an amount that approximates the total bitcoin that could have been mined and transaction fees that could have been awarded using the Company’s computing power, based upon the then current blockchain difficulty. Under this model, the Company is entitled to compensation regardless of whether the pool operator successfully records a block to the bitcoin blockchain.

Providing computing power to a mining pool for cryptocurrency transaction verification services is an output of the Company’s ordinary activities. The provision of such computing power is the sole performance obligation. The transaction consideration the Company receives is noncash consideration and is all variable. Because cryptocurrency is considered noncash consideration, fair value of the cryptocurrency award received would generally be determined using the quoted price of the related cryptocurrency in the Company’s principal market at the time of contract inception. The Company has adopted an accounting policy to aggregate individual contracts with individual terms less than 24-hours within each intraday period and apply a consistent valuation point, the start of day Coordinated Universal Time (00:00:00 UTC), to value the related noncash consideration. Revenue is recognized when it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur. After every 24-hour contract term, the mining pool transfers the cryptocurrency consideration to our designated cryptocurrency wallet.

There is no significant financing component in these transactions. Consideration payable to the customer in the form of a pool operator fee is deducted from the bitcoin the Company receives and is recorded as contra-revenue, as it does not represent a payment for a distinct good or service.”

Securities and Exchange Commission

October 11, 2023

Page 7

In identifying our performance obligation(s) under the contract we referred to Section 3, Services, which states “b. User shall be responsible for preparing the necessary equipment and bear the expenses related to using such necessary equipment to participate in the Pool and Service.” Additionally, we used judgment to consider whether the Company or the Pool Operator is the principal for the mining activities performed on the blockchain, using the principal versus agent guidance in ASC 606. Specifically, the Pool Operator directs to the mining pool participants (including the Company) the mining activities they undertake as part of the Pool. Additionally, the Pool Operator is primarily responsible for selecting the transactions to be mined, the activities to be performed, placing the mined block on the blockchain, and collecting the block reward. Furthermore, as the Company is compensated on a fixed basis per unit of computing power delivered (i.e., the FPPS payout scheme), the Pool Operator bears the risks and rewards associated with the mining activities. Based on these considerations, we concluded the Pool Operator is the principal for the mining activities directly on the blockchain and thus the Company’s performance obligation is to provide computing services to the Pool.

In evaluating the satisfaction of performance obligations in accordance with ASC 606-10-25-23 to 25-25, we considered the Pool FAQs available on Foundry’s website regarding the Pool’s payout methodology. Specifically, the Pool Operator pays out to all pool members according to the FPPS payout scheme, under which the block reward is based on a formulaic view of expected earnings and not on actual blocks mined by the Pool (e.g., using relative hashrate contributed by the User and the current network difficulty). In the FAQs, the Pool Operator explicitly states that “in the FPPS model, the Pool Operator pays out the expected value to miners for the block subsidy and the transaction fees based on their hash contribution to the Pool, therefore absorbing all the risk on when the blocks are mined.” Based on these considerations and in accordance with ASC 606-10-25-27, we determined that the Company satisfies its performance obligation (i.e., contribution of hashrate to the Pool Operator) over time as the Pool Operator simultaneously receives and consumes the benefits provided by the Company’s performance as we perform. The Company has access to monitor various metrics via the Pool Operator’s online portal, including hashrate and bitcoin rewards under the FPPS model, which are updated and settled by the Pool Operator on a daily basis (one day in arrears). As such, the Company recognizes revenue under the contract for each intraday period (less than 24 hours) in which hashrate is contributed to the Pool and when determined that it is not probable that a significant reversal of revenue recognized will occur. As the total consideration in the contract is determined daily under the FPPS payout scheme, which varies based upon hashrate contributed by the Company and the current network difficulty, we concluded that the consideration promised in the contract is variable in accordance with paragraphs 606-10-32-5 to 606-10-32-7. However, as such amounts are determined and settled by the Pool Operator within one day of completing the contract, the Company has the ability to estimate the variable consideration with reasonable certainty, such that it determined it unnecessary to estimate constraint on the variable consideration in accordance with ASC 606-10-32-11 to 606-10-32-13. For the avoidance of doubt, we advise the staff that we recognize revenue received in the form of bitcoin on the day such noncash consideration is earned (i.e., computing power provided), not upon receipt of bitcoin. For example, if the Company were to provide computing power to the Pool Operator on September 30, 2023, the Company would have the ability to estimate bitcoin earned based on hashrate provided and confirm the amount of

Securities and Exchange Commission

October 11, 2023

Page 8

bitcoin received on the following day (October 1, 2023), such that the amount of revenue reported on September 30, 2023 for that respective day’s activity would be determined with reasonably certainty.

As the consideration paid by the Pool Operator to the Company is denominated in bitcoin, we determined this represents noncash consideration and recognize revenue in accordance with ASC 606-10-32-21 to ASC 606-10-32-24. To measure the estimated fair value of the noncash consideration at contract inception, we originally determined the contract term to be each 24-hour period, such that we utilize the quoted opening price of bitcoin on the day of each daily contract term. As noted above, we have determined the contract term to be less than each 24-hour period and now adopted an accounting policy to aggregate individual contracts with individual terms less than 24-hours within each intraday period and apply a consistent point to value noncash consideration. As such, when aggregating the individual contracts in a 24-hour period, the Company will continue to use the price of bitcoin at the start of day (00:00:00 UTC) when determining the fair value of noncash consideration received, ensuring that this point of time in each 24-hour period is consistently applied. In accordance with ASC 606-10-32-23, any changes in the fair value of the digital asset after contract inception due to the form of the consideration would not affect the transaction price for the revenue contract. Please refer to our response to question #4 below for details regarding our determination that Coinbase represents the principal market for our bitcoin.

