| Majority-Owned Joint Venture with Fluidstack for 168 MW in Texas Deal Announcement | October 2025 168+ MW Hyperscale Campus in Abernathy, TX | ~$9.5 Billion in Contracted Revenue | Exclusive rights for expansion |

| SAFE HARBOR STATEMENT This presentation is for informational purposes only and contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements include statements concerning anticipated future events and expectations that are not historical facts. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements. In addition, forward-looking statements are typically identified by words such as “plan,” “believe,” “goal,” “target,” “aim,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “seek,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “strategy,” “opportunity,” “predict,” “should,” “would” and other similar words and expressions, although the absence of these words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are based on the current expectations and beliefs of TeraWulf’s management and are inherently subject to a number of factors, risks, uncertainties and assumptions and their potential effects. There can be no assurance that future developments will be those that have been anticipated. Actual results may vary materially from those expressed or implied by forward-looking statements based on a number of factors, risks, uncertainties and assumptions, including, among others: (1) the ability to mine bitcoin profitably; (2) our ability to attract additional customers to lease our HPC data centers; (3) our ability to perform under our existing data center lease agreements; (4) changes in applicable laws, regulations and/or permits affecting TeraWulf’s operations or the industries in which it operates; (5) the ability to implement certain business objectives, including its bitcoin mining and HPC data center development, and to timely and cost-effectively execute related projects; (6) failure to obtain adequate financing on a timely basis and/or on acceptable terms with regard to expansion or existing operations;(7) adverse geopolitical or economic conditions, including a high inflationary environment, the implementation of new tariffs and more restrictive trade regulations; (8) the potential of cybercrime, money-laundering, malware infections and phishing and/or loss and interference as a result of equipment malfunction or break-down, physical disaster, data security breach, computer malfunction or sabotage (and the costs associated with any of the foregoing);(9) the availability and cost of power as well as electrical infrastructure equipment necessary to maintain and grow the business and operations of TeraWulf; (10) operational and financial risks associated with the expansion of the Lake Mariner data center; and (11) other risks and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange Commission (“SEC”). Potential investors, stockholders and other readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they were made. TeraWulf does not assume any obligation to publicly update any forward-looking statement after it was made, whether as a result of new information, future events or otherwise, except as required by law or regulation. Investors are referred to the full discussion of risks and uncertainties associated with forward-looking statements and the discussion of risk factors contained in the Company’s filings with the SEC, which are available at www.sec.gov. 2 |

| Strategic Rationale Expansion of a Repeatable, Power-Advantaged Platform 1 • Extends TeraWulf’s majority-owned, contracted infrastructure platform into a second high-value market adding geographical diversification Geographic Diversification • Validates repeatability of our model: secure long-duration power → anchor tenant → high-margin lease Validates Business Model • Adds platform scale while preserving development control and operational leadership Increases Scale • Creates line of sight to 168 MW in 2026 and rights to future phases at Abernathy and future site with same counterparty Identified Expansion • Reinforces TeraWulf as a developer/operator of choice for Tier-1 AI tenants Trust From AI Leaders Power-Advantaged Infrastructure → Replicable Development Model → Scalable Earnings Base |

