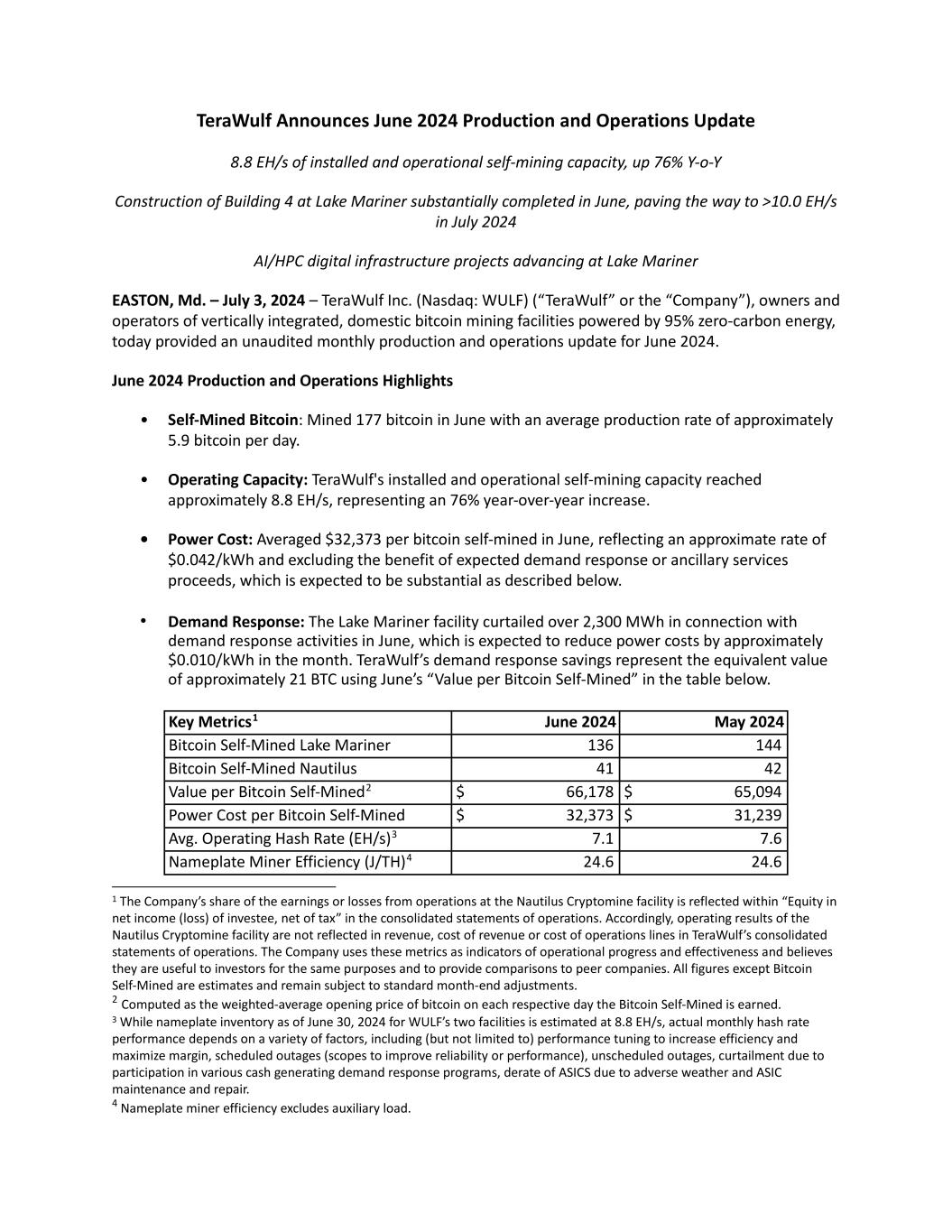

TeraWulf Announces June 2024 Production and Operations Update 8.8 EH/s of installed and operational self-mining capacity, up 76% Y-o-Y Construction of Building 4 at Lake Mariner substantially completed in June, paving the way to >10.0 EH/s in July 2024 AI/HPC digital infrastructure projects advancing at Lake Mariner EASTON, Md. – July 3, 2024 – TeraWulf Inc. (Nasdaq: WULF) (“TeraWulf” or the “Company”), owners and operators of vertically integrated, domestic bitcoin mining facilities powered by 95% zero-carbon energy, today provided an unaudited monthly production and operations update for June 2024. June 2024 Production and Operations Highlights • Self-Mined Bitcoin: Mined 177 bitcoin in June with an average production rate of approximately 5.9 bitcoin per day. • Operating Capacity: TeraWulf's installed and operational self-mining capacity reached approximately 8.8 EH/s, representing an 76% year-over-year increase. • Power Cost: Averaged $32,373 per bitcoin self-mined in June, reflecting an approximate rate of $0.042/kWh and excluding the benefit of expected demand response or ancillary services proceeds, which is expected to be substantial as described below. • Demand Response: The Lake Mariner facility curtailed over 2,300 MWh in connection with demand response activities in June, which is expected to reduce power costs by approximately $0.010/kWh in the month. TeraWulf’s demand response savings represent the equivalent value of approximately 21 BTC using June’s “Value per Bitcoin Self-Mined” in the table below. Key Metrics1 June 2024 May 2024 Bitcoin Self-Mined Lake Mariner 136 144 Bitcoin Self-Mined Nautilus 41 42 Value per Bitcoin Self-Mined2 $ 66,178 $ 65,094 Power Cost per Bitcoin Self-Mined $ 32,373 $ 31,239 Avg. Operating Hash Rate (EH/s)3 7.1 7.6 Nameplate Miner Efficiency (J/TH)4 24.6 24.6 1 The Company’s share of the earnings or losses from operations at the Nautilus Cryptomine facility is reflected within “Equity in net income (loss) of investee, net of tax” in the consolidated statements of operations. Accordingly, operating results of the Nautilus Cryptomine facility are not reflected in revenue, cost of revenue or cost of operations lines in TeraWulf’s consolidated statements of operations. The Company uses these metrics as indicators of operational progress and effectiveness and believes they are useful to investors for the same purposes and to provide comparisons to peer companies. All figures except Bitcoin Self-Mined are estimates and remain subject to standard month-end adjustments. 2 Computed as the weighted-average opening price of bitcoin on each respective day the Bitcoin Self-Mined is earned. 3 While nameplate inventory as of June 30, 2024 for WULF’s two facilities is estimated at 8.8 EH/s, actual monthly hash rate performance depends on a variety of factors, including (but not limited to) performance tuning to increase efficiency and maximize margin, scheduled outages (scopes to improve reliability or performance), unscheduled outages, curtailment due to participation in various cash generating demand response programs, derate of ASICS due to adverse weather and ASIC maintenance and repair. 4 Nameplate miner efficiency excludes auxiliary load.

