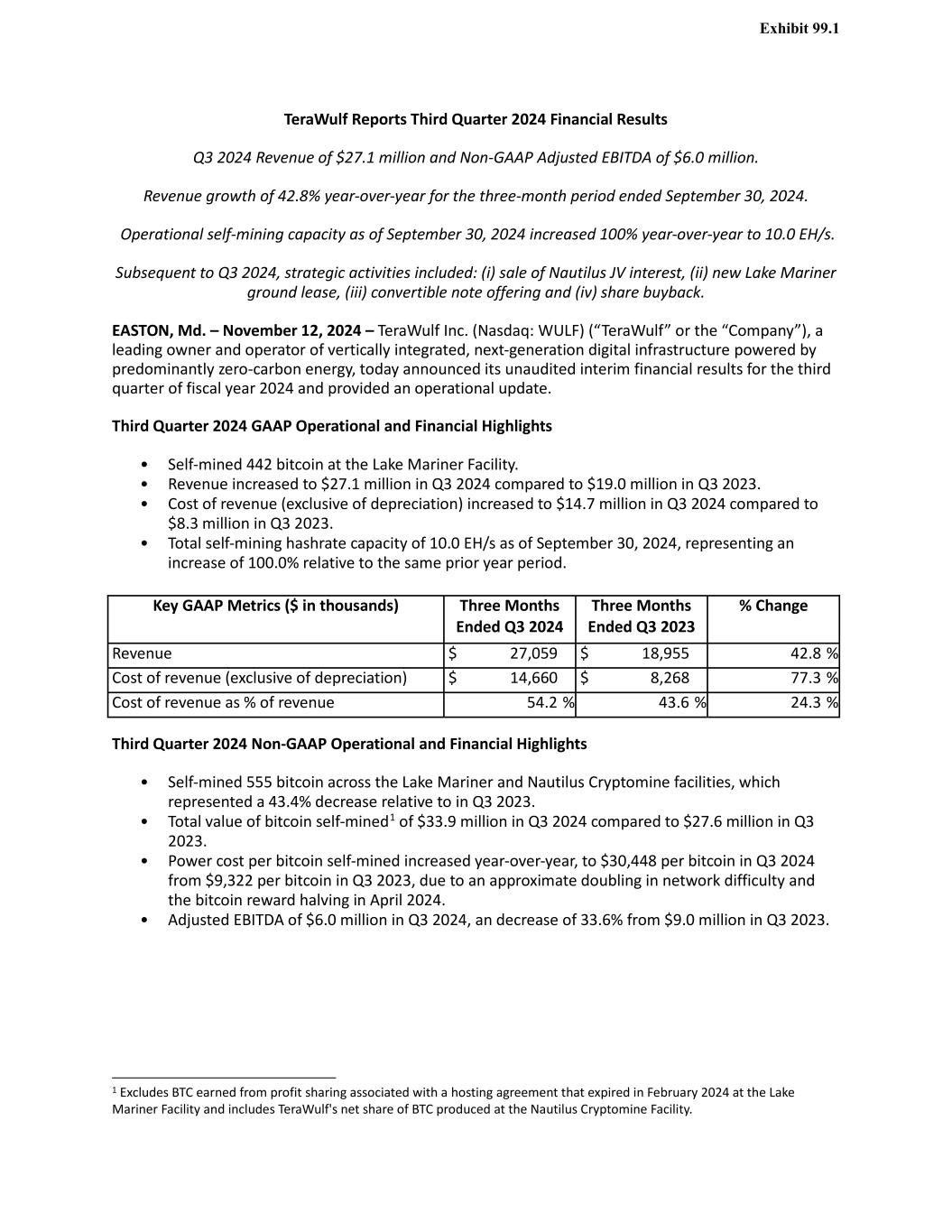

Exhibit 99.1 TeraWulf Reports Third Quarter 2024 Financial Results Q3 2024 Revenue of $27.1 million and Non-GAAP Adjusted EBITDA of $6.0 million. Revenue growth of 42.8% year-over-year for the three-month period ended September 30, 2024. Operational self-mining capacity as of September 30, 2024 increased 100% year-over-year to 10.0 EH/s. Subsequent to Q3 2024, strategic activities included: (i) sale of Nautilus JV interest, (ii) new Lake Mariner ground lease, (iii) convertible note offering and (iv) share buyback. EASTON, Md. – November 12, 2024 – TeraWulf Inc. (Nasdaq: WULF) (“TeraWulf” or the “Company”), a leading owner and operator of vertically integrated, next-generation digital infrastructure powered by predominantly zero-carbon energy, today announced its unaudited interim financial results for the third quarter of fiscal year 2024 and provided an operational update. Third Quarter 2024 GAAP Operational and Financial Highlights • Self-mined 442 bitcoin at the Lake Mariner Facility. • Revenue increased to $27.1 million in Q3 2024 compared to $19.0 million in Q3 2023. • Cost of revenue (exclusive of depreciation) increased to $14.7 million in Q3 2024 compared to $8.3 million in Q3 2023. • Total self-mining hashrate capacity of 10.0 EH/s as of September 30, 2024, representing an increase of 100.0% relative to the same prior year period. Key GAAP Metrics ($ in thousands) Three Months Ended Q3 2024 Three Months Ended Q3 2023 % Change Revenue $ 27,059 $ 18,955 42.8 % Cost of revenue (exclusive of depreciation) $ 14,660 $ 8,268 77.3 % Cost of revenue as % of revenue 54.2 % 43.6 % 24.3 % Third Quarter 2024 Non-GAAP Operational and Financial Highlights • Self-mined 555 bitcoin across the Lake Mariner and Nautilus Cryptomine facilities, which represented a 43.4% decrease relative to in Q3 2023. • Total value of bitcoin self-mined1 of $33.9 million in Q3 2024 compared to $27.6 million in Q3 2023. • Power cost per bitcoin self-mined increased year-over-year, to $30,448 per bitcoin in Q3 2024 from $9,322 per bitcoin in Q3 2023, due to an approximate doubling in network difficulty and the bitcoin reward halving in April 2024. • Adjusted EBITDA of $6.0 million in Q3 2024, an decrease of 33.6% from $9.0 million in Q3 2023. 1 Excludes BTC earned from profit sharing associated with a hosting agreement that expired in February 2024 at the Lake Mariner Facility and includes TeraWulf's net share of BTC produced at the Nautilus Cryptomine Facility.