Revenue Recognition – Data Center Hosting, page 76

| 3. | Please provide us your analysis supporting your revenue recognition policy for your data center hosting activities. In your response, where appropriate, reference for us the authoritative literature you relied upon to support your accounting: |

| • | Provide us a representative sample contract and cross reference your analysis to the specific provisions of that contract. Be sure to include terms related to the promises and related performance obligations, calculation of transaction consideration, and payment; |

| • | Tell us your consideration of whether the agreement represents a lease under ASC 842; |

| • | Tell us what consideration is payable in cryptocurrency, which cryptocurrencies you accept as payment, and how those amounts are determined; and |

| • | You determine the fair value of the cryptocurrency award using the quoted price of the related cryptocurrency in your principal market at the time of contract inception. Tell us what your principal market is, and how you determined that it was the principal market. |

Response:

The Company respectfully advises the Staff that it performed an analysis of its revenue recognition related to data center hosting arrangements in accordance with ASC 606. Please see Appendix B for a representative sample contract of a Hosting Services Agreement.

When determining whether the Hosting Services Agreement represented a lease, we considered the definition of a lease under ASC 842-10-15-3: “a contract is or contains a lease if the contract conveys the right to control the use of identified property, plant, or equipment (an identified asset) for a period of time in exchange for consideration.” Per Section 2 of the Hosting Services Agreement, the Company “will provide rack space, electrical power, ambient air cooling, internet connectivity and physical security (“Services”) for Customer’s Mining Equipment at its

Securities and Exchange Commission

October 11, 2023

Page 9

Facility.” Further, Section 7 provides that the Company has the explicit right to relocate the equipment within the Facility or to a different facility. The agreement does not provide for the customer to have rights to control the use of any part of the Lake Mariner facility. Due to the lack of identifiable asset and the lack of control, the Company determined the arrangement is not or does not contain a lease.

Per Section 4.1 of the Hosting Services Agreement, total consideration shall include [X]% of all bitcoin mined by the customer’s Mining Equipment at the Facility (the “Bitcoin Fee”), and the “Monthly Service Fee” as a cash payment equal to [Y]% of each of (i) $[Z] / MWh / month of the Customer’s Billing Demand and (ii) the actual cost of the Customer’s Billing Demand. Note that a prior version of the Hosting Services Agreement was in effect for a portion of the fiscal year ended December 31, 2022, which contained a simpler pricing structure based on a fixed rate per kWh of electricity provided to the customer, payable to the Company in cash. Other contract terms were substantially similar to the representative sample Hosting Services Agreement provided. Similar to our considerations in response to question #2 above, we determined that the total consideration is dependent upon actual mining activity and electricity consumption over the term of the contract, and thus represents variable consideration in accordance with paragraphs 606-10-32-5 to 606-10-32-7. However, as the customer participates in the Foundry USA Pool and such amounts are determined and settled by the Pool Operator within one day, the Company has the ability to estimate the variable consideration with reasonable certainty, such that it determined it unnecessary to estimate constraint on the variable consideration in accordance with ASC 606-10-32-11 to 606-10-32-13 at each reporting period.

As a portion of the total consideration paid by the customer to the Company is denominated in bitcoin, we determined this portion represents noncash consideration and recognize revenue in accordance with ASC 606-10-32-21 to ASC 606-10-32-24. To measure the estimated fair value of the noncash consideration at contract inception, we utilize the quoted opening price of bitcoin at contract inception. In accordance with ASC 606-10-32-23, any changes in the fair value of the digital asset after contract inception due to the form of the consideration would not affect the transaction price for the revenue contract. Please refer to our response to question #4 below for details regarding our determination that Coinbase represents the principal market for our bitcoin.

Cryptocurrencies, page 76

| 4. | Please tell us, and revise future filings, to disclose how you determine the quoted price of your digital assets and the principal market(s) used. Tell us how you identify these market(s). Refer to ASC Topic 820 and ASC 820-10- 35-5A. |

Response:

The Company respectfully advises the Staff that it performed an analysis of the quoted price of digital assets and the principal market(s) used in accordance with guidance per ASC 820, Fair Value Measurements. In accordance with ASC 820-10-35-3 and 820-10-35-5, a fair value measurement contemplates an orderly transaction to sell the asset or transfer the liability in its principal market (or in the absence of a principal market, the most advantageous market). Under ASC 820, a principal market is the market with the greatest volume and activity level for the asset or liability. In accordance with ASC 820-10-35-5A, we determined our principal market considering all information that is reasonably available. In the absence of evidence to the contrary, the market in which an entity normally transacts for the crypto asset is presumed to be the principal market. As disclosed within Part 1, Item 1 of our Form 10-K for the Fiscal Year Ended December 31, 2022, we store and safeguard self-mined bitcoin in a cold storage wallet

Securities and Exchange Commission

October 11, 2023

Page 10

held by our custodian NYDIG Trust Company LLC. To the extent we sell any of our mined bitcoin, we do so using NYDIG Execution LLC (“NYDIG”), a Delaware LLC registered as a Money Services Business with the Financial Crimes Enforcement Network and licensed with a BitLicense by the New York State Department of Financial Services. NYDIG has advised us that it uses Coinbase as its pricing source. As such, and as Coinbase is an established and active cryptocurrency market, we determined Coinbase to be the principal market.We further determine the fair value measurement of bitcoin based on the quoted price in that market and the fair value of the asset is measured within Level 1 as the product of the quoted price for the asset and the quantity held by the Company per ASC 820-10-35-6.