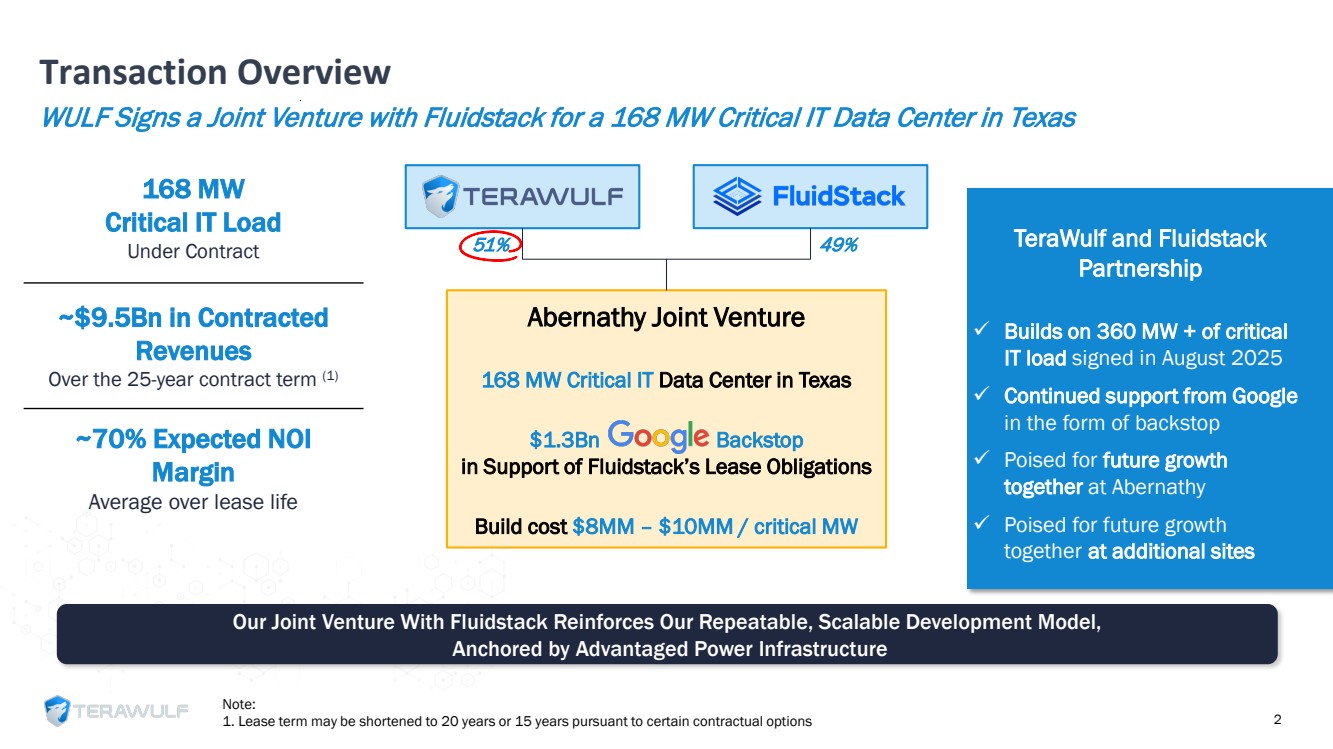

| Transaction Overview WULF Signs a Joint Venture with Fluidstack for a 168 MW Critical IT Data Center in Texas 2 168 MW Critical IT Load Under Contract ~$9.5Bn in Contracted Revenues Over the 25-year contract term (1) ~70% Expected NOI Margin Average over lease life Abernathy Joint Venture 168 MW Critical IT Data Center in Texas $1.3Bn Backstop in Support of Fluidstack’s Lease Obligations Build cost $8MM – $10MM / critical MW 51% 49% TeraWulf and Fluidstack Partnership Builds on 360 MW + of critical IT load signed in August 2025 Continued support from Google in the form of backstop Poised for future growth together at Abernathy Poised for future growth together at additional sites Our Joint Venture With Fluidstack Reinforces Our Repeatable, Scalable Development Model, Anchored by Advantaged Power Infrastructure Note: 1. Lease term may be shortened to 20 years or 15 years pursuant to certain contractual options |