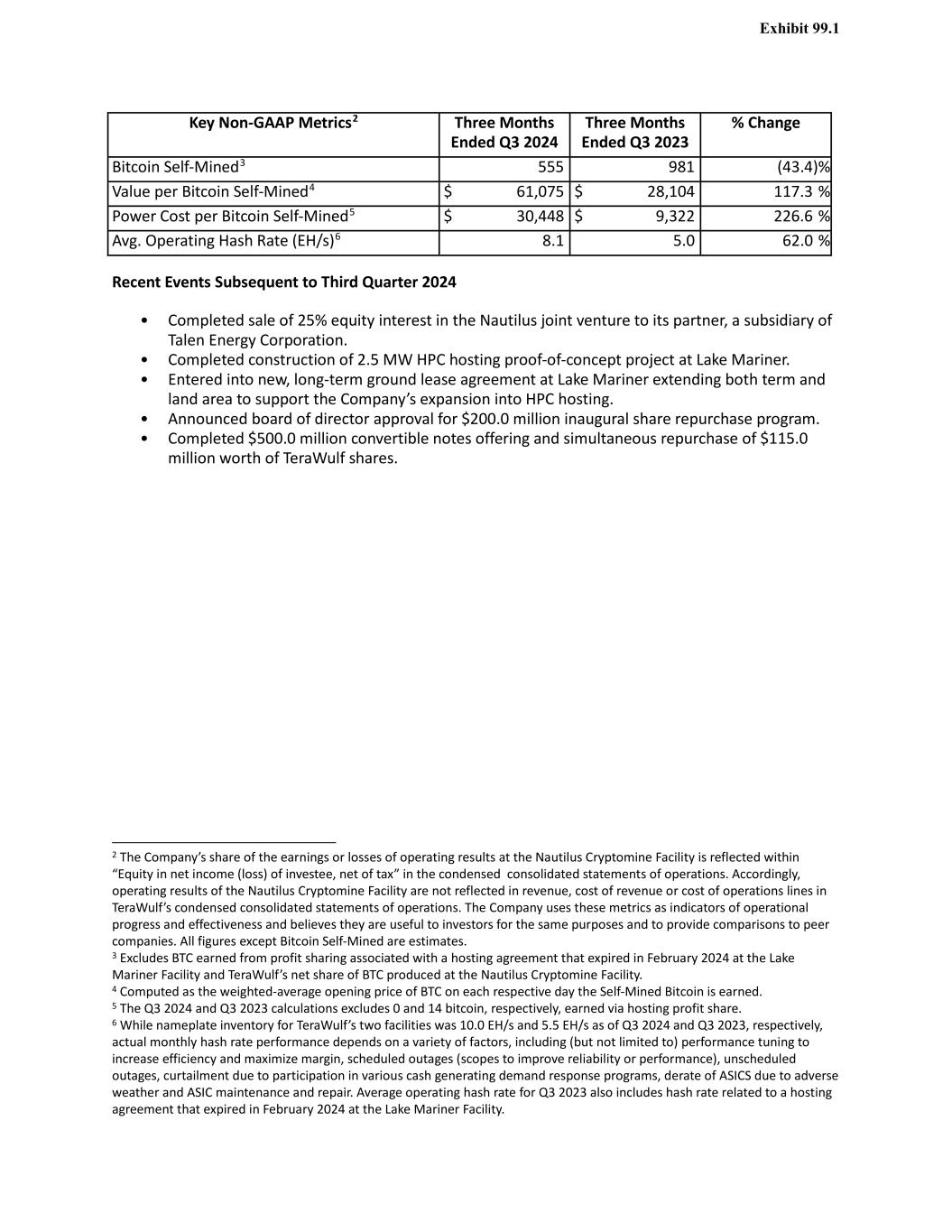

Exhibit 99.1 Key Non-GAAP Metrics2 Three Months Ended Q3 2024 Three Months Ended Q3 2023 % Change Bitcoin Self-Mined3 555 981 (43.4) % Value per Bitcoin Self-Mined4 $ 61,075 $ 28,104 117.3 % Power Cost per Bitcoin Self-Mined5 $ 30,448 $ 9,322 226.6 % Avg. Operating Hash Rate (EH/s)6 8.1 5.0 62.0 % Recent Events Subsequent to Third Quarter 2024 • Completed sale of 25% equity interest in the Nautilus joint venture to its partner, a subsidiary of Talen Energy Corporation. • Completed construction of 2.5 MW HPC hosting proof-of-concept project at Lake Mariner. • Entered into new, long-term ground lease agreement at Lake Mariner extending both term and land area to support the Company’s expansion into HPC hosting. • Announced board of director approval for $200.0 million inaugural share repurchase program. • Completed $500.0 million convertible notes offering and simultaneous repurchase of $115.0 million worth of TeraWulf shares. 2 The Company’s share of the earnings or losses of operating results at the Nautilus Cryptomine Facility is reflected within “Equity in net income (loss) of investee, net of tax” in the condensed consolidated statements of operations. Accordingly, operating results of the Nautilus Cryptomine Facility are not reflected in revenue, cost of revenue or cost of operations lines in TeraWulf’s condensed consolidated statements of operations. The Company uses these metrics as indicators of operational progress and effectiveness and believes they are useful to investors for the same purposes and to provide comparisons to peer companies. All figures except Bitcoin Self-Mined are estimates. 3 Excludes BTC earned from profit sharing associated with a hosting agreement that expired in February 2024 at the Lake Mariner Facility and TeraWulf’s net share of BTC produced at the Nautilus Cryptomine Facility. 4 Computed as the weighted-average opening price of BTC on each respective day the Self-Mined Bitcoin is earned. 5 The Q3 2024 and Q3 2023 calculations excludes 0 and 14 bitcoin, respectively, earned via hosting profit share. 6 While nameplate inventory for TeraWulf’s two facilities was 10.0 EH/s and 5.5 EH/s as of Q3 2024 and Q3 2023, respectively, actual monthly hash rate performance depends on a variety of factors, including (but not limited to) performance tuning to increase efficiency and maximize margin, scheduled outages (scopes to improve reliability or performance), unscheduled outages, curtailment due to participation in various cash generating demand response programs, derate of ASICS due to adverse weather and ASIC maintenance and repair. Average operating hash rate for Q3 2023 also includes hash rate related to a hosting agreement that expired in February 2024 at the Lake Mariner Facility.