We respectfully advise the Staff that in future filings the Company will amend the disclosures within Note 2 - Significant Accounting Policies of our Form 10-K and Form 10-Q related to “Cryptocurrencies” to disclose how we determine the quoted price of our digital currency and principal market used as follows:

“Digital currency, net

Digital currency, net is comprised of bitcoin earned as noncash consideration in exchange for providing computing power to a mining pool as well as in exchange for data center hosting services which are accounted for in connection with the Company’s revenue recognition policy disclosed above. From time to time, the Company also receives bitcoin as distributions-in-kind from its joint venture. Digital currency, net is included in current assets in the consolidated balance sheets due to the Company’s ability to sell bitcoin in a highly liquid marketplace and its intent to liquidate its bitcoin holdings to support operations when needed. The Company sells bitcoin on a first-in-first-out basis.

Digital currency, net is accounted for as intangible assets with indefinite useful lives. An intangible asset with an indefinite useful life is not subject to amortization but assessed for impairment annually, or more frequently if events or changes in circumstances indicate it is more likely than not that the asset is impaired. Impairment exists when the carrying amount exceeds its fair value. In testing for impairment, the Company has the option to first perform a qualitative assessment to determine whether it is more likely than not that an impairment exists. If it is determined that it is not more likely than not that an impairment exists, a quantitative impairment test is not necessary. If the Company concludes otherwise, it is required to perform a quantitative impairment test.

The Company has elected to bypass the optional qualitative impairment assessment and to track its bitcoin activity daily for impairment assessment purposes. The Company determines the fair value of its bitcoin on a nonrecurring basis in accordance with ASC 820 based on quoted prices on the active trading platform that the Company normally transacts and has determined is its principal market for bitcoin (Level 1 inputs) based on all information that is reasonably available. The Company performs an analysis each day to identify whether events or changes in circumstances, principally decreases in the quoted price of bitcoin on the active trading platform, indicate that it is more likely than not that its bitcoin are impaired. For impairment testing purposes, the lowest intraday trading price of bitcoin is identified at the single bitcoin level (one bitcoin). The excess, if any, of the carrying amount of bitcoin and the lowest daily trading price of bitcoin

Securities and Exchange Commission

October 11, 2023

Page 11

represents a recognized impairment loss. To the extent an impairment loss is recognized, the loss establishes the new cost basis of the asset. Subsequent reversal of previously recorded impairment losses is prohibited. The Company recognized impairment of digital currency of $[X] million and $[Y] during the [current period] and the [prior period], respectively.

Bitcoin awarded to the Company through its mining activities are included as an adjustment to reconcile net loss to cash used in operating activities on the consolidated statements of cash flows. Proceeds from sales of bitcoin are included within cash flows from operating activities on the consolidated statements of cash flows and any realized gains or losses from such sales are included in costs and operating expenses on the consolidated statements of operations. The receipt of bitcoin as distributions-in-kind from equity investees are included within investing activities on the consolidated statements of cash flows as supplemental disclosures of noncash activities.”

| 5. | We note your disclosure on page 77 and from the Statement of Cash Flows, that you have classified activities related to digital currency as part of operating cash flows in the Consolidated Statement of Cash Flows. Please provide your accounting analysis supporting your conclusion that this activity is properly classified within cash flow from operating activities, instead of cash flows from investing activities. |

Response:

The Company respectfully advises the Staff that it performed an analysis of the cash flows related to digital currency in accordance with guidance per ASC 230, Statement of Cash Flows. Specifically, ASC 230-10-45-10 to ASC 230-10-45-17 outline the classification of cash flows as investing, financing, or operating activities.

We considered whether the cash flows from digital currency (i.e., cash proceeds from the sale of bitcoin) represent cash inflows from investing activities per ASC 230-10-45-11 to 230-10-45-12. These transactions do not represent cash flows from sale of available-for-sale debt securities; receipts from collections or sales of loans made by the entity and of other entities' debt instruments; receipts from sales of equity instruments of other entities; receipts from sales of property, plant, and equipment and other productive assets; or receipts from sales of loans that were not specifically acquired for resale. As such, we determined that classification as cash inflows from investing activities would not be appropriate.

We considered whether the cash flows from digital currency represent cash inflows from financing activities per ASC 230-10-45-14. These transactions do not represent proceeds from issuing equity instruments; proceeds from issuing bonds, mortgages, notes, and from other short- or long-term borrowing; receipts from contributions and investment income that by donor stipulation are restricted for the purposes of acquiring, constructing, or improving property, plant, equipment, or other long-lived assets or establishing or increasing a donor-restricted endowment fund; or proceeds received from derivative instruments. As such, we determined that classification as cash inflows from financing activities would not be appropriate.

Based on the above we determined that classifying cash flows from digital currencies as investing or financing activities would not be appropriate. While we considered that our digital

Securities and Exchange Commission

October 11, 2023

Page 12

currency is accounted for as an intangible asset and that cash inflows and outflows related to the purchase or sale of intangible assets are typically presented as investing activities, we determined that, based on the Company’s facts and circumstances and the nature of our bitcoin sales, the cash flows associated with digital currency should be classified as operating activities during the fiscal year ended December 31, 2022. Specifically, the Company received all digital currency during 2022 as a form of noncash consideration for routine operating activities, and converted the consideration to cash on a recurring basis to support operations. As disclosed within Item 1 of our Form 10-K for the Fiscal Year Ended December 31, 2022, we state, in part,

“Our primary source of revenue is from sustainably mining bitcoin at our bitcoin mining facility sites. We also earn revenue from miner hosting services to third parties. We do not hold, sell or transact in bitcoin or any other digital assets for anyone other than ourselves. We do not hedge our bitcoin...We sell bitcoin on a daily, weekly and monthly basis to pay for all operating expenses of the Company.”