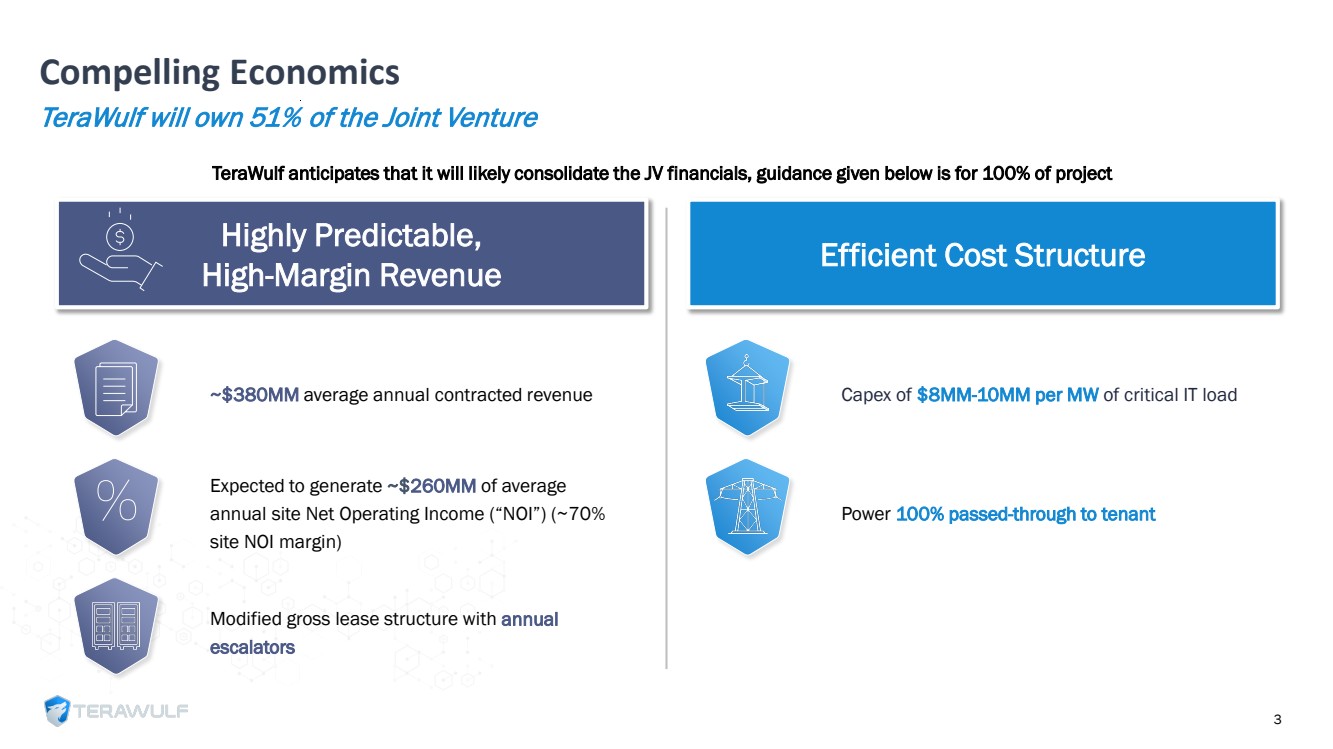

| Compelling Economics 3 Highly Predictable, High-Margin Revenue TeraWulf will own 51% of the Joint Venture Efficient Cost Structure ~$380MM average annual contracted revenue Expected to generate ~$260MM of average annual site Net Operating Income (“NOI”) (~70% site NOI margin) Modified gross lease structure with annual escalators Capex of $8MM-10MM per MW of critical IT load Power 100% passed-through to tenant TeraWulf anticipates that it will likely consolidate the JV financials, guidance given below is for 100% of project |