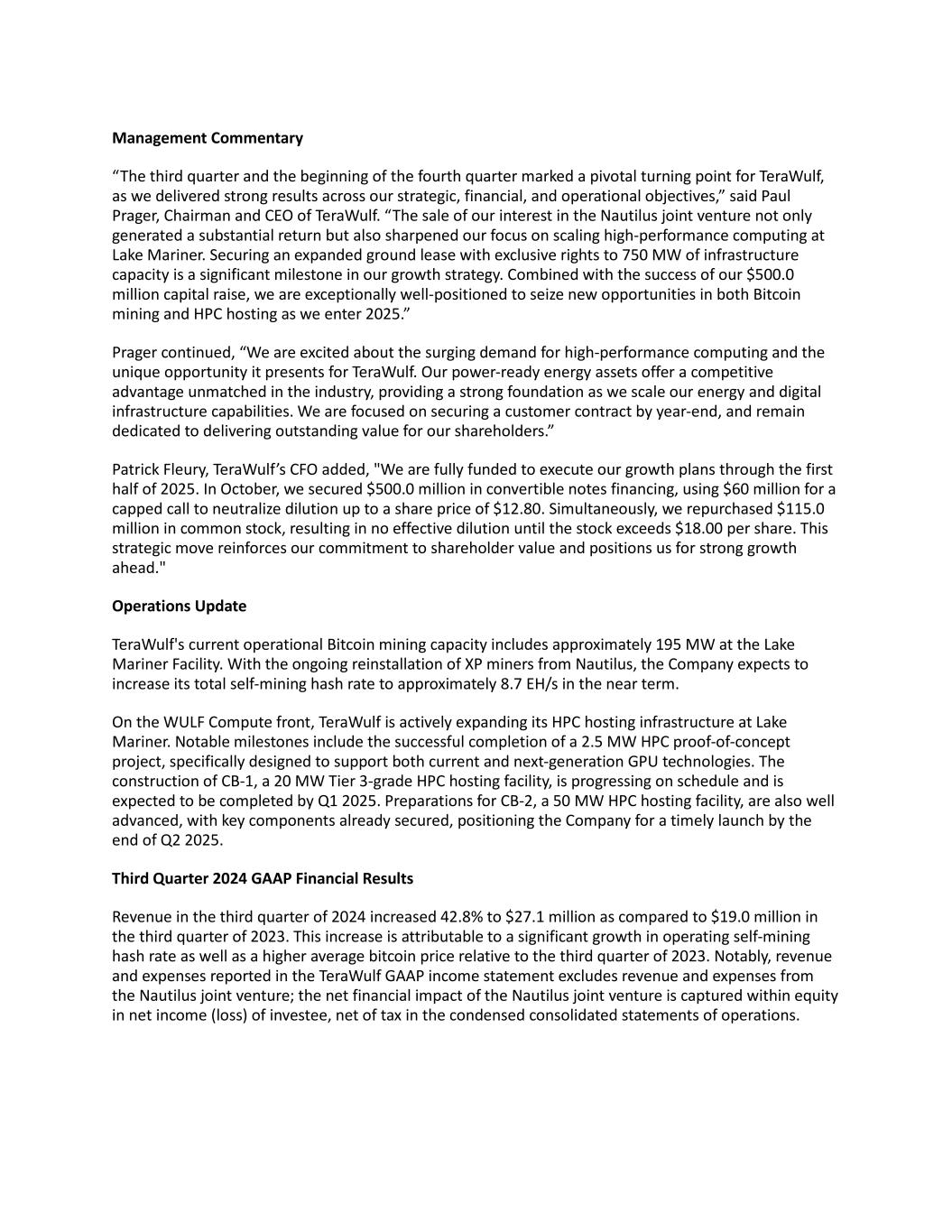

Management Commentary “The third quarter and the beginning of the fourth quarter marked a pivotal turning point for TeraWulf, as we delivered strong results across our strategic, financial, and operational objectives,” said Paul Prager, Chairman and CEO of TeraWulf. “The sale of our interest in the Nautilus joint venture not only generated a substantial return but also sharpened our focus on scaling high-performance computing at Lake Mariner. Securing an expanded ground lease with exclusive rights to 750 MW of infrastructure capacity is a significant milestone in our growth strategy. Combined with the success of our $500.0 million capital raise, we are exceptionally well-positioned to seize new opportunities in both Bitcoin mining and HPC hosting as we enter 2025.” Prager continued, “We are excited about the surging demand for high-performance computing and the unique opportunity it presents for TeraWulf. Our power-ready energy assets offer a competitive advantage unmatched in the industry, providing a strong foundation as we scale our energy and digital infrastructure capabilities. We are focused on securing a customer contract by year-end, and remain dedicated to delivering outstanding value for our shareholders.” Patrick Fleury, TeraWulf’s CFO added, "We are fully funded to execute our growth plans through the first half of 2025. In October, we secured $500.0 million in convertible notes financing, using $60 million for a capped call to neutralize dilution up to a share price of $12.80. Simultaneously, we repurchased $115.0 million in common stock, resulting in no effective dilution until the stock exceeds $18.00 per share. This strategic move reinforces our commitment to shareholder value and positions us for strong growth ahead." Operations Update TeraWulf's current operational Bitcoin mining capacity includes approximately 195 MW at the Lake Mariner Facility. With the ongoing reinstallation of XP miners from Nautilus, the Company expects to increase its total self-mining hash rate to approximately 8.7 EH/s in the near term. On the WULF Compute front, TeraWulf is actively expanding its HPC hosting infrastructure at Lake Mariner. Notable milestones include the successful completion of a 2.5 MW HPC proof-of-concept project, specifically designed to support both current and next-generation GPU technologies. The construction of CB-1, a 20 MW Tier 3-grade HPC hosting facility, is progressing on schedule and is expected to be completed by Q1 2025. Preparations for CB-2, a 50 MW HPC hosting facility, are also well advanced, with key components already secured, positioning the Company for a timely launch by the end of Q2 2025. Third Quarter 2024 GAAP Financial Results Revenue in the third quarter of 2024 increased 42.8% to $27.1 million as compared to $19.0 million in the third quarter of 2023. This increase is attributable to a significant growth in operating self-mining hash rate as well as a higher average bitcoin price relative to the third quarter of 2023. Notably, revenue and expenses reported in the TeraWulf GAAP income statement excludes revenue and expenses from the Nautilus joint venture; the net financial impact of the Nautilus joint venture is captured within equity in net income (loss) of investee, net of tax in the condensed consolidated statements of operations.

Cost of revenue (exclusive of depreciation) in the third quarter of 2024 increased 77.3% to $14.7 million compared to $8.3 million in the third quarter of 2023. Cost of revenue (exclusive of depreciation) as a percentage of revenue increased to 54.2% in the third quarter of 2024 compared to 43.6% in the third quarter of 2023, primarily due to an approximate doubling in network difficulty and the bitcoin reward halving in April 2024, partially offset by an 62.0% increase in average operating hash rate and 117.3% increase in average value per bitcoin self-mined year-over-year. During the third quarter of 2024, the Company repaid $75.8 million of debt to fully pay down the remaining balance on its Term Loans ahead of maturity. About TeraWulf TeraWulf develops, owns, and operates environmentally sustainable, next-generation data center infrastructure in the United States, specifically designed for Bitcoin mining and high-performance computing. Led by a team of seasoned energy entrepreneurs, the Company owns and operates the Lake Mariner facility situated on the expansive site of a now retired coal plant in Western New York. Currently, TeraWulf generates revenue primarily through Bitcoin mining, leveraging predominantly zero-carbon energy sources, including hydroelectric and nuclear power. Committed to environmental, social, and governance (ESG) principles that align with its business objectives, TeraWulf aims to deliver industry- leading economics in mining and data center operations at an industrial scale. Forward-Looking Statements This press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements include statements concerning anticipated future events and expectations that are not historical facts. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements. In addition, forward-looking statements are typically identified by words such as “plan,” “believe,” “goal,” “target,” “aim,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, although the absence of these words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are based on the current expectations and beliefs of TeraWulf’s management and are inherently subject to a number of factors, risks, uncertainties and assumptions and their potential effects. There can be no assurance that future developments will be those that have been anticipated. Actual results may vary materially from those expressed or implied by forward-looking statements based on a number of factors, risks, uncertainties and assumptions, including, among others: (1) conditions in the cryptocurrency mining industry, including fluctuation in the market pricing of bitcoin and other cryptocurrencies, and the economics of cryptocurrency mining, including as to variables or factors affecting the cost, efficiency and profitability of cryptocurrency mining; (2) competition among the various providers of cryptocurrency mining services; (3) changes in applicable laws, regulations and/or permits affecting TeraWulf’s operations or the industries in which it operates, including regulation regarding power generation, cryptocurrency usage and/or cryptocurrency mining, and/or regulation regarding safety, health, environmental and other matters, which could require significant expenditures; (4) the ability to implement certain business objectives and to timely and cost-effectively execute integrated projects; (5) failure to obtain adequate financing on a timely basis and/or on acceptable terms with regard to growth strategies or operations; (6) loss of public confidence in bitcoin or other cryptocurrencies and the potential for cryptocurrency market manipulation; (7) adverse geopolitical or economic conditions, including a high inflationary environment; (8) the potential of cybercrime, money-laundering, malware infections and phishing and/or loss and interference as a result of equipment malfunction or break- down, physical disaster, data security breach, computer malfunction or sabotage (and the costs