As discussed in response to question #1 above, although mining operations began in March 2022 at the Lake Mariner facility, production increased significantly in Q3 2022 subsequent to the completion of construction on Building 1. Accordingly, the Company did not retain significant bitcoin balances nor sell bitcoin until August 2022. From this point on, bitcoin sales occurred regularly with weekly to bi-weekly sales in September through December 2022 as needed to support operations. We determined that classifying these cash receipts as investing activities would not reflect the economics of the activity and could diminish an investor’s ability to assess the uncertainty of the Company’s prospective cash flows, This also is in line with guidance per ASC 230-10-45-16(c) which states, “all other cash receipts that do not stem from transactions defined as investing or financing activities” are cash inflows from operating activities. Accordingly we concluded that the cash flows from our 2022 sales of digital currencies should be classified as cash flows from operating activities within the statement of cash flows.

Form 8-K Filed August 14, 2023

Exhibit 99.1 Press Release, dated August 14, 2023

Key Non-GAAP Metrics, page 2

| 6. | We note that revenue is a defined term under ASC 606. Please tell us your consideration of whether the use of the term in your Revenue - Self-Mining Equivalent, Revenue-Hosting and Revenue Equivalent per Bitcoin would be misleading under Regulation G 101(b). Refer also to question 100.04 of the Compliance and Disclosure Interpretations for Non-GAAP Financial Measures, updated December 13, 2022. |

Response:

We acknowledge the Staff’s comment and advise the Staff that management does not believe the terms “Revenue - Self-Mining Equivalent,” “Revenue - Hosting,” and “Revenue Equivalent per Bitcoin” would be misleading under Regulation G 100(b). On page 1 of Exhibit 99.1 to the Company’s Current Report on Form 8-K filed on August 14, 2023, the earnings release begins with the section entitled “Second Quarter 2023 GAAP Operational and Financial Highlights” to

Securities and Exchange Commission

October 11, 2023

Page 13

ensure that the most directly comparable GAAP measure (revenue) is presented before the aforementioned non-GAAP measures and with equal or greater prominence. Additionally, the information in the context of the non-GAAP measures presented does not contain untrue statements of a material fact or omit to state a material fact. As denoted on page 5 of Exhibit 99.1 to the Company’s Current Report on Form 8-K filed on August 14, 2023, the Company discloses the adjustments used to derive the non-GAAP measures ‘Revenue - Self-Mining Equivalent’ and ‘Revenue - Hosting’ in footnotes 3 and 4, respectively.

We considered question 100.04 of the Compliance and Disclosure Interpretations for Non-GAAP Financial Measures, updated December 13, 2022, and do not believe these non-GAAP measures violate Rule 100(b) of Regulation G as the recognition and measurement principles used to calculate these measures are consistent with GAAP. Within ‘Revenue - Self-Mining Equivalent,’ management calculates the profit sharing associated with short-term hosting arrangements as the quantity of bitcoin received from customers as consideration in the data center hosting revenue arrangement multiplied by the fair value of bitcoin at contract inception, consistent with the measurement principles applied under GAAP as described in our response to question #3 above. Management calculates the amount included within ‘Revenue - Self-Mining Equivalent’ representing TeraWulf’s net share of bitcoin produced at Nautilus (the Joint Venture) as the quantity of bitcoin received by Nautilus as consideration for participating in mining pool activities (related to the Company’s share of the Joint Venture’s hashrate) multiplied by the fair value of bitcoin at contract inception (i.e., daily opening price for each respective day the hashrate is provided to the pool as the contract term is deemed each 24-hour period). As such, the measurement principles used to compute TeraWulf’s share of revenue earned by the Joint Venture’s mining pool activities are consistent with the measurement principles used to compute revenue for the Company’s mining pool activities as described in response to question #2 above.

While we do not believe these non-GAAP measures to be misleading, for greater clarity and improved descriptive disclosures, we advise the Staff that we will revise future filings to define these non-GAAP metrics as follows:

| Key Non-GAAP Metrics1 |

| Bitcoin Self-Mined2 |

| Value per Bitcoin Self-Mined3 |

| Power Cost per Bitcoin Self-Mined |

| Avg. Operating Hash Rate (EH/s)4 |

1 Unaudited monthly results are based on estimates, which remain subject to standard month end adjustments. The Company’s share of the earnings or losses of the Nautilus facility is reflected in the caption “Equity in net loss of investee, net of tax” in the consolidated statements of operations. Accordingly, operating results of the Nautilus facility are not reflected in the revenue, cost of revenue or cost of operations lines in TeraWulf’s consolidated statements of operations.

Securities and Exchange Commission

October 11, 2023

Page 14

2 Includes BTC earned from profit sharing associated with a short-term hosting agreement at the Lake Mariner facility and TeraWulf’s net share of BTC produced at the Nautilus facility.