Management Commentary “During June, the Company mined 177 bitcoin, equivalent to approximately 5.9 bitcoin per day, in line with May’s production,” said Sean Farrell, SVP of Operations at TeraWulf. “The Lake Mariner team also substantially completed Building 4 ahead of schedule, and is currently installing and activating approximately 10,000 of Bitmain’s latest generations of S21 and S21 Pro miners. Once fully deployed, Building 4 is expected to increase our total operating capacity to over 10.0 EH/s,” continued Farrell. “For the second half of 2024, significant activity continues at Lake Mariner. Construction has commenced on Building 5, which will add an additional 50 MW of infrastructure capacity. Our team is also finalizing the 2 MW pilot project, known as the 'WULF Den,' which will house and operate the latest generation GPUs and is targeted for completion by the third quarter. Additionally, we are developing a 20 MW co-location pilot facility, anticipated to be completed by year-end.” Production and Operations Update As of June 30, 2024, TeraWulf's operational infrastructure capacity comprised 195 MW at the Lake Mariner facility and 50 MW at the Nautilus facility, with the Company's total self-mining hash rate at approximately 8.8 EH/s. In June, TeraWulf's miners operated at an average of 7.1 EH/s. This was due to several factors: S21 miners were not installed until the end of the month, frequent demand response events, and performance tuning aimed at maximizing profit every hour of the day. Throughout June, the Nautilus facility experienced temporary performance reductions due to increased temperatures. To address this, the Nautilus team has modified the filter design to increase airflow and mitigate temperature-related performance degradation. Construction of Building 4 (35 MW) at the Lake Mariner facility was completed in June. Once all miners are installed, which is expected in July, TeraWulf’s total operational capacity will be approximately 10.0 EH/s. For a more in-depth look at Building 4 and an overview of TeraWulf’s future expansion plans including Building 5 (50 MW), please refer to the latest construction update video on the Company’s YouTube channel here. Regarding WULF Compute’s pursuit of a large-scale, AI/HPC project at the Lake Mariner site, progress continues on the previously announced construction of a 2 MW AI/HPC digital infrastructure pilot, supporting current and next-generation GPU technology. TeraWulf is also designing a 20 MW colocation pilot project at the Lake Mariner site capable of supporting 16 MW of critical IT load with liquid cooling and redundancy requirements typical of a Tier 3 data center, with a target completion date in Q4 2024. About TeraWulf TeraWulf owns and operates vertically integrated, environmentally clean bitcoin mining facilities in the United States. Led by an experienced group of energy entrepreneurs, the Company currently has two bitcoin mining facilities: the wholly owned Lake Mariner facility in New York, and Nautilus Cryptomine facility in Pennsylvania, a joint venture with Cumulus Coin, LLC. TeraWulf generates domestically produced bitcoin powered by 95% zero carbon energy resources including nuclear, hydro, and solar with a goal of utilizing 100% zero-carbon energy. With a core focus on ESG that ties directly to its business success, TeraWulf expects to provide industry leading mining economics at an industrial scale.