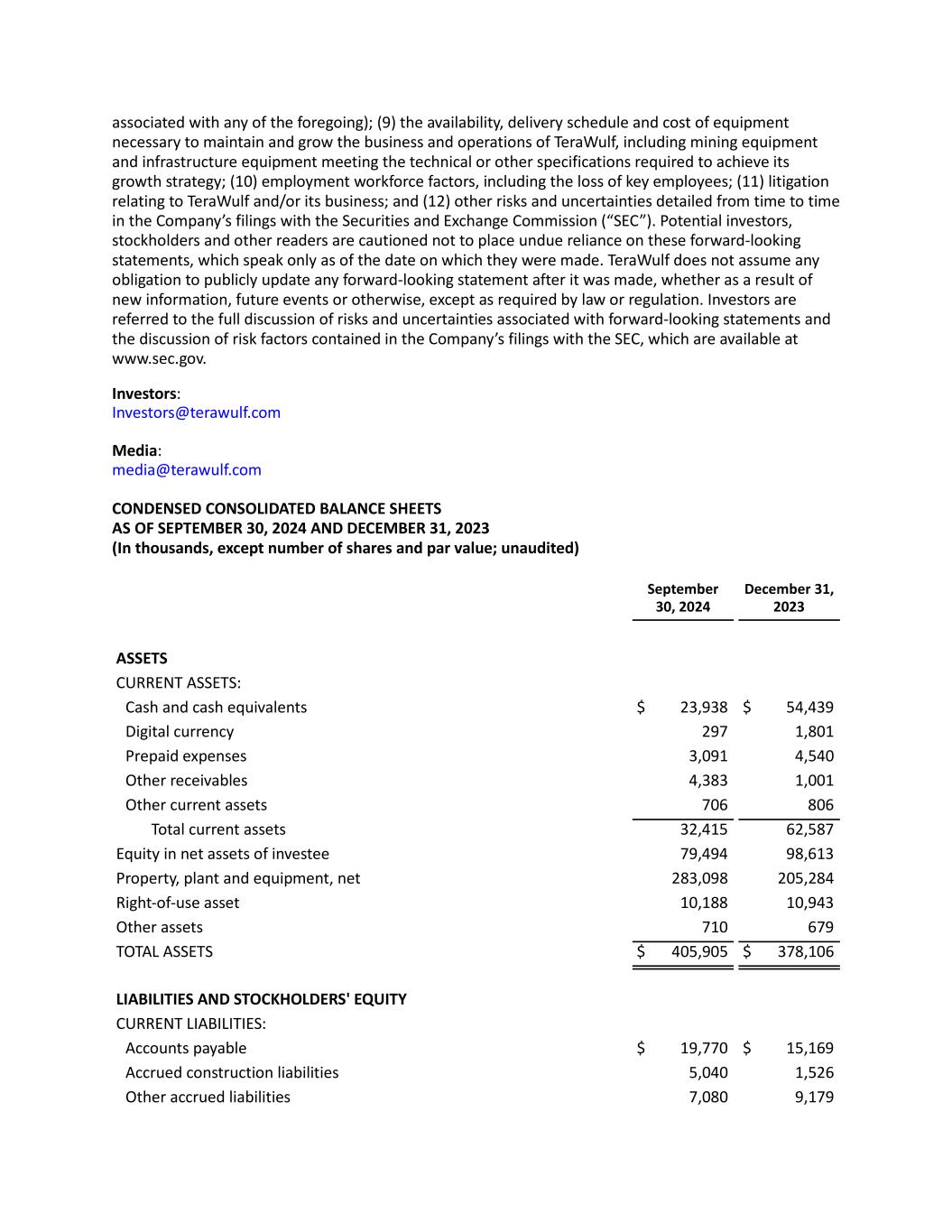

associated with any of the foregoing); (9) the availability, delivery schedule and cost of equipment necessary to maintain and grow the business and operations of TeraWulf, including mining equipment and infrastructure equipment meeting the technical or other specifications required to achieve its growth strategy; (10) employment workforce factors, including the loss of key employees; (11) litigation relating to TeraWulf and/or its business; and (12) other risks and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange Commission (“SEC”). Potential investors, stockholders and other readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they were made. TeraWulf does not assume any obligation to publicly update any forward-looking statement after it was made, whether as a result of new information, future events or otherwise, except as required by law or regulation. Investors are referred to the full discussion of risks and uncertainties associated with forward-looking statements and the discussion of risk factors contained in the Company’s filings with the SEC, which are available at www.sec.gov. Investors: Investors@terawulf.com Media: media@terawulf.com CONDENSED CONSOLIDATED BALANCE SHEETS AS OF SEPTEMBER 30, 2024 AND DECEMBER 31, 2023 (In thousands, except number of shares and par value; unaudited) September 30, 2024 December 31, 2023 ASSETS CURRENT ASSETS: Cash and cash equivalents $ 23,938 $ 54,439 Digital currency 297 1,801 Prepaid expenses 3,091 4,540 Other receivables 4,383 1,001 Other current assets 706 806 Total current assets 32,415 62,587 Equity in net assets of investee 79,494 98,613 Property, plant and equipment, net 283,098 205,284 Right-of-use asset 10,188 10,943 Other assets 710 679 TOTAL ASSETS $ 405,905 $ 378,106 LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES: Accounts payable $ 19,770 $ 15,169 Accrued construction liabilities 5,040 1,526 Other accrued liabilities 7,080 9,179