3 Computed as the weighted-average opening price of BTC on each respective day the Self-Mined Bitcoin is earned.

4 While nameplate inventory for WULF’s two facilities is 5.5 EH/s, inclusive of gross total hosted miners, actual monthly hash rate performance depends on a variety of factors, including (but not limited to) performance tuning to increase efficiency and maximize margin, scheduled outages (scopes to improve reliability or performance), unscheduled outages, curtailment due to participation in various cash generating demand response programs, derate of ASICS due to adverse weather and ASIC maintenance and repair.

| 7. | Please tell us how you determined 'Revenue - Hosting' of $1.1 million in the 3 months ended 6/30/23, and how that compares to the $1.7 million of data center hosting revenue for the three months ended June 30, 2023 you report on page 16 of your Form 10-Q for the Quarterly Period Ended June 30, 2023. Similarly, please explain how your 'Revenue - Hosting' of $1.2 million in the 3 months ended 3/31/23, and how that compared to the $2.3 million of data center hosting revenue for the three months ended March 31, 2023 you report on page 16 of your Form 10-Q for the Quarterly Period Ended March 31, 2023. |

Response:

We acknowledge the Staff’s comment and advise the Staff that as denoted within the footnote 4 on page 5 of Exhibit 99.1 to our Current Report on Form 8-K filed on August 14, 2023, we compute the non-GAAP measure ‘Revenue - Hosting’ by subtracting from data center hosting revenue (GAAP) the revenue recognized for the profit share portion of total consideration received under the contract - that is, the noncash consideration represented by the quantity of bitcoin received from the customer ([X]% of all bitcoin mined at the facility by the customer as denoted within response to question #3 above) multiplied by the fair value of bitcoin at contract inception. As denoted within our response to question #6 above, this amount is included within ‘Revenue - Self-Mining Equivalent’ such that we determined it appropriate to exclude this from ‘Revenue - Hosting’ so as to not present the same revenue amount within multiple measures concurrently in the report. As denoted within our response to question #6 above, as a matter of clarity, we advise the Staff that we will revise future filings to not include ‘Revenue - Hosting’ as a non-GAAP measure.

* * *

Securities and Exchange Commission

October 11, 2023

Page 15

Should you have any further questions on the above,

please do not hesitate to contact me at (917)

656-8424.

Sincerely,

/s/ Patrick A. Fleury

Patrick A. Fleury

Chief Financial Officer

| cc: | Stefanie Fleischmann, Chief Legal Officer | |

| Anthony Marsico, Reed Smith LLP | ||

| Michael S. Lee, Reed Smith LLP | ||

| Lynwood Reinhardt, Reed Smith LLP |

Appendix A.1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 1, 2023 (January 27, 2023)

TERAWULF INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-41163 | 85-1909475 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

9 Federal Street

Easton, Maryland 21601

(Address of principal executive offices) (Zip Code)

(410) 770-9500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.001 par value per share | WULF | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 3.02. | Unregistered Sales of Equity Securities. |

To the extent applicable, the disclosures set forth below in Item 8.01 of this Current Report on Form 8-K are incorporated by reference herein. The securities issuable pursuant to the private placement transactions disclosed under Item 8.01 will not be registered under the Securities Act of 1933, as amended (the “Securities Act”) at the time of issuance, in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act and/or Regulation D promulgated thereunder.

| Item 7.01. | Regulation FD Disclosure. |

In connection with the Offering (as defined below), TeraWulf Inc. (the “Company”) shared a presentation with prospective investors (the “Investor Presentation”). A copy of the Company’s Investor Presentation is being furnished herewith as Exhibit 99.1.

The disclosures included in this Current Report on Form 8-K under Item 7.01, including Exhibit 99.1, are being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities of that Section, unless the registrant specifically states that the information is to be considered “filed” under the Exchange Act or incorporates it by reference into a filing under the Exchange Act or the Securities Act.

| Item 8.01. | Other Events. |

Common Stock Offering

On February 1, 2023, the Company issued a press release announcing that the Company has commenced an underwritten public offering of shares of common stock, par value $0.001 per share, of TeraWulf Inc. (the “Offering”). JonesTrading Institutional Services LLC is acting as sole book-running manager for the Offering. A copy of the press release is attached hereto as Exhibit 99.2 and is incorporated by reference herein.

The Company expects to use the net proceeds from the Offering for general corporate purposes, which may include working capital and/or capital expenditures.

This Current Report on Form 8-K shall not constitute an offer to sell or a solicitation of an offer to buy securities, and shall not constitute an offer, solicitation or sale in any jurisdiction in which such an offer, solicitation or sale would be unlawful.

Entry into Binding Term Sheet for Fifth Amendment to LGSA

On January 27, 2023, the Company entered into a binding term sheet with its lenders (the “Term Sheet”) pursuant to which the parties agreed to make certain amendments to the Loan, Guaranty and Security Agreement dated as of December 1, 2021, by and among the Company, the guarantors party thereto, the lenders party thereto, and Wilmington Trust, National Association, in its capacity as administrative agent and collateral agent (as amended from time to time, the “LGSA”). The Term Sheet for the contemplated fifth amendment to the LSGA (the “Fifth Amendment”) eliminates mandatory amortization of the term loan through April 8, 2024, subject to certain conditions, including the completion of an equity capital raise with aggregate net proceeds of at least $33.5 million by March 15, 2023 (such capital raise, the “Qualifying Equity Capital Raise). The Term Sheet also provides for an excess cash flow sweep in place of scheduled principal payments, which will automatically extend to the maturity of the term loan on December 1, 2024 in the event the Company repays at least $40 million of the term loan by April 1, 2024. The modifications to the term loan’s amortization schedule are also contingent on the Company complying with certain corporate governance provisions, and that no default or event of default has occurred or is occurring under the term loan.

2

The Fifth Amendment will become effective upon the satisfaction of certain conditions, including, among other things, (i) the issuance by the Company of penny warrants to the lenders to purchase an aggregate number of shares of common stock equal to 10% of the Company’s fully diluted equity determined as of the Fifth Amendment effective date, (ii) the issuance by the Company of warrants to the lenders to purchase an aggregate number of shares of common stock equal to 5% of the Company’s fully diluted equity determined as of the Fifth Amendment effective date with an exercise price of $1.00 and (iii) receipt by the Company of binding commitments for no less than $10 million of the Qualifying Equity Capital Raise (excluding certain previously disclosed warrants the Company issued in December 2022), provided that any commitment for convertible indebtedness must provide for mandatory conversion into equity prior to March 15, 2023.

