Group Inc. (“DCG”), who also owns Foundry, our mining pool provider. At this time, there are no material risks to our business arising from our indirect exposure to Genesis. Most recently, in March 2023, SVB Financial, the parent of Silicon Valley Bank, filed for Chapter 11 bankruptcy.

We have no material direct exposure to SVB Financial, Silicon Valley Bank or Silvergate Bank. Although (i) our cryptocurrency mining business has (x) no direct exposure to any of the cryptocurrency market participants that recently filed for Chapter 11 bankruptcy and (y) no material direct exposure to SVB Financial, Silicon Valley Bank or Silvergate Bank; (ii) we have no assets, material or otherwise, that may not be recovered due to the foregoing bankruptcies or bank shutdowns; (iii) we have no direct exposure to any other counterparties, customers, custodians or other financial institutions or crypto asset market participants known to have (x) experienced excessive redemptions or suspended redemptions or withdrawal of crypto assets, (y) the crypto assets of their customers unaccounted for, or (z) experienced material corporate compliance failures; and (iv) our activities in the commercial optimization of the power supply are unaffected by the recent crypto market and banking industry events; our business, financial condition and results of operations may not be immune to unfavorable investor sentiment resulting from these recent developments in the broader cryptocurrency and banking industries.

On March 12, 2023, Signature Bank (“SBNY”) was closed by its state chartering authority, the New York State Department of Financial Services. On the same date the Federal Deposit Insurance Corporation (“FDIC”) was appointed as receiver and transferred all customer deposits and substantially all of the assets of SBNY to Signature Bridge Bank, N.A., a full-service bank that is being operated by the FDIC. The FDIC, the U.S. Treasury, and the Federal Reserve jointly announced that all depositors of SBNY would be made whole, regardless of deposit insurance limits. The Company automatically became a customer of Signature Bridge Bank, N.A. as part of this action. Normal banking activities resumed on Monday, March 13, 2023. On March 29, 2023, the Company was advised by the FDIC that the Company’s bank accounts would be closed on April 5, 2023 and any remaining funds as of that date would be distributed to the Company by check. As of March 30, 2023, the Company held approximately $0.9 million in the former SBNY accounts and intends to transfer all then remaining funds out of Signature Bridge Bank, N.A. by April 5, 2023.

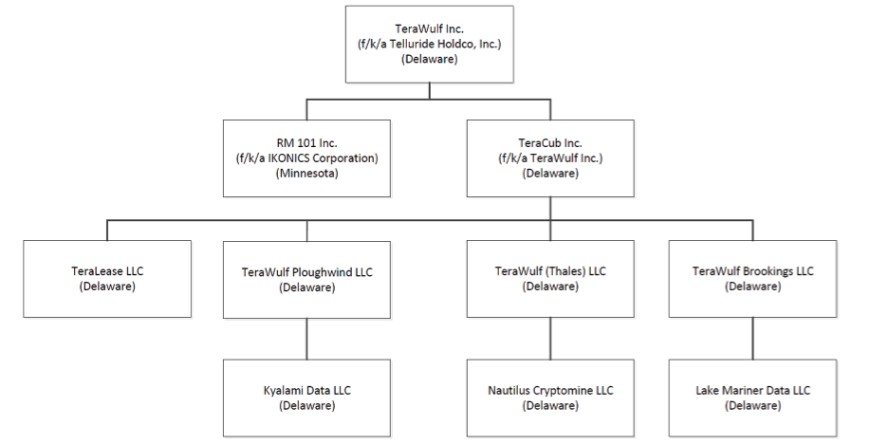

Corporate History and Structure

Paul Prager, Chief Executive Officer (“CEO”) and chairman of the board of directors of TeraWulf, co-founded TeraWulf with Nazar Khan, Chief Operating Officer and Chief Technology Officer, in 2021. Together with Kerri Langlais, Chief Strategy Officer, the TeraWulf management team has worked together for over 15 years.

TeraWulf’s business operations are conducted through several operating subsidiaries with its core operational and business activities directed through TeraWulf. The chart below sets forth TeraWulf’s corporate structure as of the date of this Annual Report. All entities on the chart have been incorporated in the State of Delaware or Minnesota as either corporations or limited liability companies, as the case may be, as indicated on the chart:

2