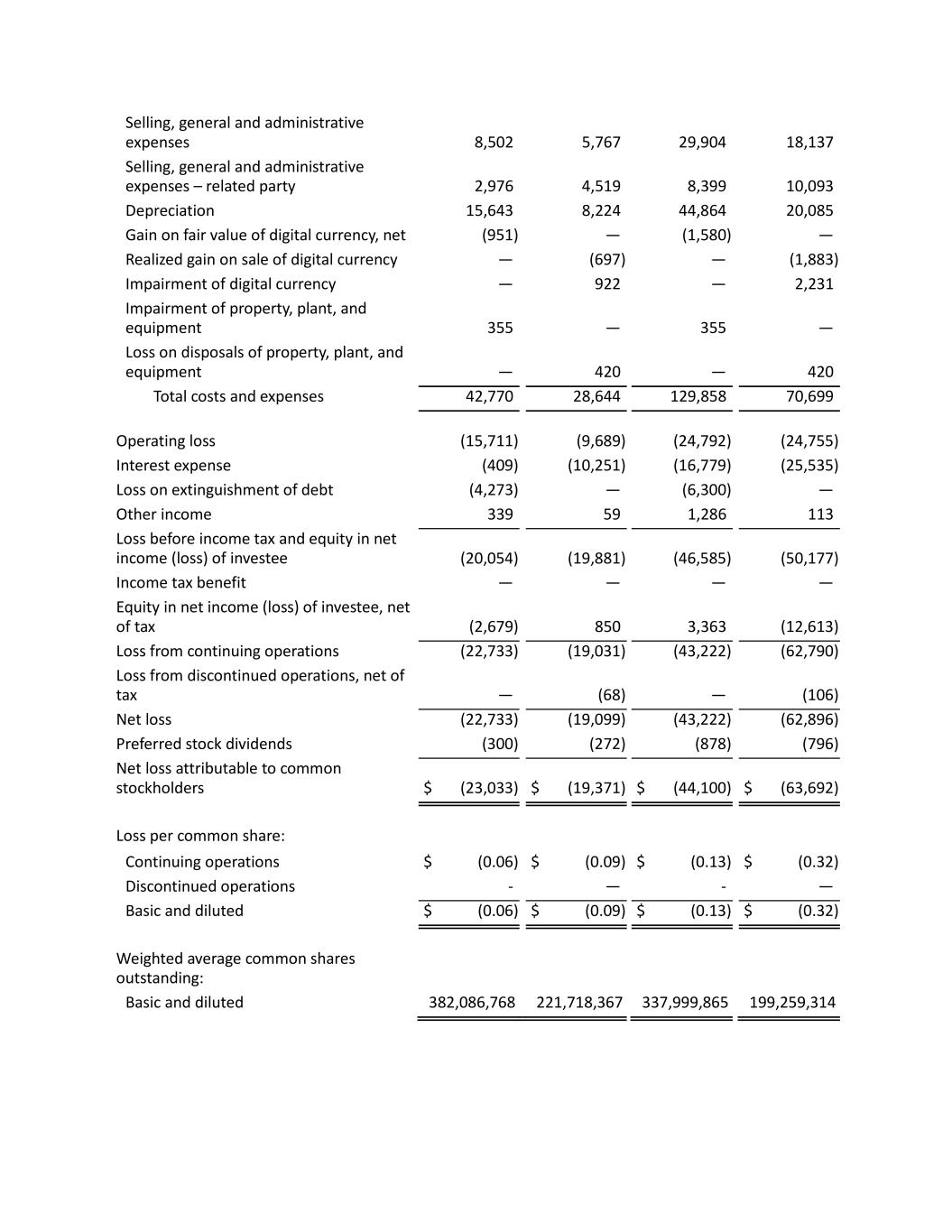

Share based liabilities due to related party — 2,500 Other amounts due to related parties 472 972 Current portion of operating lease liability 53 48 Insurance premium financing payable — 1,803 Current portion of long-term debt — 123,465 Total current liabilities 32,415 154,662 Operating lease liability, net of current portion 859 899 Long-term debt — 56 TOTAL LIABILITIES 33,274 155,617 Commitments and Contingencies (See Note 12) STOCKHOLDERS' EQUITY: Preferred stock, $0.001 par value, $100,000,000 authorized at September 30, 2024 and December 31, 2023; $9,566 issued and outstanding at September 30, 2024 and December 31, 2023; aggregate liquidation preference of $12,302 and $11,423 at September 30, 2024 and December 31, 2023, respectively 9,273 9,273 Common stock, $0.001 par value, $600,000,000 and 400,000,000 authorized at September 30, 2024 and December 31, 2023, respectively; $382,632,083 and $276,733,329 issued and outstanding at September 30, 2024 and December 31, 2023, respectively 383 277 Additional paid-in capital 666,055 472,834 Accumulated deficit (303,080) (259,895) Total stockholders’ equity 372,631 222,489 TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY $ 405,905 $ 378,106 CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024 AND 2023 (In thousands, except number of shares and loss per common share; unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Revenue $ 27,059 $ 18,955 $ 105,066 $ 45,944 Costs and expenses: Cost of revenue (exclusive of depreciation shown below) 14,660 8,268 42,986 18,383 Operating expenses 729 442 2,311 1,218 Operating expenses – related party 856 779 2,619 2,015

Selling, general and administrative expenses 8,502 5,767 29,904 18,137 Selling, general and administrative expenses – related party 2,976 4,519 8,399 10,093 Depreciation 15,643 8,224 44,864 20,085 Gain on fair value of digital currency, net (951) — (1,580) — Realized gain on sale of digital currency — (697) — (1,883) Impairment of digital currency — 922 — 2,231 Impairment of property, plant, and equipment 355 — 355 — Loss on disposals of property, plant, and equipment — 420 — 420 Total costs and expenses 42,770 28,644 129,858 70,699 Operating loss (15,711) (9,689) (24,792) (24,755) Interest expense (409) (10,251) (16,779) (25,535) Loss on extinguishment of debt (4,273) — (6,300) — Other income 339 59 1,286 113 Loss before income tax and equity in net income (loss) of investee (20,054) (19,881) (46,585) (50,177) Income tax benefit — — — — Equity in net income (loss) of investee, net of tax (2,679) 850 3,363 (12,613) Loss from continuing operations (22,733) (19,031) (43,222) (62,790) Loss from discontinued operations, net of tax — (68) — (106) Net loss (22,733) (19,099) (43,222) (62,896) Preferred stock dividends (300) (272) (878) (796) Net loss attributable to common stockholders $ (23,033) $ (19,371) $ (44,100) $ (63,692) Loss per common share: Continuing operations $ (0.06) $ (0.09) $ (0.13) $ (0.32) Discontinued operations - — - — Basic and diluted $ (0.06) $ (0.09) $ (0.13) $ (0.32) Weighted average common shares outstanding: Basic and diluted 382,086,768 221,718,367 337,999,865 199,259,314