The foregoing description of the Term Sheet is only a summary of the material terms, does not purport to be complete, and is qualified in its entirety by reference to the Term Sheet, which is filed herewith as Exhibit 99.3 and incorporated by reference herein.

Private Placements

Warrants

On January 30, 2023, the Company entered into (a) subscription agreements (the “Warrant Subscription Agreements”) with certain accredited investors (the “Warrant Investors”) pursuant to which such Warrant Investors purchased from the Company 2,380,952 warrants, each exercisable to purchase one share of the Company’s Common Stock at an exercise price of $0.00001 per share of Common Stock (the “Warrants”), in private placement transactions exempt from registration under Section 4(a)(2) and/or Regulation D under the Securities Act for an aggregate purchase price of $2.5 million, based on a price per share of Common Stock of $1.05 for a total of 2,380,952 shares of Common Stock and (b) warrant agreements (the “Warrant Agreements”) with such Warrant Investors. The Warrant Agreements govern the terms and conditions of the Warrants, which are exercisable beginning on the first business day following the date on which shareholder approval of an increase in the Company’s authorized Common Stock is obtained (the “Shareholder Approval Date”) and expire on December 31, 2023.

Pursuant to the Warrant Subscription Agreements, the Company agreed to provide customary registration rights to the Warrant Investors with respect to the Common Stock issuable upon conversion of the Warrants. The Warrant Subscription Agreements contain customary representations, warranties, covenants and is subject to customary closing conditions and termination rights.

Common Stock

As previously disclosed, on December 12, 2022, the Company entered into subscription agreements with certain accredited investors (the “December Investors”) pursuant to which, inter alia, the Company issued 11,250,000 warrants exercisable for 8,750,000 shares of common stock, at an exercise price equal to $0.40 per share of common stock (the “December Warrants”), in a private placement transaction (the “December Private Placement”) exempt from registration under Section 4(a)(2)/Regulation D under the Securities Act of 1933, as amended (the “Securities Act”). The December Warrants became exercisable on January 16, 2023 and expired on January 31, 2023.

On January 30, 2023, the Company entered into additional subscription agreements with the December Investors pursuant to which such December Investors purchased from the Company shares of the Company’s common stock, at a purchase price of $0.40 per share of common stock, in private placement transactions exempt from registration under Section 4(a)(2) and/or Regulation D under the Securities Act for an aggregate purchase price of $1.75 million (the “January Private Placement”). The January Private Placement effectively replaces 50% of the unexercised December Warrants at the same purchase price of $0.40 per share of common stock. The closing of the January Private Placement is subject to certain conditions, including the completion of a $30 million equity capital raise by the Company, which may be unilaterally waived by the December Investors, and the receipt of Shareholder Approval (as defined below).

3

On February 1, 2023, the Company entered into additional subscription agreements (together with the January Common Stock Subscription Agreements, the “Common Stock Subscription Agreements”), with certain accredited investors (the “February Common Stock Investors”), pursuant to which such February Common Stock Investors purchased from the Company shares of the Company’s common stock, as a purchase price of $0.68 per share of common stock, in private placement transactions exempt from registration under Section 4(a)(2) and/or Regulation D under the Securities Act for an aggregate purchase price of $0.94 million (the “February Private Placement”). The February Private Placement is currently expected to close on February 2, 2023.

Pursuant to the Common Stock Subscription Agreements, the Company agreed to provide customary registration rights to the Common Stock Investors. The Common Stock Subscription Agreements contain customary representations, warranties, covenants and are subject to customary closing conditions and termination rights.

Amendments to October 2022 Private Placements

As previously disclosed, on October 6, 2022, the Company entered into private placement subscription agreements with certain accredited and/or institutional investors under Section 4(a)(2) and/or Regulation D under the Securities Act pursuant to which such investors purchased units which immediately separated into shares of common stock and warrants. On January 30, 2023, certain of these investors agreed to amend the terms of their warrants such that their warrants would become exercisable only after the Shareholder Approval Date.

Convertible Promissory Notes

Amendment to Existing Convertible Promissory Notes

On January 30, 2023, the Company entered into amendments to its previously issued convertible promissory notes (the “Existing Convertible Promissory Notes”), originally issued to certain accredited investors on November 25, 2022 and further amended on December 12, 2022, in privately negotiated transactions as part of a private placement exempt from registration under Section 4(a)(2) and/or Regulation D under the Securities Act in an aggregate principal amount of approximately $3.4 million. The amendments amend the conversion date of the Existing Convertible Promissory Notes from March 1, 2023 to the third business day following the Shareholder Approval Date.

Entry into New Convertible Promissory Note

On January 30, 2023, the Company entered into a new convertible promissory note (the “New Convertible Promissory Note”) to an accredited investor in a privately negotiated transaction as part of a private placement exempt from registration under Section 4(a)(2) and/or Regulation D under the Securities Act in an aggregate principal amount of $1.25 million. The New Convertible Promissory Note has a maturity date of April 1, 2025 and accrues annual interest at a rate of 4%. The New Convertible Promissory Note is automatically convertible into Common Stock of the Company on the third business day following the Shareholder Approval Date (the “Conversion Date”) at a conversion price equal to the lowest price per share paid by investors purchasing equity securities in any sale of equity securities by the Company between the issuance date of the New Convertible Promissory Note and the Conversion Date with an aggregate gross sales price of not less than $5 million, subject to certain exclusions set forth in the New Convertible Promissory Note.