Forward-Looking Statements This press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements include statements concerning anticipated future events and expectations that are not historical facts. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements. In addition, forward-looking statements are typically identified by words such as “plan,” “believe,” “goal,” “target,” “aim,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, although the absence of these words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are based on the current expectations and beliefs of TeraWulf’s management and are inherently subject to a number of factors, risks, uncertainties and assumptions and their potential effects. There can be no assurance that future developments will be those that have been anticipated. Actual results may vary materially from those expressed or implied by forward-looking statements based on a number of factors, risks, uncertainties and assumptions, including, among others: (1) conditions in the cryptocurrency mining industry, including fluctuation in the market pricing of bitcoin and other cryptocurrencies, and the economics of cryptocurrency mining, including as to variables or factors affecting the cost, efficiency and profitability of cryptocurrency mining; (2) competition among the various providers of cryptocurrency mining services; (3) changes in applicable laws, regulations and/or permits affecting TeraWulf’s operations or the industries in which it operates, including regulation regarding power generation, cryptocurrency usage and/or cryptocurrency mining, and/or regulation regarding safety, health, environmental and other matters, which could require significant expenditures; (4) the ability to implement certain business objectives and to timely and cost-effectively execute integrated projects; (5) failure to obtain adequate financing on a timely basis and/or on acceptable terms with regard to growth strategies or operations; (6) loss of public confidence in bitcoin or other cryptocurrencies and the potential for cryptocurrency market manipulation; (7) adverse geopolitical or economic conditions, including a high inflationary environment; (8) the potential of cybercrime, money-laundering, malware infections and phishing and/or loss and interference as a result of equipment malfunction or break- down, physical disaster, data security breach, computer malfunction or sabotage (and the costs associated with any of the foregoing); (9) the availability, delivery schedule and cost of equipment necessary to maintain and grow the business and operations of TeraWulf, including mining equipment and infrastructure equipment meeting the technical or other specifications required to achieve its growth strategy; (10) employment workforce factors, including the loss of key employees; (11) litigation relating to TeraWulf and/or its business; and (12) other risks and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange Commission (“SEC”). Potential investors, stockholders and other readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they were made. TeraWulf does not assume any obligation to publicly update any forward-looking statement after it was made, whether as a result of new information, future events or otherwise, except as required by law or regulation. Investors are referred to the full discussion of risks and uncertainties associated with forward-looking statements and the discussion of risk factors contained in the Company’s filings with the SEC, which are available at www.sec.gov. Company Contact: Jason Assad Director of Corporate Communications assad@terawulf.com (678) 570-6791