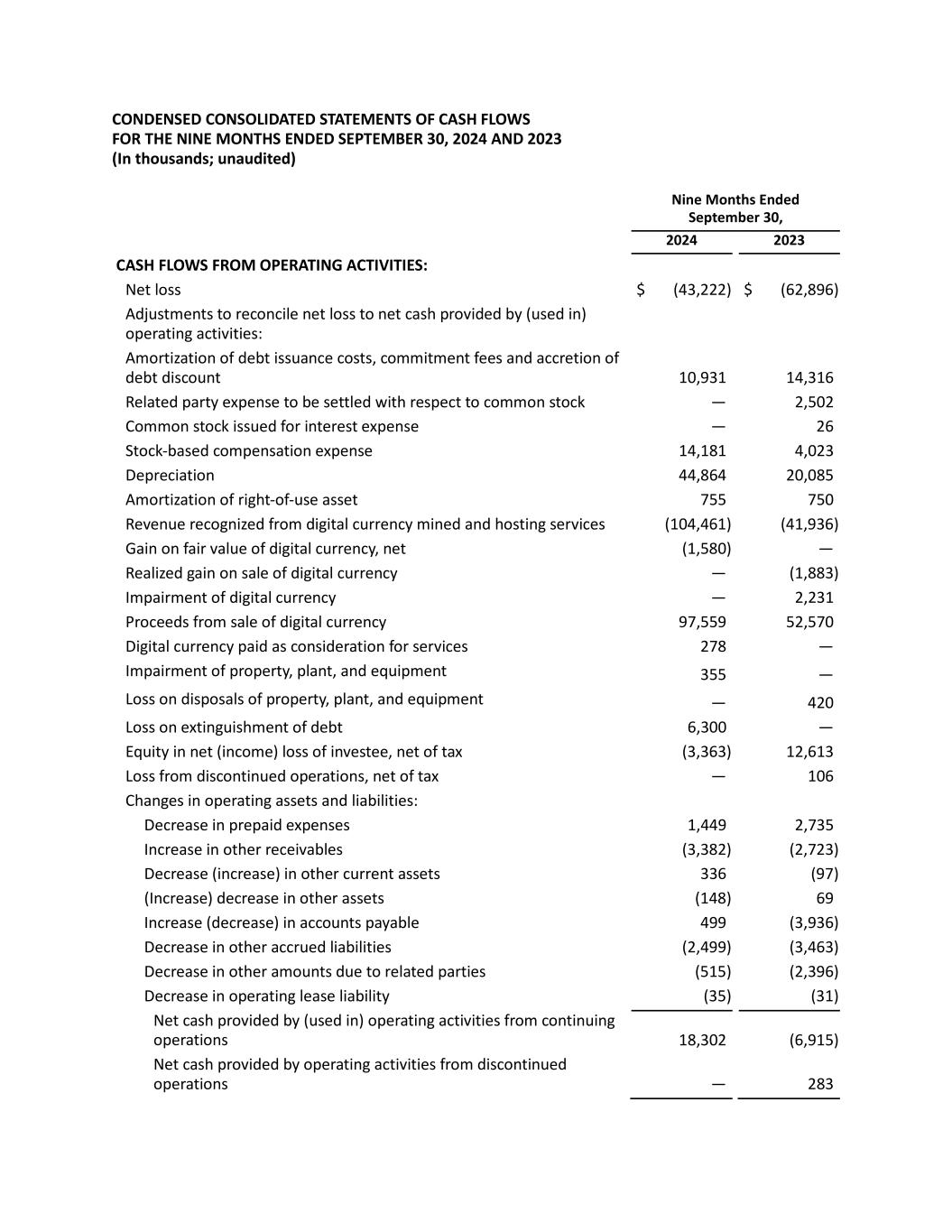

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2024 AND 2023 (In thousands; unaudited) Nine Months Ended September 30, 2024 2023 CASH FLOWS FROM OPERATING ACTIVITIES: Net loss $ (43,222) $ (62,896) Adjustments to reconcile net loss to net cash provided by (used in) operating activities: Amortization of debt issuance costs, commitment fees and accretion of debt discount 10,931 14,316 Related party expense to be settled with respect to common stock — 2,502 Common stock issued for interest expense — 26 Stock-based compensation expense 14,181 4,023 Depreciation 44,864 20,085 Amortization of right-of-use asset 755 750 Revenue recognized from digital currency mined and hosting services (104,461) (41,936) Gain on fair value of digital currency, net (1,580) — Realized gain on sale of digital currency — (1,883) Impairment of digital currency — 2,231 Proceeds from sale of digital currency 97,559 52,570 Digital currency paid as consideration for services 278 — Impairment of property, plant, and equipment 355 — Loss on disposals of property, plant, and equipment — 420 Loss on extinguishment of debt 6,300 — Equity in net (income) loss of investee, net of tax (3,363) 12,613 Loss from discontinued operations, net of tax — 106 Changes in operating assets and liabilities: Decrease in prepaid expenses 1,449 2,735 Increase in other receivables (3,382) (2,723) Decrease (increase) in other current assets 336 (97) (Increase) decrease in other assets (148) 69 Increase (decrease) in accounts payable 499 (3,936) Decrease in other accrued liabilities (2,499) (3,463) Decrease in other amounts due to related parties (515) (2,396) Decrease in operating lease liability (35) (31) Net cash provided by (used in) operating activities from continuing operations 18,302 (6,915) Net cash provided by operating activities from discontinued operations — 283

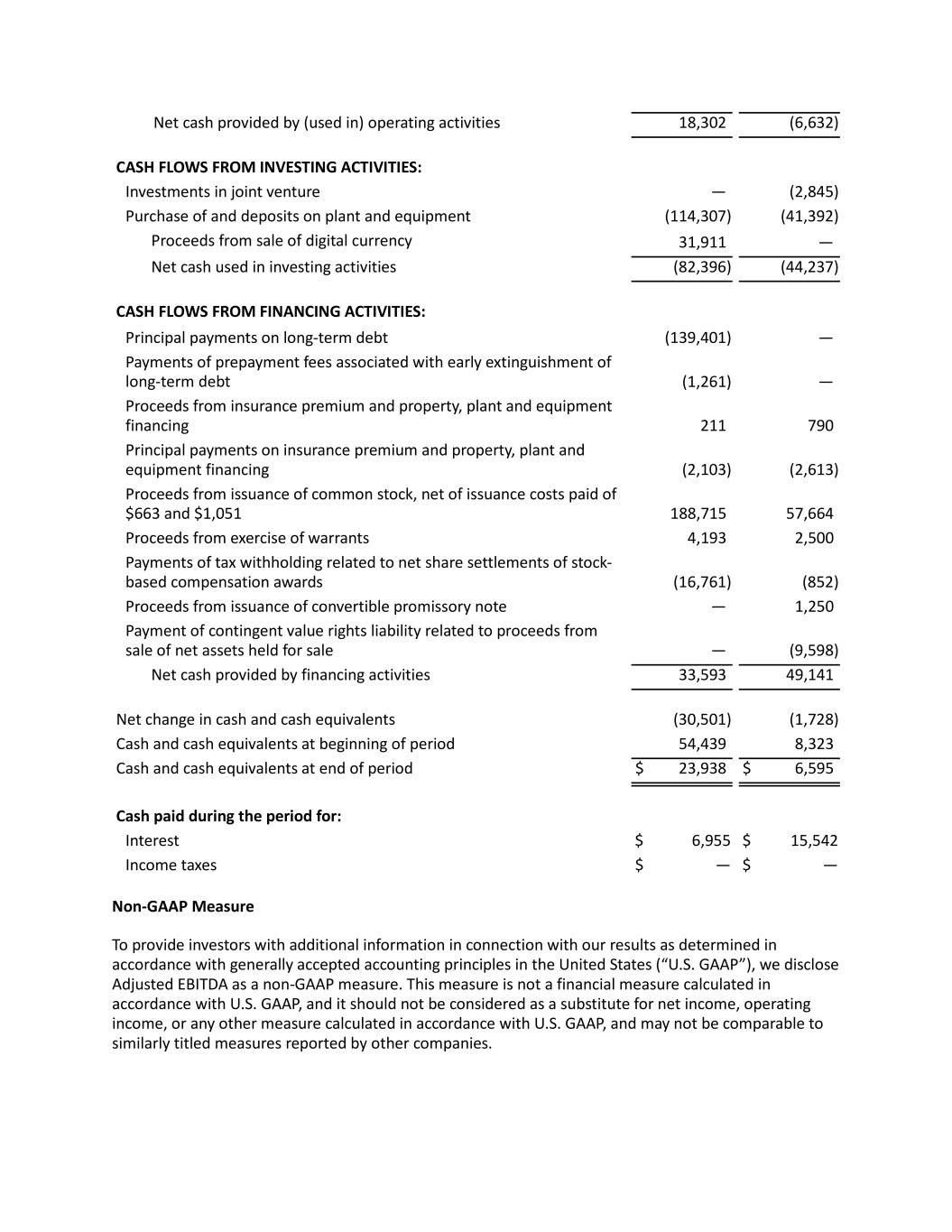

Net cash provided by (used in) operating activities 18,302 (6,632) CASH FLOWS FROM INVESTING ACTIVITIES: Investments in joint venture — (2,845) Purchase of and deposits on plant and equipment (114,307) (41,392) Proceeds from sale of digital currency 31,911 — Net cash used in investing activities (82,396) (44,237) CASH FLOWS FROM FINANCING ACTIVITIES: Principal payments on long-term debt (139,401) — Payments of prepayment fees associated with early extinguishment of long-term debt (1,261) — Proceeds from insurance premium and property, plant and equipment financing 211 790 Principal payments on insurance premium and property, plant and equipment financing (2,103) (2,613) Proceeds from issuance of common stock, net of issuance costs paid of $663 and $1,051 188,715 57,664 Proceeds from exercise of warrants 4,193 2,500 Payments of tax withholding related to net share settlements of stock- based compensation awards (16,761) (852) Proceeds from issuance of convertible promissory note — 1,250 Payment of contingent value rights liability related to proceeds from sale of net assets held for sale — (9,598) Net cash provided by financing activities 33,593 49,141 Net change in cash and cash equivalents (30,501) (1,728) Cash and cash equivalents at beginning of period 54,439 8,323 Cash and cash equivalents at end of period $ 23,938 $ 6,595 Cash paid during the period for: Interest $ 6,955 $ 15,542 Income taxes $ — $ — Non-GAAP Measure To provide investors with additional information in connection with our results as determined in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”), we disclose Adjusted EBITDA as a non-GAAP measure. This measure is not a financial measure calculated in accordance with U.S. GAAP, and it should not be considered as a substitute for net income, operating income, or any other measure calculated in accordance with U.S. GAAP, and may not be comparable to similarly titled measures reported by other companies.