This Current Report on Form 8-K shall not constitute an offer to sell or a solicitation of an offer to buy securities, and shall not constitute an offer, solicitation or sale in any jurisdiction in which such an offer, solicitation or sale would be unlawful.

4

| Item 9.01. | Financial Statements and Exhibits. |

| Exhibit No. |

Description |

| 10.1 | Foundry USA Pool Service Agreement, dated as of August 27, 2020 |

| 10.2 | Digital Asset Custodial Agreement, by and between NYDIG Trust Company LLC and Lake Mariner Data LLC, dated as of March 10, 2022 |

| 10.3 | Digital Asset Execution Agreement, by and between NYDIG Execution LLC and Lake Mariner Data LLC, dated as of September 16, 2022 |

| 10.4 | Amended and Restated Limited Liability Company Agreement of Nautilus Cryptomine LLC, effective as of August 27, 2022 |

| 99.1 | Investor Presentation |

| 99.2 | Press Release, dated February 1, 2023 |

| 99.3 | 5th Amendment to TeraWulf Loan, Guaranty and Security Agreement Binding Term Sheet, dated as of January 27, 2023 |

| 104 | Cover Page Interactive Data File (embedded within the inline XBRL document) |

5

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements include statements concerning anticipated future events and expectations that are not historical facts. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements. In addition, forward-looking statements are typically identified by words such as “plan,” “believe,” “goal,” “target,” “aim,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, although the absence of these words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are based on the current expectations and beliefs of TeraWulf’s management and are inherently subject to a number of factors, risks, uncertainties and assumptions and their potential effects. There can be no assurance that future developments will be those that have been anticipated. Actual results may vary materially from those expressed or implied by forward-looking statements based on a number of factors, risks, uncertainties and assumptions, including, among others: (1) conditions in the data mining industry, including fluctuation in the market pricing of bitcoin and other cryptocurrencies, and the economics of cryptocurrency mining, including as to variables or factors affecting the cost, efficiency and profitability of cryptocurrency mining; (2) competition among the various providers of data mining services; (3) changes in applicable laws, regulations and/or permits affecting TeraWulf’s operations or the industries in which it operates, including regulation regarding power generation, cryptocurrency usage and/or cryptocurrency mining; (4) the ability to implement certain business objectives and to timely and cost-effectively execute integrated projects; (5) failure to obtain adequate financing on a timely basis and/or on acceptable terms with regard to growth strategies or operations; (6) loss of public confidence in bitcoin or other cryptocurrencies and the potential for cryptocurrency market manipulation; (7) the potential of cybercrime, money laundering, malware infections and phishing and/or loss and interference as a result of equipment malfunction or breakdown, physical disaster, data security breach, computer malfunction or sabotage (and the costs associated with any of the foregoing); (8) the availability, delivery schedule and cost of equipment necessary to maintain and grow the business and operations of TeraWulf, including mining equipment and infrastructure equipment meeting the technical or other specifications required to achieve its growth strategy; (9) employment workforce factors, including the loss of key employees; (10) litigation relating to TeraWulf, RM 101 f/k/a IKONICS Corporation and/or the business combination; (11) the ability to recognize the anticipated objectives and benefits of the business combination; and (12) other risks and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange Commission (the “SEC”). Potential investors, stockholders and other readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they were made. TeraWulf does not assume any obligation to publicly update any forward-looking statement after it was made, whether as a result of new information, future events or otherwise, except as required by law or regulation. Investors are referred to the full discussion of risks and uncertainties associated with forward-looking statements and the discussion of risk factors contained in the Company’s filings with the SEC, which are available at www.sec.gov.

6

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| TERAWULF INC. | ||

| Dated: February 1, 2023 | By: | /s/ Patrick A. Fleury |

| Name: | Patrick A. Fleury | |

| Title: | Chief Financial Officer | |

7

Foundry USA Pool Service Agreement

The ownership and operation rights of the services provided by the Foundry USA Pool (“Pool”) are owned by Foundry Digital LLC (collectively, “Foundry”). The Foundry Terms of Service specified herein (“Terms”), along with Foundry’s Terms and Conditions (“Conditions”) and Privacy Policy (“Privacy Policy”) are the relevant rights and obligations required to be read and accepted by anyone that shall access and/or use the Pool (“User”).

By accessing and using the Pool, User accepts and agrees to the Terms, Conditions, and Privacy Policy (collectively, the “Service Agreement”). As the operator of the Pool, Foundry shall provide a mining Pool Service (as defined below) to User under the Service Agreement.

User agrees that Foundry will have the right to modify the Service Agreement at any time. User agrees to be solely responsible for reviewing the Service Agreement and/or any modifications thereto. If User does not agree to the Service Agreement and/or any of its modifications, then User shall cease to use and will not be allowed further access to the Pool and Service.

| 1. | Foundry Terms and Conditions |

| a. | Foundry’s Terms and Conditions (“Conditions”) is available at https://foundrydigital.com/terms-and-conditions. |

| 2. | Privacy and Protection |

| a. | Foundry places great importance on the protection of User’s personal information. When using the Pool and Service provided by Foundry, User agrees that Foundry will collect, store, use, disclose and protect User’s personal information in accordance with the Privacy Policy, available at https://foundrydigital.com/privacy-policy. |

| 3. | Services |

| a. | Foundry uses its own system, through the Internet and other means to provide User with a digital currency mining Pool and other services/products that may be added based on the Pool site (“Service”). For the avoidance of doubt, the Pool and Service shall not include wallet or custodial services from Foundry to User. |

| b. | User shall be responsible for preparing the necessary equipment and bear the expenses related to using such necessary equipment to participate in the Pool and Service. |