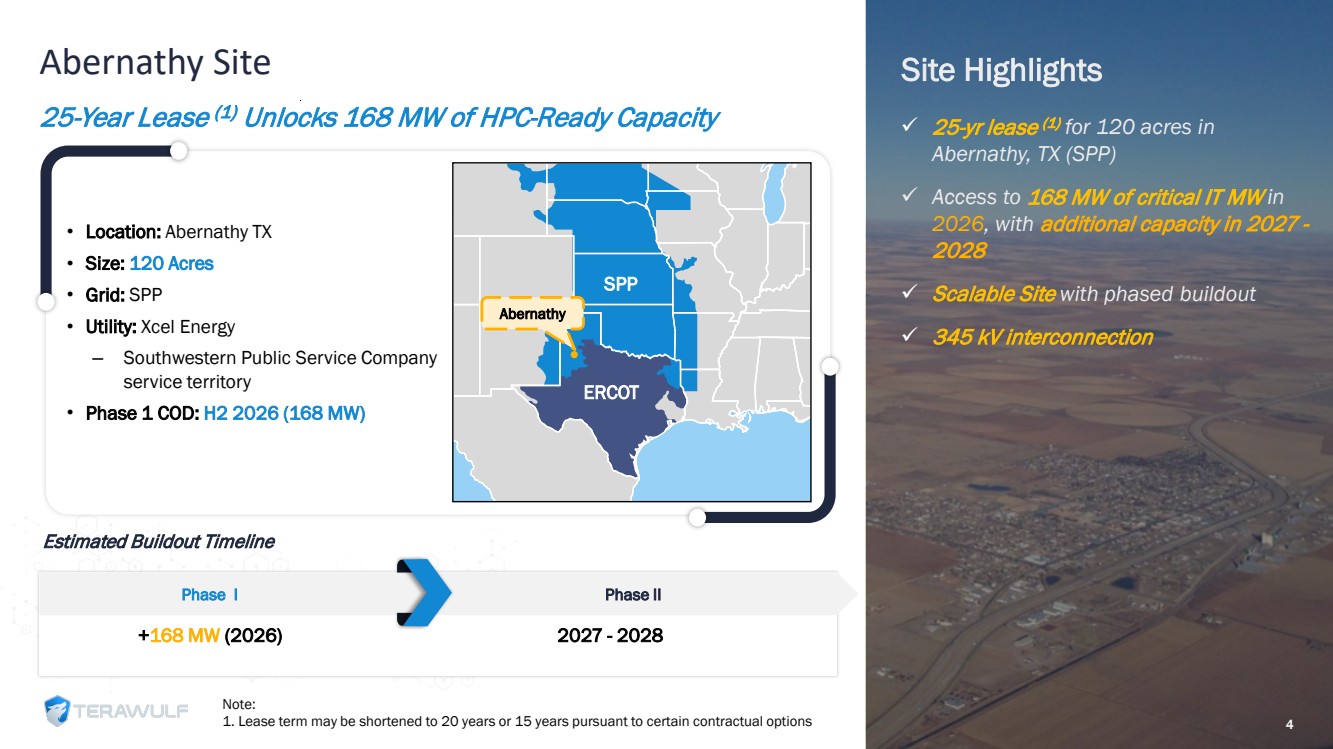

| Abernathy Site 25-Year Lease (1) Unlocks 168 MW of HPC-Ready Capacity 25-yr lease (1) for 120 acres in Abernathy, TX (SPP) Access to 168 MW of critical IT MW in 2026, with additional capacity in 2027 - 2028 Scalable Site with phased buildout 345 kV interconnection Site Highlights Estimated Buildout Timeline +168 MW (2026) 2027 - 2028 ERCOT SPP • Location: Abernathy TX • Size: 120 Acres • Grid: SPP • Utility: Xcel Energy ‒ Southwestern Public Service Company service territory • Phase 1 COD: H2 2026 (168 MW) Phase I Phase II Abernathy Note: 1. Lease term may be shortened to 20 years or 15 years pursuant to certain contractual options 4 |

| Embedded Growth Through Reserved Expansion Rights 5 • Replicates TeraWulf’s Lake Mariner expansion playbook, enabling rapid incremental build-outs • Scalable Site drives operating leverage and incremental net operating income margins over time • Maintains expansion control and development rights across the broader Abernathy campus • Establishes long-term platform visibility beyond the initial 168 MW contract ‒ Abernathy expansion reserved for a follow-on deployment by JV ‒ WULF to have exclusive right on next Fluidstack project > 168 MW |