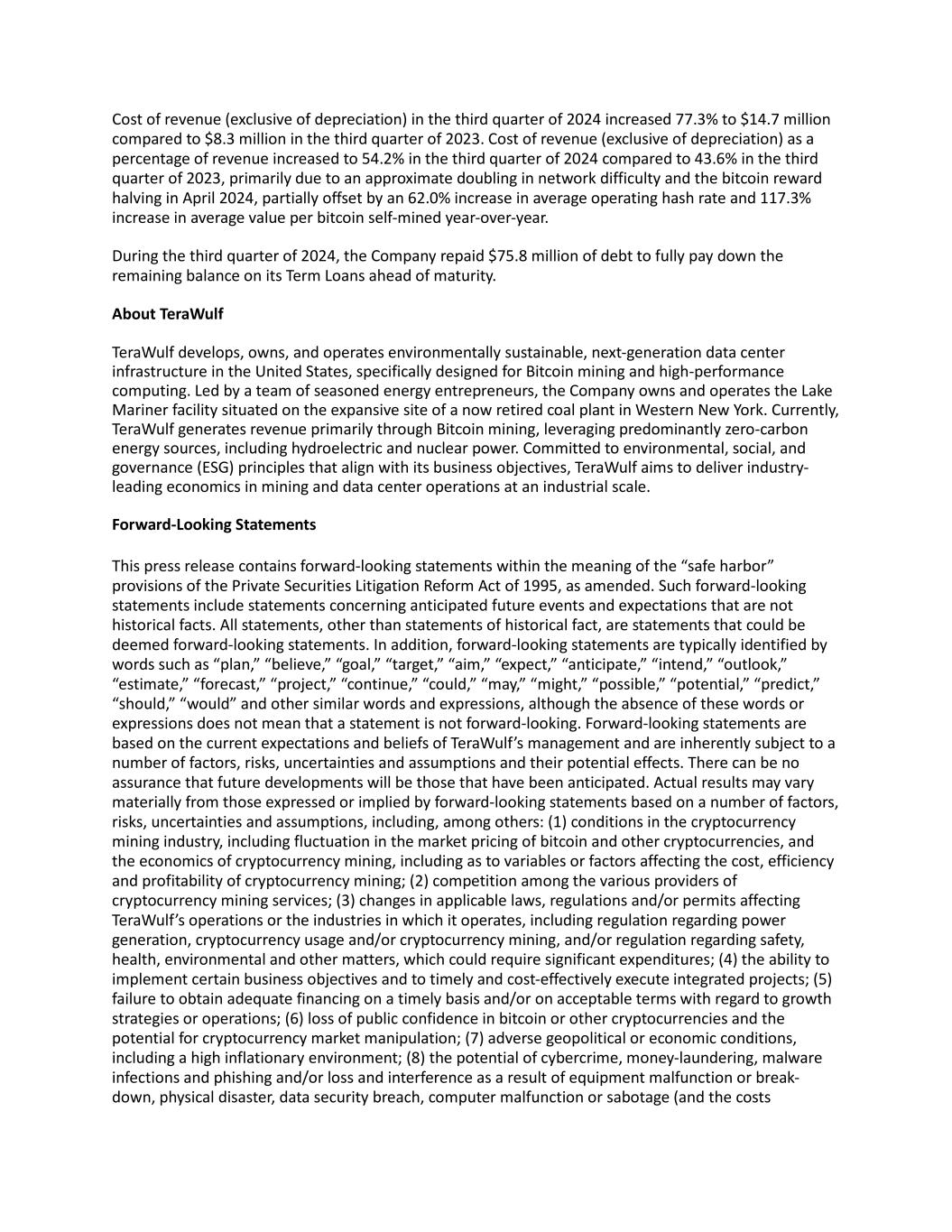

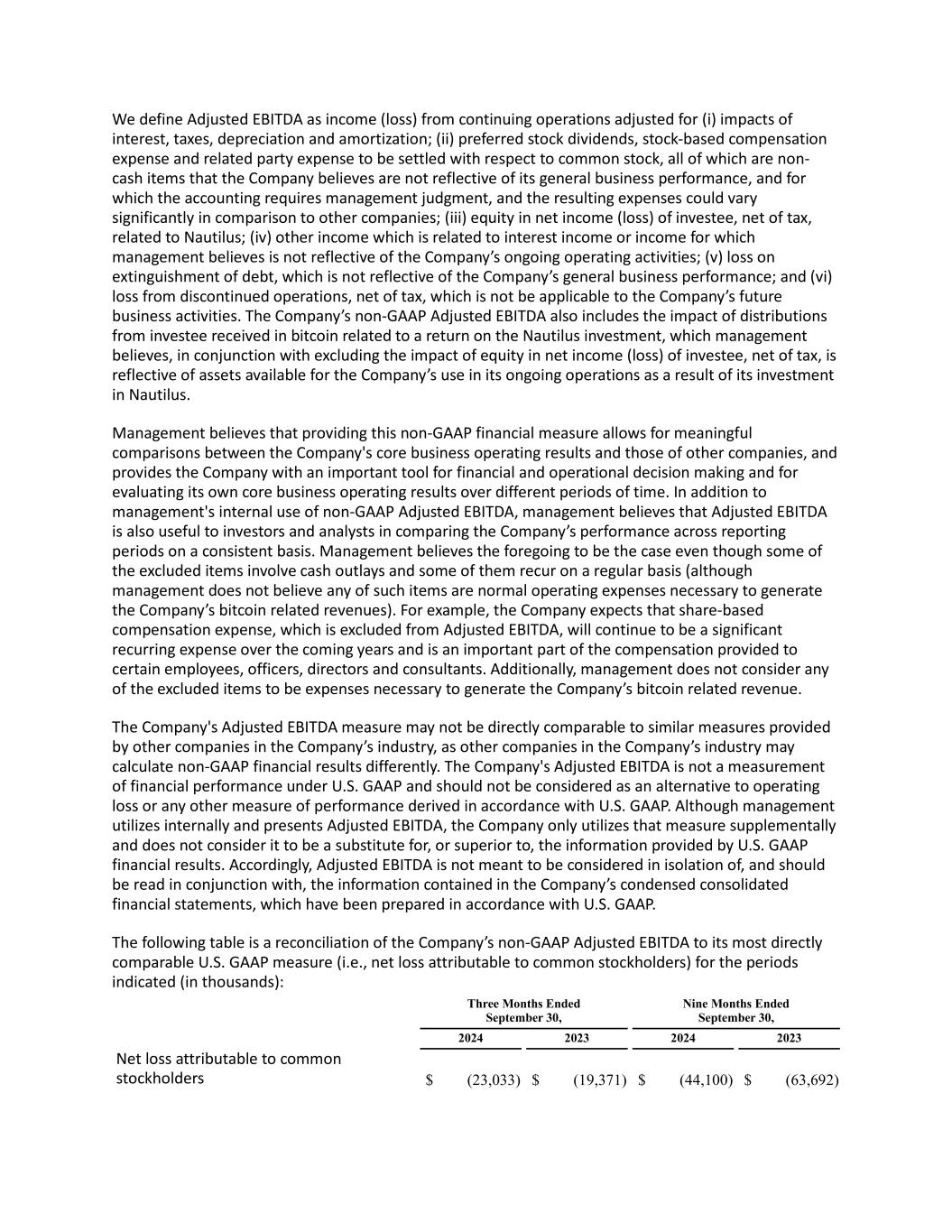

We define Adjusted EBITDA as income (loss) from continuing operations adjusted for (i) impacts of interest, taxes, depreciation and amortization; (ii) preferred stock dividends, stock-based compensation expense and related party expense to be settled with respect to common stock, all of which are non- cash items that the Company believes are not reflective of its general business performance, and for which the accounting requires management judgment, and the resulting expenses could vary significantly in comparison to other companies; (iii) equity in net income (loss) of investee, net of tax, related to Nautilus; (iv) other income which is related to interest income or income for which management believes is not reflective of the Company’s ongoing operating activities; (v) loss on extinguishment of debt, which is not reflective of the Company’s general business performance; and (vi) loss from discontinued operations, net of tax, which is not be applicable to the Company’s future business activities. The Company’s non-GAAP Adjusted EBITDA also includes the impact of distributions from investee received in bitcoin related to a return on the Nautilus investment, which management believes, in conjunction with excluding the impact of equity in net income (loss) of investee, net of tax, is reflective of assets available for the Company’s use in its ongoing operations as a result of its investment in Nautilus. Management believes that providing this non-GAAP financial measure allows for meaningful comparisons between the Company's core business operating results and those of other companies, and provides the Company with an important tool for financial and operational decision making and for evaluating its own core business operating results over different periods of time. In addition to management's internal use of non-GAAP Adjusted EBITDA, management believes that Adjusted EBITDA is also useful to investors and analysts in comparing the Company’s performance across reporting periods on a consistent basis. Management believes the foregoing to be the case even though some of the excluded items involve cash outlays and some of them recur on a regular basis (although management does not believe any of such items are normal operating expenses necessary to generate the Company’s bitcoin related revenues). For example, the Company expects that share-based compensation expense, which is excluded from Adjusted