| c. | User hereby authorizes Foundry to be fully responsible for disposal and distribution of the profit from such value-added Service. |

| d. | Foundry reserves the right to modify or interrupt the Service at any time without informing User and without liability to User or any third party not directly related. |

| 4. | User Rights and Obligations |

| a. | Prior to entering and using the Pool and Service, User agrees it must first successfully complete the client onboarding process with Genesis Global Trading Inc. (“Genesis”). |

| b. | User agrees to provide legal, true, accurate and detailed personal information, and update such information as needed. |

| c. | User shall comply with all applicable laws, rules, and regulations related to the use of the Pool and Service. |

| d. | User acknowledges and agrees that it is using the Pool and Service at its own risk. |

| e. | In the event User’s access and/or rights to the Pool and Service have been discontinued, User is solely responsible for settling the remaining balances left in its account. Foundry shall use commercially reasonable efforts to assist User with settling any remaining balances in User’s account. |

| f. | For the avoidance of doubt, Foundry shall not be responsible or liable to User for any balances remaining in User’s account three (3) months after User’s access and/or rights to the Pool and Service have been discontinued (regardless of whether the balances were left in User’s account intentionally). |

| 5. | Confidentiality |

| a. | User agrees not to disclose any Confidential Information from the Pool and/or Service. “Confidential Information” includes (but is not limited to) information regarding Foundry’s Pool, Service, documentation, software, trade secrets embodied therein and any other written or electronic information that is either (i) marked as confidential and/or proprietary, or which is accompanied by written notice that such information is confidential and/or proprietary, or (ii) not marked or accompanied by notice that it is confidential and/or proprietary but which, if disclosed to any third party, could reasonably and foreseeably cause competitive harm to the owner of such information. Confidential Information shall not include information which is: (i) publicly available, (ii) lawfully obtained by a party from third parties without restrictions on disclosure, or (iii) independently developed by a party without reference to or use of the Confidential Information. |

| b. | SOC Report- For the avoidance of doubt, the SOC Report shared with User by Foundry shall be considered “Confidential Information” as defined herein, and as such, User agrees not to disclose the SOC Report to any third-party (regardless of whether or not such third-party is separately a user of the Pool and/or Service) without the prior and express written consent of Foundry. For purposes herein, a “third party” shall not include User’s affiliates, subsidiaries, officers, directors, employees, contractors, attorneys, accountants, bankers or consultants (“Authorized Representatives”) with a need to know of such SOC Report, provided, however, that such Authorized Representatives shall be under an obligation of confidentiality and non-use of the SOC Report at least as strict as set out in this Agreement.” |

| 6. | Payouts to Users |

| a. | Notwithstanding anything in the Service Agreement to the contrary, during the Pool’s initial implementation phase, which shall continue until May 1st or as solely determined otherwise by Foundry (“Beta Phase), Foundry shall provide either full payouts or full credits (where applicable) to the User (regardless of whether or not there has been a disruption in Service). After the Beta Phase has concluded, Foundry may, at its sole discretion, offer User payment or credits in the event of a disruption in Service. |

| 7. | Term and Termination |

| a. | The Service Agreement will be in full force and effect until User’s access and usage rights to the Pool and Service are terminated by either User or Foundry in accordance with the Service Agreement, or as otherwise agreed upon between Foundry and User (“Term”). |

| b. | User may terminate the Service Agreement at any time upon settlement of any pending transactions. |

| c. | Further, Foundry may, at its sole discretion, limit, suspend or terminate User’s access to the Pool and Service if: |

| i. | User becomes subject to bankruptcy/insolvency proceedings, | ||

| ii. | User’s liquidates, dissolves, terminates, or suspends its business, | ||

| iii. | User breaches the Service Agreement, or | ||

| iv. | User performs any act or omission that materially impacts its ability to adhere to the Service Agreement. |

| 8. | Force Majeure |

| a. | Foundry shall not be liable for any non-performance of its obligations pursuant to the Service Agreement if such non-performance is caused by a Force Majeure event. In case of a Force Majeure event, Foundry has the right to suspend or terminate its services immediately under the Service Agreement. “Force Majeure” events shall mean any event or circumstance, or any combination of events or circumstances which are beyond the control of Foundry. Such events or circumstances shall include, but are not limited to events or occurrences that delay, prevent or hinder Foundry from performing such obligations, war, armed conflict, terrorist activities, acts of sabotage, blockade, fire, lightning, acts of God, national strikes, riots, insurrections, civil commotions, quarantine restrictions, epidemics, pandemics, earthquakes, landslides, avalanches, floods, hurricanes, explosions, and regulatory, administrative or similar action or delays to take actions of any governmental authority. |

TERMS & CONDITIONS

Effective Date: August 27, 2020

These Terms of Service, together with our Privacy Policy, govern your access to and use of the websites (the “Foundry Sites” or the “Sites”) of Foundry Digital LLC. and your use of any of the services provided through these Sites. These Terms of Service and any additional terms and conditions, policies, agreements and disclosures to which you have agreed are hereafter referred to collectively as the “Agreement”: Please read these Terms of Service carefully.

Your use of a Foundry Site is governed by the version of the Terms of Service in effect on the date of use. Foundry may modify the Terms of Service at any time and without prior notice. By using and accessing any Foundry Site, you acknowledge and agree to review the most current version of these Terms of Service prior to each such use. Your continued use of and access to any of the Foundry Sites constitutes your acknowledgement of, and agreement to, the then current Terms of Service. Please also note that the terms and conditions of these Terms of Service are in addition to any other agreements between you and Foundry and/or its affiliates and agents, including any customer agreements, and any other agreements that govern your use of products, services, content, tools, and information available on the Foundry Sites.