EBITDA, will continue to be a significant recurring expense over the coming years and is an important part of the compensation provided to certain employees, officers, directors and consultants. Additionally, management does not consider any of the excluded items to be expenses necessary to generate the Company’s bitcoin related revenue. The Company's Adjusted EBITDA measure may not be directly comparable to similar measures provided by other companies in the Company’s industry, as other companies in the Company’s industry may calculate non-GAAP financial results differently. The Company's Adjusted EBITDA is not a measurement of financial performance under U.S. GAAP and should not be considered as an alternative to operating loss or any other measure of performance derived in accordance with U.S. GAAP. Although management utilizes internally and presents Adjusted EBITDA, the Company only utilizes that measure supplementally and does not consider it to be a substitute for, or superior to, the information provided by U.S. GAAP financial results. Accordingly, Adjusted EBITDA is not meant to be considered in isolation of, and should be read in conjunction with, the information contained in the Company’s condensed consolidated financial statements, which have been prepared in accordance with U.S. GAAP. The following table is a reconciliation of the Company’s non-GAAP Adjusted EBITDA to its most directly comparable U.S. GAAP measure (i.e., net loss attributable to common stockholders) for the periods indicated (in thousands): Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Net loss attributable to common stockholders $ (23,033) $ (19,371) $ (44,100) $ (63,692)

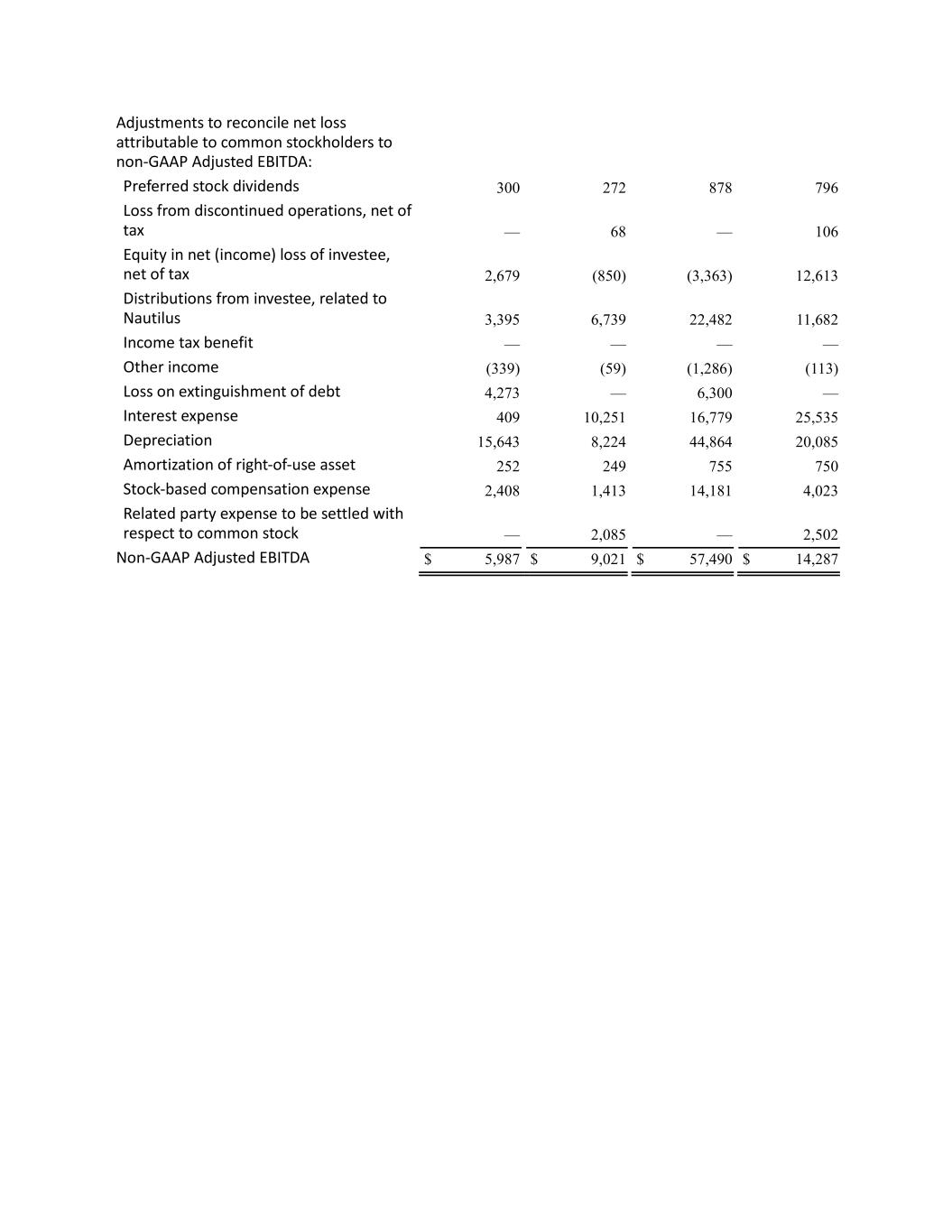

Adjustments to reconcile net loss attributable to common stockholders to non-GAAP Adjusted EBITDA: Preferred stock dividends 300 272 878 796 Loss from discontinued operations, net of tax — 68 — 106 Equity in net (income) loss of investee, net of tax 2,679 (850) (3,363) 12,613 Distributions from investee, related to Nautilus 3,395 6,739 22,482 11,682 Income tax benefit — — — — Other income (339) (59) (1,286) (113) Loss on extinguishment of debt 4,273 — 6,300 — Interest expense 409 10,251 16,779 25,535 Depreciation 15,643 8,224 44,864 20,085 Amortization of right-of-use asset 252 249 755 750 Stock-based compensation expense 2,408 1,413 14,181 4,023 Related party expense to be settled with respect to common stock — 2,085 — 2,502 Non-GAAP Adjusted EBITDA $ 5,987 $ 9,021 $ 57,490 $ 14,287